Net Present Value (NPV)

(→Big Idea) |

|||

| Line 7: | Line 7: | ||

== Big Idea == | == Big Idea == | ||

| − | The net present value (NPV) method is the most frequently used approach in the financial appraisal of a project | + | Project business case development is a critical point in a project where it uses to obtain the approval for investment in the project by presenting the benefits, cost, and risk associated with alternative options and the method of selecting the preferred solution. In a business case, financial appraisal plays a key role to answer the fundamental economic questions of whether an investment should be made and which project should be chosen among a selection of different alternatives. Because the task of financial appraisal is to predict the financial effects of planned investment and to present the data in such a way that a reasoned investment decision can be reached. The net present value (NPV) method is the most frequently used approach in the financial appraisal of a project. |

| − | + | ||

=== What is NPV? === | === What is NPV? === | ||

| Line 50: | Line 49: | ||

=== Decision rule === | === Decision rule === | ||

This gives the decision criteria of NPV. | This gives the decision criteria of NPV. | ||

| − | |||

== Applications == | == Applications == | ||

Revision as of 01:02, 13 February 2022

Written by Deepthi Tharaka Parana Liyanage Don- s203116

Contents |

Abstract

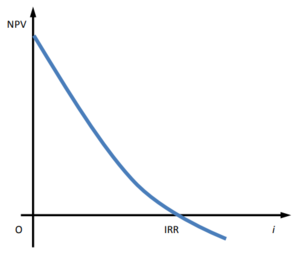

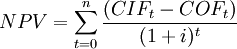

Financial appraisal is a method used to evaluate the viability of a proposed project or portfolio of investment projects by evaluating the benefits and costs that result from its execution. Investment decisions of the management are critical to a company since it decides the future of the company. This article discusses the Net Present Value (NPV) method which is widely used in financial appraisal. NPV is a dynamic financial appraisal method that considers the time value of money by applying discounting and compounding of all payment series during the investment period[1]. In simple terms, the net present value is the difference between an investment object’s incoming and outgoing payments at present time. NPV is determined by calculating the outgoing cashflows (costs) and incoming cash flows (benefits) for each period of an investment. After the cash flow for each period is calculated, the present value (PV) of each one is achieved by discounting its future value using the suitable discount rate. Net Present Value is the cumulative value of all the discounted future cash flows[2].

Firstly, this article discusses the idea behind the Net Present Value method and its underlying assumptions. Then this introduces the NPV calculation method[1] and describes the importance of the variables in the formula such as discount rate. Also, it highlights the decision criteria behind NPV and explains it with a real-life application. Finally, it critically reflects on the limitations of this method and briefly introduces the other alternative financial apprisal methods such as Internal Rate of Return (IRR), payback method, and Return on Investment (ROI).

Big Idea

Project business case development is a critical point in a project where it uses to obtain the approval for investment in the project by presenting the benefits, cost, and risk associated with alternative options and the method of selecting the preferred solution. In a business case, financial appraisal plays a key role to answer the fundamental economic questions of whether an investment should be made and which project should be chosen among a selection of different alternatives. Because the task of financial appraisal is to predict the financial effects of planned investment and to present the data in such a way that a reasoned investment decision can be reached. The net present value (NPV) method is the most frequently used approach in the financial appraisal of a project.

What is NPV?

This section explain the concept of NPV

Assumptions of NPV

This highlights the underlying assumptions in NPV

Formula

This section introduces the NPV formula & recommended steps in the calculation of the NPV.

Example Formula:

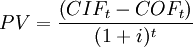

In order to consider the time value of money the net present value method considers the value of an investment at the present time by converting all information of the future into a key figure at the time today. To get the present value of future cash flows, they are discounted based on an interest discount rate (i) and the time of cashflow (t) using:

Where:

– Present Value

– Present Value

- time of the cashflow

- time of the cashflow

- Cash inflows in period t

- Cash inflows in period t

– Cash outflows in period t

– Cash outflows in period t

– Net cashflow in period t

– Net cashflow in period t

– Net cashflow in period t

– Net cashflow in period t

– The discount rate

– The discount rate

Discount Factor

This section describes how to select the discount factor and its importance.

Time period

Decision rule

This gives the decision criteria of NPV.

Applications

Application of NPV in real example

Limitations

Introduce the limitations of NPV

Alternative financial appraisal methods

This section gives a brief idea about other methods

- IRR

- payback

- ROI

Annotated Bibliography

Reference Example: The book-1.[1] The book-2.[2] The book-3.[3] The book-4.[4] The book-5.[5]

References

- ↑ 1.0 1.1 1.2 Häcker J. and Ernst D., Ch. 8 - Investment Appraisal. In: Financial Modeling. Global Financial Markets., (Palgrave Macmillan, London, 2017), pp. 343-384, https://doi.org/10.1057/978-1-137-42658-1_8

- ↑ 2.0 2.1 Ferrari, C., Bottasso, A., Conti, M. and Tei, A., Ch. 5 - Investment Appraisal. In: Economic role of transport infrastructure: Theory and models., (Elsevier, 2018), pp. 85-114, https://doi.org/10.1016/C2016-0-03558-1

- ↑ Konstantin P. and Konstantin M., Ch. 4 - Investment Appraisal Methods. In: Power and Energy Systems Engineering Economics., (Springer, Cham, 2018), pp. 39-64, https://doi.org/10.1007/978-3-319-72383-9_4

- ↑ Poggensee K. and Poggensee J., Ch. 3 - Dynamic Investment Calculation Methods. In: Investment Valuation and Appraisal., (Springer, Cham, 2021), pp. 85-140, https://doi.org/10.1007/978-3-030-62440-8

- ↑ Ing E. and Lester A., Ch. 6 - Investment Appraisal. In: Project Management, Planning and Control. 7th Edition., (Elsevier, 2017), pp. 29-36, https://doi.org/10.1016/B978-0-08-102020-3.00006-1