MCDA methods in decision making

(→MCDA vs CBA) |

|||

| Line 64: | Line 64: | ||

= Conclusion = | = Conclusion = | ||

| + | |||

| + | = References == | ||

Revision as of 18:17, 18 February 2022

Abstract

Decision making is one of the most important parts of any aspect of life. It affects the present and both immediate and long-term future. Of course, it has a huge impact on every project, naturally including engineering projects. There is a vast number of techniques and methods to help one to come up with a final decision. In this article, the focus is the MCDA analysis in decision makin. In decision making, there are different tools or criteria, such as Cost - Benefit Analysis (CBA) or the Multi Criteria Decision Analysis (MCDA). On one hand, CBA focus on the quantitative part of the project in order to reach a decision, specially focusing on monetary terms, currency change and various rates, such as inflation or consumer surplus. On the other hand, MCDA involves many other criteria, mostly qualitative, in order to reach a decision. Within MCDA, naturally, there are different techniques to use, the two main ones are AHP and Smart. As mentioned previously, the focus of this paper will be the MCDA methods in decision making. Initially, there will be an introduction on the history of the decision making and where the term comes from. Sequentially, there will be an explanation on both CBA and MCDA to reach a full understanding for both tools and comparing them. After this section, there will be a deeper explanation on the MCDA analysis, explaining the different types of MCDA and providing examples, pros and cons. Finally there will be a conclusion on the involvement of MCDA analysis and methods in the decision making, focusing on engineering projects.

Contents |

Introduction

History of Decision Making

During the middle of the last century, Chester Bernard created the term "decision making". It was intended to ve a replacement and a narrower descriptor for "resource allocation and policy making". Additionally, it was an intended term for how managers though about what decisions to make at a certain time. Also, William Starbruck, proffesor in University of Oregon clearly stated that "Decision implies the end of deliberation and the beggining of action."

Barnard along with others such as James March, Herbert Simon and Henry Mintberg laid the foundation for the study of managerial decision making. It tried to find answers to the questions of who makes decisions, and how.

The study of decision making involves a numerous amount of disciplines such as mathematics, sociology, psychology, economics, etc. It also investigated different risk and organizatoinal behaviours in relation to achieving the best outcome.

A big participant of Decision Making is risk analysis, which has evolved vastly throughout the years. It was not until World War I that risk was examiend with economic analysis, thanks to Frank Knight in 1921. Knight distinguished between risk, when the probability of an outcome is possible to calculate and an uncertainity, when the porbabilty of that outcome is unknowable. Nowadays, thanks to technology, Internet and Artificial Intelligence, tools have been created in order to improve the decision making techniques and its outcomes.

Types of Decision Making tools

The main two analysis tools in the Decision Making enviroment are Cost - Benefit Analysis and Multi - Criteria Decision Analysis. In this article, the focus will fall on MCDA.

CBA

Cost - Benefit Analysis (CBA) is a tool that is essential in order to support the decision making process. A CBA consists of quantitative data of a project, that being the enumeration and valuation in monetary terms of every cost and benefit of that project. The main result of a CBA is the Net Present Value, which in case of being positive, means that the benefits exceed costs over the project's lifetime. So, naturally, the goal is to reach a positive Net Present Value.

This method is recommended when there are not any assets or effects of the decision making that do not involve money or are not assigned a monetary value. The CBA considers different values such as discount rate or consumer surplus, which helps to reach much more precise and realistic results, especially for projects who have a considerable life span or, specifically in engineering projects, have had a long construction period.

Furthermore, CBA can be complemented with the MCDA, making use of the qualitative data involving the project and improving the outcome of the decision and lastly, the project itself.

MCDA vs CBA

While CBA reflects all the effects that can be monetarized and has the only goal of maximizing the Net Present Value, the MCDA method involves other effects that cannot be monetarized and are qualitative data.

There are clear benefits of the CBA method, which are that the conclusions of this analysis are clear and easy to compare to other projects since are given as a monetary unit value. Also, the rates that are used to perform this analysis are consistent between investments and over time. This allows to compare projects that have different timelines which is convenient for many cases.

On the other hand, the CBA method does not consider all the effects in most cases. The geopolitical and strategical issues have a vast influence in most of the projects and the CBA method does not include that.

Furthermore, MCDA may be seen as an extension of the CBA. The CBA just represents a small part of the decision-making process, so MCDA makes it possible, in just one approach, to combine the CBA with the rest of qualitative effects. To achieve that, it is necessary to perform a previous decision process, which is subjective and assigns weights to each effect involved in the project, including the CBA.

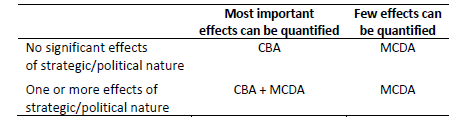

Finally, the previous process, can be performed in most cases since usually monetary and political or strategic effects are involved in most projects. Otherwise, in the table below, it is shown which methods ought to be used for each scenario.

MCDA

History

The earliest MCDA references that are known go back to the eighteenth century referred to Benjamin Frankling where he stated "Take a sheet of paper. On one side write the arguments infavour of a decision; on the other side the arguments against. Cross out arguments on each side of the paper that are relative of equal importance. When all the arguments on one side have been crossed out, the side with arguments notcrossed out is the side of the argument that should be supported”.

There are other main names that had a considerable impact on the decision making as we know today. Some of those are are Marquis de Condorcet, who wrote an essay on the application of analysis to the probability of majority decisions; George Cantor, who created set theory; or Francis Edgeworth, who integrated mathematical concepts to decision making.

Nowadays, the present MCDA field involves investigation on different approaches which are descriptive, normative, prescriptive and constructive. The constructive approach is normally used by the French school which bases his process in outranking, while the normative approach is followed by the American school.

Two big names on the most recent MCDA era are Bernard Roy and Thomas Saaty who both passed away in 2017.

Pros and Cons

Pros

While CBA reflects all the effects that can be monetarized and has the only goal of maximizing the Net Present Value, the MCDA method involves other effects that cannot be monetarized and are qualitative data.

There are clear benefits of the CBA method, which are that the conclusions of this analysis are clear and easy to compare to other projects since are given as a monetary unit value. Also, the rates that are used to perform this analysis are consistent between investments and over time. This allows to compare projects that have different timelines which is convenient for many cases.

On the other hand, the CBA method does not consider all the effects in most cases. The geopolitical and strategical issues have a vast influence in most of the projects and the CBA method does not include that.

Furthermore, MCDA may be seen as an extension of the CBA. The CBA just represents a small part of the decision-making process, so MCDA makes it possible, in just one approach, to combine the CBA with the rest of qualitative effects. To achieve that, it is necessary to perform a previous decision process, which is subjective and assigns weights to each effect involved in the project, including the CBA.

Finally, the previous process, can be performed in most cases since usually monetary and political or strategic effects are involved in most projects. Otherwise, in the table below, it is shown which methods ought to be used for each scenario.

Cons

Firstly, the MCDA method does not give an absolute value that informs the decision taker to go forward with a project or not like the CBA does, where if it results in a positive Net Present Value, the project can go forward. It mainly only allows to compare between different projects.

Furthermore, due to the necessity of the pre-decision-making process, it makes MCDA time consuming and, in some cases, also resource consuming.

To conclude, the election of weights in the MCDA method is crucial since it influiates the whole outcome of the process. Due to that, the weight assignment is a really delicate process where any false step might null the whole assessment.

Main techniques

The two main techniques in the MCDA method are the Simple Multi – Attribute Rating Technique (SMART) and The Analytic Hierarchy Process (AHP).