Benefit Cost Ratio (BCR)

(→Other formulas of CBA) |

(→Limitations of BCR) |

||

| (30 intermediate revisions by one user not shown) | |||

| Line 7: | Line 7: | ||

== Cost Benefit Analysis == | == Cost Benefit Analysis == | ||

| − | Cost-benefit analysis (CBA) is a method of economic | + | '''Cost-benefit analysis (CBA)''' is a method of economic appraisal that aims to measure the positive and negative impacts of a proposed projects. This tool has been used for centuries, with the examples dating back to the 1700s. However, wider applications of CBA dates back to the USA in the 1930s, where the methodology was developed in connection with large water projects. <ref name="Mishan"/> CBA was ‘exported’ to Europe in the 1950s and was used for decisions about building motorways CBA’s earliest applications was in the transportation area, where it was used to evaluate the profitability and desirability of public infrastructure projects.<ref name="European "/> |

| − | In the 1960s, | + | In the 1960s, CBA obtained a status as a more or less objective tool which could guide the subjective politicians, with the help of economists such as Kenneth Arrow, Milton Friedman, and Richard Musgrave, who supported that CBA could be an important method for evaluating the efficiency of government programs.<ref name="Kenneth Arrow "/> |

After that, CBA was refined over the next decades due the advent of computers and still | After that, CBA was refined over the next decades due the advent of computers and still | ||

| − | more sophisticated prediction | + | more sophisticated prediction models and is widely used in a variety of fields, including environmental regulation, health care, and transportation planning.<ref name="Schmalensee "/> |

The last years the goal is to link CBA with other methods (hard and soft operation research techniques) and setting a focus on wider impacts, | The last years the goal is to link CBA with other methods (hard and soft operation research techniques) and setting a focus on wider impacts, | ||

| Line 20: | Line 20: | ||

===Microeconomic approach=== | ===Microeconomic approach=== | ||

| − | CBA is often a microeconomic approach that enables the calculation of economic performance indicators, offering an assessment of predicted welfare improvements, to analyze the project's influence on society as a whole. While the project's direct employment or external environmental consequences are recognized in the ENPV, indirect and broader effects (such as those on secondary markets, public funds, employment, regional growth, etc.) should be disregarded. | + | CBA is often a microeconomic approach that enables the calculation of economic performance indicators, offering an assessment of predicted welfare improvements, to analyze the project's influence on society as a whole. While the project's direct employment or external environmental consequences are recognized in the ENPV, indirect and broader effects (such as those on secondary markets, public funds, employment, regional growth, etc.) should be disregarded. <ref name="European "/> |

| − | This is because of two | + | This is because of two factors: |

1. The majority of indirect and/or wider effects are typically capitalized, redistributed, and altered versions of direct effects. This has as a result for benefits to be double-counted. | 1. The majority of indirect and/or wider effects are typically capitalized, redistributed, and altered versions of direct effects. This has as a result for benefits to be double-counted. | ||

| Line 32: | Line 32: | ||

For this approach the CBA only considers the difference between the cash flows in the with-the-project and the counterfactual | For this approach the CBA only considers the difference between the cash flows in the with-the-project and the counterfactual | ||

| − | scenarios. The financial and economic performance indicators are calculated on the incremental cash flows only. | + | scenarios. The financial and economic performance indicators are calculated on the incremental cash flows only. <ref name="European "/> |

===Project appraisal steps=== | ===Project appraisal steps=== | ||

| − | A Typical CBA is structured in | + | A Typical CBA is structured in six steps:<ref name="Gerald"/> |

| − | 1. Description of the context | + | 1. '''Description of the Context''': A presentation and discussion of the socio-economic context and objectives of the project. To be more specific, the first step of the appraisal is a qualitive discussion of the socio-economic context and the objectives that are expected to be attained through the investment, both directly and indirectly. |

| − | 2. | + | 2. '''Identification of the Project''': This step involves identifying and evaluating whose costs and benefits must be considered and what indirect and network effects are going to be adequately covered. |

| − | 3. Identification of the project | + | 3. '''Identification of the alternatives''': In this step, different alternatives are identified and there is a Justification of the project design (scale, location, etc.) against alternative scenarios. |

| − | 4. | + | 4. '''Financial Analysis''': After identifying the alternatives, the next step is financial analysis which is based on the discounted cash flow approach and contains the traditional inflows and outflows of the project. |

| − | 5. | + | 5. ''' Economic Analysis''': In this step, the cost benefit analysis is implemented. CBA requires an investigation of a project’s net impact on economic welfare. |

| − | 6. | + | 6. '''Risk Assessment''': In this step, the project appraisal document must include an assessment of the project risks. This can be achieved by Sensitivity analysis, Probability distribution on important impacts, Performance indicators. Finally, there must be a discussion of the results compared to risk levels and a discussion how to mitigate the risks. |

| − | + | ||

| − | + | ||

== What is BCR? == | == What is BCR? == | ||

| − | The Benefit Cost Ratio is a profitability indicator, and it is the ratio of the present value of the benefit of the project to the present value of the cost. It is usually used to summarize the results of the cost benefit analysis (CBA) during the financial analysis of a proposed program, project or portfolio.<ref name="Gerald"/> The origins of BCR can be traced back to the early 20th century when economists and engineers first began developing methods to evaluate the costs and benefits of public infrastructure projects. One of the earliest known applications | + | The Benefit Cost Ratio is a profitability indicator, and it is the ratio of the present value of the benefit of the project to the present value of the cost. It is usually used to summarize the results of the cost benefit analysis (CBA) during the financial analysis of a proposed program, project or portfolio.<ref name="Gerald"/> The origins of BCR can be traced back to the early 20th century when economists and engineers first began developing methods to evaluate the costs and benefits of public infrastructure projects. . One of the BCR’s earliest known applications was in the United States in the 1920s, when the Bureau of Public Roads began to use it to evaluate the economic benefits of transportation projects. BCR began to be used as more in the 1930s and 1940s, when economists and engineers needed to refine and standardize methods for estimating costs and benefits. |

| − | Today, the BCR is widely used by the public and private sectors to assess the economic viability of | + | Today, the BCR is widely used by the public and private sectors to assess the economic viability of many projects and investments, such as transportation infrastructure, power generation facilities and public health initiatives etc. |

BCR is another way of comparing the present value of a project’s costs with the present value of its benefits. If the value of BCR of a project is greater than 1.0, the project is expected to have also a positive NPV and to have an internal rate of return (IRR) higher than the discount rate used in the calculations. When the BCR has a value equal to 1.0, indicates that the NPV of expected profits equals the costs. If BCR of a project is less than 1.0, the project's costs outweigh the benefits, and it should not be feasible. <ref name=" Investopedia"/> | BCR is another way of comparing the present value of a project’s costs with the present value of its benefits. If the value of BCR of a project is greater than 1.0, the project is expected to have also a positive NPV and to have an internal rate of return (IRR) higher than the discount rate used in the calculations. When the BCR has a value equal to 1.0, indicates that the NPV of expected profits equals the costs. If BCR of a project is less than 1.0, the project's costs outweigh the benefits, and it should not be feasible. <ref name=" Investopedia"/> | ||

| Line 66: | Line 64: | ||

Benefits and costs have a higher value today than tomorrow. The time value of money is a basic financial concept used to calculate the present value of an amount of money today compared to its future value. This concept is based on the idea that money has a time value because it can earn interest over time. In other words, a dollar received today is worth more than a dollar received in the future due to the potential to earn additional. <ref name=" CFI Team"/> | Benefits and costs have a higher value today than tomorrow. The time value of money is a basic financial concept used to calculate the present value of an amount of money today compared to its future value. This concept is based on the idea that money has a time value because it can earn interest over time. In other words, a dollar received today is worth more than a dollar received in the future due to the potential to earn additional. <ref name=" CFI Team"/> | ||

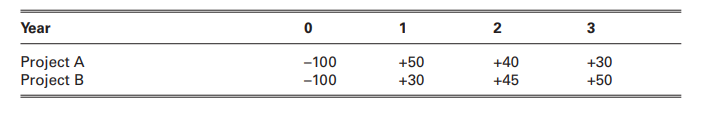

| − | There is a need for discounting when comparing any flow of funds (costs and revenues or benefits) over time. To consider the process of discounting in practice, consider two investment projects, A and B. The net cash flows of these | + | There is a need for discounting when comparing any flow of funds (costs and revenues or benefits) over time. To consider the process of discounting in practice, consider two investment projects, A and B. The net cash flows of these projects are given as: |

| − | projects are given as: | + | |

[[File:discount 1.png]] | [[File:discount 1.png]] | ||

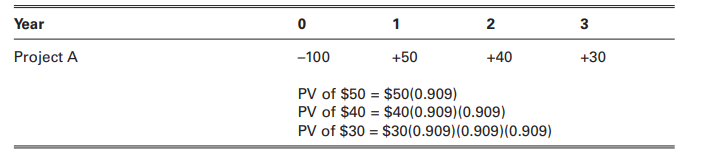

| − | The values of each year need to be discounted to calculate the present value, and | + | The values of each year need to be discounted to calculate the present value '''(PV)''', that can happen by multiplying each year's cash flow by a discount factor, which is determined by the discount rate and the number of years into the future the cash flow occurs. There is an example for these calculations making the usual assumption that the discount rate is constant from year to year. |

| Line 123: | Line 121: | ||

'''Example 2''' | '''Example 2''' | ||

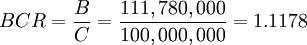

| − | The government is considering building a new | + | The government is considering building a new railway, and they want to calculate the Benefit-Cost Ratio (BCR) of the project to determine if the project is feasible. The construction cost will be $100 million and the railway is expected to generate 30 million in benefits for each year over the next 4 years. The discount Ratio is 3%. |

| + | |||

<math>B = \frac{30,000,000}{(1+0.03)^1} + \frac{30,000,000}{(1+0.03)^2} + \frac{30,000,000}{(1+0.03)^3} + \frac{30,000,000}{(1+0.03)^4}</math> | <math>B = \frac{30,000,000}{(1+0.03)^1} + \frac{30,000,000}{(1+0.03)^2} + \frac{30,000,000}{(1+0.03)^3} + \frac{30,000,000}{(1+0.03)^4}</math> | ||

| Line 131: | Line 130: | ||

<math>BCR = \frac{B}{C} = \frac{111,780,000}{100,000,000} = 1.1178</math> | <math>BCR = \frac{B}{C} = \frac{111,780,000}{100,000,000} = 1.1178</math> | ||

| − | + | The BCR is greater than 1 indicates that the project is economically viable. | |

=== Comparison Between BCR and NPV === | === Comparison Between BCR and NPV === | ||

| − | BCR and NPV are two different methods of financial appraisal. BCR measures the ratio of benefits to costs, while NPV measures the present value of future cash flows. Both methods measure the profitability of an investment with different methods. BCR focuses on determining ROI, while NPV takes into account the present value of future cash flows.<ref name="Campbell "/> | + | BCR and NPV are two different methods of financial appraisal, that are used to evaluate the profitability of investment projects. BCR measures the ratio of benefits to costs, while NPV measures the present value of future cash flows. Both methods measure the profitability of an investment with different methods. BCR focuses on determining ROI, while NPV takes into account the present value of future cash flows.<ref name="Žižlavský"/> However, BCR doesn't provide an absolute measure of profitability. For that reason, NPV is considered to be a more reliable measure of profitability. <ref name="Campbell "/> |

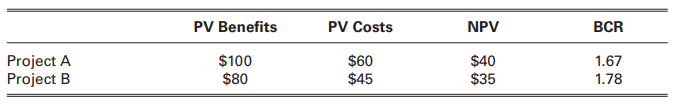

Comparing or ranking two or more projects, again assuming no budget constraint, the BCR decision-rule can give incorrect results. For example, comparing two different projects A and B , where: | Comparing or ranking two or more projects, again assuming no budget constraint, the BCR decision-rule can give incorrect results. For example, comparing two different projects A and B , where: | ||

| Line 148: | Line 147: | ||

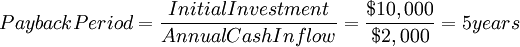

1.''' Payback Period ''' = Initial Investment / Annual Cash Inflow | 1.''' Payback Period ''' = Initial Investment / Annual Cash Inflow | ||

| − | The payback period is the length of time it takes for the initial investment to be recovered through the annual cash inflows generated by the investment. For example, if | + | The payback period is the length of time it takes for the initial investment to be recovered through the annual cash inflows generated by the investment.<ref name="Žižlavský"/> |

| + | |||

| + | For example, if the project requires an initial investment of $10,000 and generates annual cash inflows of $2,000, the payback period would be: | ||

<math> Payback Period = \frac{Initial Investment}{Annual Cash Inflow | <math> Payback Period = \frac{Initial Investment}{Annual Cash Inflow | ||

| Line 156: | Line 157: | ||

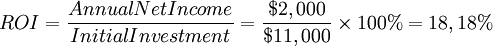

2. '''Return on Investment ''' = Annual Net Income / Initial Investment | 2. '''Return on Investment ''' = Annual Net Income / Initial Investment | ||

| − | It is a financial metric used to measure the profitability of an investment. | + | It is a financial metric used to measure the profitability of an investment. It is expressed as a percentage and is calculated as the ratio of the net profit or benefit of an investment and the cost of the investment. |

| + | |||

| + | For example, an investment cost is $10,000 in a stock and it is sold it for $12,000, the profit would be $2,000. The total cost of investment including fees and taxes was $11,000, ROI would be: | ||

<math> ROI = \frac{Annual Net Income}{Initial Investment | <math> ROI = \frac{Annual Net Income}{Initial Investment | ||

} = \frac{$2,000}{$11,000}\times 100% = 18,18 % </math> | } = \frac{$2,000}{$11,000}\times 100% = 18,18 % </math> | ||

| + | |||

| + | Net income is the amount of money gained from an investment after all expenses have been paid. The initial investment includes all costs associated with the investment, such as purchase price, fees, and any other expenses. A higher ROI suggests a more profitable investment, whereas a lower ROI can imply a less successful investment.<ref name="Žižlavský"/> | ||

3. '''Net Present Value ''' = Net Present Value / Initial Investment | 3. '''Net Present Value ''' = Net Present Value / Initial Investment | ||

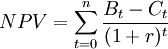

| − | It is a financial metric used to calculate the present value of future cash flows generated by an investment, taking into account the time value of money. It is a common indicator for the | + | It is a financial metric used to calculate the present value of future cash flows generated by an investment, taking into account the time value of money. It is a common indicator for the profitability of a project or investment proposal. If the value of NPV is positive, it shows that the investment is feasible and is expected to generate a positive return. If the NPV is negative, it means that the investment is expected to generate a negative return. <ref name="Žižlavský"/> |

<math> NPV=\sum_{t=0}^n \frac{B_t-C_t}{(1+r)^t} </math> | <math> NPV=\sum_{t=0}^n \frac{B_t-C_t}{(1+r)^t} </math> | ||

| Line 170: | Line 175: | ||

Where: | Where: | ||

| − | B: is the | + | B: is the Benefits in period t |

| − | C: is the | + | C: is the Cost in period t |

r: is the discount rate | r: is the discount rate | ||

| − | n: | + | n: The calculation period of the project in years |

| + | |||

4. '''Internal Rate of Return ''' = Internal Rate of Return / Discount Rate | 4. '''Internal Rate of Return ''' = Internal Rate of Return / Discount Rate | ||

| − | IRR is a profitability | + | Internal Rate of Return (IRR) is a tool of measurement of the profitability of a project and is defined as the discount rate that makes the net present value (NPV) from a particular project to be zero. The purpose is to determine the rate i that balances the benefits and costs. The IRR of each project must be higher than the discount rate and the project with higher IRR value, are more desirable. An important benefit of IRR is the fact that IRR considers the time value of money and offers a more precise indicator of an investment's profitability over time.<ref name="Investopedia "/> |

5. '''Profitability Index ''' = Present Value of Future Cash Flows / Initial Investment | 5. '''Profitability Index ''' = Present Value of Future Cash Flows / Initial Investment | ||

| − | The profitability index (PI), alternatively referred to as value investment ratio (VIR) or profit investment ratio (PIR), describes an index that represents the relationship between the costs and benefits of a proposed project.<ref name="Investopedia "/> | + | The profitability index (PI), alternatively referred to as value investment ratio (VIR) or profit investment ratio (PIR), describes an index that represents the relationship between the costs and benefits of a proposed project. The PI is a useful tool for evaluating investments because it takes into account both the magnitude and timing of cash flows. A PI greater than 1 indicates that the investment is expected to generate positive cash flows.<ref name="Investopedia "/> |

== Advantages of BCR == | == Advantages of BCR == | ||

| − | 1. The BCR | + | 1. The BCR uses the absolute amounts of benefits and costs into a ratio and can achieve a direct comparison of the benefits and costs of a project. It is financial metric that compares the total present value of benefits to the total present value of costs for a project. |

| − | 2. The BCR is a relatively simple | + | 2. The BCR is a relatively a simple tool to use and a good starting point for the financial analysis to determine the desirability of a project. |

| − | 3. | + | 3. To calculate the BCR, the time value of money through the discount rate must be considered. By taking into account the time value of money, the results are more accurate about of the assessment of the project's profitability. <ref name=" Xavier"/> |

== Limitations of BCR == | == Limitations of BCR == | ||

| Line 204: | Line 210: | ||

3. The project's potential externalities or spillover effects are not taken into account by the BCR technique. The BCR result, for instance, may not account for unanticipated negative effects a project may have on the environment or nearby communities. | 3. The project's potential externalities or spillover effects are not taken into account by the BCR technique. The BCR result, for instance, may not account for unanticipated negative effects a project may have on the environment or nearby communities. | ||

| − | 4. The BCR is commonly used in conjunction with other financial metrics, in order to format a well-informed decisions about project feasibility. | + | 4. The BCR is commonly used in conjunction with other financial metrics, in order to format a well-informed decisions about project feasibility. |

| − | 5. This method relies heavily an accurate forecasting of future costs and benefits, which can be difficult to predict with certainty. This may result in overly optimistic benefits estimates or underestimated costs, which may compromise the reliability of the BCR result. | + | 5. This method relies heavily an accurate forecasting of future costs and benefits, which can be difficult to predict with certainty. This may result in overly optimistic benefits estimates or underestimated costs, which may compromise the reliability of the BCR result. <ref name=" Xavier"/> |

| + | |||

| + | == Annotated Bibliography == | ||

| + | |||

| + | '''Shively G., An Overview of Benefit-Cost Analysis., (Gerald Shively, Purdue University, 2012)''' | ||

| + | |||

| + | This comprehensive book on cost-benefit analysis (CBA) covers the concepts and techniques used to evaluate the economic efficiency of policies and projects. The authors explore how to identify, measure, and value the costs and benefits of different policy options, including social welfare, environmental impacts, and public health outcomes. | ||

| + | |||

| + | '''Häcker J. and Ernst D., Ch. 8 - Investment Appraisal. In: Financial Modeling. Global Financial Markets, (Palgrave Macmillan, London, 2017), pp. 343-384''' | ||

| + | |||

| + | The investment appraisal chapter in the financial modeling book by Häcker J. and Ernst D. presents the concept of financial assessment and provides a good overview of methodologies used in assessing a project, program, or portfolio. The concept of NPV, the concept of BCR, how to calculate NPV and BCR are all well explained in this book. | ||

| + | |||

| + | '''H. Lopez ., The Social Discount Rate: Estimates for Nine Latin American Countries, (H. Lopez , 2012)''' | ||

| + | |||

| + | This article presents information about the discount rate, providing more in-depth knowledge. It highlights the importance of the time value of money and approaches used to select the suitable discount rate. | ||

| + | |||

| + | '''Dupuis Xavier , Applications and limitations of cost-benefit analysis as applied to cultural development, (1985)''' | ||

| + | |||

| + | This book on cost-benefit analysis (CBA) presents the limitation of the different tools used on the financial appraisal. The author, Dupuis Xavier, provides an in-depth analysis of CBA as applied to cultural development and examines its strengths and weaknesses. | ||

== References == | == References == | ||

| Line 222: | Line 246: | ||

<ref name=" Xavier"> Dupuis Xavier , ''Applications and limitations of cost-benefit analysis as applied to cultural development'', (1985), https://unesdoc.unesco.org/ark:/48223/pf0000081977 </ref> | <ref name=" Xavier"> Dupuis Xavier , ''Applications and limitations of cost-benefit analysis as applied to cultural development'', (1985), https://unesdoc.unesco.org/ark:/48223/pf0000081977 </ref> | ||

<ref name="Lopez"> H. Lopez ., ''The Social Discount Rate: Estimates for Nine Latin American Countries'', (H. Lopez , 2012), </ref> | <ref name="Lopez"> H. Lopez ., ''The Social Discount Rate: Estimates for Nine Latin American Countries'', (H. Lopez , 2012), </ref> | ||

| − | + | <ref name="Žižlavský"> Žižlavský, O., ''Net present value approach: method for economic assessment of innovation projects. Procedia-Social and Behavioral Sciences'', 19th International Scientific Conference, Economics and Management, 156 (2014), pp. 506-512.</ref> | |

</references> | </references> | ||

Latest revision as of 09:45, 9 May 2023

Contents |

[edit] Abstract

This article discusses the application of the Benefit Cost Ratio (BCR) method in the Cost Benefit Analysis. The Benefit Cost Ratio is a profitability indicator, and it is the ratio of the present value of the benefit of the project to the present value of the cost. It is usually used to summarize the results of the cost benefit analysis (CBA) during the financial appraisal of a proposed program, project or portfolio. [1] BCR indicates if the project is feasible or not, meaning the higher the BCR, the more attractive the risk-return profile of the project/asset. If the BCR value of a project is less than 1, the project's costs outweigh the benefits, and it should not be considered viable. Calculating the BCR of an asset or project is comparatively simple. In addition, the ratio considers the discount rate, hence the time value of the money.[2]. Despite the fact that BCR is a tool to show the attractiveness of a project or an asset, cannot simply be the only determinant of a project's feasibility.

Initially, this article discusses the origin of the Cost Benefit Analysis and BCR. Then, it focuses on the formula for the calculation of the Benefit Cost Ratio and how it considers the time value of the money. Next, there is a comparison between BCR and other CBA methods. After that, the article introduces other formulas and applications of the BCR. Finally, it discusses the advantages and the limitations of the Benefit Cost Ratio.

[edit] Cost Benefit Analysis

Cost-benefit analysis (CBA) is a method of economic appraisal that aims to measure the positive and negative impacts of a proposed projects. This tool has been used for centuries, with the examples dating back to the 1700s. However, wider applications of CBA dates back to the USA in the 1930s, where the methodology was developed in connection with large water projects. [3] CBA was ‘exported’ to Europe in the 1950s and was used for decisions about building motorways CBA’s earliest applications was in the transportation area, where it was used to evaluate the profitability and desirability of public infrastructure projects.[4]

In the 1960s, CBA obtained a status as a more or less objective tool which could guide the subjective politicians, with the help of economists such as Kenneth Arrow, Milton Friedman, and Richard Musgrave, who supported that CBA could be an important method for evaluating the efficiency of government programs.[5]

After that, CBA was refined over the next decades due the advent of computers and still more sophisticated prediction models and is widely used in a variety of fields, including environmental regulation, health care, and transportation planning.[6]

The last years the goal is to link CBA with other methods (hard and soft operation research techniques) and setting a focus on wider impacts, stakeholders and robustness. It is widely accepted that the use of only cost-benefit analysis (CBA) may not be sufficient to fully evaluate the complex social, economic, and environmental impacts of a particular decision or policy. As a result, there has been increasing interest in integrating CBA with other methods, such as hard and soft operations research techniques, as well as other forms of economic analysis. Moreover, there has been a focus on broader impacts beyond just the monetary costs and benefits, such as social and environmental impacts, and taking into account the perspectives of various stakeholders. This is often referred to as a "multi-criteria decision analysis" approach. [7]

CBA is based on a set of predetermined project objectives and assigns a monetary value to all the welfare impacts of the intervention, both positive (benefits) and negative (costs). To get the net total benefit, these numbers are totaled after being discounted. The Economic Net Present Value (ENPV), which is expressed in monetary values, and the Economic Rate of Return (ERR), which enables comparison and ranking for competing projects or alternatives, are the indicators used to gauge the overall success of the project. There are two approaches for CBA. [4]

[edit] Microeconomic approach

CBA is often a microeconomic approach that enables the calculation of economic performance indicators, offering an assessment of predicted welfare improvements, to analyze the project's influence on society as a whole. While the project's direct employment or external environmental consequences are recognized in the ENPV, indirect and broader effects (such as those on secondary markets, public funds, employment, regional growth, etc.) should be disregarded. [4] This is because of two factors:

1. The majority of indirect and/or wider effects are typically capitalized, redistributed, and altered versions of direct effects. This has as a result for benefits to be double-counted.

2. There is still a little experience with how to translate indirect effects into reliable project appraisal techniques.

[edit] Incremental approach

CBA compares a scenario with-the-project with a counterfactual baseline scenario without-the-project. A counterfactual scenario is what would occur if the project hadn't been started. All cash flows connected to project-area operations are projected for each year of the project's lifespan in this scenario. In cases where a project consists of a completely new asset, e.g. there is no pre-existing service or infrastructure, the without-the-project scenario is one with no operations. When making improvements to an existing facility, costs and revenues/benefits for maintaining the service at a level that it can still be used, or even minor adaptations that were planned to happen anyway, should be considered.

For this approach the CBA only considers the difference between the cash flows in the with-the-project and the counterfactual scenarios. The financial and economic performance indicators are calculated on the incremental cash flows only. [4]

[edit] Project appraisal steps

A Typical CBA is structured in six steps:[1]

1. Description of the Context: A presentation and discussion of the socio-economic context and objectives of the project. To be more specific, the first step of the appraisal is a qualitive discussion of the socio-economic context and the objectives that are expected to be attained through the investment, both directly and indirectly.

2. Identification of the Project: This step involves identifying and evaluating whose costs and benefits must be considered and what indirect and network effects are going to be adequately covered.

3. Identification of the alternatives: In this step, different alternatives are identified and there is a Justification of the project design (scale, location, etc.) against alternative scenarios.

4. Financial Analysis: After identifying the alternatives, the next step is financial analysis which is based on the discounted cash flow approach and contains the traditional inflows and outflows of the project.

5. Economic Analysis: In this step, the cost benefit analysis is implemented. CBA requires an investigation of a project’s net impact on economic welfare.

6. Risk Assessment: In this step, the project appraisal document must include an assessment of the project risks. This can be achieved by Sensitivity analysis, Probability distribution on important impacts, Performance indicators. Finally, there must be a discussion of the results compared to risk levels and a discussion how to mitigate the risks.

[edit] What is BCR?

The Benefit Cost Ratio is a profitability indicator, and it is the ratio of the present value of the benefit of the project to the present value of the cost. It is usually used to summarize the results of the cost benefit analysis (CBA) during the financial analysis of a proposed program, project or portfolio.[1] The origins of BCR can be traced back to the early 20th century when economists and engineers first began developing methods to evaluate the costs and benefits of public infrastructure projects. . One of the BCR’s earliest known applications was in the United States in the 1920s, when the Bureau of Public Roads began to use it to evaluate the economic benefits of transportation projects. BCR began to be used as more in the 1930s and 1940s, when economists and engineers needed to refine and standardize methods for estimating costs and benefits.

Today, the BCR is widely used by the public and private sectors to assess the economic viability of many projects and investments, such as transportation infrastructure, power generation facilities and public health initiatives etc.

BCR is another way of comparing the present value of a project’s costs with the present value of its benefits. If the value of BCR of a project is greater than 1.0, the project is expected to have also a positive NPV and to have an internal rate of return (IRR) higher than the discount rate used in the calculations. When the BCR has a value equal to 1.0, indicates that the NPV of expected profits equals the costs. If BCR of a project is less than 1.0, the project's costs outweigh the benefits, and it should not be feasible. [8]

In the last case, the project does require financial support. For that reason the economic analysis is mandatory to examine if the society is better off with or without the project. To achieve that, there is a evaluation of non-markets impacts and fiscal corrections.

[edit] Time value of money

Benefits and costs have a higher value today than tomorrow. The time value of money is a basic financial concept used to calculate the present value of an amount of money today compared to its future value. This concept is based on the idea that money has a time value because it can earn interest over time. In other words, a dollar received today is worth more than a dollar received in the future due to the potential to earn additional. [2]

There is a need for discounting when comparing any flow of funds (costs and revenues or benefits) over time. To consider the process of discounting in practice, consider two investment projects, A and B. The net cash flows of these projects are given as:

The values of each year need to be discounted to calculate the present value (PV), that can happen by multiplying each year's cash flow by a discount factor, which is determined by the discount rate and the number of years into the future the cash flow occurs. There is an example for these calculations making the usual assumption that the discount rate is constant from year to year.

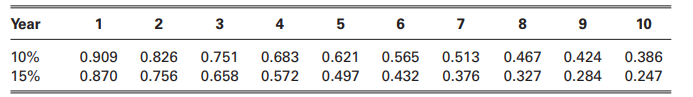

Discount Factors for 10% and 15% Discount Rates

[edit] Discount Rate

The rate at which a society is ready to exchange present consumption for future consumption is measured by the social discount rate. The discount rate is the rate of interest used to calculate the present value of future cash flows in economic appraisals. It is used to discount the expected future cash flows to their present value. The discount rate used in economic appraisals is usually determined by the current level of interest rates. Discounting is used when monetary values are distributed in time and these values should be added together in a specific year. A simple way of understanding discounting is to see it as a weight with this weight (1+i)^t determined as a function of t and the discount rate is i, as it can be seen below: [4]

A project with a cost of 1€ and with discount rate equal to 2%, has to produce benefits of 2.7€ in 50 years would be socially acceptable. However, in the case the discount rate was 5% the break-even benefit would be approximately 11.5€. For that reason, the social planners using a high discount rate tend to favor projects with benefits, which are producing benefits in a short period of time. In practice, there are two types of discount rate, the social opportunity cost and social time preference.[9]

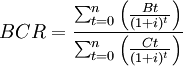

[edit] How to Calculate BCR?

Where:

t: The calculation period in years

Bt: Benefits in year t

Ct: Costs in year t

i: The discount rate

[edit] Examples

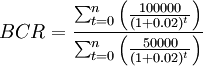

Example 1

In this section, there will be an example of how BCR can be calculated in a scenario. A company decides to lease the equipment needed for a project for $50,000 rather than purchasing it. The discount rate is 2%, and the renovations are expected to increase the company's annual profit by $100,000 for the next three years.[8]

In this example, the BCR of the project is 5.77, which indicates that the project is feasible. Moreover, the company could expect $5.77 in benefits for each $1 of costs.

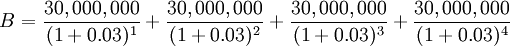

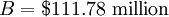

Example 2

The government is considering building a new railway, and they want to calculate the Benefit-Cost Ratio (BCR) of the project to determine if the project is feasible. The construction cost will be $100 million and the railway is expected to generate 30 million in benefits for each year over the next 4 years. The discount Ratio is 3%.

The BCR is greater than 1 indicates that the project is economically viable.

[edit] Comparison Between BCR and NPV

BCR and NPV are two different methods of financial appraisal, that are used to evaluate the profitability of investment projects. BCR measures the ratio of benefits to costs, while NPV measures the present value of future cash flows. Both methods measure the profitability of an investment with different methods. BCR focuses on determining ROI, while NPV takes into account the present value of future cash flows.[10] However, BCR doesn't provide an absolute measure of profitability. For that reason, NPV is considered to be a more reliable measure of profitability. [11]

Comparing or ranking two or more projects, again assuming no budget constraint, the BCR decision-rule can give incorrect results. For example, comparing two different projects A and B , where:

For the projects A and B, the BCR value is 1.67 and 1.78, respectively. However, using the NPV decision-rule would place A (NPV=40) above B (NPV=35). In this situation the NPV decision-rule would be the correct one to consider for ranking purposes, unless there is a budget constraint.[11]

[edit] Other formulas of CBA

1. Payback Period = Initial Investment / Annual Cash Inflow

The payback period is the length of time it takes for the initial investment to be recovered through the annual cash inflows generated by the investment.[10]

For example, if the project requires an initial investment of $10,000 and generates annual cash inflows of $2,000, the payback period would be:

2. Return on Investment = Annual Net Income / Initial Investment

It is a financial metric used to measure the profitability of an investment. It is expressed as a percentage and is calculated as the ratio of the net profit or benefit of an investment and the cost of the investment.

For example, an investment cost is $10,000 in a stock and it is sold it for $12,000, the profit would be $2,000. The total cost of investment including fees and taxes was $11,000, ROI would be:

Net income is the amount of money gained from an investment after all expenses have been paid. The initial investment includes all costs associated with the investment, such as purchase price, fees, and any other expenses. A higher ROI suggests a more profitable investment, whereas a lower ROI can imply a less successful investment.[10]

3. Net Present Value = Net Present Value / Initial Investment

It is a financial metric used to calculate the present value of future cash flows generated by an investment, taking into account the time value of money. It is a common indicator for the profitability of a project or investment proposal. If the value of NPV is positive, it shows that the investment is feasible and is expected to generate a positive return. If the NPV is negative, it means that the investment is expected to generate a negative return. [10]

Where:

B: is the Benefits in period t

C: is the Cost in period t

r: is the discount rate

n: The calculation period of the project in years

4. Internal Rate of Return = Internal Rate of Return / Discount Rate

Internal Rate of Return (IRR) is a tool of measurement of the profitability of a project and is defined as the discount rate that makes the net present value (NPV) from a particular project to be zero. The purpose is to determine the rate i that balances the benefits and costs. The IRR of each project must be higher than the discount rate and the project with higher IRR value, are more desirable. An important benefit of IRR is the fact that IRR considers the time value of money and offers a more precise indicator of an investment's profitability over time.[8]

5. Profitability Index = Present Value of Future Cash Flows / Initial Investment

The profitability index (PI), alternatively referred to as value investment ratio (VIR) or profit investment ratio (PIR), describes an index that represents the relationship between the costs and benefits of a proposed project. The PI is a useful tool for evaluating investments because it takes into account both the magnitude and timing of cash flows. A PI greater than 1 indicates that the investment is expected to generate positive cash flows.[8]

[edit] Advantages of BCR

1. The BCR uses the absolute amounts of benefits and costs into a ratio and can achieve a direct comparison of the benefits and costs of a project. It is financial metric that compares the total present value of benefits to the total present value of costs for a project.

2. The BCR is a relatively a simple tool to use and a good starting point for the financial analysis to determine the desirability of a project.

3. To calculate the BCR, the time value of money through the discount rate must be considered. By taking into account the time value of money, the results are more accurate about of the assessment of the project's profitability. [12]

[edit] Limitations of BCR

1. The main limitation of the BCR is that it reduces a project to a simple number when the feasibility of an investment or a project relies on many factors and can be undermined by unforeseen events.

2. The calculation of BCR of a project depends in many assumptions. For example, an incorrect discount rate would lead to a flawed ratio.

3. The project's potential externalities or spillover effects are not taken into account by the BCR technique. The BCR result, for instance, may not account for unanticipated negative effects a project may have on the environment or nearby communities.

4. The BCR is commonly used in conjunction with other financial metrics, in order to format a well-informed decisions about project feasibility.

5. This method relies heavily an accurate forecasting of future costs and benefits, which can be difficult to predict with certainty. This may result in overly optimistic benefits estimates or underestimated costs, which may compromise the reliability of the BCR result. [12]

[edit] Annotated Bibliography

Shively G., An Overview of Benefit-Cost Analysis., (Gerald Shively, Purdue University, 2012)

This comprehensive book on cost-benefit analysis (CBA) covers the concepts and techniques used to evaluate the economic efficiency of policies and projects. The authors explore how to identify, measure, and value the costs and benefits of different policy options, including social welfare, environmental impacts, and public health outcomes.

Häcker J. and Ernst D., Ch. 8 - Investment Appraisal. In: Financial Modeling. Global Financial Markets, (Palgrave Macmillan, London, 2017), pp. 343-384

The investment appraisal chapter in the financial modeling book by Häcker J. and Ernst D. presents the concept of financial assessment and provides a good overview of methodologies used in assessing a project, program, or portfolio. The concept of NPV, the concept of BCR, how to calculate NPV and BCR are all well explained in this book.

H. Lopez ., The Social Discount Rate: Estimates for Nine Latin American Countries, (H. Lopez , 2012)

This article presents information about the discount rate, providing more in-depth knowledge. It highlights the importance of the time value of money and approaches used to select the suitable discount rate.

Dupuis Xavier , Applications and limitations of cost-benefit analysis as applied to cultural development, (1985)

This book on cost-benefit analysis (CBA) presents the limitation of the different tools used on the financial appraisal. The author, Dupuis Xavier, provides an in-depth analysis of CBA as applied to cultural development and examines its strengths and weaknesses.

[edit] References

- ↑ 1.0 1.1 1.2 Shively G., An Overview of Benefit-Cost Analysis., (Gerald Shively, Purdue University, 2012),

- ↑ 2.0 2.1 CFI Team., Benefit-Cost Ratio (BCR), https://corporatefinanceinstitute.com/resources/accounting/benefit-cost-ratio-bcr

- ↑ E.J. Mishan ., Cost-Benefit Analysis., (E.J. Mishan, Euston Quah , 2020),

- ↑ 4.0 4.1 4.2 4.3 4.4 European Commission , Guide to Cost-Benefit Analysis of Investment Projects, (2014), https://wayback.archive-it.org/12090/20221203224508/https://ec.europa.eu/inea/sites/default/files/cba_guide_cohesion_policy.pdf

- ↑ Kenneth Arrow , Social Choice and Individual Values, (1951),

- ↑ Richard L. Schmalensee and Robert N. Stavins , The Use of Benefit-Cost Analysis in Environmental, Health, and Safety Regulation, (2013),

- ↑ Häcker J. and Ernst D., Ch. 8 - Investment Appraisal. In: Financial Modeling. Global Financial Markets, (Palgrave Macmillan, London, 2017), pp. 343-384, https://doi.org/10.1057/978-1-137-42658-1_8

- ↑ 8.0 8.1 8.2 8.3 investopedia , Profitability Index (PI): Definition, Components, and Formula, https://www.investopedia.com/terms/p/profitability.asp

- ↑ H. Lopez ., The Social Discount Rate: Estimates for Nine Latin American Countries, (H. Lopez , 2012),

- ↑ 10.0 10.1 10.2 10.3 Žižlavský, O., Net present value approach: method for economic assessment of innovation projects. Procedia-Social and Behavioral Sciences, 19th International Scientific Conference, Economics and Management, 156 (2014), pp. 506-512.

- ↑ 11.0 11.1 Harry F. Campbell and Richard P. C. Brown , Benefit-Cost Analysis: Financial and Economic Appraisal using Spreadsheets, (2003),

- ↑ 12.0 12.1 Dupuis Xavier , Applications and limitations of cost-benefit analysis as applied to cultural development, (1985), https://unesdoc.unesco.org/ark:/48223/pf0000081977