Contingency Reserves

| Line 55: | Line 55: | ||

=== Probabilistic Methods === | === Probabilistic Methods === | ||

| − | ==== Probability Tree ==== | + | ==== Simulation Methods ==== |

| + | |||

| + | ===== Probability Tree ===== | ||

A diagrammatic representation where identified risks are systematically coupled with the possible outcomes, using statistical techniques. Each individual risk is associated with a conditional expected value impact and probability of occurrence .After identifying all the risks the “best” path, with the highest result, should be the appropriate choice for the contingency amount. Note that the probability tree method can become increasingly extensive and impractical to use when dealing with large projects consisting of many layers of risks. | A diagrammatic representation where identified risks are systematically coupled with the possible outcomes, using statistical techniques. Each individual risk is associated with a conditional expected value impact and probability of occurrence .After identifying all the risks the “best” path, with the highest result, should be the appropriate choice for the contingency amount. Note that the probability tree method can become increasingly extensive and impractical to use when dealing with large projects consisting of many layers of risks. | ||

PICTURE | PICTURE | ||

| − | ==== First Order Second Method ==== | + | ===== First Order Second Method ===== |

Approximate calculation methods to calculate standard deviation of complex functions using linear algebra functions. | Approximate calculation methods to calculate standard deviation of complex functions using linear algebra functions. | ||

| − | ==== Expected Value ==== | + | ===== Expected Value ===== |

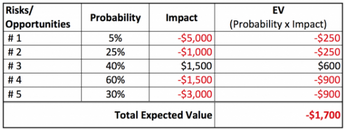

Just like the probability tree, each risk is coupled with the impact and probability of the event. Unlike the probability tree these events are not conditional events, therefore to calculating the contingency fund is simply the summation of all risks. An example is shown below to illustrate this better. | Just like the probability tree, each risk is coupled with the impact and probability of the event. Unlike the probability tree these events are not conditional events, therefore to calculating the contingency fund is simply the summation of all risks. An example is shown below to illustrate this better. | ||

| − | [[File:EV.png|thumb| | + | [[File:EV.png|thumb|center|x130px|alt=EV|Table 1: Example of Expected Value, adapted from Project Controls Academy [https://www.projectcontrolacademy.com/cost-contingency-calculation/]]] |

| + | |||

| + | ===== Program Evaluation and Review Technique (PERT) ===== | ||

| + | ===== Parametric estimating ===== | ||

| + | ===== Regression Analysis ===== | ||

| + | ===== Analytical hierarchy Process (AHP)===== | ||

| + | ===== Reference Class Forecasting ===== | ||

| + | |||

| + | === Simulation Methods === | ||

| + | |||

| + | ==== Range Estimating ==== | ||

| − | ==== | + | ==== Integrated models for cost and schedule ==== |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

== Limitations and critics == | == Limitations and critics == | ||

Revision as of 10:53, 2 October 2017

Contents |

Abstract

Developing reserves is an important part of project management planning. Managing reserves crucial for accounting for project known and unknown risks by offering some cushioning in the estimate budget while providing a more realistic business case.

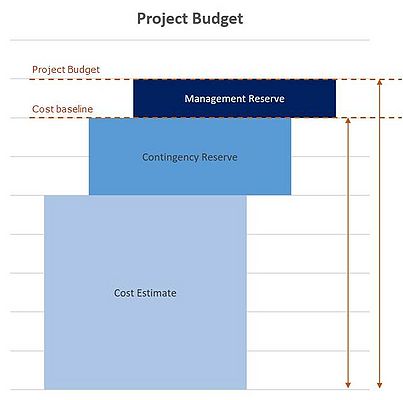

Two types of reserves exist on a capital project [1]: cost contingency reserve and management reserve. Cost contingency reserve is referred to an amount added to the project’s base estimate to cover for known-unknowns. Cost contingency does not cover any major scope changes, nor escalation or extraordinary events. Management reserve (sometimes referred as management contingency) covers the unknown-unknowns of the project, and is not included in the base estimate, meaning that the project manager or project controller is only permitted to use this reserve if the organizational management approves, unlike contingency reserves which is usually expended. The purpose of allocating contingency to the base estimate is essentially a form of mitigating risk that accounts for such uncertainties. This article explains the purpose of contingency reserves, some of its calculation methods and concludes a discussion on contingency reserves.

Motivation

There are multiple reasons why project managers should include contingency reserves. Including contingency reserves is an effective method to help control the budget and represent uncertainty. It is intended to cover costs that are not included in the base estimate of the project and to absorb any of the risks that might occur, jeopardizing the project’s costs or schedule. Managing contingency reserves enhances the predictability of the project outcomes by providing buffers against cost overruns, exhausting funds or delays [2]. Applying contingency reserves in the project’s cost can play an important role in addressing the project risk profile to important stakeholders across the organization by demonstrating the stability of the project’s outcomes. As the project matures, and project risks decrease, the contingency reserves should decrease as well.

Contingency vs Management Reserve

Contingency reserve and management reserve differ from each other and cover different spectrums of the project budget reserves. Figure 1 shows that project contingency is added to the cost estimate and is part of the cost baseline. While management is added on top of the cost baseline to complete the project budget [3]

Contingency Reserve

Contingency is allocated to cover the known-unknowns (PMI 2013) and is defined by the Association for the Advancement of Cost Engineering (AACE) as, items, conditions, or events for which the state, occurrence and/or effect is uncertain but is likely to result in additional costs. This excludes major scope changes, extraordinary events, management reserves, and escalation [1].

Management Reserve

The AACE defines management reserves as an added fund to the estimate to allow “discretionary management purposes outside of the defined scope of the project”. Therefore, management reserve is only controllable by the project manager when approved by upper management and contingency reserve is within the project manager’s control.

Management reserves on the other hand is allocated for the unknown-unknowns and is usually determined by the organization while contingency can be determined using different methods.

Project Management Institute. (2013). A guide to the project management body of knowledge (PMBOK® guide) – Fifth edition. Newtown Square, PA: Author

Calculaton Methods

There are many ways to establish cost contingency reserves; from applying simple fixed percentages to involving complex mathematical models. The AACE recognizes the following four major groups for calculating cost contingency:

- Expert Judgement

- Predetermined modelling

- Simulation analysis

- Parametric Modeling

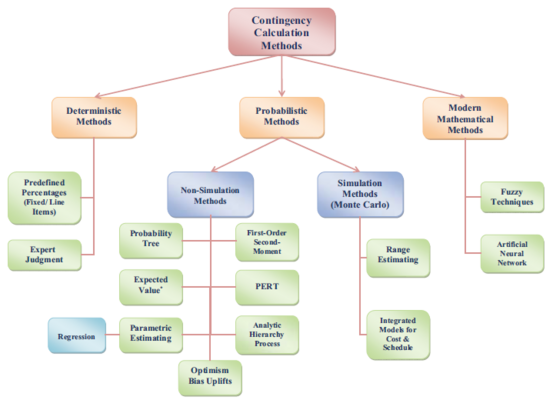

Schneck et. al,classifies two groups: (1) deterministic Models and (2) probabilistic models. And Bakhshi and Touran even add a third group to the sequence, (3) modern mathematical models. Deterministic methods are the most common and simplest method to determine contingency reserve amounts. Probabilistic and modern mathematical models are not only more complex, but also more resource costly. Even though the different classifications of estimating methods exist, most of the common methods are included. This article will alaborate on some the most common methods of the entire list of calculation methods presented by Bakhski and Touran, shown in Figure 2.

Deterministic Methods

Predetermined Percentage/Guidelines

This method is the most common and most simple one to use. A fixed percentage can be applied on the total budget or can be aggregated on each type of cost estimate. The AACE has provided predetermined guideline consisting of a table of “Classes of estimates” with different specific “expected range boundaries” , Using this method is effective, and doesn’t require expert judgement but lacks consideration of risk impacts unique to the project.

Expert Judgement

One or multiple specialists (either internal or external) with expertise in risk analysis in the specific project determine the contingency amount. Since this method is qualitative based, confidence levels cannot be provided.

Probabilistic Methods

Simulation Methods

Probability Tree

A diagrammatic representation where identified risks are systematically coupled with the possible outcomes, using statistical techniques. Each individual risk is associated with a conditional expected value impact and probability of occurrence .After identifying all the risks the “best” path, with the highest result, should be the appropriate choice for the contingency amount. Note that the probability tree method can become increasingly extensive and impractical to use when dealing with large projects consisting of many layers of risks.

PICTURE

First Order Second Method

Approximate calculation methods to calculate standard deviation of complex functions using linear algebra functions.

Expected Value

Just like the probability tree, each risk is coupled with the impact and probability of the event. Unlike the probability tree these events are not conditional events, therefore to calculating the contingency fund is simply the summation of all risks. An example is shown below to illustrate this better.

Program Evaluation and Review Technique (PERT)

Parametric estimating

Regression Analysis

Analytical hierarchy Process (AHP)

Reference Class Forecasting

Simulation Methods

Range Estimating

Integrated models for cost and schedule

== Limitations and critics ==