Ebitda

| (5 intermediate revisions by one user not shown) | |||

| Line 11: | Line 11: | ||

[[File:Ebitda-example-detail.png]] | [[File:Ebitda-example-detail.png]] | ||

| + | Collected from Corporate Finance Institute: [https://corporatefinanceinstitute.com/resources/knowledge/finance/what-is-ebitda/] | ||

| Line 75: | Line 76: | ||

== Calculation == | == Calculation == | ||

| − | There are two ways of calculating EBITDA, either through using operating income or by starting with net income. With the first one, the formula equates to EBITDA = operating income +depreciation + appreciation. The latter equation is given by EBITDA = Net income + taxes + interest expense + depreciation + amortization. Which one of these to use simply comes down to numbers available, and personal preference. | + | There are two ways of calculating EBITDA, either through using operating income or by starting with net income. With the first one, the formula equates to EBITDA = operating income +depreciation + appreciation. The latter equation is given by EBITDA = Net income + taxes + interest expense + depreciation + amortization. Which one of these to use simply comes down to numbers available, and personal preference.(Corporate Finance Institute, 2022)[https://corporatefinanceinstitute.com/resources/knowledge/finance/what-is-ebitda/] |

[[File:How-to-calculate-ebitda.jpg]] | [[File:How-to-calculate-ebitda.jpg]] | ||

| + | Collected from Collected from My Accounting Course: [https://www.myaccountingcourse.com/financial-ratios/ebitda] | ||

| Line 87: | Line 89: | ||

== References == | == References == | ||

| − | Corporate Finance Institute. (2022, 02 22). Corporate Finance Institute. | + | Corporate Finance Institute. (2022, 02 22). Corporate Finance Institute. Collected from Corporate Finance Institute: https://corporatefinanceinstitute.com/resources/knowledge/accounting/non-gaap-earnings/ |

| + | Corporate Finance Institute. (n.d.). What is ebitda. Retrieved from Corporate Finance Institute: https://corporatefinanceinstitute.com/resources/knowledge/finance/what-is-ebitda/ | ||

Graham, B. (1973). The Intelligent Investor. Harper Collins Publishers. | Graham, B. (1973). The Intelligent Investor. Harper Collins Publishers. | ||

| − | Internet Archive. (2022, 02 20). Business Dictionary. | + | My Accounting Course. (n.d.). Ebitda. Retrieved from My Accounting Course: https://www.myaccountingcourse.com/financial-ratios/ebitda |

| + | Internet Archive. (2022, 02 20). Business Dictionary. Collected from Internet Archive: https://web.archive.org/web/20170715120752/http://www.businessdictionary.com/definition/amortization.html | ||

Luciano, R. (2003). EBITDA [Earnings before Interest, Tax, Depreciation and Amortisation] as an indicator of earnings quality. JASSA. | Luciano, R. (2003). EBITDA [Earnings before Interest, Tax, Depreciation and Amortisation] as an indicator of earnings quality. JASSA. | ||

Nissim, D. (2019). EBITDA, EBITA or EBIT. Colombia Business School. | Nissim, D. (2019). EBITDA, EBITA or EBIT. Colombia Business School. | ||

| − | Peterson, R. H. (2002, 02 20). Accounting for Fixed Assets. John Wiley and Sons. | + | Peterson, R. H. (2002, 02 20). Accounting for Fixed Assets. John Wiley and Sons. Collected from Bench: https://bench.co/blog/tax-tips/depreciation/ |

Previts, G. J. (2002). Research in Accounting. JAI. | Previts, G. J. (2002). Research in Accounting. JAI. | ||

| − | Pritchard, J. (2022, 02 19). What is Interest? | + | Pritchard, J. (2022, 02 19). What is Interest? Collected from The Balance: https://www.thebalance.com/what-is-interest-315436 |

Latest revision as of 01:15, 28 March 2022

Contents |

[edit] Abstract

The objective of this article is to explain the meaning, purpose, and usage of the term “EBITDA”. First, a general overview is provided, detailing each of the words included in the abbreviation EBITDA, in addition to the relation to the topic of project, program and portfolio management. Thereafter, EBITDA is further explained as a standardized term within accounting procedures. The advantages and disadvantages of this accounting technique are then discussed.

[edit] Introduction

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a measure of a company’s operating profit. As the abbreviation entails, this operating profit is measured before the mentioned expenses of interest, taxes, depreciation, and amortization are calculated into the earnings. When one accounts for these, the net profit is found. EBITDA is a common measurement of a company’s financial success over a given period. As one might expect, this measurement can have some drawbacks in addition to strengths. This article relates to the topic of advanced engineering project, program, and portfolio management as it is a common indicator of financial success within a portfolio. Achieving a better EBITDA is the main goal within the management of many enterprises. As mentioned, it could be discussed whether this is positive or negative, but generally, investors are pleased with an improvement in EBITDA, and financial newspapers will often highlight these in their slates detailing companies’ earnings reports. It is therefore wise for any project, program, or portfolio manager to understand EBITDA.

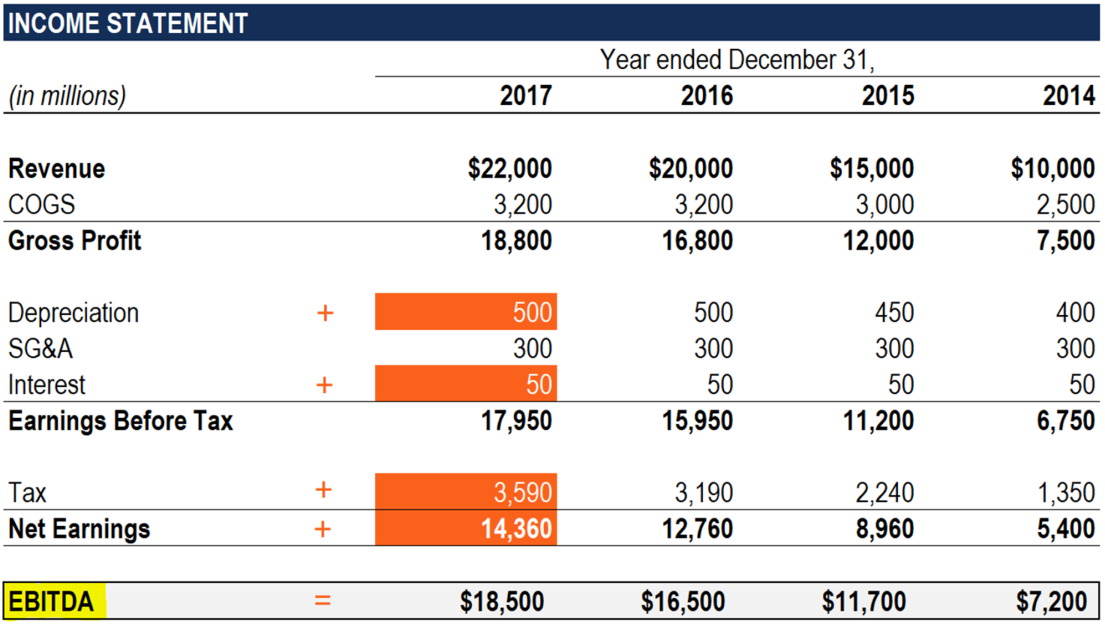

Collected from Corporate Finance Institute: [1]

Collected from Corporate Finance Institute: [1]

[edit] Earnings

Earnings are the sum of revenues after general expenses have been removed from the total. The earnings of a firm are both affected by internal and external factors. Although there are several ways of accounting for earnings, this article will focus on the mentioned EBITDA method. Furthermore, there will be more focus on the non-GAAP EBITDA. (Luciano, 2003) GAAP (Generally Accepted Accounting Principles) EBITDA is the regulatory correct of calculating EBITDA in f.eks. the United States of America. This means US companies must provide in their regulatory earnings filings. Non-GAAP on the other hand can be seen as adjusted earnings, where the numbers have been slightly adjusted to provide more visibility to investors. (Luciano, 2003)

[edit] Interest

Interest is generally the expenses an individual, a company, or an organization incurs by borrowing money and paying the borrower a certain amount in return for the loan. There are several different forms of interest, but seeing as this article is about EBITDA, the interest will relate to the interest expenses of a company. Most often, public companies will take loans from banks or a collection of individuals in the stock market. (Pritchard, 2022) This is either done by the firm approaching a bank for a loan, wherein giving the bank interest in exchange for the loan, or by issuing corporate bonds that are sold to investors. Both types will be noted on the company’s balance sheet as liabilities. They will however also be noted as assets, and the initial acquisition of a loan before investments or interest expenses will therefore not change equity too much. (Pritchard, 2022)[2]

[edit] Taxes

Taxes are deducted from the companies’ earnings as revenues for the government in the countries that a business operates in. From the perspective of an expense, this is a rather large portion of outflows from a firm. In return, however, it fluctuates based on financial success. Therefore, a business that operates in an insecure market will pay high taxes when operations are going well, and low taxes if revenues are destroyed. This contrasts with interest and amortization which generally must be paid no matter the present circumstances. (Graham, 1973)

[edit] Depreciation

Depreciation is the financial depletion of assets that a company accounts for in its income statement. This could f.eks. be a machine that will operate for 10 years. As the machine gets older and older, the owner will reduce the value of the machine, marking it as depreciation. A machine bought for 100.000$ could then be deducted in value by 10.000$ in the balance sheet every year for 10 years. These 10.000$ would then be accounted as depreciation for the owner. There are several methods a corporation could calculate depreciation by. Seeing as articles could be written about each of these, they will not be explained here. (Peterson, 2002)

[edit] Amortization

Amortization has two meanings. It could refer to the repayments of loans or loan interest over a set period. Where a borrower will pay x amount at y interval. Or it is similar to the accounting process of depreciation where an asset’s capital expenses will be spread out over a given period. As the latter is explained by depreciation, this chapter will focus on the former meaning. (Internet Archive, 2022) Loan repayments can either be divided over a period, thereby ensuring a portion of revenues are utilized to repay the lender, or they can be repaid at the loan's maturity date with regular payments for the interest expenses. As enterprises generally prefer to not have too much cash and cash equivalents sitting idly by, the procedure of postponing debt-repayments until maturity is generally done to restructure the debt. (Internet Archive, 2022)

[edit] US GAAP EBITDA

Generally Accepted Accounting Procedure EBITDA is the standardized practice in the USA for providing EBITDA in financial disclosures. Every public company listed in the US must provide this in its financial reports to potential investors and the government. It was developed by the Financial Accounting Standards Board (FASB), and attempts to improve visibility, understanding, standardization, and likeness of EBITDA reporting. (Corporate Finance Institute, 2022)

[edit] Non-GAAP EBITDA

Non-GAAP EBITDA or Adjusted EBITDA is the more common of these two different types. For every company, the factors on which they base these numbers can differ. This method is generally the more interesting of the two types for investors, as it may include details that are specific to a company but would otherwise not appear in the GAAP EBITDA. (Corporate Finance Institute, 2022)[3]

[edit] Ebitda

As stated, usage of EBITDA is widely accepted in the stock market community as an indicator of a company’s financial health. Investors argue for the validity of this indicator, as some claim it is a poor valuation metric as opposed to cash-flow f.eks, while others claim it is better. Generally, it is always best to combine different types and acquire a full detailed picture. In this case, EBITDA is one of the majors one should consider looking at. (Nissim, 2019)

The reasoning behind this is that EBITDA excludes one-offs such as depreciation, which sometimes can create serious devastation on the final net profit in an earnings sheet. While cash flow also would exclude this factor, amortization could impact this heavily. Some industries will have such a large depreciation that it turns the whole net profit negative based on an adjustment of assets. This was evidenced during 2020, when oil companies depreciated the worth of hydrocarbon reserves not yet produced, due to the lower price of oil. As the oil price is now at an all-time high in several currencies, this might have proved to be an unnecessary action, made necessary due to accounting regulations. Someone who just looks at net profits would therefore see a worse picture than someone who just looks at EBITDA. (Nissim, 2019)

This works both ways, as EBITDA may provide an incomplete picture compared to reality within an earnings report. This is particularly true for the industry sector, as machines and such must be replaced after a certain time period. While one might get the impression that the company is making money over a five-year period looking at EBITDA, this might not be true. As suddenly the total EBITDA might turn negative when new machines need to be purchased. (Previts, 2002)

[edit] Calculation

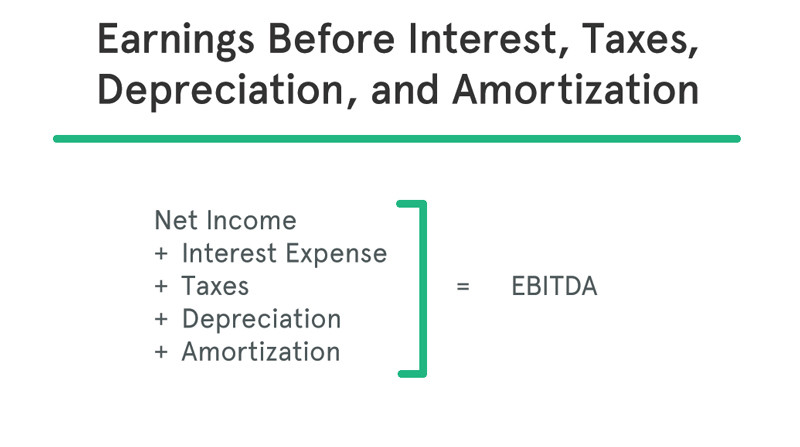

There are two ways of calculating EBITDA, either through using operating income or by starting with net income. With the first one, the formula equates to EBITDA = operating income +depreciation + appreciation. The latter equation is given by EBITDA = Net income + taxes + interest expense + depreciation + amortization. Which one of these to use simply comes down to numbers available, and personal preference.(Corporate Finance Institute, 2022)[4]

Collected from Collected from My Accounting Course: [5]

Collected from Collected from My Accounting Course: [5]

[edit] Application

A project, program or portfolio manager can utilize this tool in order to analyze past, current and future profitability, and plan accordingly. By drafting an expected EBITDA, one can attract investment and appease current stakeholders by delivering information relative to expected earnings. Furthermore, the tool can also be used as an indicator of success in previous ventures, providing feedback as to how well a project performed. With this statistic, one can then reflect over where improvements could be made, what worked, and why the final earnings ended up where they did.

[edit] References

Corporate Finance Institute. (2022, 02 22). Corporate Finance Institute. Collected from Corporate Finance Institute: https://corporatefinanceinstitute.com/resources/knowledge/accounting/non-gaap-earnings/ Corporate Finance Institute. (n.d.). What is ebitda. Retrieved from Corporate Finance Institute: https://corporatefinanceinstitute.com/resources/knowledge/finance/what-is-ebitda/ Graham, B. (1973). The Intelligent Investor. Harper Collins Publishers. My Accounting Course. (n.d.). Ebitda. Retrieved from My Accounting Course: https://www.myaccountingcourse.com/financial-ratios/ebitda Internet Archive. (2022, 02 20). Business Dictionary. Collected from Internet Archive: https://web.archive.org/web/20170715120752/http://www.businessdictionary.com/definition/amortization.html Luciano, R. (2003). EBITDA [Earnings before Interest, Tax, Depreciation and Amortisation] as an indicator of earnings quality. JASSA. Nissim, D. (2019). EBITDA, EBITA or EBIT. Colombia Business School. Peterson, R. H. (2002, 02 20). Accounting for Fixed Assets. John Wiley and Sons. Collected from Bench: https://bench.co/blog/tax-tips/depreciation/ Previts, G. J. (2002). Research in Accounting. JAI. Pritchard, J. (2022, 02 19). What is Interest? Collected from The Balance: https://www.thebalance.com/what-is-interest-315436