The Role of Due Diligence in Project Management

| (36 intermediate revisions by one user not shown) | |||

| Line 1: | Line 1: | ||

== Abstract == | == Abstract == | ||

| − | Uncertainty is an inevitable part of any given project and project managers employ a variety of tools and techniques to assess and manage the potential risks that might occur throughout the | + | Uncertainty is an inevitable part of any given project and project managers employ a variety of tools and techniques to assess and manage the potential risks that might occur throughout the project‘s lifecycle. A method that is frequently used is due diligence, often called project due diligence, which typically consists of a cost estimation, review of available data, risk analysis and a comprehensive assessment of the project. The assessment helps organizations to identify and potentially mitigate the risks and uncertainties related to the project. The main purpose of due diligence is to acquire available information about a project and assess if the project is feasible and the potential impacts it can have in the future. |

| − | The purpose of the article is mainly to evaluate the importance and value of due diligence in project management. Due diligence is a crucial component of project planning and the decision-making process for a specific project, where it | + | The purpose of the article is mainly to evaluate the importance and value of due diligence in project management. Due diligence is a crucial component of project planning and the decision-making process for a specific project, where it assists in project managers’ decision-making, so they can make risk-informed decisions based on data and not assumptions. This article will not only give the reader an insight of the purpose and importance of due diligence but more importantly an understanding of the process. A guidance will be provided for the various steps and best practices for the common due diligence techniques, which will help in applying due diligence in different project contexts. The article will go over in detail in how to conduct a project due diligence for a construction project. |

Furthermore, this article provides an insight to the limitations and challenges associated with due diligence in project management. The method will be evaluated based on the potential benefits such as improving project outcomes by lowering risk and improving project planning and decision-making, as well as its potential challenges, such as lack of sufficient or reliable data and significant investment costs. | Furthermore, this article provides an insight to the limitations and challenges associated with due diligence in project management. The method will be evaluated based on the potential benefits such as improving project outcomes by lowering risk and improving project planning and decision-making, as well as its potential challenges, such as lack of sufficient or reliable data and significant investment costs. | ||

| Line 10: | Line 10: | ||

== The Big Idea: An Introduction == | == The Big Idea: An Introduction == | ||

| − | Although due diligence is not a new concept, project due diligence is relatively new and has grown in significance over time. It is a term describing the process of evaluating a company, an investment, or a project. Project due diligence is not a legal obligation, it is a voluntary management tool that is part of a responsible risk management strategy. When it comes to project management it is of great importance to have a project scope for a given project to ensure that the project is properly planned, carried out and ultimately achieves its intended goals. It involves conducting a comprehensive analysis of the upcoming project to identify potential risks and challenges that may impact its success. However, conducting a due diligence is about reducing the uncertainty rather than to eliminate it. Project failures are often the result of the lack of a proper due diligence. | + | Although due diligence is not a new concept, project due diligence is relatively new and has grown in significance over time. It is a term describing the process of evaluating a company, an investment, or a project <ref name=DP> Pan, Jing, Rapp, Randy R., Cox, Robert F. (2012). Construction Due Diligence in Different Project Delivery Systems (2nd ed. 2012 ed.). China Architecture & Building Press. </ref>. Project due diligence is not a legal obligation, it is a voluntary management tool that is part of a responsible risk management strategy <ref name=DD> e3 Plus (2003), E3 Plus: A Framework for Responsible Exploration, Retrieved April 20 from https://www.pdac.ca/docs/default-source/priorities/responsible-exploration/e3-plus---common/e3-plus---toolkits---social-responsibility/due-diligence.pdf?sfvrsn=67c734e2_4 </ref>. When it comes to project management it is of great importance to have a project scope for a given project to ensure that the project is properly planned, carried out and ultimately achieves its intended goals. It involves conducting a comprehensive analysis of the upcoming project to identify potential risks and challenges that may impact its success. However, conducting a due diligence is about reducing the uncertainty rather than to eliminate it <ref name=DG> Smith, Nigel J., Merna, Tony, Jobling, Paul. (2006). Managing Risk in Construction Projects (2nd ed. 2006 ed.). Blackwell. </ref>. Project failures are often the result of the lack of a proper due diligence. |

| − | When the scope of the project has been established the project objectives are defined. It depends on the specific context of a given project what the project objectives will be. It is important to first identify the forces of uncertainty and where the uncertainty is coming from before the risk landscape can be effectively organized. To properly manage the risk, project due diligence must be incorporated into management and planning procedures. | + | When the scope of the project has been established the project objectives are defined. It depends on the specific context of a given project what the project objectives will be. It is important to first identify the forces of uncertainty and where the uncertainty is coming from before the risk landscape can be effectively organized. To properly manage the risk, project due diligence must be incorporated into management and planning procedures <ref name=DA> Thuesen, Christian, Oehmen, Josef. Uncertainty slides – Jan 2023, 24. April 2023. </ref>. |

| − | == | + | == Why carry out project due diligence == |

| − | + | Project due diligence is a responsible business conduct that involves thoroughly assessing the feasibility of a given project. It is an important process for risk identification, which is an action to prevent or mitigate risks. Furthermore, it promotes accountability and assists project managers in making informed decisions. <ref name=DS_31010> OECD (2019), Due Diligence for Responsible Corporate Lending and Securities Underwriting: Key considerations for banks implementing the OECD Guidelines for Multinational Enterprises, Retrieved April 27 from https://mneguidelines.oecd.org/due-diligence-guidance-for-responsible-business-conduct.htm </ref> Conducting a comprehensive project due diligence may return value to investors and minimize negative impacts to people and the environment <ref name=DD> e3 Plus (2003), E3 Plus: A Framework for Responsible Exploration, Retrieved April 20 from https://www.pdac.ca/docs/default-source/priorities/responsible-exploration/e3-plus---common/e3-plus---toolkits---social-responsibility/due-diligence.pdf?sfvrsn=67c734e2_4 </ref>. Traditional due diligence and project due diligence share common similarities, however, due diligence is generally conducted to identify financial and legal risks when acquiring a business, rather than assessing the feasibility of a single project <ref name=DS_31010> OECD (2019), Due Diligence for Responsible Corporate Lending and Securities Underwriting: Key considerations for banks implementing the OECD Guidelines for Multinational Enterprises, Retrieved April 27 from https://mneguidelines.oecd.org/due-diligence-guidance-for-responsible-business-conduct.htm </ref>. | |

| − | + | ||

| + | Project due diligence is a risk management process that often helps the project manager determine just how reliable, or unreliable, the project is and decide if the project should be pursued or not. By conducting an effective project due diligence can help to effectively manage risks associated with the project and avoid potential problems. It can potentially save the project itself <ref name=DD> e3 Plus (2003), E3 Plus: A Framework for Responsible Exploration, Retrieved April 20 from https://www.pdac.ca/docs/default-source/priorities/responsible-exploration/e3-plus---common/e3-plus---toolkits---social-responsibility/due-diligence.pdf?sfvrsn=67c734e2_4 </ref>. In order to integrate “risk thinking” into project management, four risk-informed principles have been identified. The first principle is to create transparency regarding project risks. There are always some types of risks associated in a project and the first principle sets out to explore and identify knowable uncertainties and quantify resulting risks. Once the main risks have been identified, the second principle helps the project manager in making risk-informed decisions. The probability and impact of each inherent risk is identified, and the second principle sets out to decide what actions to take to manage the risks more effectively, usually by dealing with the biggest risks first. The third principle is to minimize uncertainty in projects by reducing both internal and external uncertainty. The risks may vary depending on the project, but project managers must identify the forces of uncertainty and where the uncertainty is coming from. Furthermore, they must identify the categories the risk may impact and have a plan of action ready for if things go wrong. The fourth and last principle deals with creating resilience in the project system <ref name=DA> Thuesen, Christian, Oehmen, Josef. Uncertainty slides – Jan 2023, 24. April 2023. </ref>. When dealing with uncertainty, organizations try to respond to risks with a proactive risk management process, but it is impossible to prepare for every emergent risk. Two strategies have been identified to deal with any unforeseen risks occurring; have a ''flexible'' system in order to be being able to adapt easily and increase the project system’s ''resilience'' to ensure core tasks can continue despite major impacts of unexpected risks <ref name=DE> Wanner, Roland (2020), What Does Resilience Have to Do With Risk Management in Projects?, Retrieved April 26 from https://rolandwanner.com/resilience-in-project-risk-management/ </ref>. | ||

| − | + | By conducting a comprehensive project due diligence, using the four risk-informed principles as a guide, can help project managers to better deal with the associated risks and provide them with a more realistic timeframe for project activities and processes. Project due diligence should be conducted properly, where it is not merely an item for the project manager to cross off their list. Even though the main purpose of due diligence is to identify project-related risks, it shouldn’t be seen as a tool to obstruct opportunities. Instead, if used effectively, it can help project managers in pursuing opportunities with greater confidence because there is a better understanding of the project’s risks <ref name=DD> e3 Plus (2003), E3 Plus: A Framework for Responsible Exploration, Retrieved April 20 from https://www.pdac.ca/docs/default-source/priorities/responsible-exploration/e3-plus---common/e3-plus---toolkits---social-responsibility/due-diligence.pdf?sfvrsn=67c734e2_4 </ref>. Instituting due diligence can be beneficial for a variety of reasons. It can help identify potential operational and project-related risks, reduce cost, provide a better understanding of the project, and significantly reduce the probability of default <ref name=DS_31010> OECD (2019), Due Diligence for Responsible Corporate Lending and Securities Underwriting: Key considerations for banks implementing the OECD Guidelines for Multinational Enterprises, Retrieved April 27 from https://mneguidelines.oecd.org/due-diligence-guidance-for-responsible-business-conduct.htm </ref>. | |

| − | + | ||

| − | + | ||

| − | == The | + | === The main characteristics of project due diligence === |

| − | + | Projects have differences based on their own unique characteristics. In that case, no two projects are alike since they vary in size, budget, duration, and associated risks. However, they do share similarities. As previously stated, the scope of the project may differ, however, conducting a project due diligence should be relatively similar for all projects. Although there is not a specific template to follow when carrying out project due diligence, there are some common characteristics for every due diligence process: | |

| − | + | ||

| + | Due diligence is a ''preventative'' approach rather than a reactive approach. It is important that the project manager takes a proactive approach, so that the company can limit their need for reactive responses that may result in high costs for the company. The primary objective is to prevent causing harm to people and the environment, as well as avoid any negative impacts that are directly linked to the operations or processes of the project. If negative impacts cannot be avoided, companies should use due diligence to mitigate, prevent recurrence, and remediate them <ref name=DS_31010> OECD (2019), Due Diligence for Responsible Corporate Lending and Securities Underwriting: Key considerations for banks implementing the OECD Guidelines for Multinational Enterprises, Retrieved April 27 from https://mneguidelines.oecd.org/due-diligence-guidance-for-responsible-business-conduct.htm </ref>. | ||

| − | + | Due diligence is ''commensurate'' with risk. In other words, the level of project due diligence carried out should be directly proportional to the level of risk associated with the project. Often, risks are given a risk rating according to the probability of the risk occurring and the impact the said risk may have on the project. When the risk rating of a given risk is high, the due diligence becomes more extensive <ref name=DS_31010> OECD (2019), Due Diligence for Responsible Corporate Lending and Securities Underwriting: Key considerations for banks implementing the OECD Guidelines for Multinational Enterprises, Retrieved April 27 from https://mneguidelines.oecd.org/due-diligence-guidance-for-responsible-business-conduct.htm </ref>. | |

| − | + | ||

| − | + | ||

| − | + | ||

| + | Due diligence can involve ''prioritization'' of risks. The project manager should prioritize the risks according to the probability of the individual risk occurring and the impact it may have on the project. It is not feasible to deal with every risk at once, so the risk with the most negative impact is dealt with first. When the risks resulting in the most negative impacts have been dealt with, the less significant risks will then be addressed <ref name=DS_31010> OECD (2019), Due Diligence for Responsible Corporate Lending and Securities Underwriting: Key considerations for banks implementing the OECD Guidelines for Multinational Enterprises, Retrieved April 27 from https://mneguidelines.oecd.org/due-diligence-guidance-for-responsible-business-conduct.htm </ref>. | ||

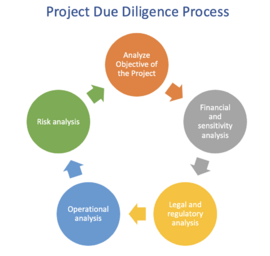

| − | = | + | Due diligence is ''dynamic'' and not static. As can be seen in figure 1, the due diligence process is ongoing, responsive, and changing. If new risks, with higher probability of negative impacts are identified later in the process, they are immediately moved higher on the list of risks waiting to be dealt with accordingly. It is important that the project manager takes the dynamic approach, where he regularly reviews the prioritization of risks and updates the list when new risks are identified <ref name=DS_31010> OECD (2019), Due Diligence for Responsible Corporate Lending and Securities Underwriting: Key considerations for banks implementing the OECD Guidelines for Multinational Enterprises, Retrieved April 27 from https://mneguidelines.oecd.org/due-diligence-guidance-for-responsible-business-conduct.htm </ref>. |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| + | When conducting project due diligence, it is important to keep in mind the aforementioned characteristics in order to maintain the risk profile. Project managers need to keep an updated list of all identified risks within the project to ensure that decisions are made with the latest available information. Additionally, the project’s scope and objectives should frequently be reviewed, in order to make sure they are still aligned with the company’s goals <ref name=DG> Smith, Nigel J., Merna, Tony, Jobling, Paul. (2006). Managing Risk in Construction Projects (2nd ed. 2006 ed.). Blackwell. </ref>. | ||

| − | |||

| + | == The application of project due diligence: Common techniques used == | ||

| + | Project due diligence can be conducted in project, program, and portfolio management to identify and mitigate potential risks in order to make risk-informed decisions about a given project. Thus, it can be favorably used by the project manager to support their decisions. Project due diligence is the process of evaluating the risks associated with a project throughout its entire life cycle <ref name=DH> r2a: Due diligence engineers (2012), Project Due Diligence vs Project Management, Retrieved April 28 from https://r2a.com.au/risk-management-framework-project-due-diligence/</ref>. In fact, many large-scale projects are not put through a thorough review process, resulting in excessive costs and delays. Large projects often have common similarities, going over budget, take longer than expected, and deliver less value than predicted. The primary reason of it happening is often a lack of upfront due diligence. Enforcing upfront accountability on project managers may lead to a more thorough and comprehensive due diligence. Project managers often take a reactive approach, where they spend a considerable amount of time analyzing why tasks fell behind and money was overspent. However, if the proactive approach was taken more often, resulting in the investment in upfront due diligence, projects would be better planned and executed <ref name=DF> Jahagirdar, Ketan (2019), Mitigate Project Risk With Upfront Due Diligence And Accountability, Retrieved April 26 from https://www.forbes.com/sites/forbesbusinesscouncil/2019/11/25/mitigate-project-risk-with-upfront-due-diligence-and-accountability/?sh=401c2e303ebc </ref>. | ||

| − | = | + | [[File:process.png|thumb|right|upright=1.5|Figure 1: Project Due Diligence Process (source: own figure).]] |

| − | + | ||

| + | Identifying the risk controls is only the first step. To aid this process, project managers may use a risk catalogue, which is a structured compilation of potential project risk events. The risk catalogue provides a list of known areas of uncertainty, however, the list is open-ended, meaning that they may need to look beyond the list in order to identify unusual but critical risks. The risk catalogue can also be used to enter preventative or reactive measures for risk avoidance <ref name=DJ> Thuesen, Christian, Oehmen, Josef. Week 10 – Risk, Uncertainty, Ignorance, 25. April 2023. </ref>. A risk catalogue of the most common risks that can occur within a project or program, used as a guidance and practical resource for project risk assessment usually consist of these seven categories <ref name=DK> Simplilearn (2023), 13 Common Project Risks and How to Tackle Them, Retrieved April 15 from https://www.simplilearn.com/common-project-risks-article </ref>: | ||

| − | + | #'''Market:''' The potential risks associated with the market or industry include shifts in customer demand, increased competition from similar competitors, changing market trends, or economic downturns. The market risk is often unpredictable and difficult to plan for. | |

| + | #'''Technology:''' Technology risk refers to technical failures, such as system breaches, which might hinder the completion of the project. | ||

| + | #'''Strategy:''' There may be risks associated with the project’s objectives, strategies, and plans. Might be incorrect assumption of market position, cost estimation or delivery time of the project. | ||

| + | #'''Finance:''' There might be risks associated with the planning accuracy of cost estimation and unexpected expenses, which might threaten the completion of the project. | ||

| + | #'''Processes and structure:''' These risks refer mostly to the internal processes and organizational structure of the company. There needs to be a good flow of information between the personnel working on the project and the project manager, where everybody needs to be working towards the same objective. | ||

| + | #'''Legal:''' Legal risk can be unpredictable. The main legal risks are contract and licensing risks. | ||

| + | #'''IT:''' The IT risks include risks associated with the project’s IT services and infrastructure. System failure must be prevented during the project’s life cycle. | ||

| + | Conducting a project due diligence is an interdisciplinary process of assessing the aforementioned categories and carrying out a comprehensive due diligence, which would assist project managers to better deal with the uncertainty associated with the given project. By detecting these risks, it might prevent the project from total or partial failure <ref name=DL> Hoffman, Scott L.L. (2001). The Law and Business of International Project Finance (2nd ed. 2001 ed.). Transnational Publishers. </ref>. | ||

| + | |||

| + | == Project due diligence in construction projects == | ||

| + | The construction industry is an inherently risky industry, so managing the risks associated with any construction project is essential for its successful completion. At the start of a construction project, different entities, such as government agencies, municipal associations or towns put out bids for contractors to participate in a construction project. In order to conduct a sufficient due diligence, all aspects of the project must be taken into account during the comprehensive review and analysis. As each construction project has its own risks and areas of needed due diligence, there is no ideal way to carry out the due diligence. However, this checklist is designed to provide a broad overview of areas to consider when conducting the project due diligence. This risk catalogue has been tailored for construction projects and consists of the most common risks that can occur during a construction project and should be used as a guidance when conducting the due diligence <ref name=DL> Hoffman, Scott L.L. (2001). The Law and Business of International Project Finance (2nd ed. 2001 ed.). Transnational Publishers. </ref>: | ||

| + | |||

| + | #'''Contractor experience:''' The first step when evaluating viable candidates in a tender is their experience and quality standard during similar projects. The outcome of the project is dependent on the contractors, so both the contractor and subcontractors must be evaluated. | ||

| + | #'''Contract risks:''' It is essential to carefully review the contracts to determine whether the contractor can feasibly fulfill the terms of the contract. | ||

| + | #'''The project site:''' The contractor must evaluate the existing conditions on the project site and identify any potential environmental or geographical issues that may impact the project. | ||

| + | #'''Permits and licenses:''' The contractor needs to make sure that all permits and licenses for the construction project have been approved. The lack of approval for all permits, results in a major concern for all participants involved in the project. | ||

| + | #'''Financial and sensitivity analysis:''' : In order to assess the feasibility of the project, there must be conducted a comprehensive financial and sensitivity analysis. The financial analysis consists mainly of cost estimation and the contractors budget for the project. | ||

| + | #'''Health and safety risks of workers:''' The contractor needs to consider the health and safety of the workers on the worksite. The main thing is preventing overburden, by correctly manning projects so the workers can take their adequate breaks, while still maintaining a timely project completion. | ||

| + | #'''Legal and regulatory risks:''' Review all legal and regulatory risks to identify any potential liabilities in the project contract. | ||

| + | |||

| + | The list presented above is in no way exhaustive. It is an open-ended checklist that is designed to provide a general list of areas that should be considered and used as a guidance when conducting the project due diligence. Additionally, organizations may choose to create their own risk catalogue, which would be more suited to their industry. | ||

| + | |||

| + | == Discussion == | ||

| + | |||

| + | === Benefits of project due diligence === | ||

| + | There are multiple benefits associated with properly conducting a comprehensive project due diligence. Effective project due diligence will enable project managers to identify, mitigate, and control risks in order to prevent harm to the project. Furthermore, project managers can reduce uncertainty and increase transparency for all parties involved. The risks associated with the project, program or portfolio are clearly defined and communicated to the stakeholders well in advance of the project’s start. In that way, project managers can take risk-informed decisions with greater confidence as the decision will be based on data and not on assumptions. The project will be closely monitored and evaluated throughout its entire life cycle, ensuring the project stays on schedule and achieves its objectives. | ||

| + | |||

| + | By taking a proactive approach and not a reactive approach the main benefits are that there is an increased understanding of the project, which will provide an impartial view of the project risks. Furthermore, that will enable better decision-making and more efficient management of risks for project managers <ref name=DG> Smith, Nigel J., Merna, Tony, Jobling, Paul. (2006). Managing Risk in Construction Projects (2nd ed. 2006 ed.). Blackwell. </ref>. | ||

| + | |||

| + | === Limitations and challenges of project due diligence === | ||

| + | Every procedure has a certain degree of limitations and challenges. That applies to project due diligence as well. Due to the organization’s lack of experience working on a certain type of project, project managers may find it challenging in identifying the associated risks as they are working in uncharted territory. Conducting project due diligence requires sufficient level of data in order to identify the risks associated with a project. If the data quality turns out to be insufficient, it requires project managers to make assumptions rather than confidently making risk-informed decisions based on the data. Furthermore, due diligence is often conducted by specialist or experts in their field, making it costly for the organization. Organizations may decide to cut corners when it comes to conducting due diligence in order to save on costs, especially if it's a small project. | ||

| + | |||

| + | == Conclusion == | ||

| + | In conclusion, conducting project due diligence is a key component used in effective project management that enables organizations to more effectively manage the risks associated with a given project. Effective project due diligence will enable project managers to identify, mitigate, and control risks in order to prevent harm to the project. Organizations can reduce their risk exposure and make risk-informed decisions with greater confidence based on data. Managing the risks involved in a construction project is essential for its successful completion, since the construction industry is in its essence an inherently risky industry. There are numerous benefits in taking a proactive approach and conducting an effective project due diligence, however, there have been identified some limitations and challenges. After a thorough examination, it has been proven that the potential benefits of conducting the project due diligence far outweigh its limitations and challenges. Lastly, it should be a requirement to conduct a thorough due diligence, no matter the scale of the project. | ||

== Annotated Bibliography == | == Annotated Bibliography == | ||

| + | '''Scott L. L. Hoffman. The Law and Business of International Project Finance. 2001''' | ||

| + | In this book, the author provides a detailed explanation on all aspects regarding project finance. He goes into detail regarding risk identification in projects and the importance of conducting a thorough project due diligence. The author provides a checklist of due diligence considerations for a project financing that serves as a guide for projects of any kind. | ||

| − | + | '''OECD (2019). Due Diligence for Responsible Corporate Lending and Securities Underwriting: Key considerations for banks implementing the OECD Guidelines for Multinational Enterprises.''' | |

| − | + | ||

| − | + | This article talks about the importance of carrying out a project due diligence and its main characteristics. It provides an overview of the due diligence project and identifies the negative impacts that may arise if due diligence is not conducted as a responsible business practice. | |

| + | |||

| + | '''Prospectors & Developers Association of Canada. e3 Plus: A Framework for Responsible Exploration. 2003''' | ||

| + | |||

| + | This article’s main objective is to encourage readers to adopt responsible governance and management practices by consistently improving their projects’ social, environmental, and health and safety performance. In order to assist practitioners put the concepts into practice, the article guidance notes on implementing the principles. | ||

| + | |||

| + | == References == | ||

| − | + | <references/> | |

Latest revision as of 16:07, 9 May 2023

[edit] Abstract

Uncertainty is an inevitable part of any given project and project managers employ a variety of tools and techniques to assess and manage the potential risks that might occur throughout the project‘s lifecycle. A method that is frequently used is due diligence, often called project due diligence, which typically consists of a cost estimation, review of available data, risk analysis and a comprehensive assessment of the project. The assessment helps organizations to identify and potentially mitigate the risks and uncertainties related to the project. The main purpose of due diligence is to acquire available information about a project and assess if the project is feasible and the potential impacts it can have in the future.

The purpose of the article is mainly to evaluate the importance and value of due diligence in project management. Due diligence is a crucial component of project planning and the decision-making process for a specific project, where it assists in project managers’ decision-making, so they can make risk-informed decisions based on data and not assumptions. This article will not only give the reader an insight of the purpose and importance of due diligence but more importantly an understanding of the process. A guidance will be provided for the various steps and best practices for the common due diligence techniques, which will help in applying due diligence in different project contexts. The article will go over in detail in how to conduct a project due diligence for a construction project.

Furthermore, this article provides an insight to the limitations and challenges associated with due diligence in project management. The method will be evaluated based on the potential benefits such as improving project outcomes by lowering risk and improving project planning and decision-making, as well as its potential challenges, such as lack of sufficient or reliable data and significant investment costs.

Contents |

[edit] The Big Idea: An Introduction

Although due diligence is not a new concept, project due diligence is relatively new and has grown in significance over time. It is a term describing the process of evaluating a company, an investment, or a project [1]. Project due diligence is not a legal obligation, it is a voluntary management tool that is part of a responsible risk management strategy [2]. When it comes to project management it is of great importance to have a project scope for a given project to ensure that the project is properly planned, carried out and ultimately achieves its intended goals. It involves conducting a comprehensive analysis of the upcoming project to identify potential risks and challenges that may impact its success. However, conducting a due diligence is about reducing the uncertainty rather than to eliminate it [3]. Project failures are often the result of the lack of a proper due diligence.

When the scope of the project has been established the project objectives are defined. It depends on the specific context of a given project what the project objectives will be. It is important to first identify the forces of uncertainty and where the uncertainty is coming from before the risk landscape can be effectively organized. To properly manage the risk, project due diligence must be incorporated into management and planning procedures [4].

[edit] Why carry out project due diligence

Project due diligence is a responsible business conduct that involves thoroughly assessing the feasibility of a given project. It is an important process for risk identification, which is an action to prevent or mitigate risks. Furthermore, it promotes accountability and assists project managers in making informed decisions. [5] Conducting a comprehensive project due diligence may return value to investors and minimize negative impacts to people and the environment [2]. Traditional due diligence and project due diligence share common similarities, however, due diligence is generally conducted to identify financial and legal risks when acquiring a business, rather than assessing the feasibility of a single project [5].

Project due diligence is a risk management process that often helps the project manager determine just how reliable, or unreliable, the project is and decide if the project should be pursued or not. By conducting an effective project due diligence can help to effectively manage risks associated with the project and avoid potential problems. It can potentially save the project itself [2]. In order to integrate “risk thinking” into project management, four risk-informed principles have been identified. The first principle is to create transparency regarding project risks. There are always some types of risks associated in a project and the first principle sets out to explore and identify knowable uncertainties and quantify resulting risks. Once the main risks have been identified, the second principle helps the project manager in making risk-informed decisions. The probability and impact of each inherent risk is identified, and the second principle sets out to decide what actions to take to manage the risks more effectively, usually by dealing with the biggest risks first. The third principle is to minimize uncertainty in projects by reducing both internal and external uncertainty. The risks may vary depending on the project, but project managers must identify the forces of uncertainty and where the uncertainty is coming from. Furthermore, they must identify the categories the risk may impact and have a plan of action ready for if things go wrong. The fourth and last principle deals with creating resilience in the project system [4]. When dealing with uncertainty, organizations try to respond to risks with a proactive risk management process, but it is impossible to prepare for every emergent risk. Two strategies have been identified to deal with any unforeseen risks occurring; have a flexible system in order to be being able to adapt easily and increase the project system’s resilience to ensure core tasks can continue despite major impacts of unexpected risks [6].

By conducting a comprehensive project due diligence, using the four risk-informed principles as a guide, can help project managers to better deal with the associated risks and provide them with a more realistic timeframe for project activities and processes. Project due diligence should be conducted properly, where it is not merely an item for the project manager to cross off their list. Even though the main purpose of due diligence is to identify project-related risks, it shouldn’t be seen as a tool to obstruct opportunities. Instead, if used effectively, it can help project managers in pursuing opportunities with greater confidence because there is a better understanding of the project’s risks [2]. Instituting due diligence can be beneficial for a variety of reasons. It can help identify potential operational and project-related risks, reduce cost, provide a better understanding of the project, and significantly reduce the probability of default [5].

[edit] The main characteristics of project due diligence

Projects have differences based on their own unique characteristics. In that case, no two projects are alike since they vary in size, budget, duration, and associated risks. However, they do share similarities. As previously stated, the scope of the project may differ, however, conducting a project due diligence should be relatively similar for all projects. Although there is not a specific template to follow when carrying out project due diligence, there are some common characteristics for every due diligence process:

Due diligence is a preventative approach rather than a reactive approach. It is important that the project manager takes a proactive approach, so that the company can limit their need for reactive responses that may result in high costs for the company. The primary objective is to prevent causing harm to people and the environment, as well as avoid any negative impacts that are directly linked to the operations or processes of the project. If negative impacts cannot be avoided, companies should use due diligence to mitigate, prevent recurrence, and remediate them [5].

Due diligence is commensurate with risk. In other words, the level of project due diligence carried out should be directly proportional to the level of risk associated with the project. Often, risks are given a risk rating according to the probability of the risk occurring and the impact the said risk may have on the project. When the risk rating of a given risk is high, the due diligence becomes more extensive [5].

Due diligence can involve prioritization of risks. The project manager should prioritize the risks according to the probability of the individual risk occurring and the impact it may have on the project. It is not feasible to deal with every risk at once, so the risk with the most negative impact is dealt with first. When the risks resulting in the most negative impacts have been dealt with, the less significant risks will then be addressed [5].

Due diligence is dynamic and not static. As can be seen in figure 1, the due diligence process is ongoing, responsive, and changing. If new risks, with higher probability of negative impacts are identified later in the process, they are immediately moved higher on the list of risks waiting to be dealt with accordingly. It is important that the project manager takes the dynamic approach, where he regularly reviews the prioritization of risks and updates the list when new risks are identified [5].

When conducting project due diligence, it is important to keep in mind the aforementioned characteristics in order to maintain the risk profile. Project managers need to keep an updated list of all identified risks within the project to ensure that decisions are made with the latest available information. Additionally, the project’s scope and objectives should frequently be reviewed, in order to make sure they are still aligned with the company’s goals [3].

[edit] The application of project due diligence: Common techniques used

Project due diligence can be conducted in project, program, and portfolio management to identify and mitigate potential risks in order to make risk-informed decisions about a given project. Thus, it can be favorably used by the project manager to support their decisions. Project due diligence is the process of evaluating the risks associated with a project throughout its entire life cycle [7]. In fact, many large-scale projects are not put through a thorough review process, resulting in excessive costs and delays. Large projects often have common similarities, going over budget, take longer than expected, and deliver less value than predicted. The primary reason of it happening is often a lack of upfront due diligence. Enforcing upfront accountability on project managers may lead to a more thorough and comprehensive due diligence. Project managers often take a reactive approach, where they spend a considerable amount of time analyzing why tasks fell behind and money was overspent. However, if the proactive approach was taken more often, resulting in the investment in upfront due diligence, projects would be better planned and executed [8].

Identifying the risk controls is only the first step. To aid this process, project managers may use a risk catalogue, which is a structured compilation of potential project risk events. The risk catalogue provides a list of known areas of uncertainty, however, the list is open-ended, meaning that they may need to look beyond the list in order to identify unusual but critical risks. The risk catalogue can also be used to enter preventative or reactive measures for risk avoidance [9]. A risk catalogue of the most common risks that can occur within a project or program, used as a guidance and practical resource for project risk assessment usually consist of these seven categories [10]:

- Market: The potential risks associated with the market or industry include shifts in customer demand, increased competition from similar competitors, changing market trends, or economic downturns. The market risk is often unpredictable and difficult to plan for.

- Technology: Technology risk refers to technical failures, such as system breaches, which might hinder the completion of the project.

- Strategy: There may be risks associated with the project’s objectives, strategies, and plans. Might be incorrect assumption of market position, cost estimation or delivery time of the project.

- Finance: There might be risks associated with the planning accuracy of cost estimation and unexpected expenses, which might threaten the completion of the project.

- Processes and structure: These risks refer mostly to the internal processes and organizational structure of the company. There needs to be a good flow of information between the personnel working on the project and the project manager, where everybody needs to be working towards the same objective.

- Legal: Legal risk can be unpredictable. The main legal risks are contract and licensing risks.

- IT: The IT risks include risks associated with the project’s IT services and infrastructure. System failure must be prevented during the project’s life cycle.

Conducting a project due diligence is an interdisciplinary process of assessing the aforementioned categories and carrying out a comprehensive due diligence, which would assist project managers to better deal with the uncertainty associated with the given project. By detecting these risks, it might prevent the project from total or partial failure [11].

[edit] Project due diligence in construction projects

The construction industry is an inherently risky industry, so managing the risks associated with any construction project is essential for its successful completion. At the start of a construction project, different entities, such as government agencies, municipal associations or towns put out bids for contractors to participate in a construction project. In order to conduct a sufficient due diligence, all aspects of the project must be taken into account during the comprehensive review and analysis. As each construction project has its own risks and areas of needed due diligence, there is no ideal way to carry out the due diligence. However, this checklist is designed to provide a broad overview of areas to consider when conducting the project due diligence. This risk catalogue has been tailored for construction projects and consists of the most common risks that can occur during a construction project and should be used as a guidance when conducting the due diligence [11]:

- Contractor experience: The first step when evaluating viable candidates in a tender is their experience and quality standard during similar projects. The outcome of the project is dependent on the contractors, so both the contractor and subcontractors must be evaluated.

- Contract risks: It is essential to carefully review the contracts to determine whether the contractor can feasibly fulfill the terms of the contract.

- The project site: The contractor must evaluate the existing conditions on the project site and identify any potential environmental or geographical issues that may impact the project.

- Permits and licenses: The contractor needs to make sure that all permits and licenses for the construction project have been approved. The lack of approval for all permits, results in a major concern for all participants involved in the project.

- Financial and sensitivity analysis: : In order to assess the feasibility of the project, there must be conducted a comprehensive financial and sensitivity analysis. The financial analysis consists mainly of cost estimation and the contractors budget for the project.

- Health and safety risks of workers: The contractor needs to consider the health and safety of the workers on the worksite. The main thing is preventing overburden, by correctly manning projects so the workers can take their adequate breaks, while still maintaining a timely project completion.

- Legal and regulatory risks: Review all legal and regulatory risks to identify any potential liabilities in the project contract.

The list presented above is in no way exhaustive. It is an open-ended checklist that is designed to provide a general list of areas that should be considered and used as a guidance when conducting the project due diligence. Additionally, organizations may choose to create their own risk catalogue, which would be more suited to their industry.

[edit] Discussion

[edit] Benefits of project due diligence

There are multiple benefits associated with properly conducting a comprehensive project due diligence. Effective project due diligence will enable project managers to identify, mitigate, and control risks in order to prevent harm to the project. Furthermore, project managers can reduce uncertainty and increase transparency for all parties involved. The risks associated with the project, program or portfolio are clearly defined and communicated to the stakeholders well in advance of the project’s start. In that way, project managers can take risk-informed decisions with greater confidence as the decision will be based on data and not on assumptions. The project will be closely monitored and evaluated throughout its entire life cycle, ensuring the project stays on schedule and achieves its objectives.

By taking a proactive approach and not a reactive approach the main benefits are that there is an increased understanding of the project, which will provide an impartial view of the project risks. Furthermore, that will enable better decision-making and more efficient management of risks for project managers [3].

[edit] Limitations and challenges of project due diligence

Every procedure has a certain degree of limitations and challenges. That applies to project due diligence as well. Due to the organization’s lack of experience working on a certain type of project, project managers may find it challenging in identifying the associated risks as they are working in uncharted territory. Conducting project due diligence requires sufficient level of data in order to identify the risks associated with a project. If the data quality turns out to be insufficient, it requires project managers to make assumptions rather than confidently making risk-informed decisions based on the data. Furthermore, due diligence is often conducted by specialist or experts in their field, making it costly for the organization. Organizations may decide to cut corners when it comes to conducting due diligence in order to save on costs, especially if it's a small project.

[edit] Conclusion

In conclusion, conducting project due diligence is a key component used in effective project management that enables organizations to more effectively manage the risks associated with a given project. Effective project due diligence will enable project managers to identify, mitigate, and control risks in order to prevent harm to the project. Organizations can reduce their risk exposure and make risk-informed decisions with greater confidence based on data. Managing the risks involved in a construction project is essential for its successful completion, since the construction industry is in its essence an inherently risky industry. There are numerous benefits in taking a proactive approach and conducting an effective project due diligence, however, there have been identified some limitations and challenges. After a thorough examination, it has been proven that the potential benefits of conducting the project due diligence far outweigh its limitations and challenges. Lastly, it should be a requirement to conduct a thorough due diligence, no matter the scale of the project.

[edit] Annotated Bibliography

Scott L. L. Hoffman. The Law and Business of International Project Finance. 2001

In this book, the author provides a detailed explanation on all aspects regarding project finance. He goes into detail regarding risk identification in projects and the importance of conducting a thorough project due diligence. The author provides a checklist of due diligence considerations for a project financing that serves as a guide for projects of any kind.

OECD (2019). Due Diligence for Responsible Corporate Lending and Securities Underwriting: Key considerations for banks implementing the OECD Guidelines for Multinational Enterprises.

This article talks about the importance of carrying out a project due diligence and its main characteristics. It provides an overview of the due diligence project and identifies the negative impacts that may arise if due diligence is not conducted as a responsible business practice.

Prospectors & Developers Association of Canada. e3 Plus: A Framework for Responsible Exploration. 2003

This article’s main objective is to encourage readers to adopt responsible governance and management practices by consistently improving their projects’ social, environmental, and health and safety performance. In order to assist practitioners put the concepts into practice, the article guidance notes on implementing the principles.

[edit] References

- ↑ Pan, Jing, Rapp, Randy R., Cox, Robert F. (2012). Construction Due Diligence in Different Project Delivery Systems (2nd ed. 2012 ed.). China Architecture & Building Press.

- ↑ 2.0 2.1 2.2 2.3 e3 Plus (2003), E3 Plus: A Framework for Responsible Exploration, Retrieved April 20 from https://www.pdac.ca/docs/default-source/priorities/responsible-exploration/e3-plus---common/e3-plus---toolkits---social-responsibility/due-diligence.pdf?sfvrsn=67c734e2_4

- ↑ 3.0 3.1 3.2 Smith, Nigel J., Merna, Tony, Jobling, Paul. (2006). Managing Risk in Construction Projects (2nd ed. 2006 ed.). Blackwell.

- ↑ 4.0 4.1 Thuesen, Christian, Oehmen, Josef. Uncertainty slides – Jan 2023, 24. April 2023.

- ↑ 5.0 5.1 5.2 5.3 5.4 5.5 5.6 OECD (2019), Due Diligence for Responsible Corporate Lending and Securities Underwriting: Key considerations for banks implementing the OECD Guidelines for Multinational Enterprises, Retrieved April 27 from https://mneguidelines.oecd.org/due-diligence-guidance-for-responsible-business-conduct.htm

- ↑ Wanner, Roland (2020), What Does Resilience Have to Do With Risk Management in Projects?, Retrieved April 26 from https://rolandwanner.com/resilience-in-project-risk-management/

- ↑ r2a: Due diligence engineers (2012), Project Due Diligence vs Project Management, Retrieved April 28 from https://r2a.com.au/risk-management-framework-project-due-diligence/

- ↑ Jahagirdar, Ketan (2019), Mitigate Project Risk With Upfront Due Diligence And Accountability, Retrieved April 26 from https://www.forbes.com/sites/forbesbusinesscouncil/2019/11/25/mitigate-project-risk-with-upfront-due-diligence-and-accountability/?sh=401c2e303ebc

- ↑ Thuesen, Christian, Oehmen, Josef. Week 10 – Risk, Uncertainty, Ignorance, 25. April 2023.

- ↑ Simplilearn (2023), 13 Common Project Risks and How to Tackle Them, Retrieved April 15 from https://www.simplilearn.com/common-project-risks-article

- ↑ 11.0 11.1 Hoffman, Scott L.L. (2001). The Law and Business of International Project Finance (2nd ed. 2001 ed.). Transnational Publishers.