Challenges and Execution of Innovation Portfolio Management

| (104 intermediate revisions by one user not shown) | |||

| Line 1: | Line 1: | ||

| + | ''Developed by Stefan Schenk'' | ||

| − | |||

| − | + | '''''Article Type 1: Explanation and Illustration of a Method''''' | |

| − | |||

| − | |||

| − | === Strategic and Operational Innovation Portfolio Management (SIPM / OIPM) === | + | ''Innovation Portfolio Management (IPM)'' can be described as a dynamic decision process concept, in which an array of active innovation projects is constantly updated and revised to deliver innovation/innovative products to market.<ref name="smith" /> <ref name="anna" /> High-tech companies are nowadays faced with a business environment which is characterized by an increasing dynamism and unpredictability. In order to stay competitive it is crucial to develop a suitable and flexible innovation strategy by means of possessing a broad setup of innovation-projects (innovation portfolio) and permanently adjusting this portfolio to the changing environment.<ref name="rui" /> Hereby IPM can deliver support as an appropriate tool to implement strategy shifts into all innovation-project activities throughout the organization in a coordinated manner. Main difficulties arising in the IPM process are related to the balance of the portfolio, the cyclic evaluation and prioritization as well as to the tactical resource allocation.<ref name="rui" /> |

| + | |||

| + | This article focuses on describing the general structure of an IPM system integrated as a connecting element between qualitative strategy definition and the project-based implementation. The IPM is seperated into a strategic and operational element (Strategic and Operational Portfolio Management).<ref name="smith2" /> Hereby there are also given tools and guidelines enabling the reader to tackle the mentioned main challenges. Finally the article is concluded with a short future outlook and open research questions. | ||

| + | |||

| + | ''Remark: This article aims at giving a macro-view on the integrated framework of IPM and proposes a basic approach of how to establish such a management system. Hereby the emphasis is especially put on an approach of how to narrow the generally large gap between nominal strategy direction and operational execution. Consequently this is not the one and only solution of conducting the IPM, but a good orientation for a first setup, which can be further refined. Furthermore also more elaborated courses of action are presented shortly along with external links, to give the reader the option to further deepen his knowledge in a particular field if needed.'' | ||

| + | |||

| + | == Innovation Portfolio Management (IPM) == | ||

| + | [[File:Portfolio.jpg|450px|right|thumb|Figure 1: Portfolio management practices - impact on organizational performance.<ref name="scott" />]] | ||

| + | === General Idea and Impact === | ||

| + | The basic idea IPM originates from is the [https://en.wikipedia.org/wiki/Project_portfolio_management ''Project and Portfolio Management Process (PPM)'']. PPM is defined as ''a formal approach that an organization can use to orchestrate, prioritize and benefit from projects. This approach examines the risk-reward of each project, the available funds, the likelihood of a project's duration, and the expected outcomes. A group of decision makers within an organization, led by a Project Management Office director, evaluates the returns, benefits and prioritization of each project to determine the best way to invest the organization’s capital and human resources.''<ref name="techtarget" /> This article expands the latter conception by relating the portfolio management procedure to the innovation management (R&D) within high-tech companies. Thus PPM gets extended into the more dynamic IPM, which is a more complex, multi-level process specifically aiming at the continuous innovation management consistent with the corporate strategy. | ||

| + | |||

| + | Traditionally innovation research was mainly focused on the appropriate management of single [https://en.wikipedia.org/wiki/New_product_development ''New Product Development (NPD)''] projects, thus focusing on innovation determinants at the project level.<ref name="anna" /> In the face of today's globalization of markets, shorter life-cycles and increasing competition as well as complexity of technologies, high-tech firms have to hold a set of multiple NPD projects (innovation portfolio) to be flexible and reduce the risk to the lowest level possible. Hereby each project generates several changes on its own. This results in a set of cascading effects throughout the rest of the NPD projects, which have to be evaluated in relation to each other.<ref name="rui" /> Additionally market changes and new business practices constrain firms to continuously reconsider the corporate competitive strategy, including their innovation portfolio. These two points create a permanently-changing decision context that cannot be conceived with a single-project perspective, but has to be managed with an overall IPM process. The desired outcome of an effective IPM is a stable pipeline of high-quality new products by linking the strategy formulation to the strategy implementation. This finally ensures long-term corporate growth and profitability.<ref name="anna" /> In Figure 1 the best practices in portfolio management which have been observed in several studies and the impact of each practice are displayed, illustrating the positive impact of IPM on organizational performance. Despite the existence of this obvious interrelationship between corporate sustainable profitability and permanent innovation, many companies possess relatively conservative innovation strategies, rather focusing on maintaining and improving existing product lines.<ref name="anna" /> The main reason for this mindset are the obstacles resulting from the extreme complexity of a well-implemented IPM process within an organization. In the following there is given a macro-overview of an IPM system to give the reader a good, general idea of the main structure and approach of an IPM system. | ||

| + | |||

| + | === Main Goals === | ||

| + | As already mentioned in the section ''General Idea and Impact'', the aimed final result of the IPM process for a firm is the delivery of high-quality innovations to the market. How does the IPM system itself have to be settled up to reach this organizational goal in the end? In research four main goals have been identified: | ||

| + | |||

| + | * ''Strategic Alignment'' is the goal with highest priority. Newly developed products have to match the corporate innovation strategy. This means that products need to support the strategy or even be critical components of it. | ||

| + | |||

| + | * ''Maximize the Portfolio Value'' means to maximize a portfolio value by allocating resources for a particular spending level. Thus the sum of the commercial value of all active innovation projects has to be maximized. Possible measurement possibilities are net present value (NPV, corresponds the difference between the present value of cash inflows and the present value of cash outflows<ref name="investopedia1" />), return on invest (ROI, measures the amount of return on an investment relative to the investment’s cost<ref name="investopedia2" />) or likelihood of final success. | ||

| + | |||

| + | * ''Right Balancing of Projects'' relates to a number of project-specific parameters, that need to be balanced over the portfolio. Possible parameters to be balanced are long-term versus short-term projects, high-risk versus low-risk projects, market concentration or technology focus. | ||

| + | |||

| + | * ''The Right Number of Projects'' is a critical feature, especially due to the tendency that most companies have more projects running than their resources allow them to do. Consequently there is a lack of human resources and time, leading to elongated time-to-market periods and a decreased quality of the delivered innovation products. Required resources for active projects and available resources necessarily have to be balanced. Possible approaches to ensure this are managing the key resource limits or the performance of a resource capacity analysis.<ref name="scott" /> | ||

| + | === Main Challenges === | ||

| + | In total there exist five main criteria characterizing effective IPM, making it one of the most complex decision-making functions within a firm: | ||

| + | |||

| + | * IPM is dealing with and dependent on future events and possible opportunities. The quality of the necessary information for project selection and prioritization decisions is in best case uncertain and in worst case unreliable. | ||

| + | |||

| + | * The environment for decision making is highly dynamic. Expectations and status of all projects within the innovation portfolio is continuously changing as markets shift and new information come up. | ||

| + | |||

| + | * All projects within the innovation portfolio are characterized by different levels of completion and compete for available resources (in this article resources are always related to human resources). Consequently a comparison among projects has to be conducted, based on information differing in quantity and quality. | ||

| + | |||

| + | * Available resources that can be allocated among the active projects are limited. Any prioritization of one project comes along with a deduction of resources for another project. Additionally resource transfers in real-world are not seamless as indicated by planning tools. | ||

| + | |||

| + | * Data availability over all the information gathered within the portfolio is critical. This further complicates an efficient and effective IPM process.<ref name="scott" /> | ||

| + | |||

| + | == Application of IPM == | ||

| + | [[File:Picture2.png|500px|right|thumb|Figure 2: IPM as linking element between strategy definition and project based execution.<ref name="smith" />]] | ||

| + | === Organizational Setup === | ||

| + | A good approach to unravel the complexity of IPM and break down the different challanges is the concept of dividing it up into a strategic and an operational part. Strategic Innovation Portfolio Management (SIPM) aims at following the right innovation projects and supplying them with resources ("''doing the right things''"). Operational Innovation Portfolio Management (OIPM) on the other side ensures an appropriate execution of the selected projects ("''doing things right''"). As stated, the IPM concept enables a company to permanently link the strategy development to execution in order to generate tangible results. Exactly at this linkage, between strategy definition and metrics-based project execution, SIPM and OIPM are positioned. The resulting arrangement is illustrated in Figure 2, with the overall IPM system in the grey box as "''transmission''" element.<ref name="smith" /> | ||

| + | To achieve a structured form of organizing the IPM, a portfolio governance in form of a ''Project Portfolio Management Office (PPMO)'' should be installed on the strategic level. This PPMO is responsible for the SIPM and has the effect of increasing IPM quality and as a consequence of that also the portfolio success, as studies have revealed.<ref name="anna" /> Furthermore, the PPMO should be complemented with major boards responsible for implementation, prioritisation and resources. Stiff RACI (responsible, accountable, consult, inform) matrices for managers should be renounced, as they interfere with fast decision processes which outbreaks project progress. Finally also an overall [https://en.wikipedia.org/wiki/Project_management_information_system IPM IT-system] delivers big advantages, especially in case of managing large portfolios. The high complexity of the involved parties, the various kinds of processes and the different organizational stages lead to the need of a supporting information system to guarantee a permanent supply with necessary information and to support time keeping procedures. Also there should be used a software suitable with your IPM structure and not the other way round. | ||

| + | |||

| + | === Strategic Innovation Portfolio Management (SIPM) === | ||

| + | The two main activities of SIPM consist of the portfolio balancing process as well as the iterating innovation portfolio evaluation and prioritization. A more detailed description is elaborated under the following two points. | ||

| + | [[File:Table_horizon.jpg|500px|right|thumb|Figure 3: Characteristics of the three innovation horizons.<ref name="smith" />]] | ||

| + | ==== Balancing Portfolio ==== | ||

| + | The intended state of a balanced portfolio is defined as an assortment of innovation projects enabling sustainable growth and profit for a company associated with its corporate strategy without being exposed to undue risks. Maintaining such a kind of balance leads to an asset base of technologies, which are essential for competitive advantage.<ref name="juliana" /> | ||

| + | |||

| + | First, the selection of projects and new innovations has to be decided carefully. Accordance with the corporate direction of strategy has highest importance. Especially for long-term projects this criteria has to be emphasized in particular, as they are shaping and representing the long-term strategy.<ref name="juliana" /> | ||

| + | |||

| + | |||

| + | In a second step the coverage of both, long-term and short-term innovation projects has to be balanced. A good method for achieving such a "''project mix''" is to define the three horizons "Short-term", "Mid-term" and "Long-term" helping to distinguish and manage innovation activities across different time frames. An exemplary outline of such a managing-model is displayed in Figure 3 together with the corresponding characteristics for each horizon. This method supports the IPM management to not loose track of pushing forward mid- and long-term innovation investments due to unintentional focus on the short-term performance. Typically it is mainly the horizon 2 activities, which get neglected due to their position between the two extremes short-term budgets and long-term focus. Finally a good balance in this category is accomplished by a parallel process of future business identification and development along with optimization of the existing business.<ref name="smith" /> | ||

| + | |||

| + | |||

| + | The third crucial criterion to be balanced regarding the portfolio is risk and uncertainty. For every project exists the risk of not meeting the specified objectives and there can always arise challenges from the outside. To analyse the risk of a single project, it has to be decomposed into component activities resulting in the [https://en.wikipedia.org/wiki/Work_breakdown_structure ''Work Breakdown Structure (WBS)'']. Hereby the decomposition can range, depending on the necessary depth of the analysis, from a simple WBS for horizon 3 projects to a complex WBS for a project standing in horizon 1. In this way the risk for all project activities can be solely analysed, in order to afterwards estimate the corresponding probabilities and consequences.<ref name="archer" /> New literature claims that in an IPM framework the risk-estimation of single projects is not sufficient anymore suggesting a portfolio-wide risk management. However, high costs, the lack of an established appraoch and the acknowledged positive effects of single project risk management in literature make portfolio risk management so far a very rarely implemented system.<ref name="JULIANE" /> A possibility to further complement the single project risk management is a staging investment approach across the innovation portfolio depending on the risk of each project. This implies to make on average high bets (investments) rather in horizon 1, medium bets in horizon 2 and low bets in the high-risk and uncertain horizon 3. This clarifies the importance of prototyping, pilot projects and market research, as they are necessary to afterwards scale projects up. A time-proven guideline for the allocation of innovation funds is 70% for horizon 1, 20% for horizon 2 and 10% for horizon 3 projects.<ref name="smith" /> | ||

| + | |||

| + | ==== Cyclic Innovation Portfolio Evaluation and Prioritization ==== | ||

| + | Cyclic innovation portfolio evaluation and prioritization is a dynamic decision process in the SIPM, in which the innovation portfolio is constantly updated and revised. In detail this means that new projects are evaluated, selected and prioritized, existing projects are upgraded, deprioritized, or even killed, and resources may be allocated and reallocated to active projects within the portfolio. This procedure is basically adopted from the multi-project based process of PPM. Main challenges within this process are uncertain information about project states, the identification of project synergies, changing opportunities evolving in the business environment and conflicting strategic goals of the firm. It is essential to update a company's portfolio by this process regularly and efficiently to prevent heavy resource bottlenecks in the innovation portfolio pipeline. As the projects within the portfolio can be based in different units within a company, this process also has to account for the different interdependencies.<ref name="anna" /><ref name="rui" /> The decisions made in this context also have a relatively heavy impact on a company's innovative capability and thus also on the company's sustainable growth and profitability. That is why the innovation projects have to be subjectively evaluated from strategic managers with different backgrounds and functions, which are able to find for a particular firm the best consensus regarding specifications and goals. This circle of deciders corresponds the already mentioned PPMO.<ref name="juliana" /> | ||

| + | |||

| + | Many quantitative and qualitative methods for project- and portfolio assessment were discussed in the literature, ranging from operations research methods to social-science-based approaches. Proposals for project selection and prioritization were mainly focusing on one of the following methods: | ||

| + | |||

| + | * Unstructured peer review | ||

| + | * Scoring methods | ||

| + | * Mathematical programming (e.g. linear / non-linear programming) | ||

| + | * Economic models (e.g. internal rate of return) | ||

| + | * Decision analysis (e.g. analytic hierarchy process) | ||

| + | * Artificial intelligence (e.g. expert systems) | ||

| + | |||

| + | The combination of different approaches via an interactive, computer-based [https://en.wikipedia.org/wiki/Decision_support_system ''Decision Support System (DSS)''] is also a possibility, giving decision makers the possibility of simulating different scenarios in an user-friendly way or prioritize concerning special goals (e.g. main focus on strategic alignment<ref name="kipper" />). The most suppressing fact of most research approaches is their extreme mathematical complexity, making the assistance of an expert decision analyst necessary for a "normal" manager to use such a system.<ref name="henriksen" /> | ||

| + | |||

| + | The most common way, and also the most reasonable way concerning the macro-perspective and dimension of this article, are scoring methods. They enable the deciders to quickly find the projects with the highest merit without being completely dependent on early estimates. There exist many indicators which possibly can be applied in the scoring model. The identification, emphasis and number of such success factors for an innovation is a very demanding task making it part of big research efforts over the last decades. Depending on the competitive structure of a market, each industry is confronted with a particular array of challenges, which are not relevant at all to other industries. Consequently there exists a particular set of scoring criteria which have to be applied for the decision process, unique to each firm.<ref name="juliana" />. A good "basic" set of reasonable criteria to build a scoring model around are ''benefits'', ''cost'', ''risk'', ''market share'', ''technical feasibility'' and ''margin'', covering the most important aspects to consider.<ref name="blumhorst" /> | ||

| + | |||

| + | If a less detailed, rather fast overview of the potential of projects is demanded, different analytical tools with different approaches and focus areas can be used. Examples are the [https://en.wikipedia.org/wiki/Growth%E2%80%93share_matrix ''Boston Consulting Group Growth-share Matrix (BCG Matrix)''] and the [https://en.wikipedia.org/wiki/G._E._multi_factoral_analysis ''McKinsey Matrix'']. These tools are mainly focusing on two, maximum three indicators in order to facilitate a depiction of the analysis. So the BCG Matrix uses relative market share and industry growth rate in a four-cell matrix as success determinants, whereas the McKinsey Matrix focuses on competitive position of a company and industry attractiveness within a nine-cell matrix. These tools however have to be used carefully as they cannot capture the complexity of a innovation portfolio decision process. So criticism of the matrices addresses among others the difficulties of measuring the chosen indicators, a lack of market structure consideration, the high uncertainty and the approach of viewing the portfolio as a closed system.<ref name="juliana" /> | ||

| + | |||

| + | No matter which approach for decision making is used, it is just a tool and should never completely replace personal management judgment and leadership. There should always be space for exceptional decisions, such as funding an innovation project which does not meet the scoring requirements. This gives the priority list of projects a final fine-tuning. After such kind of decisions however a transparent communication throughout the organization, as well as to customers and stakeholders is important.<ref name="henriksen" /><ref name="gosenheimer" /> | ||

| + | |||

| + | |||

| + | In order to implement the prioritization of the innovation portfolio, the next step is to (re)allocate the available resources in accordance to reach full alignment. Otherwise the consequent tactical OIPM cannot reach success. Strategic resource management aims to translate resource availability into corresponding constraints and implement these constraints into the analysis of alternative portfolio composition. In case a proposed innovation portfolio and its prioritization are not feasible with the available resources, the portfolio has to go through a second decision process or the magnitude of the resource pool needs to be adjusted (e.g. by hiring). | ||

| + | |||

| + | === Operational Innovation Portfolio Management (OIPM) === | ||

| + | The main purpose of the OIPM process an efficient execution of the strategic portfolio decisions along with a cyclic review and adjustment process on the tactical level, which is elaborated more deeply in the following two sections. | ||

| + | ==== Tactical Resource Allocation ==== | ||

| + | Executing the strategic portfolio plan in an efficient way requires integrated planning, managing of project interdependencies, tactical resource allocation as well as distribution of hard- and soft-skills across the project requirements. Especially the tactical resource allocation is a critical capability to master the OIPM. | ||

| + | [[File:OIPM.jpg|800px|right|thumb|Figure 4: OIPM key sequence with iteration loop. (based on<ref name="smith" />)]] | ||

| + | |||

| + | As there occur numerous dynamic changes within the portfolio along with new interrelationships, a permanent high-quality OIPM is required to deliver project results and efficiency in doing so. As orientation the key sequence ''analyse'', ''involve'', ''align'' and ''execute'' can be taken as red line for the whole process, incorporating a mixture of analysis, IT processes and intense communication. It should be highlighted that this part of the IPM is the most people-driven process, making it also a very vulnerable one. In Figure 4 the key sequence is displayed together with a dynamic iteration loop . In order to achieve engagement and correlated with that motivation of all involved resource groups they should be taken into consideration during the build-up of the innovation project portfolio plan and the related resource allocation. This is an essential building brick for success, as the team is pressured with stressful deadlines, multiple simultaneous projects demanding multiple roles. Also should the amount of analysed data during the permanent reviewing of the ongoing process be kept at a reasonable level, meaning to keep the whole system agile instead of bureaucratic and sluggish.<ref name="smith" /><ref name="rui" /> | ||

| + | |||

| + | As the PPM systematic is more dealing with managerial and organizational aspects, research attempted to tackle the challenge of resource allocation in a more elaborated and systematic way by applying techniques previously suggested for multi-project settings. Examples are the [http://staff.aub.edu.lb/~ay11/Priority%20Rules_IJPE2010.pdf ''Resource Constrained Multi-Project Scheduling Problem (RCMPSP)''], [https://en.wikipedia.org/wiki/Agile_management ''Agile''] and [https://en.wikipedia.org/wiki/Critical_chain_project_management ''Critical Chain Approaches'']. In Table 1 the main strengths and weaknesses are displayed. If more detailed knowledge of the methods in this context is required, further reading can be found in the linked scientific papers within Table 1. However, even if the transformation of these multi-project setting techniques can help during the resource allocation to a certain degree, their meaningfulness is limited due to the highly dynamic environment and the dependency complexity between the innovation projects. | ||

| + | |||

| + | {| class="wikitable" | ||

| + | |+ align="bottom" style="caption-side: bottom; text-align: central;" | Table 1: Various multi-project resource management approaches for IPM.<ref name="rui" /> | ||

| + | ! style="font-weight: bold;" | Multi-project resource management approach | ||

| + | ! style="text-align: center; font-weight: bold;" | Strengths | ||

| + | ! style="text-align: center; font-weight: bold;" | Weaknesses | ||

| + | |- | ||

| + | | style="font-weight: bold; font-style: italic;" | [http://doc.utwente.nl/70238/1/Leus04hierarchical.pdf Hierarchical planning (RCCP / RCPSP scheduling]) | ||

| + | | | ||

| + | * Two levels of planning (different granularities and time horizons) | ||

| + | * Planning flexibility | ||

| + | | | ||

| + | * Missing information exchange between two levels | ||

| + | |- | ||

| + | | style="font-weight: bold; font-style: italic;" | [http://staff.aub.edu.lb/~ay11/Priority%20Rules_IJPE2010.pdf RCMPSP scheduling] | ||

| + | | | ||

| + | * Adoption of RCPSP scheduling technique to a single network of the collated activities from multiple projects | ||

| + | * Extended by modelling the real scheduling problem | ||

| + | | | ||

| + | * very restrictive | ||

| + | * hard to be solved in reasonable computational time | ||

| + | |- | ||

| + | | style="font-weight: bold; font-style: italic;" | [http://www.uml.org.cn/softwareprocess/pdf/IEEEArticle2Final2.pdf Agile] | ||

| + | | | ||

| + | * Building on a stable team (multiple skills, versatile projects can be handled) | ||

| + | * Flexibility to adapt to changes | ||

| + | | | ||

| + | * Informal planning approach limited to small, less complex projects | ||

| + | |- | ||

| + | | style="font-weight: bold; font-style: italic;" | [http://ieeexplore.ieee.org.proxy.findit.dtu.dk/document/5998173/metrics Critical chain] | ||

| + | | | ||

| + | * Follows portfolio priorities by assigning project tasks to the drum-resource (buffer to deal with resource constraints and uncertainty | ||

| + | | | ||

| + | * Lack of supporting tools (buffer management) | ||

| + | * Identification of drum resource is a demanding task | ||

| + | |} | ||

| + | |||

| + | The high complexity of project portfolio resource allocation originates from various reasons. The most important ones are:<ref name="rui" /> | ||

| + | * ''Dynamic scope changes'': The innovation projects' scope usually changes during the development cycle ("scope creep") | ||

| + | * ''Innovation risk'': The nature of innovation always incorporates a certain degree of uncertainty. | ||

| + | * ''Complexity of inter- and intra-project technical dependencies'': Changes occuring in an innovation project propagate to other portfolio projects due to complex technical dependencies among them. | ||

| + | * ''Resource management inefficiency'': Real resource availability is smaller than officially estimated by the OIPM due to distractions from daily work. | ||

| + | * ''Lack of reliable resource information'': The assumption of perfect availability of project and program level information is not given in the real world. | ||

| + | |||

| + | ==== Cyclic Review and Adjustment Process ==== | ||

| + | OPM reviews on the tactical level, taking place at an appropriate frequency for the related industry and product development cycles, have to be based on what is important quantitatively and qualitatively. During the cyclic reviews the project plan is permanently adjusted in regard to resource availability and optimization potentials. Parallel to that there also takes place a continuous revision process from the OIPM to the SIPM, ensuring a permanent supply with information within the whole IPM system (see Figure 2). | ||

| + | |||

| + | Overall the systematic with the SIPM, the OIPM and the permanent reviewing, revising and information processes, give the IPM extreme high flexibility and the ability to answer rapid to any changing conditions. Also the gap between intended strategy and operations is narrowed.<ref name="smith" /> | ||

| + | |||

| + | == Limitations and Future Research == | ||

| + | The study of related literature reveals that the fields of PPM and IPM in particular are relatively young disciplines. There neither exists a scientifically reliable and proven approach for the whole IPM process, nor a set of specifically tailored tools for the most efficient execution of the process. It is so far rather an accumulation of existing ideas and tools from similar disciplines which are put together to form one framework in the context of IPM. Especially the efficient and effective management of the complexity arising from the multi-project setup and its countless interdependencies is a huge challenge, which is not solved out so far. If this is facilitated together with a permanent linkage between nominal strategy definition and innovation project portfolio execution, IPM can contribute to companies' innovation portfolio success without any doubt. Due to the currently low maturity level however it is recommended for companies willing to introduce an IPM system to start as simple as possible and further develop the approach over time.<ref name="scott" /> Another limitation of the presented approach is the assumption to relate resources solely to human resources. In reality resources, which need to be managed within an innovation portfolio, can exemplarily also compromise information, expertise or facilities.<ref name="business" /> This fact further complicates the management process. | ||

| + | |||

| + | Various potentials for improvement of the methodic through further research have been identified. In the author's opinion research should mainly focus on the following areas: | ||

| + | |||

| + | * Research on risk management and the associated success in an innovation project portfolio context is very sacre. The knowledge in that field should be further deepened as it can contribute critically to successful IPM. It supports the alignment as well as redistribution of resources between projects and enhances portfolio transparency. Also a portfolio-wide risk management is capable to identify in multiple projects simultaneously arising risks, which gives the possibility to consolidate activities and prevent double-work. Thus possible failure can be avoided and the possibility of project success is increased. However, it has to be considered how complex and expensive the implementation of such a kind of system is.<ref name="JULIANE" /> | ||

| + | |||

| + | * So far there exists the PPM standard approach utilized to gain oversight over the innovation projects. This means the focus lies hereby on project selection and prioritization , without giving any contribution to the management of resources among the projects within the portfolio. The latter one is currently tried to be solved out in research by usage of multi-project management tools, as already described above. So there exist two approaches to handle the overall strategic and operational IPM challenge. They are not contradictory, but at the same time they cannot be combined in a way to design an effective coordination of all resourcing decisions. This lack of an integrated process clarifies the necessity of a reconceptualised management process designed for IPM.<ref name="rui" /> | ||

| + | |||

| + | * The development of suitable measurement indicators and methodologies to increase the relevance of project and portfolio assessment as well as prioritization tools and matrices would further increase IPM quality and success rate.<ref name="juliana" /> | ||

| + | |||

== References == | == References == | ||

<references> | <references> | ||

| − | <ref name="smith">R.C. Ohr, K. McFarthing, ''Managing Innovation Portfolios - Strategic Portfolio Management'', (InnovationManagement.se, 2013), http://www.innovationmanagement.se/2013/10/11/managing-innovation-portfolios-operational-portfolio-management/.</ref> | + | <ref name="smith">R.C. Ohr, K. McFarthing, ''Managing Innovation Portfolios - Strategic Portfolio Management'', (InnovationManagement.se, 2013), http://www.innovationmanagement.se/2013/10/11/managing-innovation-portfolios-operational-portfolio-management/. '''Summary:''' This article specifically treats the overall subject of managing innovation portfolios. This source, together with source no. 4, serves as the guiding thread for this article. It covers the illustration of a rough overall organizational outline for the IPM procedure. Based on this outline the article was further elaborated with scientific papers and methods, to finally deliver an integrated framework and proposals of action.</ref> |

| + | |||

| + | <ref name="smith2">R.C. Ohr, K. McFarthing, ''Managing Innovation Portfolios - Operational Portfolio Management'', (InnovationManagement.se, 2013), http://www.innovationmanagement.se/2013/09/16/managing-innovation-portfolios-strategic-portfolio-management/. '''Summary:''' See source no. 1.</ref> | ||

| + | |||

| + | <ref name="rui">R. Abrantes, J. Figueiredo, ''Resource management process framework for dynamic NPD portfolios'', ''International Journal of Project Management'', 33 (2015): 1274-1288. '''Summary:''' This paper is mainly focused on the resource management process within the IPM (in this case it is denoted as 'New Product Development portfolio'). Additionally the paper gives also a very good idea about the IPM process in general and the difficulties of permanently adjusting the portfolio to a company's strategic direction. Between the lines there also can be identified the differentiation between strategic and operational IPM by pointing out the differences between PPM and resource scheduling approaches. So this corresponds the main idea of the article, more precisely the breaking down of the management process in strategic and operational management to finally narrow the gap between the two disciplines.</ref> | ||

| + | |||

| + | <ref name="juliana">J.H. Mikkola, ''Portfolio management of R&D projects: implications for innovation management'', ''Technovation'', 21 (2001): 423-435. '''Summary:''' This paper treats the origin and necessity of portfolio techniques within the R&D departments of high-tech firms. Furthermore it focuses on the systematic analysis and evaluation of a set of R&D projects. Several portfolio matrices are explained and the importance of the selection of sound project variables and indicators is highlighted.</ref> | ||

| + | |||

| + | |||

| + | <ref name="anna">A. Meifort, ''Innovation Portfolio Management: A Synthesis and Research Agenda'', ''Creativity and Innovation Management'', 25 (2016): 251-296. '''Summary:''' This paper is mainly about providing a review of existing IPM research. Also it underlines the fact of various disciplines within IPM being disconnected so far and even gives a research agenda to integrate everything in one perspective. The author of the paper gets to the conclusion that further research in the area of IPM is worthy. </ref> | ||

| + | |||

| + | <ref name="techtarget">''Definition - Project- and Portfolio Management'', (TechTarget, 2015), http://searchcio.techtarget.com/definition/PPM-project-and-portfolio-management. '''Summary:''' TechTarget online encyclopedia. Definition on project- and portfolio management.</ref> | ||

| + | |||

| + | <ref name="scott">S.J. Edgett, ''Portfolio management for product innovation'', ''The PDMA handbook of new product development'', (2013): 154-166. '''Summary:''' This chapter of the book 'The PDMA handbook of new product development' generally covers the field of portfolio management for product innovation. It provides good general understanding of the whole topic and illustrates in a structured manner main goals, challenges and problems. Furthermore it also contains the breakdown-structure consisting of strategic and tactical IPM. </ref> | ||

| + | |||

| + | <ref name="investopedia1">''Definition: Net Present Value (NPV)'', (Investopedia, 2016), http://www.investopedia.com/terms/n/npv.asp. '''Summary:''' Investopedia online encyclopedia. Definition on net present value.</ref> | ||

| + | |||

| + | <ref name="investopedia2">''Definition: Return on Investment (ROI)'', (Investopedia, 2016), http://www.investopedia.com/terms/r/returnoninvestment.asp?ad=dirN&qo=investopediaSiteSearch&qsrc=0&o=40186. '''Summary:''' Investopedia online encyclopedia. Definition on return on investment.</ref> | ||

| + | |||

| + | <ref name="archer">N.P. Archer, F. Ghasemzadeh, ''An integrated framework for project portfolio selection'', ''International Journal of Project Management Vol. 17'', 4 (1999): 207-216. '''Summary:''' This rather old paper does not contain many state of the art information. Within this article it is mainly used as a source of information about various project evaluation variables.</ref> | ||

| + | |||

| + | <ref name="JULIANE">J. Teller, A. Kock, ''An empirical investigation on how portfolio risk management influences project portfolio success'', ''International Journal of Project Management'', 31 (2013): 817-829. '''Summary:''' This paper treats the context between risk management and the ability to tackle the challenges of a dynamic environment. A correlation between risk transparency and risk coping capacity with portfolio success is underlined. Also a very helpful discussion of implications for portfolio managers makes part of the paper.</ref> | ||

| − | <ref name=" | + | <ref name="henriksen">A.D. Henriksen, A.J. Traynor, ''A Practical R&D Project-Selection Scoring Tool'', ''IEEE Transactions on Engineering Management Vol.46'', 2 (1999): 158-170. '''Summary:''' This rather old paper does not contain many state of the art information. It is within this article mainly used to investigate and understand basic R&D project scoring tools for project evaluation and selection. As main scoring criteria there are proposed relevance, risk, reasonableness and return. On top of that it is underlined several times the importance of management judgement for project prioritisation, even in presence of very advanced support tools.</ref> |

| − | <ref name=" | + | <ref name="blumhorst">D. Blumhorst, ''Principles of Scoring Models'', (PM times - Resources for Project Managers, 2013), https://www.projecttimes.com/articles/principles-of-scoring-models.html. '''Summary:''' This article is about a an easy approach for an ongoing project scoring. The goals is to identify projects with most merit by usage of very basic scoring criteria.</ref> |

| − | <ref name=" | + | <ref name="kipper">L.M. Kipper, ''The Use of Scoring Method for Prioritizing'', ''Jorunal of Management Research Vol.6'', 1 (2014): 156-169. '''Summary:''' The paper treats the possibility of a portfolio prioritization by usage of a scoring method. The proposed approach does not make part of this article, as it would have exceeded the demanded scope. However, there a given several good implications about portfolio prioritization as well as about the organizational setup for an IPM.</ref> |

| + | <ref name="gosenheimer">C. Gosenheimer, ''Project Prioritization - A Structured Approach To Working On What Matters Most'', ''Office of Quality Improvement - University of Wisconsin-Madison'',(2012). '''Summary:''' This paper is about how to prioritize and separate high priority projects from lower priority projects. It gives some good implications about prioritization in general as well as about scoring methods (matrices) for reaching a portfolio priority list.</ref> | ||

| − | <ref name=" | + | <ref name="business">''Definition: Resource', (Business Dictionary, 2016), http://www.businessdictionary.com/definition/resource.html#ixzz4KvG19p3i. '''Summary:''' Business Dictionary online encyclopedia. Definition on the meaning of a resource.</ref> |

</references> | </references> | ||

Latest revision as of 14:08, 18 December 2018

Developed by Stefan Schenk

Article Type 1: Explanation and Illustration of a Method

Innovation Portfolio Management (IPM) can be described as a dynamic decision process concept, in which an array of active innovation projects is constantly updated and revised to deliver innovation/innovative products to market.[1] [2] High-tech companies are nowadays faced with a business environment which is characterized by an increasing dynamism and unpredictability. In order to stay competitive it is crucial to develop a suitable and flexible innovation strategy by means of possessing a broad setup of innovation-projects (innovation portfolio) and permanently adjusting this portfolio to the changing environment.[3] Hereby IPM can deliver support as an appropriate tool to implement strategy shifts into all innovation-project activities throughout the organization in a coordinated manner. Main difficulties arising in the IPM process are related to the balance of the portfolio, the cyclic evaluation and prioritization as well as to the tactical resource allocation.[3]

This article focuses on describing the general structure of an IPM system integrated as a connecting element between qualitative strategy definition and the project-based implementation. The IPM is seperated into a strategic and operational element (Strategic and Operational Portfolio Management).[4] Hereby there are also given tools and guidelines enabling the reader to tackle the mentioned main challenges. Finally the article is concluded with a short future outlook and open research questions.

Remark: This article aims at giving a macro-view on the integrated framework of IPM and proposes a basic approach of how to establish such a management system. Hereby the emphasis is especially put on an approach of how to narrow the generally large gap between nominal strategy direction and operational execution. Consequently this is not the one and only solution of conducting the IPM, but a good orientation for a first setup, which can be further refined. Furthermore also more elaborated courses of action are presented shortly along with external links, to give the reader the option to further deepen his knowledge in a particular field if needed.

Contents |

[edit] Innovation Portfolio Management (IPM)

[edit] General Idea and Impact

The basic idea IPM originates from is the Project and Portfolio Management Process (PPM). PPM is defined as a formal approach that an organization can use to orchestrate, prioritize and benefit from projects. This approach examines the risk-reward of each project, the available funds, the likelihood of a project's duration, and the expected outcomes. A group of decision makers within an organization, led by a Project Management Office director, evaluates the returns, benefits and prioritization of each project to determine the best way to invest the organization’s capital and human resources.[6] This article expands the latter conception by relating the portfolio management procedure to the innovation management (R&D) within high-tech companies. Thus PPM gets extended into the more dynamic IPM, which is a more complex, multi-level process specifically aiming at the continuous innovation management consistent with the corporate strategy.

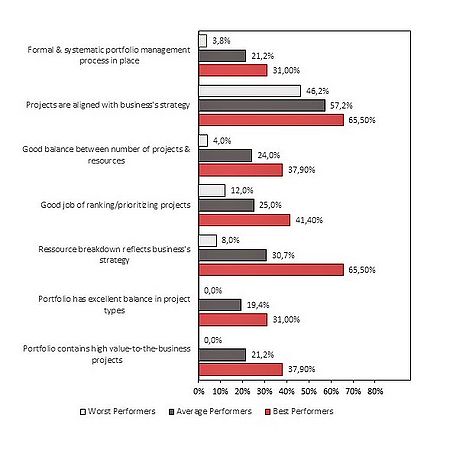

Traditionally innovation research was mainly focused on the appropriate management of single New Product Development (NPD) projects, thus focusing on innovation determinants at the project level.[2] In the face of today's globalization of markets, shorter life-cycles and increasing competition as well as complexity of technologies, high-tech firms have to hold a set of multiple NPD projects (innovation portfolio) to be flexible and reduce the risk to the lowest level possible. Hereby each project generates several changes on its own. This results in a set of cascading effects throughout the rest of the NPD projects, which have to be evaluated in relation to each other.[3] Additionally market changes and new business practices constrain firms to continuously reconsider the corporate competitive strategy, including their innovation portfolio. These two points create a permanently-changing decision context that cannot be conceived with a single-project perspective, but has to be managed with an overall IPM process. The desired outcome of an effective IPM is a stable pipeline of high-quality new products by linking the strategy formulation to the strategy implementation. This finally ensures long-term corporate growth and profitability.[2] In Figure 1 the best practices in portfolio management which have been observed in several studies and the impact of each practice are displayed, illustrating the positive impact of IPM on organizational performance. Despite the existence of this obvious interrelationship between corporate sustainable profitability and permanent innovation, many companies possess relatively conservative innovation strategies, rather focusing on maintaining and improving existing product lines.[2] The main reason for this mindset are the obstacles resulting from the extreme complexity of a well-implemented IPM process within an organization. In the following there is given a macro-overview of an IPM system to give the reader a good, general idea of the main structure and approach of an IPM system.

[edit] Main Goals

As already mentioned in the section General Idea and Impact, the aimed final result of the IPM process for a firm is the delivery of high-quality innovations to the market. How does the IPM system itself have to be settled up to reach this organizational goal in the end? In research four main goals have been identified:

- Strategic Alignment is the goal with highest priority. Newly developed products have to match the corporate innovation strategy. This means that products need to support the strategy or even be critical components of it.

- Maximize the Portfolio Value means to maximize a portfolio value by allocating resources for a particular spending level. Thus the sum of the commercial value of all active innovation projects has to be maximized. Possible measurement possibilities are net present value (NPV, corresponds the difference between the present value of cash inflows and the present value of cash outflows[7]), return on invest (ROI, measures the amount of return on an investment relative to the investment’s cost[8]) or likelihood of final success.

- Right Balancing of Projects relates to a number of project-specific parameters, that need to be balanced over the portfolio. Possible parameters to be balanced are long-term versus short-term projects, high-risk versus low-risk projects, market concentration or technology focus.

- The Right Number of Projects is a critical feature, especially due to the tendency that most companies have more projects running than their resources allow them to do. Consequently there is a lack of human resources and time, leading to elongated time-to-market periods and a decreased quality of the delivered innovation products. Required resources for active projects and available resources necessarily have to be balanced. Possible approaches to ensure this are managing the key resource limits or the performance of a resource capacity analysis.[5]

[edit] Main Challenges

In total there exist five main criteria characterizing effective IPM, making it one of the most complex decision-making functions within a firm:

- IPM is dealing with and dependent on future events and possible opportunities. The quality of the necessary information for project selection and prioritization decisions is in best case uncertain and in worst case unreliable.

- The environment for decision making is highly dynamic. Expectations and status of all projects within the innovation portfolio is continuously changing as markets shift and new information come up.

- All projects within the innovation portfolio are characterized by different levels of completion and compete for available resources (in this article resources are always related to human resources). Consequently a comparison among projects has to be conducted, based on information differing in quantity and quality.

- Available resources that can be allocated among the active projects are limited. Any prioritization of one project comes along with a deduction of resources for another project. Additionally resource transfers in real-world are not seamless as indicated by planning tools.

- Data availability over all the information gathered within the portfolio is critical. This further complicates an efficient and effective IPM process.[5]

[edit] Application of IPM

[edit] Organizational Setup

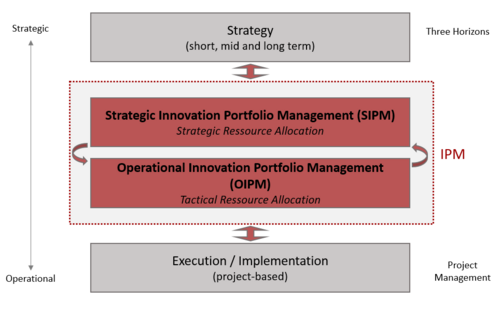

A good approach to unravel the complexity of IPM and break down the different challanges is the concept of dividing it up into a strategic and an operational part. Strategic Innovation Portfolio Management (SIPM) aims at following the right innovation projects and supplying them with resources ("doing the right things"). Operational Innovation Portfolio Management (OIPM) on the other side ensures an appropriate execution of the selected projects ("doing things right"). As stated, the IPM concept enables a company to permanently link the strategy development to execution in order to generate tangible results. Exactly at this linkage, between strategy definition and metrics-based project execution, SIPM and OIPM are positioned. The resulting arrangement is illustrated in Figure 2, with the overall IPM system in the grey box as "transmission" element.[1] To achieve a structured form of organizing the IPM, a portfolio governance in form of a Project Portfolio Management Office (PPMO) should be installed on the strategic level. This PPMO is responsible for the SIPM and has the effect of increasing IPM quality and as a consequence of that also the portfolio success, as studies have revealed.[2] Furthermore, the PPMO should be complemented with major boards responsible for implementation, prioritisation and resources. Stiff RACI (responsible, accountable, consult, inform) matrices for managers should be renounced, as they interfere with fast decision processes which outbreaks project progress. Finally also an overall IPM IT-system delivers big advantages, especially in case of managing large portfolios. The high complexity of the involved parties, the various kinds of processes and the different organizational stages lead to the need of a supporting information system to guarantee a permanent supply with necessary information and to support time keeping procedures. Also there should be used a software suitable with your IPM structure and not the other way round.

[edit] Strategic Innovation Portfolio Management (SIPM)

The two main activities of SIPM consist of the portfolio balancing process as well as the iterating innovation portfolio evaluation and prioritization. A more detailed description is elaborated under the following two points.

[edit] Balancing Portfolio

The intended state of a balanced portfolio is defined as an assortment of innovation projects enabling sustainable growth and profit for a company associated with its corporate strategy without being exposed to undue risks. Maintaining such a kind of balance leads to an asset base of technologies, which are essential for competitive advantage.[9]

First, the selection of projects and new innovations has to be decided carefully. Accordance with the corporate direction of strategy has highest importance. Especially for long-term projects this criteria has to be emphasized in particular, as they are shaping and representing the long-term strategy.[9]

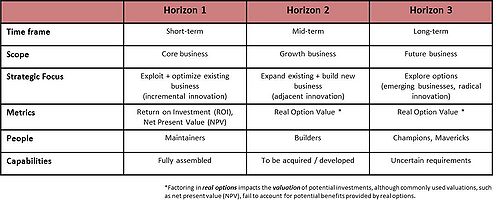

In a second step the coverage of both, long-term and short-term innovation projects has to be balanced. A good method for achieving such a "project mix" is to define the three horizons "Short-term", "Mid-term" and "Long-term" helping to distinguish and manage innovation activities across different time frames. An exemplary outline of such a managing-model is displayed in Figure 3 together with the corresponding characteristics for each horizon. This method supports the IPM management to not loose track of pushing forward mid- and long-term innovation investments due to unintentional focus on the short-term performance. Typically it is mainly the horizon 2 activities, which get neglected due to their position between the two extremes short-term budgets and long-term focus. Finally a good balance in this category is accomplished by a parallel process of future business identification and development along with optimization of the existing business.[1]

The third crucial criterion to be balanced regarding the portfolio is risk and uncertainty. For every project exists the risk of not meeting the specified objectives and there can always arise challenges from the outside. To analyse the risk of a single project, it has to be decomposed into component activities resulting in the Work Breakdown Structure (WBS). Hereby the decomposition can range, depending on the necessary depth of the analysis, from a simple WBS for horizon 3 projects to a complex WBS for a project standing in horizon 1. In this way the risk for all project activities can be solely analysed, in order to afterwards estimate the corresponding probabilities and consequences.[10] New literature claims that in an IPM framework the risk-estimation of single projects is not sufficient anymore suggesting a portfolio-wide risk management. However, high costs, the lack of an established appraoch and the acknowledged positive effects of single project risk management in literature make portfolio risk management so far a very rarely implemented system.[11] A possibility to further complement the single project risk management is a staging investment approach across the innovation portfolio depending on the risk of each project. This implies to make on average high bets (investments) rather in horizon 1, medium bets in horizon 2 and low bets in the high-risk and uncertain horizon 3. This clarifies the importance of prototyping, pilot projects and market research, as they are necessary to afterwards scale projects up. A time-proven guideline for the allocation of innovation funds is 70% for horizon 1, 20% for horizon 2 and 10% for horizon 3 projects.[1]

[edit] Cyclic Innovation Portfolio Evaluation and Prioritization

Cyclic innovation portfolio evaluation and prioritization is a dynamic decision process in the SIPM, in which the innovation portfolio is constantly updated and revised. In detail this means that new projects are evaluated, selected and prioritized, existing projects are upgraded, deprioritized, or even killed, and resources may be allocated and reallocated to active projects within the portfolio. This procedure is basically adopted from the multi-project based process of PPM. Main challenges within this process are uncertain information about project states, the identification of project synergies, changing opportunities evolving in the business environment and conflicting strategic goals of the firm. It is essential to update a company's portfolio by this process regularly and efficiently to prevent heavy resource bottlenecks in the innovation portfolio pipeline. As the projects within the portfolio can be based in different units within a company, this process also has to account for the different interdependencies.[2][3] The decisions made in this context also have a relatively heavy impact on a company's innovative capability and thus also on the company's sustainable growth and profitability. That is why the innovation projects have to be subjectively evaluated from strategic managers with different backgrounds and functions, which are able to find for a particular firm the best consensus regarding specifications and goals. This circle of deciders corresponds the already mentioned PPMO.[9]

Many quantitative and qualitative methods for project- and portfolio assessment were discussed in the literature, ranging from operations research methods to social-science-based approaches. Proposals for project selection and prioritization were mainly focusing on one of the following methods:

- Unstructured peer review

- Scoring methods

- Mathematical programming (e.g. linear / non-linear programming)

- Economic models (e.g. internal rate of return)

- Decision analysis (e.g. analytic hierarchy process)

- Artificial intelligence (e.g. expert systems)

The combination of different approaches via an interactive, computer-based Decision Support System (DSS) is also a possibility, giving decision makers the possibility of simulating different scenarios in an user-friendly way or prioritize concerning special goals (e.g. main focus on strategic alignment[12]). The most suppressing fact of most research approaches is their extreme mathematical complexity, making the assistance of an expert decision analyst necessary for a "normal" manager to use such a system.[13]

The most common way, and also the most reasonable way concerning the macro-perspective and dimension of this article, are scoring methods. They enable the deciders to quickly find the projects with the highest merit without being completely dependent on early estimates. There exist many indicators which possibly can be applied in the scoring model. The identification, emphasis and number of such success factors for an innovation is a very demanding task making it part of big research efforts over the last decades. Depending on the competitive structure of a market, each industry is confronted with a particular array of challenges, which are not relevant at all to other industries. Consequently there exists a particular set of scoring criteria which have to be applied for the decision process, unique to each firm.[9]. A good "basic" set of reasonable criteria to build a scoring model around are benefits, cost, risk, market share, technical feasibility and margin, covering the most important aspects to consider.[14]

If a less detailed, rather fast overview of the potential of projects is demanded, different analytical tools with different approaches and focus areas can be used. Examples are the Boston Consulting Group Growth-share Matrix (BCG Matrix) and the McKinsey Matrix. These tools are mainly focusing on two, maximum three indicators in order to facilitate a depiction of the analysis. So the BCG Matrix uses relative market share and industry growth rate in a four-cell matrix as success determinants, whereas the McKinsey Matrix focuses on competitive position of a company and industry attractiveness within a nine-cell matrix. These tools however have to be used carefully as they cannot capture the complexity of a innovation portfolio decision process. So criticism of the matrices addresses among others the difficulties of measuring the chosen indicators, a lack of market structure consideration, the high uncertainty and the approach of viewing the portfolio as a closed system.[9]

No matter which approach for decision making is used, it is just a tool and should never completely replace personal management judgment and leadership. There should always be space for exceptional decisions, such as funding an innovation project which does not meet the scoring requirements. This gives the priority list of projects a final fine-tuning. After such kind of decisions however a transparent communication throughout the organization, as well as to customers and stakeholders is important.[13][15]

In order to implement the prioritization of the innovation portfolio, the next step is to (re)allocate the available resources in accordance to reach full alignment. Otherwise the consequent tactical OIPM cannot reach success. Strategic resource management aims to translate resource availability into corresponding constraints and implement these constraints into the analysis of alternative portfolio composition. In case a proposed innovation portfolio and its prioritization are not feasible with the available resources, the portfolio has to go through a second decision process or the magnitude of the resource pool needs to be adjusted (e.g. by hiring).

[edit] Operational Innovation Portfolio Management (OIPM)

The main purpose of the OIPM process an efficient execution of the strategic portfolio decisions along with a cyclic review and adjustment process on the tactical level, which is elaborated more deeply in the following two sections.

[edit] Tactical Resource Allocation

Executing the strategic portfolio plan in an efficient way requires integrated planning, managing of project interdependencies, tactical resource allocation as well as distribution of hard- and soft-skills across the project requirements. Especially the tactical resource allocation is a critical capability to master the OIPM.

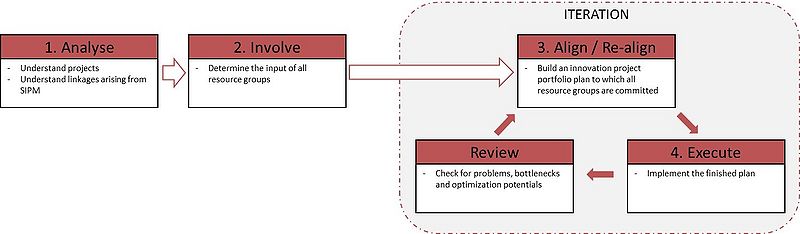

As there occur numerous dynamic changes within the portfolio along with new interrelationships, a permanent high-quality OIPM is required to deliver project results and efficiency in doing so. As orientation the key sequence analyse, involve, align and execute can be taken as red line for the whole process, incorporating a mixture of analysis, IT processes and intense communication. It should be highlighted that this part of the IPM is the most people-driven process, making it also a very vulnerable one. In Figure 4 the key sequence is displayed together with a dynamic iteration loop . In order to achieve engagement and correlated with that motivation of all involved resource groups they should be taken into consideration during the build-up of the innovation project portfolio plan and the related resource allocation. This is an essential building brick for success, as the team is pressured with stressful deadlines, multiple simultaneous projects demanding multiple roles. Also should the amount of analysed data during the permanent reviewing of the ongoing process be kept at a reasonable level, meaning to keep the whole system agile instead of bureaucratic and sluggish.[1][3]

As the PPM systematic is more dealing with managerial and organizational aspects, research attempted to tackle the challenge of resource allocation in a more elaborated and systematic way by applying techniques previously suggested for multi-project settings. Examples are the Resource Constrained Multi-Project Scheduling Problem (RCMPSP), Agile and Critical Chain Approaches. In Table 1 the main strengths and weaknesses are displayed. If more detailed knowledge of the methods in this context is required, further reading can be found in the linked scientific papers within Table 1. However, even if the transformation of these multi-project setting techniques can help during the resource allocation to a certain degree, their meaningfulness is limited due to the highly dynamic environment and the dependency complexity between the innovation projects.

| Multi-project resource management approach | Strengths | Weaknesses |

|---|---|---|

| Hierarchical planning (RCCP / RCPSP scheduling) |

|

|

| RCMPSP scheduling |

|

|

| Agile |

|

|

| Critical chain |

|

|

The high complexity of project portfolio resource allocation originates from various reasons. The most important ones are:[3]

- Dynamic scope changes: The innovation projects' scope usually changes during the development cycle ("scope creep")

- Innovation risk: The nature of innovation always incorporates a certain degree of uncertainty.

- Complexity of inter- and intra-project technical dependencies: Changes occuring in an innovation project propagate to other portfolio projects due to complex technical dependencies among them.

- Resource management inefficiency: Real resource availability is smaller than officially estimated by the OIPM due to distractions from daily work.

- Lack of reliable resource information: The assumption of perfect availability of project and program level information is not given in the real world.

[edit] Cyclic Review and Adjustment Process

OPM reviews on the tactical level, taking place at an appropriate frequency for the related industry and product development cycles, have to be based on what is important quantitatively and qualitatively. During the cyclic reviews the project plan is permanently adjusted in regard to resource availability and optimization potentials. Parallel to that there also takes place a continuous revision process from the OIPM to the SIPM, ensuring a permanent supply with information within the whole IPM system (see Figure 2).

Overall the systematic with the SIPM, the OIPM and the permanent reviewing, revising and information processes, give the IPM extreme high flexibility and the ability to answer rapid to any changing conditions. Also the gap between intended strategy and operations is narrowed.[1]

[edit] Limitations and Future Research

The study of related literature reveals that the fields of PPM and IPM in particular are relatively young disciplines. There neither exists a scientifically reliable and proven approach for the whole IPM process, nor a set of specifically tailored tools for the most efficient execution of the process. It is so far rather an accumulation of existing ideas and tools from similar disciplines which are put together to form one framework in the context of IPM. Especially the efficient and effective management of the complexity arising from the multi-project setup and its countless interdependencies is a huge challenge, which is not solved out so far. If this is facilitated together with a permanent linkage between nominal strategy definition and innovation project portfolio execution, IPM can contribute to companies' innovation portfolio success without any doubt. Due to the currently low maturity level however it is recommended for companies willing to introduce an IPM system to start as simple as possible and further develop the approach over time.[5] Another limitation of the presented approach is the assumption to relate resources solely to human resources. In reality resources, which need to be managed within an innovation portfolio, can exemplarily also compromise information, expertise or facilities.[16] This fact further complicates the management process.

Various potentials for improvement of the methodic through further research have been identified. In the author's opinion research should mainly focus on the following areas:

- Research on risk management and the associated success in an innovation project portfolio context is very sacre. The knowledge in that field should be further deepened as it can contribute critically to successful IPM. It supports the alignment as well as redistribution of resources between projects and enhances portfolio transparency. Also a portfolio-wide risk management is capable to identify in multiple projects simultaneously arising risks, which gives the possibility to consolidate activities and prevent double-work. Thus possible failure can be avoided and the possibility of project success is increased. However, it has to be considered how complex and expensive the implementation of such a kind of system is.[11]

- So far there exists the PPM standard approach utilized to gain oversight over the innovation projects. This means the focus lies hereby on project selection and prioritization , without giving any contribution to the management of resources among the projects within the portfolio. The latter one is currently tried to be solved out in research by usage of multi-project management tools, as already described above. So there exist two approaches to handle the overall strategic and operational IPM challenge. They are not contradictory, but at the same time they cannot be combined in a way to design an effective coordination of all resourcing decisions. This lack of an integrated process clarifies the necessity of a reconceptualised management process designed for IPM.[3]

- The development of suitable measurement indicators and methodologies to increase the relevance of project and portfolio assessment as well as prioritization tools and matrices would further increase IPM quality and success rate.[9]

[edit] References

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 R.C. Ohr, K. McFarthing, Managing Innovation Portfolios - Strategic Portfolio Management, (InnovationManagement.se, 2013), http://www.innovationmanagement.se/2013/10/11/managing-innovation-portfolios-operational-portfolio-management/. Summary: This article specifically treats the overall subject of managing innovation portfolios. This source, together with source no. 4, serves as the guiding thread for this article. It covers the illustration of a rough overall organizational outline for the IPM procedure. Based on this outline the article was further elaborated with scientific papers and methods, to finally deliver an integrated framework and proposals of action.

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 A. Meifort, Innovation Portfolio Management: A Synthesis and Research Agenda, Creativity and Innovation Management, 25 (2016): 251-296. Summary: This paper is mainly about providing a review of existing IPM research. Also it underlines the fact of various disciplines within IPM being disconnected so far and even gives a research agenda to integrate everything in one perspective. The author of the paper gets to the conclusion that further research in the area of IPM is worthy.

- ↑ 3.0 3.1 3.2 3.3 3.4 3.5 3.6 3.7 R. Abrantes, J. Figueiredo, Resource management process framework for dynamic NPD portfolios, International Journal of Project Management, 33 (2015): 1274-1288. Summary: This paper is mainly focused on the resource management process within the IPM (in this case it is denoted as 'New Product Development portfolio'). Additionally the paper gives also a very good idea about the IPM process in general and the difficulties of permanently adjusting the portfolio to a company's strategic direction. Between the lines there also can be identified the differentiation between strategic and operational IPM by pointing out the differences between PPM and resource scheduling approaches. So this corresponds the main idea of the article, more precisely the breaking down of the management process in strategic and operational management to finally narrow the gap between the two disciplines.

- ↑ R.C. Ohr, K. McFarthing, Managing Innovation Portfolios - Operational Portfolio Management, (InnovationManagement.se, 2013), http://www.innovationmanagement.se/2013/09/16/managing-innovation-portfolios-strategic-portfolio-management/. Summary: See source no. 1.

- ↑ 5.0 5.1 5.2 5.3 S.J. Edgett, Portfolio management for product innovation, The PDMA handbook of new product development, (2013): 154-166. Summary: This chapter of the book 'The PDMA handbook of new product development' generally covers the field of portfolio management for product innovation. It provides good general understanding of the whole topic and illustrates in a structured manner main goals, challenges and problems. Furthermore it also contains the breakdown-structure consisting of strategic and tactical IPM.

- ↑ Definition - Project- and Portfolio Management, (TechTarget, 2015), http://searchcio.techtarget.com/definition/PPM-project-and-portfolio-management. Summary: TechTarget online encyclopedia. Definition on project- and portfolio management.

- ↑ Definition: Net Present Value (NPV), (Investopedia, 2016), http://www.investopedia.com/terms/n/npv.asp. Summary: Investopedia online encyclopedia. Definition on net present value.

- ↑ Definition: Return on Investment (ROI), (Investopedia, 2016), http://www.investopedia.com/terms/r/returnoninvestment.asp?ad=dirN&qo=investopediaSiteSearch&qsrc=0&o=40186. Summary: Investopedia online encyclopedia. Definition on return on investment.

- ↑ 9.0 9.1 9.2 9.3 9.4 9.5 J.H. Mikkola, Portfolio management of R&D projects: implications for innovation management, Technovation, 21 (2001): 423-435. Summary: This paper treats the origin and necessity of portfolio techniques within the R&D departments of high-tech firms. Furthermore it focuses on the systematic analysis and evaluation of a set of R&D projects. Several portfolio matrices are explained and the importance of the selection of sound project variables and indicators is highlighted.

- ↑ N.P. Archer, F. Ghasemzadeh, An integrated framework for project portfolio selection, International Journal of Project Management Vol. 17, 4 (1999): 207-216. Summary: This rather old paper does not contain many state of the art information. Within this article it is mainly used as a source of information about various project evaluation variables.

- ↑ 11.0 11.1 J. Teller, A. Kock, An empirical investigation on how portfolio risk management influences project portfolio success, International Journal of Project Management, 31 (2013): 817-829. Summary: This paper treats the context between risk management and the ability to tackle the challenges of a dynamic environment. A correlation between risk transparency and risk coping capacity with portfolio success is underlined. Also a very helpful discussion of implications for portfolio managers makes part of the paper.

- ↑ L.M. Kipper, The Use of Scoring Method for Prioritizing, Jorunal of Management Research Vol.6, 1 (2014): 156-169. Summary: The paper treats the possibility of a portfolio prioritization by usage of a scoring method. The proposed approach does not make part of this article, as it would have exceeded the demanded scope. However, there a given several good implications about portfolio prioritization as well as about the organizational setup for an IPM.

- ↑ 13.0 13.1 A.D. Henriksen, A.J. Traynor, A Practical R&D Project-Selection Scoring Tool, IEEE Transactions on Engineering Management Vol.46, 2 (1999): 158-170. Summary: This rather old paper does not contain many state of the art information. It is within this article mainly used to investigate and understand basic R&D project scoring tools for project evaluation and selection. As main scoring criteria there are proposed relevance, risk, reasonableness and return. On top of that it is underlined several times the importance of management judgement for project prioritisation, even in presence of very advanced support tools.

- ↑ D. Blumhorst, Principles of Scoring Models, (PM times - Resources for Project Managers, 2013), https://www.projecttimes.com/articles/principles-of-scoring-models.html. Summary: This article is about a an easy approach for an ongoing project scoring. The goals is to identify projects with most merit by usage of very basic scoring criteria.

- ↑ C. Gosenheimer, Project Prioritization - A Structured Approach To Working On What Matters Most, Office of Quality Improvement - University of Wisconsin-Madison,(2012). Summary: This paper is about how to prioritize and separate high priority projects from lower priority projects. It gives some good implications about prioritization in general as well as about scoring methods (matrices) for reaching a portfolio priority list.

- ↑ Definition: Resource', (Business Dictionary, 2016), http://www.businessdictionary.com/definition/resource.html#ixzz4KvG19p3i. Summary: Business Dictionary online encyclopedia. Definition on the meaning of a resource.