Construction Cost Management

(→Cost Control Methods) |

|||

| (49 intermediate revisions by one user not shown) | |||

| Line 1: | Line 1: | ||

| − | ''' | + | ''Developed by Apostolos Bougas'' |

| − | [[File: | + | |

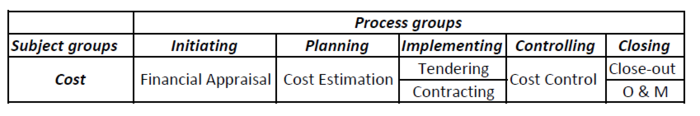

| + | '''Construction Cost Management''' is one of the most important aspects of a construction project planning process, as cost and money are strictly related to the project and have a major influence on it during its whole lifecycle. This wiki article provides a general overview of all the cost aspects during a construction project lifetime. The article is divided into sections according to the Danish ISO Standard DS/ISO: 21500:2013 Guidance on Project Management. These sections cover the entire lifecycle of a project in general, and so, of a construction project. Each section was related with the costs aspects of a construction project which are relevant for it. The article starts with presenting the financial appraisal of a construction company, then continues into describing the cost estimation, then delves into aspects on tendering and contracting. The cost control of the project is later mentioned, finally followed by the cost aspects on closing and after that of a construction project. In each section, the most important cost aspects and techniques, which are performed by cost managers, are briefly presented. The article stands out as a guide for cost construction management. | ||

| + | |||

| + | [[File:Cost_management.PNG |thumb|right|700px|Figure 1: Construction Cost Management Processes]] | ||

=Introduction= | =Introduction= | ||

| Line 16: | Line 19: | ||

=Initiating= | =Initiating= | ||

| − | ==<span class="plainlinks">[http://apppm.man.dtu.dk/index.php/Financial_appraisal_in_construction Feasibility or Financial Appraisal]</span>== | + | ==<span class="plainlinks">[http://apppm.man.dtu.dk/index.php/Financial_appraisal_in_construction Feasibility or Financial Appraisal]</span><ref name="Maylor">3. Maylor, H. (2010), "Project Management". Fourth Edition</ref>== |

'''Financial appraisal in construction''' is one of the most important and earliest stages of the construction project planning process. The purpose of the financial appraisal is to determine whether the project is worthwhile, comparing its costs with its expected benefits. It stands as a key element for deciding whether or not to proceed with a construction project and any project in general. Also, it stands out as a key element for choosing between alternative construction projects. Financial appraisal addresses not only the adequacy of funds, but also the financial viability of the project, estimating in the end if and when the project returns a profit or not. | '''Financial appraisal in construction''' is one of the most important and earliest stages of the construction project planning process. The purpose of the financial appraisal is to determine whether the project is worthwhile, comparing its costs with its expected benefits. It stands as a key element for deciding whether or not to proceed with a construction project and any project in general. Also, it stands out as a key element for choosing between alternative construction projects. Financial appraisal addresses not only the adequacy of funds, but also the financial viability of the project, estimating in the end if and when the project returns a profit or not. | ||

| Line 35: | Line 38: | ||

==Cost Estimation== | ==Cost Estimation== | ||

===Introduction=== | ===Introduction=== | ||

| − | The capital cost for a construction project consists of the following expenses:<ref name="PMI_book"></ref> | + | The '''capital cost''' for a construction project consists of the following expenses:<ref name="PMI_book"></ref> |

*Land acquisition | *Land acquisition | ||

*Planning and feasibility studies | *Planning and feasibility studies | ||

| Line 50: | Line 53: | ||

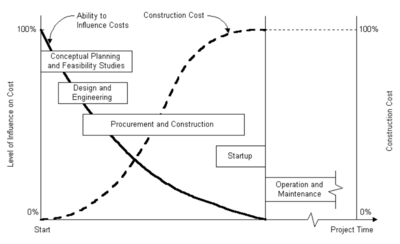

All estimates are approximations, based on judgement and experience. Estimator must put the project on paper, then estimate the quantities. Estimator also needs to offer alternative construction methods and solutions, determining the sources and consequently the cost of each method and solution. Cost estimation stage is the construction project phase, in which possible areas for major cost savings can be suggested. Changes in the project should take place in this phase, otherwise they usually lead to delays and inordinate cost increases. | All estimates are approximations, based on judgement and experience. Estimator must put the project on paper, then estimate the quantities. Estimator also needs to offer alternative construction methods and solutions, determining the sources and consequently the cost of each method and solution. Cost estimation stage is the construction project phase, in which possible areas for major cost savings can be suggested. Changes in the project should take place in this phase, otherwise they usually lead to delays and inordinate cost increases. | ||

| − | [[File:Construction_cost_over_time.PNG |thumb|center| | + | [[File:Construction_cost_over_time.PNG |thumb|center|400px|Figure 2: Ability to influence Construction Cost over time]] |

| − | === | + | ===Contingency=== |

| + | The development of construction budget requires prediction for contingencies and unexpected costs during the construction phases. The contingency is included either in every single item or in the whole project. The calculation of contingency is based on historical experience and the expected difficulty of the particular project. Contingency cost derive from the following areas<ref name="PMI_book"> Hendrickson C., Au T., (2008) ''Project Management for Construction: Fundamental Concepts for Owners, Engineers, Architects and Builders'', Version 2.2, [URL:http://http://pmbook.ce.cmu.edu/] Retrieved on 13 December 2017</ref>: | ||

| + | *Design development changes | ||

| + | *Schedule changes | ||

| + | *Administration changes such as wages rates and payments | ||

| + | *Changes in site conditions | ||

| + | *Third party requirements such as new permits | ||

| + | |||

| + | Contingency budget, which is not spent eventually during construction, is returned to the client near the end of the construction phase, or additional work and elements are added to the project, after agreement with the client. | ||

| + | |||

| + | ===Types of cost estimates=== | ||

====Conceptual & Preliminary Estimate==== | ====Conceptual & Preliminary Estimate==== | ||

| + | This type of estimate is used in the early planning design phase of the project | ||

'''Methods''' | '''Methods''' | ||

*Cost Indices | *Cost Indices | ||

| − | + | *Cost-Capacity Factors | |

| − | + | ||

| − | *Cost-Capacity Factors | + | |

| − | + | ||

| − | + | ||

*Component Ratios | *Component Ratios | ||

*Parameter Costs | *Parameter Costs | ||

====Detailed Estimate==== | ====Detailed Estimate==== | ||

| + | This type of estimate is used in the late planning design phase of the project by the client and the consultancy team or by the contractor for submitting the tender. | ||

'''Methods''' | '''Methods''' | ||

| Line 86: | Line 97: | ||

*Neural network models | *Neural network models | ||

*Case-based reasoning models | *Case-based reasoning models | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

=Implementing= | =Implementing= | ||

==Tendering== | ==Tendering== | ||

| − | Pricing is determined by a large number of factors. The bid, which is submitted by a contractor, depends mostly on cost estimation and contractor's profit. Competitive tendering or bidding is a decision-making under uncertainty procedure. Every contractor or bidder submits a tender without knowing the tender nature of its competitors. Cost Estimation of the necessary work that needs to be performed and profit stand out as the main drivers for tendering. However, the higher the estimated cost, the more unlikely is that the construction firm will acquire the project. Moreover, the higher the profit, less possibilities there are for a contractor to acquire the job. On the other hand, if the profit is too low, there is a high chance for the bidder to go bankrupt. The decision on the tender price apart from cost project estimation and profit relies on the overall strategy and survival of the construction company and the tendency for risk. Some of such other factors influencing tenders are: | + | '''Pricing''' is determined by a large number of factors. The bid, which is submitted by a contractor, depends mostly on cost estimation and contractor's profit. '''Competitive tendering''' or '''bidding''' is a decision-making under uncertainty procedure. Every contractor or bidder submits a tender without knowing the tender nature of its competitors. Cost Estimation of the necessary work that needs to be performed and profit stand out as the main drivers for tendering. However, the higher the estimated cost, the more unlikely is that the construction firm will acquire the project. Moreover, the higher the profit, less possibilities there are for a contractor to acquire the job. On the other hand, if the profit is too low, there is a high chance for the bidder to go bankrupt. The decision on the tender price apart from cost project estimation and profit relies on the overall strategy and survival of the construction company and the tendency for risk. Some of such other factors influencing tenders are<ref name="PMI_book"> Hendrickson C., Au T., (2008) ''Project Management for Construction: Fundamental Concepts for Owners, Engineers, Architects and Builders'', Version 2.2, [URL:http://http://pmbook.ce.cmu.edu/] Retrieved on 13 December 2017</ref>: |

| − | *Exogenous Economic Factors | + | *Exogenous Economic Factors such as geographic locations and market trends |

| − | *Characteristics of Bidding Competition | + | *Characteristics of Bidding Competition such as the number of bidders |

| − | * | + | *Objectives of Contractors |

| − | *Contractors' Comparative Advantages | + | *Contractors' Comparative Advantages such as superior technology, greater experience, lower cost units, better management |

==Contracting <ref name="PMI_book"> Hendrickson C., Au T., (2008) ''Project Management for Construction: Fundamental Concepts for Owners, Engineers, Architects and Builders'', Version 2.2, [URL:http://http://pmbook.ce.cmu.edu/] Retrieved on 13 December 2017</ref>== | ==Contracting <ref name="PMI_book"> Hendrickson C., Au T., (2008) ''Project Management for Construction: Fundamental Concepts for Owners, Engineers, Architects and Builders'', Version 2.2, [URL:http://http://pmbook.ce.cmu.edu/] Retrieved on 13 December 2017</ref>== | ||

| Line 125: | Line 125: | ||

*Guaranteed Maximum Cost Contract | *Guaranteed Maximum Cost Contract | ||

| + | In lump sum contract, al the risk is assigned to the contractor. In a unit price contract, the risk of inaccurate estimation of uncertain quantities for some key tasks has been transferred from the contractor to the client. The fixed percentage or fixed fee is determined at the start of the project, while variable fee and target estimates are used as motivation to reduce costs by sharing any cost savings. A guaranteed maximum cost arrangement imposes a penalty on a contractor for cost overruns and failure to complete the project on time. With a guaranteed maximum price contract, cost overruns below the maximum are divided between the owner and the contractor, while the contractor is responsible for costs overruns over the maximum. | ||

=Controlling= | =Controlling= | ||

| Line 130: | Line 131: | ||

==Cost Control== | ==Cost Control== | ||

| − | The primary objective of Construction Cost Control is the delivery of the project within the approved budget. Procedures and methods for construction cost control provide the project managers the tools to track the progress of the progress and to evaluate and correct possible problems which may occur. The main goal of this construction stage is to identify deviations from the project plan and project | + | The primary objective of Construction Cost Control is the delivery of the project within the approved budget. Procedures and methods for construction cost control provide the project managers the tools to track the progress of the progress and to evaluate and correct possible problems which may occur. The main goal of this construction stage is to identify deviations from the project plan and project budget rather to suggest methods for cost savings, as deviations can result in delays and, consequently, lead to cost overruns. |

| − | ===Cost Control Methods=== | + | ===Cost Control Methods<ref name="Coursera"> Odeh I. (2017), Cost Estimating and Cost Control, Columbia University, [URL:https://www.coursera.org/learn/construction-cost-estimating] Retrieved on 29 December 2017</ref>=== |

The abovementioned methods are used for controlling cost and progress and forecasting on a particular task, and not in the project as a whole. | The abovementioned methods are used for controlling cost and progress and forecasting on a particular task, and not in the project as a whole. | ||

| Line 150: | Line 151: | ||

The cost incurred to date can be also used to estimate the work completed to date. | The cost incurred to date can be also used to estimate the work completed to date. | ||

| − | ==Earned Value Method<ref name="PMI_EV"> Project Management Institute(PMI). (2005) "Practice Standard for Earned Value Management", [URL:https://blog.alevi.ru/wp-content/uploads/2015/08/Earned-Value-Management.pdf] Retrieved on 29 December 2017</ref>== | + | ==<span class="plainlinks">[http://apppm.man.dtu.dk/index.php/Earned_Value_Management_(EVM)_in_construction_projects Earned Value Method]</span> <ref name="PMI_EV"> Project Management Institute(PMI). (2005) "Practice Standard for Earned Value Management", [URL:https://blog.alevi.ru/wp-content/uploads/2015/08/Earned-Value-Management.pdf] Retrieved on 29 December 2017</ref>== |

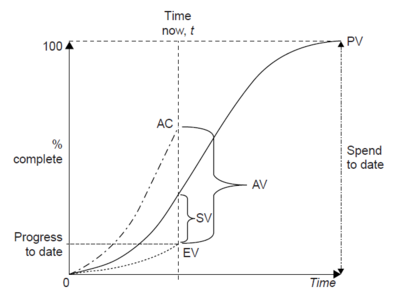

| − | + | '''Earned Value Method''' is the most common cost control method, which is used on construction projects for the entire project and not only for particular tasks. Earned Value Method is used to calculate the progress that has been achieved on a project using a <span class="plainlinks">[http://apppm.man.dtu.dk/index.php/The_work_breakdown_structure_in_project_management Work Breakdown Structure]</span> (WBS). It is implemented to control both costs and the schedule of complex construction projects. | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

'''Objectives''' | '''Objectives''' | ||

| Line 168: | Line 165: | ||

*'''''Actual Cost (AC)''''' Actual Cost or Actual Cost of Work Performed indicates the amount of resources that have been expended to achieve the actual work performed to date. It is compared to the Earned Value at a specific point to identify if the project is under or over budget though budget variance (AV). | *'''''Actual Cost (AC)''''' Actual Cost or Actual Cost of Work Performed indicates the amount of resources that have been expended to achieve the actual work performed to date. It is compared to the Earned Value at a specific point to identify if the project is under or over budget though budget variance (AV). | ||

| − | [[File:Earned_value.PNG |thumb|center|400px|Figure | + | [[File:Earned_value.PNG |thumb|center|400px|Figure 2: Earned Value Method ]] |

| − | ==Project Cash Flow== | + | ==Project Cash Flow<ref name="Coursera"> Odeh I. (2017), Cost Estimating and Cost Control, Columbia University, [URL:https://www.coursera.org/learn/construction-cost-estimating] Retrieved on 29 December 2017</ref>== |

Cash is the important resource that a contractor has to manage during the project construction lifecycle. Many construction companies may appear to be rich on paper and still go bankrupt. Companies must have enough liquidity to pay their financial obligations during the construction lifecycle. Thus, the forecasting of cash needs over lifecycle of a project is extremely important for a construction company and a contractor. The cash resources for a project cover payrolls, payments for equipment use, subcontract payment requests as suppliers, | Cash is the important resource that a contractor has to manage during the project construction lifecycle. Many construction companies may appear to be rich on paper and still go bankrupt. Companies must have enough liquidity to pay their financial obligations during the construction lifecycle. Thus, the forecasting of cash needs over lifecycle of a project is extremely important for a construction company and a contractor. The cash resources for a project cover payrolls, payments for equipment use, subcontract payment requests as suppliers, | ||

===Basic Cash Flow Equation=== | ===Basic Cash Flow Equation=== | ||

| Line 187: | Line 184: | ||

Although this equation seems easily comprehensible, in construction industry, there are more difficulties and complexities related to it. This section of the wiki article tries to identify some of the complexities and difficulties, but not to analyze them into so much detail. | Although this equation seems easily comprehensible, in construction industry, there are more difficulties and complexities related to it. This section of the wiki article tries to identify some of the complexities and difficulties, but not to analyze them into so much detail. | ||

| − | |||

| − | |||

===Conservatism=== | ===Conservatism=== | ||

| − | Conservatism is a generally accepted accounting method, followed by most construction companies around the world. The basic idea of conservatism is that you recognize an expense as soon as it exists. You recognize a revenue as soon as it is received. This idea reflects on the reality in construction industry as the contractor should forecast and calculate revenue, only when they will be received. Bankruptcy and stop of the contract by the client can also result in serous economic losses to the contractors if conservatism is not applied to their financial accounts | + | Conservatism is a generally accepted accounting method, followed by most construction companies around the world. The basic idea of conservatism is that you recognize an expense as soon as it exists. You recognize a revenue as soon as it is received. This idea reflects on the reality in construction industry as the contractor should forecast and calculate revenue, only when they will be received. Bankruptcy and stop of the contract by the client can also result in serous economic losses to the contractors if conservatism is not applied to their financial accounts. |

===Cash Flows=== | ===Cash Flows=== | ||

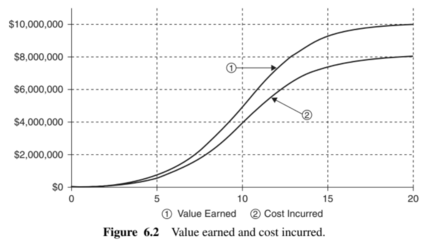

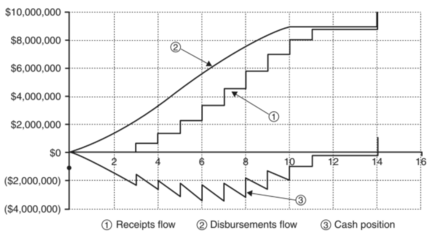

| − | The Expenses in Cash flow forecasting is the Actual Cost Curve, from the Earned Value Method as it can be seen from Figure | + | The Expenses in Cash flow forecasting is the Actual Cost Curve, from the Earned Value Method as it can be seen from Figure 3. |

| − | [[File:Earned_value_vs_cost.PNG |thumb|center|430px|Figure | + | [[File:Earned_value_vs_cost.PNG |thumb|center|430px|Figure 3: Earned Value and Actual Cost ]] |

Calculation and forecasting on Revenues depend on four factors: | Calculation and forecasting on Revenues depend on four factors: | ||

| − | *Earned Value | + | *'''Earned Value''' |

| − | *Retainage - The amount of payments that is kept or held back from the clinet to the contractors as a guarantee that the contractor will cooperate and finish the project in a timely and professional manner. | + | *'''Retainage''' - The amount of payments that is kept or held back from the clinet to the contractors as a guarantee that the contractor will cooperate and finish the project in a timely and professional manner. |

| − | *Billings - The payments from the client to the contractor | + | *'''Billings''' - The payments from the client to the contractor |

| − | *Payment Cycles - Period of time between the billing and the receipt of payment. | + | *'''Payment Cycles''' - Period of time between the billing and the receipt of payment. |

For the cash flow prediction there is also the equation: | For the cash flow prediction there is also the equation: | ||

| Line 208: | Line 203: | ||

<math>Earned\ Value - Retainage = Billings </math> | <math>Earned\ Value - Retainage = Billings </math> | ||

| − | In the below Figure | + | In the below Figure 4, curve 1 illustrates the Actual Cost of the project - Expenses, curve 2 the Revenues, taken into consideration Payment Cycles, as Billings are considered in the cash flow immediately after the receipt of payment. Curve 3 illustrates the Capital Curve as Maximum Debt or Profit for a contractor over a specific period of time, usually over every payment cycle. |

| − | [[File:Cash_flows.PNG |thumb|center|430px|Figure | + | [[File:Cash_flows.PNG |thumb|center|430px|Figure 4: Cash flows ]] |

===Improving Cash Flows=== | ===Improving Cash Flows=== | ||

| − | From Figure | + | From Figure 4 it can be observed that contractors are usually in debt during the most of construction lifetime, until the retainage is released by the client at the end of the project. This debt must be financed by the contractor, through company money or though establishment of a line of credit from a bank. However, there are other methods to minimize the maximum debt of the contractor every payment cycle. These methods are listed below as: |

*Acceleration of Revenues, through Mobilization Payment | *Acceleration of Revenues, through Mobilization Payment | ||

*Front Loading | *Front Loading | ||

| Line 220: | Line 215: | ||

=Closing= | =Closing= | ||

| − | ==Close Out Agenda== | + | ==Close Out Agenda<ref name="Coursera"> Odeh I. (2017), Cost Estimating and Cost Control, Columbia University, [URL:https://www.coursera.org/learn/construction-cost-estimating] Retrieved on 29 December 2017</ref>== |

| − | It is extremely important for the project and cost manager to close out the project in a clean, organized and sensible way, without leaving pending actions, ensuring a proper financial status. The project and cost manager must prepare all | + | It is extremely important for the project and cost manager to close out the project in a clean, organized and sensible way, without leaving pending actions, ensuring a proper financial status. The project and cost manager must prepare all the necessary documents and ensure that all change orders have been closed out and agreed. Final payments have been or are near to be executed. Final Reporting, including Project Turnover must be also documented. Below, the essential components which must be included in a Final Account are listed, as the Final Handover Documents of the project. |

'''Final Account''' | '''Final Account''' | ||

| Line 240: | Line 235: | ||

==Operation Costs and Maintenance Costs== | ==Operation Costs and Maintenance Costs== | ||

| − | The Operation and Maintenance Cost of a construction project include the life-cycle costs of this project over the subsequent years. It is of utmost importance for the client and the consultants to realize that, although construction cost is the the most significant as it stands as the largest amount of the overall project cost, the other cost components are also major expenditure, which in some cases their value can be equal to construction costs. Therefore, it should be carefully considered and thoroughly calculated. The expenses related to this type of cost are the following | + | The Operation and Maintenance Cost of a construction project include the life-cycle costs of this project over the subsequent years. It is of utmost importance for the client and the consultants to realize that, although construction cost is the the most significant as it stands as the largest amount of the overall project cost, the other cost components are also major expenditure, which in some cases their value can be equal to construction costs. <ref name="PMI_book"></ref> Therefore, it should be carefully considered and thoroughly calculated. The expenses related to this type of cost are the following:<ref name="PMI_book"></ref> |

*Land rent | *Land rent | ||

*Labor and material for maintenance services and repair | *Labor and material for maintenance services and repair | ||

| Line 256: | Line 251: | ||

=Annotated bibliography= | =Annotated bibliography= | ||

:'''1. Halpin D. W., Senior B. A., (2009), Financial Management and Accounting Fundamentals for Construction, John Wiley and Sons Inc., Hoboken, New Jersey''' | :'''1. Halpin D. W., Senior B. A., (2009), Financial Management and Accounting Fundamentals for Construction, John Wiley and Sons Inc., Hoboken, New Jersey''' | ||

| − | ::<u>Summary:</u> The book covers aspects in construction industry and construction firms related to company and project revenue and expense management. The book emphasizes how project information regarding financial activities is collected to provide effective financial management. The book also reflects present-day practices and, also, information regarding business taxation, project cost control and construction economics. The book targets students and | + | ::<u>Summary:</u> The book covers aspects in construction industry and construction firms related to company and project revenue and expense management. The book emphasizes how project information regarding financial activities is collected to provide effective financial management. The book also reflects present-day practices and, also, information regarding business taxation, project cost control and construction economics. The book targets students and practicioners with a engineering background, but limited knowledge and training in financial management and accounting. |

:'''2. DS/ISO 21500:2013 Vejledning i projektledelse, Guidance on project management 2.udgave''' | :'''2. DS/ISO 21500:2013 Vejledning i projektledelse, Guidance on project management 2.udgave''' | ||

| − | ::<u>Summary:</u> This international Standard offers guidance on concepts and aspects of project management, important for | + | ::<u>Summary:</u> This international Standard offers guidance on concepts and aspects of project management, important for successful planning, implementation and performance of projects. This international Standard targets on senior managers and project sponsors to provide them a better understanding and the necessary tools for effective project managers. Morevover, it targets project managers and their teams and developers of other national standards to have a common basis for their projects and to use them for further developing, respectively. |

| + | |||

| + | :'''3. Maylor, H. (2010), "Project Management". Fourth Edition''' | ||

| + | ::<u>Summary:</u> This book cover all the topics of project management, focusing in the theory, as well as in the application and usage of the ideas discussed in it. The book points great emphasis into the 4D-model of the project. | ||

| + | |||

| + | :'''4. Winch, G. M. (2010), "Managing Construction projects". Second edition''' | ||

| + | ::<u>Summary:</u> The book presents a holistic approach of construction management. The basic principles of construction project management are presented along with different tools and techniques that aims to enhance construction performance and provide innovative techniques. The use of information and communication technologies is also a point of interest in the book. | ||

| + | |||

| + | :'''5. Hendrickson C., Au T., (2008) Project Management for Construction: Fundamental Concepts for Owners, Engineers, Architects and Builders, Version 2.2''' | ||

| + | ::<u>Summary:</u> This book cover the participants, the processes and the techniques of construction project management. The book targets on completion of construction projects in timely and cost effective manner, key for understanding the project owner needs. Specific techniques such as economic evaluation, scheduling, management of information systems, cost control and monitoring are presented and thoroughly analyzed in this online book. It is intended for graduate students or professionals with an interest in construction management. | ||

| − | :''' | + | :'''6. Kim G. H. et al. (2004) Comparison of construction cost estimating models based on regression analysis, neural networks, and case-based reasoning, Building and Environment, Vol. 39, Issue 10, pp.1235-1242, Elsevier ''' |

| − | ::<u>Summary:</u> This | + | ::<u>Summary:</u> This article examines the performance of three cost estimation models. As adequate estimation of construction cost is of utmost importance to construction projects, the article delves into examinations based on multiple regression analysis, neural networks and case-based reasoning. The results obtained by the three models and a comparison between them are presented. |

| − | :''' | + | :'''7. Odeh I. (2017), Cost Estimating and Cost Control, Columbia University''' |

| − | ::<u>Summary:</u> This online course presents the various types of construction cost estimating from the conceptual design phase through the more detailed design phase of a project. Moreover, the course highlights the importance of controlling costs, pointing more emphasis on the Earned Value Method and how to monitor project cash flow. Finally, the online course gives the viewers and students a general overview about | + | ::<u>Summary:</u> This online course presents the various types of construction cost estimating from the conceptual design phase through the more detailed design phase of a project. Moreover, the course highlights the importance of controlling costs, pointing more emphasis on the Earned Value Method and how to monitor project cash flow. Finally, the online course gives the viewers and students a general overview about Current Technological Trends in Construction Industry, as well as, an introduction to Lean Construction. |

| − | :''' | + | :'''8. Project Management Institute(PMI). (2005) "Practice Standard for Earned Value Management"''' |

| − | ::<u>Summary:</u> This practice standard has been developed as a supplement to ''A Guide to the Project Management Body of | + | ::<u>Summary:</u> This practice standard has been developed as a supplement to ''A Guide to the Project Management Body of Knowledge''. The standard assumes that the reader possesses some basic project management knowledge, before dealing with this standard. The standard provides an overall overview about the Earned Value Method (EVM), presenting the key components, variances, indices and forecasts which can be developed through that method and guidance how to apply successfully this method for better cost and schedule performance. |

Latest revision as of 19:30, 20 November 2018

Developed by Apostolos Bougas

Construction Cost Management is one of the most important aspects of a construction project planning process, as cost and money are strictly related to the project and have a major influence on it during its whole lifecycle. This wiki article provides a general overview of all the cost aspects during a construction project lifetime. The article is divided into sections according to the Danish ISO Standard DS/ISO: 21500:2013 Guidance on Project Management. These sections cover the entire lifecycle of a project in general, and so, of a construction project. Each section was related with the costs aspects of a construction project which are relevant for it. The article starts with presenting the financial appraisal of a construction company, then continues into describing the cost estimation, then delves into aspects on tendering and contracting. The cost control of the project is later mentioned, finally followed by the cost aspects on closing and after that of a construction project. In each section, the most important cost aspects and techniques, which are performed by cost managers, are briefly presented. The article stands out as a guide for cost construction management.

Contents |

[edit] Introduction

Cost Management in construction industry and the measurement of the financial activities involved there are unique and completely different from financial management of other industries. The basic production unit of the construction industry is the project. Thus, in contrast to the other industries, the number of projects in construction, is relatively small compared to other industries. Considering also the expended time frame and the multiple stakeholders, which are involved in this one project, the major differences in the cost management from other industries can be realized[1].

Construction Cost Management is presented as a subject group as in DS/ISO 21500:2013. It is analyzed in the processes groups, illustrating by the aforementioned standard. The definition of the process group according to the DS/ISO 21500:2013 is the following[2]:

- Initiating The initiating process is used to start a project phase or project, to define the project phase or projects objectives and to authorize the project manager to proceed with the project work.

- Planning The planning process is used to develop planning detail. This detail should be sufficient to establish baselines against which project implementation can be managed and project performance can be measured and controlled.

- Implementing The implementing process is used to perform the project management activities and to support the provision of the project's deliverables in accordance with the project plans.

- Controlling The controlling processes are used to monitor, measure and control project performance against the project plan. Consequently, preventive and corrective actions may be taken and change requests made, when necessary, in order to achieve project objectives.

- Closing The closing processes are used to formally establish that the project phase or project is finished, and to provide lessons learned to be considered and implemented as necessary.

[edit] Initiating

[edit] Feasibility or Financial Appraisal[3]

Financial appraisal in construction is one of the most important and earliest stages of the construction project planning process. The purpose of the financial appraisal is to determine whether the project is worthwhile, comparing its costs with its expected benefits. It stands as a key element for deciding whether or not to proceed with a construction project and any project in general. Also, it stands out as a key element for choosing between alternative construction projects. Financial appraisal addresses not only the adequacy of funds, but also the financial viability of the project, estimating in the end if and when the project returns a profit or not.

[edit] Methods

- Payback Period - simply considers the cash flow of costs and benefits

- Net Present Value (NPV) – considers the ‘time value’ of cash flows

- Internal Rate of Return (IRR) – sets basic return criteria on the time value of money

[edit] Challenges

- Optimism Bias - There is a demonstrated tendency for project appraisers to be overly optimistic[4]. This behaviour is not intentional. Psychological reasons are the route for this.

- Strategic misrepresentation - Project managers act in bad faith when estimating financial project appraisals. Strategic misrepresentation can be seen to political and organizational reasons.

[edit] Reference Class Forecasting Method

Reference Class Forecasting Method is a method for financial appraisal of construction projects who forces the project manager to have an outside view and compare the future project with others. The main aim of the RCF method is to optimize the forecasts in construction projects, so that cost overruns and benefits shortfalls can be avoided.

[edit] Planning

[edit] Cost Estimation

[edit] Introduction

The capital cost for a construction project consists of the following expenses:[5]

- Land acquisition

- Planning and feasibility studies

- Architectural design and engineering consultancy

- Construction of the project, including labour and equipment

- Field supervision of construction works

- Insurance and taxation during the construction of the project

- Owner general office overhead

- Equipment and furnishings after completion of construction

- Inspection and testing

These cost components depend on the nature, size, location and management of the construction project. The client is interested in achieving the lowest possible overall cost along with the maximum quality. Both the client, through the consultants, and the contractor make cost estimations of the construction project. The consultants perform cost estimating for the evaluation of the overall cost of the project. The contractor estimates the cost for his tender submit. The consultants also take into considerations in their estimates both the maintenance and operation costs. On the other hand, the contractor is not interested in these types of costs.

All estimates are approximations, based on judgement and experience. Estimator must put the project on paper, then estimate the quantities. Estimator also needs to offer alternative construction methods and solutions, determining the sources and consequently the cost of each method and solution. Cost estimation stage is the construction project phase, in which possible areas for major cost savings can be suggested. Changes in the project should take place in this phase, otherwise they usually lead to delays and inordinate cost increases.

[edit] Contingency

The development of construction budget requires prediction for contingencies and unexpected costs during the construction phases. The contingency is included either in every single item or in the whole project. The calculation of contingency is based on historical experience and the expected difficulty of the particular project. Contingency cost derive from the following areas[5]:

- Design development changes

- Schedule changes

- Administration changes such as wages rates and payments

- Changes in site conditions

- Third party requirements such as new permits

Contingency budget, which is not spent eventually during construction, is returned to the client near the end of the construction phase, or additional work and elements are added to the project, after agreement with the client.

[edit] Types of cost estimates

[edit] Conceptual & Preliminary Estimate

This type of estimate is used in the early planning design phase of the project

Methods

- Cost Indices

- Cost-Capacity Factors

- Component Ratios

- Parameter Costs

[edit] Detailed Estimate

This type of estimate is used in the late planning design phase of the project by the client and the consultancy team or by the contractor for submitting the tender.

Methods

- Measurements

- Quantity-Take off

[edit] Limitations and Challenges

- Changes in relative prices result on serious changes in construction costs

- Prediction over long period of time is quite difficult

- Possibility of errors in analysis, due to uncertainties

[edit] Computer Aided Cost Estimation

Cost Estimation of construction projects in the preliminary design stage is a rather challenging task, due to the lack of available project information. Therefore, cost estimation models using parametric computational methods have been developed. Such cost estimating model techniques in the preliminary design phase are [6]:

- Multi regression models

- Neural network models

- Case-based reasoning models

[edit] Implementing

[edit] Tendering

Pricing is determined by a large number of factors. The bid, which is submitted by a contractor, depends mostly on cost estimation and contractor's profit. Competitive tendering or bidding is a decision-making under uncertainty procedure. Every contractor or bidder submits a tender without knowing the tender nature of its competitors. Cost Estimation of the necessary work that needs to be performed and profit stand out as the main drivers for tendering. However, the higher the estimated cost, the more unlikely is that the construction firm will acquire the project. Moreover, the higher the profit, less possibilities there are for a contractor to acquire the job. On the other hand, if the profit is too low, there is a high chance for the bidder to go bankrupt. The decision on the tender price apart from cost project estimation and profit relies on the overall strategy and survival of the construction company and the tendency for risk. Some of such other factors influencing tenders are[5]:

- Exogenous Economic Factors such as geographic locations and market trends

- Characteristics of Bidding Competition such as the number of bidders

- Objectives of Contractors

- Contractors' Comparative Advantages such as superior technology, greater experience, lower cost units, better management

[edit] Contracting [5]

Construction contracts is the mean for pricing a construction project and stands out as an official agreement between the client, the contractor and the possible other stakeholders, who are involved in the contract. Contracts are a structure for the allocation of risks between the involved parties in the project. The type of contract, which will be used for the construction of a project, is decided solely by the client, who also sets the term on the contractual agreement. Different type of contracts pose also different risks for the contractor. Some types of contractual agreement, which are used in construction industry, are listed below:

- Lump Sum Contract

- Unit Price Contract

- Cost Plus Fixed Percentage Contract

- Cost Plus Fixed Fee Contract

- Cost Plus Variable Percentage Contract

- Target Estimate Contract

- Guaranteed Maximum Cost Contract

In lump sum contract, al the risk is assigned to the contractor. In a unit price contract, the risk of inaccurate estimation of uncertain quantities for some key tasks has been transferred from the contractor to the client. The fixed percentage or fixed fee is determined at the start of the project, while variable fee and target estimates are used as motivation to reduce costs by sharing any cost savings. A guaranteed maximum cost arrangement imposes a penalty on a contractor for cost overruns and failure to complete the project on time. With a guaranteed maximum price contract, cost overruns below the maximum are divided between the owner and the contractor, while the contractor is responsible for costs overruns over the maximum.

[edit] Controlling

[edit] Cost Control

The primary objective of Construction Cost Control is the delivery of the project within the approved budget. Procedures and methods for construction cost control provide the project managers the tools to track the progress of the progress and to evaluate and correct possible problems which may occur. The main goal of this construction stage is to identify deviations from the project plan and project budget rather to suggest methods for cost savings, as deviations can result in delays and, consequently, lead to cost overruns.

[edit] Cost Control Methods[7]

The abovementioned methods are used for controlling cost and progress and forecasting on a particular task, and not in the project as a whole.

Units Completed

This method is applicable to tasks which involve repeated production of easily measured work quantities, with each quantity requiring approximately the same amount of effort. For instance, the linear meters of piping installed can be compared to the required amount of piping, so that the percentage of piping completed can be estimated.

Incremental Milestones

This method for estimated the amount of work, which is completed to date, can be applied for any cost control account, which consists of subtasks, which must be handled in sequencial order. The completion of each subtask is considered as a milestone and represents a certain amount of the project or process. The percentage, chosen to represent these milestones, is usually based on the number of work hours estimated to be required from that point to the total completion of the required process. Also, this percentage can be either based on average values from historical data.

Supervisor Opinion

This method is used on tasks in construction, which are lack of definable intermediate milestones and/or when the time for these required tasks is extremely difficult to be accurately estimated. The judgements of the percentage of the work completed by this method is prepared form inspectors, supervisors or project managers. Good estimating skills and field observations are essential for accurate results, when this method is used.

Cost Ratio

The cost incurred to date can be also used to estimate the work completed to date.

[edit] Earned Value Method [8]

Earned Value Method is the most common cost control method, which is used on construction projects for the entire project and not only for particular tasks. Earned Value Method is used to calculate the progress that has been achieved on a project using a Work Breakdown Structure (WBS). It is implemented to control both costs and the schedule of complex construction projects.

Objectives The main objective of the EVM is determining project progress from a cost status or a schedule status perspective. From cost perspective, EVM identifies whether the project is on budget, over budget or under budget. Similarly, from a schedule perspective, it can be determined if the project is on, ahead or behind schedule.

Key parameters

The three main parameters of the EVM are:

- Earned Value (EV) Earned Value or Budgeted Cost of Work Performed reflects the amount of work which has been accomplished at a specific point in the schedule. It is the cost basis for the amount of money which can be invoiced to the client against the contractual master schedule. It is also used for cash flow calculations.

- Planned Value (PV) Planned Value (PV) or Budgeted Cost of Work Scheduled (BWCS) is the budgeted work which is scheduled to be performed during the project. Planned Value is presented in a chart illustrating the cumulative resources budgeted across the project schedule. It can be compared to the Earned Value at a defined point to indicate if the project is ahead or below schedule.

- Actual Cost (AC) Actual Cost or Actual Cost of Work Performed indicates the amount of resources that have been expended to achieve the actual work performed to date. It is compared to the Earned Value at a specific point to identify if the project is under or over budget though budget variance (AV).

[edit] Project Cash Flow[7]

Cash is the important resource that a contractor has to manage during the project construction lifecycle. Many construction companies may appear to be rich on paper and still go bankrupt. Companies must have enough liquidity to pay their financial obligations during the construction lifecycle. Thus, the forecasting of cash needs over lifecycle of a project is extremely important for a construction company and a contractor. The cash resources for a project cover payrolls, payments for equipment use, subcontract payment requests as suppliers,

[edit] Basic Cash Flow Equation

The basic equation which is used for cash flow forecasting and calculation is:

where,

Revenue: the money coming into a construction company or a contractor

Expenses: the money a contractor or a construction company has to pay for the construction work to be done

Capital: the money left in the end, can be positive as profit or negative as debt

Although this equation seems easily comprehensible, in construction industry, there are more difficulties and complexities related to it. This section of the wiki article tries to identify some of the complexities and difficulties, but not to analyze them into so much detail.

[edit] Conservatism

Conservatism is a generally accepted accounting method, followed by most construction companies around the world. The basic idea of conservatism is that you recognize an expense as soon as it exists. You recognize a revenue as soon as it is received. This idea reflects on the reality in construction industry as the contractor should forecast and calculate revenue, only when they will be received. Bankruptcy and stop of the contract by the client can also result in serous economic losses to the contractors if conservatism is not applied to their financial accounts.

[edit] Cash Flows

The Expenses in Cash flow forecasting is the Actual Cost Curve, from the Earned Value Method as it can be seen from Figure 3.

Calculation and forecasting on Revenues depend on four factors:

- Earned Value

- Retainage - The amount of payments that is kept or held back from the clinet to the contractors as a guarantee that the contractor will cooperate and finish the project in a timely and professional manner.

- Billings - The payments from the client to the contractor

- Payment Cycles - Period of time between the billing and the receipt of payment.

For the cash flow prediction there is also the equation:

In the below Figure 4, curve 1 illustrates the Actual Cost of the project - Expenses, curve 2 the Revenues, taken into consideration Payment Cycles, as Billings are considered in the cash flow immediately after the receipt of payment. Curve 3 illustrates the Capital Curve as Maximum Debt or Profit for a contractor over a specific period of time, usually over every payment cycle.

[edit] Improving Cash Flows

From Figure 4 it can be observed that contractors are usually in debt during the most of construction lifetime, until the retainage is released by the client at the end of the project. This debt must be financed by the contractor, through company money or though establishment of a line of credit from a bank. However, there are other methods to minimize the maximum debt of the contractor every payment cycle. These methods are listed below as:

- Acceleration of Revenues, through Mobilization Payment

- Front Loading

- Delaying of Expenses

[edit] Closing

[edit] Close Out Agenda[7]

It is extremely important for the project and cost manager to close out the project in a clean, organized and sensible way, without leaving pending actions, ensuring a proper financial status. The project and cost manager must prepare all the necessary documents and ensure that all change orders have been closed out and agreed. Final payments have been or are near to be executed. Final Reporting, including Project Turnover must be also documented. Below, the essential components which must be included in a Final Account are listed, as the Final Handover Documents of the project.

Final Account

Final Account is the final cost report of the entire construction project concluding all the financial monitoring. Both the client, the consultant and the general contractor are responsible for its preparation and a collaborative effort are essential from both parties. A Final Account includes:

- Original Contract Sum

- Adjustments to Contract Sum

- Confirmation of Change Orders

- Loss/Expenses Claims

- Confirmations of Contractors Agreements to final sums

Final Handover Documents

- Built Drawings

- Operation and Maintenance Manuals

- Warranties

- Final Project & Cost Management Reports, including Final Account

[edit] Operation Costs and Maintenance Costs

The Operation and Maintenance Cost of a construction project include the life-cycle costs of this project over the subsequent years. It is of utmost importance for the client and the consultants to realize that, although construction cost is the the most significant as it stands as the largest amount of the overall project cost, the other cost components are also major expenditure, which in some cases their value can be equal to construction costs. [5] Therefore, it should be carefully considered and thoroughly calculated. The expenses related to this type of cost are the following:[5]

- Land rent

- Labor and material for maintenance services and repair

- Periodic renovations

- Insurance and taxation

- Financing costs

- Utilities

- Owner's other expenses regarding the facility

Although these costs refer after the close-out of the project, partly or whole estimation of them must be done in earlier stages of the project lifetime, in the financial appraisal of the construction project or in the cost estimation phase.

[edit] References

- ↑ Halpin D. W., Senior B. A., (2009), Financial Management and Accounting Fundamentals for Construction, John Wiley and Sons Inc., Hoboken, New Jersey

- ↑ DS/ISO 21500:2013 Vejledning i projektledelse, Guidance on project management 2.udgave, 2013-09-27

- ↑ 3. Maylor, H. (2010), "Project Management". Fourth Edition

- ↑ Winch, G. M. (2010), "Managing Construction projects". Second edition

- ↑ 5.0 5.1 5.2 5.3 5.4 5.5 Hendrickson C., Au T., (2008) Project Management for Construction: Fundamental Concepts for Owners, Engineers, Architects and Builders, Version 2.2, [URL:http://http://pmbook.ce.cmu.edu/] Retrieved on 13 December 2017

- ↑ Kim G. H. et al. (2004) Comparison of construction cost estimating models based on regression analysis, neural networks, and case-based reasoning, Building and Environment, Vol. 39, Issue 10, pp.1235-1242, Elsevier https://doi.org/10.1016/j.buildenv.2004.02.013

- ↑ 7.0 7.1 7.2 Odeh I. (2017), Cost Estimating and Cost Control, Columbia University, [URL:https://www.coursera.org/learn/construction-cost-estimating] Retrieved on 29 December 2017

- ↑ Project Management Institute(PMI). (2005) "Practice Standard for Earned Value Management", [URL:https://blog.alevi.ru/wp-content/uploads/2015/08/Earned-Value-Management.pdf] Retrieved on 29 December 2017

[edit] Annotated bibliography

- 1. Halpin D. W., Senior B. A., (2009), Financial Management and Accounting Fundamentals for Construction, John Wiley and Sons Inc., Hoboken, New Jersey

- Summary: The book covers aspects in construction industry and construction firms related to company and project revenue and expense management. The book emphasizes how project information regarding financial activities is collected to provide effective financial management. The book also reflects present-day practices and, also, information regarding business taxation, project cost control and construction economics. The book targets students and practicioners with a engineering background, but limited knowledge and training in financial management and accounting.

- 2. DS/ISO 21500:2013 Vejledning i projektledelse, Guidance on project management 2.udgave

- Summary: This international Standard offers guidance on concepts and aspects of project management, important for successful planning, implementation and performance of projects. This international Standard targets on senior managers and project sponsors to provide them a better understanding and the necessary tools for effective project managers. Morevover, it targets project managers and their teams and developers of other national standards to have a common basis for their projects and to use them for further developing, respectively.

- 3. Maylor, H. (2010), "Project Management". Fourth Edition

- Summary: This book cover all the topics of project management, focusing in the theory, as well as in the application and usage of the ideas discussed in it. The book points great emphasis into the 4D-model of the project.

- 4. Winch, G. M. (2010), "Managing Construction projects". Second edition

- Summary: The book presents a holistic approach of construction management. The basic principles of construction project management are presented along with different tools and techniques that aims to enhance construction performance and provide innovative techniques. The use of information and communication technologies is also a point of interest in the book.

- 5. Hendrickson C., Au T., (2008) Project Management for Construction: Fundamental Concepts for Owners, Engineers, Architects and Builders, Version 2.2

- Summary: This book cover the participants, the processes and the techniques of construction project management. The book targets on completion of construction projects in timely and cost effective manner, key for understanding the project owner needs. Specific techniques such as economic evaluation, scheduling, management of information systems, cost control and monitoring are presented and thoroughly analyzed in this online book. It is intended for graduate students or professionals with an interest in construction management.

- 6. Kim G. H. et al. (2004) Comparison of construction cost estimating models based on regression analysis, neural networks, and case-based reasoning, Building and Environment, Vol. 39, Issue 10, pp.1235-1242, Elsevier

- Summary: This article examines the performance of three cost estimation models. As adequate estimation of construction cost is of utmost importance to construction projects, the article delves into examinations based on multiple regression analysis, neural networks and case-based reasoning. The results obtained by the three models and a comparison between them are presented.

- 7. Odeh I. (2017), Cost Estimating and Cost Control, Columbia University

- Summary: This online course presents the various types of construction cost estimating from the conceptual design phase through the more detailed design phase of a project. Moreover, the course highlights the importance of controlling costs, pointing more emphasis on the Earned Value Method and how to monitor project cash flow. Finally, the online course gives the viewers and students a general overview about Current Technological Trends in Construction Industry, as well as, an introduction to Lean Construction.

- 8. Project Management Institute(PMI). (2005) "Practice Standard for Earned Value Management"

- Summary: This practice standard has been developed as a supplement to A Guide to the Project Management Body of Knowledge. The standard assumes that the reader possesses some basic project management knowledge, before dealing with this standard. The standard provides an overall overview about the Earned Value Method (EVM), presenting the key components, variances, indices and forecasts which can be developed through that method and guidance how to apply successfully this method for better cost and schedule performance.