Stakeholder Analysis

| (50 intermediate revisions by one user not shown) | |||

| Line 1: | Line 1: | ||

| − | ''' | + | ''Developed by Christian Nerup Sørensen'' |

| − | + | ||

| − | + | ||

| − | + | '''Summary:''' | |

| − | Stakeholder, Stakeholder Analysis, Stakeholder Mapping, [[Project Management]], [[Program Management]], [[Portfolio Management]]. | + | A stakeholder can shortly be defined as one that can affect or be affected by the actual project, program or portfolio. A stakeholder can therefore be an employee or a customer - but also a union or a local society. |

| + | |||

| + | Management of a project, program or portfolio happens to be complex and require an extensive overview of several aspects and constraints. In order to act appropriate and create sustainability, the management often has to consider these aspects and constraints not only from their own point of view, but also from a number of other stakeholders views. | ||

| + | |||

| + | In stakeholder analysis, all stakeholders first have to be identified and relevant information has to be gathered. The stakeholders are then mapped based on relevant parameters. Some of the most typical parameters when mapping are power, interest and influence, which is often visualised in a 2D diagram. The map gives an overview of the stakeholders and can serve as a foundation for planning how to deal with stakeholders. Dealing with stakeholders can contain both communication and other types of engagement. | ||

| + | |||

| + | '''Keywords:''' Stakeholder, Stakeholder Analysis, Stakeholder Mapping, [[Project Management]], [[Program Management]], [[Portfolio Management]]. | ||

| Line 20: | Line 24: | ||

</blockquote> | </blockquote> | ||

| − | + | Several other versions of this definition can be found in literature alike, but they generally convey the same idea. Stakeholders are e.g. employees, customers, suppliers and communities. | |

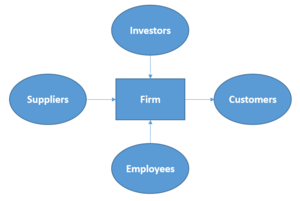

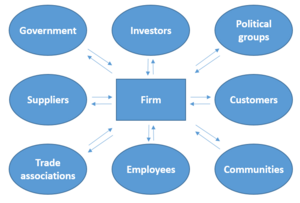

| − | Figure 1 shows a classic input/output model with suppliers, investors and employees that | + | It is important to distinguish between shareholder and stakeholder, and understand that stakeholder analysis includes analysis of the shareholders but also considers all other stakeholders. Figure 1 shows a classic input/output model with suppliers, investors and employees that provides an input so the company can generate an output to the customers. This is a very simple approach where the company are seen as an isolated system that does not interact with its surroundings. Figure 2 shows a stakeholder model, where the company are interacting with several stakeholders. The transformation from Figure 1 to Figure 2 illustrates the difference of a shareholder and stakeholder approach. |

| − | + | Both when managing projects, programs and portfolios, it is relevant for the management to know who their stakeholders are and their characteristics in relation to the project, program or portfolio. This might be their influence, impact, interest, attitude etc. This can be used for optimising communication and engagement, as well as realising common interests that can be developed into an advantage. | |

| − | + | The interaction with stakeholders as shown in Figure 1 might in some situations be limited and indirect. But stakeholders that traditionally, for a specific type of project, program or portfolio, are limited or indirect might be relevant to engage further? | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

=Background= | =Background= | ||

| − | In 1932 Dodd | + | In 1932 Dodd outlined one of the first arguments within this area, stating that a company should not only focus on shareholders, but also consider the entire spectra of stakeholders when managing a company<ref>Dodd Jr., E. Merrick. 1932. “For Whom Are Corporate Managers Trustees?”. Harvard Law Review 45 (7): 1145.</ref>. However, Dodd did not use the term ''stakeholder'', since this was not developed within the field at that time. The term ''stakeholder'' arose in the first half of the 1960´s. Among others, Freeman (1984)<ref>Freeman, R,E. 1984. Strategic Management: A Stakeholder Approach. Boston, MA: Pitman.</ref> are crediting an internal memorandum from Stanford Research Institute in 1963 for being the first to apply the term ''Stakeholder'' in this field of literature. In 1995 Donaldson and Preston <ref>Donaldson, T., and LE Preston. 1995. “The stakeholder theory of the corporation - Concepts, evidence and implications”. Academy of management review 20 (1): 65-91.</ref> determined the existence of three types of stakeholder theory: |

*'''Instrumental stakeholder theory''' argues that companies/organisations that take stakeholders into consideration will benefit from doing so. | *'''Instrumental stakeholder theory''' argues that companies/organisations that take stakeholders into consideration will benefit from doing so. | ||

| − | *'''Descriptive stakeholder theory''' is just stating that the company/organisation | + | *'''Descriptive stakeholder theory''' is just stating that the company/organisation has stakeholders and that they should analyse not only the shareholders but all stakeholders. |

| − | *'''Normative stakeholder theory''' evaluates why a company/organisation should | + | *'''Normative stakeholder theory''' evaluates why a company/organisation should consider their stakeholders. |

Baker and Nofsinger (2012)<ref>Baker, H. Kent., and John R. Nofsinger. 2012. Socially Responsible Finance and Investing : Financial Institutions, Corporations, Investors, and Activists. Wiley.</ref> use Coca-Cola for examplifing the three types of stakeholder theory: | Baker and Nofsinger (2012)<ref>Baker, H. Kent., and John R. Nofsinger. 2012. Socially Responsible Finance and Investing : Financial Institutions, Corporations, Investors, and Activists. Wiley.</ref> use Coca-Cola for examplifing the three types of stakeholder theory: | ||

<blockquote> | <blockquote> | ||

| − | *An instrumental stakeholder theorist might say: Coca-Cola should manage its water policies | + | *An instrumental stakeholder theorist might say: Coca-Cola should manage its water policies to minimize the negative impact of reputation effects on firm value. |

*A descriptive stakeholder theorist might say: Coca-Cola´s water policies are an important defining characteristic of the firm. | *A descriptive stakeholder theorist might say: Coca-Cola´s water policies are an important defining characteristic of the firm. | ||

*A normative stakeholder theorist might say: Coca-Cola has a duty to protect the environment, so it should pay more attention to its water policies. | *A normative stakeholder theorist might say: Coca-Cola has a duty to protect the environment, so it should pay more attention to its water policies. | ||

</blockquote> | </blockquote> | ||

| − | All three theories are used in stakeholder analysis depending on need and interest. Different companies/ | + | All three theories are used in stakeholder analysis depending on need and interest. Different companies/organisations will use different approaches. |

=Process= | =Process= | ||

| − | In | + | In literature, several descriptions of stakeholder analysis processes can be found and most large companies/organisations will have their own definition of the process. They generally follow this structure: |

*A: Identify stakeholders | *A: Identify stakeholders | ||

| Line 73: | Line 66: | ||

# Prepare stakeholder management strategy | # Prepare stakeholder management strategy | ||

| − | The identification of stakeholders could be done by | + | This process will be explained more detailed in the following subsections: |

| + | |||

| + | ===Identify stakeholders=== | ||

| + | The identification of stakeholders could be done by brainstorming. Typical stakeholders are: | ||

{| | {| | ||

| Line 96: | Line 92: | ||

| − | The list will | + | The list will typically also include a handful of more specific stakeholders depending on the situation. The stakeholders can also be identified in a more detailed manner - e.g. by different departments within the company/organisation if they e.g. have different interests. |

| − | It will often make sense to identify which stakeholders are key stakeholders. The definition of a key stakeholder vary depending on type of project, programme or portfolio. Key stakeholders might by identified when mapping the stakeholders as described below. | + | It will often make sense to identify which stakeholders are key stakeholders. The definition of a key stakeholder vary depending on type of project, programme or portfolio. Key stakeholders might by identified when mapping the stakeholders as described in the mapping section further below. A key stakeholder could be defined based on e.g. power and interest. |

| − | When gathering information it is important to act neutral and not | + | ===Gather information on stakeholders=== |

| + | When gathering information it is important to act neutral and not confuse it with the analysis itself. | ||

| − | Identifying the | + | ===Identify stakeholders priorities=== |

| + | Identifying the stakeholders´ priorities is the first step of the more in depth analysis. Priorities will often include cost, schedule and quality and can e.g. be measured on a 3 level scale: 1.Acceptable, 2.Adaptable; 3.Not acceptable. | ||

| − | Determine stakeholders strengths and weaknesses - or do a complete SWOT inventory will often be a beneficial part of the stakeholder analysis. | + | ===Determine stakeholders strengths and weaknesses=== |

| − | *'''Strength:''' What are the | + | Determine stakeholders´ strengths and weaknesses - or do a complete SWOT inventory, will often be a beneficial part of the stakeholder analysis. Making a SWOT analysis of the stakeholders consists of determining the following elements: |

| + | *'''Strength:''' What are the stakeholders´ specialities and forces? How can this strengthen the project/programme/portfolio? | ||

*'''Weaknesses:''' In which area does the stakeholder not excel? To what degree can this weaken the project/programme/portfolio? | *'''Weaknesses:''' In which area does the stakeholder not excel? To what degree can this weaken the project/programme/portfolio? | ||

*'''Opportunities:''' Which beneficial situations and options can the stakeholder possible experience? How can the project/programme/portfolio benefit from this opportunity? | *'''Opportunities:''' Which beneficial situations and options can the stakeholder possible experience? How can the project/programme/portfolio benefit from this opportunity? | ||

| − | *''' | + | *'''Threats:''' Which challenges and difficulties can be seen from the stakeholders perspective? Will this develop into a threat for the project/programme/portfolio? |

| − | + | ||

| − | + | ||

| − | + | ===Identify stakeholder support=== | |

| + | It is always important to know your friends. That is what identifying stakeholder support is about. It is of course good to know who are supporting and who are opposing the project/programme/portfolio in general. Nevertheless, it might also be relevant to consider specific scenarios or stages in the project/programme/portfolio, where the support-opposing ratio will change. E.g. if you are a citizen living next to the construction site of a new metro station. Then you will have several opposes during the noisy and dusty construction works, but you will probably support the project when it is completed and you have a new metro station next door. | ||

| − | + | ===Predict stakeholder behaviour=== | |

| + | Analysing the stakeholders´ support and role in different phases and situations will enable one to predict the stakeholders´ behaviour. However, in order to predict their behaviour other factors might have to be taken into consideration - e.g. power, interest and influence. This is typically analysed by mapping the stakeholders, which will be discussed in the section below. | ||

| − | As a tool for combining the analysis a stakeholder table and map are often created. A stakeholder table can typically contain: | + | ===Prepare stakeholder management strategy=== |

| + | Preparation of stakeholder management strategy deals with question about how to engage the stakeholders in the project/programme/portfolio in an appropriate way. This can result in creating an engagement plan that will not only contain engagement actions, but also determine in which phase of the project/programme/portfolio the actions should be applied. | ||

| + | |||

| + | As a tool for combining all the above mentioned elements in the analysis, a stakeholder table and map are often created. A stakeholder table can typically contain: | ||

*Stakeholder name. | *Stakeholder name. | ||

| − | *Category - | + | *Category - e.g. internal, authorities or end users |

*Relation | *Relation | ||

*Role | *Role | ||

| Line 124: | Line 126: | ||

*SWOT | *SWOT | ||

*Engagement plan | *Engagement plan | ||

| + | |||

The table will then act as an overview of the analysis. The mapping of stakeholders will be discussed in the section below. | The table will then act as an overview of the analysis. The mapping of stakeholders will be discussed in the section below. | ||

=Mapping stakeholders= | =Mapping stakeholders= | ||

| − | + | ||

| − | + | ||

==Why mapping stakeholders== | ==Why mapping stakeholders== | ||

| − | Mapping stakeholders can be seen as the central part of the stakeholder analysis because it creates an insight | + | Mapping stakeholders can be seen as the central part of the stakeholder analysis, because it creates an insight into the different essential parameters and enables one to compare them. This creates a tool that can be used to determine the level of support, predict behaviours and shape an engagement plan. |

Companies/Organisations might develop their own type of stakeholder map for evaluation. The map can then consider very specific parameters related to the actual project/programme/portfolio. | Companies/Organisations might develop their own type of stakeholder map for evaluation. The map can then consider very specific parameters related to the actual project/programme/portfolio. | ||

==Types of maps== | ==Types of maps== | ||

| − | Several types of stakeholder maps are described in | + | Several types of stakeholder maps are described in literature, many comparing two parameters in a diagram or matrix that gives an indication of the criticality of the stakeholders. Typical parameters are: |

| + | *'''Power:''' Power can be defined as how much power a stakeholder has in relation to affecting the project/programme/portfolio. | ||

| + | *'''Interest:''' The stakeholder might be more or less interested in the project. The stakeholders interest in the project/programme/portfolio can both be social, economical or environmental interests etc. The interest is typically measured on a low-high scale, but can also be measured on other scales that depends on the type of interest rather than the amount, e.g. a scale spanning from national to international or from short-term to long-term. | ||

| + | *'''Attitude:''' Stakeholders might have positive or negative attitudes towards the project/programme/portfolio. | ||

| + | *'''Dynamism:''' The dynamism of a stakeholder indicates how predictable he is. | ||

| + | *'''Support:''' Support is often mixed up with attitude. However, support should be seen as taking action - e.g. you might have a negative attitude but you do not obstruct and therefore your support is neutral. | ||

| − | The following subsections introduces | + | The following subsections introduces two common types of stakeholder maps. Other types and further information about mapping stakeholders can be found at http://apppm.man.dtu.dk/index.php/Mapping_stakeholders. |

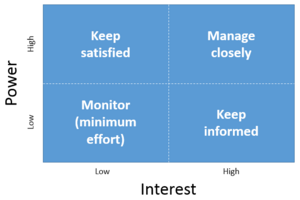

===Power/Interest diagram=== | ===Power/Interest diagram=== | ||

| − | The power/interest diagram was introduced by Gardner et al. (1989)<ref>Gardner, J.R., Rachlin, R., Sweeny, H.W.A and Richards, A. 1989. Handbook of Strategic Planning. Blackwell Publishing Ltd</ref> and describes level of power as one dimension and stakeholder´s interest in the other dimension. | + | [[File:Power-Interest.PNG|300px|thumb|right|Figure 3: Power/Interest diagram. Modified from Gardner et al.(1989).]] |

| + | The power/interest diagram was introduced by Gardner et al. (1989)<ref>Gardner, J.R., Rachlin, R., Sweeny, H.W.A and Richards, A. 1989. Handbook of Strategic Planning. Blackwell Publishing Ltd</ref> and describes level of power as one dimension and stakeholder´s interest in the other dimension. | ||

| + | The diagram can be used for identifying what type of relationship the organisation should have with its stakeholders, and at the same time help in the analysis of communication and engagement planning. Stakeholders with low interest and low power will require a minimum of communication, because the stakeholder´s limited interest means that he does not care too much about the project/program/portfolio, and if an issue should occur his power is limited - also implying a limited risk. Stakeholders with high interest and low power should be well informed due to their interest, but not necessarily more due to the fact that they represent a limited risk since they have low power. Stakeholders with low interest and high power should be kept satisfied - the probability that a risk occurs might be low since they are not that interested, but the impact might be large due to the high power. It is therefore important to keep them satisfied in order to mitigate a potential large risk. Stakeholders with both high interest and power should be managed closely. Project/Program/Portfolio management are dealing with a group of stakeholders that can generate heavy risks. Therefore it is important that management carefully consider engagement for these stakeholders and to what degree special reservations should be taken. | ||

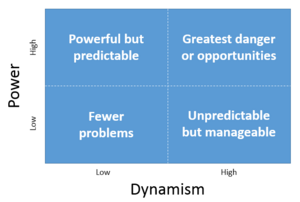

| − | + | ===Power/Dynamism diagram=== | |

| + | [[File:Power-dynamism.PNG|300px|thumb|right|Figure 4: Power/Dynamism diagram. Modified from Gardner et al.(1989).]] | ||

| + | Gardner et al. (1989) also described the power/dynamism diagram as shown in Figure 4. The diagram gives a good overview of the magnitude of potential risks and opportunities related to the stakeholders, since the power can be seen as the magnitude of the impact, and dynamism to some degree can be equalised with possibility for risks or opportunity to occur. | ||

| − | + | The power/dynamism diagram can be used for strategic planning and risk analysis based on the identification of the stakeholders "political" orientation. Stakeholders with low power and low dynamism will generate limited issues. Stakeholders with high power and low dynamism might be powerful but also predictable and risk mitigation related to this category can therefore be managed by proper planning. Stakeholders with low power and high dynamism might on the other hand be unpredictable and difficult to plan, but will be manageable due to their limited power. High power as well as high dynamism results in stakeholders associated with potential great danger - that are dangerous risks in the project/program/portfolio. But it is important to underline that the stakeholders carrying the greatest risks also are carrying the greatest opportunities. The high dynamism can generate a powerful impact but this can be positive as well as negative impact. | |

| − | + | =Benefits= | |

| + | Among others Zhang (2011)<ref>Zhang, Yanru. 2011. “The Analysis of Shareholder Theory and Stakeholder Theory”. Proceedings - 2011 4th International Conference On Business Intelligence and Financial Engineering, Bife 2011, Proc. - Int. Conf. Bus. Intell. Financ. Eng., Bife: 90-92.</ref> argues that a stakeholder approach consider a long-term development strategy for the company/organisation, while a shareholder approach focuses on short-term profit. | ||

| − | + | The stakeholder analysis will give a solid foundation for decision making and strategy development. Several elements in the execution process can benefit from the stakeholder analysis, since initiatives can be shaped more appropriate. | |

| − | + | ||

| − | + | Stakeholders that are engaged appropriately will help the company/organisation to obtain a better reputation among the stakeholders, which typically will have a boomerang effect and be able to create value on the companies/organisations goodwill account. | |

| − | + | ||

| − | + | Another account where value can be put in is CSR. Engaging stakeholders can directly be seen as increasing focus on corporate social responsibility. Taking your surroundings into consideration, and of course engaging them in a social responsible manner, is very much in line with the philosophy behind CSR. | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

=Challenges and uncertainty= | =Challenges and uncertainty= | ||

Analysing stakeholders can be an extensive task. The amount of stakeholders, depending on circumstances and level of detail, will typically be between 15 and 50. The analysis will therefore require a significant amount of work. | Analysing stakeholders can be an extensive task. The amount of stakeholders, depending on circumstances and level of detail, will typically be between 15 and 50. The analysis will therefore require a significant amount of work. | ||

| − | When gathering information about the stakeholders, it might not be possible to collect all information by contacting stakeholders. It will therefore be necessary to assume some conditions, which | + | When gathering information about the stakeholders, it might not be possible to collect all information by contacting stakeholders. It will therefore be necessary to assume some conditions. Some parameters such as power, dynamism and interest are typically not easy measurable parameters, but are a question of subjective assessment, which can result in an analysis with limited robustness. |

| − | As discussed earlier their will typically be both supporters and opponents. | + | As discussed earlier, their will typically be both supporters and opponents. It might turn out that one have to handle unpopular communication with opponents. |

| + | |||

| + | =Conclusion= | ||

| + | Stakeholder analysis is a strong and relevant tool for both projects, programmes and portfolios. It creates valuable insight in internal organisation as well as all surrounding companies/organisations that affects or might be affected by the project, program or portfolio. This insight can be used for optimising communication and engagement. As well as ensuring a healthy long-term strategy. | ||

| + | |||

| + | But the analysis might be heavy work and may not necessarily give 100 per cent clear answers. To which level of detail a stakeholder analysis should be conducted therefore always has to be considered. However, identifying and to some degree analysing them should never be neglected. | ||

=References= | =References= | ||

{{Reflist}} | {{Reflist}} | ||

| − | |||

<references/> | <references/> | ||

=Further reading= | =Further reading= | ||

*Reed, Mark S., Anil Graves, Norman Dandy, Helena Posthumus, Klaus Hubacek, Joe Morris, Christina Prell, Claire H. Quinn, and Lindsay C. Stringer. 2009. “Who'S In and Why? A Typology of Stakeholder Analysis Methods For Natural Resource Management”. Journal of environmental management 90 (5): 1933-1949. | *Reed, Mark S., Anil Graves, Norman Dandy, Helena Posthumus, Klaus Hubacek, Joe Morris, Christina Prell, Claire H. Quinn, and Lindsay C. Stringer. 2009. “Who'S In and Why? A Typology of Stakeholder Analysis Methods For Natural Resource Management”. Journal of environmental management 90 (5): 1933-1949. | ||

Latest revision as of 12:17, 20 December 2018

Developed by Christian Nerup Sørensen

Summary:

A stakeholder can shortly be defined as one that can affect or be affected by the actual project, program or portfolio. A stakeholder can therefore be an employee or a customer - but also a union or a local society.

Management of a project, program or portfolio happens to be complex and require an extensive overview of several aspects and constraints. In order to act appropriate and create sustainability, the management often has to consider these aspects and constraints not only from their own point of view, but also from a number of other stakeholders views.

In stakeholder analysis, all stakeholders first have to be identified and relevant information has to be gathered. The stakeholders are then mapped based on relevant parameters. Some of the most typical parameters when mapping are power, interest and influence, which is often visualised in a 2D diagram. The map gives an overview of the stakeholders and can serve as a foundation for planning how to deal with stakeholders. Dealing with stakeholders can contain both communication and other types of engagement.

Keywords: Stakeholder, Stakeholder Analysis, Stakeholder Mapping, Project Management, Program Management, Portfolio Management.

Contents |

[edit] Introduction

According to the ISO 21500 standard [1] a stakeholder is defined as:

Person, group or organization that has interests in, or can affect, be affected by, or perceive itself to be affected by, any aspect of the project.

Several other versions of this definition can be found in literature alike, but they generally convey the same idea. Stakeholders are e.g. employees, customers, suppliers and communities.

It is important to distinguish between shareholder and stakeholder, and understand that stakeholder analysis includes analysis of the shareholders but also considers all other stakeholders. Figure 1 shows a classic input/output model with suppliers, investors and employees that provides an input so the company can generate an output to the customers. This is a very simple approach where the company are seen as an isolated system that does not interact with its surroundings. Figure 2 shows a stakeholder model, where the company are interacting with several stakeholders. The transformation from Figure 1 to Figure 2 illustrates the difference of a shareholder and stakeholder approach.

Both when managing projects, programs and portfolios, it is relevant for the management to know who their stakeholders are and their characteristics in relation to the project, program or portfolio. This might be their influence, impact, interest, attitude etc. This can be used for optimising communication and engagement, as well as realising common interests that can be developed into an advantage.

The interaction with stakeholders as shown in Figure 1 might in some situations be limited and indirect. But stakeholders that traditionally, for a specific type of project, program or portfolio, are limited or indirect might be relevant to engage further?

[edit] Background

In 1932 Dodd outlined one of the first arguments within this area, stating that a company should not only focus on shareholders, but also consider the entire spectra of stakeholders when managing a company[2]. However, Dodd did not use the term stakeholder, since this was not developed within the field at that time. The term stakeholder arose in the first half of the 1960´s. Among others, Freeman (1984)[3] are crediting an internal memorandum from Stanford Research Institute in 1963 for being the first to apply the term Stakeholder in this field of literature. In 1995 Donaldson and Preston [4] determined the existence of three types of stakeholder theory:

- Instrumental stakeholder theory argues that companies/organisations that take stakeholders into consideration will benefit from doing so.

- Descriptive stakeholder theory is just stating that the company/organisation has stakeholders and that they should analyse not only the shareholders but all stakeholders.

- Normative stakeholder theory evaluates why a company/organisation should consider their stakeholders.

Baker and Nofsinger (2012)[5] use Coca-Cola for examplifing the three types of stakeholder theory:

- An instrumental stakeholder theorist might say: Coca-Cola should manage its water policies to minimize the negative impact of reputation effects on firm value.

- A descriptive stakeholder theorist might say: Coca-Cola´s water policies are an important defining characteristic of the firm.

- A normative stakeholder theorist might say: Coca-Cola has a duty to protect the environment, so it should pay more attention to its water policies.

All three theories are used in stakeholder analysis depending on need and interest. Different companies/organisations will use different approaches.

[edit] Process

In literature, several descriptions of stakeholder analysis processes can be found and most large companies/organisations will have their own definition of the process. They generally follow this structure:

- A: Identify stakeholders

- B: Analyse stakeholders

- C: Engage stakeholders

Cleland (1994)[6] states a typical process:

- Identify stakeholders

- Gather information on stakeholders

- Identify stakeholders priorities

- Determine stakeholders strengths and weaknesses

- Identify stakeholder support

- Predict stakeholder behaviour

- Prepare stakeholder management strategy

This process will be explained more detailed in the following subsections:

[edit] Identify stakeholders

The identification of stakeholders could be done by brainstorming. Typical stakeholders are:

| - Employees | - Shareholders |

| - Media | - Suppliers |

| - Government | - Customers |

| - Community | - Managers |

| - Directors | - Competitors |

| - Sponsors | - Consumers |

The list will typically also include a handful of more specific stakeholders depending on the situation. The stakeholders can also be identified in a more detailed manner - e.g. by different departments within the company/organisation if they e.g. have different interests.

It will often make sense to identify which stakeholders are key stakeholders. The definition of a key stakeholder vary depending on type of project, programme or portfolio. Key stakeholders might by identified when mapping the stakeholders as described in the mapping section further below. A key stakeholder could be defined based on e.g. power and interest.

[edit] Gather information on stakeholders

When gathering information it is important to act neutral and not confuse it with the analysis itself.

[edit] Identify stakeholders priorities

Identifying the stakeholders´ priorities is the first step of the more in depth analysis. Priorities will often include cost, schedule and quality and can e.g. be measured on a 3 level scale: 1.Acceptable, 2.Adaptable; 3.Not acceptable.

[edit] Determine stakeholders strengths and weaknesses

Determine stakeholders´ strengths and weaknesses - or do a complete SWOT inventory, will often be a beneficial part of the stakeholder analysis. Making a SWOT analysis of the stakeholders consists of determining the following elements:

- Strength: What are the stakeholders´ specialities and forces? How can this strengthen the project/programme/portfolio?

- Weaknesses: In which area does the stakeholder not excel? To what degree can this weaken the project/programme/portfolio?

- Opportunities: Which beneficial situations and options can the stakeholder possible experience? How can the project/programme/portfolio benefit from this opportunity?

- Threats: Which challenges and difficulties can be seen from the stakeholders perspective? Will this develop into a threat for the project/programme/portfolio?

[edit] Identify stakeholder support

It is always important to know your friends. That is what identifying stakeholder support is about. It is of course good to know who are supporting and who are opposing the project/programme/portfolio in general. Nevertheless, it might also be relevant to consider specific scenarios or stages in the project/programme/portfolio, where the support-opposing ratio will change. E.g. if you are a citizen living next to the construction site of a new metro station. Then you will have several opposes during the noisy and dusty construction works, but you will probably support the project when it is completed and you have a new metro station next door.

[edit] Predict stakeholder behaviour

Analysing the stakeholders´ support and role in different phases and situations will enable one to predict the stakeholders´ behaviour. However, in order to predict their behaviour other factors might have to be taken into consideration - e.g. power, interest and influence. This is typically analysed by mapping the stakeholders, which will be discussed in the section below.

[edit] Prepare stakeholder management strategy

Preparation of stakeholder management strategy deals with question about how to engage the stakeholders in the project/programme/portfolio in an appropriate way. This can result in creating an engagement plan that will not only contain engagement actions, but also determine in which phase of the project/programme/portfolio the actions should be applied.

As a tool for combining all the above mentioned elements in the analysis, a stakeholder table and map are often created. A stakeholder table can typically contain:

- Stakeholder name.

- Category - e.g. internal, authorities or end users

- Relation

- Role

- Priorities

- SWOT

- Engagement plan

The table will then act as an overview of the analysis. The mapping of stakeholders will be discussed in the section below.

[edit] Mapping stakeholders

[edit] Why mapping stakeholders

Mapping stakeholders can be seen as the central part of the stakeholder analysis, because it creates an insight into the different essential parameters and enables one to compare them. This creates a tool that can be used to determine the level of support, predict behaviours and shape an engagement plan.

Companies/Organisations might develop their own type of stakeholder map for evaluation. The map can then consider very specific parameters related to the actual project/programme/portfolio.

[edit] Types of maps

Several types of stakeholder maps are described in literature, many comparing two parameters in a diagram or matrix that gives an indication of the criticality of the stakeholders. Typical parameters are:

- Power: Power can be defined as how much power a stakeholder has in relation to affecting the project/programme/portfolio.

- Interest: The stakeholder might be more or less interested in the project. The stakeholders interest in the project/programme/portfolio can both be social, economical or environmental interests etc. The interest is typically measured on a low-high scale, but can also be measured on other scales that depends on the type of interest rather than the amount, e.g. a scale spanning from national to international or from short-term to long-term.

- Attitude: Stakeholders might have positive or negative attitudes towards the project/programme/portfolio.

- Dynamism: The dynamism of a stakeholder indicates how predictable he is.

- Support: Support is often mixed up with attitude. However, support should be seen as taking action - e.g. you might have a negative attitude but you do not obstruct and therefore your support is neutral.

The following subsections introduces two common types of stakeholder maps. Other types and further information about mapping stakeholders can be found at http://apppm.man.dtu.dk/index.php/Mapping_stakeholders.

[edit] Power/Interest diagram

The power/interest diagram was introduced by Gardner et al. (1989)[7] and describes level of power as one dimension and stakeholder´s interest in the other dimension. The diagram can be used for identifying what type of relationship the organisation should have with its stakeholders, and at the same time help in the analysis of communication and engagement planning. Stakeholders with low interest and low power will require a minimum of communication, because the stakeholder´s limited interest means that he does not care too much about the project/program/portfolio, and if an issue should occur his power is limited - also implying a limited risk. Stakeholders with high interest and low power should be well informed due to their interest, but not necessarily more due to the fact that they represent a limited risk since they have low power. Stakeholders with low interest and high power should be kept satisfied - the probability that a risk occurs might be low since they are not that interested, but the impact might be large due to the high power. It is therefore important to keep them satisfied in order to mitigate a potential large risk. Stakeholders with both high interest and power should be managed closely. Project/Program/Portfolio management are dealing with a group of stakeholders that can generate heavy risks. Therefore it is important that management carefully consider engagement for these stakeholders and to what degree special reservations should be taken.

[edit] Power/Dynamism diagram

Gardner et al. (1989) also described the power/dynamism diagram as shown in Figure 4. The diagram gives a good overview of the magnitude of potential risks and opportunities related to the stakeholders, since the power can be seen as the magnitude of the impact, and dynamism to some degree can be equalised with possibility for risks or opportunity to occur.

The power/dynamism diagram can be used for strategic planning and risk analysis based on the identification of the stakeholders "political" orientation. Stakeholders with low power and low dynamism will generate limited issues. Stakeholders with high power and low dynamism might be powerful but also predictable and risk mitigation related to this category can therefore be managed by proper planning. Stakeholders with low power and high dynamism might on the other hand be unpredictable and difficult to plan, but will be manageable due to their limited power. High power as well as high dynamism results in stakeholders associated with potential great danger - that are dangerous risks in the project/program/portfolio. But it is important to underline that the stakeholders carrying the greatest risks also are carrying the greatest opportunities. The high dynamism can generate a powerful impact but this can be positive as well as negative impact.

[edit] Benefits

Among others Zhang (2011)[8] argues that a stakeholder approach consider a long-term development strategy for the company/organisation, while a shareholder approach focuses on short-term profit.

The stakeholder analysis will give a solid foundation for decision making and strategy development. Several elements in the execution process can benefit from the stakeholder analysis, since initiatives can be shaped more appropriate.

Stakeholders that are engaged appropriately will help the company/organisation to obtain a better reputation among the stakeholders, which typically will have a boomerang effect and be able to create value on the companies/organisations goodwill account.

Another account where value can be put in is CSR. Engaging stakeholders can directly be seen as increasing focus on corporate social responsibility. Taking your surroundings into consideration, and of course engaging them in a social responsible manner, is very much in line with the philosophy behind CSR.

[edit] Challenges and uncertainty

Analysing stakeholders can be an extensive task. The amount of stakeholders, depending on circumstances and level of detail, will typically be between 15 and 50. The analysis will therefore require a significant amount of work.

When gathering information about the stakeholders, it might not be possible to collect all information by contacting stakeholders. It will therefore be necessary to assume some conditions. Some parameters such as power, dynamism and interest are typically not easy measurable parameters, but are a question of subjective assessment, which can result in an analysis with limited robustness.

As discussed earlier, their will typically be both supporters and opponents. It might turn out that one have to handle unpopular communication with opponents.

[edit] Conclusion

Stakeholder analysis is a strong and relevant tool for both projects, programmes and portfolios. It creates valuable insight in internal organisation as well as all surrounding companies/organisations that affects or might be affected by the project, program or portfolio. This insight can be used for optimising communication and engagement. As well as ensuring a healthy long-term strategy.

But the analysis might be heavy work and may not necessarily give 100 per cent clear answers. To which level of detail a stakeholder analysis should be conducted therefore always has to be considered. However, identifying and to some degree analysing them should never be neglected.

[edit] References

- ↑ ISO21500. 2012. Guidance on Project Management. International Organization for Standardization.

- ↑ Dodd Jr., E. Merrick. 1932. “For Whom Are Corporate Managers Trustees?”. Harvard Law Review 45 (7): 1145.

- ↑ Freeman, R,E. 1984. Strategic Management: A Stakeholder Approach. Boston, MA: Pitman.

- ↑ Donaldson, T., and LE Preston. 1995. “The stakeholder theory of the corporation - Concepts, evidence and implications”. Academy of management review 20 (1): 65-91.

- ↑ Baker, H. Kent., and John R. Nofsinger. 2012. Socially Responsible Finance and Investing : Financial Institutions, Corporations, Investors, and Activists. Wiley.

- ↑ Cleland, David. 1994. Project Management: Strategic Design and Implementation. McGraw-Hill Inc.

- ↑ Gardner, J.R., Rachlin, R., Sweeny, H.W.A and Richards, A. 1989. Handbook of Strategic Planning. Blackwell Publishing Ltd

- ↑ Zhang, Yanru. 2011. “The Analysis of Shareholder Theory and Stakeholder Theory”. Proceedings - 2011 4th International Conference On Business Intelligence and Financial Engineering, Bife 2011, Proc. - Int. Conf. Bus. Intell. Financ. Eng., Bife: 90-92.

- ↑ Template:Cite book

[edit] Further reading

- Reed, Mark S., Anil Graves, Norman Dandy, Helena Posthumus, Klaus Hubacek, Joe Morris, Christina Prell, Claire H. Quinn, and Lindsay C. Stringer. 2009. “Who'S In and Why? A Typology of Stakeholder Analysis Methods For Natural Resource Management”. Journal of environmental management 90 (5): 1933-1949.