Cash flow and milestone payments

Rasmusbjerg (Talk | contribs) (→Definition of Cash flow and milestone payment) |

Rasmusbjerg (Talk | contribs) (→Cash flow and milestone payment in general) |

||

| (171 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| − | |||

==Abstract== | ==Abstract== | ||

| − | This article will focus on how Cash flow and milestone payment <ref name='' | + | This article will focus on, how Cash flow and milestone payment <ref name=Milestone> ''O'Brien, Dan & Revell, Grant (2005); The Milestone Payment System: Results based funding in vocational rehabilitation – volume 23 issue 2, pp 101-114'' </ref> can help a manager in either program, project or portfolio, to see the costs, income vs outcome of the operation, and to help the manager motivating the freelancers, to reach a selected amount of goals. Preferably common goals, to get the freelancers working together, by offering milestone payments along the way. |

| − | |||

| − | + | The two fundamental ideas of cash flow and milestone payments will be described, and to get an idea of how to implement the two in management. To describe these tools, the following will be analyzed and described: | |

| − | + | *How to use the cash flow tool, to get an idea of how the money is flowing in the business, and to see the payments. The income vs. the outflow. | |

| − | + | *How to use milestone payment to set up a program to award the hired freelances, if they are doing their job according to the managers timeline and quality, or to give a group of freelancers a common goal and give them a “team” feeling to get them to work together the best way possible. | |

| − | To help understand these models | + | The goal of combining the two, are to use milestone payments and cash flow in a symbiosis to get the milestones incorporated in the cash flow, to get an understanding of the payments going in/out of the company, project etc. according to the time schedule, as a tool of planning. Furthermore, to focus on how the two can be used on a daily/weekly base, to get the most out of the models. |

| + | |||

| + | To help understand these models “Cost Management<ref name=PMBOK> ''Project Management Institute, Inc. (PMI). (2017). Guide to the Project Management Body of Knowledge (PMBOK® Guide) (6th Edition). chapter 7.'' </ref>” will be used as a management style, because it relates to the idea of cash flow. Because of this relation, it also relates to milestone payment, because it is also a tool to control the money coming out in form of salaries and bonuses, according to the agreed contracts between the manager/company and the hired freelancers. | ||

==Introduction== | ==Introduction== | ||

| − | This article will focus on: | + | '''This article will focus on''': |

| − | + | *Cash flow<ref name=Civil></ref> | |

| − | + | *Milestone payment<ref name=Civil></ref> | |

| − | + | *Implementing the two together in cost management<ref name=PMBOK></ref> | |

| − | + | ||

| − | + | ||

| + | *What advantages the two tools have, when they are used in a combination. | ||

==Definition of Cash flow and milestone payment== | ==Definition of Cash flow and milestone payment== | ||

| − | To get an idea of what the two tools | + | To get an idea of what the two tools contains, a breakdown of them, is an idea: |

| − | + | ||

| − | + | '''Cash Flow''' | |

| − | + | Cash flow in its basic elements consists of the two<ref name=Civil> ''ICE Publishing (2016), Civil Engineering Procedure (7th Edition), chapter 7'' </ref>. | |

| − | + | *Money flowing '''in''' to the project, portfolio, business etc. | |

| + | *Money flowing '''out'''. | ||

| − | |||

| − | Milestones are some of the important key points, that means something throughout the duration of the project. The milestones are something that the | + | This means, that cash flow is a tool, that gives an overview of the money coming in and out of the project etc. The cash flow model diverts, after what type of either program, project or portfolio its covering. The reason the model divert, are that the span of the three are different, and that the objective can be different, depending on the expected outcome. |

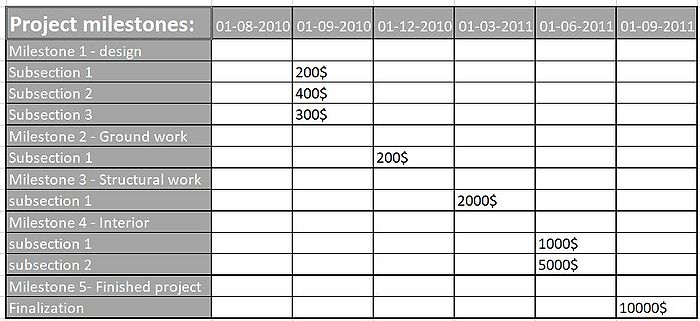

| − | The definition of milestone payment (progress payment) are, that the | + | Below (on figure 1) is a figure of cash out-flow shown in a project. Figure 1, also shows a way to implement milestones in cash flow. |

| + | |||

| + | [[File:Milestonep.JPG|center|thumb|700px|Figure 1: Cash out-flow in a building, using milestones in a project]] | ||

| + | |||

| + | |||

| + | '''Milestone payments''' | ||

| + | |||

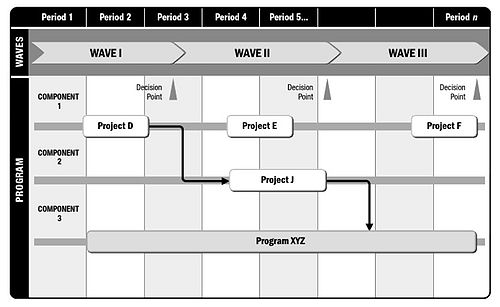

| + | Milestones are some of the important key points (also described in<ref name=Civil></ref>), that means something throughout the duration of the project. The milestones are something that the management decides, when taken the activities in scope in consideration. The idea is then, that the key milestones can be pointed out and lined up in a timeframe diagram. As an example, a roadmap could be used<ref name=roadmap> '' Project Management Institute. (PMI). (2017). The Standard for Program Management, Fourth Edition, section 3.'' </ref>. A roadmap shows how activities can be connected to another, and how this milestone then become a key milestone, by blocking other actions afterwards. | ||

| + | An example for a roadmap is shown below in figure 2. | ||

| + | [[File: Roadmap.JPG|center|thumb|500px|Figure 2: A roadmap showing milestones in form of projects in a program <ref name=roadmap/>]] | ||

| + | |||

| + | A roadmap allows the management to see, what milestones that needs to be done (critical path<ref name=path> ''https://www.projectmanager.com/blog/understanding-critical-path-project-management 7, An explanation of Critical Path, Accessed 02/03/2019'' </ref>), in an order that allows other tasks can begin, and therefore what the key milestones are. In this example, the roadmap is a part of the strategy alignment in a program management system<ref name=roadmap/>. This is to clarify the milestones in an example based upon activities, That’s required to be completed before the following set of activities can begin. | ||

| + | |||

| + | The definition of milestone payment<ref name=Milestone></ref> (progress payment) are, that the freelancers get payed, when an agreed milestone is achieved, according to the contract between the management and freelancers. | ||

The milestones are something that either are agreed on mutually, or decided beforehand, and are in the spectrum between the start and the end of the program, phase, project, portfolio etc. | The milestones are something that either are agreed on mutually, or decided beforehand, and are in the spectrum between the start and the end of the program, phase, project, portfolio etc. | ||

As the word “progress payment” strongly hints, it means that its payment after the progress. | As the word “progress payment” strongly hints, it means that its payment after the progress. | ||

==Cash flow and milestone payment in general== | ==Cash flow and milestone payment in general== | ||

| + | '''Cash flow''' | ||

| − | Cash flow is a tool, that gives an indication about the money moving in and out of the company, | + | Cash flow is a tool, that gives an indication about the money moving in and out of the company, project, program or portfolio<ref name=Civil></ref>. It shows the management how much, and how the money is being spent, what income they are generating, and what they are subjected to get. The cash flow can be used as a tool over a selected time related period, or over the entire lifespan of the company etc. |

Cash flow is way of measure the amount of “cash” or value in the company/project etc. | Cash flow is way of measure the amount of “cash” or value in the company/project etc. | ||

| − | |||

| − | |||

| − | |||

| − | + | The problem with the cash flow tool is, that it only calculates the things that can be “converted” into cash, and therefore only liquid assets. By other words, cash flow describes the overall financial performance, and is thus a tool to show the shareholders/management the true value in liquid assets, flowing in and out. | |

| + | A good idea to help handling the cash flow tool, are to make a chart showing each phase in the process. | ||

| + | As an example, a selected view of an outflow of cash, in a building project, is shown on figure 1: | ||

| − | + | ||

| − | Often in a building project, the cash coming in | + | Figure 1 shows, the cash flow of a random building-project. The figure shows the outflow of cash in the project, each month. This gives an overview of what money are being spend on the project. To make this a complete cash flow diagram, an addition in terms of inflow would be needed. |

| − | Milestone | + | Often in a building project, the cash coming in as agreed beforehand contractually . Sometime in form of milestone payments, or at the start/end of the project. This off course all depends on the contractually agreed terms. Then the meaning of a chart over cash flow, are to give an idea to the management of the money being spent and generated and can be updated running along the project. Then the chart works like a cash flow with constant value to the management, because the chart is up to date and shows the cash flow of the project. |

| − | The chart over cash flow can also be used, as an example in milestone payment. The big parts of the chart would then work as the milestones, to get an idea of when they should be complete, and what money these milestones are associated with according to the freelancers. This shows the freelancers when they should be done with their milestones, | + | An advantage of cash flow is, that combines and relates to a lot of other tools. As this article is about cash flow and milestone payment, of course these to combines. Another example could be Capital Expenditure (CAPEX<ref name=''CAPEX''> ''https://www.investopedia.com/terms/c/capitalexpenditure.asp CAPEX, explanation of CAPEX, |

| + | Accessed 01/03/2019.'' </ref>). CAPEX are the funds a company are using to acquire, upgrade and maintain physical assets, such as equipment, industrial facilities or property. In according to CAPEX, cash flow’s purpose is to help the management to determine how big a pool of cash there are to invest in CAPEX. The cash flow and CAPEX also collaborates when calculating the cash flow to CAPEX ratio. This ratio describes the ability to acquire assets in the long term. | ||

| + | |||

| + | '''Milestone payment''' | ||

| + | |||

| + | Milestone payment<ref name=Milestone></ref> is also a very widely based tool. Meaning, it can be implemented by the management in a lot of different scenarios. In general terms, there are two ways to differentiate milestone payment: | ||

| + | |||

| + | *'''In minor projects.''' A good example here could be Research and development projects (R&D<ref name=rnd> ''http://www.investopedia.com/terms/r/randd.asp R&D, explanation of r&d, Accessed 28/02/2019.'' </ref>) | ||

| + | |||

| + | *'''In big projects.''' For instance, an olympic stadium | ||

| + | |||

| + | Then the general idea behind milestone payments are, to make a common goal and an incitement towards working together. If it works well, the idea of milestone payment is, that everyone gets “bonusses” if they achieve the goals there were agreed upon in advance. It gives everybody a reason to do their best to get the collaboration to work, because everybody gets rewarded if they get to the milestones on time (or before time) according to the time/work plan. This type of milestone payment is often if it’s a bigger project and could work in the process of building an olympic stadium. | ||

| + | If it’s a smaller type of project, for instance an R&D project<ref name=rnd></ref>, milestone payment can be used as a payment arrangement between the contractor and freelancers. The contractor can then use this method to pay the freelancer when the agreed milestones are complete according to time and quality. | ||

| + | |||

| + | The chart over cash out-flow (figure 1) can also be used, as an example in milestone payment. The big parts of the chart would then work as the milestones, to get an idea of when they should be complete, and what money these milestones are associated with according to the freelancers. This shows the freelancers when they should be done with their milestones according to what’s on the critical path<ref name=path></ref>, what payment they are expected to get, and what time they should be completed by. | ||

==Implementation in cost management== | ==Implementation in cost management== | ||

| − | + | To implement cash flow and milestone payment in cost management, an understanding of cost management must first be acquired. There are four central management processes in cost management. | |

| − | + | ||

| − | + | ||

| − | + | ||

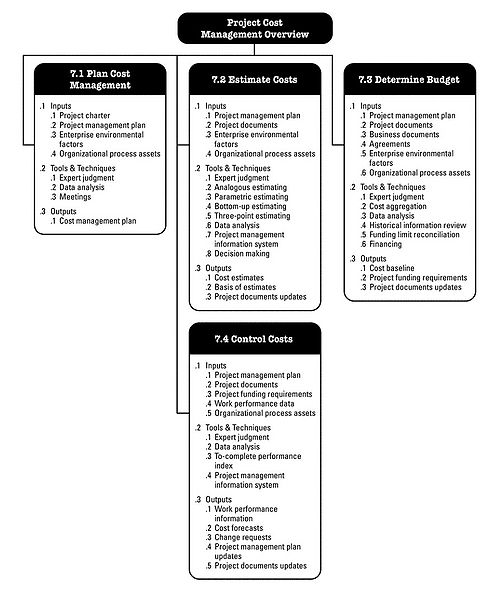

| − | The | + | '''The four cost management processes'''<ref name=PMBOK/> |

| − | + | The ideas behind these four processes are: | |

| − | + | *'''Plan cost management''' – The defining process of defining cost and budget estimation, and how it’s being managed, monitored and controlled. | |

| − | + | *'''Estimate cost''' – Estimating the momentary cost of the project. | |

| + | |||

| + | *'''Determine budget''' – Determine the budget, going through every aspect of the project, and thereby determine the cost base line. | ||

| − | + | *'''Cost controls''' – Monitoring the project to follow the cost and update the cost base line. | |

| − | These four processes are all about the same thing. Money. In cost management, it’s all about degrading the cost aspect of the project, to get an idea of the fundamental information needed about money, that the management needs to know. To use the books own words, it’s about | + | Figure 4 shows an overview of cost management. This gives a more explicit idea of, what to do, and what the elementary steps in project cost management are. |

| − | + | ||

| − | The goal with Cash flow is the same. The cash flow tool also works around money. Helping the management to get an overview of the money flowing in and out. As described under “Cash flow and milestone payment in general” it gives an indication of what amount om money the project etc. is generating, or what is being spent. This gives the idea, that the two ideas can work together, because they both circulate around money, and both takes ground in the aspect of the management to see what’s been generated or available from the agreed contract, what’s needed to do the job and the base line cost. This comparison shows, that the two models are much alike. But the alikeness as always, have an end of comparison. The end comes in form of the managing aspect. “Cost management” also concerns about how it’s being managed, monitored, controlled and updating costs according to the base line costs. | + | [[File:Hej.jpg|500px|thumb|center|Figure 4: Project cost management overview <ref name=PMBOK/>]] |

| + | |||

| + | |||

| + | These four processes are all about the same thing. Money. In cost management, it’s all about degrading the cost aspect of the project, to get an idea of the fundamental information needed about money, that the management needs to know. To use the books own words, it’s about "''the processes involved in planning, estimating, budgeting, financing, funding, managing, and controlling costs so that the project can be completed within the approved budget''<ref name=''2''> ''Project Management: A guide to the Project Management Body of Knowledge (PMBOK guide) 6 th Edition (2017) chapter 7. page 231. line 1-3'' </ref>”. As the four processes show, it’s about how the management can get an idea of the money needed, in the continuous work of either project, program or portfolio. | ||

| + | |||

| + | The goal with Cash flow is the same. The cash flow tool also works around money. Helping the management to get an overview of the money flowing in and out. As described under “Cash flow and milestone payment in general” it gives an indication of what amount om money the project etc. is generating, or what is being spent. This gives the idea, that the two ideas can work together, because they both circulate around money, and both takes ground in the aspect of the management to see what’s been generated or available from the agreed contract, what’s needed to do the job and the base line cost. This comparison shows, that the two models are much alike. But the alikeness as always, have an end of comparison. The end comes in form of the managing aspect. “Cost management” also concerns about how it’s being managed, monitored, controlled and updating costs according to the base line costs<ref name=PMBOK/>. | ||

This is here payment milestones can be implemented, to get a hold on these factors. Milestone payment gives the hiring part control of the freelancers. As described in “Cash flow and milestone payment in general”, milestone payment’s usage depends on the employers. The Employers have their project etc. and thereby chooses what kind of freelancers they want to hire, and how they want to manage their project. This means, that the employers can “control” their freelancers with the milestone payment, because it allows them to pay the hired part, when they have done their job according to the contractually agreed quality and time-span. | This is here payment milestones can be implemented, to get a hold on these factors. Milestone payment gives the hiring part control of the freelancers. As described in “Cash flow and milestone payment in general”, milestone payment’s usage depends on the employers. The Employers have their project etc. and thereby chooses what kind of freelancers they want to hire, and how they want to manage their project. This means, that the employers can “control” their freelancers with the milestone payment, because it allows them to pay the hired part, when they have done their job according to the contractually agreed quality and time-span. | ||

| + | |||

| + | '''Key concepts in project cost management''' | ||

| + | |||

| + | To follow up on this comparison and trying to implement cash flow and milestone payments in project cost management, it’s important to remember the key concepts. As the book also states, some of the important aspects of the project cost management are to remember the key concepts. | ||

| + | |||

| + | The primary key concepts are<ref name=PMBOK/>: | ||

| + | |||

| + | *Knowing the cost required to complete the project activities. | ||

| + | |||

| + | *Knowing what to do to keep the costs down in the project | ||

| + | |||

| + | *Recognizing and identifying the key stakeholders | ||

| + | |||

| + | *Knowing what elements or processes that are unnecessary to the project | ||

| + | |||

| + | *Predicting the final financial aspect of the project. | ||

| + | |||

| + | All these aspects are some of the key concepts in the cost management, and they all have a big part in cost management. As an example, how important these key concepts can be, could be to do an analysis on some of them. | ||

| + | |||

| + | Identifying the key stakeholders can be a crucial part in the cost management. Trying to identify them and satisfying them could be crucial in the project. If they are satisfied and thinking good thoughts about their investment in the project, they are more likely to be helpful in problem-shooting and agreeing to alternate changes to help the project. | ||

| + | |||

| + | Other aspects could be the cost aspect of the key concepts. It’s of course a crucial task to predict the final cost, to be able to make a profit. The business is built around money and are all about making money. Thereby this aspect is indeed a key concept. Because of this, the concept of knowing the needed cost from the beginning and knowing what’s necessary for the project, are also key aspects. Without knowing anything about this, the cost management would be a difficult to follow, and thereby also difficult to implement cash flow and milestone payment in this. | ||

==Risks involved in implementing cash flow and milestone payments== | ==Risks involved in implementing cash flow and milestone payments== | ||

As anything else, there’s a risk involved whit doing this. Meaning that, the picture painted by the models, is what it is. A set up model, that shows what the model usually shows. In this case, the models show the cash flow, and allows the user to set up a milestone payment, by agreeing to the milestones with the freelancers. | As anything else, there’s a risk involved whit doing this. Meaning that, the picture painted by the models, is what it is. A set up model, that shows what the model usually shows. In this case, the models show the cash flow, and allows the user to set up a milestone payment, by agreeing to the milestones with the freelancers. | ||

| − | The | + | The problems and risks related to the two things could be: |

| − | + | *A certain view of a cash flow. Meaning an understanding of cash flow, that depends on the person creating the flow. | |

| − | + | *The wrong picked milestones and thereby the payments according to these milestones. | |

| − | This means, that milestone payment can be a different type and size in every project, program or portfolio. This also means, that milestone payment is a tool to use wisely, because it can divert from the previous examples of milestone payment | + | This means, that milestone payment can be a different type and size in every project, program or portfolio. This also means, that milestone payment is a tool to use wisely and with care, because it can divert from the previous examples of milestone payment. Some of the main reasons it might divert could be if the involved parties behave differently, or the project etc. comprehends something different. |

| − | + | ||

| − | + | ||

| + | Another possible risk to always keep in mind while using payment milestones<ref name=Milestone></ref>, are the fact that if a milestone is missed due to the project being postponed, and the freelancers were working together to achieve the milestones to get payed, the incitement of money that got them to work together as best as possible might disappears due to the lack of achieving the first goal. This could mean that the rest of the project are being postponed even more, due to the misalignment between the freelancers/subcontractors. | ||

==Reflection on the implementation of Cash flow and milestone payments in cost management== | ==Reflection on the implementation of Cash flow and milestone payments in cost management== | ||

| − | This article has now focused on what cash flow and milestone payments are, what the general definition of the two are, how it can be implemented and used with other management tools | + | This article has now focused on what cash flow and milestone payments are, what the general definition of the two are, how it can be implemented and used with other management tools. Furthermore, the risks of the implementation of the two tools have been considered and analyzed, to get an understanding of what some of the risk’s involved whit the tools. There is always a small risk related to using models, because the models are affected by the ones making it. As the example in cash flow shows, the tool is easily affected by the ones making it, and what type of project, business etc. there are on the line in the models. |

| − | As always, there are a risk involved with implementing and using tools. This is because there always are possible views and outcomes of the models. As the example in the” cash flow and milestone payments in general” section shows, a cash flow chart can be super helpful in the management. It can be used to show the freelancers what their milestones are, and what kind of payment they are subjects to get when their milestones are completed. Then the | + | As always, there are a risk involved with implementing and using tools. This is because there always are possible views and outcomes of the models. As the example in the” cash flow and milestone payments in general” section shows, a cash flow chart with implemented milestones can be super helpful in the management. It can be used to show the freelancers what their milestones are, and what kind of payment they are subjects to get when their milestones are completed. Then the management gets a constant overview of the cash flow in the project, an always have an idea of the cost base line, as described in the “cost management<ref name=PMBOK/>” section. |

| + | |||

| + | Another thing to remember in this reflection, are the references that have been used in this article. | ||

| + | As the bibliography shows, the two PMI books get referenced quite often. The PMI<ref name=PMBOK/><ref name=roadmap/> books are of course very relevant and are the “standard” to the subject of project management. But as the name of one of the PMI books says, it’s a ‘book of knowledge’, meaning that the book doesn’t necessarily explains what needs to be done to make it work, its more concerned and concentrated about the tools and different management styles. This leaves it up to the person who interprets the different models, on how to use them and how to work with them. This article’s goal was as stated in the abstract, to help the person reading this article to a better understanding of the cash flow and milestone payment, and how to implement it in cost management. And this article then delivers some pointers and guidelines on how to do it, and especially what to be concerned and aware about when using it. | ||

| + | |||

| + | ==Annotated Bibliography== | ||

| + | |||

| + | *''' O'Brien, Dan & Revell, Grant (2005); The Milestone Payment System: Results based funding in vocational rehabilitation - from Funding Consumer Directed Employment Outcomes – volume 23 issue 2, pp 101-114:''' | ||

| + | |||

| + | This research article is based on the milestone payment system. | ||

| + | |||

| + | This article will help the reader to get a better understanding on how the milestone payment system will, hopefully, improve the work-rate, quality, shorten the time span and the co-work in a given project etc. the article then focuses on how this tool have helped previously to give better results for managers, and to reach the acquired goals. | ||

| + | |||

| + | |||

| + | * '''Project Management Institute, Inc. (PMI). (2017). Guide to the Project Management Body of Knowledge (PMBOK® Guide) (6th Edition). chapter 7:''' | ||

| + | PMBOK book chapter 7 is about ''"project cost management"''. | ||

| + | |||

| + | It’s the PMI standard book, on this subject. | ||

| + | As the title of the book says, this is a guide to project management. In this case, chapter 7 is about cost management and all the aspect connected to this management-style. It will in basic terms describe the most essential tools and skills to the reader, so that it can be used as a tool to use this management style to maybe cut costs in the project, or to get other key aspects of the book, in order to make the project-work flow. | ||

| + | |||

| + | |||

| + | *'''ICE Publishing (2016), Civil Engineering Procedure (7th Edition), chapter 7:''' | ||

| + | Chapter 7 is about the ''"planning and control of construction"'' | ||

| + | |||

| + | In this book, chapter 7 is about the planning and control of construction. The book then provides some tools on, how to help the reader achieving the goals set for planning and controlling the construction. This comes in handy for every management, faced with problems on the to mentioned areas, and the book then focus on some of the basics, like cash flow and milestones (and therefore milestone payments), as tools to help reaching the goals for the management. | ||

| + | |||

| + | |||

| + | *'''Project Management Institute. (PMI). (2017). The Standard for Program Management, Fourth Edition, section 3'''. | ||

| + | The book in general is the PMI standard book for program management. | ||

| + | Section 3 in this book is about strategy alignment. It’s covering the aspect of trying to align a project strategy, and to align the projects strategy with the organization’s general objectives, goals and strategy. | ||

==References== | ==References== | ||

Latest revision as of 19:58, 4 March 2019

[edit] Abstract

This article will focus on, how Cash flow and milestone payment [1] can help a manager in either program, project or portfolio, to see the costs, income vs outcome of the operation, and to help the manager motivating the freelancers, to reach a selected amount of goals. Preferably common goals, to get the freelancers working together, by offering milestone payments along the way.

The two fundamental ideas of cash flow and milestone payments will be described, and to get an idea of how to implement the two in management. To describe these tools, the following will be analyzed and described:

- How to use the cash flow tool, to get an idea of how the money is flowing in the business, and to see the payments. The income vs. the outflow.

- How to use milestone payment to set up a program to award the hired freelances, if they are doing their job according to the managers timeline and quality, or to give a group of freelancers a common goal and give them a “team” feeling to get them to work together the best way possible.

The goal of combining the two, are to use milestone payments and cash flow in a symbiosis to get the milestones incorporated in the cash flow, to get an understanding of the payments going in/out of the company, project etc. according to the time schedule, as a tool of planning. Furthermore, to focus on how the two can be used on a daily/weekly base, to get the most out of the models.

To help understand these models “Cost Management[2]” will be used as a management style, because it relates to the idea of cash flow. Because of this relation, it also relates to milestone payment, because it is also a tool to control the money coming out in form of salaries and bonuses, according to the agreed contracts between the manager/company and the hired freelancers.

[edit] Introduction

This article will focus on:

- Cash flow[3]

- Milestone payment[3]

- Implementing the two together in cost management[2]

- What advantages the two tools have, when they are used in a combination.

[edit] Definition of Cash flow and milestone payment

To get an idea of what the two tools contains, a breakdown of them, is an idea:

Cash Flow

Cash flow in its basic elements consists of the two[3].

- Money flowing in to the project, portfolio, business etc.

- Money flowing out.

This means, that cash flow is a tool, that gives an overview of the money coming in and out of the project etc. The cash flow model diverts, after what type of either program, project or portfolio its covering. The reason the model divert, are that the span of the three are different, and that the objective can be different, depending on the expected outcome.

Below (on figure 1) is a figure of cash out-flow shown in a project. Figure 1, also shows a way to implement milestones in cash flow.

Milestone payments

Milestones are some of the important key points (also described in[3]), that means something throughout the duration of the project. The milestones are something that the management decides, when taken the activities in scope in consideration. The idea is then, that the key milestones can be pointed out and lined up in a timeframe diagram. As an example, a roadmap could be used[4]. A roadmap shows how activities can be connected to another, and how this milestone then become a key milestone, by blocking other actions afterwards. An example for a roadmap is shown below in figure 2.

A roadmap allows the management to see, what milestones that needs to be done (critical path[5]), in an order that allows other tasks can begin, and therefore what the key milestones are. In this example, the roadmap is a part of the strategy alignment in a program management system[4]. This is to clarify the milestones in an example based upon activities, That’s required to be completed before the following set of activities can begin.

The definition of milestone payment[1] (progress payment) are, that the freelancers get payed, when an agreed milestone is achieved, according to the contract between the management and freelancers. The milestones are something that either are agreed on mutually, or decided beforehand, and are in the spectrum between the start and the end of the program, phase, project, portfolio etc. As the word “progress payment” strongly hints, it means that its payment after the progress.

[edit] Cash flow and milestone payment in general

Cash flow

Cash flow is a tool, that gives an indication about the money moving in and out of the company, project, program or portfolio[3]. It shows the management how much, and how the money is being spent, what income they are generating, and what they are subjected to get. The cash flow can be used as a tool over a selected time related period, or over the entire lifespan of the company etc. Cash flow is way of measure the amount of “cash” or value in the company/project etc.

The problem with the cash flow tool is, that it only calculates the things that can be “converted” into cash, and therefore only liquid assets. By other words, cash flow describes the overall financial performance, and is thus a tool to show the shareholders/management the true value in liquid assets, flowing in and out. A good idea to help handling the cash flow tool, are to make a chart showing each phase in the process. As an example, a selected view of an outflow of cash, in a building project, is shown on figure 1:

Figure 1 shows, the cash flow of a random building-project. The figure shows the outflow of cash in the project, each month. This gives an overview of what money are being spend on the project. To make this a complete cash flow diagram, an addition in terms of inflow would be needed.

Often in a building project, the cash coming in as agreed beforehand contractually . Sometime in form of milestone payments, or at the start/end of the project. This off course all depends on the contractually agreed terms. Then the meaning of a chart over cash flow, are to give an idea to the management of the money being spent and generated and can be updated running along the project. Then the chart works like a cash flow with constant value to the management, because the chart is up to date and shows the cash flow of the project.

An advantage of cash flow is, that combines and relates to a lot of other tools. As this article is about cash flow and milestone payment, of course these to combines. Another example could be Capital Expenditure (CAPEX[6]). CAPEX are the funds a company are using to acquire, upgrade and maintain physical assets, such as equipment, industrial facilities or property. In according to CAPEX, cash flow’s purpose is to help the management to determine how big a pool of cash there are to invest in CAPEX. The cash flow and CAPEX also collaborates when calculating the cash flow to CAPEX ratio. This ratio describes the ability to acquire assets in the long term.

Milestone payment

Milestone payment[1] is also a very widely based tool. Meaning, it can be implemented by the management in a lot of different scenarios. In general terms, there are two ways to differentiate milestone payment:

- In minor projects. A good example here could be Research and development projects (R&D[7])

- In big projects. For instance, an olympic stadium

Then the general idea behind milestone payments are, to make a common goal and an incitement towards working together. If it works well, the idea of milestone payment is, that everyone gets “bonusses” if they achieve the goals there were agreed upon in advance. It gives everybody a reason to do their best to get the collaboration to work, because everybody gets rewarded if they get to the milestones on time (or before time) according to the time/work plan. This type of milestone payment is often if it’s a bigger project and could work in the process of building an olympic stadium. If it’s a smaller type of project, for instance an R&D project[7], milestone payment can be used as a payment arrangement between the contractor and freelancers. The contractor can then use this method to pay the freelancer when the agreed milestones are complete according to time and quality.

The chart over cash out-flow (figure 1) can also be used, as an example in milestone payment. The big parts of the chart would then work as the milestones, to get an idea of when they should be complete, and what money these milestones are associated with according to the freelancers. This shows the freelancers when they should be done with their milestones according to what’s on the critical path[5], what payment they are expected to get, and what time they should be completed by.

[edit] Implementation in cost management

To implement cash flow and milestone payment in cost management, an understanding of cost management must first be acquired. There are four central management processes in cost management.

The four cost management processes[2]

The ideas behind these four processes are:

- Plan cost management – The defining process of defining cost and budget estimation, and how it’s being managed, monitored and controlled.

- Estimate cost – Estimating the momentary cost of the project.

- Determine budget – Determine the budget, going through every aspect of the project, and thereby determine the cost base line.

- Cost controls – Monitoring the project to follow the cost and update the cost base line.

Figure 4 shows an overview of cost management. This gives a more explicit idea of, what to do, and what the elementary steps in project cost management are.

These four processes are all about the same thing. Money. In cost management, it’s all about degrading the cost aspect of the project, to get an idea of the fundamental information needed about money, that the management needs to know. To use the books own words, it’s about "the processes involved in planning, estimating, budgeting, financing, funding, managing, and controlling costs so that the project can be completed within the approved budget[8]”. As the four processes show, it’s about how the management can get an idea of the money needed, in the continuous work of either project, program or portfolio.

The goal with Cash flow is the same. The cash flow tool also works around money. Helping the management to get an overview of the money flowing in and out. As described under “Cash flow and milestone payment in general” it gives an indication of what amount om money the project etc. is generating, or what is being spent. This gives the idea, that the two ideas can work together, because they both circulate around money, and both takes ground in the aspect of the management to see what’s been generated or available from the agreed contract, what’s needed to do the job and the base line cost. This comparison shows, that the two models are much alike. But the alikeness as always, have an end of comparison. The end comes in form of the managing aspect. “Cost management” also concerns about how it’s being managed, monitored, controlled and updating costs according to the base line costs[2].

This is here payment milestones can be implemented, to get a hold on these factors. Milestone payment gives the hiring part control of the freelancers. As described in “Cash flow and milestone payment in general”, milestone payment’s usage depends on the employers. The Employers have their project etc. and thereby chooses what kind of freelancers they want to hire, and how they want to manage their project. This means, that the employers can “control” their freelancers with the milestone payment, because it allows them to pay the hired part, when they have done their job according to the contractually agreed quality and time-span.

Key concepts in project cost management

To follow up on this comparison and trying to implement cash flow and milestone payments in project cost management, it’s important to remember the key concepts. As the book also states, some of the important aspects of the project cost management are to remember the key concepts.

The primary key concepts are[2]:

- Knowing the cost required to complete the project activities.

- Knowing what to do to keep the costs down in the project

- Recognizing and identifying the key stakeholders

- Knowing what elements or processes that are unnecessary to the project

- Predicting the final financial aspect of the project.

All these aspects are some of the key concepts in the cost management, and they all have a big part in cost management. As an example, how important these key concepts can be, could be to do an analysis on some of them.

Identifying the key stakeholders can be a crucial part in the cost management. Trying to identify them and satisfying them could be crucial in the project. If they are satisfied and thinking good thoughts about their investment in the project, they are more likely to be helpful in problem-shooting and agreeing to alternate changes to help the project.

Other aspects could be the cost aspect of the key concepts. It’s of course a crucial task to predict the final cost, to be able to make a profit. The business is built around money and are all about making money. Thereby this aspect is indeed a key concept. Because of this, the concept of knowing the needed cost from the beginning and knowing what’s necessary for the project, are also key aspects. Without knowing anything about this, the cost management would be a difficult to follow, and thereby also difficult to implement cash flow and milestone payment in this.

[edit] Risks involved in implementing cash flow and milestone payments

As anything else, there’s a risk involved whit doing this. Meaning that, the picture painted by the models, is what it is. A set up model, that shows what the model usually shows. In this case, the models show the cash flow, and allows the user to set up a milestone payment, by agreeing to the milestones with the freelancers. The problems and risks related to the two things could be:

- A certain view of a cash flow. Meaning an understanding of cash flow, that depends on the person creating the flow.

- The wrong picked milestones and thereby the payments according to these milestones.

This means, that milestone payment can be a different type and size in every project, program or portfolio. This also means, that milestone payment is a tool to use wisely and with care, because it can divert from the previous examples of milestone payment. Some of the main reasons it might divert could be if the involved parties behave differently, or the project etc. comprehends something different.

Another possible risk to always keep in mind while using payment milestones[1], are the fact that if a milestone is missed due to the project being postponed, and the freelancers were working together to achieve the milestones to get payed, the incitement of money that got them to work together as best as possible might disappears due to the lack of achieving the first goal. This could mean that the rest of the project are being postponed even more, due to the misalignment between the freelancers/subcontractors.

[edit] Reflection on the implementation of Cash flow and milestone payments in cost management

This article has now focused on what cash flow and milestone payments are, what the general definition of the two are, how it can be implemented and used with other management tools. Furthermore, the risks of the implementation of the two tools have been considered and analyzed, to get an understanding of what some of the risk’s involved whit the tools. There is always a small risk related to using models, because the models are affected by the ones making it. As the example in cash flow shows, the tool is easily affected by the ones making it, and what type of project, business etc. there are on the line in the models.

As always, there are a risk involved with implementing and using tools. This is because there always are possible views and outcomes of the models. As the example in the” cash flow and milestone payments in general” section shows, a cash flow chart with implemented milestones can be super helpful in the management. It can be used to show the freelancers what their milestones are, and what kind of payment they are subjects to get when their milestones are completed. Then the management gets a constant overview of the cash flow in the project, an always have an idea of the cost base line, as described in the “cost management[2]” section.

Another thing to remember in this reflection, are the references that have been used in this article. As the bibliography shows, the two PMI books get referenced quite often. The PMI[2][4] books are of course very relevant and are the “standard” to the subject of project management. But as the name of one of the PMI books says, it’s a ‘book of knowledge’, meaning that the book doesn’t necessarily explains what needs to be done to make it work, its more concerned and concentrated about the tools and different management styles. This leaves it up to the person who interprets the different models, on how to use them and how to work with them. This article’s goal was as stated in the abstract, to help the person reading this article to a better understanding of the cash flow and milestone payment, and how to implement it in cost management. And this article then delivers some pointers and guidelines on how to do it, and especially what to be concerned and aware about when using it.

[edit] Annotated Bibliography

- O'Brien, Dan & Revell, Grant (2005); The Milestone Payment System: Results based funding in vocational rehabilitation - from Funding Consumer Directed Employment Outcomes – volume 23 issue 2, pp 101-114:

This research article is based on the milestone payment system.

This article will help the reader to get a better understanding on how the milestone payment system will, hopefully, improve the work-rate, quality, shorten the time span and the co-work in a given project etc. the article then focuses on how this tool have helped previously to give better results for managers, and to reach the acquired goals.

- Project Management Institute, Inc. (PMI). (2017). Guide to the Project Management Body of Knowledge (PMBOK® Guide) (6th Edition). chapter 7:

PMBOK book chapter 7 is about "project cost management".

It’s the PMI standard book, on this subject. As the title of the book says, this is a guide to project management. In this case, chapter 7 is about cost management and all the aspect connected to this management-style. It will in basic terms describe the most essential tools and skills to the reader, so that it can be used as a tool to use this management style to maybe cut costs in the project, or to get other key aspects of the book, in order to make the project-work flow.

- ICE Publishing (2016), Civil Engineering Procedure (7th Edition), chapter 7:

Chapter 7 is about the "planning and control of construction"

In this book, chapter 7 is about the planning and control of construction. The book then provides some tools on, how to help the reader achieving the goals set for planning and controlling the construction. This comes in handy for every management, faced with problems on the to mentioned areas, and the book then focus on some of the basics, like cash flow and milestones (and therefore milestone payments), as tools to help reaching the goals for the management.

- Project Management Institute. (PMI). (2017). The Standard for Program Management, Fourth Edition, section 3.

The book in general is the PMI standard book for program management. Section 3 in this book is about strategy alignment. It’s covering the aspect of trying to align a project strategy, and to align the projects strategy with the organization’s general objectives, goals and strategy.

[edit] References

- ↑ 1.0 1.1 1.2 1.3 O'Brien, Dan & Revell, Grant (2005); The Milestone Payment System: Results based funding in vocational rehabilitation – volume 23 issue 2, pp 101-114

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 2.6 2.7 Project Management Institute, Inc. (PMI). (2017). Guide to the Project Management Body of Knowledge (PMBOK® Guide) (6th Edition). chapter 7.

- ↑ 3.0 3.1 3.2 3.3 3.4 ICE Publishing (2016), Civil Engineering Procedure (7th Edition), chapter 7

- ↑ 4.0 4.1 4.2 4.3 Project Management Institute. (PMI). (2017). The Standard for Program Management, Fourth Edition, section 3.

- ↑ 5.0 5.1 https://www.projectmanager.com/blog/understanding-critical-path-project-management 7, An explanation of Critical Path, Accessed 02/03/2019

- ↑ https://www.investopedia.com/terms/c/capitalexpenditure.asp CAPEX, explanation of CAPEX, Accessed 01/03/2019.

- ↑ 7.0 7.1 http://www.investopedia.com/terms/r/randd.asp R&D, explanation of r&d, Accessed 28/02/2019.

- ↑ Project Management: A guide to the Project Management Body of Knowledge (PMBOK guide) 6 th Edition (2017) chapter 7. page 231. line 1-3