Portfolio Evaluation Tools

| (121 intermediate revisions by 6 users not shown) | |||

| Line 2: | Line 2: | ||

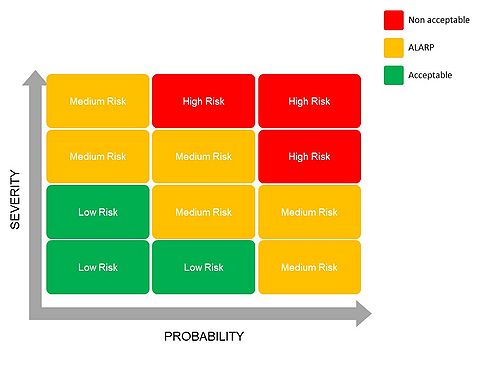

A risk matrix is an effective and broadly used risk assessment tool. It is quite quick to create, and it is an easy way to identify problems. In some cases, it is also used to rank the risks to understand which one needs to be addressed first. Therefore, this tool has mainly two application: | A risk matrix is an effective and broadly used risk assessment tool. It is quite quick to create, and it is an easy way to identify problems. In some cases, it is also used to rank the risks to understand which one needs to be addressed first. Therefore, this tool has mainly two application: | ||

* Decision making regarding the acceptance of risk | * Decision making regarding the acceptance of risk | ||

| − | * Prioritize which risk needs to be addressed first. | + | * Prioritize which risk needs to be addressed first <ref name="Prioritize risks"> Prioritizing Risks http://apppm.man.dtu.dk/index.php/Risk_matrix#cite</ref>. |

The matrix has two dimensions, the severity that indicates the extent of damages of the risk and the probability that shows how likely is that risk to happen. A combination of them will allow to collocate a risk inside the matrix. | The matrix has two dimensions, the severity that indicates the extent of damages of the risk and the probability that shows how likely is that risk to happen. A combination of them will allow to collocate a risk inside the matrix. | ||

As it can be seen in the figure, three different areas can be isolated: | As it can be seen in the figure, three different areas can be isolated: | ||

| Line 8: | Line 8: | ||

:It can be seen that there is a low probability and a low severity and that indicates that the risk of an event is not high enough, or it is controlled. Usually no actions are required in this area. | :It can be seen that there is a low probability and a low severity and that indicates that the risk of an event is not high enough, or it is controlled. Usually no actions are required in this area. | ||

;ALARP (As Low As Reasonably Practicable) risk | ;ALARP (As Low As Reasonably Practicable) risk | ||

| − | :This area it’s often indicated in yellow. As long as the event is placed in that zone, the risk can be accepted. | + | :This area it’s often indicated in yellow. As long as the event is placed in that zone, the risk can be accepted. |

;Non acceptable risk | ;Non acceptable risk | ||

| − | :This red zone is characterized by both high severity and probability. In this case, there is the need of much more control to bring severity or probability down. | + | :This red zone is characterized by both high severity and probability. In this case, there is the need of much more control to bring severity or probability down <ref name="NA risk"> Non acceptable risk https://www.cgerisk.com/knowledgebase/Risk_matrices</ref>. |

| − | [[File:riskmatrix.jpg|Risk Matrix|500px]] | + | [[File:riskmatrix.jpg|1300px|thumb|center|Risk Matrix|500px]] |

==Benefit== | ==Benefit== | ||

| − | The main benefits of this tool are that it is easy to apply and in most of the cases it does not require an extensive knowledge in risk management to use it. Furthermore, risk matrices can promote conversation in risk topics that sometimes can be avoided by managers because they may only focus in profits and revenues. | + | The main benefits of this tool are that it is easy to apply and in most of the cases it does not require an extensive knowledge in risk management to use it. Furthermore, risk matrices can promote conversation in risk topics that sometimes can be avoided by managers because they may only focus in profits and revenues <ref name="Ben"> Benefits and Limitations risk matrix https://riskmanagementguru.com/risk-matrices-pros-cons-and-alternatives.html/</ref>. |

==Limitations== | ==Limitations== | ||

| − | The biggest constraint of risk matrices is that it is mainly based on qualitative discussions and thus, it lacks on quantitative and objective data. | + | The biggest constraint of risk matrices is that it is mainly based on qualitative discussions and thus, it lacks on quantitative and objective data <ref name="Ben"> Benefits and Limitations risk matrix https://riskmanagementguru.com/risk-matrices-pros-cons-and-alternatives.html/</ref>. |

=Risk Management Process (RMP)= | =Risk Management Process (RMP)= | ||

| − | Implementing a risk management process is crucial for an organization. It does not require large investment or high level of knowledge to be effective. The RMP can be implemented follow five steps that are briefly explained. | + | Implementing a risk management process is crucial for an organization. It does not require large investment or high level of knowledge to be effective. The RMP can be implemented follow five steps that are briefly explained <ref name="rmp"> RMP steps https://www.clearrisk.com/risk-management-blog/bid/47395/the-risk-management-process-in-5-steps</ref>. |

#Identify potential risks <br />In this first process, potential risks and their characteristics are identified. They can be hazard risks, operational risks, financial risks or strategic risks and thus, this phase can involve internal expertise but also external consultants or researcher. Furthermore, it is important to keep this process update because the risk environment is always changing. | #Identify potential risks <br />In this first process, potential risks and their characteristics are identified. They can be hazard risks, operational risks, financial risks or strategic risks and thus, this phase can involve internal expertise but also external consultants or researcher. Furthermore, it is important to keep this process update because the risk environment is always changing. | ||

#Measure frequency and severity <br /> This step analyses the likelihood of a risk occurring and the impact of it, if it occurs. That process is used to prioritize the risk and therefore, to choose where to spend money and time on. The risk assessment can be done for instance using a risk matrix and it must be kept updated. | #Measure frequency and severity <br /> This step analyses the likelihood of a risk occurring and the impact of it, if it occurs. That process is used to prioritize the risk and therefore, to choose where to spend money and time on. The risk assessment can be done for instance using a risk matrix and it must be kept updated. | ||

| Line 28: | Line 28: | ||

#Decide which solution to use and implement it <br /> Once all the solutions are listed, the organization will choose one of them and will set up a plan to implement it. | #Decide which solution to use and implement it <br /> Once all the solutions are listed, the organization will choose one of them and will set up a plan to implement it. | ||

#Monitor result <br /> It is important to track and monitor risks because risk management is a process and not a project and thus, it needs to be constantly revisited on an ongoing base. | #Monitor result <br /> It is important to track and monitor risks because risk management is a process and not a project and thus, it needs to be constantly revisited on an ongoing base. | ||

| − | |||

| + | [[File:rmp.jpg|500px|thumb|center|Risk Management Process steps]] | ||

| + | |||

| + | =Potential Problem Analysis (PPA)= | ||

| + | PPA is a risk reduction method designed to determine preventive strategies as well as response and recovery plans for problems that could emerge in a given situation. | ||

| + | |||

| + | This method was developed by Kepner and Tregoe <ref name="KT"> Kepner, C. H. & Tregoe, B. B. (1965). The Rational Manager. McGraw-Hill</ref> and it has proven to be extremely useful in situations where costs of failure are high and the schedule for the plan´s completion is significant and articulated. Moreover, in the case of innovative products, it improves the understanding of potential risks and makes it possible to design contingency plans. | ||

| + | |||

| + | In the timeline, PPA finds its place after the planning of the project, when analyzing the possible risks. The first step of the process is to analyze what the weaknesses of the plan are, thus which are the problems that might occur. Secondly, the causes that might generate these problems are depicted. Thirdly, two fundamental elements in the risk analysis are decided: the likelihood of that problem to occur and the impact that it would have on the project. Once the risk has been stated and analyzed, in the fourth phase preventative actions to reduce or limit the risk of occurrence are developed, and in the fifth phase, the residual risk is decided. The last phase of the process makes it possible to think of a contingency plan whether the residual risk has not been brought down to zero. | ||

| + | |||

| + | Some limitations related to the PPA process are that it is a qualitative decisional tool to address transparent problems, where all relevant actors must be involved and discuss together. It might, therefore, be time-consuming and can it be overwhelming to identify every potential problem, and the process also requires a significant amount of thinking out of the box. | ||

| + | |||

| + | On the other hand, it is an effective tool to foresee what could possibly go wrong and generate improvement opportunities. Moreover, it can be represented through a table <ref name="PPA"> Potential Problem Analysis in Emergency Planning https://apps.who.int/iris/bitstream/handle/10665/42083/9241545194.pdf?sequence=1&isAllowed=y </ref>, making it easier for the actors to visualize the different steps and connections. | ||

| + | |||

| + | [[File:PPA.png|500px|thumb|center|Potential Problem Analysis Evaluation Table]] | ||

| + | |||

| + | =Monte Carlo Simulation Technique= | ||

| + | The Monte Carlo technique is a computerized mathematical tool that allows to quantify and evaluate risk factors and decision making. It is used in finance, project management, energy manufacturing, engineering and many other industries to provide the decision-makers with a range of possible outcomes and the probabilities that they will occur for every choice of action. | ||

| + | |||

| + | This technique was first used by scientists working on the atomic bomb during the II World War <ref name="MC"> Monte Carlo Simulation https://www.palisade.com/risk/monte_carlo_simulation.asp </ref>. It consists in substituting models of possible outcomes with a range of values and performing numerous recalculations and iterations the Monte Carlo simulation produces distributions of possible outcomes. | ||

| + | |||

| + | The Monte Carlo simulation can be done following these steps: <ref name="MCSteps"> Monte Carlo Simulation Steps https://functionbay.com/documentation/onlinehelp/default.htm#!Documents/runstepsofmontecarlosimulation.htm </ref> | ||

| + | |||

| + | #Creation of a spreadsheet that has dynamic relationships between input assumed values and key values. | ||

| + | #Sensitivity analysis to highlight the variables that impact on the outcome the most. | ||

| + | #Specification of probability distributions for the key uncertain inputs. | ||

| + | #Simulation of numerous scenarios and registration of the outcomes. | ||

| + | #Summary of recorded output results to measure risk and likelihood of the different outcomes. | ||

| + | |||

| + | A great advantage of this tool is that it gives graphical results, which can be easily explained to the stakeholders. Moreover, with this method it can be clearly seen which inputs have the biggest impact on the bottom-line results, as well as the correlations between the different factors taken into consideration. Finally, it makes it possible to understand not only what could happen, but also what likelihood each outcome has. | ||

| + | |||

| + | On the contrary, the method´s great advantage is in a sense also its main weakness. This is because the assumptions made for the input values must be fair, as the output is only as good as the inputs. In addition, the method doesn´t tend to contemplate extreme events or situations related to behavioral aspects that might occur. | ||

=Strategic Benchmarking= | =Strategic Benchmarking= | ||

| − | Compares strategies, business approaches and business models in order to strengthen your own strategic planning and determine your strategic priorities. The idea is to understand what strategies underpin successful companies (or teams or business units) and then compare these strategies with your own to identify ways you can be more competitive. | + | Compares strategies, business approaches and business models in order to strengthen your own strategic planning and determine your strategic priorities. The idea is to understand what strategies underpin successful companies (or teams or business units) and then compare these strategies with your own to identify ways you can be more competitive. <ref name="The different"> The Different Types Of Benchmarking – Examples And Easy Explanations https://www.bernardmarr.com/default.asp?contentID=1753/</ref> <ref name="Strategic"> Strategic Benchmarking Overview https://it.toolbox.com/blogs/craigborysowich/strategic-benchmarking-overview-120606 |

| + | /</ref>. | ||

Use Strategic Benchmarking to:<br /> | Use Strategic Benchmarking to:<br /> | ||

| Line 42: | Line 73: | ||

*predict future trends in the industry, <br /> | *predict future trends in the industry, <br /> | ||

*identify the organization's competitive position in the marketplace. <br /> | *identify the organization's competitive position in the marketplace. <br /> | ||

| − | |||

| − | |||

| − | |||

| − | |||

=Project Evaluation and Selection for the Formation of the Optimal Portfolio= | =Project Evaluation and Selection for the Formation of the Optimal Portfolio= | ||

| − | According to the PMI, the portfolio management process is a series of interrelated processes. This article focuses mainly on the Evaluation, Selection, Prioritization and Portfolio Balancing phases. The processes and tasks described in this section have been recognized as good practices in the discipline of portfolio management | + | According to the PMI, the portfolio management process is a series of interrelated processes. This article focuses mainly on the Evaluation, Selection, Prioritization and Portfolio Balancing phases. The processes and tasks described in this section have been recognized as good practices in the discipline of portfolio management <ref name="Evaluation"> Project Evaluation and Selection for the Formation of the Optimal Portfolio http://wiki.doing-projects.org/index.php/Project_Evaluation_and_Selection_for_the_Formation_of_the_Optimal_Portfolio/</ref>. |

| − | + | ||

| − | http://wiki.doing-projects.org/index.php/Project_Evaluation_and_Selection_for_the_Formation_of_the_Optimal_Portfolio | + | |

| − | + | ||

=Managing a portfolio of growth options: The strategic tradeoffs between growth and risk= | =Managing a portfolio of growth options: The strategic tradeoffs between growth and risk= | ||

| Line 64: | Line 88: | ||

*The preferred trade-off between growth and risk <br /> | *The preferred trade-off between growth and risk <br /> | ||

| − | The framework has been developed with the small and medium-sized firm in mind. It can be applied by a firm’s senior management team in a limited period of time, assuming prior research has been undertaken in developing growth options and the right people are at the table. The framework is purposefully flexible; dimensions can be added or deleted, in line with current market dynamics. < | + | The framework has been developed with the small and medium-sized firm in mind. It can be applied by a firm’s senior management team in a limited period of time, assuming prior research has been undertaken in developing growth options and the right people are at the table. The framework is purposefully flexible; dimensions can be added or deleted, in line with current market dynamics <ref name="Managing"> MANAGING A PORTFOLIO OF GROWTH OPTIONS: THE STRATEGIC TRADEOFFS BETWEEN GROWTH AND RISK |

| + | https://iveybusinessjournal.com/publication/managing-a-portfolio-of-growth-options-the-strategic-tradeoffs-between-growth-and-risk/</ref>. | ||

| − | + | =Stakeholders Mapping= | |

| + | |||

| + | Managing the stakeholders is one of the key activities when developing a project. Part of this managing consists on performing a global study on these stakeholders through the following phases<ref name="Stakeholders managment"> Stakeholders management http://wiki.doing-projects.org/index.php/Stakeholder_Management/</ref>: | ||

| + | #Identify stakeholders | ||

| + | #Analyse stakeholders | ||

| + | #Engage stakeholders | ||

| + | |||

| + | During the second stage of this study, while doing the analysis of the stakeholders, it is essential to map these stakeholders to have an idea of how they are committed on different parameters.<ref name="Stakeholders Analysis"> Stakeholders management http://wiki.doing-projects.org/index.php/Stakeholder_analysis/</ref> | ||

| + | The most common parameters used to compare the stakeholders are: | ||

| + | *'''Powder''' | ||

| + | *'''Interest''' | ||

| + | *'''Attitude''' | ||

| + | *'''Dynamism''' | ||

| + | *'''Support''' | ||

| + | Based on these key parameters there exist some diagrams correlating two of the aspects which can be used as tools to perform an accurate analysis of the stakeholders. | ||

| + | |||

| + | One of the most frequent maps is the Powder/Interest diagram.http:<ref name="Stakeholders Analysis"> Powder Interest Matrix //wiki.doing-projects.org/index.php/File:Power-Interest.PNG/</ref> | ||

| + | |||

| + | |||

| + | [[File:Powder_interest.jpg|1700px|thumb|center|Powder Interest Matrix|1000px]] | ||

| + | |||

| + | |||

| + | |||

| + | This diagram can be used for identifying what type of relationship the organisation should have with its stakeholders, and at the same time help in the analysis of communication and engagement planning. | ||

| + | |||

| + | The stakeholders mapping tool, including the different existing diagrams, will give a solid foundation for decision making and strategy development, which will be fundamental for the stakeholders management. | ||

| + | |||

| + | =Investment Portfolio Management= | ||

| + | Investment Portfolio Management is the science of making decisions about asset management , matching investments to objectives, asset allocation for private investors (mutual funds or exchange-traded funds) and institutions (insurance companies, pension funds, corporations, charities) and balancing risk against performance. <ref name="Investment Portfolio Management"> Investment Portfolio Management http://wiki.doing-projects.org/index.php/Investment_portfolio_management</ref> | ||

| + | |||

| + | A wide range of investments and financial products are available when building an investment portfolio. Those products are accessible for individual and institutional investors. Investors use investment products to meet various investment goals and objectives. The most well known investment products are: stocks and stock funds, bonds and bond funds and financial derivatives. | ||

| + | |||

| + | One of the main problems associated with organizations, is that the ratio between Human resources, money and perspective or future projects is inordinate. In order to avoid this problem, the Investment Portfolio Management tool follows the principles of the “Portfolio Management Process” which contains the following five primary steps. | ||

| + | |||

| + | *Clarify business objectives | ||

| + | *Capture and research requests and ideas | ||

| + | *Select the best projects using defined differentiators that align, maximize and balance the portfolio | ||

| + | *Validate portfolio feasibility and initiate projects | ||

| + | *Manage and monitor the portfolio | ||

| + | |||

| + | Specifying the scope of the process to financial products (stocks, bonds, mortages, derivatives) instead of the whole project. | ||

| + | |||

| + | One of the main aspects to take into account in Investment management is the risk. There are three kinds of risk: | ||

| + | |||

| + | *Project Risks | ||

| + | *Technical Risks | ||

| + | *Financial Risks | ||

| + | |||

| + | Focusing on the financial risks, risk management is the process of identification, analysis and acceptance or mitigation of uncertainty in investment decisions. Essentially, risk management occurs when an investor or fund manager analyses and attempts to quantify the potential for losses in an investment and then takes the appropriate action (or inaction) given his investment objectives and risk tolerance. | ||

=Benefits Realization Plan= | =Benefits Realization Plan= | ||

| − | '''Benefits Realization Plan (BRP)''' is a document that delineates the necessary activities that an organization has to accomplish in order to create, achieve, maximize and sustain the planned benefits. In order to ensure that benefits are realized BRP outlines a timeline and all the resources and tools that are necessary throughout the time period of the project or program | + | '''Benefits Realization Plan (BRP)''' is a document that delineates the necessary activities that an organization has to accomplish in order to create, achieve, maximize and sustain the planned benefits. In order to ensure that benefits are realized BRP outlines a timeline and all the resources and tools that are necessary throughout the time period of the project or program <ref name="Guiding the PMI">PMI Through leadership series, Guiding the PMI, Benefits realization management framework [Internet]. Available from: https://www.pmi.org/-/media/pmi/documents/public/pdf/learning/thought-leadership/benefits-realization-management-framework.pdf</ref> <ref name="PMI Pulse Beyond the project">PMI’s Pulse of the Profession 2016. Beyond the project, Sustain benefits to optimize business value[Internet]. Available from: https://www.pmi.org/-/media/pmi/documents/public/pdf/learning/thought-leadership/pulse/sustain-project-benefits-optimize-value.pdf?v=30dce373-17a5-4068-84fa-d15c150e856a</ref> <ref name="Project Management Institute"> Project Management Institute, Inc. (2017). Guide to the Project Management Body of Knowledge (PMBOK Guide) (6th Edition). Project Management Institute, Inc. (PMI). Available from https://app.knovel.com/hotlink/toc/id:kpGPMBKP02/guide-project-management/guide-project-management </ref>. It serves as a tool in the [[#Self-link to a section|Benefits Realization Management]] to locate, monitor, and manage all the benefits associated with a program or project <ref name="Department of Finance-Ireland"> UK Department of Finance. An Roinn Airgeadais. Planning for programme and project benefits realisation. Guidance literature, Published 16 January 2007 [Internet]. Available from https://www.finance-ni.gov.uk/articles/planning-programme-and-project-benefits-realisation</ref>. BRP, as defined by the various reports of PMI, is closely related to the Benefits Life Cycle and most of the steps in the two processes present a lot of similarities. |

| − | It includes the following main key elements ( | + | It includes the following main key elements <ref name="Guiding the PMI">PMI Through leadership series, Guiding the PMI, Benefits realization management framework [Internet]. Available from: https://www.pmi.org/-/media/pmi/documents/public/pdf/learning/thought-leadership/benefits-realization-management-framework.pdf</ref> <ref name="PMI Pulse Delivering value">PMI’s Pulse of the Profession 2016. Delivering value, Focus on benefits during project execution [Internet]. Available from: https://www.pmi.org/-/media/pmi/documents/public/pdf/learning/thought-leadership/pulse/benefits-focus-during-project-execution.pdf</ref><ref name="PMI Levin"> Levin, G. (2015). Benefits – a necessity to deliver business value and a culture change but how do we achieve them? Paper presented at PMI Global Congress 2015—North America, Orlando, FL. Newtown Square, PA: Project Management Institute [Internet]. Available from: https://www.pmi.org/learning/library/guidelines-successful-benefits-realization-9909</ref> <ref name="Project Management Institute"> Project Management Institute, Inc. (2017). Guide to the Project Management Body of Knowledge (PMBOK Guide) (6th Edition). Project Management Institute, Inc. (PMI). Available from https://app.knovel.com/hotlink/toc/id:kpGPMBKP02/guide-project-management/guide-project-management</ref>: |

| − | #'''Identification of benefits''': Benefits and associated assumptions, and how each benefit will be achieved | + | #'''Identification of benefits''': Benefits and associated assumptions, and how each benefit will be achieved. <ref name="Guiding the PMI">PMI Through leadership series, Guiding the PMI, Benefits realization management framework [Internet]. Available from: https://www.pmi.org/-/media/pmi/documents/public/pdf/learning/thought-leadership/benefits-realization-management-framework.pdf</ref> |

| − | #Benefits Analysis: Metrics, KPIs, and procedures to measure progress against benefits. Financial measures include the Net Present Value (NPV), Return of Investment (ROI), Internal Rate of Return (IRR), Payback Period (PBP) and Benefit-Cost Ratio (BCR) ( | + | #'''Benefits Analysis''': Metrics, KPIs, and procedures to measure progress against benefits. Financial measures include the Net Present Value (NPV), Return of Investment (ROI), Internal Rate of Return (IRR), Payback Period (PBP) and Benefit-Cost Ratio (BCR) <ref name="Project Management Institute"> Project Management Institute, Inc. (2017). Guide to the Project Management Body of Knowledge (PMBOK Guide) (6th Edition). Project Management Institute, Inc. (PMI). Available from https://app.knovel.com/hotlink/toc/id:kpGPMBKP02/guide-project-management/guide-project-management </ref>. For intangible benefits, the quantification or monetarization requires strong analytical skills and tools such as a comparative or scenario analysis, and cost-benefit and value analysis <ref name="PMI Pulse Delivering value">PMI’s Pulse of the Profession 2016. Delivering value, Focus on benefits during project execution [Internet]. Available from: https://www.pmi.org/-/media/pmi/documents/public/pdf/learning/thought-leadership/pulse/benefits-focus-during-project-execution.pdf</ref> <ref name="PMI Levin"> Levin, G. (2015). Benefits – a necessity to deliver business value and a culture change but how do we achieve them? Paper presented at PMI Global Congress 2015—North America, Orlando, FL. Newtown Square, PA: Project Management Institute [Internet]. Available from: https://www.pmi.org/learning/library/guidelines-successful-benefits-realization-9909</ref>. |

| − | #Benefits realization roles and responsibilities: Roles and responsibilities required to manage benefits. The roles and the responsible for each project can be assigned when the organization understands all the anticipated benefits throughout the lifetime of the project | + | #'''Benefits realization roles and responsibilities''': Roles and responsibilities required to manage benefits. The roles and the responsible for each project can be assigned when the organization understands all the anticipated benefits throughout the lifetime of the project <ref name="PMI Pulse Delivering value">PMI’s Pulse of the Profession 2016. Delivering value, Focus on benefits during project execution [Internet]. Available from: https://www.pmi.org/-/media/pmi/documents/public/pdf/learning/thought-leadership/pulse/benefits-focus-during-project-execution.pdf</ref>. According to the PMIs Pulse report 2016 ‘Delivering Value, Focus on benefits during project execution’ even though the responsibility of tracking, analyzing and reporting whether project’s or program’s benefits are achieved is not attributed solely on project managers, they should be the first to report when the outcome is not the intended. Particular roles and responsibles as defined by PMI can be found [[#Self-link to a section|here]]. |

| − | #Transition of benefits: In what way the resulting benefits and capabilities will be transitioned into an operational state to achieve benefits. In addition, it should be also outlined how the results are transitioned to the main stakeholders, individuals, groups, or organizations that are responsible for sustaining the benefits. | + | #'''Transition of benefits''': In what way the resulting benefits and capabilities will be transitioned into an operational state to achieve benefits. In addition, it should be also outlined how the results are transitioned to the main stakeholders, individuals, groups, or organizations that are responsible for sustaining the benefits. |

| − | #Determination and evaluation of benefit achievement: Processes for determining the extent to which each project or program benefit is achieved prior to formal closure. | + | #''''Determination and evaluation of benefit achievement''': Processes for determining the extent to which each project or program benefit is achieved prior to formal closure. |

| − | #Risks for realization of benefits ( | + | #'''Risks''' for realization of benefits <ref name="Project Management Institute"> Project Management Institute, Inc. (2017). Guide to the Project Management Body of Knowledge (PMBOK Guide) (6th Edition). Project Management Institute, Inc. (PMI). Available from https://app.knovel.com/hotlink/toc/id:kpGPMBKP02/guide-project-management/guide-project-management</ref>. |

| + | |||

| + | |||

| + | [[#here|Benefits Realization Management (BRM)]] provides organizations with a way to measure how projects and programs add true value to the enterprise <ref name="Guiding the PMI">PMI Through leadership series, Guiding the PMI, Benefits realization management framework [Internet]. Available from: https://www.pmi.org/-/media/pmi/documents/public/pdf/learning/thought-leadership/benefits-realization-management-framework.pdf</ref> and incorporates the activities of managing benefits throughout the life of the project.<ref name="PMI Pulse Beyond the project">PMI’s Pulse of the Profession 2016. Beyond the project, Sustain benefits to optimize business value[Internet]. Available from: https://www.pmi.org/-/media/pmi/documents/public/pdf/learning/thought-leadership/pulse/sustain-project-benefits-optimize-value.pdf?v=30dce373-17a5-4068-84fa-d15c150e856a</ref> BRM is built on three main axes: Identify, Execute and Sustain benefits. It is an important process in program, project or portfolio management as it gives insights to whether an organization should go through or interrupt the project. According to the PMI Pulse of Profession 2016, organizations with mature BRM practices waste US$112 million less for every US$1 billion invested in projects and programs.<ref name="PMI Pulse Beyond the project">PMI’s Pulse of the Profession 2016. Beyond the project, Sustain benefits to optimize business value[Internet]. Available from: https://www.pmi.org/-/media/pmi/documents/public/pdf/learning/thought-leadership/pulse/sustain-project-benefits-optimize-value.pdf?v=30dce373-17a5-4068-84fa-d15c150e856a</ref> | ||

| + | |||

| + | |||

| + | [[#here|Roles and Responsibles]] in Benefits Realization Management according to PMIs Pulse of the Profession 2016 (2016).<ref name="PMI Pulse Delivering value">PMI’s Pulse of the Profession 2016. Delivering value, Focus on benefits during project execution [Internet]. Available from: https://www.pmi.org/-/media/pmi/documents/public/pdf/learning/thought-leadership/pulse/benefits-focus-during-project-execution.pdf</ref> | ||

| + | *'''Executive sponsor''': Ensures the project or program produces maximum value for the organization. | ||

| + | *'''Benefits or business owner''': Takes overall responsibility for monitoring | ||

| + | *'''Project Manager''': Leads the team responsible for achieving the project objectives. | ||

| + | *'''Program Manager''': Maintains responsibility for the leadership, conduct, and performance of a program. | ||

| + | *'''Portfolio Manager''': Establishes, balances, monitors, and controls portfolio components in order to achieve strategic business objectives. | ||

| + | |||

| + | = Benefits Sustainment Plan = | ||

| + | |||

| + | '''Benefits Sustainment Plan (BSP)''' is a tool that is developed so that after the end of a project or a program the achieved benefits will continue to add value to the organization. PMI defines the Benefits Sustainment Plan as ‘’a tool to identify risks, processes, measures, metrics, and tools necessary to ensure the continued realization of the benefits’’ <ref name="Guiding the PMI"> PMI Through leadership series, Guiding the PMI, Benefits realization management framework [Internet] Available from: https://www.pmi.org/-/media/pmi/documents/public/pdf/learning/thought-leadership/benefits-realization-management-framework.pdf</ref>. It is very important for an organization to work for the sustainment of benefits after the closure of a project or program because this way it maximizes the value that has gained from its implementation. | ||

| + | |||

| + | Some of the main activities, but not the only ones, of a Benefit Sustainment Plan are the following:<ref name="PMI Pulse Beyond the project">PMI’s Pulse of the Profession® 2016. Beyond the project, Sustain benefits to optimize business value[Internet]. Available from: https://www.pmi.org/-/media/pmi/documents/public/pdf/learning/thought-leadership/pulse/sustain-project-benefits-optimize-value.pdf?v=30dce373-17a5-4068-84fa-d15c150e856a</ref> | ||

| + | *Conduct a post-project evaluation. | ||

| + | *Communicate recommendations and outcomes of the project or program throughout the organization. | ||

| + | *Manage risks associated with the project’s outcome. | ||

| + | *Compare the actual outcome with what was planned. | ||

| + | *Plan changes to continue monitor performance | ||

| + | |||

| + | The benefits Sustainment Plan takes place after the closure if the project or program and in many cases it is not performed from the people who planned it. Therefore, it is very important to reassure that a BSP is well structured and executed correctly even though the project or program is closed. | ||

| + | |||

| + | = Benefit Register = | ||

| + | |||

| + | The Benefit Register, is ‘‘a collection and list of the planned benefits used to measure and communicate the delivery or benefits throughout the duration of the project or program’’<ref name="Benefits and Realization Framework/PMI"> Beneftis Realization Management Framework | PMI https://www.pmi.org/-/media/pmi/documents/public/pdf/learning/thought-leadership/benefits-realization-management-framework.pdf</ref>. Moreover, the benefit register includes who is responsible for measuring the benefits, their expected realization, the means of measuring the benefits, etc. Essential is that the benefits should incorporate the purpose of the related project/program and rationalize the duration and budget that are involved in making the change. | ||

| + | |||

| + | The relevant input for the creation of the benefit register can be obtained via different channels, such as but not limited to, sponsor, senior leadership, program/project intake form and/or business case, organizational and/or business unit strategic plans and initiatives, existing documentation, subject matter experts within business unit(s), and other stakeholders (such as staff, students, faculty) <ref name="IST Project Management Office"> IST Project Management Office https://uwaterloo.ca/ist-project-management-office/methodologies/program-management/program-benefit-delivery/benefits-register</ref>. | ||

| + | |||

| + | The author of the benefit register is the project/program manager. Furthermore, any change that is related to the benefits must be authorized by the project/program manager through a formal request. | ||

| + | |||

| + | There are 5 main steps that can be followed for the creation of the Benefit Register <ref name="IST Project Management Office"> IST Project Management Office https://uwaterloo.ca/ist-project-management-office/methodologies/program-management/program-benefit-delivery/benefits-register</ref>: | ||

| + | |||

| + | *'''Understanding Project/Program Information'''<br /> In order to identify the benefits, it is necessary to investigate documentations such as business cases, research/analysis and intake forms as well as to interview sponsors or stakeholders. The reason for approving the program/project and the expectations tied to the outcome should be considered, as much as deliverables of success. Important is that benefits can be both tangible and intangible but must be measurable. | ||

| + | |||

| + | *'''Enter Benefits in Benefit Register'''<br /> The following fields can be filled out as a template for the benefit register: Benefit ID, Benefit Title and Description, Requestor, State, Link to Objectives (Project, Business, Strategic), Owner, Planned Outcome, Stakeholders and Beneficiaries, Program/Project ID and/or Name, Measure Description & Expected Result, Baseline Measure, Measure Frequency, Actual Measures, Status, Expected Realization Date, Actual Realization Date | ||

| + | |||

| + | *'''Update of the Document'''<br /> The document needs to be updated during the evolvement of the project/program, as approved benefit changes occur. | ||

| + | |||

| + | *'''Execution of Benefit Measurements'''<br /> The benefit measurements that have been stated in the register need to be executed to record results. | ||

| + | |||

| + | *'''Uploading Benefit Register'''<br /> | ||

| + | |||

| + | In the upcoming periods, the register should be monitored to ensure that the execution of the project/program does follow a path delivering the outlined benefits, and assess program success during the closing stage of the projcet/program. | ||

| + | |||

| + | = Cost Benefit Analysis = | ||

| + | |||

| + | The Cost Benefit Analysis compares the business value of a project with the cost of producing it. It is a tool that is used by project managers during the project initiation phase of a project, in which the sponsor and project manager must justify the project to get the organization’s approval on that <ref name="pmt"> Cost-Benefit Analysis in Project Initiation https://4pm.com/2016/12/19/cost-benefit-analysis/</ref>. | ||

| + | |||

| + | In this manner, benefits that are involved in the course of action are being compared to the costs associated with it. | ||

| + | |||

| + | Results of the Cost-Benefit Analysis are described as a payback period, the duration for benefits to repay the costs. | ||

| + | |||

| + | The Cost-Benefit Analysis can capture several different application areas from the recruitment of a new team-member to determining the feasibility of a capital purchase. | ||

| + | |||

| + | Three main steps are associated with the usage of the tool <ref name="Cost-Benefit Analysis"> Cost-Benefit Analysis https://www.mindtools.com/pages/article/newTED_08.htm</ref>: | ||

| + | |||

| + | '''Step One: Brainstorm Costs and Benefits'''<br /> | ||

| + | |||

| + | *The costs that are related to the project should be brainstormed and formed into a list. | ||

| + | |||

| + | *The same procedure should be done for the benefits. | ||

| + | |||

| + | *The lifetime of the project should be investigated to determine if costs or benefits occur within time. | ||

| + | |||

| + | '''Step Two: Assign a Monetary Value to the Costs''' <br /> | ||

| + | |||

| + | *As many costs as possible should be determined by including the physical and human resources that are needed as well as costs incurring once the project is finished. | ||

| + | |||

| + | ''' Step Three: Assign a Monetary Value to the Benefits'''<br /> | ||

| + | |||

| + | Together with stakeholders it should be determined how to value tangible and intangible items. | ||

| + | |||

| + | '''Step Four: Compare Costs and Benefits'''<br /> | ||

| + | |||

| + | *Costs of the value should be compared to the benefits by calculating total cost and total benefits and determining whether benefits outweigh costs. | ||

| + | |||

| + | *Determine payback period and break even point. | ||

| + | |||

| + | The cost-benefit analysis is the foundation of the Return on Investment (ROI), Internal Rate of Return (IRR) and Net Present Value (NPV). | ||

| + | |||

| + | |||

| + | |||

| + | = References = | ||

| + | <references/> | ||

Latest revision as of 16:17, 9 March 2020

[edit] Risk Matrix

A risk matrix is an effective and broadly used risk assessment tool. It is quite quick to create, and it is an easy way to identify problems. In some cases, it is also used to rank the risks to understand which one needs to be addressed first. Therefore, this tool has mainly two application:

- Decision making regarding the acceptance of risk

- Prioritize which risk needs to be addressed first [1].

The matrix has two dimensions, the severity that indicates the extent of damages of the risk and the probability that shows how likely is that risk to happen. A combination of them will allow to collocate a risk inside the matrix. As it can be seen in the figure, three different areas can be isolated:

- Acceptable risk

- It can be seen that there is a low probability and a low severity and that indicates that the risk of an event is not high enough, or it is controlled. Usually no actions are required in this area.

- ALARP (As Low As Reasonably Practicable) risk

- This area it’s often indicated in yellow. As long as the event is placed in that zone, the risk can be accepted.

- Non acceptable risk

- This red zone is characterized by both high severity and probability. In this case, there is the need of much more control to bring severity or probability down [2].

[edit] Benefit

The main benefits of this tool are that it is easy to apply and in most of the cases it does not require an extensive knowledge in risk management to use it. Furthermore, risk matrices can promote conversation in risk topics that sometimes can be avoided by managers because they may only focus in profits and revenues [3].

[edit] Limitations

The biggest constraint of risk matrices is that it is mainly based on qualitative discussions and thus, it lacks on quantitative and objective data [3].

[edit] Risk Management Process (RMP)

Implementing a risk management process is crucial for an organization. It does not require large investment or high level of knowledge to be effective. The RMP can be implemented follow five steps that are briefly explained [4].

- Identify potential risks

In this first process, potential risks and their characteristics are identified. They can be hazard risks, operational risks, financial risks or strategic risks and thus, this phase can involve internal expertise but also external consultants or researcher. Furthermore, it is important to keep this process update because the risk environment is always changing. - Measure frequency and severity

This step analyses the likelihood of a risk occurring and the impact of it, if it occurs. That process is used to prioritize the risk and therefore, to choose where to spend money and time on. The risk assessment can be done for instance using a risk matrix and it must be kept updated. - Examine alternative solutions

Once an organization has all the potential risk, some solutions need to be evaluated. Usually there are this options:- Accept the risk: the risk is simply accepted because the probability that it happens as well as its severity are low. Accepting the risk does not require any further action.

- Avoid the risk: the activity that cause this risk must be stopped because it is too dangerous and perhaps an alternative can be found.

- Risk control: in this case a prevention of that risk is involved to reduce its impact if it occurs.

- Risk transfer: the risk is transferred to a third part. For instance, a particular activity can be outsourced, or insurance can be purchased.

- Decide which solution to use and implement it

Once all the solutions are listed, the organization will choose one of them and will set up a plan to implement it. - Monitor result

It is important to track and monitor risks because risk management is a process and not a project and thus, it needs to be constantly revisited on an ongoing base.

[edit] Potential Problem Analysis (PPA)

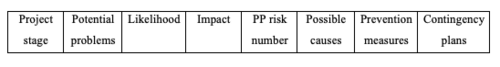

PPA is a risk reduction method designed to determine preventive strategies as well as response and recovery plans for problems that could emerge in a given situation.

This method was developed by Kepner and Tregoe [5] and it has proven to be extremely useful in situations where costs of failure are high and the schedule for the plan´s completion is significant and articulated. Moreover, in the case of innovative products, it improves the understanding of potential risks and makes it possible to design contingency plans.

In the timeline, PPA finds its place after the planning of the project, when analyzing the possible risks. The first step of the process is to analyze what the weaknesses of the plan are, thus which are the problems that might occur. Secondly, the causes that might generate these problems are depicted. Thirdly, two fundamental elements in the risk analysis are decided: the likelihood of that problem to occur and the impact that it would have on the project. Once the risk has been stated and analyzed, in the fourth phase preventative actions to reduce or limit the risk of occurrence are developed, and in the fifth phase, the residual risk is decided. The last phase of the process makes it possible to think of a contingency plan whether the residual risk has not been brought down to zero.

Some limitations related to the PPA process are that it is a qualitative decisional tool to address transparent problems, where all relevant actors must be involved and discuss together. It might, therefore, be time-consuming and can it be overwhelming to identify every potential problem, and the process also requires a significant amount of thinking out of the box.

On the other hand, it is an effective tool to foresee what could possibly go wrong and generate improvement opportunities. Moreover, it can be represented through a table [6], making it easier for the actors to visualize the different steps and connections.

[edit] Monte Carlo Simulation Technique

The Monte Carlo technique is a computerized mathematical tool that allows to quantify and evaluate risk factors and decision making. It is used in finance, project management, energy manufacturing, engineering and many other industries to provide the decision-makers with a range of possible outcomes and the probabilities that they will occur for every choice of action.

This technique was first used by scientists working on the atomic bomb during the II World War [7]. It consists in substituting models of possible outcomes with a range of values and performing numerous recalculations and iterations the Monte Carlo simulation produces distributions of possible outcomes.

The Monte Carlo simulation can be done following these steps: [8]

- Creation of a spreadsheet that has dynamic relationships between input assumed values and key values.

- Sensitivity analysis to highlight the variables that impact on the outcome the most.

- Specification of probability distributions for the key uncertain inputs.

- Simulation of numerous scenarios and registration of the outcomes.

- Summary of recorded output results to measure risk and likelihood of the different outcomes.

A great advantage of this tool is that it gives graphical results, which can be easily explained to the stakeholders. Moreover, with this method it can be clearly seen which inputs have the biggest impact on the bottom-line results, as well as the correlations between the different factors taken into consideration. Finally, it makes it possible to understand not only what could happen, but also what likelihood each outcome has.

On the contrary, the method´s great advantage is in a sense also its main weakness. This is because the assumptions made for the input values must be fair, as the output is only as good as the inputs. In addition, the method doesn´t tend to contemplate extreme events or situations related to behavioral aspects that might occur.

[edit] Strategic Benchmarking

Compares strategies, business approaches and business models in order to strengthen your own strategic planning and determine your strategic priorities. The idea is to understand what strategies underpin successful companies (or teams or business units) and then compare these strategies with your own to identify ways you can be more competitive. [9] [10].

Use Strategic Benchmarking to:

- set aggressive but realistic performance goals for the organization or business process,

- identify ways to improve the organization or business process,

- support a continuous improvement philosophy within the organization,

- predict future trends in the industry,

- identify the organization's competitive position in the marketplace.

[edit] Project Evaluation and Selection for the Formation of the Optimal Portfolio

According to the PMI, the portfolio management process is a series of interrelated processes. This article focuses mainly on the Evaluation, Selection, Prioritization and Portfolio Balancing phases. The processes and tasks described in this section have been recognized as good practices in the discipline of portfolio management [11].

[edit] Managing a portfolio of growth options: The strategic tradeoffs between growth and risk

How to strategically manage the tradeoffs between growth and risk in a portfolio of growth options is the focus of this article. In the article, we develop a framework to assist leadership teams in determining the relative merits of alternative growth options and identifying those options with the strongest probability of success. The framework critically assesses each option with respect to:

- The market, revenue and profit growth potential

- The potential strategic risk

- The preferred trade-off between growth and risk

The framework has been developed with the small and medium-sized firm in mind. It can be applied by a firm’s senior management team in a limited period of time, assuming prior research has been undertaken in developing growth options and the right people are at the table. The framework is purposefully flexible; dimensions can be added or deleted, in line with current market dynamics [12].

[edit] Stakeholders Mapping

Managing the stakeholders is one of the key activities when developing a project. Part of this managing consists on performing a global study on these stakeholders through the following phases[13]:

- Identify stakeholders

- Analyse stakeholders

- Engage stakeholders

During the second stage of this study, while doing the analysis of the stakeholders, it is essential to map these stakeholders to have an idea of how they are committed on different parameters.[14] The most common parameters used to compare the stakeholders are:

- Powder

- Interest

- Attitude

- Dynamism

- Support

Based on these key parameters there exist some diagrams correlating two of the aspects which can be used as tools to perform an accurate analysis of the stakeholders.

One of the most frequent maps is the Powder/Interest diagram.http:[14]

This diagram can be used for identifying what type of relationship the organisation should have with its stakeholders, and at the same time help in the analysis of communication and engagement planning.

The stakeholders mapping tool, including the different existing diagrams, will give a solid foundation for decision making and strategy development, which will be fundamental for the stakeholders management.

[edit] Investment Portfolio Management

Investment Portfolio Management is the science of making decisions about asset management , matching investments to objectives, asset allocation for private investors (mutual funds or exchange-traded funds) and institutions (insurance companies, pension funds, corporations, charities) and balancing risk against performance. [15]

A wide range of investments and financial products are available when building an investment portfolio. Those products are accessible for individual and institutional investors. Investors use investment products to meet various investment goals and objectives. The most well known investment products are: stocks and stock funds, bonds and bond funds and financial derivatives.

One of the main problems associated with organizations, is that the ratio between Human resources, money and perspective or future projects is inordinate. In order to avoid this problem, the Investment Portfolio Management tool follows the principles of the “Portfolio Management Process” which contains the following five primary steps.

- Clarify business objectives

- Capture and research requests and ideas

- Select the best projects using defined differentiators that align, maximize and balance the portfolio

- Validate portfolio feasibility and initiate projects

- Manage and monitor the portfolio

Specifying the scope of the process to financial products (stocks, bonds, mortages, derivatives) instead of the whole project.

One of the main aspects to take into account in Investment management is the risk. There are three kinds of risk:

- Project Risks

- Technical Risks

- Financial Risks

Focusing on the financial risks, risk management is the process of identification, analysis and acceptance or mitigation of uncertainty in investment decisions. Essentially, risk management occurs when an investor or fund manager analyses and attempts to quantify the potential for losses in an investment and then takes the appropriate action (or inaction) given his investment objectives and risk tolerance.

[edit] Benefits Realization Plan

Benefits Realization Plan (BRP) is a document that delineates the necessary activities that an organization has to accomplish in order to create, achieve, maximize and sustain the planned benefits. In order to ensure that benefits are realized BRP outlines a timeline and all the resources and tools that are necessary throughout the time period of the project or program [16] [17] [18]. It serves as a tool in the Benefits Realization Management to locate, monitor, and manage all the benefits associated with a program or project [19]. BRP, as defined by the various reports of PMI, is closely related to the Benefits Life Cycle and most of the steps in the two processes present a lot of similarities. It includes the following main key elements [16] [20][21] [18]:

- Identification of benefits: Benefits and associated assumptions, and how each benefit will be achieved. [16]

- Benefits Analysis: Metrics, KPIs, and procedures to measure progress against benefits. Financial measures include the Net Present Value (NPV), Return of Investment (ROI), Internal Rate of Return (IRR), Payback Period (PBP) and Benefit-Cost Ratio (BCR) [18]. For intangible benefits, the quantification or monetarization requires strong analytical skills and tools such as a comparative or scenario analysis, and cost-benefit and value analysis [20] [21].

- Benefits realization roles and responsibilities: Roles and responsibilities required to manage benefits. The roles and the responsible for each project can be assigned when the organization understands all the anticipated benefits throughout the lifetime of the project [20]. According to the PMIs Pulse report 2016 ‘Delivering Value, Focus on benefits during project execution’ even though the responsibility of tracking, analyzing and reporting whether project’s or program’s benefits are achieved is not attributed solely on project managers, they should be the first to report when the outcome is not the intended. Particular roles and responsibles as defined by PMI can be found here.

- Transition of benefits: In what way the resulting benefits and capabilities will be transitioned into an operational state to achieve benefits. In addition, it should be also outlined how the results are transitioned to the main stakeholders, individuals, groups, or organizations that are responsible for sustaining the benefits.

- 'Determination and evaluation of benefit achievement: Processes for determining the extent to which each project or program benefit is achieved prior to formal closure.

- Risks for realization of benefits [18].

Benefits Realization Management (BRM) provides organizations with a way to measure how projects and programs add true value to the enterprise [16] and incorporates the activities of managing benefits throughout the life of the project.[17] BRM is built on three main axes: Identify, Execute and Sustain benefits. It is an important process in program, project or portfolio management as it gives insights to whether an organization should go through or interrupt the project. According to the PMI Pulse of Profession 2016, organizations with mature BRM practices waste US$112 million less for every US$1 billion invested in projects and programs.[17]

Roles and Responsibles in Benefits Realization Management according to PMIs Pulse of the Profession 2016 (2016).[20]

- Executive sponsor: Ensures the project or program produces maximum value for the organization.

- Benefits or business owner: Takes overall responsibility for monitoring

- Project Manager: Leads the team responsible for achieving the project objectives.

- Program Manager: Maintains responsibility for the leadership, conduct, and performance of a program.

- Portfolio Manager: Establishes, balances, monitors, and controls portfolio components in order to achieve strategic business objectives.

[edit] Benefits Sustainment Plan

Benefits Sustainment Plan (BSP) is a tool that is developed so that after the end of a project or a program the achieved benefits will continue to add value to the organization. PMI defines the Benefits Sustainment Plan as ‘’a tool to identify risks, processes, measures, metrics, and tools necessary to ensure the continued realization of the benefits’’ [16]. It is very important for an organization to work for the sustainment of benefits after the closure of a project or program because this way it maximizes the value that has gained from its implementation.

Some of the main activities, but not the only ones, of a Benefit Sustainment Plan are the following:[17]

- Conduct a post-project evaluation.

- Communicate recommendations and outcomes of the project or program throughout the organization.

- Manage risks associated with the project’s outcome.

- Compare the actual outcome with what was planned.

- Plan changes to continue monitor performance

The benefits Sustainment Plan takes place after the closure if the project or program and in many cases it is not performed from the people who planned it. Therefore, it is very important to reassure that a BSP is well structured and executed correctly even though the project or program is closed.

[edit] Benefit Register

The Benefit Register, is ‘‘a collection and list of the planned benefits used to measure and communicate the delivery or benefits throughout the duration of the project or program’’[22]. Moreover, the benefit register includes who is responsible for measuring the benefits, their expected realization, the means of measuring the benefits, etc. Essential is that the benefits should incorporate the purpose of the related project/program and rationalize the duration and budget that are involved in making the change.

The relevant input for the creation of the benefit register can be obtained via different channels, such as but not limited to, sponsor, senior leadership, program/project intake form and/or business case, organizational and/or business unit strategic plans and initiatives, existing documentation, subject matter experts within business unit(s), and other stakeholders (such as staff, students, faculty) [23].

The author of the benefit register is the project/program manager. Furthermore, any change that is related to the benefits must be authorized by the project/program manager through a formal request.

There are 5 main steps that can be followed for the creation of the Benefit Register [23]:

- Understanding Project/Program Information

In order to identify the benefits, it is necessary to investigate documentations such as business cases, research/analysis and intake forms as well as to interview sponsors or stakeholders. The reason for approving the program/project and the expectations tied to the outcome should be considered, as much as deliverables of success. Important is that benefits can be both tangible and intangible but must be measurable.

- Enter Benefits in Benefit Register

The following fields can be filled out as a template for the benefit register: Benefit ID, Benefit Title and Description, Requestor, State, Link to Objectives (Project, Business, Strategic), Owner, Planned Outcome, Stakeholders and Beneficiaries, Program/Project ID and/or Name, Measure Description & Expected Result, Baseline Measure, Measure Frequency, Actual Measures, Status, Expected Realization Date, Actual Realization Date

- Update of the Document

The document needs to be updated during the evolvement of the project/program, as approved benefit changes occur.

- Execution of Benefit Measurements

The benefit measurements that have been stated in the register need to be executed to record results.

- Uploading Benefit Register

In the upcoming periods, the register should be monitored to ensure that the execution of the project/program does follow a path delivering the outlined benefits, and assess program success during the closing stage of the projcet/program.

[edit] Cost Benefit Analysis

The Cost Benefit Analysis compares the business value of a project with the cost of producing it. It is a tool that is used by project managers during the project initiation phase of a project, in which the sponsor and project manager must justify the project to get the organization’s approval on that [24].

In this manner, benefits that are involved in the course of action are being compared to the costs associated with it.

Results of the Cost-Benefit Analysis are described as a payback period, the duration for benefits to repay the costs.

The Cost-Benefit Analysis can capture several different application areas from the recruitment of a new team-member to determining the feasibility of a capital purchase.

Three main steps are associated with the usage of the tool [25]:

Step One: Brainstorm Costs and Benefits

- The costs that are related to the project should be brainstormed and formed into a list.

- The same procedure should be done for the benefits.

- The lifetime of the project should be investigated to determine if costs or benefits occur within time.

Step Two: Assign a Monetary Value to the Costs

- As many costs as possible should be determined by including the physical and human resources that are needed as well as costs incurring once the project is finished.

Step Three: Assign a Monetary Value to the Benefits

Together with stakeholders it should be determined how to value tangible and intangible items.

Step Four: Compare Costs and Benefits

- Costs of the value should be compared to the benefits by calculating total cost and total benefits and determining whether benefits outweigh costs.

- Determine payback period and break even point.

The cost-benefit analysis is the foundation of the Return on Investment (ROI), Internal Rate of Return (IRR) and Net Present Value (NPV).

[edit] References

- ↑ Prioritizing Risks http://apppm.man.dtu.dk/index.php/Risk_matrix#cite

- ↑ Non acceptable risk https://www.cgerisk.com/knowledgebase/Risk_matrices

- ↑ 3.0 3.1 Benefits and Limitations risk matrix https://riskmanagementguru.com/risk-matrices-pros-cons-and-alternatives.html/

- ↑ RMP steps https://www.clearrisk.com/risk-management-blog/bid/47395/the-risk-management-process-in-5-steps

- ↑ Kepner, C. H. & Tregoe, B. B. (1965). The Rational Manager. McGraw-Hill

- ↑ Potential Problem Analysis in Emergency Planning https://apps.who.int/iris/bitstream/handle/10665/42083/9241545194.pdf?sequence=1&isAllowed=y

- ↑ Monte Carlo Simulation https://www.palisade.com/risk/monte_carlo_simulation.asp

- ↑ Monte Carlo Simulation Steps https://functionbay.com/documentation/onlinehelp/default.htm#!Documents/runstepsofmontecarlosimulation.htm

- ↑ The Different Types Of Benchmarking – Examples And Easy Explanations https://www.bernardmarr.com/default.asp?contentID=1753/

- ↑ Strategic Benchmarking Overview https://it.toolbox.com/blogs/craigborysowich/strategic-benchmarking-overview-120606 /

- ↑ Project Evaluation and Selection for the Formation of the Optimal Portfolio http://wiki.doing-projects.org/index.php/Project_Evaluation_and_Selection_for_the_Formation_of_the_Optimal_Portfolio/

- ↑ MANAGING A PORTFOLIO OF GROWTH OPTIONS: THE STRATEGIC TRADEOFFS BETWEEN GROWTH AND RISK https://iveybusinessjournal.com/publication/managing-a-portfolio-of-growth-options-the-strategic-tradeoffs-between-growth-and-risk/

- ↑ Stakeholders management http://wiki.doing-projects.org/index.php/Stakeholder_Management/

- ↑ 14.0 14.1 Stakeholders management http://wiki.doing-projects.org/index.php/Stakeholder_analysis/

- ↑ Investment Portfolio Management http://wiki.doing-projects.org/index.php/Investment_portfolio_management

- ↑ 16.0 16.1 16.2 16.3 16.4 PMI Through leadership series, Guiding the PMI, Benefits realization management framework [Internet]. Available from: https://www.pmi.org/-/media/pmi/documents/public/pdf/learning/thought-leadership/benefits-realization-management-framework.pdf

- ↑ 17.0 17.1 17.2 17.3 PMI’s Pulse of the Profession 2016. Beyond the project, Sustain benefits to optimize business value[Internet]. Available from: https://www.pmi.org/-/media/pmi/documents/public/pdf/learning/thought-leadership/pulse/sustain-project-benefits-optimize-value.pdf?v=30dce373-17a5-4068-84fa-d15c150e856a

- ↑ 18.0 18.1 18.2 18.3 Project Management Institute, Inc. (2017). Guide to the Project Management Body of Knowledge (PMBOK Guide) (6th Edition). Project Management Institute, Inc. (PMI). Available from https://app.knovel.com/hotlink/toc/id:kpGPMBKP02/guide-project-management/guide-project-management

- ↑ UK Department of Finance. An Roinn Airgeadais. Planning for programme and project benefits realisation. Guidance literature, Published 16 January 2007 [Internet]. Available from https://www.finance-ni.gov.uk/articles/planning-programme-and-project-benefits-realisation

- ↑ 20.0 20.1 20.2 20.3 PMI’s Pulse of the Profession 2016. Delivering value, Focus on benefits during project execution [Internet]. Available from: https://www.pmi.org/-/media/pmi/documents/public/pdf/learning/thought-leadership/pulse/benefits-focus-during-project-execution.pdf

- ↑ 21.0 21.1 Levin, G. (2015). Benefits – a necessity to deliver business value and a culture change but how do we achieve them? Paper presented at PMI Global Congress 2015—North America, Orlando, FL. Newtown Square, PA: Project Management Institute [Internet]. Available from: https://www.pmi.org/learning/library/guidelines-successful-benefits-realization-9909

- ↑ Beneftis Realization Management Framework | PMI https://www.pmi.org/-/media/pmi/documents/public/pdf/learning/thought-leadership/benefits-realization-management-framework.pdf

- ↑ 23.0 23.1 IST Project Management Office https://uwaterloo.ca/ist-project-management-office/methodologies/program-management/program-benefit-delivery/benefits-register

- ↑ Cost-Benefit Analysis in Project Initiation https://4pm.com/2016/12/19/cost-benefit-analysis/

- ↑ Cost-Benefit Analysis https://www.mindtools.com/pages/article/newTED_08.htm