Successive Cost Estimation

(→Limitations and Critical Reflection) |

(→Quantitative Phase) |

||

| Line 61: | Line 61: | ||

| − | Through successively detailing the uncertainties, the global standard deviation will decrease, which is shown in the example in the next section. The process should be continued, until the global value of the standard deviation does no longer improve through specification or a more precise specification of the remaining items is not possible. Usually, 8-12 cycles are conducted, which means, that about 80-90% of the uncertainty are covered by the analysis. The priority for further detailing is given by the variance of each item after each successive step. This process description only gives an overview of the real process. Here correction factors are applied and each time the analysis breaks down, and an additional uncertainty for the breakdown must be added. <ref name="LIC2000" /> | + | Through successively detailing the uncertainties, the global standard deviation will decrease, which is shown in the example in the next section. The process should be continued, until the global value of the standard deviation does no longer improve through specification or a more precise specification of the remaining items is not possible. Usually, 8-12 cycles are conducted, which means, that about 80-90% of the uncertainty are covered by the analysis. The priority for further detailing is given by the variance of each item after each successive step. During each specification step it is also important to identify possible opportunities next to the risks. This process description only gives an overview of the real process. Here correction factors are applied and each time the analysis breaks down, and an additional uncertainty for the breakdown must be added. <ref name="LIC2000" /> |

'''Action plan:''' | '''Action plan:''' | ||

Revision as of 13:46, 4 March 2022

Contents |

Abstract

The successive principle is a method for managing uncertainty and can be applied to budgeting and scheduling, as well as other disciplines of Project Management, Systems Engineering, Risk Analysis and Cost Engineering.[1] It was developed by Steen Lichtenberg, a former professor at the Technical University of Denmark (DTU).

Uncertainty is part of every project and marks the base for risks. Managing risks in a project proactively is of high importance, which can not only be a threat, but also be an opportunity with positive influence on the project success. [2] Especially infrastructure and construction projects suffer from underestimation of costs. Depending on the geographical area, the costs for infrastructure projects overrun in 9 of 10 cases and the real costs drift far off the cost estimations. The projects might fail and therefore seriously hazard the involved companies. Too optimistic and subjective estimations can arise from technical, economic, psychological and political pitfalls. [3]

The successive principle tries to minimize the subjective influence by successively eliminating uncertainties with a top-down approach and can be contextualized next to other classical risk analysis techniques. It differs from them through focusing on a cooperation of experts from estimating, scheduling, technical specifications, etc. and therefore creates a precise whole picture without disregarding a single aspect. Moreover, it synergizes subjective estimations with statistical theory and faces uncertainty also as an opportunity. [4] A diverse analysis team follows a given procedure successively defining new uncertainties and eliminating these through the combination of subjective (psychological) and objective (statistical) techniques. It is implemented into organizations mainly in the Nordic countries and has lead to success even in project with very high uncertainty. Although already being implemented successfully, criticism arises from the extensive preparations, a non balanced composition of the analysis group and human error in calculations. [5]

The basic idea and procedure of the Successive Principle is described in detail and a simplified calculation example is given. Furthermore, example applications, as well as limitations and a critical reflection of the method in relation to project management standards are given.

Theory and Principles

The main goal for the development of the Successive Principle was to avoid the many pitfalls when applying classical risk management methods, which lead to cost overruns. It combines psychology, statistics and cost engineering and is based on the following key elements: [5]

- Uncertainty exists and cannot be avoided and therefore needs to be considered and tackled

- Multidisciplinary, evened groups can evaluate smart and unbiased

- Eliminating uncertainty by successively detailing and building a quantitative model

- Getting a holistic view by adding overall influences and everything influencing the project [6]

It also differs from traditional project management methods in three further points. [6] While typically the areas of large uncertainty are not tackled because of subjectivity, the Successive Principle picks exactly these for detailing and is able to be more precise than a traditional approach, considering more, but less subjective items. Furthermore, the new principle prioritizes the items with highest uncertainty and thus seeks diving into the most difficult items to estimate, which again differs from the traditional approach. Another change is made in the treatment of interrelated areas. The management of schedules, cost, resources and technical issues is now combined, specialists from each area are working together and thus interrelated areas are treated together, in order to not deflect the holistic view on the project. [6]

Procedure of the Method

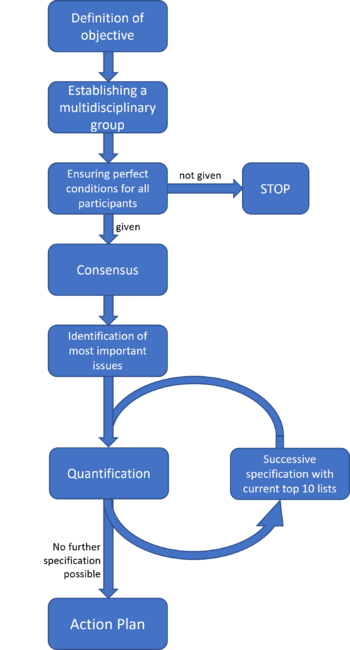

The procedure of applying the successive principle can be split into a qualitative and a quantitative phase with several subtasks. Successive detailing takes place in the quantitative phase after setting the preconditions up in the qualitative phase. The general process is illustrated in figure 1 [4]

Qualitative Phase

Identification of subject and purpose:

The first step of each analysis consists of setting the scope and concrete goal, which should include more than just a cost minimization goal. It should contain preconditions, e.g. how profitability is measured and which currency is used. Furthermore, it defines the system of involved companies, which types of problems should be addressed and what limits the analysis. [4] Subject to the analysis can be a project in all stages of its life cycle or also setting general strategic plans. [6]

Establishing a group:

The analysis is conducted by a team of 7 to 15 experts, while the group size should not exceed 25 participants. It is very important, experts from all major key areas are included. To avoid bias and make the analysis precise, the group should also consist of generalists, specialists, optimists and pessimists and should include all genders and relevant age groups. The group will work in sessions of 2-3 days, which should be attended by most of the participants. An experienced manager is guiding the group through the entire process and has to ensure, that the group dynamics are flawless and thus the result as objective as possible. It could be necessary to hire an external consultant for this facilitating task. [4]

Ensure perfect conditions:

It is important to ensure, that a neutral environment is selected for the workshops, where all participants feel comfortable and can focus totally on the analysis. A perfect environment communication has to be established. [4]

Consensus:

In the first group session, the participants get introduced to each other and a discussion about the goals, preconditions and scope defined in the first step is carried out. It is important, that all participants understand all key concepts and therefore an open discussion is key to success. The results of the discussion should be documented afterwards. [4]

Identifiy and order most imporant issues:

The last step in the qualitative phase is to identify the main issues regarding the project. This starts with a group brainstorming to find 50-100 key words describing the issues. These can be further developed using matrices for pre-grouping, which also promote creativity. It is important to include positive issues in order to collect opportunities. The issues are then grouped into statistically independent groups, called overall influences, with an aim of obtaining 8-15 groups. For each of the overall influences, two cases are created, a base as a reference, and a future situation to include opportunities, double sided manners and risks. It will be also necessary to build a group with not groupable issues, as well as one with issues related to the analysis itself (e.g. pessimism and optimism). [4]

Quantitative Phase

Quantification and successive specification:

The quantitative phase begins with running through successive cycles, to reduce uncertainty. In each circle, beginning with the overall influences, now called items are detailed using the “Hierarchical work breakdown structure.” Therefore, each item gets split into sub items in each circle. The calculation of the uncertainty is based on the “subjective probability theory.” [4] For each item, triple estimates are made, which consist of the estimated extreme minimum and maximum values and a most likely value. A mean value of these is build, while the most likely value is multiplied with the factor 3.

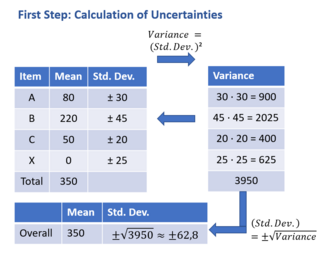

The standard deviation and variance are calculated as well. Taking the square route of the sum of the single variances leads to the overall global standard deviation.

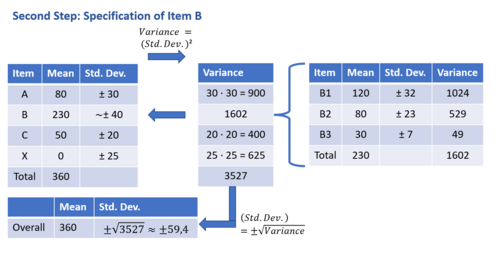

Through successively detailing the uncertainties, the global standard deviation will decrease, which is shown in the example in the next section. The process should be continued, until the global value of the standard deviation does no longer improve through specification or a more precise specification of the remaining items is not possible. Usually, 8-12 cycles are conducted, which means, that about 80-90% of the uncertainty are covered by the analysis. The priority for further detailing is given by the variance of each item after each successive step. During each specification step it is also important to identify possible opportunities next to the risks. This process description only gives an overview of the real process. Here correction factors are applied and each time the analysis breaks down, and an additional uncertainty for the breakdown must be added. [4]

Action plan:

With the specified costs and uncertainties, an action plan is developed by the team as a final step of the analysis. It should mainly focus on the results of the successive specification and can be initiated with a brainstorming. A basis could also be the remaining top ten list of uncertainties, which cannot be specified further in that stage of a project. The goal is to establish actions to utilize opportunities, protect against risks and reduce the general uncertainty. [4]

Example Calculation

To illustrate the top-down approach, a simplified example calculation is given. The calculation shows, how the overall uncertainty can be decreased by successively breaking down the largest uncertainties. In the example (see figure 1 and 2), three items (A, B, C) and an additional item for the overall influences (X) are used. Fictional numbers for mean values and standard deviation of each item are set, which in would be calculated from the triple estimates. These add up to an overall mean value and standard deviation. The variance for each item can be calculator by squaring the standard deviation and the item with the highest standard deviation is defined as the largest uncertainty. In a second step, the item B with the highest standard deviation is broken down into sub items, which are again filled with the results from the triple estimates and the table updated. With the breakdown, the variance of item B can be lowered and thus the total variance and overall standard deviation decrease. This also means, that the uncertainty decreased. If this successive procedure is carries out for all items and into, always starting with the highest uncertainty, the overall uncertainty can be lowered significantly. This is done by successively creating new “top ten lists” starting with the item, that has the highest uncertainty. [5] The example also shows, that while mean values might increase through specification, the overall uncertainty decreases. This happens, because the standard deviation of each subitem is expected to decrease, which is connected to a smaller range of the triple estimate values.

Application

The Successive Principle has various fields of application: Budget estimations, scheduling, analysis of risk and opportunities and forecasts of the project duration and commercial success. It also helps starting off a project, building a team, supports co-operation and communication and is therefore an integrated approach. [4] Applied, it brought many risky and cost intensive construction, IT, and other public projects in Scandinavia to success, while two of these are given here.

It was used for estimating the costs of the Lillehammer Olympic games in 1994 after first tries of cost estimation did not deliver satisfying results. The Olympic games in the end caused exactly the amount, which was estimated with the successive principle. [1] Another application of the successive principle was planning and constructing the 10000-seat arena Oslo spectrum. The first cost estimations were evaluated using the Successive Principle in a two-day analysis session, which unveiled, that because of optimism the project would cost double the price of the first cost estimations. A redesign of the arena was done, and another evaluation proofed, that the project would only cost 95% of the budget, while the standard deviation was low enough to not overrun reserves. With one further estimation later in the project, it finally was finished before schedule with a deviation of 1% from the cost estimation and fitting the budget. [6]

Limitations and Critical Reflection

Although the experiences from applying of the Successive Principle are prosperous, the method brings some limitation, which will be critically reflected here. The first limitation is based on the group formation, which opens the question, if a different group composition would also lead to a different analysis result. A group – or single members could be very optimistic or pessimistic and the result therefore drift into one direction. The Successive Principle tries to tackle this with the triple estimates, which bring another problem: The range between the minimum and maximum value can differ a lot between the estimations, which must be dealt with. [5]

The Method is capable of handling human error avoiding the many pitfalls in risk management. It can open the blind spot for opportunities, which is a major difference to commonly used methods. But the opportunities still need to be detected and exploited proactively, supported by the successive principle. This is exactly the treatment of risk suggested by the standard ISO:21502, which includes not only the handling of threat, but also of opportunities. The identification, assessment and treatment of risks requested by the standard are fulfilled by the principle. [7]. Furthermore, a suggested establishment of reserves on top of estimated costs in the standard is covered by the principle as well. [4] Uncertainty can be handled in early stages of the project, while it usually is addressed too late. However, it does not include the environment of the project, client and possible future developments clearly. [5] As the scope of the analysis is clearly defined, the possible exclusion of major risks like war and natural catastrophes causes uncertainty, that is not covered at all. A major challenge is the implementation of the principle into well established companies because it requires change and specific circumstances. The company should support modern management and be open to innovation because the principle is unconventional. Criticism is often based on the Bayesian theory, which differs from the classical statistics, but makes the handling of subjective uncertainty possible. The section explaining the procedure shows the importance of the preparation before the workshop and that an experienced facilitator in group dynamics, statistics and the principle itself is needed, who could be hard to find. [8] Moreover, the establishment of an optimal group needs to be possible as well as a willingness to face the true uncertainties of the project. All of this makes an involvement and commitment of senior management necessary. [5] The Successive Principle fits to processes suggested by the standards, which will be explained by some examples. Furthermore, it extends and interconnects all factors of the project “including subjective factors, hidden assumptions, and especially areas of uncertainty or potential change”, to get an holistic perspective on the project. [6]. The PMI Standard for risk management requests an identification of risks before the project or phase is authorized. [2] This exactly is addressed by the Successive Principle because it even when applied early in a project, tries to assess all uncertainties. It can be contextualized to the planning process group in the knowledge areas project schedule and cost management and therefore fits into risk management in context of project management, defined by the PMI standard. [2]. The PMI standard also names six key factors for Risk Management success, two of the factors are highly emphasized by the Successive Principle: Recognizing the value of risk management and open and honest communication, which is explained in the section about the theory and procedure. The challenge of including senior management is in fact a key success factor according to the PMI standard, namely organizational commitment. [2] All in all, the Successive Principle can be criticized in several points, especially because of the high effort needed to conduct a proper analysis. But because the Principle lead to success when applied and suits the ISO and PMI standards, companies, who struggle especially in cost estimation and scheduling could consider this more proactive uncertainty management approach.

Annotated Bibliography

- Lichtenberg, S. (2000). Proactive management of uncertainty using the Successive Principle - a practical way to manage opportunities and risks. Polyteknisk Press

- The main publication about the Successive Principle. It includes chapters, which focus on the single steps of the procedure. Especially the quantitative phase is elaborated thoroughly. Calculation models and evaluation techniques are defined in detail. Specific profitability, timing and scheduling applications are explained, and case studies conducted. All in all, it is the handbook for those, who are interested in managing uncertainties proactively and one of the only publication deeply explaining the Successive Principle. Because of the emphasis on extending the traditional Risk Management techniques it is highly relevant, but builds on a solid basic knowledge of Risk Management.

- Lichtenberg S., Klakegg, O.J. Successful Control of Major Project Budgets. Administrative Sciences. 2016; 6(3):8.

- The latest article about the topic. It summarizes the method shortly, without digging to deep into details. The application to scheduling and cost analysis is discussed in regard to the final research results of the method. Many experiences and results from projects, where the Successive Principle was applied, are given and their final costs analysed. Finally, the whole approach is critically reflected, and existing challenges listed, which makes this paper a peer review paper. It is the recommended to read, because it reflects on the whole development process of the method from early research to large scale application nowadays.

- Project Management Institute, Inc. (PMI). (2019). Standard for Risk Management in Portfolios, Programs, and Projects.

- This book is an extension to the standard books from PMI. It includes exact definitions for terms regarding Risk Management. The key concepts and framework for Risk Management in Portfolio Program and Project Management are given. Separate chapters explain the context for each of the three management disciplines. The book can be ideally used to get an overview of the general key concepts of Risk Management, to be able to evaluate the usability of certain Risk Management tools and methods. It is not explaining specific methods, but providing the basic framework necessary develop and evaluate Risk Management practices.

References

- ↑ 1.0 1.1 Lichtenberg, S., (2006) The Successive Principle – a scientific crystal ball for management. Conference Paper. The international Cost Engineering Council

- ↑ 2.0 2.1 2.2 2.3 Project Management Institute, Inc. (PMI). (2019). Standard for Risk Management in Portfolios, Programs, and Projects. Project Management Institute, Inc. (PMI)

- ↑ Flyvbjerg, B., Skamris Holm, M., Buhl, S. (2002). Underestimating Costs in Public Works Projects: Error or Lie? , Journal of the American Planning Association, 68:3, 279-295

- ↑ 4.00 4.01 4.02 4.03 4.04 4.05 4.06 4.07 4.08 4.09 4.10 4.11 4.12 Lichtenberg, S. (2000). Proactive management of uncertainty using the Successive Principle - a practical way to manage opportunities and risks. Polyteknisk Press

- ↑ 5.0 5.1 5.2 5.3 5.4 5.5 Lichtenberg, S., Klakegg, O.J. (2016). Successful Control of Major Project Budgets. Administrative Sciences. 2016; 6(3):8.

- ↑ 6.0 6.1 6.2 6.3 6.4 6.5 Archibald, R., Lichtenberg, S. (2016). Experiences Using Next Generation Management Practices The Future Has Already Begun, PM World Journal, 5:8

- ↑ International Organization for Standardization. (2020). Project, programme and portfolio management - guidance on project management. (DS/ISO 21502:2020)

- ↑ Lichtenberg, S., Klakegg, O.J. (2015). Successive cost estimation – successful budgeting of major projects. 29th World Congress International Project Management Association (IPMA).