Project Cost Estimation Methods

(→Project Cost Estimation Techniques) |

(→Project Cost Estimation Techniques) |

||

| Line 85: | Line 85: | ||

Both the optimistic and pessimistic estimate are designed to be quite reasonable, despite the fact that they represent the most improbable scenarios<ref name="five"/>. | Both the optimistic and pessimistic estimate are designed to be quite reasonable, despite the fact that they represent the most improbable scenarios<ref name="five"/>. | ||

| − | + | Three-point estimating produces durations or cost numbers in two ways one is a PERT distribution and the other one is a triangular distribution as shown in figure 2. | |

| − | Three-point estimating produces durations or cost numbers in two ways one is a PERT distribution and the other one is a triangular distribution as shown in figure 2. | + | |

| + | The triangular distribution is the average of the three different scenarios and is calculated by: | ||

| + | ::::::::::(O + M + P) / 3 | ||

| + | |||

| + | The PERT distribution is calculated by using a weighted average, overweighting the ‘most probable' estimate. This means the most likely scenario is assigned a four times higher value then the other scenarios, hereby converting the three-point estimate into a bell-shaped curve | ||

| + | The PERT distribution's formula is as follows: | ||

| + | ::::::::::(O + 4⋅M + P) / 6 | ||

| + | |||

| + | where: | ||

| + | |||

| + | E = Expected amount of time or cost | ||

| + | |||

| + | O = Optimistic estimate | ||

| + | |||

| + | M = Most likely estimate | ||

| + | |||

| + | P = Pessimistic estimate | ||

| + | |||

'''[[PERT]]''' | '''[[PERT]]''' | ||

Revision as of 14:56, 22 March 2022

Contents |

Abstract

Prior to the start of a project, cost estimation is critical. It is an important phase in project management since it is used to calculate and manage the project budget, which is often the most important parameter within the standard success criteria of cost, schedule, and performance targets. The cost of a project is for the first time estimated upon the start of the project or sometimes even before. Afterwards, the cost is re-estimated on a regular basis to account for new information, scope changes, and the project's timetable [1]. The cost of a project has the potential to impact nearly every area of the project, making it one of the most critical jobs for a project manager. A poorly written budget will result in incorrect asset allocation, unrealistic expectations, and, in the worst-case situation, project failure & customer disappointment. Simply said, a project's budget must be accurate for it to succeed. Cost estimation is one of the most helpful tools in a project manager's arsenal for creating an adequate budget. There are different methods of cost estimation available in the literature such as analogue estimation, parametric estimation, bottom up estimation, expert judgement, and three-point estimation. Each method has its own pros and cons for different projects. The application of each cost estimation method varies from project to project and the nature of the project. [2]

Throughout the article different kind of cost estimating techniques will be examined to determine which approach is most appropriate for different types of projects, as well as different stages of the project. The article will provide an extra focus towards the three-point estimation. This is due to the fact that the three-point estimation method has proven to provide the most precise estimate, hereby reducing the chance of failure and the possibility of unrealistic or excessively high cost estimates [3].

Note that this article only provides a discussion of selection of cost estimation methods. For further insight into the concrete application of these methods, it is recommended to do further reading in the annotated bibliography and references.

About Cost Estimation

A cost estimation is a calculated estimate of the number of resources necessary to accomplish a project or components of a project, which is typically done by dividing the projects into more manageable parts. Cost estimates are used to allocate funding to the deliverables and work packages of the project. These kind of cost estimates are usually stated in monetary terms, to enable comparisons across project. They can however also be stated in alternative units such as staff hours or staff days, if the monetary values are not appropriate or irrelevant. The estimate of project costs is one of the most critical components of project planning and management. The reason for this being that every project relies upon three main components: scope, budget and timeline. Budget is here often times one of the most essential things in order to gain approval of upper management or the person funding the project. The budget is typically very difficult to estimate accurately in the beginning of a project, due to lack of information and data, and estimates are typically increasing im accuracy as the project progresses. Therefore, cost estimation is divided into three different overall categories, according to PMBOK®, which is a set of standard terminology and guidelines for project management [4]:

- Rough order of magnitude (ROM)

- Budget Estimate

- Definitive estimate

All three categories vary in terms of precision, project stages in which they are used, and tools and procedures accessible.

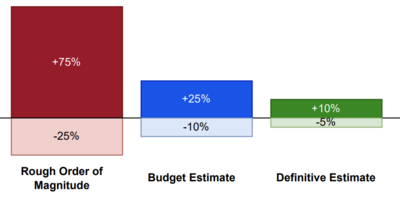

The ROM is a rough numerical estimate or approximation, established at the very early phases of a project when there is not much information available, such as during its inception or even earlier – In the case of the cost-benefit analysis, this would mean during the project selection process. This gives the decision makers the possibility early on to asses whether to proceed with the project or not. According to PMBOK, The accuracy range of ROM is -25 percent to +75 percent. The range was formerly stated as +/-50 percent in prior versions of the PMBOK, such as the 4th edition. As ROM estimations are rather inaccurate because of the wide range of probable results, they are usually replaced by more precise estimates, such as the definitive estimate. The "top-down" estimation approach is most commonly used here[4].

The budget estimate is typically applied in the beginning phase of a project, when the final specifications of the project are still unclear, but there is a good understanding of the primary features and technical requirements. It here assists in finding a preliminary cost and budget strategy, that is more accurate than that of the ROM, with a -10 percent to +25 percent accuracy. This approach also most commonly makes use of the "top-down" approach[5].

The definitive estimate is the PMBOK's most precise sort of estimate. Its precision varies from -5 to +10 percent. This high degree of precision is generally only possible when the project has been meticulously planned and all required information for a credible estimate of the work is available. As a result, definite estimates are often established later in the project. This is often refered to as "Progressive elaboration", here addressing the process of refining preliminary estimations during the life of a project[4].

Applying the different types of estimates

As mentioned, costs are calculated at various stages of the project [2] and cost estimation procedures are according to PMBOK typically "carried out periodically during the duration of the project"[4]. At the early stage of a project, when the project charter or business case is being prepared, a project manager must identify the resources necessary to finish. Due to the lack of data available at that stage, the project manager is likely to provide a ROM according to the project tasks and its complexity rather than a budget estime or a precise estimate [4]. Although this estimate is not very precise, it gives the stakeholders and project manager a good idea about whether or not to proceed with the project. As further information becomes available later in the project, the ROM is replaced with a more precise budget estimate, and lastly a definite estimate. Of course this may vary from project to project, and some may skip the budget estimate or start directly with the definite estimate.

Following the project's inception phase, the budget will be reassessed using the approaches described in this article throughout the different phases. Costs are often re-estimated in succeeding stages, as relevant new info and details become available or as the scope of the project or timetable changes. One of the most typical reasons for re-estimating costs is when the project's controlling indicators indicate that the initial budget baseline cannot be fulfilled.

Project Cost Estimation Techniques

The choice of Project managers cost estimations techniques are influenced by a number of factors. This amongst others includes the size and scope of the project, the availability of data from previous projects and the stage which the project is in. Some companies may also require that all projects must be funded in line with strict principles, while others may depend on the project manager's expertise. Many firms tend to depend on estimates in the early stages of project development, rather than more accurate forecasts. All these factors directly influence whether a ROM, a budget estimate or a definite estimate is being made. Five of the most commonly applied techniques for doing such estimates are described in the following section [4]:

Analogous estimating, also referred to as top-down estimating, is the process of applying previously observed cost figures and variables to new projects or segments of projects. The kind and structure of the referenced project activities must be similar to the present project in order to ensure accuracy. This method determines the predicted resource needs of a present project by analyzing the past data in terms of numbers and parameters. For the present project, the past values are used, and they may be changed to account for variations in project scope or its complexity. Analogous estimating falls under the category of gross value estimation, as is is often used when doing estimates without having a lot of information available. Comparable estimates are used when a project has access to previous data on similar types of work but lacks the specifics and resources to make more exact estimates [4].

Bottom-up estimate is a method for calculating the cost of work units at the lowest possible level of detail. The cost estimates for all project components are then combined to arrive at a total project cost estimate. Generally, these estimations are often made after breaking down the project into smaller work packages and even individual tasks. Whereas there is no specific rule on who should do these estimates, it is typical to ask those stakeholders who are actively involved in appropriate activities and work packages to do so. As a result, the bottom-up estimating technique often produces substantially more accurate results than analogous estimations. Getting these estimates on the lowest level and integrating them, on the other hand, often demands significant resources and may become a political minefield, particularly for big or complicated projects [4].

A statistical approach for determining the projected amount of funds or time required to complete a project, an activity, or a portion of a project is known as parametric estimation. An estimate is calculated using a statistical or ostensible relationship between a group of factors and a cost or time value. The size of the present project is then scaled in accordance with the observed association. For instance, in highway construction, the cost and timing for constructing a mile in a previous project might be used to estimate the resources and timetable for the current project. This, however, requires statistical proof of the association as well as a comparison of the two projects' features [4]. It is also considered a technique for estimating expenses at various degrees of granularity, the method by which it is implemented differs significantly. Some projects create complicated statistical models and do extensive regression analyses on a variety of variables. They may also create algorithms and provide a large amount of resources to the deployment and testing of such models. This is an approach that can be used for large projects, sometimes known as "large - scale projects," when even minor estimating mistakes can have a huge impact. On the other hand, smaller projects may employ parametric estimate by creating functions or simply using the 'rule of three' if there is proof or a plausible assumption that observable parameters and values correspond. It may also need expert judgement to determine if the predicted regressions are realistic and suitable to the task or the project.

Expert judgement may be used in both top-down and bottom-up estimation. Its precision is highly dependent on the quantity and expertise of the professionals participating, the understanding of the activities planned and phases, and the kind of project. If the primary stakeholder and team are familiar with the type of work that will be performed on the project, expert judgement may be used to provide an estimate. This involves a working knowledge of the project's topic and its environment, such as the organization and the industry [6].

Expert judgement may be seen in two ways:

- Estimation of the ROM at the outset of a project. As there are often not many team member at the beginning, and precise estimates are not available due to inexistence of data, estimates are often times performed by top-down estimation approach

- Inquiring the people in charge of the various activities or work packages make an estimate of how much time and resources they think it will take to produce the deliverables outlined in the WBS. It is often times possible to get quite precise findings from this kind of expert judgement.

Expert judgement, in addition to being an estimating approach in and of itself, is also inherent in the other estimation procedures. Instances include determining if earlier work and the present project are comparable or determining whether revisions to parametric estimation are necessary.

The three-point estimate approach is a simple, but efficient way of evaluating work, time and cost. Three different estimates are employed here, which are usually gathered from experienced specialists:

- Most likely estimate

Realistic expectation about the duration of the different activities, with the resources most likely to be available, as well as potential interruptions etc.

- Optimistic estimate

The amount of work or time necessary to perform a job under ideal circumstances in the most likely estimate. It illustrates what is referred to as the "best-case scenario".

- Pessimistic estimate

The amount of work or time necessary to perform a job under the least ideal circumstances in the most likely estimate— it shows the worst-case scenario.

Both the optimistic and pessimistic estimate are designed to be quite reasonable, despite the fact that they represent the most improbable scenarios[8].

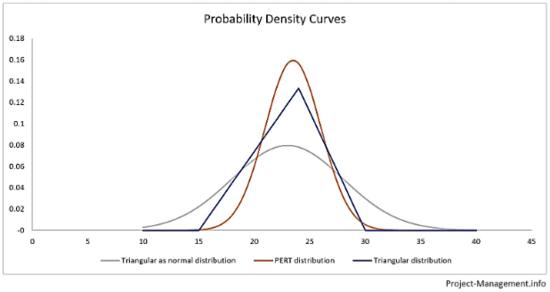

Three-point estimating produces durations or cost numbers in two ways one is a PERT distribution and the other one is a triangular distribution as shown in figure 2.

The triangular distribution is the average of the three different scenarios and is calculated by:

- (O + M + P) / 3

The PERT distribution is calculated by using a weighted average, overweighting the ‘most probable' estimate. This means the most likely scenario is assigned a four times higher value then the other scenarios, hereby converting the three-point estimate into a bell-shaped curve The PERT distribution's formula is as follows:

- (O + 4⋅M + P) / 6

where:

E = Expected amount of time or cost

O = Optimistic estimate

M = Most likely estimate

P = Pessimistic estimate

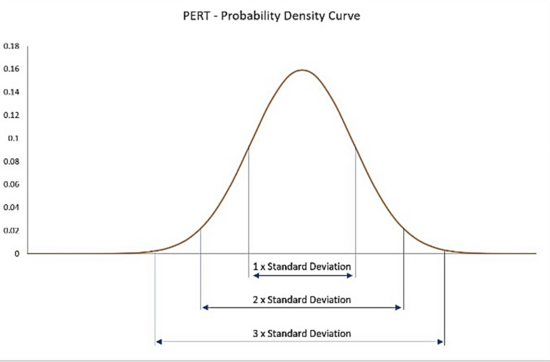

PERT (Program Evaluation and Review Technique) is an advanced project scheduling and management system. PERT is generally utilized as a complement to the Critical Path Method when it comes to activity scheduling. It may, however, be used for single-item and activity estimations. The PERT distribution is based on three-point estimate values. It may be used at all levels of planning, from individual actions to major projects. Finding the correct level of granularity for meaningful estimates, on the other hand, may need considerable critical and conceptual thought. Overweighting the ‘most probable' estimate is part of the PERT technique. It converts a three-point estimate into a bell-shaped curve, allowing probabilities of predicted value ranges to be calculated [8].

Differences between Triangular and PERT Distribution

The PERT method converts the three-point estimate into a bell-shaped, fairly normally distributed curve, while the triangular distribution consists mostly of the three estimated points. As a consequence, it may be used to calculate the probability of projected time ranges. Figure 2 depicts the differences between the PERT distribution, the triangular distribution, and a presentation of the three-point estimate as if it were a normal distribution. The areas underneath the probability distribution curves indicate the cumulative probabilities of each range of estimates. Typically, these ranges are computed by multiplying the expected value +/- standard deviation by one, two, or three, as illustrated in Figure 3[7] . The triangular distribution has the following formula:

- (O + M + P) / 3

The PERT distribution's formula is as follows:

- (O + 4⋅M + P) / 6

where:

E = Expected amount of time or cost

O = Optimistic estimate

M = Most likely estimate

P = Pessimistic estimate

Limitations

Altough the project cost estimation techniques provide a good way of calculating the overall cost of the project, these techniques have some limitations as well. Applications of each techniques varies from project to project and their complexities. In case of analogous estimation, it is applicable at the very basic level of the project and it does not provide the most precise estimates. It is appropriate at initial planning phases of the project rather than in execution phases. On the other hand, Parametric estimation undoubtedly is a more accurate estimation technique, but it consumes more time and resources in preparing the model and gather historical data from the past projects to apply on current project for estimation.

Bottom up estimation also has limitations in certain dimensions, as it does not provide the accurate estimate of the project as its estimate based on the sum of the activities of the project. It ignores the additional effort required of integrating the activities, while executing the enterprise and complex projects. On the contrary, expert judgement also has some disadvantages as it is also very expensive and time consuming, as the company needs to hire an expert from the outside in this method. Lastly, in three-point estimation, there is not any major limitation, but it takes a lot of time to provide the estimate for both optimistic, pessimistic and most likely for each task.

Comparison of Estimation Techniques

| |

Analogous Estimating |

Bottom-up Estimating |

Parametric Estimating |

Expert Judgment |

Three-Point Estimating |

|---|---|---|---|---|---|

| Input Data |

Data from previous comparable projects |

Activities & their scope of labour |

Data from previous comparable projects |

The professionals' knowledge and experience |

Different techniques for estimating costs |

| Method |

Using data of past similar projects & adapting it |

Estimating costs at the lowest possible detail, then summing up the different components |

Using data of past projects the present project's cost per parameter unit. |

Experts provide estimates of the resources required to perform the job within the scope of the project, either from the top-down or from the bottom-up. |

An optimistic, pessimistic, and most probable estimate is produced using one of the four other approaches and are then based on the Pert distribution or triangular converted into a weighted average value . |

| Output Type |

Total cost of the project, as well as a cost of each activity |

Total cost of the project, as well as a cost of each activity |

Total cost of the project, as well as a cost of each activity |

Varies from each project, but often times several outputs |

Improved estimates of costs, aswell as the standard deviation of those costs |

| Limitations | Not very precise estimations Mostly applicable in the beginning of a project |

Does not address for the ressources required for combining each activity |

Requires historical data which is both time consuming to gather and may not always be available |

Expensive & time consuming | Time consuming to provide an estimate for three scenarios |

Conclusion

The methodologies of cost estimation recommended by the PMBOK have been reviewed in this article. It is worth noting that the estimates' degree of information and complexity tends to rise as the project progresses. ROM estimates are typically the only kind of estimation available at the start phase. Bottom-up and parametric estimating methodologies, which are often only accessible later in a project's life cycle, are frequently required for definitive estimates, as these are the methods that generally produce the most precise cost estimates. They're typically employed when the budget has to be re-evaluated and a fresh estimate included at the end. Estimates that are more exact, such as parametric estimates based on historical statistical correlations of comparable projects, are not accessible in many projects. In such cases, the three-point estimation method is an effective way to analyse and balance subject matter expert estimates or top down estimation technique. The PERT distribution is undoubtedly the most precise method for condensing the worst-case, best-case, and most likely possibilities into a single value. The standard deviation is used to account for both the inherent errors and the possible dispersion of estimates. This might explain why, despite the fact that PERT has been available for decades and could have been used by our grandparents, it is still a popular tool for project estimating and scheduling.

Annotated bibliography

H. Kwon and C. W. Kang, “Improving Project Budget Estimation Accuracy and Precision by Analyzing Reserves for Both Identified and Unidentified Risks,” Project Management Journal, vol. 50, no. 1, pp. 86–100. This article provides the reader important information about how to estimate the budget accurately, when is the best time to calculate the budget and which cost estimation method is the optimal method for all types of project.

D. A. N. Gregory K. Mislick, Cost Estimation: Methods and Tools. This E-book provides the overview of all cost estimation methods and tools to estimate the cost for all types of project. It has detailed description of estimated tools which can estimate cost of enterprise projects with maximum precision.

R. T. Hughes, “Expert judgement as an estimating method,” Information and Software Technology, vol. 38, no. 2, pp. 67–75, Jan. 1996. This article gives the reader an important information about expert judgment-based estimates of projects specifically in information technology and software domain

C. E. Clark, “Letter to the Editor—The PERT Model for the Distribution of an Activity Time,” Operations Research, vol. 10, no. 3, pp. 405–406, Jun. 1962. This article guides the reader how to use the PERT distribution, estimate the activity duration and cost accurately and how it is efficient method as compared to other estimation methods.

References

- ↑ D. A. N. Gregory K. Mislick, Cost Estimation: Methods and Tools

- ↑ 2.0 2.1 Project Management: "Managing Successful Projects with PRINCE2" 6th Edition (2017) pp. 109–111

- ↑ H. Kwon and C. W. Kang, “Improving Project Budget Estimation Accuracy and Precision by Analyzing Reserves for Both Identified and Unidentified Risks,” Project Management Journal, vol. 50, no. 1, pp. 86–100, Feb. 2019

- ↑ 4.0 4.1 4.2 4.3 4.4 4.5 4.6 4.7 4.8 Project Management: A guide to the Project Management Body of Knowledge (PMBOK guide).

- ↑ Altexsoft - Rough Order of Magnitude: Making Initial Project Estimates with High Uncertainty,” Available online: https://www.altexsoft.com/blog/rough-order-of-magnitude/

- ↑ R. T. Hughes, “Expert judgement as an estimating method,” Information and Software Technology, vol. 38, no. 2, pp. 67–75, Jan. 1996

- ↑ 7.0 7.1 7.2 Project Management - Three-Point Estimating and PERT Distribution (Cost & Time Estimation),” Available online: https://project-management.info/three-point-estimating-pert/

- ↑ 8.0 8.1 C. E. Clark, “Letter to the Editor—The PERT Model for the Distribution of an Activity Time,” Operations Research, vol. 10, no. 3, pp. 405–406, Jun. 1962