Benefit Cost Ratio (BCR)

(→Time value of money) |

(→Discount Rate) |

||

| Line 23: | Line 23: | ||

=== Discount Rate === | === Discount Rate === | ||

| − | The discount rate is the rate of interest used to calculate the present value of future cash flows in economic appraisals. It is used to discount the expected future cash flows to their present value. The discount rate used in economic appraisals is usually determined by the current level of interest rates. | + | The discount rate is the rate of interest used to calculate the present value of future cash flows in economic appraisals. It is used to discount the expected future cash flows to their present value. The discount rate used in economic appraisals is usually determined by the current level of interest rates. Discounting is used when monetary values are distributed in time and these values should be added together in a specific year. A simple way of understanding discounting is to see it as a weight with this weight (1+i)-t determined as a function of t and the discount rate is i. |

=== How to Calculate BCR? === | === How to Calculate BCR? === | ||

Revision as of 17:33, 18 February 2023

Contents |

Abstract

This article discusses the application of the Benefit Cost Ratio (BCR) method in the Cost Benefit Analysis. The Benefit Cost Ratio is a profitability indicator, and it is the ratio of the present value of the benefit of the project to the present value of the cost. It is usually used to summarize the results of the cost benefit analysis (CBA) during the financial appraisal of a proposed program, project or portfolio. [1] BCR indicates if the project is feasible or not, meaning the higher the BCR, the more attractive the risk-return profile of the project/asset. If the BCR value of a project is less than 1, the project's costs outweigh the benefits, and it should not be considered viable. Calculating the BCR of an asset or project is comparatively simple. In addition, the ratio considers the discount rate, hence the time value of the money.[2]. Despite the fact that BCR is a tool to show the attractiveness of a project or an asset, cannot simply be the only determinant of a project's feasibility.

Initially, this article discusses the origin of the Cost Benefit Analysis and BCR. Then, it focuses on the formula for the calculation of the Benefit Cost Ratio and how it considers the time value of the money. Next, there is a comparison between BCR and other CBA methods. After that, the article introduces other formulas and applications of the BCR. Finally, it discusses the advantages and the limitations of the Benefit Cost Ratio.

Cost Benefit Analysis

Cost-benefit analysis (CBA) is a method of economic assessment that seeks to quantify the positive and negative impacts of a proposed decision or project. The technique has been used for centuries, with the earliest known examples dating back to the 1700s. However, the use of CBA were mandatory only after regulations were established by the US government in the 1930s CBA is often used to determine whether or not a proposed decision or project is worth investing in. It is also used to compare different options or to determine which option will provide the greatest benefit to its stakeholders.[3] After that, CBA was refined over the next decades due the advent of computers and still more sophisticated prediction models. The last years the goal is to link CBA with other methods (hard and soft operation research techniques) and setting a focus on wider impacts, stakeholders and robustness.

What is BCR?

The Benefit Cost Ratio is a profitability indicator, and it is the ratio of the present value of the benefit of the project to the present value of the cost. It is usually used to summarize the results of the cost benefit analysis (CBA) during the financial appraisal of a proposed program, project or portfolio.[1]

If the value of BCR of a project is greater than 1.0, the project is expected to have also a positive NPV and to have an internal rate of return (IRR) higher than the discount rate used in the calculations. When the BCR has a value equal to 1.0, indicates that the NPV of expected profits equals the costs. If BCR of a project is less than 1.0, the project's costs outweigh the benefits, and it should not be feasible. [4]

Time value of money

The time value of money is a basic financial concept used to calculate the present value of an amount of money today compared to its future value. This concept is based on the idea that money has a time value because it can earn interest over time. In other words, a dollar received today is worth more than a dollar received in the future due to the potential to earn additional. [2]

Discount Rate

The discount rate is the rate of interest used to calculate the present value of future cash flows in economic appraisals. It is used to discount the expected future cash flows to their present value. The discount rate used in economic appraisals is usually determined by the current level of interest rates. Discounting is used when monetary values are distributed in time and these values should be added together in a specific year. A simple way of understanding discounting is to see it as a weight with this weight (1+i)-t determined as a function of t and the discount rate is i.

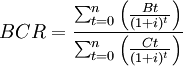

How to Calculate BCR?

Where:

t: The calculation period in years

Bt: Benefits in year t

Ct: Costs in year t

i: The discount rate

Examples

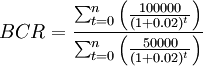

In this section, there will be an example of how BCR can be calculated in a scenario. A company decides to lease the equipment needed for a project for $50,000 rather than purchasing it. The discount rate is 2%, and the renovations are expected to increase the company's annual profit by $100,000 for the next three years.[4]

In this example, the BCR of the project is 5.77, which indicates that the project is feasible. Moreover, the company could expect $5.77 in benefits for each $1 of costs.

Comparison Between BCR and NPV

BCR and NPV are two different methods of financial appraisal. BCR measures the ratio of benefits to costs, while NPV measures the present value of future cash flows. Both methods measure the profitability of an investment with different methods. BCR focuses on determining ROI, while NPV takes into account the present value of future cash flows.

Other formulas of BCR

1. Payback Period BCR = Initial Investment / Annual Cash Inflow

2. Return on Investment BCR = Annual Net Income / Initial Investment

3. Net Present Value BCR = Net Present Value / Initial Investment

4. Internal Rate of Return BCR = Internal Rate of Return / Discount Rate

5. Profitability Index BCR = Present Value of Future Cash Flows / Initial Investment

Advantages of BCR

1. The BCR translates the absolute amounts of benefits and costs into a ratio.

2. It is a simple method and a good starting point in determining if a project is feasible or not.

3. For the calculation of BCR the time value of money through the discount rate is considered.

Limitations of BCR

1. The main limitation of the BCR is that it reduces a project to a simple number when the feasibility of an investment or a project relies on many factors and can be undermined by unforeseen events.

2. The calculation of BCR of a project depends in many assumptions. For example, an incorrect discount rate would lead to a flawed ratio.

References

- ↑ 1.0 1.1 Shively G., An Overview of Benefit-Cost Analysis., (Gerald Shively, Purdue University, 2012),

- ↑ 2.0 2.1 CFI Team., Benefit-Cost Ratio (BCR), https://corporatefinanceinstitute.com/resources/accounting/benefit-cost-ratio-bcr

- ↑ E.J. Mishan ., Cost-Benefit Analysis., (E.J. Mishan, Euston Quah , 2020),

- ↑ 4.0 4.1 Investopedia., Benefit-Cost Ratio (BCR): Definition, Formula, and Example, https://www.investopedia.com/terms/b/bcr.asp