Private Finance Initiative

(→Benefits) |

(→Benefits) |

||

| Line 205: | Line 205: | ||

*PFI contracts that have an extended concession period or no transfer is that it forces the Design and constructions teams to consider the whole life cycle of the asset in more detail. | *PFI contracts that have an extended concession period or no transfer is that it forces the Design and constructions teams to consider the whole life cycle of the asset in more detail. | ||

| − | An example of whole life costing because of PFI can be seen in a roadworks project in South Wales<ref>[ | + | An example of whole life costing because of PFI can be seen in a roadworks project in South Wales<ref>[http://www.pmi.org/learning/road-success-roadworks-reduced-cost-2773 PMI article - "Road to Success" ]</ref> . Here a toll road provides the revenue over a long concession period. The feasibility study revealed that a minimum of 68% road operation was required to be maintained to run the project at a profit. A redesign to improve quality was required to reduce the risk of road closure to repair and maintenance. |

==Limitations== | ==Limitations== | ||

Revision as of 12:25, 27 September 2015

Private Finance Initiative (PFI) is where the debt incurred by a project is repaid by the income that comes from the completed asset.

It was started by entrepreneurs in America extracting oil in Texas, here the project would be financed against the asset in the ground (value of the oil). It was necessary to do this because projects became too large and companies didn't have the assets to secure a loan against. The financial reward of successful oil extraction was large enough for the lenders to accept the risk of failure.

PFI has been commonly used in the UK since it was implemented in 1992 by John Major leader of the Conservative government[1]. one of the largest projects using this method being the channel tunnel between England and France[2].

PFI is used all over the world but primarily in Anglo-Saxon countries such as the U.S., Australia, Canada, South Africa but is also used in forward-thinking countries such as Chile and the Netherlands.

Contents |

Financial Management Structure

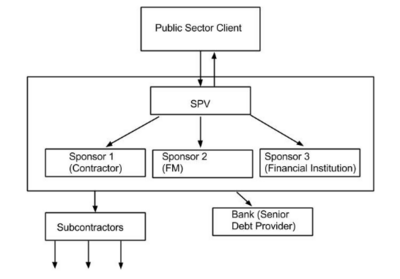

The procedure involves private companies coming together to form the special purpose vehicle (SPV) as shown in Fig 1. This would typically consist of at least one contractor, facilities manager and financier. These institutions are required to provide some capital to ensure their commitment to the project but this is not enough to fund the whole project. Banks are then approached to provide some financial backing. Following this a thorough risk and feasibility study has to be carried out to ensure that the return on the project is worth the initial investment.

Key words:

Equity - This is money provided by the sponsors or shareholders. Dividends are returned on the equity only after all other debts and interest is paid off. In the case of project failure dividends may not be returned on the equity so this is where the risk lies. Usually a large dividend is expected as a reward for taking on such a high risk.

Senior debt - this is money borrowed from banks or other financial institutions and is the first money to be payed off on a PFI project. This can be unsecured or secured as explained earlier.

Concession - This is the period where the public sector allows the private sector entity to own and operate the asset by charging users for a service.

Non-Recourse - This is when a bank providing a loan for a project can only be re-paid from income of that project and not from other assets of the receiving borrower.

| Comparison Conventional Finance Vs Project Finance | ||

|---|---|---|

| Characteristic | Conventional Finance | Project Finance |

| Other names | Corporate finance, Company finance, Public sector finance, Public sector finance | Private Sector Finance, Public Private Partnership |

| Loan Type | Recourse | Non-Recourse |

| Secured debt against capital | Secured | Non-Secured |

| Accounting | On balance sheet | Off balance sheet |

| Finance | Public sector capital eg. taxes, private corporation assets from profits of other projects | Debt provided by banks. Equity from project stakeholders |

| Client | Public Authority, Private Company | Pubic Authority |

Variations

A sign of its complexity is the many names and variations it has. PFI can also be known as non-recourse (or limited recourse if mixed with other financing) unsecured or off-balance-sheet financing. Non-recourse means that the financial lenders have no recourse to claim against if the project is a failure. It is unsecured because the loan is not secured by any assets other than those of the project itself and its future income. It is called off balance sheet because the capital invested in the project will not appear on the balance sheet of the parent company. Being off-balance sheet also gave tax advantages to these projects.

Private financing can take different forms but are fundamentally very similar. Public-Private Partnership (PPP) always involves both private and public sectors sharing the benefits of sale, transfer or exploitation of an asset but this is not always financed by PFI sometimes it can be paid for with the public sector capital.

It should be noted that PFI is separate to privatisation because in the former, the asset or service remains public, in the latter a public service is being transferred to the private sector[4].

Different formats of PFI

BOOT or BOT

Build-operate-own-transfer or build-operate-transfer is where the private entity constructs the asset and then operates it for a concession period arranged with the public sector entity. This concession period allows the private entity to recover its debts and earn a profit before transferring the asset to the public sector. Sometimes it is not appropriate for the private sector entity to own the asset so the public sector will take ownership immediately even though it is operated by a private company.

BOO

Build-own-operate works the same except the asset is kept privately and not exchanged after the concession period often because the asset no longer has any remaining value.

DBFO

Design-Build-Finance-Operate is similar to BOO except with the added design responsibility for the private sector entity.

DBFO format PFIs are recently becoming the preferred method in the UK because there is no transfer of the asset so a long term contract is made. Here focus is on provision of a service rather than facility so the private sector entity handles procurement, ownership and operation. The project is defined by its output (service) rather than input.

Why is it important?

Finance in general is important to a project because it is often the largest cost in a project particularly on longer duration projects. This is because the interest on loans used to finance the project can rapidly increase during the project life-cycle until the loan is paid off. This financing cost can be much greater than the costs of materials, labour, design and construction. PFI is a growing method of financing project which is already widely used is many countries. In March 2014 the UK government estimated their portfolio of PFI projects has a total capital value of £56549 Million spread over 728 projects.[5]

Project financing differs to conventional financing (which is provided by the parent company’s capital or revenue expenditure) by being a stand-alone entity. PFI is generally associated with larger complex projects which become more complex with the added difficulty of financial planning. This project finance entity has a limited life where as a normal corporate entity continues its life indefinitely over many different projects.

When is Project Finance appropriate?

PFI solutions are best used

- Instead of direct financing when it is necessary to transfer risk to the private sector and this improves value for money.

- Cases where a combination of sponsors produce greater financial leverage than they would individually.

- Large projects of over $1 billion will benefit from using PF because of the large capital required to carry out the project which is too much for one single company. It also mitigates some of the risk which can be high in for example a large natural resource exploitation project where new technology is being pioneered.

Ideal projects for project financing are

- Those that once built will be significantly more valuable than the cost to produce them.

- Have little uncertainty in the finish date

- Capable to function economically independently

- Where tax shield benefits are gained from the extra leverage of combined sponsors

- Politically sensitive projects where minimal disclosure to the public is an advantage

- Projects that span over more than one country so the conventional financing methods would also be complex between different countries’ public sector entities.

When isn't it appropriate?

- When conventional public financing or corporate financing is a safer or more profitable approach.

- Projects with an uncertain completion date are difficult to financially manage because it is unclear when the debt can be paid off.

- Projects where it is uncertain whether the asset will provide the necessary returns to pay off its debts and produce dividends.

In the UK the Royal Armouries Museum[6] faced many problems because it was built as a PFI project but it didn't attract enough visitors to produce the required revenue to pay off the debts as arranged. In the UK many projects set up by the government have been criticised[1] for using PFI methods when (before risk) the cost of the project would be significantly lower as a conventionally financed project. The PFI method only became marginally advantageous after the cost of risk was calculated. From experience it has been shown that projects with high risk are not suitable for PFI funding. These are particularly demand risk (whether the asset will create the projected revenue) and technological risk (when using frontier technologies that have not been tried and tested).

How PFI should be best implemented

By selecting PFI, an extra level of complexity is added to the project. For successful PFI projects it is crucial to be well managed to provide certainty particularly in the delivery time and price. To achieve this there are many management techniques (as described on this wiki-site) that could be used but the following are particularly relevant:

- Tried and tested technique - using proven technology over innovative methods

- Change management during the project

- Transfer of construction risks to the contractor

- Close monitoring of the contractor and using milestone incentives to keep on schedule.

The finance of the project is based on the returns it will provide after completion so the main risk lies in successful completion and operation. This requires an extensive feasibility and risk analysis review before the financier agrees to participate.

Selecting the best PFI company to supply the project becomes more complicated under PFI methods because they usually become responsible for both design and construction of the project. In conventional methods the public sector entity uses either in-house designers or well trusted private companies. These designers are then responsible for monitoring and controlling the contractor to make sure defects are avoided. With PFI contracts the designer, contractor and operator is chosen in one package so they cannot be trusted to monitor one another. Therefore careful selective tendering has to be carried out to find a trustworthy PFI company that won’t deliver an inferior quality project. Ive [7] suggests this should be done by a 2 stage bidding process. Firstly bids are selected by best technical delivery. Secondly the lowest cost is selected and this includes the added cost of risks. If the lowest priced bid is not within budget (but close) then that offer could be chosen as a preferred bidder and then renegotiated (without pressure from competitive bids) to reduce the cost by reducing deliverables.

Public sector entities have been criticised for a lack of transparency and not being honest with their reasons for using PFIs. This was seen when the UK government was found to be paying much higher prices over long periods than it would cost with a conventionally financed method[1]. To avoid these problems a strong feasibility study should be carried out to ensure value for money is being achieved and this needs to be clearly communicated to all stakeholders.

The Feasibility Study

A thorough assessment of the project viability must be made by each sponsor because the risks that are encountered by the project are borne by themselves. This involves the sponsors and lenders assessing their main targets that need to be achievable in order for the project to be worthwhile. For the sponsors their main concerns are raising the required funds at the right time and maximizing the revenues while minimizing expenses. Another concern is that the risk has been properly portioned out to the other partners and financiers.

For the lending parties the schedule needs to be checked so that repayments will be made on time with the necessary interest. Risk management also needs to be implemented in a well structured way.

So far these are standard checks for all types of financing of projects, when PFI is used extra scrutiny of the project has to be done. For example it also has to be ensured that after completion, the project produces enough money from its operation to pay off the debt incurred. In addition the risk of failure has to be weighed up so that the profit is high enough to be worth the risk involved.

Planning Project Finance

A lot of the planning for this will have already been worked out during the feasibility package such as the total cost of the project, now this needs to be finalised so the amount to be borrowed is known. This needs to be a detailed schedule so that debt is drawn at the right time to ensure the required cash flow is available but without accruing unnecessary interest.

Financing processes that should be used by the sponsor when setting up the financing structure of a project include

- Net present value analysis - regarding the profitability of the project

- Debt contract negotiation

- Financial distress risk

Arranging the financial package

This involves putting the plan into place so that loans are scheduled for the right times and cash flows are timed correctly. Other tasks to be carried out are

- Raising funding from equity

- Finding additional sponsors

- Arranging insurance

Monitoring and controlling of the financial package should be continued throughout the project to monitor and ensure the financial plan stays on track with spending and drawing of equity. This will also help the financial package to adapt to unforeseeable changes such as the need for further equity. The monitoring and controlling stage is also very important in the operational phase to run the asset at the maximum possible profit.

Risk management

Possible Financial risks

In a large complex project with a detailed financial structure there are many risks that can occur in financing from economical and political changes to commercial and contractual problems.

Economically this includes

- inflation

- increasing interest rates

- fluctuations in currency and exchange rates between countries

This kind of economical change is certain over the lifespan of a large project and requires a lot of resources to be properly analysed.

Political problems could occur when there is a change of government during the project lifetime and the newly elected government does not support the project or the spending it requires. Also if the country is at risk of a natural disaster or declaration of war the demand for the asset may suddenly be forgotten. A change in legislation and regulations could also increase costs, for example if new safety regulations become implemented.

Controlling the risks

This can be seen in more depth in other specific risk management articles but the main process that should be used to control all risks including financial ones are as follows:

- Set up a suitable risk management structure

- Identify all of the possible risks

- Qualitative assessment to identify the likelihood and severity of each risk

- Quantitative analysis of the main risks using methods such as Monte Carlo simulation

- Mitigation strategy set out to either avoid the risk or reduce the chance and severity of each risk. Other options are to pass the risk on to other parties such as an insurance company. A contingency plan should also be put in place in-case of the worst happening.

- Risk monitoring throughout the project reduces the surprise and also the impact of actuated risks.

PFI in portfolio management

The UK has been forced to review their strategies on portfolio management involving PFIs. In a document released about the Management of Portfolios by Office Of Government Commerce it was identified that a post implementation review after each PFI project should be made to ensure their future use is still the best choice. This process will review if the forecast benefits were actually realised and if the value for money was achieved whilst also noting the lessons to be learned for next time.

The alignment between financial managers and portfolio managers is also very important because the financial managers have the best knowledge of implications when choosing project financing over conventional financing.

Benefits

With conventional financing of a project the large amount of capital required in the short time of its initial phases is very high compared to the overall lifetime of the asset and gradual income or benefits that only begin after completion. So for governments making large investments in infrastructure projects the spending is quickly noticed by the taxpayers whereas the benefits of the completed asset are seen much later, quite possibly after the government has been voted out because of its overspending. PFI delays the cost of the project until the actual service is being provided to the user so the project benefits are closely linked to the cost. Other benefits of using PFI include:

- There is a distribution of risk and rewards between the sponsors. These are identified early at the negotiation stage so the risk can be shared fairly.

- The borrowing capacity is expanded by the combination of several sponsors.

- By having so many sponsors, companies with a poor credit rating can obtain a better interest rate on debt than they would individually.

- Portfolio managers can favour PFI projects because they are ‘off the balance sheet’ so can maximise the number of projects in the portfolio while requiring less of the limited resources. This benefit has been diminished however, since the implementation of the International financing reporting standards which has now stopped public sectors from hiding these debts from their accounts.

- For a PFI project a joint venture is often created between designer, constructor and facilitator this generates an alliance format. A high level of trust is initiated because of a greater sharing of risk. This leads to other benefits generally associated with alliances such as increasing skills base and improved communication and collaboration.

- PFI contracts that have an extended concession period or no transfer is that it forces the Design and constructions teams to consider the whole life cycle of the asset in more detail.

An example of whole life costing because of PFI can be seen in a roadworks project in South Wales[8] . Here a toll road provides the revenue over a long concession period. The feasibility study revealed that a minimum of 68% road operation was required to be maintained to run the project at a profit. A redesign to improve quality was required to reduce the risk of road closure to repair and maintenance.

Limitations

- Transparency is often a problem with project financing which makes some stakeholders unwilling to use it. With this method it is often unclear who is providing what sums of money which is particularly alarming to taxpayers.

- PFI is often more complex than regular methods because there are multiple actors and involves projects that are already large and complex with long construction times. This can lead to a chaotic project.

- The cost of debt is usually larger with PFI than it normally would be with corporate financing or public works.

- Higher transaction costs are incurred because of the added complexity for example from tax and legal issues or designing the project governance.

Notable projects using PFI [9]

- Channel tunnel[2]

- Second Severn Bridge

- Euro Disney Land

Additional Reading

Books

- P Morris, J Pinto "The Wiley guide to project, programme & Portfolio management"

- J.D. Finnerty "Project Financing: Asset-Based Financial Engineering, Second Edition"

- Graham Winch "Managing Construction Projects"

Articles

- The Financial Structure of Private Finance Initiative Projects by Akintola Akintoye1 , Matthias Beck , Cliff Hardcastle , Ezekiel Chinyio and Darinka Asenova

In this useful article the authors interviewed 48 leading UK companies using PFI to identify the most commonly used financial structure.

- On the Eurotunnel project. This article thoroughly reviews the project

- Investopedia video which clearly explains the main concepts of PFI in a short and simple way.

References

- ↑ 1.0 1.1 1.2 Guardian newspaper article on PFIs in the UK

- ↑ 2.0 2.1 Study of the Euro Tunnel Project, M. Grant

- ↑ The Financial Structure of Private Finance Initiative Projects (2001) Akintola Akintoye1 , Matthias Beck , Cliff Hardcastle , Ezekiel Chinyio and Darinka Asenova.

- ↑ MIT lecture slides on PFI

- ↑ HM Treasury:Private Finance Initiative projects: 2014 summary data

- ↑ Royal Armouries project in Leeds

- ↑ P Morris, J Pinto - The Wiley guide to project, programme & Portfolio management - Chapter 14

- ↑ PMI article - "Road to Success"

- ↑ [ACCA World PFI project survey] http://www.accaglobal.com/content/dam/acca/global/PDF-technical/public-sector/rr-126-001.pdf