Best Practices for Project Portfolio Selection

m (→Examples) |

(→Examples) |

||

| Line 99: | Line 99: | ||

'''Scoring models''' | '''Scoring models''' | ||

| + | |||

Scoring models typically consists of four basic components | Scoring models typically consists of four basic components | ||

*Categories of criteria to determine model type | *Categories of criteria to determine model type | ||

Revision as of 21:45, 17 September 2016

Almost any larger company nowadays must have a succesfull Project Portfolio Management (PPM) in order to preserve a positive revenue. PPM is essential to ensure that a company chooses the right projects to pursue, however it is not always as straightforward as it might seem to choose the best fit projects. In fact is it very challenging to choose which projects to have in a company's portfolio.

Coopers et al. (2001) analysis has concluded that there are five dominant methods or tools that a larger amount of organisations uses to ensure a good Project Portfolio Management. These methods or tools consists of [1]:

- Financial methods, includes financial key figures.

- Business strategy, defines the strategy for allocating financial ressources.

- Bubble Diagram, plots project in a X-Y coordinate where several factors are relevant for determine a projects worth.

- Scoring Models, sums up a projects score from a range of criteria.

- Checklists, uses yes/no questions related specifik to the company.

A combination of one or more of the methods and tools can be seen as best practices within Project Portfolio Management.

The aim of this article is therefore to enlighten the Project Portfolio selection methods and tools and their best practices. Furthermore will this article describe the limitations and benefits of these best practices and how they can complement each other.

Contents |

Introduction

Projects are everywhere today, no matter where you look you will see a project. The variation of projects is almost impossible to describe. They can be everything from small, non-profit and private projects to large, expensive and global projects. Hence projects are the foundation of organizations, the ability to manage them becomes more and more essential for surviving in the business. Larger organizations with many projects rely heavily on managing their projects in order to ensure that the projects are beneficial for them. This is where Project Portfolio Management (PPM) plays an important role. So what is Project Portfolio Management? PPM has several reasons for its importance; financial – to maximize the return, to maintain competitive advantage, to properly and efficiently allocate resources, to ensure the link between project selection and business strategy, to achieve balance and focus in projects and to provide a better objectivity in the selection process. A shorter description is that PPM is the process of evaluating, selecting, prioritizing and managing an organizations projects with the end goal to have the best fitted projects for the organization.

The selection process is one of the more important areas of PPM since it is the process where the projects gets chosen for the portfolio. This process can be very difficult to control due to the tremendous amount of methods and tools which can be applied. However Cooper’s (2001) [1] studies shows that five methods and tools are more commonly used by Senior Portfolio Managers and are his definition of ‘best practices’ within the selection process of PPM.

The Five Tools

Cooper (2001) strongly advice that organizations use a combination of several methods and tools in the selection process. He also express how todays successful organizations are changing their decision making from primarily be based on financial tools to now base their decision making on not only financial tools but rather a combination of several methods and tools. This ensures that most possible factors are takin into account when selection projects for the portfolio. As described earlier Cooper (2001) has given his assessment of the ‘best practices’ for project portfolio selection. This section will give an overview of the ‘best practices’ by describing the tools and methods separately. The following section will describe their dependencies of each other.

Purpose of the tools

Financial methods

The financial methods and tools are used by 77 percent of businesses. The financial methods include a variety of profit and return metrics i.e. NPV (Net Present Value), RONA (Return on Net Assets) and ROI (Return on Investment). The financial methods are most often used to rank projects against each other by comparing the expected economic value that each project will generate. Other financial methods use the hurdle rate (also known as minimum rate of return) of each project as a comparison basis. These methods are often used on individual projects as a Go/Kill decision method.

Business strategy

The business’s strategy is also a very popular tool for project selection. It is used by 65 percent of businesses which may be explained in that they have many strengths and few weaknesses. The business’s strategy is used to allocate resources. The resources are allocated into separate areas based on their strategic priorities. Of course these various a lot within the different business’s, but there are still tendencies to some areas being more dominating.

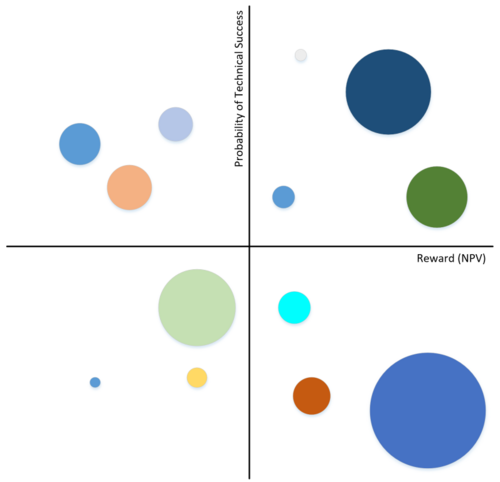

Bubble diagram

The bubble diagrams are getting very popular and are receiving a lot of exposure in different software solutions. The idea is fairly basic; projects are plotted on an X-Y coordinate map often as balloons or circles. The size of the balloons can indicate a number of factors i.e. the bigger the balloon, the bigger the project is. Each of the four quadrants represents a category and each project will be placed in one of the quadrants. The bubble diagram can therefore have many aspects depending on how you define the X-Y axis’s. The most common bubble diagram is the Risk/Reward diagram where you typically have the NPV on one axis and the probability for success on the other access.

Scoring models

The scoring model is in fact a very basic method, however also often used by organizations to create a fast and intuitive overview of the projects rating. 38 percent of organizations uses this model to rate projects. The weighting scale is very easy to understand. It could as an example were a rating scale from 1-5 or 0-10. It can also be as simple as a scale with low, medium and high. This all depends on the question depth and its expected complexity. Some of the most commonly used criteria’s are financial reward and strategic fit, however the selection criteria can also be regarding risk and probability of success.

Checklists

The last tool is the checklist. The checklist method is not as popular as the other where only 20% of the organizations uses it. The checklist consists of a number of Yes/No questions as the evaluation criteria. To determine whether a project is good enough is must achieve enough Yes’s, or at least a specific amount of Yes’s. Checklists tends to be viewed at as a supporting tool instead of a decision making tool.

Dependency of each other

Cooper (2001) express that no method or tool used alone will give a correct result. Further he explains that the best results of portfolio management come from organizations relying on multiple methods and tools. Cooper’s (2001) studies shows that organizations who are best at portfolio management uses an average of 2.43 different methods and tools per business in their portfolio selection. Further the studies show that half (47,5%) of the best organizations uses three or more methods however organizations who practice portfolio management worst have a tendency to rely on far fewer with an average of only 1.83 methods or tools per business, where half of them only focus on a single method or tool.

Application

This section will explain how each of the tools can be applied in an organization. The examples will to some extent be a bit superficial, since the mathematical perspective of the tools won’t be explained to its depth. Some these ’best practices’ have a broader perspective than a specific tool (i.e. financial methods and business strategy) and therefore will the examples be explained one of the more popular methods within its area.

Examples

Financial methods

As explained above, the financial methods have a broad perspective and the example will therefore be on one of the more popular used methods. There are many factors there each play a role when trying to find how good the chances are for a project to be successful. The method there will be explained is used to determine the Expected Commercial Value of a project (ECV). The ECV method will help compare the probabilities of success for each project into an easier understandable net present value. The equation of the ECV method is as follows:

EVC = (NPV * PCS – C) * PTS – D

- NPV = Net Present Value

- PCS = Probability of commercial success

- C = Commercialization costs

- PTS = Probability of technical success

- D = Development costs

The model below gives a more intuitive picture of how the equation should be interpreted. A quick walk trough of the model:

- first of all, there are some costs in development,

- then you get to a point where you analyze if the development resulted in a technical success.

- If the development wasn’t a success, then the value of the project is zero.

- If the development was a success, you will have to launch it,

- and from there you will have to analyze whether the launch will be a success.

- As before, is the launch analysis resulted is a negative commercial success, then the value of the project will be zero.

- However, if everything is estimated to be a success then you will end with an Expected Commercial Value.

Business strategy

The methods within business strategy is somewhat similar to the financial methods since it also is a very broad perspective. There are many different ways to use the organizations strategy as selection criteria for projects. A method seen very commonly in allocation of resources is the ‘Strategic Buckets’ method. The ‘Strategic Bucket’ method helps the portfolio managers categorize each project, which then makes it easier to allocate their resources. There are different ways to rank a project in each bucket, however when all projects are ranked it gives the portfolio managers a complete overview of projects and resources. There are many different factors that you can divide your bucket list into. An example could be a bucket for each production line, a bucket for the maintenance of the production line and perhaps one for productions reductions. That gives the portfolio managers four buckets where they can sort their projects in. Each bucket will most likely also have a maximum budget allocated, so by listing all the project within each area helps in getting an overview of how the budget should be prioritized on the projects.

Bubble diagram

The Bubble diagram is actually a tool instead of the two methods described above. The Bubble diagram has many plots for analyzing projects. The most common plot is the Risk/Reward plot and is highly used in management practices. Since Risk/Reward is the most popular plot, the example will take its stand in that. The X-axis represents the Net Present Value (NPV) and the Y-axis represents the probability of technical success (PTS). Each project will be illustrated with a circle, where the size of circle represents, as an example, its annually resources. Other examples of axis used in popular Bubble diagram plots could be Technical Newness vs. Market Newness or Competitive Position vs. Project Attractiveness.

Scoring models

Scoring models typically consists of four basic components

- Categories of criteria to determine model type

- Range of values of criteria

- Measurement and description of each value

- Importance of weight of the criteria

When these components have been chosen, the scoring model can be created. It usually looks like a line of statements but divided into their respective categories. An example of two statements could look like this:

- Strategic Leverage

- Synergy with other projects within the organization.

- Platform for growth.

The idea is then to rate the statements on a given scale, 1-5 or 1-10 etc. In order to achieve the must correct and reliable answers, the statements has to be well thought through combined with the statements has to be able to give us the right answers.