Applying the Pareto Principle in Risk Management

| Line 86: | Line 86: | ||

<em><span style="color:#44546a;"> Figure 2 - Pareto Chart </span></em><em><span style="color:#44546a;">[3] | <em><span style="color:#44546a;"> Figure 2 - Pareto Chart </span></em><em><span style="color:#44546a;">[3] | ||

| − | |||

| − | |||

</span></em></p> | </span></em></p> | ||

Revision as of 15:01, 13 April 2023

Contents |

Abstract

The

The Pareto Analysis, also known as the 80/20 rule, is a widely used concept in project management and quality control that states that 80% of the effects come from 20% of the causes [1]. This idea can also be applied in risk management to assist firms in prioritizing and allocating resources efficiently.

Many other techniques can be combined with the Pareto analysis to provide a more thorough evaluation of each risk, improving the final results and overcoming Pareto Analysis’ limitations.

By employing this evaluation, organizations can enhance their risk management procedures, concentrate their attention on the most important risks, and make more informed decisions.

This article provides an in-depth overview of the Pareto Analysis and its application in risk management. It is divided in the following sections:

- What is Pareto Analysis?: describing the Pareto Principle's origins and purpose.

- How to build a Pareto Chart: explaining how to create and interpret the visual representation of the Pareto Principle.

- Pareto Analysis Applications: offering guidance on the different applications of this tool, describing its use in different areas and giving some examples.

- Limitations: describing the main drawbacks of this tool.

- Overcome Pareto Analysis’ Limitations using other tools: explaining how to combine it with other techniques to overcome its limitations.

- Conclusion

The paper also gives an annotated bibliography of crucial readings to aid firms in applying the Pareto Principle in risk management. These references cover a wide range of issues, from the Pareto Principle's fundamentals to its application in certain business situations and industries.

What is Pareto Analysis?

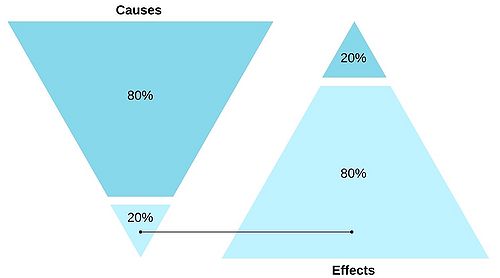

A well-known and frequently used tool in risk management, quality management, and project management is the Pareto Analysis, also known as the 80/20 rule or Pareto Principle. As shown in Figure 1, this rule, which was established by Italian economist and sociologist Vilfredo Pareto in the late 19th century, argues that only 20% of causes result in 80% of the effects [1].

Figure 1 - Methodology based on the Pareto-analysis [2]

The Pareto Principle is often used in various fields, including business, economics, and quality management, to help managers identify the most critical factors that are impacting their operations and to prioritize improvement efforts.

The 80-20 rule is applied to categorize the problems based on their effect on profits, customer complaints, technical issues, product defects, or delays. The problems are then assigned a score based on their negative impact on the company, and an action plan is developed and implemented to solve the highest-scored problems first. This approach helps allocate resources efficiently by targeting issues that have a significant impact on profits, sales, and customers, resulting in a disproportionate improvement.

How to build a Pareto Chart

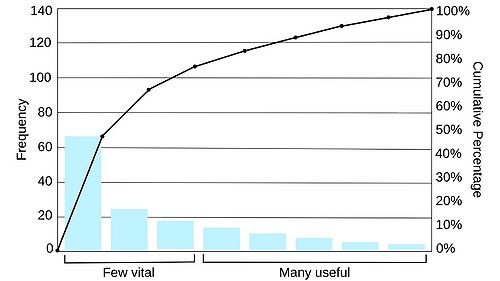

In Pareto Analysis, data is graphically represented in the form of a Pareto chart, which is a bar graph that arranges items in order of frequency or impact.

As shown in Figure 2, the X-axis represents the causes and the Y-axis shows the effects. The tallest bar in the graph symbolises the cause that has the most influence, while the cumulative line represents the cumulative total of the items.

The steps to create a Pareto Chart are the following [3]:

- Add up the data on the effect of each contributor and sum them together to get the grand total.

- Rearrange the contributors from largest to smallest.

- Calculate the cumulative-percentage-of-total.

- Insert a bar graph to show the amount of each contributor's impact.

- Insert a line graph to represent the cumulative-percent of total.

Figure 2 - Pareto Chart [3]

An example of the use of Pareto Analysis is shown in the case study of Erasmus Medical Centre Sophia (EMC) [2], a compact University Medical Centre (UMC) that offers all healthcare functions and has a complex heating, ventilation and air conditioning (HVAC) system. In the context of energy management, the Pareto analysis can help identify the healthcare functions in UMCs that consume the most energy and have the most potential for energy reduction.

The study aimed to assess the energy reduction potential of different healthcare functions in EMC by differentiating energy consumption to these functions. This was done by analyzing energy intensity and the total energy distribution per healthcare function, which allowed for the identification of the healthcare functions with the largest energy consumption. Based on this analysis, isolation rooms and surgery rooms were identified as the functions that consume significantly more energy than other healthcare functions, making them critical functions to focus on for energy reduction.

The case study of Pareto analysis in EMC demonstrated that the approach is a useful tool for determining energy reduction potential in UMCs. The study showed that by identifying the healthcare functions that consume the most energy and applying targeted actions to reduce their energy consumption, organizations can reduce their overall energy consumption and achieve cost savings.

Pareto Analysis Applications

The Pareto Analysis can be used in Business and Management to identify areas that could improve in order to boost productivity and efficiency.

Pareto Analysis can be used in Sales and Marketing to effectively allocate resources and prioritise efforts [1]. For instance, a business can find out that 20% of its goods generate 80% of its sales and use this knowledge to focus on enhancing and advertising the best-selling products.

In Finance this analysis can be particularly useful when analysing investment portfolios, to identify for instance the 20% of investments that provide 80% of the portfolio's returns, using the gained knowledge to make informed decisions about which investments to hold, sell, or devote additional resources to [4].

In the Manufacturing sector, this tool can be used to boost productivity and efficiency. Companies might utilise Pareto Analysis to see which 20% of the production procedures are to blame for 80% of the products, to concentrate their efforts on the most important processes.

Pareto Analysis can also be applied in the field of Human Resources to pinpoint the most frequent causes of employee churn and deal with them, and in Customer Service to find the most common customer complaints to solve to raise customer satisfaction.

Focusing on the management field, some examples of areas where the Pareto principle can be applied are project management, quality management, and risk management.

In Project Management, this analysis can be used to rank hazards according to importance, so that the management can concentrate resources on the risks that are more likely to have an influence on the project. An example of use is to pinpoint the 20% of tasks that account for 80% of the project's results. Project managers may guarantee that the project is finished on schedule and within budget by concentrating on these activities. For instance, a construction company can use Pareto Analysis to identify the few quantity of its construction jobs that account for the most of the time spent on a project and concentrate its resources on these tasks to shorten the project's overall duration.

In Quality Management, the Pareto Analysis can be used to determine the most frequent reasons for flaws in a good or service and to rank those reasons in order of their importance [5]. This can assist management in concentrating their efforts on the issues that are most likely to result in significant improvements in the product or service's quality. Pareto Analysis can be used in this situation to determine the most prevalent causes of faults in a product or service and rank those causes in terms of importance. The product or service can then be improved using this knowledge, raising the quality overall. An example is to use this tool by a company that manufactures computer components to pinpoint the 20% components that account for the 80% of defects and concentrate quality control efforts on these components.

In Risk Management, the Pareto Analysis is a particularly crucial tool, because it enables management to concentrate efforts on the most significant risks rather than attempting to handle all hazards at once. This makes it possible for risk management to be more effective and efficient, which eventually lead to better results [6]. The Pareto Analysis also aids in spotting patterns and trends in the data, which may be used to spot new and developing dangers that may not have been considered in the past. An example of use in this area is to identify the few part of risks that are likely to have the greatest potential impact. Focusing on these hazards will enable management to take action to lessen them, so lowering the overall risk to the firm.

Limitations of Pareto Analysis in Risk Management

Although the Pareto Analysis can be a useful tool in risk management, it's crucial to be aware of its limits. Conducting a Pareto Analysis can be time-consuming and requires significant resources, which can be an obstacle for small organizations. Also, the results of a Pareto Analysis are not self-implementing, and it is up to the organization to follow through on recommendations. Without proper implementation, the benefits of the analysis may be limited.

The first limitation is in fact that the theory is based on the idea that only 20% of causes result in 80% of the consequences, which may not always be the case. There may be a different distribution of causes and effects in some situations, making the Pareto Analysis less effective [7].

Another important limitation of this tool is that the Pareto analysis does not take into account the interdependencies between risks [7]. For example, if two risks are ranked as being less critical individually, their combined impact may be greater than the one of a single, higher-ranked risk.

Another drawback is that this analysis present only a partial view of the hazards. Pareto analysis only considers the frequency of occurrence of a problem, and does not take into account the impact or severity of the problem [8]. For example, a problem that occurs frequently but can be easily resolved may not be as important as a problem that occurs less frequently but has a major impact.

Also, Pareto analysis has a limited perspective on the problems as it only focuses on identifying the causes that contribute to the majority of the issues, without considering the underlying causes of problems, but simply identifying their symptoms [7]. This means that without a root cause analysis, it is difficult to determine the most effective solutions for the problems identified in a Pareto chart.

The process of identifying the most significant problems and ranking them is subjective, and it is up to the person conducting the analysis to determine which problems are most important. Results can be influenced by the data used and the perspective of the person conducting the analysis.

This tool is highly dependent on data quality [8]. The quality of the data used in Pareto analysis is critical, and any errors or inaccuracies in the data can result in incorrect conclusions. To minimize this limitation, it is important to consider multiple sources of data and to validate results with stakeholders to ensure accuracy and objectivity.

Finally, one of the biggest limitations of Pareto Analysis is its focus on past data. This means that the analysis is limited to historical information and does not consider current or future trends and conditions. As a result, the decision-making process may not take into account current or emerging problems that need to be addressed. Additionally, the Pareto analysis may not accurately reflect the true state of the process if the underlying data changes over time [8]. Therefore, it is crucial to complement Pareto analysis with other techniques and approaches that provide a more comprehensive view of the situation and allow for a more informed decision-making process.

Overcome Pareto Analysis’ Limitations using other tools

As previously noted, Pareto Analysis is a very helpful tool in risk management, but it has significant drawbacks that reduce its effectiveness. To avoid this issue, other techniques and approaches can be used in conjunction with Pareto analysis. The specific combination of tools and techniques used will depend on the situation and the goals of the analysis. However, by combining Pareto analysis with other tools and approaches, decision makers can have a more comprehensive understanding of a situation and make more informed decisions that take into account both past and current data.

The Root Cause Analysis (RCA) is an example of tool that can be combined with Pareto Analysis. While Pareto analysis is a useful tool for identifying the most significant factors contributing to a problem, it has limitations in identifying the root cause of the problem. This is where RCA can be used to complement the Pareto analysis. RCA helps to identify the underlying causes of problems by considering multiple factors, including current and future conditions, to determine the best course of action [2].

By using RCA alongside Pareto analysis, it is possible to identify the key causes of a problem and then investigate the underlying reasons for those causes. This allows for a more comprehensive understanding of the problem and can help to develop effective solutions that target the root cause. Overall, combining the strengths of Pareto analysis with RCA can provide a more thorough approach to problem-solving and lead to more effective and sustainable solutions.

Another tool that can be used is Process Mapping, that creates a visual representation of a process to help identify areas that need improvement, taking into account both past and current data [9]. One of the key limitations of Pareto analysis is in fact that it only provides insight into the most common problems, and not necessarily the underlying causes of those problems. Here, process mapping can be a useful addition to the toolbox for solving issues. A complex process is divided into smaller, easier-to-manage processes via process mapping, and potential improvement areas are noted.

By using process mapping in conjunction with Pareto analysis, it’s possible to gain a more comprehensive understanding of the process, and identify opportunities for improvement beyond just the most common issues. This approach can help to create a more effective and sustainable solution to the problem, as it addresses the root causes of the issues rather than just the symptoms.

For example, the Pareto analysis can be used to identify the most critical issues based on historical data, while the process mapping provides a visual representation of the process and helps to identify the root causes of problems. By combining these two tools, decision makers can have a more complete understanding of the process and be better equipped to make informed decisions.

A viable option is combining Pareto Analysis with the Expected Value (EV) technique, which entails assessing each risk's expected impact, multiplying it by its probability of occurrence, and ranking the risks according to their expected value [10]. Pareto Analysis prioritizes risks based on their potential impact, while EV technique evaluates the expected outcome of a decision by determining the average result based on a probability distribution of potential outcomes. By combining these two techniques, organizations can make informed decisions by prioritizing the most critical issues and evaluating potential solutions based on expected outcomes.

An example of the joint use of Pareto analysis and expected value is a company trying to reduce customer complaints. Pareto Analysis can identify that slow response times are the main cause of customer complaints. The expected value tool can help determine whether hiring additional customer service representatives or investing in new software is more likely to reduce customer complaints.

Combining these two techniques provides organizations with a comprehensive and data-driven approach to improvement, leading to more effective and efficient results. The use of both Pareto Analysis and expected value helps organizations ensure their resources are allocated effectively to areas where they will have the greatest impact, making data-driven decisions based on a comprehensive analysis of the situation and expected outcomes.

Conclusion

In conclusion, the Pareto Analysis is a valuable tool for organizations that are seeking to improve their operational processes, allowing managers to prioritize the issues and risks that have the biggest impact the business.

However, this tool has also some limitations that must be taken into account. To overcome these boundaries, it is recommended to combine the Pareto Analysis with other analytical tools and techniques. For instance, Root Cause Analysis can help identify the underlying causes of an issue, while Process Mapping can provide a detailed overview of the process and its potential weaknesses. Expected Value Analysis can help evaluate the potential impact of various solutions to determine which ones are most likely to yield the desired results.

By integrating Pareto Analysis with these techniques, organizations gain a more comprehensive understanding of the issues and risks they face, leading to more efficient and effective decision-making.

Bibliography

|

[1] |

M. T. C. Team, "Pareto Analysis," [Online]. Available: https://www.mindtools.com/afzbk2y/pareto-analysis. |

|

[2] |

W. Z. ILSE SCHOENMAKERS, "Pareto analysis: a first step towards nZEB Hospitals," REHVA Journal, October 2017. |

|

[3] |

Juran, "How to Construct a Pareto Diagram," 14 March 2019. [Online]. Available: https://www.juran.com/blog/how-to-construct-a-pareto-diagram/. |

|

[4] |

D. Dikov, "Applying the Pareto Principle in Financial Analysis," magnimetrics, [Online]. Available: https://magnimetrics.com/pareto-principle-in-financial-analysis/. |

|

[5] |

J. Gerardi, "Pareto Chart (Pareto Analysis) in Quality Management," Project Cubicle, 13 februray 2018. [Online]. Available: https://www.projectcubicle.com/pareto-chart-pareto-analysis/#:~:text=Pareto%20Analysis%20is%20a%20valuable,the%20opportunities%20for%20investment%2C%20etc.. |

|

[6] |

risksandventures, "Risk Assessment Techniques - Showing What Matters With Pareto Charts," 03 july 2020. [Online]. Available: https://www.risksandventures.com/2020/07/03/risk-assessment-techniques-pareto-charts/. |

|

[7] |

O. Guy-Evans, "Pareto Principle (The 80-20 Rule)," 12 May 2022. [Online]. Available: https://www.simplypsychology.org/pareto-principle.html. |

|

[8] |

e. Management, "Pareto Analysis – Application, Chart, Advantages, and Disadvantages," 13 June 2022. [Online]. Available: https://efinancemanagement.com/financial-management/pareto-analysis#Disadvantages. |

|

[9] |

J. Courtnell, "The Ultimate List of 45 Business Process Improvement Tools (Lean Six Sigma & Beyond)," Process.st, 12 February 2021. [Online]. Available: https://www.process.st/process-improvement-tools/. |

|

[10] |

P. TEAM, "Project Risk and Risk Management," 20 January 2010. [Online]. Available: https://pmhut.com/project-risk-and-risk-management. |