Risk management in project portfolios

(→Risk Integration at Portfolio Level) |

(→Risk Integration at Portfolio Level) |

||

| Line 24: | Line 24: | ||

== Risk Integration at Portfolio Level == | == Risk Integration at Portfolio Level == | ||

| − | In order to | + | In order to BLAB |

== History == | == History == | ||

<references /> | <references /> | ||

Revision as of 16:18, 23 November 2014

This article is an overview and summary of relevant body of knowledge concerning risk management in project portfolios. Project portfolio management (PPM) is the set of managerial activities that are required to manage a collection of projects and programs needed to achieve stratetic business objectives.[1] It has been widely accepted that Risk Management is an important part of Project Management. Project risk management enables an organisation to limit the negative impact of uncertain events and/or to reduce the probability of these negative events materialising, while simultaneously aiming to capture opportunities [2]. However, project risk management is only effective to a limited extent because it lacks a portfolio wide view. [3] The information available regarding risk management at portfolio level is fairly scarce. Methods like Monte Carlo Simulations can be used to create efficient frontier charts in order to best as possible choose risk/return balance within the portfolio. Numerical methods are however often associated only with risks (known unkowns) and not uncertanties (unknown unknowns).

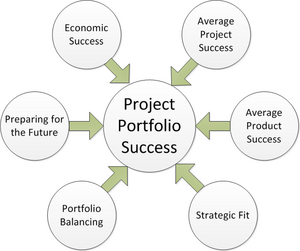

Project Portfolio Succes

Project portfolio succes is defined on 6 parameters: Average project success, average product success, strategic fit, portfolio balancing, preparing for the future and economic success.[3] Combined these parameters give portfolio managers a way to assess the overall succes of a specific project portfolio.

- Average project success

- Level of success regarding the iron triangle (cost, quality and time). Also includes the compliance with the fulfillment of the defined specifications of all projects in the portfolio

- Average product succes

- Level of success of all projects in the portfolio. This includes both market and commercial success.

- Strategic fit

- To which extent the projects in the portfolio reflects the corporate business.

- Portfolio balancing

- The equilibrium between high-risk and low-risk projects, long-term and short-term projects, and technologies and markets.

- Preparing for the future

- The ability to quickly react to changes in the environment and seize opportunities in the long term.

- Economic success

- Adresses the overall market succes and commercial success of an organization or business unit.

Risk Integration at Portfolio Level

In order to BLAB

History

- ↑ Blichfeldt & Eskerod, 2008; Project Management Institute, 2008b

- ↑ Petit. ”Project portfolios in dynamic environments: Organizing for uncertainty.” International Journal of Project Management, 539-553 (2012)

- ↑ 3.0 3.1 Teller, Kock & Gemünden. "Risk Management in Project Portfolios Is More Than Managing Project Risks: A Contingency Perspective on Risk Management". Project Management Journal, 67-80 (2014)