Value Chain Analysis

| Line 33: | Line 33: | ||

The Deloitte survey (Deloitte, 2004) identified that companies, which could be classified as ‘value chain complexity masters’ (Deloitte, 2004), were distinctly more profitable that other companies surveyed, on average 73% more profitable. | The Deloitte survey (Deloitte, 2004) identified that companies, which could be classified as ‘value chain complexity masters’ (Deloitte, 2004), were distinctly more profitable that other companies surveyed, on average 73% more profitable. | ||

The analysis is based on 300 survey respondents, each with annual revenues of at least US$200 million. Value chain complexity masters were identified by value chain capability factors (product innovation, time to market, sourcing effectiveness, product quality, manufacturing flexibility, manufacturing productivity and cost effectiveness, customer service and supply chain cost structure) and value chain complexity factors (global dispersion of value chain functions – sourcing, manufacturing, engineering, and marketing & sales). The companies that had a high complexity and high capability they were classed as a complexity master’. | The analysis is based on 300 survey respondents, each with annual revenues of at least US$200 million. Value chain complexity masters were identified by value chain capability factors (product innovation, time to market, sourcing effectiveness, product quality, manufacturing flexibility, manufacturing productivity and cost effectiveness, customer service and supply chain cost structure) and value chain complexity factors (global dispersion of value chain functions – sourcing, manufacturing, engineering, and marketing & sales). The companies that had a high complexity and high capability they were classed as a complexity master’. | ||

| + | Compared to other companies in the survey, complexity masters had developed superior capabilities in (Deloitte, 2004): | ||

| + | * Customer related operations - extensive investment in customer collaboration projects and customer relationship management. | ||

| + | * Product related operation - improvements in R&D through better process integration and investments in product data management systems and product lifecycle management systems. | ||

| + | * Supply chain operations - characterised by performance improvement initiatives such as quality management, quick change-over, lean manufacturing, and had also invest heavily in technologies such as advanced planning and scheduling software, warehouse management and transportation systems. | ||

| + | Although not published in the peer-reviewed academic literature, this research confirms that the value chain model is important in achieving competitive advantage. It demonstrates that where best practice is found, superior financial performance is also found. | ||

Revision as of 21:13, 16 September 2016

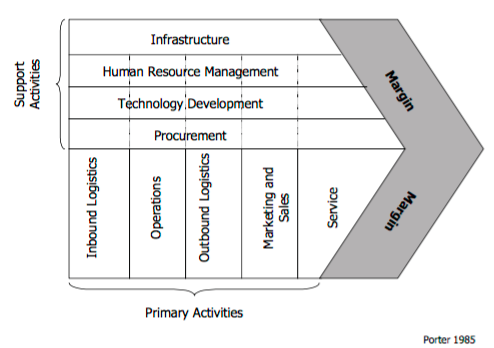

The term ‘Value Chain’ was used by Michael Porter in his book "Competitive Advantage: Creating and Sustaining superior Performance" (1985). The value chain analysis describes the activities the organization performs and links them to the organizations competitive position. The goal of this analysis is to identify activities that are a source of cost or differentiation advantage and to identify those that could yield to the firms/projects competitive advantage, thereby helping to create products or services at a price which the customers are willing to pay for.

Contents |

The Concept

Value chain analysis describes the activities within and around an organization, and relates them to an analysis of the competitive strength of the organization. Therefore, it evaluates which value each particular activity adds to the organizations products or services. This idea was built upon the insight that an organization is more than a random compilation of machinery, equipment, people and money. Only if these things are arranged into systems and systematic activates it will become possible to produce something for which customers are willing to pay a price. Porter argues that the ability to perform particular activities and to manage the linkages between these activities is a source of competitive advantage. Porter distinguishes between two sets of activities. Activities that are directly associated with the creation or delivery of a product or service are termed primary activities and support activities are those that are linked to each primary activity that aims to improve its efficiency and effectiveness.

Primary Activities

- Inbound Logistics: all activities associated with the receiving, distributing and storing of incoming materials

- Operations: converting inputs (raw materials, energy and labor) into outputs (the final product/service)

- Outbound Logistics: all activities associated with the storage and movement of the final product to the end user

- Marketing and Sales: all activities involved in the assessment and encouragement of customers to purchase and the activities associated in providing a medium to purchase the product

- Service: activities related to the maintenance and enhancement of value to the end user after the product is sold

Secondary Activities

- Procurement: the acquisition of goods or services from an external source

- Human Resource Management: all activities associated with the management of people as per the requirements

- Technology Development: all activities related to the equipment, hardware, software, technical knowledge and procedures to transform the inputs into outputs

- Infrastructure: all other activities including legal, finance, accounting, public relations and quality assurance

Margin

The term 'Margin' implies that organizations realize a profit margin that depends on their ability to manage the linkages between all activities in the value chain. In other words, the organization is able to deliver a product / service for which the customer is willing to pay more than the sum of the costs of all activities in the value chain. The linkages are flows of information, goods and services, as well as systems and processes for adjusting activities. Their importance is best illustrated with some simple examples: Only if the Marketing & Sales function delivers sales forecasts for the next period to all other departments in time and in reliable accuracy, procurement will be able to order the necessary material for the correct date. And only if procurement does a good job and forwards order information to inbound logistics, only then operations will be able to schedule production in a way that guarantees the delivery of products in a timely and effective manner – as predetermined by marketing. In the result, the linkages are about seamless cooperation and information flow between the value chain activities.

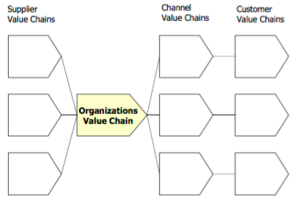

Organisations Value Chain

In most industries, it is rather unusual that a single company performs all activities from product design, production of components, and final assembly to delivery to the final user by itself. Most often, organizations are elements of a value system or supply chain. Hence, value chain analysis should cover the whole value system in which the organization operates. Within the whole value system, there is only a certain value of profit margin available. This is the difference of the final price the customer pays and the sum of all costs incurred with the production and delivery of the product/service (e.g. raw material, energy etc.). It depends on the structure of the value system, how this margin spreads across the suppliers, producers, distributors, customers, and other elements of the value system. Each member of the system will use its market position and negotiating power to get a higher proportion of this margin. Nevertheless, members of a value system can cooperate to improve their efficiency and to reduce their costs in order to achieve a higher total margin to the benefit of all of them (e.g. by reducing stocks in a Just-In-Time system).

Industry Adoption

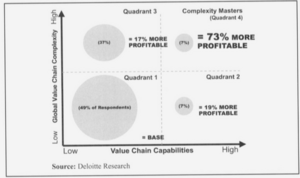

The evidence of improved financial performance of companies adopting value chain principles can be highlighted from a survey conducted by Deloitte, conducting research into international value chains.

The Deloitte survey (Deloitte, 2004) identified that companies, which could be classified as ‘value chain complexity masters’ (Deloitte, 2004), were distinctly more profitable that other companies surveyed, on average 73% more profitable. The analysis is based on 300 survey respondents, each with annual revenues of at least US$200 million. Value chain complexity masters were identified by value chain capability factors (product innovation, time to market, sourcing effectiveness, product quality, manufacturing flexibility, manufacturing productivity and cost effectiveness, customer service and supply chain cost structure) and value chain complexity factors (global dispersion of value chain functions – sourcing, manufacturing, engineering, and marketing & sales). The companies that had a high complexity and high capability they were classed as a complexity master’. Compared to other companies in the survey, complexity masters had developed superior capabilities in (Deloitte, 2004):

- Customer related operations - extensive investment in customer collaboration projects and customer relationship management.

- Product related operation - improvements in R&D through better process integration and investments in product data management systems and product lifecycle management systems.

- Supply chain operations - characterised by performance improvement initiatives such as quality management, quick change-over, lean manufacturing, and had also invest heavily in technologies such as advanced planning and scheduling software, warehouse management and transportation systems.

Although not published in the peer-reviewed academic literature, this research confirms that the value chain model is important in achieving competitive advantage. It demonstrates that where best practice is found, superior financial performance is also found.