Construction Cost Management

(→Detailed Estimate) |

(→Application) |

||

| Line 66: | Line 66: | ||

*Measurements | *Measurements | ||

*Quantity-Take off | *Quantity-Take off | ||

| − | |||

| − | |||

| − | |||

| − | |||

===Limitations and Challenges=== | ===Limitations and Challenges=== | ||

Revision as of 15:11, 28 December 2017

Construction Cost Management

Contents |

Introduction

Cost Management in construction industry and the measurement of the financial activities involved there are unique and completely different from financial management of other industries. The basic production unit of the construction industry is the project. Thus, in contrast to the other industries, the number of projects in construction, is relatively small compared to other industries. Considering also the expended time frame and the multiple stakeholders, which are involved in this one project, the differences in the cost management from other industries can be realized[1].

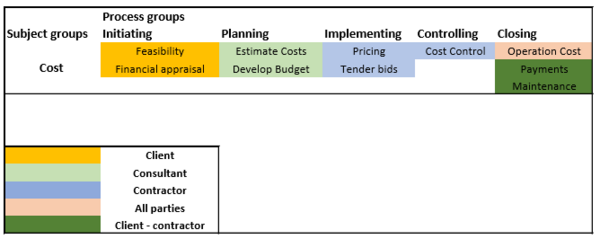

Construction Cost Management is presented as a subject group as in DS/ISO 21500:2013. It is analyzed in the processes groups, illustrating by the aforementioned standard. The definition of the process group according to the DS/ISO 21500:2013 is the following[2]:

- Initiating The initiating process is used to start a project phase or project, to define the project phase or projects objectives and to authorize the project manager to proceed with the project work.

- Planning The planning process is used to develop planning detail. This detail should be sufficient to establish baselines against which project implementation can be managed and project performance can be measured and controlled.

- Implementing The implementing process is used to perform the project management activities and to support the provision of the project's deliverables in accordance with the project plans.

- Controlling The controlling processes are used to monitor, measure and control project performance against the project plan. Consequently, preventive and corrective actions may be taken and change requests made, when necessary, in order to achieve project objectives.

- Closing The closing processes are used to formally establish that the project phase or project is finished, and to provide lessons learned to be considered and implemented as necessary.

Initiating

Feasibility or Financial Appraisal

Financial appraisal in construction is one of the most important and earliest stages of the construction project planning process. The purpose of the financial appraisal is to determine whether the project is worthwhile, comparing its costs with its expected benefits. It stands as a key element for deciding whether or not to proceed with a construction project and any project in general. Also, it stands as a key element for choosing between alternative construction projects. Financial appraisal addresses not only the adequacy of funds, but also the financial vialibity of the project, estimating in the end if and when the project returns a profit or not.

Methods

- Payback Period - simply considers the cash flow of costs and benefits

- Net Present Value (NPV) – considers the ‘time value’ of cash flows

- Internal Rate of Return (IRR) – sets basic return criteria on the time value of money

Challenges

- Optimism Bias - There is a demonstrated tendency for project appraisers to be overly optimistic[3]. This behaviour is not intentional. Psychological reasons are the route for this.

- Strategic misrepresentation - Project managers act in bad faith when estimating financial project appraisals. Strategic misrepresentation can be seen to political and organizational reasons.

Reference Class Forecasting Method

Reference Class Forescasting Method is a method for financial appraisal of construction projects who forces the project manager to have an outside view and compare the future project with others. The main aim of the RCF method is to optimize the forecasts in construction projects, so that cost overruns and benefits shortfalls can be avoided.

Planning

Cost Estimation

The capital cost for a construction project consists of the following expenses:

- Land acquisition

- Planning and feasibility studies

- Architectural design and engineering consultancy

- Construction of the project, including labour and equipment

- Field supervision of construction works

- Insurance and taxation during the construction of the project

- Owner general office overhead

- Equipement and furnishings after completion of construction

- Inspection and testing

Cost Estimating Techniques

All estimates are approximations, bsed on judgement and experience. Estimator must be the project on parer, then estimate the quantities. Estimator also need to offer alternative construction methods and solutions, determining the sources and consequently the cost of each method and solution.

Conceptual & Preliminary Estimate

Methods

- Cost Indices

- Cost-Capacity Factors

- Component Ratios

- Parameter Costs

Detailed Estimate

Methods

- Measurements

- Quantity-Take off

Limitations and Challenges

- Changes in relative prices result on serious changes in construction costs

- Prediction over long period of time is quite difficult

- Possibility of errors in analysis, due to uncertainties

Cost Indices

Quantity take-off

Computer Aided Cost Estimation

Cost Estimation of construction projects in the preliminary design stage is a rather challenging task, due to the lack of available project information. Therefore, cost estimation models using parametric computational methods have been developed. Such cost estimating model techniques in the preliminary design phase are [4]:

- Multi regression models

- Neural network models

- Case-based reasoning models

Implementing

Pricing is determined by a large number of factors. The bid, which is submitted by a contractor, depends on

- cost estimation

- contractor's profit

Tendering

Contracting [5]

Construction contracts is the mean for pricing a construction project and stands out as an official agreement between the client, the contractor and the possible other stakeholders, who are involved in the contract. Contracts are a structure for the allocation of risks between the involved parties in the project. The type of contract, which will be used for the construction of a project, is decided solely by the client, who also sets the term on the contractual agreement. Different type of contracts pose also different risks for the contractor. Some types of contractual agreement, which are used in construction industry, are listed below:

- Lump Sum Contract

- Unit Price Contract

- Cost Plus Fixed Percentage Contract

- Cost Plus Fixed Fee Contract

- Cost Plus Variable Percentage Contract

- Target Estimate Contract

- Guaranteed Maximum Cost COntract

Controlling

The primary objective of Construction Cost Control is the delivery of the project within the approved budget.

Cost Control

Cost Control Methods

Units Completed

This method is applicable to tasks which involve repeated production of easily measured work quantities, with each quantity requiring approximately the same amount of effort. For instance, the linear meters of piping installed can be compared to the required amount of piping, so that the percentage of piping completed can be estimated.

Incremental Milestones

This method for estimated the amount of work, which is completed to date, can be applied for any cost control account, which consists of subtasks, which must be handled in sequencial order. The completion of each subtask is considered as a milestone and represents a certain amount of the project or process. The percentage, chosen to represent these milestones, is usually based on the number of work hours estimated to be required from that point to the total completion of the required process. Also, this percentage can be either based on average values from historical data.

Supervisor Opinion

This method is used on tasks in construction, which are lack of definable intermediate milestones and/or when the time for these required tasks is extremely difficult to be accurately estimated. The judgements of the percentage of the work completed by this method is prepared form inspectors, supervisors or project managers. Good estimating skills and field observations are essential for accurate results, when this method is used.

Cost Ratio

The cost incurred to date can be also used to estimated the work completed to date.

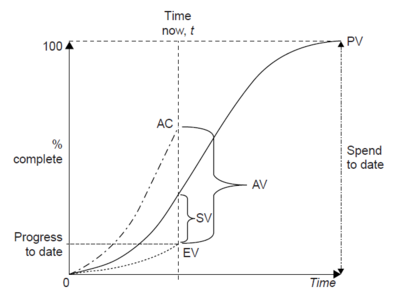

Earned Value Method

Earned Value Method is the most common cost control method, which is used on construction projects. Earned Value Method is used to calculate the progress that has been achieved on a project using a Work Based System Structure (WBS). It is implemented to control both costs and the schedule of complex construction projects.

Definition

Objectives The main objective of the EVM is determining project progress from a cost status or a schedule status perspective. From cost perspective, EVM identifies whether the project is on budget, over bugdet or under budget. Similarly, from a schedule perspective, it can be determined if the project is on, ahead or behind schedule.

Key parameters

The three main parameters of the EVM are:

- Earned Value (EV) Earned Value or Budgeted Cost of Work Performed reflects the amount of work which has been accomplished at a specific point in the schedule. It is the cost basis for the amount of money which can be invoiced to the client against the contractual master schedeule. It is also used for cash flow calculations.

- Planned Value (PV) Planned Value (PV) or Budgeted Cost of Work Scheduled (BWCS) is the budgeted work which is scheduled to be performed during the project. Planned Value is presented in a chart illustrating the cumulative resources budgeted across the project schedule. It can be compared to the Earned Value at a defined point to indicate if the project is ahead or below schedule.

- Actual Cost (AC) Actual Cost or Actual Cost of Work Performed indicates the amount of resources that have been expended to achieve the actual work performed to date. It is compared to the Earned Value at a specific point to identify if the project is under or over budget though budget variance (AV).

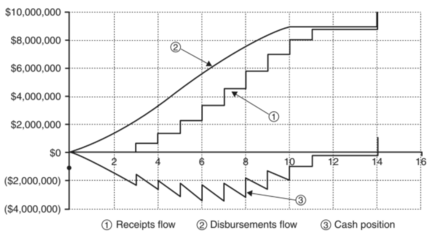

Project Cash Flow

Cash is the important resource that a contractor has to manage during the project construction lifecycle. Many construction companies may appear to be rich on paper and still go bankrupt. Companies must have enough liquidity to pay their financial obligations during the construction lifecycle. Thus, the forecasting of cash needs over lifecycle of a project is extremely important for a construction comapny and a contractor. The cash resources for a project cover payrolls, payments for equipment use, subcontact payment requests as suppliers,

Basic Cash Flow Equation

The basic equation which is used for cash flow forecasting and calculation is:

where,

Revenue: the money coming into a construction company or a contractor

Expenses: the money a contractor or a construction company has to pay for the construction work to be done

Capital: the money left in the end, can be positive as profit or negative as debt

Although this equation seems easily comprehensable, in construction industry, there are more difficulties and complexities related to it. This section of the wiki article tries to identify some of the complexities and difficulties, but not to analyze them into so uch detail.

Accrual and Cash Method

Conservatism

Conservatism is a generally accepted acounting method, followed by most construction companies around the world. The basic idea of conservatism is that you recognize an expense as soon as it exists. You recognize a revenue as soon as it is received. This idea is a reflection of the reality in construction industry as the contractor should forecast and calculate revenue, only when they will be received. Bankruptcy and stop of the contract by the client can also result in serous economic losses to the contractors if conservatism is not applied to their financial accounts. As a result, for the tracking of revenues, cash method is used and for recognizing the expenses the accrual method is used, instead.

Cash Flows

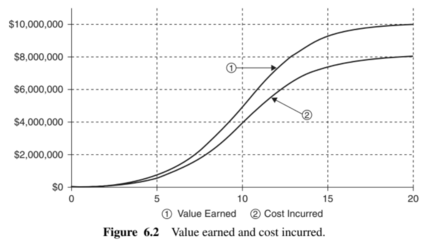

The Expenses in Cash flow forecasting is the Actual Cost Curve, from the Earned Value Method as it can be seen from Figure X.

Calculation and forecasting on Revenues depend on four factors:

- Earned Value

- Retainage - The amount of payments that is kept or held back from the clinet to the contractors as a guarantee that the contractor will cooperate and finish the project in a timely and professional manner.

- Billings - The payments from the client to the contractor

- Payment Cycles - Period of time between the billing and the receipt of payment.

For the cash flow prediction there is also the equation:

In the below Figure X, curve 1 illustrates the Actual Cost of the project - Expenses, curve 2 the Revenues, taken into consideration Payment Cycles, as Billings are considered in the cash flow immediately after the receipt of payment. Curve 3 illustrates the Capital Curve as Maximum Debt or Profit for a contractor over a specific period of time, usually over every payment cycle.

Improving Cash Flows

From Figure X it can be observed that contractors are usually in debt during the most of construction lifetime, until the retainage is released by the client at the end of the project. This debt must be financied by the contractor, through company money or though establishment of a line of credit from a bank. However, there are other methods to minimize the maximum debt of the contractor every payment cycle. These methods are listed below as:

- Acceleration of Revenues, through Mobilization Payment

- Front Loading

- Delaying of Expenses

Closing

Operation Costs and Maintenance Costs

The Operation and Maintenance Cost of a construction project include the life-cycle costs of this project over the subsequent years. It is of utmost importance for the client and the consultants to realize that, although construction cost is the the most significant as it stands as the largest amount of the overall project cost, the other cost components are also major expenditure, which in some cases their value can be equal to construction costs. Therefore, it should be carefully considered and thoroughly calculated. The expenses related to this type of cost are the following

- Land rent

- Labor and material for maintenance services and repair

- Periodic renovations

- Insurance and taxation

- Financing costs

- Utilities

- Owner's other expenses regarding the facility

Close Out Agenda

Making sure you are ready to wrap up the project and leaving it in a clean, sensible, organized financial status Including all changes change orders have been closed out and agreed Final payments have been or near to being executed Finanal Reporting and Project Trunover

Final Account

Final Account is the final cost report of the entire construction project concluding all the financial monitoring. Both the client, the consultant and the general contractor are responsible for its preparation and a collaborative effort are essential from both parties. A Final Account includes:

- Original Contract Sum

- Adjustments to Contract Sum

- Confirmation of Change Orders

- Loss/Expenses Claims

- Confirmations of Contractors Agreements to final sums

Client Care Review

Critical component of project closeout. It includes:

- Engages client for active feedback

- Offers constructive criticism to improe as a professional

- Enhances Client retention rates

Final Handover Documents

- Built Drawings

- Operation and Maintenance Manuals

- Warranties

- Final Project & Cost Management Reports, including Final Account

Notable Mentions

Technology trends in Construction Cost Management

5D Estimating Building Information Systems

Software, many, platforms, getting the data for estimation to the interest parties, inhouse software for pricing in companies, due to fierce competition

Integrated Project Delivery and Target Value Design

3D Scanning

Offsite Manufacturing

Lean Constuction

References

- ↑ Halpin D. W., Senior B. A., (2009), Financial Management and Accounting Fundamentals for Construction, John Wiley and Sons Inc., Hoboken, New Jersey

- ↑ DS/ISO 21500:2013 Vejledning i projektledelse, Guidance on project management 2.udgave, 2013-09-27

- ↑ Winch, G. M. (2010), "Managing Construction projects". Second edition

- ↑ Kim G. H. et al. (2004) Comparison of construction cost estimating models based on regression analysis, neural networks, and case-based reasoning, Building and Environment, Vol. 39, Issue 10, pp.1235-1242, Elsevier https://doi.org/10.1016/j.buildenv.2004.02.013

- ↑ Hendrickson C., Au T., (2008) Project Management for Construction: Fundamental Concepts for Owners, Engineers, Architects and Builders, Version 2.2, [URL:http://http://pmbook.ce.cmu.edu/] Retrieved on 13 December 2017

Annotated bibliography

- 1. Winch, G. M. (2010), "Managing Construction projects". Second edition

- Summary: The book presents a holistic approach of construction management. The basic principles of construction project management are presented along with different tools and techniques that aims to enhance construction performance and provide innovative techniques. The use of information and communication technologies is also a point of interest in the book.

- 2. Kerzner, H., Ph.D., (2006), "Project Management: A systems approach to planning, scheduling and controlling". Ninth edition

- Summary: The book illustrates the basic principles of project management. The book is targeting for enhancing the project skills of not only students, but also executives, pointing out that project management can be related to every profession apart from engineeering, including information systems and business.

- 3. Maylor, H. (2010), "Project Management". Fourth Edition

- Summary: This book cover all the topics of project management, focusing in the theory, as well as in the application and usage of the ideas discussed in it. The book points great emphasis into the 4D-model of the project.

- 4. Flyvbjerg, B. (2008) "Curbing Optimism Bias and Strategic Misrepresentation in Planning": Reference Class Forecasting in Practice, European Planning Studies Vol. 16, No. 1

- Summary: This paper presents the method and illustrates the first instance of reference class forecasting. The paper targets in the inaccuracy of the financial appraisal in planning in construction, explains them in terms of optimism bias and strategic representation and present a method of eliminating this inaccuracy.