Risk management in project portfolios

(→Project Portfolio Uncertainty Dimensions) |

(→Project Portfolio Uncertainty Dimensions) |

||

| Line 30: | Line 30: | ||

| | | | ||

|- | |- | ||

| − | |Engwall and Jerbrant (2003) | + | |Engwall and Jerbrant<ref name="EngwallAndJerbrant">Engwall & Jerbrant. "The resource allocation syndrome: the prime challenge of multi-project management?" Int. J. Proj. Manag. 21(6), 403-409 (2003)</ref> |

|Resourcing between projects (over-commitment and scheduling deficiencies) | |Resourcing between projects (over-commitment and scheduling deficiencies) | ||

| | | | ||

| | | | ||

|- | |- | ||

| − | |Müller et al. (2008) | + | |Müller et al.<ref name="MullerMartinsuoAndBlomquist">Mûller, Martinsuo & Blomquist. "Project portfolio control and portfolio management performance in different contexts." Proj. Manag. J. 39(3), 28-42 (2008) |

|Governance type moderates some relationships between portfolio control and success | |Governance type moderates some relationships between portfolio control and success | ||

|External dynamics moderate some relationships between portfolio control and success | |External dynamics moderate some relationships between portfolio control and success | ||

Revision as of 21:54, 1 December 2014

This article is an overview and summary of relevant body of knowledge concerning risk management in project portfolios. Project portfolio management (PPM) is the set of managerial activities that are required to manage a collection of projects and programs needed to achieve stratetic business objectives.[1]

It has been widely accepted that Risk management is an important part of Project Management. Project risk management enables an organisation to limit the negative impact of uncertain events and/or to reduce the probability of these negative events materialising, while simultaneously aiming to capture opportunities [2]. However, project risk management is only effective to a limited extent because it lacks a portfolio wide view. [3]

The information available regarding risk management at portfolio level is fairly scarce. Methods like Monte Carlo Simulations can be used to create efficient frontier charts in order to best as possible choose risk/return balance within the portfolio. Numerical methods are however often associated only with risks (known unkowns) and not uncertanties (unknown unknowns).

Contents |

Project Portfolio Uncertainty Dimensions

The uncertainties at the portfolio level can be found within three dimensions[4]: Uncertainty from organizational complexity, from environment, and from single projects.

The uncertainty from organizational complexity may stem from the system being used to manage the portfolio, the projects' relationships with the parent organization, interdependencies between projects, and other managerial features specific to the organization in question. The degree of the uncertainties based in complexity, is of course dependent on the degree to which autonomy is experienced and gained from the parent organization.[4] External uncertainties include a more complex business context in the assessment of uncertainty. The mindset is that, if broader project and business networks have an effect on single projects and their management, they will eventually impact project portfolios too. It has been shown that market and technology turbulence, and external dynamics are relevant in mediating or moderating the relationship between certain project portfolio management dimensions and project portfolio success.[4] The uncertainty derived from single projects are relevant for portfolios due to changes, deviations and unexpected events. The dependencies between projects mean that single projects might affect the entire portfolio of projects. In general it can be said that changes in single projects are reflected on changes in other projects and the portfolio as a whole.[4]

Note that uncertainties are not negative by nature, they might as well have positive effects. Uncertainties therefor include both threats and opportunities.

The below table contain findings related to and examples of the three different dimensions of uncertainty.

| Sources of uncertainties and their effect in previous empirical studies[4] | |||

|---|---|---|---|

| Source | Uncertainty from organizational complexity | Uncertainty from environment | Uncertainty from single projects |

| Christiansen and Varnes[5], Blichfeldt and Eskerod[6], Loch (2000)[7] | Politics and negotiation affect project portfolio decision making | ||

| Engwall and Jerbrant[8] | Resourcing between projects (over-commitment and scheduling deficiencies) | ||

| Müller et al.Cite error: Closing </ref> missing for <ref> tag

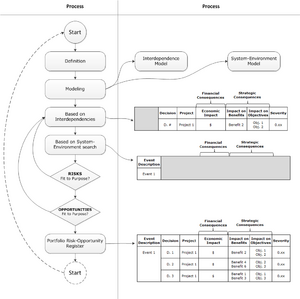

The relationship between the project portfolio success and risk management is found to be very dependent on the characteristics of portfolio and environment. High level of external turbulence, high level of portfolio dynamics (measurement of how often projects within the portfolio change), high technological uncertainty, high number of R&D projects in portfolio, etc. are all drivers for increased risk management at the portfolio level. In contrast however, these characteristics also call for a high degree of freedom and flexibility, in order to quickly and easily mitigate any threats or take advantage of opportunities. Any increase in formal risk management will lower the flexibility of projects and portfolio, but the advantages of risk management will most often justify the lowered flexibility that comes with formal processes. It should be noted that project portfolios with low external turbulence and portfolio dynamics may not profit as much from integrating risk information at the portfolio level, and the results may not be beneficial from a cost/benefit perspective.[3] A Project Portfolio Risk-Opportunity Identification FrameworkIn order to address the uncertanties present within a specific portfolio, Sanchez et al. propose a framework for project portfolio risk-opportunity identification. The output is a register, which highlights the potential events that could impact the achievement of the goals. Using this framework, the links between an organization's strategic objectives and project portfolio processes are maintained and the uncertainty of achieving these strategic goals is decreased.[9] Steps of the FrameworkThe framework is build up of 7 distinct steps:[9]  Flow of Framework Steps and Respective Outputs[9]

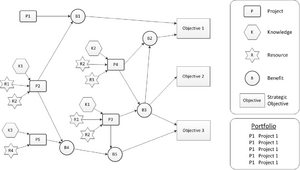

Interdependence Model Interdependence model showing how objectives and projects are linked[9] A range of dependencies between projects can be mapped with regards to different views on dependency. In this specific framework dependencies are looked at from three perspectives: Resource dependency, strategic dependency, and knowledge dependency. Resource dependency occurs when projects are linked due to shared resources. Strategic dependency occurs when projects work in collaboration to achieve the mission of an organization. Knowledge dependency exists when different projects share the same knowledge, whether generating it or using it as input to develop something else. Note that the interdependence model does not consist of a hierachical structure of project interrelations, but rather a network where projects are interconnected in terms of their contribution to the benefits and final goals of the organization. I.e. Strategic resources such as specialists or special equipment are modeled as inputs to projects.[9]

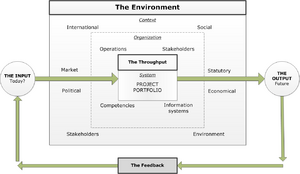

System-Environment Model System-environment model adapted from Hayes (2000)[9] The system-environment model consists of five key elements (adapted from Hayes (2000)):[9]

The system as a whole is viewed as the project portfolio in question. The project portfolio can therefor be seen as the throughput whereby the organization implements the strategic plan to reach its vision. The risk-opportunity identification is oriented to increase the probability of the goal achievement, meaning that the search focuses on circumstances that may decrease or increase the chance of achievement. In this perspective risks are seen as circumstances threatening the achievement and opportunities as circumstances facilitating it.[9]

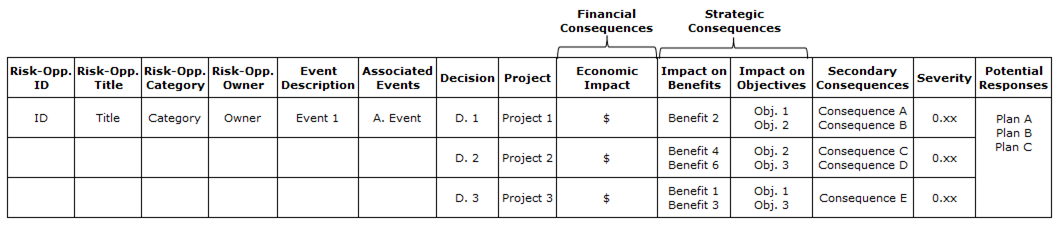

The Risk-Opportunity Register The risk-opportunity register[9] The final risk-opportunity register shows the events that may produce consequences. The register contains the following columns:[9]

ConclusionUncertainty in project portfolios stem from a variety of areas. The uncertainty at the portfolio level is produced by project uncertainties, but it is not enough for portfolio managers to only consider risk and opportunities which arise at the project level. The fact that synergies and project dependencies reside within the context of the project portfolio, means that portfolio managers must also identify joint uncertainties and their implications on the portfolio level.

References

|

|||