Net Present Value (NPV)

Written by Deepthi Tharaka Parana Liyanage Don- s203116

Contents |

Abstract

Financial appraisal is a method used to evaluate the viability of a proposed project or portfolio of investment projects by evaluating the benefits and costs that result from its execution. Investment decisions of the management are critical to a company since it decides the future of the company. This article discusses the Net Present Value (NPV) method which is widely used in financial appraisal. NPV is a dynamic financial appraisal method that considers the time value of money by applying discounting and compounding of all payment series during the investment period[1]. In simple terms, the net present value is the difference between an investment object’s incoming and outgoing payments at present time. NPV is determined by calculating the outgoing cashflows (costs) and incoming cash flows (benefits) for each period of an investment. After the cash flow for each period is calculated, the present value (PV) of each one is achieved by discounting its future value using the suitable discount rate. Net Present Value is the cumulative value of all the discounted future cash flows[2].

Firstly, this article discusses the idea behind the Net Present Value method. Then this introduces the NPV calculation method[1] and describes the importance of the variables in the formula such as discount rate. Also, it highlights the decision criteria behind NPV and explains it with a real-life application. Finally, it critically reflects on the limitations of this method and briefly introduces the other alternative financial apprisal methods such as Internal Rate of Return (IRR), payback method, and Return on Investment (ROI).

Big Idea

Project business case development is a critical point in a project where it uses to obtain the approval for investment in the project by presenting the benefits, cost, and risk associated with alternative options and the method of selecting the preferred solution. In a business case, financial appraisal plays a key role to answer the fundamental economic questions of whether an investment should be made and which project should be chosen among a selection of different alternatives. Because the task of financial appraisal is to predict the financial effects of planned investment and to present the data in such a way that a reasoned investment decision can be reached[1]. The net present value (NPV) method is the most frequently used approach in the financial appraisal of a project.

What is NPV?

Net Present Value (NPV) is the present value of the future net cash flows of an investment project. In simple terms, the net present value (NPV) is the difference between the present value of all future incoming cash flows and the present value of all future outgoing cash flows. NPV is a widely used method in financial appraisal that considers the time value of money by applying discounting or compounding of all payment series during the investment period[3].

Time value of money

Time value of money means that a sum of money is worth more now than the same sum of money in the future. That is because the money you have now can use it to make more money by running a business, buying something now and selling it later for more, or simply putting it in the bank and earning interest. Money can grow only through investing and investment delay is an opportunity cost where not having the money right now also includes the loss of additional income, which could be earned by simply having cash earlier. [invest-change]Future money is also less valuable because inflation erodes its buying power. Moreover, receiving money in the future rather than now may involve some risk and uncertainty regarding its recovery. For these reasons, future cash flows are worth less than the present cash flows. NPV assesses the profitability of a given project on the basis that cash flow in the future is not worth the same as a cash flow today. The time value of money is recognized in NPV by applying discounting or/and compounding to all payment series during the investment period[3].

Formula

The following formula use these common variables:

– Present Value

– Present Value

- time of the cashflow

- time of the cashflow

- Cash inflows in period t

- Cash inflows in period t

– Cash outflows in period t

– Cash outflows in period t

=

=  – Net cashflow in period t

– Net cashflow in period t

– Investment in t=0

– Investment in t=0

– Liquidation proceeds in t=n

– Liquidation proceeds in t=n

– The discount rate

– The discount rate

– Total number of periods

– Total number of periods

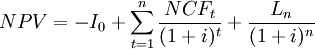

In order to consider the time value of money the net present value method considers the value of an investment at the present time by converting all information of the future into a key figure at the time today. This projection of the value that a future cash flow has in the present is called "present value" (PV).

Projection figure

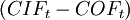

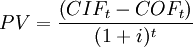

To get the Present value (PV) of future cash flows, they are discounted using:

For example, if a project is expected to receive $5,000 with 10% discount rate after 4 years, its present value (PV) can be calculated as:

Net present value combines these projections of net cash flows to assess the overall value of a project from the present view. In simple terms, The net present value is calculated from the difference of the present value of all future incoming cash flows(revenues/benefits) and the present value of all future outgoing cash flows(costs).

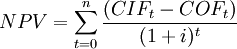

The net present value is given by:

The difference between the cash inflows and cash outflows  gives the net cash flow

gives the net cash flow  of the corresponding period. For normal investments which are characterized by initial investment

of the corresponding period. For normal investments which are characterized by initial investment  , discounting of the expected net cash flows to t = 0 achieves comparability with the initial investment. Subtracting the initial investment outlay

, discounting of the expected net cash flows to t = 0 achieves comparability with the initial investment. Subtracting the initial investment outlay  from the present value of the net cash flows gives the net present value (NPV). If a possible final payment

from the present value of the net cash flows gives the net present value (NPV). If a possible final payment  for the liquidation of the investment in t = n is also considered, the calculation of the net present value can formally be written as follows:

for the liquidation of the investment in t = n is also considered, the calculation of the net present value can formally be written as follows:

As a summary, the following steps are recommended for the calculation of the Net present value[1]:

- Determination of the initial outflow for the investment

.

.

- Estimate the expected net cash flows

from the investment for each period of the planning horizon.

from the investment for each period of the planning horizon.

- Determination of the discount uniform rate

(it is assumed that the discount rate remains unchanged over the life of the investment), in other words, the rate of return required by the investor.

(it is assumed that the discount rate remains unchanged over the life of the investment), in other words, the rate of return required by the investor.

- Discounting of the expected net cash flows

with the discount rate to the time period when the investment is made (determination of the present value).

with the discount rate to the time period when the investment is made (determination of the present value).

- Subtraction of the initial investment

from the present value. This yields the net present value (NPV).

from the present value. This yields the net present value (NPV).

Note that This specification also allows the possible incorporation of payments from earlier periods and time periods t < 0 can also be considered. The discount factor 1/(1 + i)t is automatically converted into a compounding factor and the final value of all cash flows which occur before time 0 is correctly assessed in t = 0[1].

Other NPV Formula

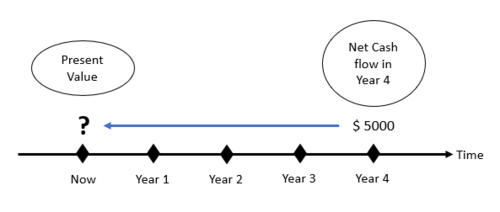

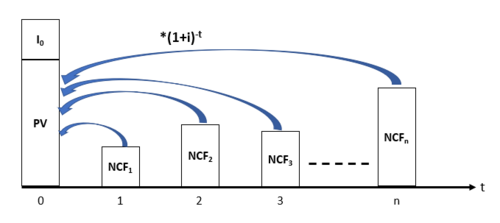

NPV of an annuity

If the net cash inflows are uniform and equidistant and occur at the end of each period, the series of net cash flows can be interpreted as an annuity [1]. The payments or receipts occur at the end of each period for an ordinary annuity while they occur at the beginning of each period for an annuity due. Using the formula for the present value of an ordinary annuity, it follows that:

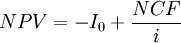

NPV of a perpetuity

For the special case that  is considered as perpetuity, which is given for an infinite and constant stream of identical cash flows the NPV can be expressed as follows:

is considered as perpetuity, which is given for an infinite and constant stream of identical cash flows the NPV can be expressed as follows:

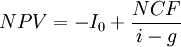

NPV with growing perpetuity

In the case where the net cash flows  are growing indefinitely at the rate g (growth rate) with g < i the NPV can be obtained as:

are growing indefinitely at the rate g (growth rate) with g < i the NPV can be obtained as:

Discount Factor

Selection

The discount rate will be company-specific as it’s related to how the company gets its funds. It’s the rate of return that the investors expect or the cost of borrowing money. If shareholders expect a 12% return, that is the discount rate the company will use to calculate NPV. If the firm pays 4% interest on its debt, then it may use that figure as the discount rate. Typically the CFO’s office sets the rate. (refresher note) In applied work, the assumption of a perfect capital market is not defendable. Investments are financed using equity and/or debt and different costs of capital exist. If an investment is financed exclusively with equity, the discount rate can be derived from an alternative return available in the capital markets (cost of equity) or the average return of a similar investment object. Investments that are exclusively debt-financed can be assessed using the cost of debt to discount the net cash flows. If an investment relies on both equity and debt financing, the discount rate can be calculated as the weighted average of cost of equity and cost of debt. In this respect, the discount rate can be interpreted as the minimum rate of return that the investor demands for his activities [1].

Importance

It is worth noticing that the discount rate is a critical factor because it is not neutral to the net result of the comparison of costs and benefits; in fact, a high rate reduces the impact of what happens in the last years analyzed, whereas on the opposite a low discount rate reduces the impact of what happens in the first years considered7. As transport infrastructure are characterized by high costs in their first stage of life while benefits emerge only after the construction stage, the adoption of a (relatively) high discount rate may be considered a prudential choice, since it gives more importance to what happens in the first years of the infrastructure project when the flow of costs and benefits may be estimated more accurately. Due to the relevance of the discount rate on the goodness of the analysis, a reference value is often suggested by the institutions interested in supervising public investments; notwithstanding analysts may adopt a different discount rate on justification [2].

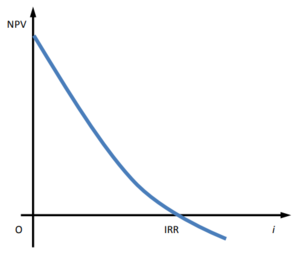

The NPV depends on the choice about the discount rate, and on the time span considered by the analysis. Regarding the choice of the discount rate it is important to consider that the NPV is an inverse function of the discount rate i used in Eq. (5.1), as shown in Fig. 5.2 illustrating that the higher the interest rate, the smaller the net present value. Graph 1

Moreover, in case of a comparison among several mutually exclusive investment alternatives, the NPV gives a precise rank order only if the discount rate is univocally determined. Otherwise, the analysis may fall into one of the three cases shown in Fig. 5.3 where the relationship between NPV and the discount rate (i) is compared for two alternatives (labeled I and II, respectively).

Time period

Decision rule

This gives the decision criteria of NPV.

Applications

As per the above equation, (1+r) n is called the future value factor. There are pre-defined tables that specify the rate of interest and its value after ‘n’ number of years. It can also be utilized with the help of a calculator or an excel spreadsheet as well. The below snapshot is an instance of how the rate is calculated for different interest rates and at different time intervals.

Limitations

Introduce the limitations of NPV

Alternative financial appraisal methods

This section gives a brief idea about other methods

- IRR

- payback

- ROI

Annotated Bibliography

Reference Example: The book-1.[1] The book-2.[2] The book-3.[3] The book-4.[4] The book-5.[5]

References

- ↑ 1.00 1.01 1.02 1.03 1.04 1.05 1.06 1.07 1.08 1.09 1.10 1.11 Häcker J. and Ernst D., Ch. 8 - Investment Appraisal. In: Financial Modeling. Global Financial Markets., (Palgrave Macmillan, London, 2017), pp. 343-384, https://doi.org/10.1057/978-1-137-42658-1_8

- ↑ 2.0 2.1 2.2 Ferrari, C., Bottasso, A., Conti, M. and Tei, A., Ch. 5 - Investment Appraisal. In: Economic role of transport infrastructure: Theory and models., (Elsevier, 2018), pp. 85-114, https://doi.org/10.1016/C2016-0-03558-1

- ↑ 3.0 3.1 3.2 Konstantin P. and Konstantin M., Ch. 4 - Investment Appraisal Methods. In: Power and Energy Systems Engineering Economics., (Springer, Cham, 2018), pp. 39-64, https://doi.org/10.1007/978-3-319-72383-9_4

- ↑ Poggensee K. and Poggensee J., Ch. 3 - Dynamic Investment Calculation Methods. In: Investment Valuation and Appraisal., (Springer, Cham, 2021), pp. 85-140, https://doi.org/10.1007/978-3-030-62440-8

- ↑ Ing E. and Lester A., Ch. 6 - Investment Appraisal. In: Project Management, Planning and Control. 7th Edition., (Elsevier, 2017), pp. 29-36, https://doi.org/10.1016/B978-0-08-102020-3.00006-1

![N P V=-I_{0}+N C F \cdot\left[\frac{(1+i)^{n}-1}{i \cdot(1+i)^{n}}\right]+\frac{L_{n}}{(1+i)^{n}}](/images/math/f/b/b/fbb9818d6744581d2a9ff5023d8e9138.png)