Metrics in Portfolio management

Contents |

Abstract

According to the Project Management Institute (PMI), a metric is a "description of a project or product attribute and how to measure it" [1]. It is, indeed, a quantitative measure of performance or outcome that provides a basis for comparison, evaluation, or improvement.

Peter Drucker famously said, "if you can not measure it, you can not improve it". However, it is not enough just to measure. The ultimate purpose of metrics is, as well, to provide the right information to the right person at the right time, using the correct media and in a cost-effective manner [2]. Notably, building effective metrics is extremely relevant when it comes to decision making at all levels of a company, project or portfolio. Thereby, knowing specifically what to measure when it comes to portfolio management is a must to ensure the future of the organization.

One the other hand, it is relevant to note that advances in project metrics have been rapid, but advances in portfolio metrics have been slow because not all companies maintain a project management office (PMO) dedicated to portfolio management activities. This leads to changes in the role of the project manager, the metrics used, and the dashboard displays [2].

The purpose of this article is to describe the type of metrics needed to evaluate Portfolio performance and outline their differences from the well-known metrics to measure Project performance. Firstly, this article will focus on introducing to general terms. Secondly, the relevant role of the portfolio management will be highlighted. Hereafter, what is needed to create an effective metric will take part in this essay. Lastly, different useful metrics and techniques for portfolio management will be listed and explain in detail.

General terms

Firstly, to understand the topic under study, both the basics of Portfolio Management and Metrics need to be introduced.

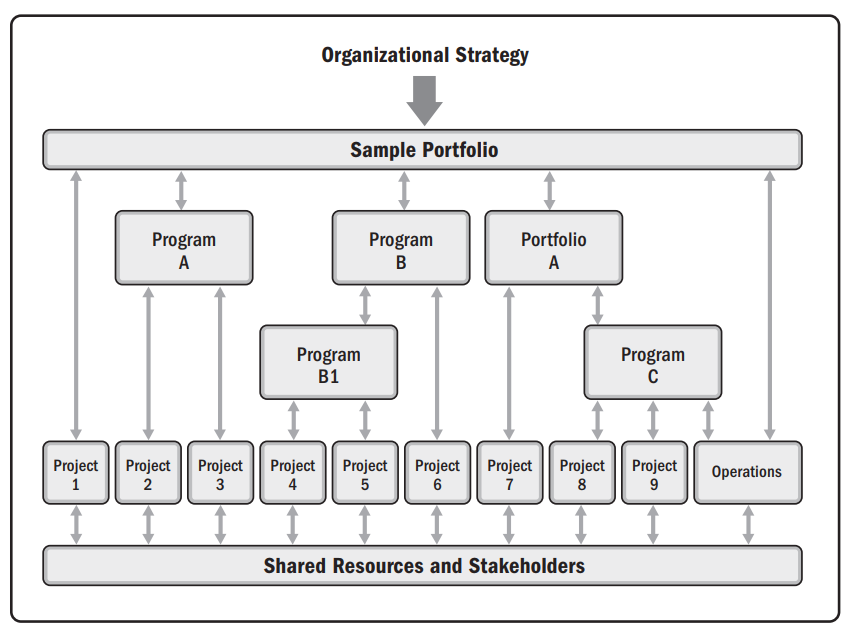

Portfolio management is the centralized management of one or more portfolios to achieve strategic objectives. It is the application of portfolio management principles to align the portfolio and its components with the organizational strategy [1].

Roles and responsibilities of a portfolio management PMO

The PMO generally establishes the metrics needed to validate the performance of the overall portfolio of projects.

Effective metrics

Value based metrics vs. Traditional metrics

"Project Management Metrics, KPIs, and Dashboards" by Harold Kerzner [2] highlights the key differences between traditional metrics and value-based metrics and explains how each type of metric can be useful. It is argues that traditional metrics are useful for tracking project performance and ensuring that it is completed within the constraints of the triple constraint model (time, cost, and scope) called Iron triangle. However, these metrics may not necessarily provide a comprehensive view of the projects' overall value to the organization.

On the other hand, value-based metrics are centered on the strategic objectives and intended benefits. They help to ensure that the projects are aligned with the organization's strategic objectives and that it generates the expected benefits. However, value-based metrics may be more difficult to measure and track than traditional metrics. The definition of value and how it is measured can differ depending on the industry, company, and the characteristics of the business. Different stakeholders may have their own ideas of what value means to them, such as job security, profitability, reputation, or the creation of intellectual property. It can be challenging to meet the needs and expectations of all stakeholders at once

Notably, while traditional metrics have as primarily audience the project manager and the team, value (or value reflective) metrics are more useful for the clients/stakeholders.

The importance of the value component in the definition of success cannot be overstated. When management makes poor decisions managing project portfolios, companies end up working on the wrong projects. For example, the deliverable requested can be produced but either there is no market for the product or stakeholders may be displeased with management’s performance.

In any case, Kerzner suggests that the use of value-based metrics and traditional metrics in combination can provide a more accurate and comprehensive assessment of the project's performance. The traditional metrics can be used to monitor the performance of the project and ensure that it is completed within the constraints of the triple constraint model. The value-based metrics can be used to measure the project's overall impact on the organization and assess its contribution to the organization's strategic objectives.