Risk Management in Oil and Gas Industry

Oil and Gas industry is one of the most critical operations in the production sphere. Therefore, every state of the art technology and methodology is implemented straight into the highly demanding management and pro-duction processes. Project Management techniques and especially Risk Management [1][2][3], are widely used in order to provide appropriate responses to the emerging cross disciplinary risks; environmental, technical, financial and managerial. Risk Management is a systematic handling of the potential risks and is divided into the Risk Management Planning, Risk Identification [4], Risk Analysis[5], Risk Response Planning and Risk Control processes. The purpose of the article is to describe the Risk Management toolset and techniques, present and analyse their recent performance in the Oil and Gas industry.

Contents |

Introduction

Risk Categories

Environmental Risks

Engineering Risks

Economical Risks

Managerial Risks

Risk Management

Risk Management Planning

Risk Identification

Risk Analysis

Risk Response Planning

Risk Control

Case study: Dong Energy

Dong Energy's perception to the risks encountered is that they are "natural part" of their activities and at the same time a "precondition" for profits [1] [2]. They manage the risks to ALARP (As Low As Reasonably Practicable) levels via risk management.

Structure and Management

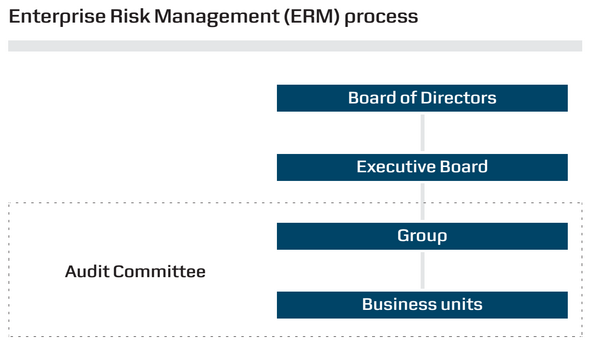

The organization established to various internal boards and committees (see Figure 1) that are responsible for monitoring and responding the risks. At portfolio level the risks are split to various activities (not only in the oil industry) in order to minimize the dependency to one activity and at the same time maximize their flexibility. The risk is controlled via investing and divesting with responsibility of the Group Executive Management. Risk management planning is assessed and revised yearly in order to identify and prioritize possible risks. The top risks at this level are categorized according to their time length (short-term, long-term and recurring), to their type (market, operational and regulatory) and to their level of possible management influence. Finally they are ranked according to their potential influence on the company's value and creditability.

Potential Risks

Among the top 10 risks lay Market risks (#1), development and construction of production assets (#2), renegotiation of oil-indexed gas contracts (#3), construction of the Hejre platform (#4) and oil and gas reserves replacement (#9). The uncertainty is clarified to the production volumes, sales volumes and to the future gas purchase contracts. Since, Dong's portfolio expands beyond the limits of the petroleum enterprise there are risks related to other activities such as wind or heating energy.

Risk mitigation

It is useful to comment that the largest risk was the Market risks due to the unstable oil price, while the construction assets were delayed due to challenges. Also, it must be underlined the construction of the Hejre (#4) was separated from the construction assets (#2) because of its financial size. At this point the reflexes of the organizations seem accurate enough to identify and predict a specific emerging risk and separate it from the others in order to optimize its management. Finally, it should be noted that risks that were successfully encountered like the renegotiation of oil-indexed gas contracts, decreased at the importance scale.

Comments

In terms of financial risk management it could only be described as a success story the ability to withstand the prolonged oil-price drop via openings to other types of energy forms. Mitigation techniques are used in order to encounter the risks such as price hedging contracts, insurance back-up, its organizational structure fluctuations and operational adjustments. For example the risk of reduced cash flows was mitigated by hedging agreements.

Case study: A.P. Moller - Maersk Group

Maersk Group follows a different approach on the risk management[3].

Risk Categorization

First of all the risks are divided to known and emerging risks. The known risks are evaluated according to their overall risk trend to stable or increasing. The four major risks were identified: supply and demand fluctuations at the container line, oil price, major oil spill and major cyber-attack.

Risk Mitigation

The first one is a disturbance in the East-West trades due to overcapacity and it was mitigated by a smart and competitive business network, improving customer loyalty and simplifying the organization platforms. The oil price drop risk was mitigated by ending the small and fragile contract and by focusing at large and stable contractors that need high quality drilling operations. Major oil spill risk is characterized stable, despite the fact that deeper and high temperature - high pressure (HT/HP) reservoirs are engaged, because of the simultaneous implementation of initiatives. Finally, the cyber-attack is highly graded due to the large dependency of the Group to the logistics and the internal communication and safeguard. Therefore is closely monitored and money are invested to develop counter-measures to new types of high-tech cyber-attacks. Emerging risks due to huge developments at shale gas and oil production at USA, could eventually cause disturbance in the demand of containerized transportation and therefore capital allocation with horizon of 3-5 years is considered. In order to visualize the internal cash flow between different sectors within the Group a correlation matrix is constructed. If the correlation is positive the relationship is flourishing (and vice versa), whereas if the correlation is zero there is no connection.

Structure and responsibility

The risks are managed by an enterprise risk management process that it is presented frequently to the board and also it is audited by external committee.

Comments

The complexity of the portfolio management enlarges due to the vast overboard spreading (over 130 countries with different social-political circumstances and conditions etc.). The risk was reduced up 34% because of the merging of the four business units (Maersk Drilling, Maersk Oil Maersk Line, APM Terminals) to one coagulation rather than stand-alone risk control.

Conclusion

Annotated bibliography

- ↑ 1.0 1.1 "http://assets.dongenergy.com/DONGEnergyDocuments/com/Investor/Annual_Report/2014/dong_energy_annual_report_en.pdf"

- ↑ "http://griuk.dongenergy.com/pdf/uk/28-29.pdf"

- ↑ http://files.shareholder.com/downloads/ABEA-3GG91Y/0x0x577327/558ecc77-6292-48e8-a624-75d0493b55d6/Risk_Management_UK.pdf

- ↑ http://files.shareholder.com/downloads/ABEA-3GG91Y/0x0x577327/558ecc77-6292-48e8-a624-75d0493b55d6/Risk_Management_UK.pdf