Risk Management in Oil and Gas Industry

Oil and Gas industry is one of the most critical operations in the production sphere. Therefore, every state of the art technology and methodology is implemented straight into the highly demanding management and production processes. Project Management [1] techniques and especially Risk Management [2][3][4], are widely used in order to provide appropriate responses to the emerging cross disciplinary risks; environmental, technical, financial and managerial. Risk Management is a systematic handling of the potential risks and is divided into the Risk Management Planning, Risk Identification [5], Risk Analysis[6], Risk Response Planning and Risk Control processes. The purpose of the article is to describe the Risk Management toolset and techniques, present and analyse their recent performance in the Oil and Gas industry.

Contents |

Introduction

Risk Management is a vital part for Oil and Gas enterprise. Despite the over-a-century experience of production, the accidents and the downfalls seem to occur endlessly. The risks are described by diversity, multi-factor roots and high level of complexity and uncertainty. This article's purpose is to review the mindset in the industry via case study scenarios and present a compilation of the toolset currently implemented.

Risk Categories

The risk can be categoriazed either according to their influence in various Key Performance Indicator's [7] or their special nature and their time duration. It is important to underline that all of them are internally connected and if not fastly encounter could become leathal for any activity. The risks at this report are divided as Yanting et al. proposed: [1]

Natural environmental Risks

Natural environment risk can be either climatic risks or geologic risks. The first ones involve the risk increation due to extreme cold or heat or rainfalls tornedo's etc. that are derivations from the normal conditions and extra complications in the completition of a task. The geological risks enfold every aspect regarding the reseroir conditions and characteristics estimation which affect the whole production estimations and procedure. The latter are described by high uncertainty.

Engineering Risks

Engineering risks are seperated to exploration (eg reserves estimation), development (eg wrong extraction method or engineering complex challenges) and construction risks.

Management Risks

These risks contain primary human resource risk which means the overall quality, the international comminication, the cultural differences, the leadership etc. Another factor is the organizational risk such as planning that does not reflect possible activities, misjudgements etc. Also operating equipment risks, dispute risks, environmental protection risks exist at this category.

Economical Risks

Economical risks are financial, market, economic policy risks.

Case study: Dong Energy

Dong Energy's perception to the risks encountered is that they are "natural part" of their activities and at the same time a "precondition" for profits [2] [3]. They manage the risks to ALARP (As Low As Reasonably Practicable) levels via risk management.

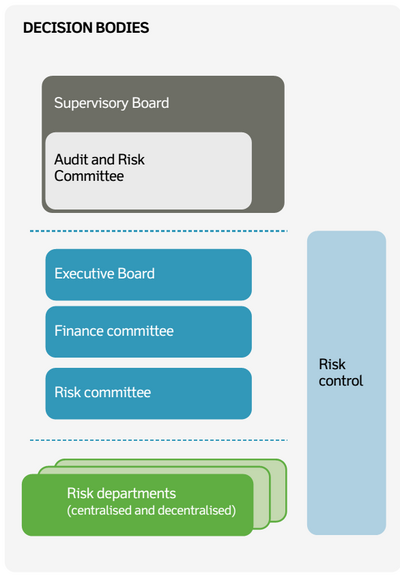

Structure and Management

The organization established to various internal boards and committees (see Figure 1) that are responsible for monitoring and responding the risks. At portfolio level the risks are split to various activities (not only in the oil industry) in order to minimize the dependency to one activity and at the same time maximize their flexibility. The risk is controlled via investing and divesting with responsibility of the Group Executive Management. Risk management planning is assessed and revised yearly in order to identify and prioritize possible risks. The top risks at this level are categorized according to their time length (short-term, long-term and recurring), to their type (market, operational and regulatory) and to their level of possible management influence. Finally they are ranked according to their potential influence on the company's value and creditability.

Potential Risks

Among the top 10 risks lay Market risks (#1), development and construction of production assets (#2), renegotiation of oil-indexed gas contracts (#3), construction of the Hejre platform (#4) and oil and gas reserves replacement (#9). The uncertainty is clarified to the production volumes, sales volumes and to the future gas purchase contracts. Since, Dong's portfolio expands beyond the limits of the petroleum enterprise there are risks related to other activities such as wind or heating energy.

Risk mitigation

It is useful to comment that the largest risk was the Market risks due to the unstable oil price, while the construction assets were delayed due to challenges. Also, it must be underlined the construction of the Hejre (#4) was separated from the construction assets (#2) because of its financial size. At this point the reflexes of the organizations seem accurate enough to identify and predict a specific emerging risk and separate it from the others in order to optimize its management. Finally, it should be noted that risks that were successfully encountered like the renegotiation of oil-indexed gas contracts, decreased at the importance scale.

Comments

In terms of financial risk management it could only be described as a success story the ability to withstand the prolonged oil-price drop via openings to other types of energy forms. Mitigation techniques are used in order to encounter the risks such as price hedging contracts, insurance back-up, its organizational structure fluctuations and operational adjustments. For example the risk of reduced cash flows was mitigated by hedging agreements.

Case study: A.P. Moller - Maersk Group

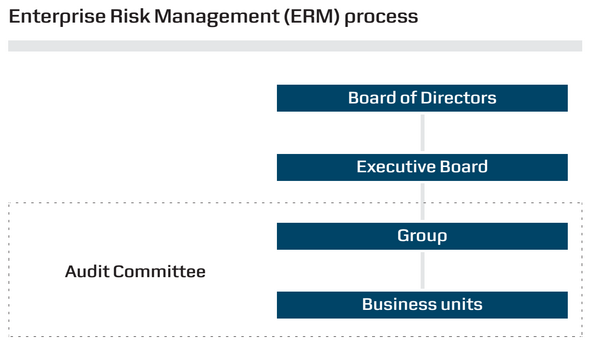

Maersk Group follows a different approach on the risk management. The main focus of their analysis is the internal relationships between the four business units (Maersk Drilling, Maersk Oil Maersk Line, APM Terminals). The risks are managed by an enterprise risk management process that it is presented frequently to the board and also it is audited by external committee (see Figure 2). [4].

Potential Risks

First of all the risks are divided to known and emerging risks. The known risks are evaluated according to their overall risk trend to stable or increasing. The four major risks were identified: supply and demand fluctuations at the container line, oil price, major oil spill and major cyber-attack.

Risk Mitigation

The first one is a disturbance in the East-West trades due to overcapacity and it was mitigated by a smart and competitive business network, improving customer loyalty and simplifying the organization platforms. The oil price drop risk was mitigated by ending the small and fragile contract and by focusing at large and stable contractors that need high quality drilling operations. Major oil spill risk is characterized stable, despite the fact that deeper and high temperature - high pressure (HT/HP) reservoirs are engaged, because of the simultaneous implementation of initiatives. Finally, the cyber-attack is highly graded due to the large dependency of the Group to the logistics and the internal communication and safeguard. Therefore is closely monitored and money are invested to develop counter-measures to new types of high-tech cyber-attacks. Emerging risks due to huge developments at shale gas and oil production at USA, could eventually cause disturbance in the demand of containerized transportation and therefore capital allocation with horizon of 3-5 years is considered. In order to visualize the internal cash flow between different sectors within the Group a correlation matrix is constructed. If the correlation is positive the relationship is flourishing (and vice versa), whereas if the correlation is zero there is no connection. The complexity of the portfolio management enlarges due to the vast overboard spreading (over 130 countries with different social-political circumstances and conditions etc.). The risk was reduced up 34% because of the merging of the four business units to one coagulation rather than stand-alone risk control.

Case study: BP

BP[8] is organizes risk management activities at three major categories: day-to-day risk management, business and strategic risk management and oversight and governance. Their relationship looks like a chain that has some individual parts and some connected. Especially the second one act like a communication pot between the facilities and the board.

The structure

The structure of the internal executive committees, looks similar to the previous two organizations. However, an extreme risk like the Mexico Gulf Oil spill is encountered by a seperate committee devoted only on this matter. In terms of response it seems like a serious attempt to response to the risk.

Potential Risks

The risk management is planned in a yearly basis, but with the possibility to reshape it even more often if an unexpected risk is encountered. The current risk management is focused on the effects of the major oil spill of the Mexico Gulf which resulted a wide variety of risks. Legal strategy for litigation, environmental remediation, oil spill effects mitigation, reputation restoration, compliance with government agreements and settlements. Other potential risks: a) strategical and commercial risks that could emerge such as geopolitical risks (eg situation at Ukraine on 2014), b) Strategic and commercial risks (Prices and markets, Access, renewal and reserves progression, Major project delivery, Geopolitical, Rosneft investment, Liquidity, financial capacity and financial, including credit, exposure, Joint arrangements and contractors, Digital infrastructure and cybersecurity, Climate change and carbon pricing, Competition, Crisis management and business continuity and Insurance). c) Safety and operational risks (Process safety, personal safety, and environmental risks, Drilling and production, Security, Product quality) and d) Compliance and control risks (US government settlements, Regulation, Ethical misconduct and non-compliance, Treasury and trading activities and Reporting)

Major projects delivery that contribute a lot the financial planning and cash flow balance are encountered also as potential risk. Therefore, they are monitored closely throughout their life circle and evaluated with predefined indicators in order to implement nessessary improving corrections or even discontinue an activity.

Conclusion

Annotated bibliography

- ↑ Yanting Z. and Liyun X. Research on Risk Management of Petroleum Operations, Energy Procedia, 5, pp.2330-2334.

- ↑ 2.0 2.1 "http://assets.dongenergy.com/DONGEnergyDocuments/com/Investor/Annual_Report/2014/dong_energy_annual_report_en.pdf"

- ↑ "http://griuk.dongenergy.com/pdf/uk/28-29.pdf"

- ↑ http://files.shareholder.com/downloads/ABEA-3GG91Y/0x0x577327/558ecc77-6292-48e8-a624-75d0493b55d6/Risk_Management_UK.pdf

- ↑ http://files.shareholder.com/downloads/ABEA-3GG91Y/0x0x577327/558ecc77-6292-48e8-a624-75d0493b55d6/Risk_Management_UK.pdf

- ↑ http://www.bp.com/content/dam/bp/pdf/investors/BP_Annual_Report_and_Form_20F_2014.pdf