Bubble diagram as visual tool

Contents |

Abstract

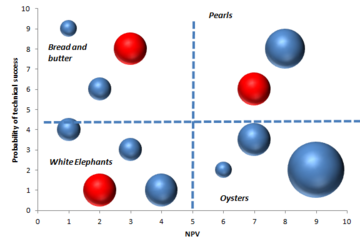

The bubble diagram is a graphing technique used in project portfolio management to making decision, especially to display balance in new product project portfolios. These visual representation is an adaptation of the four quadrant BCG (star; cash cow; dog; wildcat) diagrams developed in 1970 by Bruce D. Handerson as strategy models [1]. The diagram is a variant of the regular x-y plot, where circle or ellipse are used instead the single points, and extra information are provided by varying the shape, the size and the colour. Furthermore the chart can usually be divided in four section to facilitate recognition of different situations. The most popular chart is the risk-reward which shows the probability of success on the vertical axis and the NPV ( Net Present Value) over a period of time on the horizontal axis.[2] The risk-reward portfolio mapping involves keeping the projects into four different categories:

- Pearls: high probability of success and generate high payoffs

- Oysters: long shots, but with high payoffs

- Bread & Butter: low-risk projects with low rewards

- White Elephants: low probability and low payoff projects

However it is possible to plot other different parameters on these bubble diagrams in order to seek balance:

- Ease vs attractiveness

- Strength vs attractiveness

- Cost vs timing

- Strategic vs benefit

- Cost vs benefit

This method is widely used by the companies even if just a small percentage use it as the dominant. This article aspirates to perform an overview of the bubble diagram method and its uses through some practical example and a comparison with other visual tools and different methods as the financial methods, strategic methods and scoring model. [3] Furthermore will be analyzed the advantages and the disadvantages of this method and will be discussed if actually can give a real help to the decision making in Portfolio Management.

Introduction to visual tools and portfolio management

Traditional project management is a process whereby each project is approved and managed independently focusing on the triple constraint (scope, time, cost) of the single project separate from other projects. [4] By contrast Portfolio management is a dynamic decision process, whereby a business’s list of active new product (and development) projects is constantly updated and revised. In this process, new projects are evaluated, selected and prioritized; existing projects may be accelerated, killed or de-prioritized; and resources are allocated and reallocated to active projects. The emphasis of portfolio management is on ensuring that each project contributes to the overall organizational success.[5]

To achieve this success, many different tools and methods are used. Below the main goals setted by using portfolio management are listed and the importance of the bubble charts to reach few of them is highlighted :

- Maximize the value of the portfolio for a given resource expenditure.

- Maintain the competitive position of the business.

- Balance choosing the right mix of projects : for this point, the use of bubble diagram and other visual tools is important in order to reach the best results.

- Achieving a strategically aligned portfolio : Also for this goal, the bubble chart results really usefull.

- Achieving the right number of projects for the limited resources available.

Bubble diagram

Bubble charts are useful graphs for comparing the relationships between data objects in more than 2 numeric-data dimensions: the X-axis data, the Y-axis data, and the other data represented by the bubble size, color and shape.

In project portfolio, using the bubble charts can be a great help in making insightful business investment decisions.

In order to avoid misleading charts, is important to understand the relationship between the bubble size and the data represented by the size. In the common case of circular bubbles, if the data is proportional to the radius, the data will be altered since the bubble area grows exponentially as the square of the radius ( ). For a better representation of the data, bubble data should be represented directly by the area using the circumference of the circle, in this case the bubble grows linearly in relationship to the diameter (

). For a better representation of the data, bubble data should be represented directly by the area using the circumference of the circle, in this case the bubble grows linearly in relationship to the diameter ( ).

However, sometimes if one wants to exaggerate the differences or a more easily contrast between two projects, could be useful represent the data proportional to the radius. [7]

In portfolio management projects , visual charting techniques , as bubble diagram, are employed in order to display balance in new product project portfolios.

The most widely used and highly popular bubble diagram in portfolio management is the one that displays project risk (probability of success) on y axis and reward on X axis.

).

However, sometimes if one wants to exaggerate the differences or a more easily contrast between two projects, could be useful represent the data proportional to the radius. [7]

In portfolio management projects , visual charting techniques , as bubble diagram, are employed in order to display balance in new product project portfolios.

The most widely used and highly popular bubble diagram in portfolio management is the one that displays project risk (probability of success) on y axis and reward on X axis.

The risk-reward portfolio mapping involves keeping the projects into various categories as per the quadrant they fall into. As mentioned before, each quadrant correspond to a different situation distinguished from the others by a particular name. Below a brief description for every quadrant is reported:

- Bread and Butter (upper left): These type of projects have high probability of success but low reward. They are are small, simple projects which include extensions, modifications, fixes and updating.

- White Elephants (bottom left). These are the projects with low probability and low reward. Every business wants to avoid them, but inevitably there are always few and they are difficult to kill. In this case there are too many of them.

- Pearls (upper right quadrant): Most businesses aspire more of these. These are the potential star products, projects with a high probability of technical success, and which are also expected to give a very high reward. There are two Pearl projects, and one of them has been allocated considerable resources (denoted by the sizes of the circles).

- Oysters (bottom left): These are the long-shot projects, where high reward is expected, but as the same time also a low probability of technical success. These are the projects where technical innovations will open the way for solid payoffs. [8]

An example of bubble diagram is shown in Figure 1 where the size of each bubble shows the annual resources spent on each project (Euros per year or people or work-months allocated to the project) and the color shows the timing : The red color is for projects with imminent lunch, while the blue colors represents an early stage project.

Analyzing this example, is possible to notice the high number of White Elephants that should be reduced, but on the other hand there are good investments for Oysters resources that means possible innovations in the future. The lack of Pearls is easily visible and at the same time there is a balanced number of Bread and Butter. Is important to don’t have big bubbles in Bread and Butter which means much money and resources spent for low value projects.

A relevant feature of this chart is that forces management to consider the resources implications and deal with it as well as the timing. Given finite resources (e.g., a limited number of people or money), the sum of the areas of the circles must be a constant. That means , if you add one project to the diagram, you must subtract another; alternatively you can shrink the size of several circles.

Thus, this apparently simple risk/reward diagram shows a lot more than simply risk and reward data: it also shows resource allocation, timing and the balance between the projects.

Besides the most common risk – rewards chart, many other parameters could be used with the bubble charts in order to provide different information. Below the table show the most popular parameters used in the bubble charts:

| Chart Type | Y-Axis | X-Axis | % |

| Risk vs. Reward | Probability of Succes | NPV, Total benefit after years of launch | 44,4 |

| Newness | Market newness | Technical newness | 11,1 |

| Ease Vs. Attractiveness | Market attractiveness (growth, potential consumer appeal, life cycle) | Technical feasibility | 11,1 |

| Strengths Vs. Attractiveness | Market attractiveness (growth, potential consumer appeal, life cycle) | Competitive position | 11,1 |

| Cost Vs. timing | Time to impact | Cost to implement | 9,7 |

| Strategic Vs. Benefit | Business intent, NPV, attractiveness | Strategic focus or fit | 8,9 |

| Cost Vs. benefit | Cumulative development costs | Cumulative Reward | 5,6 |

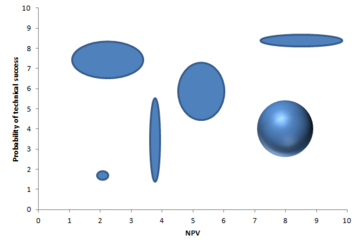

Variant of Bubble chart

Exist also some variants of the bubble diagram, one of them is used to effectively describe uncertain estimates. For each project there are optimistic and pessimistic estimates taking in count uncertain variables, leading to a range of values both for NPV and probability of technical success. In this case as shown in Fig.2 , the size and the shape of the bubble present the uncertainty of projects: very small bubbles mean highly sure estimates on each dimension, instead large ellipses mean high uncertainty (a big range between worst case and best case) for that project. [9]

Strength and weakness

The BC cannot be made before all the data have been collected and processed. Very few or no studies can be found in the literature regarding the exact effect of the chart in use. It is therefore impossible to generalize and conclude generically whether the BC is worth implementing in a company. In order to get an overview a list of benefits and disadvantages is conducted. This list can be used to understand in which situation BCs would be easy to implement and use, and in which situation the implementation of such a chart can be a costly and non-benefiting project.

Strengths

- Efficient when many different processes are running at the same time

It’s a really useful tool to have a fast overview for decision making, especially when you have to take in consideration many different projects at the same time. Give the possibility to compare many similar projects in a short time and get fast conclusions. As mentioned before, in this way the bubble chart represent a good tool for reach the balance choosing the right mix of projects.

- Easy to use

Really easy to implement in many different project situation There is no need of any specialist to make it and to read it neither Is possible to make it in short time

- Easy to learn

Since this visual tool is basic and simple, the employees can learn how to use it in a fast way and without needing any special crash course. Furthermore this means that means not expenses to implement it.

- Easy to update, modify and maintain

Since is a visual chart, it’s fast and low cost to maintain and update due to the changing of data

Weakness

- Dependencies and project synergy are not showed

The bubble diagrams cannot show the dependency between different projects, so it won’t be the best tool to use in case there is big number of projects with many interdependencies which are need to be investigated. As the same time, also under the cost profile will be important to know if it is possible to share some steps between different projects in order to decrease the all expenses.

- Difficulties to find errors in data

The diagram count directly on the data and in the case one error occur in the data, will be hard to find out where the bubble diagram will be wrong . Furthermore if one mistake has been done with the data, it will show up several times making this system weaker .

- Difficulties to quantify the data

This tool is more useful to give an overview of the projects than give the exactly values about the risk, rewards and other parameters. To find the values for the NPV for example, in every project the values should be calculated and put on the scale between 1 and 100, even if is known that in some projects could be almost impossible to quantify.

- Difficulties to compare different kind of project

It is always hard to compare different types of project as the same time like for example strategic projects and product-development project. Both types of project are important and can be of great value, but the NPV of strategic fitting projects is hard to know, and the product-development project will often seem more popular.

Other visual tools for Portfolio Management

Besides the Bubble charts, there is a large variety of histograms and pie charts which help to portray portfolio balance too. Furthermore there are plenty parameters or variables across which one would like to look to for the balance of a project. Here some examples of variables and charts are reported:

Timing is a important parameter to take in consideration for balance. Usually is important to find a balance between short term and long term projects, in this way will be possible to have constant stream of new products launch spread over the years and no a sudden log-jam of product launches all in one year. For the timing variable, a histogram could be a good choice since captures the issue of timing and illustrate the distribution of resources for specific projects according to the time of launch

Another variable connected to the timing is the cash flow. Here the aim is to balance the projects in such way that allow to have a cash inflows reasonably balanced with cash outflows in the business. Also here is possible to use a histogram where the inflows and the outflows are showed for every project.

Besides timing, the different project types is another big concern. How is possible to check the amount of resources spent on development of new products versus product renewals (improvements and replacements), or product extensions, or product maintenance? Here another visual tool is used : pie charts are easily understandable and fast interpretation, moreover they effectively capture the spending split across project types. Furthermore the pie charts are used also to displaying market segments, product lines and technologies.

Comparison to other Portfolio methods

After mentioned few different visual methods for portfolio management, in this section other popular methods will be briefly described and compared to each others in order to understand what are they useful for and in which cases one is better than another. The most common methods are the financial methods, 77.3 percent of businesses use this approach in portfolio management and 40.4 percent of businesses use this as the dominant method.

Famous methods are also the strategic approaches: for instance, It is useful to use in order to decide how to allocate the money across different types of project or envelopes, developing a business’s strategy and ranking the project by different parameters. A total of 64.8 percent of businesses use this approach and for 26.6 percent of businesses, this is the dominant method.

Another category is give by the scoring model where formulas assigns points based on known information to predict an unknown future outcome. So scaled ratings are used to produce a Project Attractiveness Score which becomes the criterion used to make project selection and/or ranking decisions. These models are used by 37.9 percent of businesses and in 18.3 percent, this is the dominant decision method. The last group of approaches presented are the Check lists: It is easily understandable, the projects are evaluated on a set of yes /no questions. In order to proceed with a project, a certain number of approves (yes) needs to be reached. The number of Yes’s is used to make Go/Kill and/or prioritization (ranking) decisions. Only 17.5 percent of businesses use check lists and in only 2.7 percent is this the dominant method.

It’s important to highlight that the popularity does not necessarily means that one method is better than another one. When different performances have been rated on six metrics, companies that mostly relied on financial tools as the dominant portfolio selection, score the worst. Popularity does not necessarily equate to effectiveness, however. Financial tools are useful in many projects but also bring to an unbalanced portfolio of lower value projects; and projects that lack strategic alignment. By contrast, businesses using bubble diagrams obtain a balanced and strategic aligned portfolio as the same as strategic methods. In the end, scoring models present the best result for selecting high value projects, and also yield a balanced portfolio.

discussion and conclusion

I am still work on it . . .

References

- ↑ B.D. Handerson, The Experience Curve - Reviewed IV. The Growth Share Matrix or The Product Portfolio.

- ↑ R.G. Cooper, S.J. Edgett, E.J. Kleinschmidt, R&D Portfolio Management Best Practices Study, Industrial Research Institute (IRI), Washington, DC., 1997.

- ↑ R.G. Cooper, S.J. Edgett, E.J. Kleinschmidt, Best practices for managing R&D portfolios, 1998.

- ↑ Project Portfolio Management Tools and Techniques Di Parviz F. Rad,Ginger Levin 10-13