BCG Matrix in Portfolio Management

Contents |

Abstract

The growth share matrix, also known as product portfolio matrix or Boston Consulting Group matrix, is a tool created with effort and collaboration by BCG partners. Alan Zakon made the first sketch and later, together with his colleagues, refined it. BCG's founder Bruce D. Henderson popularized the concept in an essay titled "The Product Portfolio" in BCG's publication Perspectives in 1970. The purpose of the matrix is to help organizations and businesses to analyse their business projects, that is, their product lines. This benefits the company allocate resources and is used as an analytical tool in brand marketing, product management, strategic management, and portfolio analysis. This article will thoroughly explain each component of the matrix and its meaning, together with a clear business case relevant to the category. Moreover, a it will also provide a critical overview of this matrix by looking into its strengths and when its best utilized against its limitations and misuses in the industry. Finally, a comparison to other similar matrices used in portfolio management, such as McKinsey matrix, etc.

The fundamental elements and underlying assumptions of BCG Matrix

The BCG Matrix evaluates a company's product portfolio by considering the relative strength of each business product and the growth rate of its corresponding market or industry. This approach provides a comprehensive analysis of the company's product portfolio, enabling more informed decision making. In addition, it had the potential to transmit corporate decisions to subsidiary companies. Henderson commented on the Matrix at that time, stating[1]:

"Such a single chart with a projected position five years out is sufficient alone to tell a company's profitability, debt capacity, growth potential, dividend potential and competitive strength"..

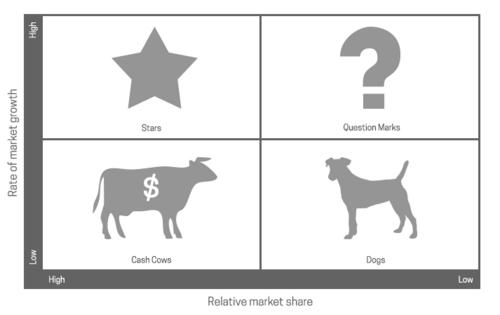

Categorization of businesses into four distinct portfolio groups

The matrix is divided into four quadrants, each representing a different type of business unit: cash cows, dogs, question marks, and stars. To use the BCG matrix, analysts plot a scatter graph to rank the business units (or products) on the basis of their relative market shares and growth rates. This allows them to visualize the company's overall product portfolio and identify which units are performing well and which may need attention.

- Cash cows

- Cash cows are products that have high market share in a mature industry. These products generate good profits for the portfolio. They are to be "milked" continuously with as little investment as possible, since such investment would be wasted in an industry with low growth. The profit generated from cash cows is utilized to fund stars and question marks, which are expected to become cash cows.

- Dogs

- Also known as pets, are products with low market share in a mature industry. These products usually "break even", generating barely enough profit to stay in competition. They should be sold off once short-term harvesting has been maximized.

- Question marks

- Question marks are businesses with a low market share in a developing market. They are a starting point for most businesses. Question marks have the potential to gain market share and become stars, and eventually cash cows when market growth slows. If question marks do not succeed in becoming a market leader, they will turn into dogs.

- Stars

- Stars are products with a high market share in a developing industry. They are an ex-question marks with a market- or niche-leading trajectory.

The underlying premise here is that market growth is linked to investment opportunities. As businesses expand, they offer a lucrative avenue for investment, as the funds allocated to them have the potential to compound over time and yield even greater returns in the future. However, the larger a market grows, the greater the need for cash to sustain market share and competitive position, otherwise, they become dogs due to low relative market share. In the BCG Matrix, market growth is the sole determinant of market attractiveness.

Product life cycle

The different segments of the BCG-Matrix can also be associated with specific stages of the product life cycle. Question marks are typically products in the introduction phase, where costs are high, but sales and profits are low. Therefore, a strategy of investment is required to attract customers and increase market share in an overall growing market. Successful management of the product leads it into the growth phase where it becomes a star, and profitability rises through economies of scale and a significant increase in sales. However, the entry of more competitors may ultimately lead to price decreases and may push profits down. In the maturity stage, sales volume reaches its peak, and the company with the biggest relative market share has a significant advantage. Based on the experience curve effect, the company can harvest profits as it has the highest production volumes and leads the market. Products in this stage are the cash cows. Finally, in the saturation and decline stage, sales and profits decrease, and the market becomes unattractive. Products in this stage may be phased out, and companies seek a squeeze-out and divestment strategy, similar to how dogs are treated

Matrix best practices

For better representation of business units on the Matrix, a portfolio analysis is usually conducted which involves the assessment of various Strategic Business Units (SBUs) [2] along with their corresponding product markets. SBUs are essentially businesses that are concentrated on a particular combination of products and markets. It is critical for these SBUs to possess a certain level of autonomy while also sharing similar resources and structures. This enables independent decision-making for each SBU without affecting the others within the portfolio. Nevertheless, defining SBUs can be arduous since products within an SBU may exhibit varying market growth rates and relative market shares. In the Matrix, the relative significance of each SBU is depicted through the size of a circle, which can be scaled proportionally to either sales or assets.

A portfolio analysis is typically performed to improve the representation of business units on the Matrix, which involves the evaluation of various SBUs as well as their corresponding product markets. SBUs are essentially businesses that focus on a specific combination of products and markets. It is critical that these SBUs have some autonomy while sharing similar resources and structures. This allows each SBU to make independent decisions without affecting the others in the portfolio. However, defining SBUs can be difficult because products within an SBU may have varying market growth rates and relative market shares. The relative importance of each SBU is represented in the Matrix by the size of a circle, which can be scaled proportionally to either sales or assets. [3]

Based on Henderson's experience curve concept, which he introduced prior to the Matrix in 1968, it is hypothesized that the company with the largest market share will have the highest profit margin. This is because a company's position in relation to its competitors is a significant determinant of its profitability, with a stronger position implying higher profits. The most basic measure of relative competitive position is relative market share, which can be calculated by dividing a business's (i.e., SBU's) market share by that of its largest competitor. As a result, a higher relative market share indicates a greater potential for cash generation for the company.

The aim of the matrix in decision making

The core principle of the BCG-Matrix is to achieve a balance of positive and negative cash flows among different businesses. As previously demonstrated, each quadrant can be categorized as either a net cash generator or cash user. Hence, assumptions regarding the cash position of each of the four quadrants are crucial to the effectiveness of the concept. As per the matrix, companies should strive to have "stars" that secure the future of the company with their high market share and growth. "Cash cows" are also essential as they provide the capital for future investments and cover present expenses. Additionally, a selected range of "question marks" is necessary as they can be transformed into "stars" through the infusion of funds. Conversely, "dogs" are deemed unnecessary and serve as an indication of failure, thus warranting liquidation. [4]

Case study

Despite its simplicity and illustrative approach, applying matrix does require some elements that need to be given special attention. To demonstrate the matrix ability to derive the right strategic decision, a case study will be presented and thoroughly discussed. Despite having discussed the core quadrants of the BCG-Matrix, careful attention must be given to the scaling of axes and the positioning of the horizontal and vertical dividing lines that create the four quadrants of the matrix. A continuous scale is used for the vertical axis (growth rate), and it is suggested in some literature to set the dividing line at the expected inflation-adjusted growth in gross national income (GNI). However, Henderson and Hedley recommended that the dividing line should be placed at a growth rate of 10%, as this is the discount rate that companies typically use during times of low inflation. Any growth above 10% is considered especially attractive for investment. It is vital to implement the appropriate scale for the vertical axis, as it can have significant implications for classifying a business as a star, cash cow, dog, or question mark. For the horizontal axis (relative market share), a logarithmic scale is used to be consistent with the experience curve effect. The dividing line is set at 1.0, as only the relative market share of the largest competitor can be left of this line, with all others falling below this value by definition. It should be noted that these guidelines serve only as an approximate guide, and that adaptations may need to be made to achieve accurate results and derive appropriate strategic decisions for the business portfolio. Once the matrix is constructed with its four quadrants, each SBU or product can be plotted within it based on its relevance in sales or assets.

Assumptions

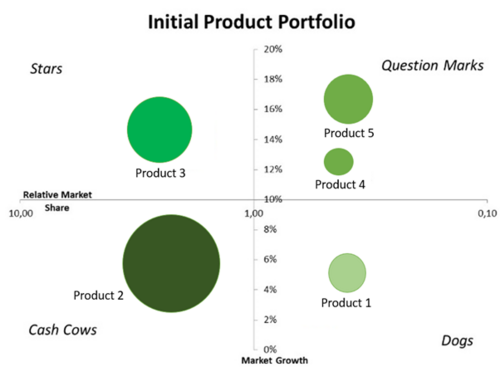

Assuming a portfolio of a hypothetical company is depicted in the matrix in Figure below where it illustrates several business units and indicates their respective quadrant assignments. The area of each circle represents the volume of total sales. The portfolio is seen to possess a strong cash cow product 2 and a promising star, product 3. Additionally, the company holds several question marks, which are product 4 and 5 and a dog, product 1. It is essential to recognize that each business necessitates distinct strategic objectives to maximize opportunities. Prescribing a singular, overarching goal for all businesses would be erroneous. Therefore, the strategic implications are contingent on the individual characteristics of each business unit and must be carefully evaluated.

The management strategic decisions therefore would be:

- Cash cows: Maintain, since they currently generate profitability.

- Dogs: Expected to generate some profits, but may be divested soon.

- Stars: Keep, hoping to expand its current market share.

- Question marks: Invest in some to gain market share and sell others for cash.

Scenarios

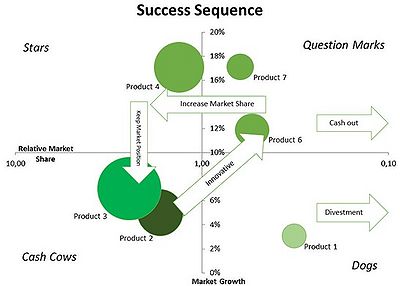

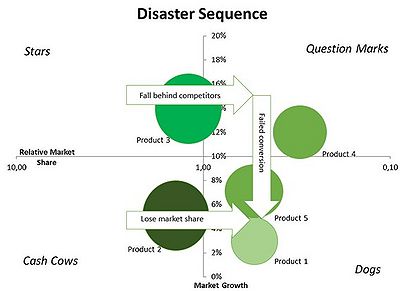

The strategy for the question marks is the most important, as investing in all of them could result in a lack of funds to develop them into stars and cash cows. As a result, the company's resources would be depleted while there would be no return. Henderson referred to this as the "sequence of disaster" (see Figure below). Instead, the company should invest in a few promising question marks and quickly divest the rest. This will result in a "success sequence" in which the question marks generate future net cash flow. The figures below depict how the company could have performed over a three-year period under this scenario (Success Sequence) and the previous one (Disaster Sequence). The two scenarios can be summarized as follows:

- The company made "the best" decisions in managing its business portfolio in the Success sequence. First, the cash cow, Product 2, provided enough funds to develop Product 3, a former star, into a strong market leader. Despite the market slowing, Product 3 capitalized on its market position and became a cash cow, contributing more to total sales than Product 2. Concerning the question marks, the company pursued two approaches. Product 5 demonstrated promise but required significant investment, so it was sold for a good price and is no longer in the portfolio. While product 4 was developed with significant cash investment and became the company's new star. Despite a slowing in market growth, product 4 increased its market share significantly. The company had enough funds to innovate and develop new question marks, products 6 and 7, through the cash out of product 5 and the positive cash flow from the cash cows. However, the company could not sell product 1, which was a dog, so investment was reduced to allow for a slow death without compromising future success of the company.

- On the other hand, the Disaster Sequence, the company distributed investments equally among all its products instead of developing customized strategies for each. This ultimately result poor management and a decline in market share for product 2 (cash cow), leading to less net return for the company. Furthermore, product 3 (star) lost market share due to aggressive competition and may soon become a dog if immediate action is not taken. The company's inability to commit to a clear strategy also affected products 4 and 5 (former question marks), which failed to convert into stars despite receiving investment funds, draining the company's resources without providing any returns. In addition, the company invested in product 1 (dog), which continues to require more cash than it generates. With the market growth not expected to increase, the company's current leader is likely to maintain its strong position, making it difficult for product 1 to succeed.

Strengths and limitations

“A company should have a portfolio of products with different growth rates and different market shares. The portfolio composition is a function of the balance between cash flows.… Margins and cash generated are a function of market share.”

— Bruce Henderson, “The Product Portfolio,” 1970.

One of the strengths of the BCG matrix is that it provides a simple framework for understanding a company's product portfolio. The matrix is easy to understand and provides a visual representation of a company's products. It helps companies identify where to focus their resources by highlighting areas of the portfolio that require investment and areas that can be "milked" for revenue. The matrix also helps companies identify products that may need to be divested or discontinued.

However, the BCG matrix has several limitations. First, the matrix is based solely on market share and market growth, ignoring other important factors such as competition and customer demand. Second, the matrix assumes that high market share and high growth are always desirable, which is not always the case. Third, the matrix is static and does not account for changes in the market over time. Products can move between categories over time, but the matrix does not provide a framework for this.

Despite its theoretical usefulness and widespread use, the efficacy of the growth-share matrix in contributing to business success has been investigated by several academic studies, resulting in its removal from some significant marketing textbooks. In 1992, a study was conducted by Slater and Zwirlein where they examined 129 firms that used the BCG matrix in their portfolio planning models. The study has shown that those firms tend to have lower shareholder returns. Furthermore, the BCG matrix has been criticized on several other grounds. For instance, it categorizes dogs as entities with low market share and relatively low market growth rate.

Comparison to other matrices

Alternatively, there are several methods in portfolio management that can offer a similar view on the growth share of a company. The most widely used method is developed by McKinsey and it is called – you guessed it, McKinsey matrix, also known as the directional policy matrix.

McKinsey matrix categorises business organizations into those with good prospects and those with less good prospects. It places business organizations according to two aspects:

- how attractive the relevant market is in which they are operating

- the competitive strength of the strategic business unit in that market.

The attractiveness can be measured by PESTEL or five forces analyses, while business unit strength can be defined by competitor analysis (for instance, the strategy canvas). For instance, managers in an organization with the portfolio shown in Figure will be concerned that they have relatively low shares in the largest and most attractive market, whereas their greatest strength is in a market with only medium attractiveness and smaller markets with little long-term attractiveness.

The matrix also offers strategy guidelines given the positioning of the business units. It suggests that the businesses with the highest growth potential and the greatest strength are those in which to invest for growth. Those that are the weakest and in the least attractive markets should be divested or ‘harvested’ (i.e. used to yield as much cash as possible before divesting). The directional policy matrix is more complex compared to the BCG matrix. However, it can have two advantages. First, unlike the simpler four-box BCG matrix, the nine cells of the directional policy matrix acknowledge the possibility of a difficult middle ground.

Annotated bibliography

- ↑ [Henderson, Bruce D. (1970). The Experience Curve - Reviewed IV. The Growth Share Matrix or The Product Portfolio]

- ↑ [Strategic business unit] https://en.wikipedia.org/wiki/Strategic_business_unit

- ↑ [Hedley, Barry (1977). Strategy and the "Business Portfolio", p. 9-15]

- ↑ [The Growth Share Matrix] https://www.bcg.com/publications/2014/growth-share-matrix-bcg-classics-revisited