Applying the Pareto Principle in Risk Management

Contents |

Abstract

The Pareto Analysis, commonly known as the 80/20 rule, is a powerful tool for project, program, and portfolio management, that states that 80% of the effects come from 20% of the causes.

It can be applied in risk management to identify and prioritize risks based on their potential impact on a specific project, program, or portfolio. The choice of management domain determines the extent of its application, such as identifying and prioritizing risks for a particular project in project management, across multiple related projects in program management, or across an entire portfolio of projects and programs in portfolio management.

This article provides an application-oriented guide to use Pareto Analysis in risk management for project management. It aims to offer a practical and comprehensive template and instructions for utilizing this tool effectively.

It is divided in the following sections:

- Pareto Analysis in Project Risk Management: describing the Pareto Principle's origins and purpose, and how it can be applied in Project Risk Management.

- How to build a Pareto Chart - Case Study: explaining how to create and interpret the visual representation of the Pareto Principle and illustrating a case study.

- Pareto Analysis Applications: offering guidance on the different applications of this tool, describing its use in different areas and giving some examples.

- Limitations: describing the main drawbacks of this tool.

- Overcome Pareto Analysis’ Limitations Using Other Tools: explaining how to combine it with other techniques to overcome its limitations.

- Conclusion

The paper also gives an annotated bibliography of crucial readings to aid firms in applying the Pareto Principle in risk management. These references cover a wide range of issues, from the Pareto Principle's fundamentals to its application in certain business situations and industries.

Pareto Analysis in Project Risk Management

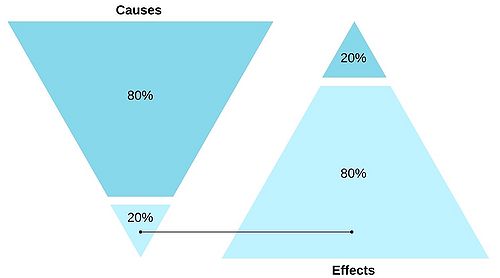

A well-known and frequently used tool in project, program and portfolio management is the Pareto Analysis, also known as the 80/20 rule or Pareto Principle. As shown in Figure 1, this rule, which was established by Italian economist and sociologist Vilfredo Pareto in the late 19th century, argues that only 20% of causes result in 80% of the effects.

Figure 1 - Methodology based on the Pareto-analysis (source: own figure)

According to Managing Successful Projects with PRINCE2 2017 Edition in Section 10.4.2 [1], after risks have been assessed, Pareto Analysis can be used to rank them to determine the order in which they should be addressed. In particular, this tool can be applied to direct management efforts towards hazards that have the greatest potential to affect project objectives.

The Pareto Principle is often used in various fields, including business, economics, and quality management, to help managers identify the most critical factors that are impacting their operations and to prioritize improvement efforts. In the context of Project Risk Management, the Pareto Principle can be applied to identify and prioritize risks that may have a significant impact on the project. By employing this evaluation, organizations can enhance their risk management procedures, concentrate their attention on the most important risks, and make more informed decisions.

As stated in The Standard for Risk Management in Portfolios, Programs and Projects in Section 2.3.4 [2], Project Risk Management is "a Knowledge Area of project management that identifies and manages project risks that could impact cost, schedule, or scope baselines." According to this guide in Section 3.2.4[2], the goals of Project Risk Management are aimed at enhancing the likelihood and effect of opportunities, while decreasing the potential impact and probability of threats. One of the key success factors of Project Risk Management described in Section 2.4 [2] is the integration of risk management practices with organizational project management. In fact, successful risk management involves an adequate execution of organisational project management, including the allocation of resources required for successful risk management application.

The Project Management Body of Knowledge (PMBOK® Guide) [3] states that the failure to manage risks has the potential to cause projects to deviate from their plans and ultimately fail to achieve defined objectives. Therefore, the effectiveness of Project Risk Management is directly related to project success.

In order to increase the Project Risk Management performance, the 80-20 rule can be applied to understand how to allocate resources efficiently by targeting issues that have a significant impact on profits, sales, and customers.

Successful risk management is crucial for project success, as failure to manage risks can result in project deviations and failure to achieve objectives. Integrating risk management practices with organizational project management and allocating adequate resources are therefore key factors for successful risk management, and this is where the Pareto Analysis can help.

How to build a Pareto Chart - Case Study

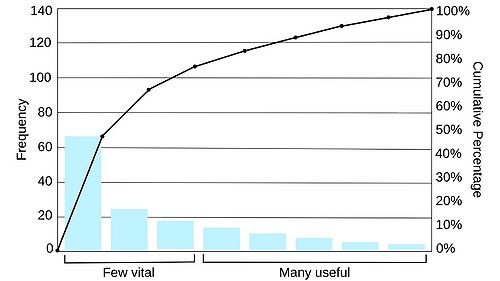

In Pareto Analysis, data is graphically represented in the form of a Pareto chart, which is a bar graph that arranges items in order of frequency or impact.

As shown in Figure 2 below, the X-axis represents the causes and the Y-axis shows the effects. The tallest bar in the graph symbolises the cause that has the most influence, while the cumulative line represents the cumulative total of the items.

Figure 2 - Pareto Chart (source: own figure)

As a quantitative method for risk analysis, Pareto analysis allows project managers to estimate the overall risk and prioritize the most significant risks that could impact the project objectives. As mentioned in Section 4.5.1 of The Standard for Risk Management in Portfolios, Programs and Projects [2], this method enables project managers to distinguish the quantified risks that exceed the stakeholders' tolerance levels from those that are within acceptable tolerances. By identifying the risks that threaten objectives beyond the stakeholders' tolerance levels, project managers can allocate their resources to implement vigorous risk responses to protect the most critical objectives.

The steps to create a Pareto Chart are the following:

- Gather and organize the data on the different contributors to the problem or outcome. This data can be collected through surveys, observations, process analysis, or other methods. Once the data is collected, it is important to ensure that it is accurate, reliable, and relevant to the problem at hand. In order to determine the probability and impact of each risk, it is possible to apply the framework described in Section 3.3.1 of The Standard for Risk Management in Portfolios, Programs and Projects [2]. However, it is important to notice that there are many other factors that should be considered while evaluating risks.

- Add up the data on the effect of each contributor and sum them together to get the grand total. This step helps to identify the overall magnitude of the problem and provides a baseline for comparison. It is also important to ensure that the data is consistent, standardized, and comparable across different contributors and time periods.

- Rearrange the contributors from largest to smallest, based on their impact or frequency. This step helps to identify the most significant contributors and the ones that have the most potential for improvement. It is also important to consider the context, scope, and goals of the Pareto Chart, and to select the most relevant and meaningful contributors for the problem or outcome.

- Calculate the cumulative-percentage-of-total, which is the percentage of the total impact that each contributor represents, relative to the other contributors. This step helps to visualize the relative importance of each contributor and to identify the threshold for the Pareto principle.

- Insert a bar graph to show the amount of each contributor's impact, and a line graph to represent the cumulative-percent of total.

An example of the use of Pareto Analysis is shown in the case study Pareto Analysis: a First Step Towards nZEB Hospitals of Erasmus Medical Centre Sophia (EMC) [4], a compact University Medical Centre (UMC) that offers all healthcare functions and has a complex heating, ventilation and air conditioning (HVAC) system. In the context of energy management, the Pareto analysis can help identify the healthcare functions in UMCs that consume the most energy and have the most potential for energy reduction.

The study aimed to assess the energy reduction potential of different healthcare functions in EMC by differentiating energy consumption to these functions. This was done by analyzing energy intensity and the total energy distribution per healthcare function, which allowed for the identification of the healthcare functions with the largest energy consumption. Based on this analysis, isolation rooms and surgery rooms were identified as the functions that consume significantly more energy than other healthcare functions, making them critical functions to focus on for energy reduction.

The case study of Pareto analysis in EMC demonstrated that the approach is a useful tool for determining energy reduction potential in UMCs. The study showed that by identifying the healthcare functions that consume the most energy and applying targeted actions to reduce their energy consumption, organizations can reduce their overall energy consumption and achieve cost savings.

Pareto Analysis Applications

The Pareto Analysis can be used in management to identify areas that could improve in order to boost productivity and efficiency. Focusing on the management field, some examples of areas where the Pareto principle can be applied are project management, program management, and porfolio management.

In Project Management, this analysis can be used to rank hazards according to importance, so that the management can concentrate resources on the risks that are more likely to have an influence on the project. An example of use is to pinpoint the 20% of tasks that account for 80% of the project's results. Project managers may guarantee that the project is finished on schedule and within budget by concentrating on these activities. For instance, a construction company can use Pareto Analysis to identify the few quantity of its construction jobs that account for the most of the time spent on a project and concentrate its resources on these tasks to shorten the project's overall duration.

In Program Management, Pareto analysis can be used to determine which issues or tasks are causing the majority of problems or delays, allowing the team to focus their efforts on the most critical areas. By analyzing data on program performance, program managers can identify the 20% of issues that are causing 80% of the problems and address them first. This approach can help program managers make informed decisions about where to allocate resources and prioritize tasks, ultimately leading to a more efficient and effective program. Additionally, Pareto analysis can help program managers monitor progress and track the impact of improvements over time, ensuring that the program is continually improving and delivering value.

In Portfolio Management, Pareto analysis can be used to identify the assets or investments that contribute the most to portfolio performance, as well as those that detract from it. By focusing on the top-performing assets, portfolio managers can optimize their investment strategies and potentially improve overall returns. Additionally, identifying underperforming assets through Pareto analysis can help managers make informed decisions about whether to hold or divest those assets, leading to a more efficient and effective portfolio.

In particular, in Risk Management, Pareto analysis can be used to identify the risks that pose the greatest threat to project, program or portfolio success. By analyzing data on previous risks and their impact on performance, risk managers can identify the 20% of risks that are responsible for 80% of the negative outcomes. With this information, risk managers can focus their efforts on mitigating the most critical risks, while also developing contingency plans for less critical risks. This approach can help managers to better allocate resources and manage risk in a more effective and efficient way, ultimately leading to improved project, program or portfolio outcomes.

Limitations of Pareto Analysis in Risk Management

Although the Pareto Analysis can be a useful tool in risk management, it's crucial to be aware of its limits. Conducting a Pareto Analysis can be time-consuming and requires significant resources, which can be an obstacle for small organizations. Also, the results of a Pareto Analysis are not self-implementing, and it is up to the organization to follow through on recommendations. Without proper implementation, the benefits of the analysis may be limited.

The first limitation is in fact that the theory is based on the idea that only 20% of causes result in 80% of the consequences, which may not always be the case. There may be a different distribution of causes and effects in some situations, making the Pareto Analysis less effective.

Another important limitation of this tool is that the Pareto analysis does not take into account the interdependencies between risks. For example, if two risks are ranked as being less critical individually, their combined impact may be greater than the one of a single, higher-ranked risk.

Another drawback is that this analysis present only a partial view of the hazards. Pareto analysis only considers the frequency of occurrence of a problem, and does not take into account the impact or severity of the problem. For example, a problem that occurs frequently but can be easily resolved may not be as important as a problem that occurs less frequently but has a major impact.

Also, Pareto analysis has a limited perspective on the problems as it only focuses on identifying the causes that contribute to the majority of the issues, without considering the underlying causes of problems, but simply identifying their symptoms. This means that without a root cause analysis, it is difficult to determine the most effective solutions for the problems identified in a Pareto chart.

The process of identifying the most significant problems and ranking them is subjective, and it is up to the person conducting the analysis to determine which problems are most important. Results can be influenced by the data used and the perspective of the person conducting the analysis.

This tool is highly dependent on data quality . The quality of the data used in Pareto analysis is critical, and any errors or inaccuracies in the data can result in incorrect conclusions. To minimize this limitation, it is important to consider multiple sources of data and to validate results with stakeholders to ensure accuracy and objectivity.

Finally, one of the biggest limitations of Pareto Analysis is its focus on past data. This means that the analysis is limited to historical information and does not consider current or future trends and conditions. As a result, the decision-making process may not take into account current or emerging problems that need to be addressed. Additionally, the Pareto analysis may not accurately reflect the true state of the process if the underlying data changes over time. Therefore, it is crucial to complement Pareto analysis with other techniques and approaches that provide a more comprehensive view of the situation and allow for a more informed decision-making process.

Overcome Pareto Analysis’ Limitations Using Other Tools

As previously noted, Pareto Analysis is a very helpful tool in risk management, but it has significant drawbacks that reduce its effectiveness. To avoid this issue, other techniques and approaches can be used in conjunction with Pareto analysis.

The Root Cause Analysis (RCA) is an example of tool that can be combined with Pareto Analysis. While Pareto analysis is a useful tool for identifying the most significant factors contributing to a problem, it has limitations in identifying the root cause of the problem. This is where RCA can be used to complement the Pareto analysis. As mentioned in Section 4.4.1 of The Standard for Risk Management in Portfolios, Programs and Projects [2], RCA helps to identify the underlying causes of problems by considering multiple factors, including current and future conditions, to determine the best course of action.

By using RCA alongside Pareto analysis, it is possible to identify the key causes of a problem and then investigate the underlying reasons for those causes. This allows for a more comprehensive understanding of the problem and can help to develop effective solutions that target the root cause.

Another tool that can be used is Process Mapping, that, as described in the book Process Mapping and Management [5], creates a visual representation of a process to help identify areas that need improvement, taking into account both past and current data. One of the key limitations of Pareto analysis is in fact that it only provides insight into the most common problems, and not necessarily the underlying causes of those problems. Here, process mapping can be a useful addition to the toolbox for solving issues. A complex process is divided into smaller, easier-to-manage processes via process mapping, and potential improvement areas are noted.

By using process mapping in conjunction with Pareto analysis, it’s possible to gain a more comprehensive understanding of the process, and identify opportunities for improvement beyond just the most common issues.

Another option is combining Pareto Analysis with the Expected Value (EV) technique. As explained in Managing Successful Projects with PRINCE2 2017 Edition in Section 10.4.2.1 [1], this technique is useful to assess the expected values of risks by multiplying the expected impact by its probability of occurrence. Pareto Analysis prioritizes risks based on their potential impact, while EV technique evaluates the expected outcome of a decision by determining the average result based on a probability distribution of potential outcomes. By combining these two techniques, organizations can make informed decisions by prioritizing the most critical issues and evaluating potential solutions based on expected outcomes.

Combining these two techniques provides organizations with a comprehensive and data-driven approach to improvement, leading to more effective and efficient results. The use of both Pareto Analysis and expected value helps organizations ensure their resources are allocated effectively to areas where they will have the greatest impact.

Conclusion

In conclusion, the Pareto Analysis is a valuable tool for organizations that are seeking to improve their operational processes, allowing managers to prioritize the issues and risks that have the biggest impact the business.

However, this tool has also some limitations that must be taken into account. To overcome these boundaries, it is recommended to combine the Pareto Analysis with other analytical tools and techniques. For instance, Root Cause Analysis can help identify the underlying causes of an issue, while Process Mapping can provide a detailed overview of the process and its potential weaknesses. Expected Value Analysis can help evaluate the potential impact of various solutions to determine which ones are most likely to yield the desired results.

By integrating Pareto Analysis with these techniques, organizations gain a more comprehensive understanding of the issues and risks they face, leading to more efficient and effective decision-making.

Annotated Bibliography

|

[1] |

AXELOS, Managing Successful Projects with PRINCE2 2017 Edition, The Stationery Office Ltd, 2017.

|

|

[2] |

PMI, The Standard for Risk Management in Portfolios, Programs and Projects, Newtown Square, Pennsylvania 19073-3299 USA: Project Management Institute, Inc., 2019.

|

|

[3] |

PMI, A Guide to the Project Management Body of Knowledge (PMBOK® Guide), Newtown Square, Pennsylvania 19073-3299 USA: Project Management Institute, Inc., 2021.

|

|

[4] |

W. Z. ILSE SCHOENMAKERS, Pareto analysis: a first step towards nZEB Hospitals, REHVA Journal, October 2017.

|

|

[5] |

S. Conger, Process Mapping and Management, Business Expert Press, 2011.

|

|

[6] |

REFERENCE 6 |

References

- ↑ 1.0 1.1 AXELOS, Managing Successful Projects with PRINCE2 2017 Edition, The Stationery Office Ltd, 2017.

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 The Standard for Risk Management in Portfolios, Programs and Projects, Newtown Square, Pennsylvania 19073-3299 USA: Project Management Institute, Inc., 2019

- ↑ A Guide to the Project Management Body of Knowledge (PMBOK® Guide), Newtown Square, Pennsylvania 19073-3299 USA: Project Management Institute, Inc., 2021.