Satisficing

Abstract

This article investigates the satisficing strategy for decision-making processes in a project, program and portfolio management perspective, and discusses its main limitation, which is accuracy or lack thereof. The name of this strategy stems from the merging of two words: satisfy and suffice, with the main purpose being to speed up the decision-making process by picking the first acceptable solution that meets the set objectives [1]. In this article, both efficiency and accuracy of the satisficing strategy are taken into account to provide a more comprehensive view of the satisficing strategy through introduction of the Illusion of Validity concept. First, the main idea of it is drawn through the explanation of definitions and theory, and providing a short historical context. Then, a detailed example of employing a satisficing strategy in project management is described, being supported with another project management tool called Schedule Performance Index (SPI). Further examples of applications are discussed in the context of project, program and portfolio management. Lastly, limitations and annotated bibliography are presented.

Definition

Satisficing is a strategy for a decision-making process. It was first defined by Herbert Simon in 1947 by merging two words together: satisfy and suffice [2]. At its core, using this strategy leads to making choices that are good enough, rather than the best ones. It is a tangible solution for administrators (project, programs and/or portfolio managers for the context of this article) who can see the complexity of the world, noticing that it is impossible to objectively make the best decision. Humans’ perception allows to consider only a couple of situations and concepts at the same time, meaning that plenty of aspects will be left out anyway. As Herbert states: “One can leave out of account those aspects of reality and that means most aspects that appear irrelevant at a given time.” (1947, page 119 [1] ) This marks a great limitation that is imposed within human nature. Phrases such as ‘fair price’ or ‘reasonable profit’ mirror the satisficing theory [1]. , as they suggest that a certain amount is good enough, but do not depict the whole scale of potentially maximised outcomes and use an ambiguous reference system. In short, satisficing is a strategy that allows its users to balance the trade-off between finding the optimal solution and the limitations of resources and time. Satisficing comes in many different forms, depending on the study and business branches where it is used and discussed. For the purpose of this article, a 3-step model with aspirational level is presented based on Artinger interpretation [2]. This form ensures high transparency of the satisficing concept and provides structured and easy to follow directions when managing projects, programs and portfolios.

- Step 1: Set an aspirational level and deadline to reach it.

- Step 2: Search until the aspirational level is exceeded or met for the first time.

- Step 3: If the aspirational level is not reached within the fixed deadline defined in Step 1, decrease the aspirational level and reflect on the past available options or continue the search until the new lowered aspirational level is met or exceeded..

Historical context and development

In order to fully understand the content of the satisficing theory, it is critical to acknowledge the context in which it was first developed. Simon Herbert with his theory has opposed the underlying principles of neoclassical economists. Herbert contended that people are marked by bounded rationality and use heuristics to facilitate decision-making, in contrast to the claims of neoclassical economics, which presumes that people have access to the perfect information and always make rational decisions [1]. Herbert also emphasised the need to consider social norms, cultural values, and institutional structures in addition to individual preferences and self-interest when making decisions. In that sense, Herbert’s theory was grounded and applicable in real-world contexts. The most essential expansion of satisficing strategy was done by Kahneman [3], who demonstrated how cognitive biases influence decision-making. Through his research in cognitive and behavioural science he added a new dimension to the theory. Both Herbert’s and Kahnemann’s approaches recognise that decision-makers often rely on heuristics and shortcuts when making decisions, rather than undergoing a fully rational and deliberate process [4]. Since then, the satisficing theory has developed from economics to other branches, such as management or psychology. Different approaches to satisficing were proposed, from static to dynamic, defined by the decision environment [2] and other factors dependent on the context and industry.

Balancing efficiency and accuracy: Illusion of validity in Satisficing

One of the key advantages of satisficing is its efficiency, as it helps to make decisions faster, that is as soon as the aspirational level is reached, rather than striving for maximisation and the best possible result. It is an efficient approach to decision-making, as it minimises the time it takes to make a decision and ensures that its outcome is good enough to continue the project. Yet, there is another dimension that is critical for a satisficing strategy to be successful - accuracy. Aspirational levels set have to be accurate, as well as judgement of qualitative data should remain unbiased to ensure success. Both of these can be challenging to achieve in a real world application, since satisficing is considered to be a quick decision-making strategy that pushes things forward. In this context, accuracy can easily be omitted which might lead to unwanted end results. To account for this hindrance, this article expands the satisficing strategy with the theory of Illusion of Validity. Defined by Kahneman and Tversky, it is a cognitive bias that occurs when people overestimate the accuracy of judgement based on intuition and subjective perception of the world [5]. Illusion of validity is especially strong when an individual specialises in a certain area. With knowledge gained on the topic, the overconfidence in one’s prediction and evaluation of reality increases. It is difficult for us to accept the limits of our ability to predict the outcomes because of our bias to create and believe coherent stories from the past. [6]. It is easy to omit the fact that the world is a difficult and complex reality, and when overconfidence comes into place, decisions become inaccurate. Moreover, this phenomenon is strengthened by a powerful professional culture present in almost any work environment, where like-minded individuals support each other in believing in this illusion of validity. [3]. This makes it even harder to evaluate and counteract those events. Project, program or portfolio managers can often create a coherent version of the story, based on which aspirational levels are set. Then, when such a story and principles (to set aspirational levels for satisficing strategy) are presented to stakeholders, there are no reasons to undermine them. To introduce efficiency to the decision-making process, an easy to follow 3-step guide for satisficing strategy was introduced. However, it is not the case while accounting for accuracy. Kahneman [3] argues that becoming aware of the bias coming from the Illusion of Validity does not solve the issue, and neither does discussing the decision with individuals from the professional environment. The presented concept of Illusion of Validity is only one aspect of extensive studies in a field of cognitive biases and heuristics. Therefore, it is not possible to provide a simple instruction on how to ensure a sufficient level of accuracy while implementing the satsificing strategy. Nevertheless, it can be highly beneficial for project, program and portfolio managers to become familiar with such literature to become aware of one’s own limitations.

Application of satisficing

Satisficing strategy is not limited to one model that has to be strictly followed. Depending on the practitioner’s needs, different models can be chosen and followed. There are plenty of comprehensive dynamic mathematical models [7] that require extensive data inputs and calculations. However, those models usually require distinct expertise to use them, while being excessive for majority of the cases [8]. Therefore, the focus of this article is limited to descriptive models that can be easily understood and applied to any project, program or portfolio case. First, an example of using the satisficing strategy linked with scheduled performance index (SPI) is described.

Satisficing strategy using SPI

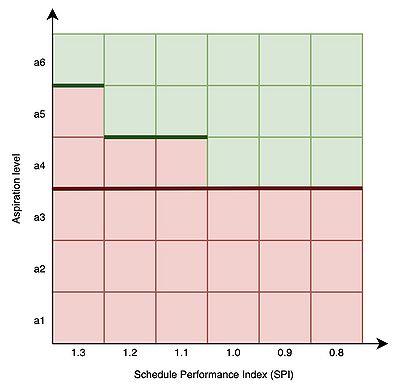

To showcase how a satisficing strategy can be applied, Schedule Performance Index (SPI) is considered. SPI is an index that measures the schedule performance of a given project. If SPI equals 1, project is exactly on schedule. Any value above 1 indicates that project is ahead of the schedule, whereas a value dropping below that number means that the project is behind the schedule. This index is dynamic and changes throughout the lifetime of the project and therefore creates great value for project managers interested in applying satisficing strategy in a decision-making process, as it sets a clear time constraint. In the most simple terms, a satisficing strategy can be plotted on a two-axis chart, one reflecting the aspirational level that can be adjusted, based on time measure (in this case, the SPI index). The core principles for applying a satisficing strategy can be determined as setting an aspirational level and trying to reach it. If no solution is found at the aspiration level in the time period t, the aspiration level should be lowered appropriately to ensure a responsible allocation of resources.

To apply a satisficing strategy using Schedule Performance Index, let’s assume that there is a need to hire a person to become a head for internal anti-doping testing in the project of organising a tennis tournament in Spain. Since the project is new and not part of the ATP tour yet, the testing is run internally. Let's consider six relevant characteristics for person to work at this position:

a1 - fluency in Spanish

a2 - previous experience in IDTM or other anti-doping agency recognised worldwide

a3 - a master degree in biology, chemistry or similar

a4 - a minimum of 5 years of experience in running anti-doping tests

a5 - a minimum of 8 years of experience in running anti-doping tests

a6 - a friendly and approachable personality, as well as a calm and organised personality

Now, depending on the value of SPI, the project manager can hire the right candidate, while ensuring that this decision will be taken in a timely manner and with a responsible allocation of resources. If the project is well ahead of schedule (eg. SPI = 1.3), a candidate must fulfil all points from a1 to a5, whereas a6 is optional and the lack of this factor will not impact the decision on hiring the candidate. With the SPI decreasing from 1.3 to 1.2, and then 1.1, the requirement of 8 years of experience is reduced to 5 years of experience. Eventually, if the project is right on schedule (SPI = 1), or behind it (SPI < 1) the experience restrictions are dropped and candidates that are fluent in Spanish, have experience in an anti-doping agency and got master degree in biology, chemistry or similar will be hired. Note how those restrictions will never be dropped as all of them are critical, and regardless of the value of SPI, those conditions must be met. Furthermore, the shown example was simplified by introducing discrete variables. In the real-world context, the competencies might not always be binary and many different layers influence the candidate selection process.

Application in project, program and portfolio management

This section provides more inisights on how a satisficing strategy can be applied in the context of project, program and portfolio management.

In project management, a satisficing strategy is most viable when looking at different constraints of the project. In the first example, the constraint of time (which corresponds to the Schedule Performance Index) was the main contribution to lowering the aspirational level. Similarly, financial constraints could also be taken into account during this process. Each of the skills potentially increases the salary requirements of the candidate. Therefore, in order not to overspend on skills that are ‘nice to have’, rather than essential, it is advised to use a satisficing strategy in picking a candidate that fulfils those necessary functions and costs less than an overqualified applicant. To remain fairly accurate in choosing those aspirational levels, it could be beneficial to define them in cooperation with another person involved in the project, to gain a broader perspective on the matter. In a situation where both impact and uncertainty of the decision is high, it is advised to make an informal request for guidance from “corporate programme management or the customer if necessary” (page 188, 2017 [9]).

In program management, an implementation of satisficing strategy can lead to fulfilling an efficiency benefit. A program manager could organise a workshop for project managers within the department and teach the core principles and good practices of using the satisficing strategy in decision-making process, with clear instructions how it should be performed to support the organisation's objectives. Successful implementation could significantly increase efficiency, as decisions would be made faster which in the broad perspective leads to resource saving. Outputs of a decision would be sufficient and satisfactory to continue different projects according to the plan, and faster decision-making would decrease potential delays in the process, as well as take the weight of the project managers’ shoulders who would follow simple principles in decision-making and avoid unnecessary maximisation that does not create value in the broad organisational context.

In portfolio management, a satisficing strategy can be used as a means to diversify the portfolio through a selection of programs that are meeting most, but not all, of the criteria. With lowering the aspirational level, the selection of possible solutions grows, which directly corresponds to higher diversification. Such a diversification can lead to the same expected return on investment while lowering its risk.[10] Size of portfolio and financial impact should also be taken into account. Satisficing is more suitable for environments where things need to be pushed forward and be just ‘good enough’. Therefore, it is not always viable to pursue a satisficing strategy when stakes are high as other decision-making techniques can accommodate such a situation better.

Limitations

One of the most important limitations of satisficing - a potential lack of accuracy - was addressed by introducing the concept of illusion of validity, bringing focus to subjective bias while using this decision-making strategy. Although it does not resolve the issue definitively, it is a valuable point of view and context for everyone who needs to make decisions on a daily basis. Another limitation of satisficing is its ambiguity which leads to many different interpretations of this strategy and its execution. With extensive literature on the topic, it is easy to provide a universal definition, but the actual modes of implementation can look very different depending on the approach used.

Satisficing is an appropriate strategy when decisions need to be taken fast and efficiently, as they are only partially contributing to the final outcome. On the other hand, in situations where decisions would have a major impact and excellence is required, this strategy might not be suitable. Satisficing is only one of many decision-making strategies, and within the scope of this article it would not be possible to compare all of them. Managers should know an extensive range of different decision-making models to fit them in the right context [10] . Therefore, to get the most of the concept of satisficing, it is advised to familiarise oneself with other decision-making tools and methods from this wiki site in order to choose the most appropriate ones for a given context.

Annotated bibliography

Simon Herbert A and Chester I Barnard. Administrative Behavior : A Study of Decision-Making Processes in Administrative Organization. Macmillan 1947. - It is a first publication, where satisficing was defined by Simon Herbert. It is the foundation for all the succeeding research on the topic.

Project Management: "Managing Successful Projects with PRINCE2" 6th Edition. 2017 - primary source of information about projects, which was used throughout the writing process of the whole article to ensure that it is relevant for practitioners.

Artinger, Florian M. Gigerenzer, Gerd Jacobs, Perke Satisficing: Integrating Two Traditions Journal of Economic Literature - One of the most recent and comprehensive studies on satisficing that analyses different aspects and approaches in Satisficing. Presented 3-step model with aspirational levels was designed based on the example from this study.

Daniel Kahneman. Thinking, fast and slow. Farrar, Straus and Giroux. 2011 - main inspiration and source of the Illusion of Validity theory, which helped to expand further on the satisficing topic by addressing limitations of humans from behavioristic point of view in decision-making processes.

References

- ↑ 1.0 1.1 1.2 1.3 Simon Herbert A and Chester I Barnard. Administrative Behavior : A Study of Decision-Making Processes in Administrative Organization. Macmillan 1947.

- ↑ 2.0 2.1 2.2 Artinger, Florian M. Gigerenzer, Gerd Jacobs, Perke Satisficing: Integrating Two Traditions Journal of Economic Literature 60 2 598-635 2022 10.1257/jel.20201396 https://www.aeaweb.org/articles?id=10.1257/jel.20201396 ****

- ↑ 3.0 3.1 3.2 Daniel Kahneman. Thinking, fast and slow. Farrar, Straus and Giroux. 2011

- ↑ Gary Klein. A naturalistic decision-making perspective on studying intuitive decision making. Journal of Applied Research in Memory and Cognition, 1(4), 226-227. 2011.

- ↑ Daniel Kahnemann and Amos Tversky. On the psychology of prediction. 1973.

- ↑ Taleb, N. N.The black swan: the impact of the highly improbable.2nd ed., Random trade pbk. 2010

- ↑ Wall, Kent D. A Model of Decision Making under Bounded Rationality. Journal of Economic Behavior and Organization. 1993.

- ↑ Simon, Herbert A. 1955. A Behavioral Model of Rational Choice. Quarterly Journal of Economics 69 (1): 99–118. 1955.

- ↑ Project Management: "Managing Successful Projects with PRINCE2" 6th Edition. 2017

- ↑ 10.0 10.1 Portfolio Management: The standard for portfolio management, 4th Edition (2013)