Contingency Reserves

Contents |

Abstract

Developing reserves is an important part of project management planning. Managing reserves crucial for accounting for project known and unknown risks by offering some cushioning in the estimate budget while providing a more realistic business case.

Two types of reserves exist on a capital project [1]: cost contingency reserve and management reserve. Cost contingency reserve is referred to an amount added to the project’s base estimate to cover for known-unknowns. Cost contingency reserve does not cover any major scope changes, nor escalation or extraordinary events. Management reserve (sometimes referred as management contingency) covers the unknown-unknowns of the project, and is not included in the base estimate, meaning that the project manager or project controller is only permitted to use this reserve if the organizational management approves, unlike contingency reserves which is usually expended. The purpose of allocating contingency to the base estimate is essentially a form of mitigating risk that accounts for such uncertainties. This article explains the purpose of contingency reserves, some of its calculation methods and concludes a discussion on contingency reserves.

Motivation

There are multiple reasons why project managers should include contingency reserves. Including contingency reserves is an effective method to help control the budget and represent uncertainty. It is intended to cover costs that are not included in the base estimate of the project and to absorb any of the risks that might occur, jeopardizing the project’s costs or schedule. Managing contingency reserves enhances the predictability of the project outcomes by providing buffers against cost overruns, exhausting funds or delays [6]. Applying contingency reserves in the project’s cost can play an important role in addressing the project risk profile to important stakeholders across the organization by demonstrating the stability of the project’s outcomes. As the project matures, and project risks decrease, the contingency reserves should decrease as well.

Contingency vs Management Reserve

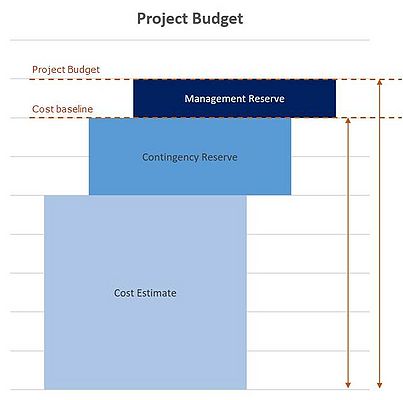

Contingency reserve and management reserve differ from each other and cover different spectrums of the project budget reserves. Figure 1 shows that project contingency is added to the cost estimate and is part of the cost baseline. While management is added on top of the cost baseline to complete the project budget [7]

Contingency Reserve

Contingency is allocated to cover the known-unknowns (PMI 2013) and is defined by the Association for the Advancement of Cost Engineering (AACE) as, items, conditions, or events for which the state, occurrence and/or effect is uncertain but is likely to result in additional costs. This excludes major scope changes, extraordinary events, management reserves, and escalation [1].

Management Reserve

The AACE defines management reserves as an added fund to the estimate to allow “discretionary management purposes outside of the defined scope of the project”. Therefore, management reserve is only controllable by the project manager when approved by upper management and contingency reserve is within the project manager’s control.

Management reserves on the other hand is allocated for the unknown-unknowns and is usually determined by the organization while contingency can be determined using different methods.

Project Management Institute. (2013). A guide to the project management body of knowledge (PMBOK® guide) – Fifth edition. Newtown Square, PA: Author

Calculaton Methods

There are many ways to establish cost contingency reserves; from applying simple fixed percentages to involving complex mathematical models. The AACE recognizes the following four major groups for calculating cost contingency:

- Expert Judgement

- Predetermined modelling

- Simulation analysis

- Parametric Modeling

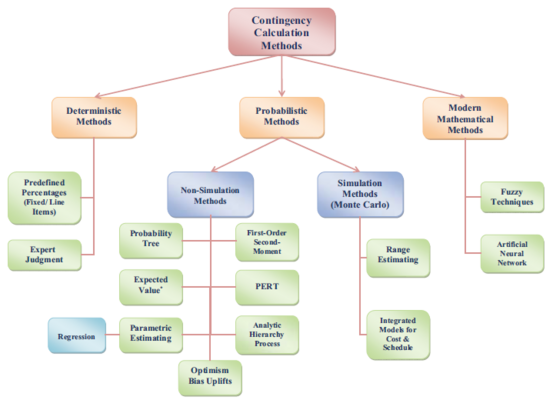

Schneck et. al,classifies two groups: (1) deterministic Models and (2) probabilistic models. And Bakhshi and Touran even add a third group to the sequence, (3) modern mathematical models. Deterministic methods are the most common and simplest method to determine contingency reserve amounts. Probabilistic and modern mathematical models are not only more complex, but also more resource costly. Even though the different classifications of estimating methods exist, most of the common methods are included. This article will alaborate on some the most common methods of the entire list of calculation methods presented by Bakhski and Touran, shown in Figure 2.

Deterministic Methods

Predetermined Percentage/Guidelines

This method is the most common and most simple one to use. A fixed percentage can be applied on the total budget or can be aggregated on each type of cost estimate. The AACE has provided predetermined guideline consisting of a table of “Classes of estimates” with different specific “expected range boundaries” , Using this method is effective, and doesn’t require expert judgement but lacks consideration of risk impacts unique to the project.

Expert Judgement

One or multiple specialists (either internal or external) with expertise in risk analysis in the specific project determine the contingency amount. Since this method is qualitative based, confidence levels cannot be provided.

Probabilistic Methods

Non-Simulation Methods

Probability Tree

A diagrammatic representation where identified risks are systematically coupled with the possible outcomes, using statistical techniques. Each individual risk is associated with a conditional expected value impact and probability of occurrence .After identifying all the risks the “best” path, with the highest result, should be the appropriate choice for the contingency amount. Note that the probability tree method can become increasingly extensive and impractical to use when dealing with large projects consisting of many layers of risks.

PICTURE

First Order Second Method

Approximate calculation methods to calculate standard deviation of complex functions using linear algebra functions.

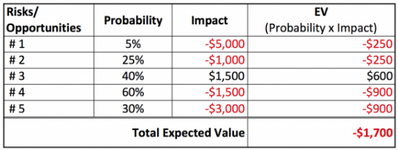

Expected Value

Just like the probability tree, each risk is coupled with the impact and probability of the event. Unlike the probability tree these events are not conditional events, therefore to calculating the contingency fund is simply the summation of all risks. An example is shown below to illustrate this better.

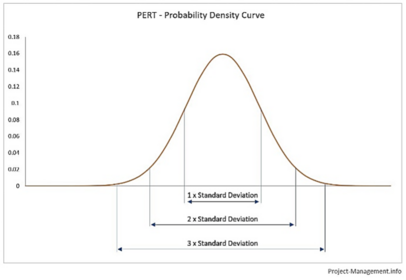

Program Evaluation and Review Technique (PERT)

This method is also known as the three-point-estimate technique and assumes a Beta distribution. The method requires an optimistic value, most likely value, and pessimistic value as input for each cost item. These three estimates are either attained using historical data or using expert knowledge. Consequently, the variance and mean can be determined. An example from iSixSigma is shown below[8]:

Optimistic = 10K = a

Most likely = 13K = m

Pessimistic = 25K = c

The mean, based on beta statistical distribution, is calculated as follows: μ = (a + 4m + b)/6

Which gives an approximation of 14,5 K The standard deviation is 2.25K

Parametric estimating

The AACE states that parametric methods are usually associated with estimating costs using design parameters. This method can be applied to estimating contingency, by establishing a relationship between cost overrun (output) and a set of risk factors (input). Some of the recommended risk parameters can be the level of scope definition, process complexity, and project size. Empirical methods such as multivariate regression analysis or neural networks are applied to establish relationships between the outcome and the variables. Even though it is a simple to use, due to the empirical nature of this method parameters are assumed to have predictable relationship with the outcome. This is however not always the case for some risks [9].

Regression Analysis

An effective method for early cost estimates when not much detail is available yet. In regression models redundant variables are unwanted, so it preferred to not include too many assumptions in model. It starts by collecting historical data on variables that drive differences in cost outcomes. Just like parametric estimating, this is an empirical method with similar side effects, such as assuming linear relationships between variables.

Analytical hierarchy Process (AHP)

This model allows risk to be analysed by subjective and qualitative inputs. In each work package, risk factors are identified then the overall risk calculated using the AHP. Using the overall risk of the work packages the total targeted cost is determined and compared to the base cost. The difference represents the cost contingency.

Reference Class Forecasting

Reference Class Forecasting uses historical data from finished projects and classifies these in categories based on type, size, and complexity. Probability distribution of cost overrun is compared among each other and given maximum cost overrun. This results in an uplift function with respect to risk. Uplift refers to the increase of the original budget to reach at the project budget for a given level of certainty function with respect to risk [Baskhi, Touran]. The drawback of this method is that it requires a relative large sample set (database of projects) to avoid errors.

Simulation Methods

Range Estimating

Different form the non-simulated methods is that range estimating does not incorporate single point estimates but rather assigns a range of possible outcomes to the cost elements. Critical cost elements are selected and applied with ranges. The Monte Carlo simulation program iterates cost elements along the specified range, which eventually generates a cumulative distribution function (CDF). The CDF describes the probability that the project budget will be less than the specified budget. Given the input of a specific confidence level, the simulation can produce an amount. The difference of this estimated range amount and the initial project budget is the contingency.

Integrated models for cost and schedule

Even though cost and schedule are related in some ways, both probabilistic methods for cost and schedule estimates are performed separately due to absence of the direct link. Some people have however developed models integrating cost and schedule. The Activity Based Costing simulation applies range estimating and probabilistic scheduling at the work breakdown structure. Touran and Bakshi have developed a model using Monte Carlo Simulation and Martingale series that exposes cost, schedule, and escalation uncertainties for multi-year programs.

Modern Mathemathical Models

Fuzzy Techniques

Fuzzy logic is not considered a probabilistic and it is intended to capture vagueness, uncertainty, imprecision, embedded human knowledge, human behavior, and intuition. Essentially Fuzzy set theory is seen as modern mathematical tool that helps quantify qualitative risk assessment. The Quantitative Qualitative Information on Risks (QQIR) is a method that generates a probability density function from aggregated information on expert opinion with fuzzy weighted average method. The PDF can then be used to assess risk and consequently contingency. According to Chan. et. al. fuzzy techniques are becoming more familiar in construction management areas.

Artificial Neural Network (ANN)

ANN is an artificial learning algorithm that recognizes patterns and relationships from data for generalizing solutions for future problems. The downside of probabilistic methods stated above, is the linearity assumption. ANN is effective in modelling complex, nonlinear relationships. Due to the learning mechanism, ANN has the capability to generate estimate outputs quicker when exposed to new scenarios. Polat, indicates that the outcome of his research using ANN on 195 international construction companies is valid and captures the underlying drivers and relationships between risk factors and contingency amount in bid prices on construction projects [10]

Reflection on Methods

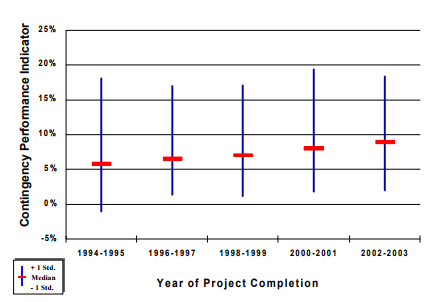

It is evident that many different methods exist to assess project risk and calculate cost contingency reserves, and new methods keep on appearing in the industry. An AACE published journal by Burroughs and Juntima in 2004, investigated the performance of contingency estimating among some common methods over a time period of 10 years. Contingency Performance Indicator (CPI) was used as a measure to quantitavely evealuate the accuracy of the project’s contingency and is defined by the difference between the percent contingency used and contingency estimated pg 1. One of the surprising results of their study shows that the CPI has actually worsened over time as displayed in Figure XX.

This was driven by a dramatic increase of smaller projects. The CPI of large projects has been quite constant throughout the studied period. This finding was especially surprising due to the fact of the increasing number of projects adopting more sophisticated methods.

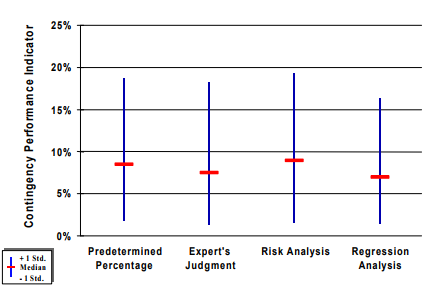

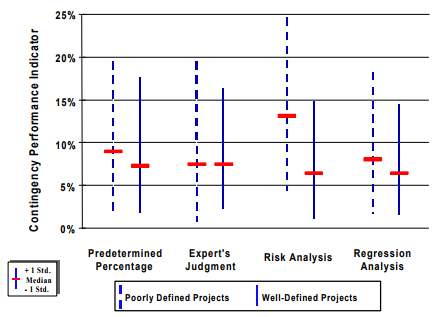

To get a better understanding of the worsened CPI, performance of the four estimating methods (1) Predetermined Percentage, (2) Expert Judgement, (3) Risk Analysis and (4) Regression Analysis were evaluated. While there is no significant difference among the CPI among the four methods (as shown in Figure 3), the performance of contingency estimating really differentiates between poorly and well-defined projects.

Figure 40: CPI comparison among the four different methods, adapted from Exploring Techniques for Contingency Setting [4] |

Figure 44: CPI performance among the four different methods compared between poorly-defined and well-defined projects, adapted from Exploring Techniques for Contingency Setting [5] |

Figure 4 reveals that there is very little CPI difference in the two deterministic models whether the project’s scope is poorly or well-defined. A large difference contingency estimating performance establishes when applying risk analysis and regression analysis on poorly defined projects. When project are well-defined the probabilistic methods actually yield better results than the deterministic ones.

Discussion

Assigning cost contingency is a huge challenge faced by many projects. The policies and procedures should address the guidelines, ownerships and definitions for terminology to ensure proper utilization and control of cost contingencies. Conflict of interest between the project team and project owner can arise while discussing cost contingency. The project manager wants the contingency level to be set high for more flexibility. And upper management wants the contingency level to be set as low as possible since they view contingency as unnecessary budget if the project is executed properly. If the contingency level is set too low, the project manager will have to request additional funds which will result in stagnating negotiations and micromanaging of the project by upper management. Who owns the unexpended contingency reserve should also be clarified in the contingency policy.

The definition of cost contingency reserves is another matter that is not always clear and often confused with management reserves since both serve the purpose of managing risks. Besides, once unknown but expected risks are materialized in the project budget they are often perceived as an allowance which they are not [11]. Allowances account for known and expected risks and therefore should be included in the base estimate. Cost contingency and management reserves may account for risk factors with high cost impact and with an improbable chance of occurring (such as variations in market or natural disasters). Thus, including this reserve amount to the base estimate to cover for cost overrun in other areas is pointless. [12]. It can be argued that high-impact and low- low-probability risks should be handled on program level and not project level [13]. The National Research Council urges to address all these matters crisp and clear to avoid any confusion that could potentially jeopardize the project.

Not only is it important to specify the policies regarding cost contingency in the organization, apply the proper method to estimate and determine the amount of cost contingency reserves is a process on its own. As the article outlined, many calculation methods exist, ranging from simple deterministic methods to sophisticated probabilistic methods. Among these methods different accuracy or contingency estimates yield depending on scope definition, complexity and size of the project. While deterministic methods show relatively constant performance (even when the scope is poorly defined), probabilistic methods such as risk analysis (Monte Carlo Simulation) and regression analysis yield better results when more detailed project data is available. Although probabilistic methods can take more time to develop, once the model is developed they can be easily implemented for future projects delivering accurate results [14].