Financial appraisal of project proposals

Contents |

Abstract

Generally, project managers have a difficulty in selecting the potential project proposals which give the best rewards for the company into their program or portfolio bounded by limited budget. One way to do this is to apply financial appraisal tools to evaluates the best investment bundle based on predicted costs and revenues which have been determined from either ground-up or top-down costing where input is estimated cost and competitive price respectively. The evaluation also depends on the size of the project and the time span over which the costs and benefits are going to be spread[1]. Usually, project managers take responsibility for two types of decision which are investment and financial decision. The investment decision is the decision that focuses on the concept of what to do in order to gain the maximum value, financial decision, however, related on how the projects should get the money from in order to run.

The aim of this article is to present techniques to make an accept or reject decision on investing project which are present worth analysis, annual worth analysis, payback period, and rate of return analysis which based on the concept of the “Time value of money”, and application of these tools also their limitations.

Time Value of Money

$1 of today is worth more than $1 of tomorrow

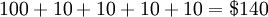

Time Value of Money (TVM) is the concept that money available today provide more benefit with the same amount than tomorrow. The reason is that on hand money today can be invested to generate more money in the future. To begin with, a basic knowledge of simple interest and compound interest must be manifested. The first interest perception is where the interest rate is calculated based on principal only and it is constant throughout the period, while compound interest is the other way round which calculated on the principal plus total amount of interest accumulated in the entire preceding period which makes the amount of interest increased over time. The example below is demonstrated to clarify the difference between these two interest.

Example: Given the rate of return of 10% per year and the principal of $100, what is the balance in the following four years.

- Simple Interest:

- Compound Interest:

Cost Estimation

Overview of cost estimation Cost estimation play an important role in every single project, when the project has been built, generally the managers always make a question about costs and revenues. In practice revenues can be generated with an ease by adding profit margin but not cost, since the complexity is huge that it contains several components depended on particular project. Typically cost can be distinguished in to two types namely direct cost that can be traced back to a cost object with less effort where cost object can be a product, department, project, to name but a few, for instance, direct labour cost, commission, and material cost. Indirect cost, however, is a reversed of direct cost where it cannot be accurately track to an exact cost object, examples of this cost are depreciation, insurance, electricity bill, and office space rental cost. As mention before, there are two aspects of specify a project cost; bottom-up costing and top-down costing.

- Bottom-up costing – suite best when the market competition is less.

- Top-down costing – work well when competition is high that it can limit cost component.

+++++++++++++++++++++++++++figure++++++++++++++++++++

Generally, there are several techniques to estimate cost of the project, asking an expert for the opinion and make a comparison to the situation is one of the magnificent estimators. Performing a quantitative method also the good way, techniques such as Cost Indexes, Cost Capacity Equations, Factor Method, and Activity Based Costing (ABC), where first three techniques can only comply direct cost but not ABC that can estimate both direct and indirect cost.

Financial Appraisal Tools

The propose of financial appraisal is to justify and select whether the return of the project is cover all the cost or minimize the loss, in case of public project such as construct a railway line which we know in advance that it is going to be loss but the project provides a social benefit that cannot measure by money. Throughout the procedure, cost and revenue of each project must be estimated by cost and revenue estimation techniques as mention above. After this, Minimum Attractive Rate of Return (MARR) is essential, project managers generally use an interest rate from financial institutions to determine this value. The document provides an overview of the following financial appraisal tools including example of each;

- Present Worth Analysis

- Annual Worth Analysis

- Payback Period

- Rate of Return Analysis

Present Worth Analysis

In present worth analysis, present value is calculated based on MARR of each project, the method is quite popular and easy to understand and determine the economic advantage of each alternative since all the estimated future costs and revenues are transformed back into equivalent present value; means that entire cashflow is converted into present dollars. The present worth comparison of equal life span alternative is straightforward, however, when implement present worth comparison with different life span projects, 2 additional method called least common multiplication (LCM) and study period must be applied in order to make their life span equivalent to each other during the study. General assumptions are;

- Inflow and outflow cash but not an initial investment capital occur at the end of each period.

- Alternatives life-cycle will be repeated with the same pattern over each life cycle when applying LCM.

Example

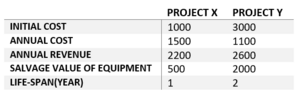

Project manager is considering to run a project that generate highest profit to the company, two candidate called project X and project Y are study, costs and profit for each project are given below. Which project should be select with MARR of 10% per year?

Apply LCM method to compare alternatives.

PWx = -1000 - 1500(P/A,10%,2) + 2200(P/A,10%,2) + 500(P/F,10%,1) + 500(P/F,10%,2) = $1429.75

PWy = -3000 - 1100(P/A,10%,2) + 2600(P/A,10%,2) + 2000(P/F,10%,2) = $1256.2

Project X is selected due to the fact that it generates higher net present value.

Annual Worth Analysis

In annual worth analysis, all cost or revenue are converted to equivalent uniform annual value for the entire life cycle of the project, AW is quite easy to understand by individuals who is familiar with annual amounts such as dollar per year, dollar per month. The idea of this analysis is identical to present worth analysis which try to justify economical advantage from each project or evaluate an economical worthiness of a single project. When all estimated cash flow are converted to AW value, the value is assigned to every year of the project life cycle, likewise for each additional year. To compare two projects with unequal life span, three assumptions are made;

- Services provided by projects are needed at least the LCM of the life of the projects.

- The first cycle of cash flows is repeated for a successive cycle.

- All estimated cash flows in the cycle will be the same.

Example

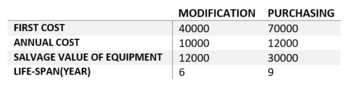

Project manager of gum factory is considered for an improvement to an automated packing production process whether modifying a current machine to be automated or purchasing whole new automated machine. Which project should the project manager run with the given MARR of 15% per year.

AWmodification = - 10000 – 40000(A/P,15%,6) + 12000(A/F,15%,6) = -$19198 /year

AWpurchasing = -3000 - 1100(P/A,10%,2) + 2600(P/A,10%,2) + 2000(P/F,10%,2) = -$24882 /year

Project manager should modify the current process since it generates lower negative value.

Rate of Return Analysis

Rate of return(ROR) has been recognized by several names: internal rate of return (IRR), return on investment (ROI), this is the rate that accomplished balance of the cash flow of a particular project to exactly zero considering interest rate. The complexity of this technique is greater than present worth analysis and annual wort analysis, and in some case, where the direction of project cash flows change more than once, multiple value of ROR will occur according to the number of changes in cash flows direction which follow Descartes’s rule[REF].

The calculation of ROR is done by setting up an equation of either PW or AW and specified them equal to zero to find I value called i*. In single project evaluation, if i* is greater than MARR, we should accept the project as it is economically viable. However, in multiple project comparisons, evaluate them only based on ROR might lead to erroneous conclusion, assume that project A that required an investment of $40000 has i* of 40% per year, while project B needed $80000 for an investment has i* of 25% per year. Intuitively, we may choose to run project A since it has greater i*, however, taking an amount of investment into account, project B may earn more profit. To step aside this situation, incremental cash flow is applied.

To do so, drawing a cash flows table of each project, if they do not have identical life cycle, LCM is applied. Next, select the project with largest investment and subtracted by the smaller project. This incremental cash flow shows the extra cost required if the project with the larger first cost is selected in order to determine ROR of the difference in cash flows. If the incremental cash flow of a higher investment project does not justify based on MARR, select the cheaper one. Note that IRR for each project that we want to compare must greater than MARR.

Example

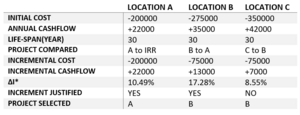

A football team want to build a new stadium, three different locations are identified. If the MARR is 10%, which is the best location for a new stadium.

First we order projects by increasing initial cost, then calculated IRR of lowest cost project, location A in this case, which is 10.49%. Then compare location B to A with an incremental cashflow;

0 = -75000+ 13000(P/A, ∆i*,30); (P/A, ∆i*,30) = 5.7692; so, I that make P/A factor with 30 years equal to 5.7692 is 17.28% which is greater than MARR at 10%, therefore location B is economically preferable than location A.

Compare C to B; 0 = -75,000 + 7000(P/A, ∆i*, 30) which make P/A value is 10.7143 (∆i* = 8.55%). So location C is eliminated, and the only location remain is B.

Payback Period

Project Selection under Budget Constraint

Limitation

Discussion

References

- ↑ Harvey Maylor (2010) 'Project Management'. Bath, United Kingdom: Pearson Education Limited