Cash flow & payment milestones

Contents |

Abstract

Project Cost Management includes the processes involved in planning, estimating, budgeting, financing, funding, managing, and controlling costs so that the project can be completed within the approved budget.[1]. Two main concerns, that are crucial in Project Cost Management are cash flow and payment milestones.

Cash flow, its monitoring and analysis is a subject that has been on the agenda for any existing or conducted project or portfolio. Diversity of scale and scope of the projects makes cash flow rather complex and multidimensional issue. Recommended approach for getting a good understanding of this issue is to study cases, projects and portfolios of relevant scale, scope and area to currently investigated project. Similarly it is with payment milestones, which are part of cash flow organisation and planning.

This article will contain two chapters, one for each issue. Apart from diversification of definitions of cash flow [2] and payment milestones for project, program and portfolio, this article will focus on practical information for Project Managers, and present some real life relevant techniques and tools. For cash flow, the focus will be set on Gantt chart method, and for payment milestones, there will be two methods introduced: Program Evaluation and Review Technique (PERT) and Critical Path Method (CPM). It will also answer the question "Why cash flow and payment milestones are so important in Project Cost Management?" and how to approach them.

Introduction

Cash Flow definition

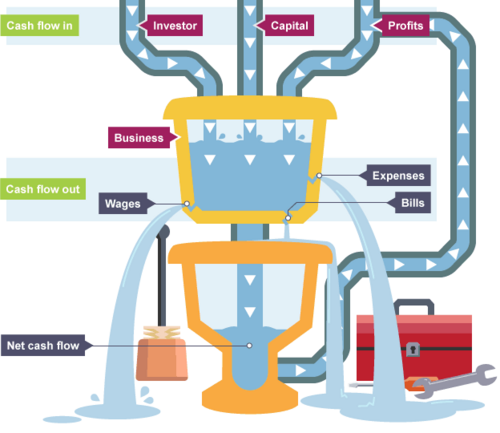

Cash flow is a term used to describe money movement (flow) in business in defined time period. Cash flow is determined by the following factors: time, nominal amount, currency and account [3].There are two main subdivisions of this term - cash flow in and cash flow out.

Cash flow in stands for money that is coming into the business. It may come from investors, who are investing or financing the company, from gathered capital that business owner has, or from profits that business is making from selling products or services.

Cash flow out stands for money that is going out of the business. It may go for covering the wages of hired workers, bills like rental payment or mortgage for facilities or services, and other expenses like taxation.

The difference between cash flow in and cash flow out is called net cash flow.

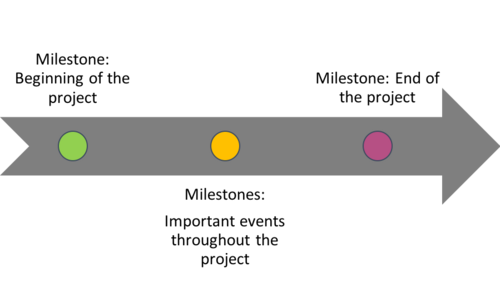

Milestones definition

Each project has a determined timeframe, or duration. Milestones are key reference points, or events on this timeline, that are crucial for measuring the project progress and achieving the final outcome. In project management milestones can be called signal anchors [5] and are used for marking following deliverables:

- Start of the project

- End of the project

- Start of determined phase of the project

- End of determined phase of the project

- Reviews

- Budget checks

Milestones are fixed points, so in contrast to the timeline, they do not have duration, they are fixed dates.

Payment milestones are another kind of milestones, that are strictly dedicated to finances. They are fixed dates, when certain percent of money is being payed or received. The bigger the project, the bigger the budget, and therefore the more payment milestones present.

Cash flow and payment milestones in Project Cost Management

Cash Flow Analysis

Referring to popular saying that "Cash is King" - money is one of the most important resources in business [6] and requires proper control and analysis. Skillful financial data management allows to extract from cash flow several measures crucial for Project Cost Management. Some of them are:

- Project value or rate of return. It is basically a profit of an investment. Cash flow is implemented in some financial models, such as IRR or NPV.

- Project liquidity. It can be determined how easily the financial obligations can be met during the project.

- Project risk evaluation. It can be determined what is the uncertainty about deviation from expected earnings or expected outcome.

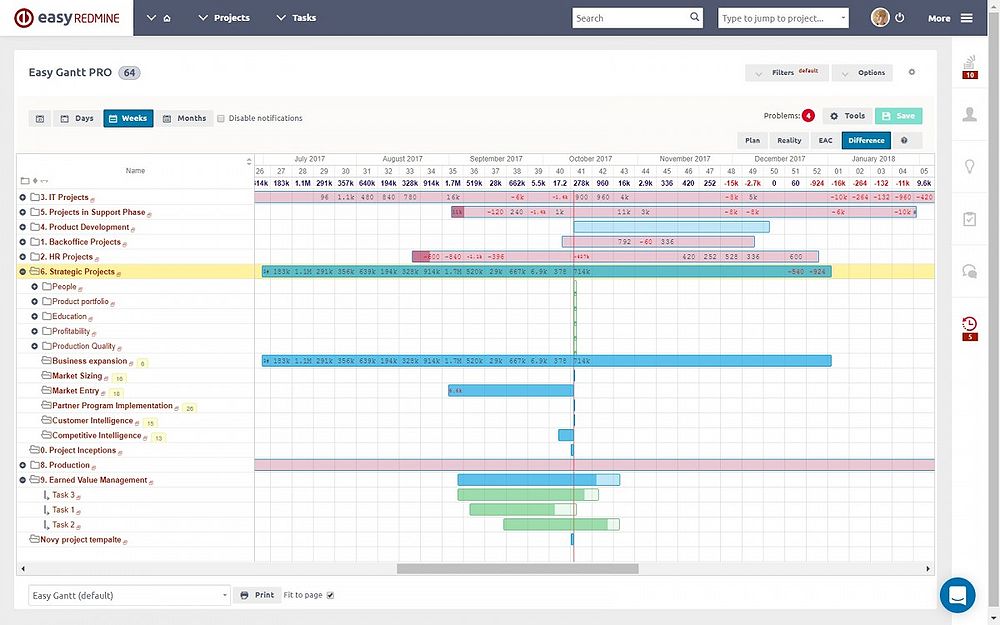

There are several tools and methods of cash flow analysis. One of the most common and universal method is Gantt chart. It is a method useful for an instant overview of project profitability over time, comparison of planned and actual flows of cash and for better balancing of cash flows across all projects.[7]. At gantt.com following description of a Gantt chart can be found[8]:

A Gantt chart, commonly used in project management, is one of the most popular and useful ways of showing activities (tasks or events) displayed against time. On the left of the chart is a list of the activities and along the top is a suitable time scale. Each activity is represented by a bar; the position and length of the bar reflects the start date, duration and end date of the activity. This allows you to see at a glance:

- What the various activities are

- When each activity begins and ends

- How long each activity is scheduled to last

- Where activities overlap with other activities, and by how much

- The start and end date of the whole project

It is possible to crate Gantt charts in programs like Microsoft Excel or Numbers for Mac, however there are several online tools dedicated for this particular method. One of them is easyREDMINE [7] offering straight forward design and guide for those less experience with this method.

For more tools and explanation of Cash Flow analysis, Iowa State University website can be visited [9], as well as Planning Engineer [10]

Payment Milestones in Project Cost Management

Payment milestones are significant element of every project or portfolio schedule. Solid financial planning allows for smooth project flow and simplifies controlling process. To prepare such plan, and create adequate and efficient milestones, there can be several techniques or methods used. One of them is Program Evaluation and Review Technique (PERT). PERT is project management tool used to schedule, organize, and coordinate tasks within a project. More detailed description of PERT is as follows:

"PERT is a method of analysing the tasks involved in completing a given project, especially the time needed to complete each task, and to identify the minimum time needed to complete the total project. It incorporates uncertainty by making it possible to schedule a project while not knowing precisely the details and durations of all the activities. It is more of an event-oriented technique rather than start- and completion-oriented and is used more in projects where time is the major factor rather than cost. It is applied to very large-scale, one-time, complex, non-routine infrastructure and Research and Development projects." [11]

Another method that can be used for Payment Milestones establishment is Critical Path Method (CPM).

"The critical path method is a step-by-step project management technique to identify activities on the critical path. It is an approach to project scheduling that breaks the project into several work tasks, displays them in a flow chart, and then calculates the project duration based on estimated durations for each task. It identifies tasks that are critical, time-wise, in completing the project." [12]

Both methods were established in 1950's and since then, were refined and modified for modern projects expectations. Application of such techniques in project gives its schedule organised and divided into intervals structure, which makes it easier to follow. It also gives better overview on most important activities, that are usually critical to complete within schedule.

Implementation in real life projects

For better understanding of presented above techniques and methods, it is recommended to review a real-life project case. A good example would be case of construction project, described in Chapter 12 [13] of book "Project Management for Construction" by Chris Hendrickson [14]. It gives a broad overview on cost control, monitoring and accounting of a variety of construction projects. Hendrickson starts with project budget establishment, going through forecasting for activity cost control, where he gets into details, presenting and explaining useful formulas with examples. Next, he talks about financial accounting systems and cost accounts, which is an introduction to control of project cash flows. In this chapter, an example of a cash flow status report can be found, with its decent explanation. The next sections are dedicated to schedule control and schedule and budget updates, where Hendrickson talks about milestones and project segmentation.

Hendrickson in his book, and in this particular chapter provides practical examples with real data, which can be adjusted and duplicated for other project purposes. It is important for any future or current Project Manager to have a good background knowledge and experience with different cases that were solved in the past. This gives not only a good overview on how financial planning and controlling can be conducted, but also highlights critical areas, where most issues occur.

Importance of Cash Flow and Payment Milestones

Why keeping track of cash flow is important in project management? There may be two outcomes coming from the cash flow analysis - either cash flow is positive or negative. To achieve positive cash flow, there are two main factors to focus on: organisation and planning.

In case of any project, or portfolio of projects, project manager has to be aware of how much money is coming in, and how much money is being spent. Proportionally to the size and scope of the project, or portfolio, those income and outcome is more complex for bigger projects. To control complicated money flow, it is necessary to have a financial plan. This is where payment milestones come handy. If at the beginning of the project a system of money verification will be established, it will be possible and rather straight forward to follow and control it. Awareness of when is the right moment to spend money gives project manager more chance of staying within the budget frame, and keeping project financial condition in good shape.

In case when there is no proper organisation and planning in cash flow, there is a big danger of spending too much money on some project stages, which can cause lack of resources for other stages. The outcome may be either stretching the budget, which is optimistic variant. More realistic is, that there will be delays in some stages of project, which will project on the schedule and overall project outcome.

Annotated Bibliography

Project Management Institute (2013). A Guide to the Project Management Body of Knowledge (PMBOK® guide)

A Guide to the Project Management Body of Knowledge (PMBOK® Guide) – Fifth Edition provides guidelines for managing individual projects and defines project management related concepts. It also describes the project management life cycle and its related processes, as well as the project life cycle.

The PMBOK® Guide contains the globally recognized standard and guide for the project management profession. A standard is a formal document that describes established norms, methods, processes, and practices. As with other professions, the knowledge contained in this standard has evolved from the recognized good practices of project management practitioners who have contributed to the development of this standard.[1]

Simon A. Burtonshaw-Gunn. "Risk and Financial Management in Construction." Gower Publishing Limited, 2009.

In today’s climate the need for a closer understanding of the relationship between the two inter-related topics of risk management and finance on construction projects is becoming increasingly crucial to achieving the objectives of the investor, the end-user and the constructor and its supply chain, especially as interest in PFI and PPP arrangements continues to grow around the world. Risk and Financial Management in Construction shows the relationship between the Construction Project Manager’s task of balancing time, cost and quality and the need to satisfy the client’s requirements efficiently, effectively and professionally whilst at the same time contributing to the contractor’s future sustainability. The book covers Risk Management describing the tools and methods to reduce the occurrence and consequences of risk, and the financial management of construction projects from raising funding, to contract strategy and through to estimating, budgeting and cost control. It includes a chapter covering international project risk, bringing together the issues of risk management, prime contracting, and PFI funding for construction projects undertaken away from the contractors main home market. Risk and Financial Management in Construction is aimed at those practising in, or studying to enter, the project management profession in providing a strategic and operational knowledge of these subjects allowing the reader easy access to the key points through a wide selection of models, checklists and easy to find lists in all of the key areas. [15]

Chris Hendrickson. "Project Management for Construction. Fundamental Concepts for Owners, Engineers, Architects and Builders." Prentice Hall, 2000. ISBN 0-13-731266-0

This book develops a specific viewpoint in discussing the participants, the processes and the techniques of project management for construction. This viewpoint is that of owners who desire completion of projects in a timely, cost effective fashion. While this book is devoted to a particular viewpoint with respect to project management for construction, it is not solely intended for owners and their direct representatives. By understanding the entire process, all participants can respond more effectively to the owner's needs in their own work, in marketing their services, and in communicating with other participants. In addition, the specific techniques and tools discussed in this book (such as economic evaluation, scheduling, management information systems, etc.) can be readily applied to any portion of the process. [14]

References

- ↑ 1.0 1.1 Project Management Institute (2013). A Guide to the Project Management Body of Knowledge (PMBOK® guide). Newtown Square, Pennsylvania: Project Management Institute, Inc

- ↑ "Cash Flow." Accessed on February 2018. https://www.investopedia.com/terms/c/cashflow.asp

- ↑ "Cash Flow". Accessed in February 2018. https://en.wikipedia.org/wiki/Cash_flow:.

- ↑ "Cash Flow Scheme", BBC, Accessed in February 2018. https://www.bbc.co.uk/education/guides/z67mpv4/revision

- ↑ "Signal Anchors". Accessed in February 2018. https://en.wikipedia.org/wiki/Milestone_(project_management)

- ↑ Simon A. Burtonshaw-Gunn, "Risk and Financial Management in Construction", Gower Publishing, Ltd., 2009. https://books.google.dk/books?id=r4R3gDES5lMC&pg=PA158&lpg=PA158&dq=cash+flow+and+payment+milestones+in+Project+Cost+Management&source=bl&ots=pXc4hlRRCk&sig=8Ma_EihrAuCnJ4lHyi_P7cKf2IQ&hl=en&sa=X&ved=0ahUKEwievtuBh6bZAhWSKCwKHQL-CMMQ6AEIfDAH#v=onepage&q=cash%20flow%20and%20payment%20milestones%20in%20Project%20Cost%20Management&f=false

- ↑ 7.0 7.1 7.2 "EasyREDMINE" https://www.easyredmine.com/software/project-finances/2747-cash-flow-in-gantt-chart

- ↑ Website providing information about Gantt charts. http://www.gantt.com/

- ↑ "Iowa State University website". Accessed in February 2018. https://www.extension.iastate.edu/agdm/wholefarm/html/c3-14.html

- ↑ "Planning Engineer website". Accessed in 2018. https://planningengineer.net/create-gantt-chart-and-cash-flow-using-excel-with-sample-file/

- ↑ "Program evaluation and review technique (PERT)". Accessed in February 2018. https://en.wikipedia.org/wiki/Program_evaluation_and_review_technique

- ↑ "Critical path method (CPM)". Accessed on February 2018. https://www.smartsheet.com/critical-path-method

- ↑ C.Hendrickson, "Project Management for Constructions" 2nd Edition, Prentice Hall, 2000. Chapter 12, http://pmbook.ce.cmu.edu/12_Cost_Control,_Monitoring,_and_Accounting.html

- ↑ 14.0 14.1 C.Hendrickson, "Project Management for Constructions" 2nd Edition, Prentice Hall, 2000. http://pmbook.ce.cmu.edu

- ↑ Simon A. Burtonshaw-Gunn, "Risk and Financial Management in Construction", Gower Publishing, Ltd., 2009. https://books.google.dk/books?id=sE5BDgAAQBAJ&dq=cash+flow+and+payment+milestones+in+Project+Cost+Management