Project Risk Management and Project Risk Management Processes

The Risk Management is a methodology which aims to control the uncertainties that may occur in a project.The methodology started to be studied after the World War II, when large companies with diversified portfolios began to be developped and the need for insurance against the risks started to grow. Project and Risk managers must eliminate the uncertainties, in order to ensure that the project will achieve its goals. The uncertainties and the risks can be related to the duration of activities, to the absence of adequate resources, to the time and cost or other external factors, that can cause undesired effects to the project's performance. In order to manage these risks effectively and efficiently there are processes that can be implemented to deal with risks. The processes include 4 different phases:the 1st phase is the risk management planning which identifies how to plan the activities of the risk management. The 2nd phase is the risk identification which contibutes to the recognition of the risks, the 3rd is the risk analysis that measures the probability and the results of a risk. Finally the 4th step is the risk response planning which enables managers to eliminate the identified risks and establish methods to monitor and control them.

Contents |

History

Risk Management began to be studied after World War II, in order to protect individuals and companies from various losses associated with accidents [1]. Several sources (Crockford 1982, Harrington and Neihaus 2003, Williams and Heins 1995) date the origin of modern risk management to 1955-1964. During the 1950s, new forms of risk management emerged due to the fact that the risk of several new businesses was high and impossible to be insured. Specifically, in the 1960s new planning activities started to be developped such as risk prevention or self-protection and self insurance activities against different kind of losses or risks. Later in the 1970s, financial risk managenent was a first priority for many companies including banks and insurers. The reason was that many companies were exposed to risks that were related to price fluctuations such as interest rates, exchange rates or prices of the raw materials. The next decade, the use of derivatives as risk management tool expanded rapidly as companies intensified their financial risk management. Companies also developped internal risk management models and capital calculations formulas to deal with anticipated risks, as the international risk regulation had already began.

The table below presents some of the most important milestones in the history of risk management.

Fig. 1: Milestones in the history of Risk Management

Uncertainty in Project Management

The uncertainties in any project, are the facts that can cause negative or positive effect on the objectives of the project. Most of the project management activities aim to manage the uncertainties that may occur from the earliest stages of the project's life cycle. The lack of available information or knowledge are considered to be some of the basic reasons that cause uncertainties in a project. Although they can affect the project's final performance, uncertainties stem from factors that cannot be anticipated or measured. Some examples include unforseen tasks, unexpected resource requirements and faulty allocations of time. However, uncertainties can be positive as opportunities and negative as threats. Risk Management is considered to be the methodology that undertakes the management of both threats and opportunities. Traditionally, managers focus on identifying, evaluating and managing threats ( or as some call it, risks). Nevertheless, the last decade there has been a stronger focus on how to manage the opportunities facing a project. The uncertainties can occur throughout the project's life cycle, but also in the pre-execution stages when they contribute to uncertainty in five areas.

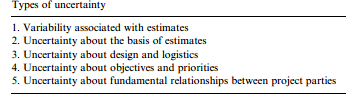

The table below illustrates the five areas of uncertainty

All these areas are really important and they affect the project's final performance. As the list goes down the areas become fundamentally more important to the project's performance. For instance the variability associated with estimates involves the other four areas and each of them invloves dependencies on later areas in the list.

The six Ws framework for the roots of uncertainty

The most important issues that risk management aims to address are related to objectives and relationships between project's parties. Such issues need to be taken into consideration very early in the project and throughout the project's life cycle. For this purpose Chris Chapman[2] and Stephen Ward[3] offer a six Ws framework which is based on the following questions:

1. Who - who are the parties ultimately involved ? (parties)

2. Why - what do the parties want to achieve ? (motives)

3. What - what is it the parties are interested in ? (design)

4. Whichway - how is it to be done ? (activities)

5. Wherewithal - what resources are required ? (resources)

6. When - when does it have to be done ? (timetable)

Answering these questions which are associated with the uncertainty, is fundamental in order to achieve effective identification and management of both theats and opportunities that may occur during the project's life cycle. In figure 3, the flow lines show how the roots of uncertainties influence the project. The arrows indicate the knock-on effects of the uncertainties on each entity. In the earliest stages of the project's life cycle, uncertainty is considered to be in its highest level. The complex part in many projects is to highlight the nature of the important roots of uncertainties. Nevertheless, we can identify that the what, whichway and wherewithal describe the quality of the project, therefore the lower part of figure 3 corresponds to the cost-time-quality triad which is really important for the project's performance.

The Scope of Project Risk Management

Project Risk Management is the systematic process of identifying, analyzing and responding to project risks, in order to take advantage of the impact of positive events that may occur and to decrease the probability of negative events to occur. The project risk management is based on an integrated analysis of all the sources of uncertainty that outlined above. Really effective PRM will develop plans that will address all the six Ws questions. The PRM includes important processes that must be designed and planned at the highest level within a company. The project managers are responsible for the management of the risks, while at the same time they have to gain the support of the stakeholders as far as the risk identification, the planning and the implementation of the responses are concerned.

Why do we need Risk Management ?

Nowdays, risks are part of every firm's financial and economic activity. The risk management is a process in a project's life cycle that aims to reduce the possibilities of its failure and increase the possibilities for its success. However, there are unexpected events that may occur, that can bring benefits or do harm in a project. A more rigorous approach to risk management at all levels of the business can contribute to :

- Secure project/business objectives

- Improve project/business performance

- Facilitate improves customer service

- Learn from past experiences

- Focus on due diligence

- Address changing markets

- Fulfil corporate governance regulations

Risks can turn into opportunities, but also can cause negative impacts in the project's performance. Most of the effort of business and project management is focused on the elements that could bring success to the project. However, the last few years it is believed that spending time focusing on the elements that could cause failure, can yield important benefits.

Project Risk Management features

Project Risk Management promotes an original way of thinking among the business. It ensures that during a project's life cycle all the risks that will be generated, have to be evaluated objectively in order to select the best actions that will mitigate the risks and increase the possibility of success. An effective project risk management should satisfy some basic factors :

- Consider both downside risks (threats) and upside risks (opportunities).

- Challenge project participants and draw from their expertise.

- Promote innovative thinking.

- Focus management attention on key areas of risk.

- Incorporate a standard risk management framework, while remaining flexible to adopt to project specific issues.

- Allow for the ongoing management of risk with continuity through all phases of the project development.

Benefits of effective Project Risk Management

The risk management has a great impact on a project's performance. The correlation between project processes and their outcomes have been investigated over the last years. There is a general agreement that risk management is one of the most influential processes for providing benefits in terms of project time, cost and quality. Moreover, using risk management in an effective way will enhance the ability of stakeholders to make better decissions in order to achieve mission and goals. It also provides managers with useful tools to anticipate changes and to allocate appropriate resources. Specifically, project risk management enhances the flexibility withing a business, while at the same time enables a better compliance management system for the company.

Project Risk Management Processes

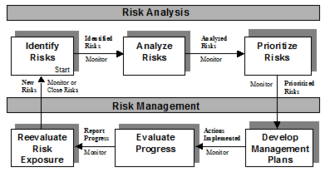

In general, project risk management is a process that aims to identify and manage the events that could negatively affect projects. Risks measure a project's inability to achieve its objectives withinh specified constrains. Constains may include cost, schedule, and technical performance objectives. The importance of risk management can be measured, based on two different components. The first one is the probability of failing to achieve specified objectives, while the second is the impact of failing to achieve these objectives. The risk management processes designed for projects are characterized by the six elements illustrated in figure 4. This process is iterative and continuously performed throughout the project's life cycle. The first part of the whole process includes three elements and addresses the risk analysis part. The other part addresses the risk management of the project and includes the last three elements.

Elements in the two parts :

- Risk Analysis : Identify Risks --> Analyze Risks --> Prioritize Risks

- Risk Management : Develop Management Plans --> Evaluate Progress --> Reevaluate Risk Exposure

Risk Analysis

Risk Identification : Risk Identification is the process of determining events that could potentially prevent the project from achieving its objectives. For effective risk identification, it is required that you have defined the scope of the project. Moreover, the involvement of as many as possible stakeholders in the process will contribute to the achievement of better results. Specifically, there are tools that managers can use in order to enhance the effectiveness of this important process. Tools such as :

- documentation reviews, checklist and project assumption analysis

- information gathering techniques : brainstorming, nominal group, interviews, root cause analysis

- diagramming techniques : process/system flow charts, influence diagrams

- SWOT

- expert judgment

Analyze Risks : This element of the process can be divided to two sub-stages: the first one is the qualitative analysis that focuses on identification and subjective assessment of risks and the second one is the quantitative analysis that focuses on the objective assessment of the risks. A qualitative analysis allows managers to identify the risk sources or factors. This procedure is usually associated with some form of assessment which includes the description of each risk and its impact or a subjective labelling of each risk. In general, the main idea is to identify key risks which will then be analysed and managed in more detail. On the other hand, the quantitative analysis involves more sophisticated techniques, usually requiring computer software. This procedure includes the measurement of uncertainties in cost and time estimates and also the probabilistic combination of individual uncertainties. An initial quantitative analysis is essential, as it brings valuable benefits in terms of understanding the project and its problems.