Porter's 5 Forces - A strategic planning model

Contents |

Abstract

The Porter's Five Forces Model is a strategic analysis tool often used by companies to understand the profitability and structural underlying drivers of projects and to develop competitive strategies. These five forces are supplier power, buyer power, competitive rivalry, the threat of substitution, the threat of new entry [1]. The goal of the model is to help identify the strengths and weaknesses of a project and then determine the structure and strategy [2]. In a certain sense, competitive strategy derives from a deep understanding of the project's competitive landscape. In any industry or project, whether it is producing products or providing services, the law of competition can be reflected through these five forces. For project managers and operators, it is easy to get confused in project operation because of unknown reasons. This is an effective tool to find what really makes the industry profitable. Analyzing exactly which trends will have a big impact on the project, where the constraints are, and if those constraints can be relaxed, it may allow the company to find a really strong competitive position.

The analysis of the five forces model requires a certain knowledge background, but it is relatively easy to practice and apply. This tool can be applied from small-scale projects to large-scale industries. For project management, it is an effective tool to develop a competitive strategy in the market.

This article will explore how to use Porter’s Five Forces model to find the fundamental factors of project profitability, analyze the practical application of the model, and discuss the limitations of the model with critical thinking.

Big idea

The Context: Strategic Planning

Generally, project management can be regarded as the process of achieving the objectives of the strategic plan. Strategic planning is the process of formulating and implementing policies for the future direction of an organization [3]. A strategic plan is usually developed based on professional analysis and experience prior to the implementation of some activities and initiatives. It includes measures and systems to achieve the overall goal. Additionally, a line of sight must be created from strategy to tactics to operation for a successful strategic plan [4]. The things that must be done during a strategic planning processing: 1. Research the current business state and environment 2. A vision of an ideal state for the next three to five years 3. Develop a planned path for how to get from one place to another

The Model: Porter’s Five Forces

Known as the father of the competitive strategy, Michael Porter is an active advocate for thorough research and analysis of the nature of competition. The concept of Porter's five forces first appeared in his 1979 paper. As defined in the Project Management Standards book [5], this model would be a planning model, where future strategic plans are developed based on an analysis of the current state of the market. For more than two decades, Porter's Five Forces Model has been one of the business concepts familiar to corporate strategists. Porter wrote in Competitive Strategies published in 1980 [6]:

"In any industry, whether domestically or internationally, whether it is a product or a service, the rules of competition lie in five competitive forces. The collective power of these five competitive forces determines a company's profitability. The strength of these five forces will vary across industries and will continue to change as the industry evolves."

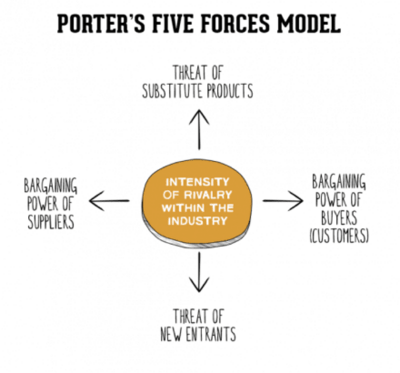

The model, as shown in figure1, consists of five force groups: the bargaining power of suppliers and buyers, the threat of potential entrants, the threat of substitutes, and competition among peers. This analysis method belongs to the micro-analysis in the external environment analysis method, which shows the profit space of the enterprise in the project. The model is a measure of the industry situation, not a measure of firm capabilities. Usually, this analysis method can also be used for entrepreneurial ability analysis to reveal the profitability of a project in the entire industry.

The model is an easy-to-understand framework that facilitates companies to participate in market competition. For strategists, these five forces act as leverage when executing any strategy that could affect the competitive position of the business.

Application

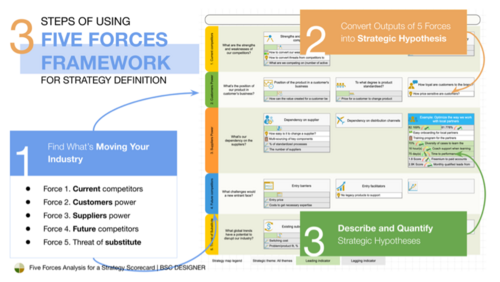

There are three basic steps in applying the Five Forces Model:

• Collection of information and data

Before applying these five forces for analysis, companies must gather as much information as possible about the industry. Like the example shown in Figure 2, finding what’s moving the industry?

• Analyze results with charts

After obtaining enough information, it is necessary to analyze and organize the information to identify the factors that affect the development of the industry. Because for different industries, the factors and problems affecting their development are different.

• Develop and articulate strategies based on results

Convert the result. From the analysis, several factors that affect the profitability of the industry are derived, and these are translated into improvement strategies that increase the benefit of the company.

The five forces model can not only be used before the project starts, but also for strategic analysis and maintenance in the middle and later stages of the project.

Here is a case study:

James Rajasekar et al. use Porter's Five Forces model to conduct a study of the Oman telecommunications industry, exploring the competitive forces that have the greatest impact on it. The data in the article was collected mainly from secondary sources, such as public interviews with the CEOs of companies and the collection of government reports. The data collected were collated and analyzed. As shown in the figure, the threat of new entrants was used as an example to assess the influence of each, and the same was done for the other four forces.

The results of the study show that the greatest competitive forces in the industry stem from the threat of substitutes and competition between competitors. While buyer power and the threat of entry also have a significant impact, suppliers have limited influence. This result has strategic implications for the company and brings new insights and provides strategic indications for competition in the telecommunications industry in Oman. This tool can effectively help strategy makers in the industry to develop and update effective strategies in the face of constant change in the telecoms service industry.

The Process: The Five Forces

Horizontal forces

1. Threat of New Entrants

New entrants here refer to new businesses entering the industry. Competitors don't just refer to mainstream companies that already exist in the market. When an industry becomes profitable and has a certain influence in the market, new companies will be attracted. If the barriers to entry are low, it is easy for new companies to enter the market, and the dynamics of the industry will change with it. Therefore, managers must improve market strategies through long-term data analysis. Barriers to entry can come from the following seven aspects:

• Economies of scale

The unit cost of a product decreases as the absolute quantity increases. If new entrants enter the country in large numbers, existing companies will react strongly. If they enter on a small scale, they are forced to put themselves at a cost disadvantage.

• Government policies

Governments can block entry into industries through restrictions such as licensing requirements. In some highly regulated industries, businesses that are already in the market adjust their business in response to regulation.

• Access to distribution channels

Incumbents lock-in distribution channels may become a kind of barrier.

• Switching costs

Buyers may face many additional costs when selecting new entrants, such as new technology support, purchase of new equipment, retraining of employees, etc.

• Capital requirements

Refers to the purchase of some infrastructure, research and development, publicity, and other financial resources needed. Some startups can avoid some capital requirements by partnering with third-party investment firms.

• Product differentiation

Customer loyalty can get in the way. If the existing enterprise has high brand awareness and customer loyalty, the new entrant will need to spend the high costs to reduce the original customer loyalty. Start-up companies, should have clear goals when launching new products and accurately convey the advantages of the products to customers. Rich marketing resources keep startups at an edge.

• Cost disadvantages

Existing enterprises may have obtained some cost advantages such as government financial support, proprietary technology, and raw material channels, which are difficult for new entrants to obtain.

2. Threat of Substitutes

Substitutes do not refer to the same products in the industry. It can come from other industries and have similar features to products that already exist, giving consumers similar advantages. The low threat of substitute products makes an industry more attractive and also increases the profit potential of firms in that industry. In contrast, a highly threatening substitute product makes an industry less attractive and also reduces the profit potential of firms in that industry. These points below indicate that the threat of alternatives is low:

• High consumer switching cost

If consumer switching costs are high, which means that these factors will deter consumers from buying alternatives, then the threat of alternative products is low.

• The level and situation of substitutes

If the quality of the substitute product is not as superior as that of the industry product, or substitutes are more expensive than the industry product, raising the price ceiling of the industry product, the threat posed by this substitute is relatively small. Similarly, if the functionality of the substitute is not comparable to that of the industry product, or if there are no very close substitutes for the product in the sector, the threat is also small.

3. Competitive Rivalry

Different levels of competition have different effects on industries. Low-intensity competition makes an industry more attractive and increases the potential profit potential of firms already competing within that industry. In contrast, intense competition makes an industry less attractive and reduces the potential profit potential of companies already competing within that industry. The intensity of competition is high if any of the following occurs.

• The level of competitors

A large number of competitors, competitors of comparable size, equal market share with competitors, competitors who are very diverse in their strategies, etc. All of the above factors lead to the industry being under high competitive intensity.

In addition, factors such as low brand loyalty (low consumer switching costs), overcapacity and production capacity, high costs and losses due to industry shutdowns, and non-differentiation of products all contribute to increased competitive intensity.

Vertical forces

1. Bargaining power of suppliers

The role of the company is that of a buyer before the supplier. The bargaining power of the supplier has a direct impact on the competitive environment in which the buyer finds itself and affects the buyer's profitability. There are many ways in which a strong supplier can exert pressure on the buyer. For example by increasing prices, reducing the quality and availability of products, etc. These represent costs to the buyer. Such suppliers increase the competitiveness of the industry and reduce the profit margins and potential of buyers. Conversely, weak suppliers are largely controlled by the buyer in terms of price and quality, and the industry becomes less competitive while the buyer's profit potential increases. The power of the suppliers is high in the following situations:

• Suppliers are more concentrated or easily backward integrated

High supplier entitlement if there are few suppliers and many buyers, or if suppliers can easily integrate or start producing the buyer's products themselves.

• High switching costs or low knowledge on the part of the buyer

High bargaining power of the supplier if it is costly for the buyer to switch from one supplier's product to another or if the buyer is product insensitive and uneducated.

• High product differentiation or no substitution

The bargaining power of a supplier is high if the supplier's products are highly differentiated compared to the market or if there are few substitutes in the market..

2. Bargaining power of buyers

In this part of the analysis, the company switches from its previous role as the buyer to seller, and the buyer is the customer. In the industry, the bargaining power of the buyer also affects the competitive environment in which the seller finds itself, as well as its ability to make a profit. A strong buyer will put pressure on the seller in many ways. For example, they demand higher product quality, lower prices, additional and better services, etc. These are all directly related to the seller's costs, increasing the competitiveness of the industry and reducing the profit potential of the seller. Conversely, if buyers are in a weaker position, both quality and price depend on the seller, making the industry less competitive and the seller's profit potential more profitable. The power of the buyers is high in the following situations:

• The advantage of buyers

The power of the buyer is high if there is a greater concentration of buyers than sellers, in other words, if there are fewer buyers and more sellers. If the cost of switching from one seller's product to another is low, or if the buyer is very price-sensitive, then the buyer's bargaining power is high. The bargaining power of the buyer is high if the customer buys a large number of standardized products from the seller and the majority of the seller's sales come from the same buyer.

• Easy backward integration

The bargaining power of the customer is high if the buyer can easily integrate backward or start producing the seller's products themselves.

• Substitutes are available

Buyer power is high if there are substitutes available in the market.

Limitations

Porter’s five forces framework, as a powerful tool in analyzing the competitiveness of business models, has been successfully applied in many fields. However, the drawbacks of Porter’s five forces framework are inevitable as well.

To begin with, Porter’s five forces framework is a short-term static model. Although Porter described the competitive analysis as a dynamic process, the five forces framework cannot achieve it, unless doing it many times. In this rapidly changing era, any change may affect the accuracy of the five forces model.

Secondly, the results of Porter’s five force framework represent an industry, instead of a company. When companies conduct a strategic analysis, they usually use SWOT analysis and use the results of the five forces framework as data input. This feature restricts the development of Poster’s five forces model. Moreover, Poster’s model cannot deal with the non-profit industry. The key factor of the five forces model is interest. That is how competitors and threats come. Thus, it is not applicable to a non-profit organization.

Besides, according to Tony Grundy, the industry value chains are oversimplified by Porter’s framework. In the actual value chain, the position of the company is more complicated, and it is difficult to really distinguish the supplier, consumer or competitor.

In addition, none of the above factors relating to Porter's Five Forces may be applicable when analyzing a given industry. In the case of buyer bargaining power, for example, some of the factors listed above may indicate high buyer bargaining power and others may indicate low buyer bargaining power. The results are not always straightforward to understand. Therefore, when using these data to assess the competitive structure and profit potential of a market, it is necessary to consider the subtleties of the analysis and the circumstances of companies and industries.

Annotated Bibliography

• Kerzner, Harold. 2019. Using the Project Management Maturity Model, 3rd Edition, chapter 1

The core of the book emphasizes the importance and methods of project management and the benefits and value it can bring to a business or industry. In the introductory section, questions relating to project management are answered. The book not only details current views but also illustrates some misconceptions and past views. In chapter 1, the concept and process of strategic planning is introduced and its necessity is highlighted. The reasons for the failure of some strategic plans in project management are also analyzed, contributing to a comprehensive understanding of the concept and importance of strategic planning.

• Porter, Michael E. 1980. Competitive Strategy: Techniques for Analyzing Industries and Competitors. Free Press.

Written by Porter himself, the book opens with an introduction to comprehensive methods and techniques for analyzing industries and competitors. And goes on to analyze competitive strategies in fragmented, emerging, mature, declining and global industries one by one. The book concludes with an introduction to the analytical techniques required when companies face major strategic decisions: vertical integration, expansion of business capabilities, abandonment of communications to enter new business areas, etc. It helps managers to anticipate and plan strategically for sudden moves by competitors, new entrants in their own industry, and transformations in industry structure.

• Rajasekar James, & Mueid Al Raee, 2013. "An analysis of the telecommunication industry in the Sultanate of Oman using Michael Porter's competitive strategy model."

This article is an example of the application of Porter's Five Forces model, which is used to identify the greatest competitive forces affecting the telecommunications industry in Oman. So, in this article, you can see the steps and results of the analysis of the application of Porter's five forces model. The model has important strategic implications for all the players in the business and develops effective strategies for the players in the industry in the face of the changing dynamics of that business.

References

- ↑ Grundy, T. “Rethinking and Reinventing Michael Porter's Five Forces Model.” Strategic Change, vol. 15, no. 5, John Wiley & Sons, Ltd., 2006, pp. 213–29, doi:10.1002/jsc.764.

- ↑ "https://www.investopedia.com/terms/p/porter.asp Porter's 5 Forces"

- ↑ Kerzner, H. (2019). Using the Project Management Maturity Model, 3rd Edition, Using the Project Management Maturity Model, Third Edition. Using the Project Management Maturity Model, 3rd Edition. John Wiley & Sons

- ↑ Kubiak, T. M., & Benbow, D. W. (2009). The certified six sigma black belt handbook. Certified Six Sigma Black Belt Handbook (2nd Edition) (pp. xxvii, 620 p (unknown). ASQ Quality Press.

- ↑ The standard for project management. (2021). A Guide To the Project Management Body of Knowledge (pmbok® Guide) – Seventh Edition and the Standard for Project Management (english) (pp. xxvi, 67, 274 Seiten (unknown). Project Management Institute, Inc.

- ↑ Porter, M. E. (1980). Competitive strategy : techniques for analyzing industries and competitors (pp. XX, 396 S (unknown). Free Press.