Data-Driven Decision-Making under Uncertainty

Developed by Anton Reiling

........

Abstract

........

Contents |

Decision-Making Approaches

.

Minimax Criterion

.

Maximax Criterion

.

Hurwicz Criterion

.

Minimax Regret

.

Laplace Criterion

.

Application to Supplier Selection within Project Management

These approaches can also be applied to Project, Program and Portfolio Management. However, since they assume that the given data is certain per scenario and can be expressed as a number, the range of sensible application descreases. One example for utilizing these approaches are simple decisions regarding Supplier Selection.

Let's take the following example to see how the different methods influence the decision which supplier to select: For a software project, parts of the front-end development are outsourced to a third-party supplier, which needs to be chosen according to their costs. Since mostly supplier and customer agree on a quotation with a cost estimate  , the resulting costs

, the resulting costs  can be higher or lower than the estimate, depending on incidents during the projects like delays, reworking or other unplanned costs. Of course, some additional costs are already included in the cost estimate to grant the supplier a buffer. This example will consider the following 5 scenarios:

can be higher or lower than the estimate, depending on incidents during the projects like delays, reworking or other unplanned costs. Of course, some additional costs are already included in the cost estimate to grant the supplier a buffer. This example will consider the following 5 scenarios:

- Scenario 1: Best scenario: None of the predicted costs actually occured:

- Scenario 2: The actual costs are lower than the estimated costs, but not as low as

:

:

- Scenario 3: The actual costs match the estimated costs:

- Scenario 4: The actual costs are higher than the estimated costs, but not as high as

:

:

- Scenario 5: Worst scenario: On top of the predicted costs a high number of unexpected costs occurs which increases the overall costs drastically:

The following two suppliers can be chosen: Supplier A guarantees a fixed price of 100 monetary units, no matter which scenario will ocur (i.e. how many unexpected costs will occur). Supplier B however, proposes and estimated price of 100 monetary units. The actual price can vary depending on the scenario, which the following table illustrates:

| Suppliers | S1 | S2 | S3 | S4 | S5 |

|---|---|---|---|---|---|

| Supplier A | 100 | 100 | 100 | 100 | 100 |

| Supplier B | 80 | 95 | 100 | 105 | 150 |

Applying the described approaches to this problem yields the following results:

- Minimax Criterion:

→ Supplier A

→ Supplier A

- Maximax Criterion:

→ Supplier B

→ Supplier B

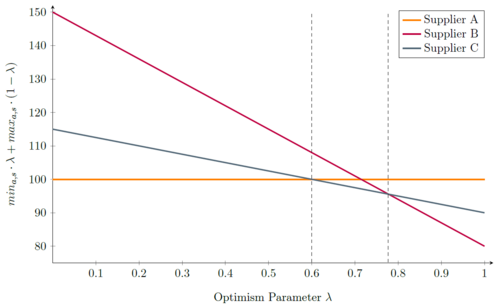

- Hurwicz Criterion:

![[\min(a=2,s) * \lambda + \max(a=2,s) * (1-\lambda)] - [\min(a=1,s) * \lambda + \max(a=1,s) * (1-\lambda)] > 0 for \lambda < \tfrac{5}{7}](/images/math/2/5/8/258ef7438c7256016a87b95ece1b364e.png) (→ Suppplier A)

(→ Suppplier A)  (→ Suppplier B)

(→ Suppplier B)

- Minimax Regret:

→ Supplier A

→ Supplier A

- Laplace Criterion:

→ Supplier A

→ Supplier A

It can be seen that due to the assymetric distribution towards higher average costs for Supplier B the Minimax Regret and the Laplace Criterion suggest to choose Supplier A. For the same reason the Hurwicz Criterion suggests to choose Supplier A for a higher Range in  than to choose Supplier B. Since we have costs independent from the scenario for Supplier A it stands to reason that the Minimax Criterion suggests Supplier A and the Maximax Criterion Supplier B.

than to choose Supplier B. Since we have costs independent from the scenario for Supplier A it stands to reason that the Minimax Criterion suggests Supplier A and the Maximax Criterion Supplier B.

It can be critisized that only the costs were considered in this example and not features like reliability or service quality. Also, all the outcomes were assumed to have an equal probablity of happening which is also rather unrealistic. Especially considering scenario 5 equally probable put a high weight on the 150 monetary units of Supplier B for this scenario. However, for minor supplier selection decisions these approaches provide results with low effort.

Limitations

.

Annotated bibliography

.