Balanced scorecard: connecting the performance measures

Abstract

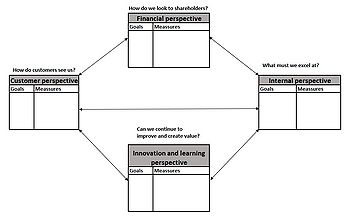

Performance indicators help companies/organizations to assess and make improvements to increase the feasibility of success and overall continuation of satisfactory operations. Tangible assets can be easily measured through financial accounting, such as profit margins, and therefore it’s easy to differentiate between if the organization is successful or unsuccessful. However, With the constant change in the market, intangible assets have become as important as tangible ones, such as customer satisfaction, the efficiency of services, reputation, etc. To increase accessibility for top managers and provide important information relevant to the organization through indicators, Robert S. Kaplan and David P. Norton researched different organizations. They came up with the “Balanced scorecard”, which is a systematic approach to align goals to strategy. This approach also gives managers an overview of these indicators and how each one of them connects to each other from 4 different perspectives: Financial, Customer, Internal and Innovation, and Learning. By visualizing these perspectives in the form of a balanced scorecard, a connection can be made between them, and increasing/decreasing one indicator will, in turn, affect other indicators. Having an overview of these indicators, organizations can adjust their operations to align with their current goals or create new goals with the help of the indicators. Despite this, limitations are still in place, such as managers resistance to change, incorrect emphasis, and misinterpretation of indicators that are presented.

Contents |

Big idea

Origins and purpose

The Balanced scorecard was first introduced in the year 1992 by Robert Kaplan and David Norton after they had conducted a study on organizations regarding performance measurement [1]. Organizations at the time almost entirely measured their performances through financial indicators, but as the world of business was exponentially growing, the demand for a more detailed measurement was needed. To satisfy this demand, Kaplan and Norton presented a solution in the form of a scorecard that took in consideration 4 perspectives that would help the organizations strategic goals to come into fruition. Each of these perspectives focus on different dimensions of the business spectrum and are divided into the following:

- Financial

- Customer

- Internal

- Innovation and learning

Balanced scorecards can help organizations identify new potential areas of improvement through the measured indicators within these perspectives. This is supported by the fact that managers can take decisions that are backed by data and therefore decide to improve in areas that are lacking within the organization.

The goal of these perspectives was to provide measurements that would align with strategic goals that organizations had set for themselves [1]. Having a clear vision to reach a certain goal is important in the competitive landscape. So, one can make a claim that having a tool such as the balanced scorecard would be a helpful tool in obtaining a said goal. As the saying goes, "knowledge is power" and the balanced scorecard can give valuable insights into organizations performance and give them a chance to make informed decisions based on data obtained from the scorecards. This knowledge enables organizations to adapt their strategies if new trends emerge in the market, which helps them be relevant and competitive with rival organizations.

Though the original version of the Balanced scorecards is still used by businesses today, other types of them have been proposed to fit a certain narrative. One example is the suggestion of adding social and environmental aspects to the scorecards [2].This can be really helpful in our socio-economic landscape, especially since awareness regarding our impact on sustainability and environmental impact has increased immensely in the last couple of years. Though it might not have been the intention of Kaplan and Norton, the format of the framework leaves room for new perspectives to be added. One thing to keep in mind is to make sure that that aspect will add value to the company's strategic goal.

Perspectives and the importance of connection

Financial

The most well-known and the most normally measured perspective is the financial perspective since in order for organizations to thrive in the competitive business landscape and ensure long-term success, financial stability is important. Managers should though be aware that short-term financial measurements can be misleading to the overall picture, such as quarterly sales [1]. Financial performance indicators can be measured and put in a straightforward way that represents the organizations ability to gain revenue. Measuring financial performance indicators can be done in a number of ways. One of those indicators is net profit margin, which is a percentage of a organizations net income, divided by its net sales. Another one is organizations return on investment (ROI) which is the value of an investment, divided by its cost. There are of course more indicators such as cash flows. Back in the day, these metrics were the only measures of success for organizations, since profit was the main driving factor for organizations. Now a days other metrics have become as important as the financial gain since the landscape has drastically changed throughout recent years.

Customer

As the business landscapes expands and evolves, so does the important of how external factors impact how business is concluded. Customers are a key external factor on how an organization functions since they are the ones that provide revenue. Customer satisfaction can impact a brands image which in turn can lead to either negative or positive effect, depending on the situation. Measuring this performance indicator can be in the form of surveys sent out to customers, complaints received, sales of new products and more. In short, this perspective focuses on how the organization appeals to the customers[1]. One interesting principle that reinforces the importance of this metric is the Pareto Principle which argues that for businesses, 80% of its profit comes from 20% of their customers [3]. This shows that the customers are important metrics that organizations have to measure, in order to raise their financial gain among other things.

Internal

Processes that the organization has to be proficient at to add value for shareholders and customers are identified as internal processes(3). By identifying, measuring and evaluating these processes, organizations can increase their value in different ways, such as better customer satisfaction, decreased cost due to optimized setups, supplier relationship and more. When focusing on this perspective, one has to keep in mind that these attributes are supposed to indicate what must the organization excel at to have a competitive edge[4].These values don’t necessarily have to be operations processes, they could also be employee training and other similar values. By identifying, measuring, and evaluating these processes, organizations can increase their value in different ways, such as better customer satisfaction, decreased cost due to optimized setups, supplier relationship and more. When focusing on this perspective, one has to keep in mind that these attributes are supposed to indicate what must the organization excel at to have a competitive edge. This can be used with other implementation of methods, such as LEAN that focuses on continuous improvement and minimizing risks which would improve internal processes.

Innovation and learning

Improvement and the thrive for innovation have always been part of the business landscape, especially in the 21st digital age. It helps organizations stay relevant and competitive in their perspective fields since failing to follow innovation has been the downfall of many organizations. One example of this is Blockbuster which was a huge video-rental franchise in its time that was famous around the world, but with the rise of Netflix and other online streaming services trouble was on the horizon. Blockbuster’s reluctance to adapt to the new innovation trend that was happening at the time ended in their downfall[5]. Learning ties into innovation since learning from previous endeavours, successful or unsuccessful, will improve the internal value of the organization and helps with future endeavours that the organization might venture into. Metrics that could be measured in this perspective are for instance time to develop the next generation of tech, process time to maturity for manufacturing learning, and how new products compare to rival competitors on the market [1].

Connection between the perspectives

When working with balanced scorecards to measure the performance within an organization one has to realize that it can easily go down the road of thinking about each perspective as a single entity and narrowing down that view without regard to the others. All four perspectives can influence each other in either a positive or a negative direction depending on how they are handled. One way to prevent this early on is getting employees aboard and asking themself “Where do we want to go?” in other words, what’s the vision?[6]. This makes it so that employees are aligned with the organizational vision, and it can make the process of implementing balanced scorecards more efficient. Let’s take a look at a hypothetical example regarding the financial perspective: An organization focuses solely on the financial aspect of the perspective i.e. cash flow, ROI, among others, They see that the have good financial gains over a period of time and it is then decided that the organizations keeps on the same roll without changing anything. What they didn’t notice is that the brand image was starting to weaken to increase of complaints and also that process creating their products was becoming less efficient and therefore compromising long-term sustainability. This is just a hypothetical situation but it shows that it isn’t enough to solely focus one perspective but to look at the whole as well. Strategy maps are an important tool that immensely helps both visualising the measured performance indicators but also showing the relationship between the perspectives. Strategy maps show the cause and effect between the indicators in the perspectives while keeping them aligned with organizational goal. To simplify what the combination of strategy maps and balanced scorecards is, it asks, “how do we get there” and shows us a path to that can help in reaching an end goal[6].

Real life application

In 2007 a study was conducted by Teemu Malmi where the objective was to observe and analyse 17 Finnish organizations, located in different industries and of different sizes, that have some sort of a way implemented Balanced scorecards into their business structure. It was found out that the majority followed the Kaplan and Norton approach of having financial, customer, internal, and Innovation and learning as their perspectives. Despite following the Kaplan and Norton approach there were still applied in different ways depending on the organizations, such as the scope it was applied to. One noticeable difference was some organizations didn’t have a clear target when implementing, the reason for this was to use balanced scorecards as a measuring tool to see what they can do better in their operations, rather than helping them with their strategic goals. With this information, a question was proposed to individuals that work worked different jobs and different organizations if balanced scorecards were more of a measuring tool or a tool for implementing strategy. The result was that the tool was a useful option in both cases. After the implementation of balanced scorecards, the organizations noticed an improvement in their operation. One organization stated that their employees became more involved in wanting to improve things within the organization, this might be due to employees wanting to improve on the measured content. Another one stated that their planning and control have changed so that they don’t have sales and profit targets. This shows that balanced scorecards not only has to be directly connected to an organization's strategic goal but also a useful measurement tool for other means[7].

Another case study is the implementation of a Balanced Scorecard at a Higher Education Institution (HEI). This study shows that balanced scorecards aren’t only connected to organizations that aim to make a profit, but also educational institutions among others. it is stated that in order for universities to be more be more competitive in the future, use of strategic management models are needed. Balanced scorecards provide measures that will help with decision making and therefore help the university[8].

Limitations

Resistance to change

People can be hesitant about implementing processes into their lives, and more so if it’s in a business landscape. The thought process can be that since the business is doing well, why is there a need for change or implement something new. This might be true in the short-term but if businesses want to thrive, they have to adapt to modern business practices and also have a competitive advantage. The use of balanced scorecards can give businesses the measurements of their performance indicators to see how they fair against their competitive rivals. This can be achieved for instance by using Porter’s five forces, which argues that organizations need to be able to analyse their industry’s strength and weaknesses by viewing their competitors. The framework focuses on areas as the name suggests, the threat of new entrants, Bargaining power of buyers, Bargaining power of suppliers, Threat of new substitutes, and Competitive rivalry [9]. Balanced scorecard can be of help to Porters five forces by comparing the measured indicators obtained from the 4 Perspectives (financial, customer, internal, innovation and learning) and compare them with their rival competitors. By showing the benefits of both Porters five forces and balanced scorecards, managers can be persuaded into implementing changes that can be highly beneficial for organizations if implemented correctly. By having a lack of knowledge or a lack of agreement on the purpose of the perspectives can lead to misalignment of goals which in turn leads to misinterpretation results. A way to prevent this is to from the start inform everyone involved in the balanced scorecard about the what and why, what are we measuring and why are we measuring it[4]. Then there’s the issue of deciding how the measurement should be implemented, processed, and then reviewed (as stated earlier in this section). The choice of method for measuring intangible performance indicators has to be decided at the earliest, be it a survey, interview, or something entirely different.

misinterpretation

Misinterpretation As with a lot of methods/tools, the correct definition of the use and purpose of it is vital to prevent misinterpretation which could lead to the results being disadvantageous to organizations goals. Results from the measurement of intangible performance indicators, such as employee morale or reputation, leave a lot of room for misdiagnosis of the current state. The cause of this is that opinions on intangible are often subjective since it’s difficult for us as human beings to agree on intangible results. Let’s take employee knowledge as an example, if two different individuals were asked to give an assessment of the knowledge of employees at the organization, there is a high possibility that the answers will differ. Another example is that if a survey yields high employee satisfaction, then one might assume that no further action is needed. But what it might also mean is that the employees are only satisfied with how things are and have no interest in furthering innovation and other opportunities that would benefit the organization. That’s why correct interpretation is needed and potentially looking at the bigger picture when looking at results

Incorrect emphasis

Since the goal of the balanced scorecards is to provide measurements that help organizations with strategic goals, correct emphasis is needed. It is important to have the right choice of measurable performance indicators that align with the organizations strategic goals, if done incorrectly then it can lead to a misalignment between the organization's goals and its actual performance. It is also important to not solely focus on a single perspective since the four perspectives that Kaplan and Norton provide, are all connected and affect one another. For example, if an organization has the goal of improving its brand image, then let’s say that it will put emphasis solely on the customer perspective. They might decrease prices and increase volume of stock so that delivery time will be shorter and among other things. If the other performance indicators are neglected, then it might lead to inefficient internal processes which in turn leads to negative outcomes from the financial perspective. This could be in the form of increased cost, decreased ROI and among other things. To ensure that correct emphasis is applied, organizations have to have a strategic goal (as stated earlier) and involve employees in what that goal is[6].

References

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 Kaplan, R. S. & Norton, D. P. (1992). The balanced scorecard: measures that drive performance. Harvard Business Review, 71–80.

- ↑ Brignal, S. (2002). . The Unbalanced Scorecard: a Social and Environmental Critique". Proceedings, Third International Conference on Performance Measurement and Management (PMA2002).

- ↑ Sanders, R. (1987), "THE PARETO PRINCIPLE: ITS USE AND ABUSE", Journal of Services Marketing, Vol. 1 No. 2, pp. 37-40. https://doi.org/10.1108/eb024706.

- ↑ Niven, P. R. (2010). Balanced Scorecard Step-by-Step (2nd ed.). Wiley.

- ↑ Olito, F. and Bitter, A. (2023) Blockbuster: The rise and fall of the movie rental store, and what happened to the Brand, Business Insider. Business Insider. Available at: https://www.businessinsider.com/rise-and-fall-of-blockbuster?r=US&IR=T (Accessed: May 3, 2023).

- ↑ 6.0 6.1 6.2 Cokins, G. (2009). Performance Management: Integrating Strategy Execution, Methodologies, Risk, and Analytics (1st ed.). Wiley.

- ↑ Malmi, T. (2001). Balanced scorecards in Finnish companies: A research note. Management Accounting Research, 12(2), 207–220. https://doi.org/10.1006/mare.2000.0154

- ↑ Oliveira, C., Oliveira, A., Fijałkowska, J., & Silva, R. F. (2021). Implementation of Balanced Scorecard. Management : Journal of Contemporary Management Issues, 26(1), 169–188. https://doi.org/10.30924/mjcmi.26.1.104

- ↑ Gerard Bruijl. The relevance of porter’s five forces in today’s innovative and changing business environment. SSRN Electronic Journal, 01 2018