Balanced scorecard: connecting the performance measures

Abstract

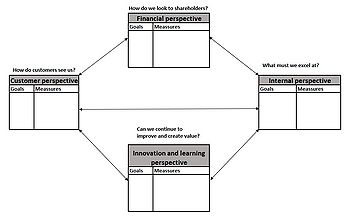

Performance indicators help companies/organizations to assess and make improvements to increase the feasibility of success and overall provide a product/service that is up to standards. Tangible assets can be easily measured through financial accounting, such as cash flow, ROI, and more, and therefore it’s easy to differentiate between if the organization is successful or unsuccessful on the financial side of things. However, With the constant change in the market, intangible assets have become as important as tangible ones, such as customer satisfaction, the efficiency of services, brand image, etc. To increase accessibility for top managers and provide important information relevant to the organization through indicators, Robert S. Kaplan and David P. Norton made a study researching different types of organizations. They came up with the idea of a “Balanced scorecard”, which is a systematic approach to align goals to strategy and provide managers with more insight into their organization. This approach also gives managers an overview of these indicators and how each one of them connects to each other from 4 different perspectives: Financial, Customer, Internal and Innovation, and Learning. By visualizing these perspectives in the form of a balanced scorecard, a connection can be made between them, and increasing/decreasing one indicator will, in turn, affect other indicators since no perspective is truly unconnected to the other ones. Having an overview of these indicators, organizations can adjust their operations to align with their current goals or create new goals with the help of the indicators. Despite this, limitations are still in place, such as managers’ resistance to change, incorrect emphasis, and misinterpretation of indicators that are presented.

Contents |

Big idea

Origins and purpose

The Balanced scorecard was first introduced in the year 1992 by Robert Kaplan and David Norton after they had conducted a study on organizations regarding performance measurement [1]. Organizations at the time almost entirely measured their performances through financial indicators, but as the world of business was exponentially growing, the demand for a more detailed measurement was needed. To satisfy this demand, Kaplan and Norton presented a solution in the form of a scorecard that took into consideration 4 perspectives that would help the organization’s strategic goals to come to fruition. Each of these perspectives focuses on different dimensions of the business spectrum and are divided into the following:

- Financial

- Customer

- Internal

- Innovation and learning

Balanced scorecards can help organizations identify new potential areas of improvement through the measured indicators within these perspectives. This is supported by the fact that managers could find it easier to make decisions when they are backed by data and therefore decide to improve in areas that are lacking within the organization.

The goal of these perspectives was to provide measurements that would align with strategic goals that organizations had set for themselves[1]. Having a clear vision to reach a certain goal is important in the competitive landscape. So, one can make a claim that having a tool such as the balanced scorecard would be a helpful tool in obtaining a set strategic goal. As the saying goes, "knowledge is power" and the balanced scorecard can give valuable insights into organizations performance and give them a chance to make informed decisions based on data obtained from the scorecards. This knowledge enables organizations to adapt their strategies if new trends emerge in the market, which helps them be relevant and competitive with rival organizations.

Though the original version of the Balanced scorecards is still used by businesses today, other variations of them have been proposed to fit a certain narrative. One example is the suggestion of adding social and environmental aspects to the scorecards [2].This can be really helpful in our socio-economic landscape, especially since awareness regarding our impact on sustainability and environmental impact has increased immensely in the last couple of years. Though it might not have been the intention of Kaplan and Norton, the format of the framework leaves room for new perspectives to be added. One thing to keep in mind is to make sure that that aspect will add value to the company’s strategic goal, if it doesn’t add value then it could hinder the progress

Perspectives and the importance of connection

Financial

The most well-known and the most regularly measured perspective is the financial perspective since in order for organizations to thrive in the competitive business landscape and ensure long-term success. Financial stability is important for organizations for a number of reasons, mainly to keep current operations going but another one is to make space for future projects that could improve the current system. Managers should though be aware that short-term financial measurements can be misleading to the overall picture, such as quarterly sales which could give a false assessment of the current situation [1]. Financial performance indicators can be measured and put in a straightforward way that represents the organization’s ability to gain revenue. Measuring financial performance indicators can be done in a number of ways. One of those indicators is net profit margin, which is a percentage of an organization’s net income, divided by its net sales. Another one is the organization’s return on investment (ROI) which is the value of an investment, divided by its cost. There are of course more indicators such as cash flows. Back in the day, these metrics were the main measures of success for organizations, since profit was the main driving factor for organizations at the time (and still in a lot of cases in today’s market). Nowadays other metrics have become as important as financial gain since the landscape has drastically changed throughout recent years.

Customer

As the business landscape evolves throughout the years, so does the importance of knowing how external factors might impact how business is concluded. Customers are a key external factor in how an organization functions since they are the ones that provide revenue. Customer satisfaction can impact a brand’s image which in turn can lead to either negative or positive effects, depending on the situation. Measuring this performance indicator can be in the form of surveys sent out to customers, complaints received, sales of new products, and more. In short, this perspective focuses on how the organization appeals to the customers [1]. One interesting principle that reinforces the importance of this metric is the Pareto Principle which argues that for businesses, 80% of their profit comes from 20% of their customers [3]. This shows that the customers are important metrics that organizations have to measure, in order to raise their financial gain among other things.

Internal

Processes that the organization has to be proficient at in order to add value for shareholders and customers are identified as internal processes [4]. These values don’t necessarily have to be operations processes, they could also be employee training and other similar values. By identifying, measuring, and evaluating these processes, organizations can increase their value in different ways, such as better customer satisfaction, decreased cost due to optimized setups, supplier relationships, and more. When focusing on this perspective, one has to keep in mind that these attributes are supposed to indicate what must the organization excel at to have a competitive edge [5].This can be used with other implementation of methods, such as some methods that are part of the LEAN ideology that focuses on continuous improvement and minimizing waste which would improve internal processes. For instance, by decreasing waste in the form of overproduction with methods like a pull system, value is added since inventory cost will be lower. This was just a short example, but it shows that there are many types of methods that complement the internal perspective.

Innovation and learning

Improvement and the thrive for innovation have always been part of the business landscape, especially in the 21st digital age. It helps organizations stay relevant and competitive in their perspective fields since failing to follow innovation has been the downfall of many organizations. One example of this is Blockbuster which was a huge video-rental franchise in its time that was famous around the world. One interesting thing is that Blockbuster had the opportunity to buy Netflix bet in the end decided not to, which was their first mistake. With the rise of Netflix and other online streaming services trouble was on the horizon and since Blockbuster stayed on the same path, their demise was imminent. Blockbuster’s reluctance to adapt to the new innovation trend that was happening at the time ended in their downfall [6]. This is just one of many stories of a company neglecting the changing environment and refusing to adapt to the changing market by putting more investment into innovation and learning. Learning ties into innovation since learning from previous endeavours, successful or unsuccessful, will improve the internal value of the organization and helps with future endeavours that the organization might venture into. Metrics that could be measured in this perspective are for instance time to develop the next generation of tech, process time to maturity for manufacturing learning, and how new products compare to rival competitors on the market [1].

Connection between the perspectives

When working with balanced scorecards to measure the performance within an organization one has to realize that it can easily go down the road of thinking about each perspective as a single entity and narrowing down that view without regard to the others. All four perspectives can influence each other in either a positive or a negative direction depending on how they are handled. One way to prevent this early on is getting employees aboard and asking themself “Where do we want to go?” in other words, what’s the vision?[4]. This makes it so that employees are aligned with the organizational vision and by having people aboard with the strategic goal, the process of implementing balanced scorecards is more efficient. Let’s take a look at a hypothetical example regarding the financial perspective to get an image of how a narrowed view could impact an organization: An organization focuses solely on the financial aspect of the perspectives i.e. cash flow, ROI, and among other indicators, They see that they have good financial gains over a period of time and it is then decided that the organizations keeps on the same roll without changing anything. What they didn’t notice is that the brand image was starting to weaken because of the increased number of complaints and also that process of creating their products was becoming less efficient and therefore compromising long-term sustainability. This is just a hypothetical situation, but it shows that it isn’t enough to solely focus on one perspective but to look at the whole as well. In order for getting the maximum out of balanced scorecards, there is a need to have a tool that shows the strategy that the organization is heading towards. Strategy maps can fulfill that role, they are an important tool that immensely helps both visualizing the measured performance indicators and also showing the relationship between the perspectives. Strategy maps show the cause and effect between the indicators in the perspectives while keeping them aligned with organizational strategic goals. To simplify what the combination of strategy maps and balanced scorecards is, it asks, “How do we get there” and shows us a path that can help in reaching an end goal [4].

Real life application

In 2007 a study was conducted by Teemu Malmi where the objective was to observe and analyse 17 Finnish organizations, located in different industries and of different sizes, that have some sort of a way implemented Balanced scorecards into their business structure. It was found out that the majority followed the Kaplan and Norton approach of having financial, customer, internal, and, Innovation and learning as their perspectives. Despite following the Kaplan and Norton approach they were still applied in different ways depending on the organizations, such as the scope it was applied to. One noticeable difference was some organizations didn’t have a clear target when implementing. The reason for this was to use balanced scorecards as a measuring tool to see what they can do better in their operations, rather than helping them with their strategic goals. With this information, a question was proposed to individuals that work worked different jobs and different organizations if balanced scorecards were more of a measuring tool or a tool for implementing strategy. The result was that the tool was a useful option in both cases. After the implementation of balanced scorecards, the organizations noticed an improvement in their operation. One organization stated that their employees became more involved in wanting to improve things within the organization, this might be due to employees wanting to improve on the measured content since they could see what could be improved by looking at the measured performance indicators. Another one stated that their planning and control have changed so that they don’t focus solely on sales and profit targets. This shows that balanced scorecards not only have to be directly connected to an organization’s strategic goal but are also a useful measurement tool for other means[7].

Another case study is the implementation of a balanced scorecard at a Higher Education Institution (HEI). This study shows that balanced scorecards aren’t only connected to organizations that aim to make a profit, but also for educational institutions and other types of institutes. it is stated that in order for universities to be more competitive in the future, the use of strategic management models is needed. Balanced scorecards provide measures that will help with decision-making and therefore help the university[8].

Limitations

Resistance to change

People can be hesitant about implementing processes into their lives, and more so if it’s in a business landscape. The thought process can be that since the business is doing well, why is there a need for change or to implement something new? This might be true in the short-term but if businesses want to thrive, they have to adapt to modern business practices and also have a competitive advantage. The use of balanced scorecards can give businesses the measurements of their performance indicators to see how they fair against their competitive rivals. This can be achieved for instance by using Porter’s five forces, which argues that organizations need to be able to analyse their industry’s strengths and weaknesses by viewing their competitors. The framework focuses on areas as the name suggests, the threat of new entrants, the Bargaining power of buyers, the Bargaining power of suppliers, the Threat of new substitutes, and Competitive rivalry [9]. A balanced scorecard can be of help to Porter’s five forces by comparing the measured indicators obtained from the 4 Perspectives (financial, customer, internal, innovation and learning) and comparing them with their rival competitors. By showing the benefits of both Porter’s five forces and balanced scorecards, managers can be persuaded into implementing changes that can be highly beneficial for organizations if implemented correctly.

Misinterpretation

Misinterpretation As with a lot of methods/tools, the correct definition of the use and purpose of it is vital to prevent misinterpretation which could lead to the results being disadvantageous to the organization’s goals. Results from the measurement of intangible performance indicators, such as employee morale or reputation, leave a lot of room for misdiagnosis of the current state. The cause of this is that opinions on intangible are often subjective since it’s difficult for us as human beings to agree on intangible results. Let’s take employee knowledge as an example, if two different individuals were asked to give an assessment of the knowledge of employees at the organization, there is a high possibility that the answers will differ. Another example is that if a survey yields high employee satisfaction, then one might assume that no further action is needed. But what it might also mean is that the employees are only satisfied with how things are and have no interest in furthering innovation and other opportunities that would benefit the organization. That’s why correct interpretation is needed and potentially looking at the bigger picture when looking at results. Having a lack of knowledge or a lack of agreement on the purpose of the perspectives can lead to misalignment of goals which in turn leads to misinterpretation results. A way to prevent this is to from the start inform everyone involved in the balanced scorecard about the what and why, what are we measuring and why are we measuring it [5]. Then there’s the issue of deciding how the measurement should be implemented, processed, and then reviewed (as stated earlier in this section). The choice of method for measuring intangible performance indicators has to be decided at the earliest, be it a survey, interview, or something entirely different

Incorrect emphasis

Since the goal of balanced scorecards is to provide measurements that help organizations with strategic goals, correct emphasis is needed. It is important to have the right choice of measurable performance indicators that align with the organization’s strategic goals, if done incorrectly then it can lead to a misalignment between the organization's goals and its actual performance. It is also important to not solely focus on a single perspective since the four perspectives that Kaplan and Norton provide, are all connected and affect one another. For example, if an organization has the goal of improving its brand image, then let’s say that they will put emphasis solely on the customer perspective. They might decrease prices and increase the volume of stock so that delivery time will be shorter and among other things. If the other performance indicators are neglected, then it might lead to inefficient internal processes which in turn leads to negative outcome from the financial perspective. This could be in the form of increased cost, decreased ROI, and other things. To ensure that correct emphasis is applied, organizations have to have a strategic goal (as stated earlier) and involve employees in what that goal is[4].

Annotated bibliography

Kaplan, R. S. & Norton, D. P. (1992). The balanced scorecard: measures that drive performance. Harvard Business Review 70, 71-80.[1]

This publication is the original work that Kaplan and Norton published to introduce their findings regarding balanced scorecards. The work goes into the 4 perspectives that they introduced and also talks about their findings regarding the companies and their success, that had been observed for this case study. This laid the groundwork for a change of thought regarding performance management since providing evidence that adding these perspectives and also showing the connection between them could prove useful for organizations if done correctly.

Cokins, G. (2009). Performance Management: Integrating Strategy Execution, Methodologies, Risk, and Analytics (1st ed.). Wiley [4]

This book focuses on explaining performance management frameworks such as balanced scorecards, strategy maps and more. It goes into ways to successfully implementing these frameworks and some key elements that have to be taken into account when implementation takes place. The book also consist of media article and blogs that Cokins has made regarding performance management. This book gave great insight into the importance of strategic goals in relation to balanced scorecards and also connecting strategic maps to it as well.

Niven, P. R. (2010). Balanced Scorecard Step-by-Step (2nd ed.). Wiley [4]

As the name suggest, this book is a detailed guide to learn about balanced scorecards. It takes the idea of Kaplan and Norton and stretched out their ideas in order to provide a comprehensive overview of balanced scorecards. The book led to easier understanding regarding the perspective and similar to Cokins, showed the importance of connecting strategic goals to the scorecards. The challenges of balanced scorecards are also addressed in this book which give an important insight since the if companies decide to implement balanced scorecards, knowing the challenges is of upmost importance

References

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 1.6 Kaplan, R. S. & Norton, D. P. (1992). The balanced scorecard: measures that drive performance. Harvard Business Review, vol 70, 71–80.

- ↑ Brignal, S. (2002). . The Unbalanced Scorecard: a Social and Environmental Critique". Proceedings, Third International Conference on Performance Measurement and Management (PMA2002).

- ↑ Sanders, R. (1987), "THE PARETO PRINCIPLE: ITS USE AND ABUSE", Journal of Services Marketing, Vol. 1 No. 2, pp. 37-40. https://doi.org/10.1108/eb024706.

- ↑ 4.0 4.1 4.2 4.3 4.4 4.5 Cokins, G. (2009). Performance Management: Integrating Strategy Execution, Methodologies, Risk, and Analytics (1st ed.). Wiley.

- ↑ 5.0 5.1 Niven, P. R. (2010). Balanced Scorecard Step-by-Step (2nd ed.). Wiley.

- ↑ Olito, F. and Bitter, A. (2023) Blockbuster: The rise and fall of the movie rental store, and what happened to the Brand, Business Insider. Business Insider. Available at: https://www.businessinsider.com/rise-and-fall-of-blockbuster?r=US&IR=T (Accessed: May 3, 2023).

- ↑ Malmi, T. (2001). Balanced scorecards in Finnish companies: A research note. Management Accounting Research, 12(2), 207–220. https://doi.org/10.1006/mare.2000.0154

- ↑ Oliveira, C., Oliveira, A., Fijałkowska, J., & Silva, R. F. (2021). Implementation of Balanced Scorecard. Management : Journal of Contemporary Management Issues, 26(1), 169–188. https://doi.org/10.30924/mjcmi.26.1.10

- ↑ Gerard Bruijl. The relevance of Porter’s five forces in today’s innovative and changing business environment. SSRN Electronic Journal, 01 2018