Management of risk

Risk is part of all our lives. We need to take risks to grow and develop. Effectively managed risk in hospitals, airport security, construction sites, projects, programmes, portfolios and in so many more circumstances help societies achieve.

Management of risk involves identification, assessment, and prioritization of risks. Coordinated and economical application of resources to minimize, monitor, and control the probability and/or impact of unfortunate events or to maximize the realization of opportunities.

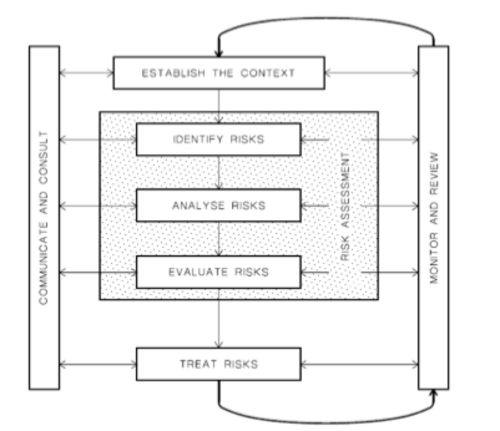

Figure 1 shows what is involved in risk management. Identifying, analysing and evaluating risks are all part of risk assessment and will be further analysed in the risk assessment section.

Because risk is inherent in everything we do, risk professionals undertake roles that are very diverse. It includes roles in insurance, business, health and safety, corporate governance, engineering, planning and financial services to name a few.

In this article general methodologies and important principles of risk management will be outlined, risk assessment will be explained and programme risk management introduced. Benefits and limitations of risk management will be discussed before stating the conclusions.

Contents |

Introduction

Organizations of all types and sizes face internal and external factors and influences that make it uncertain whether and when they will achieve their objectives. Risk is the effect this uncertainty has on an organization's objectives. Risk can be managed by identifying it, analysing it and then evaluating whether the risk should be modified by risk treatment in order to satisfy their risk criteria. Constant communication and consultation with stakeholders is a key for the process to run smoothly as well as monitoring and reviewing the risk and making sure that the correct actions are taken to ensure that no further risk treatment is required.

Risk management can be applied to an entire organization, at its many areas and levels, at any time. It can also be applied to specific functions, projects and activities.

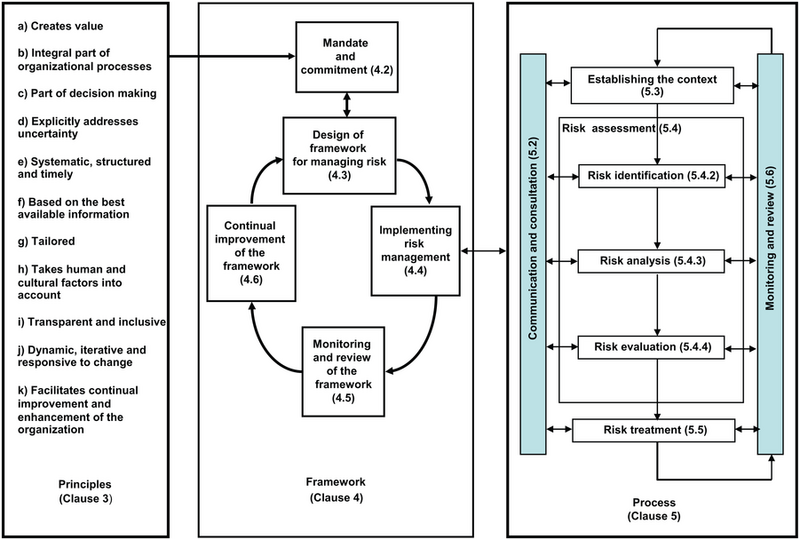

The practice of risk management is used within many sectors in order to meet diverse needs. Despite that wide range, adoption of consistent processes within a comprehensive framework can help to ensure that risk is managed effectively, efficiently and coherently across an organization. ISO 31000 is an international standard that describes a generic approach and provides the principles and guidelines for managing any form of risk in a systematic, transparent and credible manner and withing any scope and context. [1]

As can be seen in figure 1, the first step is to establish the context in order to figure out the individual needs, audiences, perceptions and criteria for each specific sector while applying risk management. Establishing the context will capture the objectives of the organization, the environment in which it pursues those objectives, its stakeholders and the dicersity of risk criteria. those factors will help reveal and assess the nature and complexity of its risks.

The international standard has stated that when risk management is implemented and maintained in accordance with ISO, it enables an organization to achieve the following objectives:

- Increase the likelihood of achieving objectives

- encourage proactive management

- Be aware of the need to identify and treat risk throughout the organization

- Improve the identification of opportunities and threats

- Comply with relevant legal and regulatory requirements and international norms

- Improve mandatory and voluntary reporting

- Improve governance

- Improve stakeholder confidence and trust

- Establish a reliable basis for decision making and planning

- Improve controls

- Effectively allocate and use resources for risk treatment

- Improve operational effectiveness and efficiency

- Enhance health and safety performance, as well as environmental protection

- Improve loss prevention and incident management

- Minimize losses

- Improve organizational learning

- Improve organizational resilience

Important principles

The following principles should be complied with by an organization in order for risk management to be effective.

Management of risk:

- Creates and protects value - Contributes to the demonstrable achievement of objectives and improvement of performance in, for example, security, environmental protection, project and program management.

- Integral part of all organizational processes - Risk management is not a stand-alone activity that is separate from the main activities and processes of the organization. It is part of the responsibilities of management and an integral part of all organizational processes, including strategic planning and all project and change management processes.

- Part of decision making - Helps decision makers make informed choices, prioritize actions and distinguish among alternative courses of action.

- Explicitly addresses uncertainty - Risk management explicitly takes account of uncertainty, the nature of that uncertainty, and how it can be addressed.

- Systematic, structured and timely - A systematic, structured and timely approach to risk management contributes to efficiency and to consistent, comparable and reliable results.

- Based on the best available information - The inputs to the process of managing risk are based on information sources such as historical data, experience, stakeholder feedback, observation, forecasts and expert judgement. Decision makers should however inform themselves of, and should take into account, any limitations of the data or modelling used or the possibility of divergence among experts.

- Is tailored - It is aligned with the organization's external and internal context and risk profile.

- Takes human and cultural factors into account - Recognizes the capabilities, perceptions and intentions of external and internal people that can facilitate or hinder achievement of the organization's objectives.

- Is transparent and inclusive - For risk management to be relevant and up-to-date, appropriate and timely involvement of stakeholders and, in particular, decision makers at all levels of the organization has to be ensured. By doing so also allows stakeholders to be properly represented and to have their views taken into account in determining risk criteria.

- Is dynamic, iterative and responsive to change - Continually senses and responds to change. As external and internal events occur, context and knowledge change, monitoring and review of risks take place, new risks emerge, some change, and others disappear.

- Facilitates continual improvement of the organization - Organizations should develop and implement strategies to improve their risk management maturity alongside all other aspects of their organization.

Risk assessment

Risk assessment is the determination of quantitative or qualitative estimate of risk related to a concrete situation and a recognized hazard. Two components of risk are required for calculations in quantitative risk assessment. The magnitude of the potential loss (L) and the probability (p) that the loss will occur. If the countermeasure for handling a certain risk exceeds the value of the expected loss it is called acceptable risk. That kind of risk is understood and tolerated

Qualitative

A pre-defined rating scale is used to prioritize the identified project risks. The probability or likelihood and the impact on a project objectives should they occur gives the score for a certain risk. A qualitative risk analysis also includes the appropriate categorization of the risks. Source-based or effect-based.

Quantitative

A further analysis of the highest priority risks during which a numerical or quantitative rating is assigned in order to develop a probabilistic analysis of the project. Possible outcomes for the project are quantified and the probability of achieving specific project objectives is assessed. When there is uncertainty a quantitative approach can be used to make decisions. It also creates realistic and achievable cost, schedule or scope targets.

Quantitative risk analysis can only be successfully carried out if there is high-quality data, a well-developed project model, and a prioritized lists of project risks. That usually yields from performing a qualitative risk analysis. [2]

| Qualitative | Quantitative |

|---|---|

| risk-level | project level |

| subjective evaluation of probability and impact | probabilistic estimates of time and cost |

| quick and easy to perform | time consuming |

| no special software or tools required | may require specalized tools |

Programme risk management

There are four defined steps in programme risk management. Identify step, assess step, plan step and implement step. In order for a programme to run as smoothly as possible, these four steps must be followed. Other factors play along these four steps, good and effective communication is the most important factor. Communication has to be good throughout each and every step. Let's take a better look at the four steps.

Identify step

In the beginning of programme management, the identification of uncertain events which can both be threats and opportunities takes place. The programme's objectives and scope, what assumptions have been made, who the stakeholders are and where the programme fits inside the organization as well as the environment should be understood. If those aspects are understood it enables the programme to search for risk methodically and take the correct actions should a response be needed at some point.

Actual risks should then be identified. Both threats to the programme objectives and opportunities to overachieve on outcomes and benefits.

Assess step

The assessment of risk can be broken down into two activities. Estimate the threats and the opportunities in terms of their probability impact and proximity on the one hand, and on the other hand to evaluate the net aggregated effect of the identified threats and opportunities on the programme. This is explained in detail in the Risk assessment section.

Plan step

Preparation of specific management response to the threats and opportunities that have been identified are the primary goal of the plan step. The objective is to remove or reduce the threats and to maximize the opportunities.

Implement step

Here it shall be ensured that the previously planned risk management actions are successfully implemented and monitored as to their effectiveness. Corrective actions should be taken where responses do not live up to expectations. It is an important factor that roles and responsibilities are allocated. Someone has to be responsible for the management and control of the risk. Key roles in that perspective are: Risk owner is responsible for the management and control of all aspects of the risks assigned to them. Managing, tracking and reporting the implementation of the selected actions to address the threats or to maximize the opportunities is included in that role. Risk actionee is responsible for the implementation of risk response actions. Support and take directions from the risk owner.

Tools

There are many tools used in risk assessment, sometimes it is recommended to use more than one tool in risk assessment. They all have their own focus areas. Lets take a better look at the most frequently used tools.

Hazard and operability study (HAZOP)

Failure mode effect analysis (FMEA)

Structured What-IF technique (SWIFT)

Fault Tree Analysis (FTA)

Benefits

The most notable potential benefits of a well-structured and efficiently run risk management are. [3]

- Improved strategic and business planning

- More effective use of resources

- An ability to quickly grasp new opportunities

- Fewer unwelcome surprises

- Enhanced communication

- Ability to reassure key stakeholders throughout the organization

- Continuous improvement

- robust contingency planning

For projects

Contingency in projects can make or break them. Too much contingency is uncompetitive and too little increases the chance of failure. Risk assessment helps set contingency levels. It aims to figure out the most probable level of risk and gives the confidence level of outcome targets.

For portfolios

For businesses

Limitations

Conclusions

References

Among strategies used to manage threats are.

- Transferring the threat to another party

- Avoid the threat

- Reducing both the negative effect and lowering the probability of the threat

- Accepting the potential negative consequences of a particular thread is the only option.

- For uncertain events with benefits (opportunities) the opposite is done.