Risk management in project portfolios

This article is an overview and summary of relevant body of knowledge concerning risk management in project portfolios. Project portfolio management (PPM) is the set of managerial activities that are required to manage a collection of projects and programs needed to achieve stratetic business objectives.[1] It has been widely accepted that Risk Management is an important part of Project Management. Project risk management enables an organisation to limit the negative impact of uncertain events and/or to reduce the probability of these negative events materialising, while simultaneously aiming to capture opportunities [2]. However, project risk management is only effective to a limited extent because it lacks a portfolio wide view. [3] The information available regarding risk management at portfolio level is fairly scarce. Methods like Monte Carlo Simulations can be used to create efficient frontier charts in order to best as possible choose risk/return balance within the portfolio. Numerical methods are however often associated only with risks (known unkowns) and not uncertanties (unknown unknowns).

Contents |

Project Portfolio Uncertainty Dimensions

The uncertainties at the portfolio level can be found within three dimensions[4]: Uncertainty from organizational complexity, from environment, and from single projects.

The uncertainty from organizational complexity may stem from the system being used to manage the portfolio, the projects' relationshops with the parent organization, interdependencies between projects, and other managerial features specific to the organization in question.[5]

- Uncertainty from the environment due to factors external to the company that affect the portfolio

- Uncertainty from organizational complexity due to the parent organization's systems, structures and activities that affect the portfolio and include portfolio-level issues and inter-project dependencies

- Uncertainty from single projects due to changes, deciations and unexpected events that may take place within the portfolio at the singe-project level and may have an effect at the portfolio level

| Sources of uncertainties and their effect in previous empirical studies[4] | |||

|---|---|---|---|

| Source | Uncertainty from organizational complexity (1) | Uncertainty from environment (2) | Uncertainty from single projects (3) |

| Christiansen and Varnes (2008), Blichfeldt and Eskerod (2008), Loch (2000) | Politics and negotiation affect project portfolio decision making | ||

| Engwall and Jerbrant (2003) | Resourcing between projects (over-commitment and scheduling deficiencies) | ||

| Müller et al. (2008) | Governance type moderates some relationships between portfolio control and success | External dynamics moderate some relationships between portfolio control and success | |

| Nobeoka and Cusumano (1995, 1997) | Design and technology transfer from ongoing projects may speed up development in parallel and forthcoming projects | ||

| Olsson (2008) | Projects may share similar risks | Uncertainties in project environments may be relevant for the entire portfolio | Single project-level risks may accumulate at the portfolio level |

| Perks (2007) | Inter-functional integration has an impact on project portfolio management through project control and evaluation criteria | ||

| Petit (2012) | Financial and resource uncertainties are unforeseen and affect the projects' ability to deliver results | Technical and market uncertainties, norms and regulations are foreseen uncertainties that have an impact on project portfolio scope and structure | |

| Petit and Hobbs (2010) | Changes in processes, structures, budgets and strategy influence the portfolio | New customers and markets, and changes in supplier/third-party contracts incluence the portfolio | Uncertainty in project scope, problems with project performance, and needs for customization have effects on other projects |

| Teller et al. (2012) | Project portfolio complexity strengthens the relationship between project portfolio management formalization and PPM quality | ||

| Voss and Kock (2013) | Portfolio complexity strenghtens the relationship between relationshop value for customer and portfolio success | Technology turbulence strenghens the relationship between relationship value for customer and portfolio success | |

| Zika-Viktorsson et el. (2006) | Project personnel perceive project overload, due to lack of opportunities for recuperation, udadequate routines, scarce time resources and a large number of simultaneous projects | ||

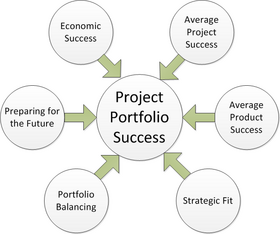

Project Portfolio Succes

Project portfolio succes is defined on six parameters: Average project success, average product success, strategic fit, portfolio balancing, preparing for the future and economic success.[3] Combined these parameters give portfolio managers a way to assess the overall succes of a specific project portfolio.

- Average project success

- Level of success regarding the iron triangle (cost, quality and time). Also includes the compliance with the fulfillment of the defined specifications of all projects in the portfolio

- Average product succes

- Level of success of all projects in the portfolio. This includes both market and commercial success.

- Strategic fit

- To which extent the projects in the portfolio reflects the corporate business.

- Portfolio balancing

- The equilibrium between high-risk and low-risk projects, long-term and short-term projects, and technologies and markets.

- Preparing for the future

- The ability to quickly react to changes in the environment and seize opportunities in the long term.

- Economic success

- Adresses the overall market succes and commercial success of an organization or business unit.

Correlations between Risk Management and Project Portfolio Success

With the above understanding of project portfolio success, it has been possible to examine correlations between the use of risk management and project portfolio success. Teller et al.[3] concludes the following points through their investigation of project portfolios:

- Formal project risk management is positively related to project portfolio success

- The integration of risk information into project portfolio management is positively related to project portfolio success

- The simultaneous use of a formal project risk management process and the integration of risk information into project portfolio management increase the positive effect on project portfolio success (positive interaction effect)

- The relationship between formal project risk management and project portfolio success is stronger in portfolios with an R&D focus

- The relationship between the integration of risk information into project portfolio management and project portfolio success becomes stronger as external turbulence increases

- The relationshop between formal project risk management and project portfolio success becomes stronger with increasing portfolio dynamics

History

- ↑ Blichfeldt & Eskerod, 2008; Project Management Institute, 2008b

- ↑ Petit. ”Project portfolios in dynamic environments: Organizing for uncertainty.” International Journal of Project Management, 539-553 (2012)

- ↑ 3.0 3.1 3.2 Teller, Kock & Gemünden. "Risk Management in Project Portfolios Is More Than Managing Project Risks: A Contingency Perspective on Risk Management". Project Management Journal, 67-80 (2014)

- ↑ 4.0 4.1 Matinsuo, Korhonen & Laine. "Identifying, framing and managing uncertainties in project portfolios". International Journal of Project Management 32, 732-746 (2014)

- ↑ Cite error: Invalid

<ref>tag; no text was provided for refs namedUncertaincy