Financial appraisal of project proposals

Contents |

Abstract

Generally, portfolio managers have a difficulty in selecting the potential project proposals which give the best rewards for the company into their portfolio bounded by a limited budget. One way to maximize the value of project portfolio is to apply financial appraisal tools to evaluate the best investment bundle based on predicted costs and revenues which have been determined from either ground-up or top-down costing where the input is estimated cost and competitive price respectively. The evaluation also depends on the size of the project and the time span over which the costs and benefits are going to be spread[1]. Usually, portfolio managers take responsibility for two types of decision which are investment and financial decision[2]. The investment decision is the decision that focuses on the concept of what to do in order to gain the maximum value, financial decision, however, related on how the projects should get the money from in order to run.

The aim of this article is to present a simple financial techniques to make an accept or reject decision on investing project which are present worth analysis, annual worth analysis, payback period, and rate of return analysis based on the concept of the “Time value of money”, and application of these tools also their limitations which would be beneficial to portfolio managers to pick profitable projects into their portfolio. However, this article considers only financial criterion which may not align with a strategy for a portfolio that aims to maximize customer's satisfaction or bring a high degree of innovation.

Background

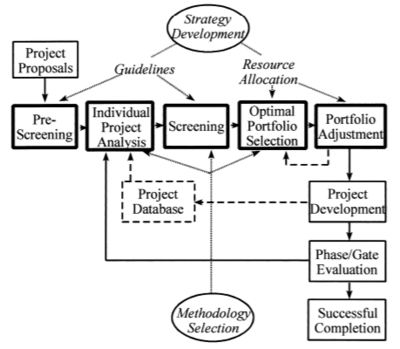

To establish a portfolio, several criteria must be taken into account, which can be either quantitative or qualitative, where the most popular criteria are to maximize portfolio value, balancing portfolio, and align with company's strategy[REF]. According to PMI, the analysis of portfolio should include business, financial, risk, human resources issue, marketing, and technical criteria[REF]. In general, there are several tools and framework for project portfolio selection, where the main criteria to accept or reject a bundle of a project is financial indicators in order to achieve a high-value organization's portfolio. However, in practice, companies usually select more investment projects than its resource and capital and implement the high priority projects at the beginning[REF]. This means that projects that have not been selected at the beginning can be launched with the remaining resources and market conditions. The framework of constructing a portfolio suggested by Archer and Ghasemzadeh is in the following figure[REF].

Time Value of Money

$1 of today is worth more than $1 of tomorrow

Time Value of Money (TVM) is the concept that money available today provide more benefit with the same amount than tomorrow[REF]. The reason is that on hand money today can be invested to generate more money in the future. To begin with, a basic knowledge of simple interest and compound interest must be manifested. The first interest perception is where the interest rate is calculated based on principal only and it is constant throughout the period, while compound interest is the other way round which calculated on the principal plus total amount of interest accumulated in the entire preceding period which makes the amount of interest increased over time. The example below is demonstrated to clarify the difference between these two interest.

Example: Given the rate of return of 10% per year and the principal of $100, what is the balance in the following four years.

- Simple Interest:

- Compound Interest:

Cost Estimation

Overview of cost estimation Cost estimation plays an important role in every single project when the project has been built, generally, the managers always make a question about costs and revenues. In practice, revenues can be generated with an ease by adding profit margin but not cost since the complexity is huge that it contains several components depended on a particular project. Typically cost can be distinguished into two types namely direct cost that can be traced back to a cost object with less effort where cost object can be a product, department, project, to name but a few, for instance, direct labor cost, commission, and material cost. Indirect cost, however, is a reversed of direct cost where it cannot be accurately tracked to an exact cost object, examples of this cost are depreciation, insurance, electricity bill, and office space rental cost. As mention before, there are two aspects of specifying a project cost; bottom-up costing and top-down costing.

- Bottom-up costing – suite best when the market competition is less.

- Top-down costing – work well when competition is high that it can limit cost component.

+++++++++++++++++++++++++++figure++++++++++++++++++++

Generally, there are several techniques to estimate cost of the project, asking an expert for the opinion and make a comparison to the situation is one of the magnificent estimators. Performing a quantitative method also the good way, techniques such as Cost Indexes, Cost Capacity Equations, Factor Method, and Activity Based Costing (ABC), where first three techniques can only comply direct cost but not ABC that can estimate both direct and indirect cost.

Financial Appraisal Tools

The propose of financial appraisal is to justify and select whether the return of the project is cover all the cost or minimize the loss and filter projects into company portfolio, in case of public project such as construct a railway line which we know in advance that it is going to be loss but the project provides a social benefit that cannot measure by money. Throughout the procedure, cost and revenue of each project must be estimated by cost and revenue estimation techniques as mention above. After this, Minimum Attractive Rate of Return (MARR) is essential, portfolio managers generally use an interest rate from financial institutions to determine this value[REF]. The document provides an overview of the following financial appraisal tools including example of each;

- Present Worth Analysis

- Annual Worth Analysis

- Payback Period

- Rate of Return Analysis

Present Worth Analysis

In present worth analysis, present value is calculated based on MARR of each project, the method is quite popular and easy to understand and determine the economic advantage of each alternative since all the estimated future costs and revenues are transformed back into equivalent present value; means that entire cashflow is converted into present dollars. The present worth comparison of equal lifespan alternative is straightforward, however, when implementing present worth comparison with different lifespan projects, 2 additional methods called least common multiplication (LCM) and study period must be applied in order to make their lifespan equivalent to each other during the study. General assumptions are;

- Inflow and outflow cash but not an initial investment capital occur at the end of each period.

- Alternatives life-cycle will be repeated with the same pattern over each life cycle when applying LCM.

Example

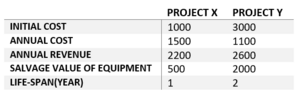

A project manager is considering to run a project that generates highest profit for the company, two candidates which are project X and project Y are study, costs and profit for each project are given below. Which project should be select with MARR of 10% per year?

Apply LCM method to compare alternatives.

PWx = -1000 - 1500(P/A,10%,2) + 2200(P/A,10%,2) + 500(P/F,10%,1) + 500(P/F,10%,2) = $1429.75

PWy = -3000 - 1100(P/A,10%,2) + 2600(P/A,10%,2) + 2000(P/F,10%,2) = $1256.2

Project X is selected due to the fact that it generates higher net present value.

Annual Worth Analysis

In annual worth analysis, all cost or revenue are converted to an equivalent uniform annual value for the entire lifecycle of the project, AW is quite easy to understand by individuals who are familiar with annual amounts such as Dollar per year, dollar per month. The idea of this analysis is identical to present worth analysis which tries to justify economical advantage from each project or evaluate an economical worthiness of a single project. When all estimated cash flow is converted to AW value, the value is assigned to every year of the project life cycle, likewise for each additional year. To compare two projects with unequal lifespan, three assumptions are made;

- Services provided by projects are needed at least the LCM of the life of the projects.

- The first cycle of cash flows is repeated for a successive cycle.

- All estimated cash flows in the cycle will be the same.

Example

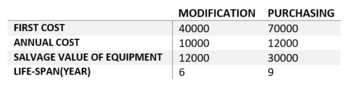

Project manager of gum factory is considered for an improvement to an automated packing production process whether modifying a current machine to be automated or purchasing the whole new automated machine. Which project should the project manager run with the given MARR of 15% per year?

AWmodification = - 10000 – 40000(A/P,15%,6) + 12000(A/F,15%,6) = -$19198 /year

AWpurchasing = -3000 - 1100(P/A,10%,2) + 2600(P/A,10%,2) + 2000(P/F,10%,2) = -$24882 /year

The project manager should modify the current process since it generates lower negative value.

Rate of Return Analysis

Rate of return(ROR) has been recognized by several names: internal rate of return (IRR), return on investment (ROI), this is the rate that accomplished the balance of the cash flow of a particular project to exactly zero considering interest rate. The complexity of this technique is greater than present worth analysis and annual wort analysis, and in some case, where the direction of project cash flows change more than once, multiple values of ROR will occur according to the number of changes in cash flows direction which follow Descartes’s rule[REF].

The calculation of ROR is done by setting up an equation of either PW or AW and specified them equal to zero to find I value called i*. In single project evaluation, if i* is greater than MARR, we should accept the project as it is economically viable. However, in multiple project comparisons, evaluate them only based on ROR might lead to an erroneous conclusion, assume that project A that required an investment of $40000 has i* of 40% per year, while project B needed $80000 for an investment has i* of 25% per year. Intuitively, we may choose to run project A since it has greater i*, however, taking an amount of investment into account, project B may earn more profit. To step aside this situation, incremental cash flow is applied.

To do so, drawing a cash flows table for each project, if they do not have an identical life cycle, LCM is applied. Next, select the project with the largest investment and subtracted by the smaller project. This incremental cash flow shows the extra cost required if the project with the larger first cost is selected in order to determine ROR of the difference in cash flows. If the incremental cash flow of a higher investment project does not justify based on MARR, select the cheaper one. Note that IRR for each project that we want to compare must greater than MARR.

Example

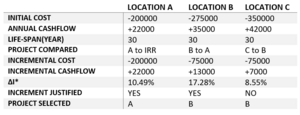

A football team wants to build a new stadium, three different locations are identified. If the MARR is 10%, which is the best location for a new stadium.

First, we order projects by increasing initial cost, then calculated IRR of lowest cost project, location A in this case, which is 10.49%. Then compare location B to A with an incremental cash flow;

0 = -75000+ 13000(P/A, ∆i*,30); (P/A, ∆i*,30) = 5.7692; so, I that make P/A factor of 30 years equal to 5.7692 is 17.28% which is greater than MARR at 10%, therefore location B is economically preferable than location A.

Compare C to B; 0 = -75,000 + 7000(P/A, ∆i*, 30) which make P/A value is 10.7143 (∆i* = 8.55%). So location C is eliminated, and the only location remain is B.

Payback Period

Payback period refers to an exact period of time needed for a single project in order to recover a negative cash flow or to reach a break-even point. Generally, the payback period is applied without taking interest rate into account since it is easier to solve and it also based on the concept that the investors wish to recover the capital as fast as possible, based on this concept, it is adequate to neglect interest rate and apply undiscounted cash flow. To be more precise, discounted cash flow including interest rate is applied in this analysis, this will answer the question that how many years does it need for the project cash flow will recover the investment including a certain interest rate.

Example

A new IT system will have the first cost of $40000 with the expected annual maintenance cost of $20000, annual revenue associated with the new IT system is expected to be $28000. What is the payback period when an interest rate is neglected and when i = 15%

PBP when i = 0%; 40000/(28000-20000) = 5 years

PBP when i = 15%; applied present worth analysis; 0 = -40000 + 8000(P/A,15%,n), so n that make P/A factor with i = 15% equals to 5 is 9.92 years

From the above example, we can conclude that we need around five years more to recover the investment when it has i = 15%.

Project Selection under Budget Constraint

Since investment capital is a scarce resource for every single company, portfolio managers should carefully select projects into their portfolio corresponding to their goal whether the company is focusing on short-term or long-term goals or even maximize customer's satisfaction is one of the possible goals which is difficult to perform a financial appraisal technique according to this goal. Usually, there are three types of project which are independent project, mutually exclusive project, and contingent project, the first type is where a project whose acceptance or rejection is independent of the acceptance or rejection of other projects[REF], thus, all the project that passes the criterion can be accepted. However, mutually exclusive projects refer to a batch of projects which only one project can be selected for an investment, this can be a set of projects that accomplish the same result. Where a contingent project is the one that can be accepted only if one or more other projects is accepted first[REF], for example, project A cannot be accepted unless project B is accepted. To select project into a portfolio, perform a linear programming which the objective function is to maximize the sum of net cash flows subject to a capital investment constraint that summation of the initial investment of selected projects must not greater than a specified budget limit could be done or even perform above financial appraisal techniques with a common MARR which called capital rationing also a good fashion.

linear programming model

- maximize

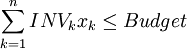

- subject to

and

and  k

k

Where;

is present worth of project

is present worth of project  at MARR = i%

at MARR = i%

is initial investment of project

is initial investment of project

is a binary decision variable whether project

is a binary decision variable whether project  should be run or not

should be run or not

Capital rationing approach

Capital rationing is a technique that makes an evaluation on profitable projects available for investment within the capital available. The procedure to make a decision on projects which have various lifespan according to capital budget using present worth analysis is as follows:

1. Develop all mutually exclusive project bundles with total investment is not exceed capital budget, generally, a total number of a bundle can be calculated by using  where

where  is a total number of project proposals.

is a total number of project proposals.

2. Sum the net cash flow for all projects in each year from year 1 (year 0 is the beginning) in each bundle.

3. Perform present worth analysis on every bundle at the same MARR.

4. Select the bundle that returns highest present worth where any bundle with present worth less than zero should be discarded since it does not give a return at MARR.

Challenges

Project investment decision is the most significant decision in various companies have to make, these techniques are applied in many companies which some applied only one technique to justify their project, while some company used a combination of those tools to make a decision[REF]. However, these fours techniques are extremely vulnerable to the forecasted information that made by analysts that even a small adjustment such as MARR can lead to an inaccurate solution or in a worst-case scenario, a different conclusion is generated. Generally, optimism bias is one of the root cause of this problem that the project proponents attach some value to some investment option which they over predict the revenue stream of that project leading to a failure when running selected projects[REF]. Moreover, a high degree of confidence about future cash flows is needed in the analysis, a low degree of transparency of company's operation generates a difficulty of predicting revenues, operating expenses and capital investment with certainty. In addition to those common drawbacks mentioned earlier, advantages and disadvantages of each financial appraisal tools are summarized in the following table.

| Technique | Pros | Cons |

|---|---|---|

| Present and Annual Worth Analysis | Tell whether which project increase company's value | State in term of Dollar, not in percentage, so it difficult to compare projects with different size |

| Consider risk of future project cash flow through the cost of capital | ||

| Consider whole cash flow | ||

| Rate of Return | Tell whether which project increase company's value | May does not give the maximized value project when performing a mutually exclusive comparison |

| Consider risk of future cash flow through the cost of capital | May does not give the maximized value project when performing a capital rationing | |

| Consider whole cash flow | Can not be applied in the situation that there are more than one investment during the project life cycle | |

| Payback Period | Consider risk of future project cash flow through the cost of capital | Do not indicate which project increase company's value |

| Simple to compute when do not consider interest rate | Ignores cash flow beyond payback period |

References

- ↑ Harvey Maylor (2010) 'Project Management'. Bath, United Kingdom: Pearson Education Limited

- ↑ https://www.managementstudyguide.com/role-of-portfolio-manager.htm