Business Analytics in Civil Engineering Projects

Contents |

Abstract

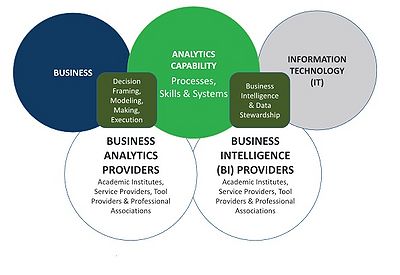

Business Analytics in Civil Engineering Projects and Civil Engineering Companies has become a significant solution in problems of operational management and in decision making. Nowadays with the development of the Information Technology is possible for management team to do the pricing of any kind of project (Infrastructure, Housing and Building, Energy, Environmental) taking into account stakeholders, time, costs, risk, macroeconomic and political context. However, to be able to use the methodology is necessary to understand the importance of using analytical tools such as Project Finance, Monte-Carlo Analysis and in some cases Statistics Linear Methods. The outstanding fact about doing pricing to a civil engineering project with business analytics is that managers and investors will have resume data and factual information about a predicted project, moreover to forecast the project would not only create future indicators for the project but also will support managers in the planning of other areas like legal area (Contracts with suppliers, Governmental, Institutional client, customer) and Risk Management Area, the forecasted information(indicators) after being processed is beneficial to the organization specially when it is compared with the reality of the project in a Business Intelligence atmosphere.The reader must comprehend that the role of the manager or management team of a civil engineering company is to create and generate the most amount of value possible to the organization and therefore to the investors. In order to be able to achieve that objective, knowledge in business analytics (probability, accounting, finance, statistics, programing) and data analysis is essential and compulsory. This article will focus on how managers should apply business analytics in construction companies and civil engineering projects and will illustrate how to build Models an abstraction of reality that are useful for make good decision, Saxena & Srinivasan (2013) states.

For business analytics, a decision model is an abstraction that shows key variables and relationships. We use models to learn about their real-life counter-parts. We judge how well a model corresponds with reality by manipulating its variables and observing the results, and then we use it as a proxy for the complex reality—a useful proxy that can be used to generate insights and optimal decisions. (p.31) [1]

Building Information Modeling (BIM) Analysis 3D

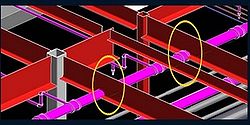

Building Information Modeling (Revit, AutoCAD Civil 3D or ArchiCad) is a technological tool usually to represent 3D models in a cloud computing collaborative environment in order to avoid human mistakes in the phase of designs, particularly between teams of the same project but from different study line.Usually, in the common market the design flaws are caused due to fact that designers are using CAD as a tool to represent their sketches and no BIM. In that order of ideas designers don’t understand the magnitude of the whole project, the stakeholders involved and the visualization in detail of small and big modifications that others members of the designer team (structural team, architectural team, mechanical team, etc) have performed in the project. Additionally, any change in the designs that is not opportunely informed in the pre-operative phase of the project might cause a high cost overrun during the operative phase of the project. That is why the management team should comprehend the main difference between CAD models and BIM models besides the risk related to each method during the design phases.

CAD model is based in Data, Data is a collection of symbols randomly put together that does not convey in any sense in contrast BIM is based in information, if data is organized in a way that convey in any sense or meaning will create knowledge that can be defined as information with the addition of a person’s own world view, Kumar (2015) [2]

BIM Models

•BIM is constructed on object-based information modellin

•The model is systematized in terms of the hierarchy of the objects (types,families, Disciplines, categories and parameters.)

•Each object has parameters (parameters can be pre-defined or users can create new parameters) and a series of rules about its behavior.

•Use of pre-defines or standards objects (users can create objects and standardized it)

•Users can define new objects

•Users can modify parameters and properties of the object

•Users can store all information about a building or civil engineering construction in one place

•Users can obtain easily useful information about different aspects of the building for instance quantities of areas, volumes, lengths, units, money or time etc.

•Easy connection between other software’s Robot, Excel or CAD files this usually useful for parametric designs.

•Computing Clouding

CAD Models

•Fundamentally put together or join together a collection of symbols and geometric shapes using different approaches.

•Usually don’t use object-based information modelling

•No Computing Clouding

With BIM is possible to elude the delays in the construction phase commonly produced for the typical designs failure. It is cheaper to spend money in the design phases trying to avoid errors in the overlay of the plans (Hydraulic, mechanical, structural and architectural) and coordinate the whole designer team, that to improvise during the operative phase of the project. Mainly costs in real life and in the operative stage are expensive because if someone found a big mistake in the blueprints for instance in overlapping of two or more elements or bad dimensioning of the element in real life that could affect the scheduling and the cost of project, difficulty that could be evaded with models and simulations. The problem for the management team is that clients and customers are not willing to pay for those errors and risk and therefore investors have to assume the losses of their money.

Benefits for BIM tools

Basically, the main benefits of an object-based information modelling program are:

•it’s easier to find clashes between two or more elements that other commonly programs due to fact that BIM do it automatically.

•Modifications or changes in one element means to change all the blueprints and view of the element and that is made mechanically, this is because the whole model is parametrized

•The Impact of ensuring all dimensions and labelling of each element in all instances of the model

•Co-ordination between diverse sketches by different stakeholders, such as architects or structural engineers.

•Design visualization

•Material and cost estimation

•easy updating of work quantity

There are other benefits for BIM tool that some organizations have started to use for diverse purpose for example; condition monitoring using 3d laser scanning, integrated design and fabrication, design checking and integrated energy performance analysis. Kumar (2015, p.29) [2]

BIM tools for Management team

BIM also facilitate the management of contractors and suppliers specially in legal terms, the work of the project manager will be easier due to the fact that responsibilities, risk, cost and time can be defined in relations of the quantities of work estimated by BIM. Project manager will be able to do better contracts with the suppliers and contractors; they will not have to wait until one part of the project has been executed to know how much time approximately they have to spend or how much income they should receive. In that logic the planning of supply chain management in a civil engineering project will be more synthesized and organized for the project management team.

Lastly, the management team and in generally the organization not only would receive good and factual information about a civil engineering models but also will be able to alter and to change quickly the model depending on client’s requirements, for example changes in the geometric shapes of a building, changes in the geometric shapes of a road or maybe in the geometric shapes of a bridge, tunnel or dam it’s now possible because the model is parameterized and designers are organized and co-operating. the brightness of the method is that managers will be capable to forecast and predict different types of scenarios, line bases and cash flows that not only depends on economic, cost and time topics but also that depends on the quantity, geometric and shape of the project.

Time scheduling Analysis 4D

Four Dimensional Model is a way that is used to represent time and space in the model, 4D animations simulates the process of transforming space over the time, to reproduce an animation in this stage, it is necessary the use of NavisWorks which involves the 3D graphic model (Revit) with a construction scheduling (Microsoft Project or Primavera), Kumar (2015, p.29). [2] Project Managers and the management team can determinate the time duration of the project with Critical Phat Method (CPM) or PERT Method that is a extension of CPM. The knowledge of time and duration in the project is important to management team because is a parameter that the financial area take into account for their future studies, this parameter plus the concept of the value money over time will determinate the price of the project with a high confidence interval. In other words, the project analysis will illustrate transparency of forecasting data and information to the investors or shareholders, to the consumers or clients and to management team, the roles are established and with them the risks and responsibilities.The Critical Path Method (CPM)

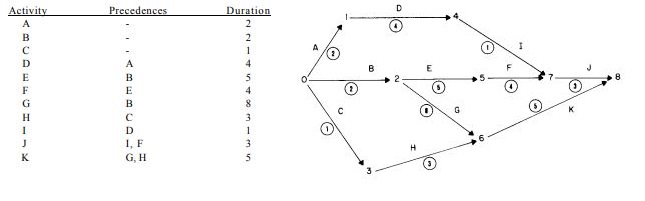

The advantage of the critical phat method is seen in the planning stages, the operational team is required to think and deliberate logically about how the project should be performed, parameters such as; activities, specifications and objectives of each activity, precedence for activities, duration and calculation of start and finishing times and the determination of the slack or the float in the activities are necessary to build the CPM. The steps for build the CPM are constructing a networking diagram to illustrate precedence between activities, calculate start, finish and slack times and finally construct a chart to display the results of the calculation and the precedence, state Anderson & Stanton (2008, p.2-3). [3]

Network Diagram

The network Diagram support the management team to illustrate the precedence relationship among the activities of the project, this diagram is composed by arrows which indicate the order of activity and nodes which indicate the point of starts and termination of each activity. Respectively the node is labeled in two ways the first one the integer number linked to the node and the second one capital letter linked to the activity. The project managers should collect information in field or previous experiences to be able to perform the analysis in a complex project, here is a small example:

Anderson & Stanton states the following rules (2008, p.4) to take into account:[3]

1. Each activity is represented by an arrow in the network

2. “Dummy” activities are created whenever needed to portray the logic relationship, usually represents.

3. No two activities should be identified by the same beginning event and same end event.

4. This questions should be answering as each activity is added to the network.

• What activities must be completed immediately before this activity can start?

• What activities must follow this activity?

Calculation start, finish and slack time

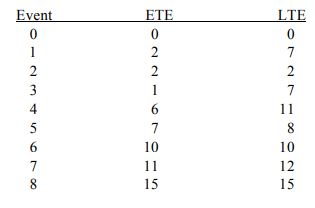

Calculation of start and finish activities are done to determinate the slack time, the slack or float time is used to know the critical path of the project. Calculation involve two main phases “forward pass” and “backward pass”, basically the forward pass focus in the earliest possible ending time of an activity and is denoted bye ETE(i) the earlies time event which i is the label of the activity and backward pass computes the latest possible finish time and is denoted as LTE(J) the latest time event, which j represent the label of the activity

ETE (j)=MAX[ETE (i)+D(i,j)]

LTE (i)=MIN[LTE (j)-D(i,j)]

D(i,j)=Duration from activity i to activity j

The critical phat method has two variants that can be calculated, the first one by arcs and the second one by nodes, in this article is illustrated how to calculate the critical phat by arc variant, it is optional for the reader to investigate how to calculate CPT with the nodes variant. The critical phat is determinate by the difference between LTE(i)- ETE(i) if this difference is 0 the activity is part of the critical phat if it’s above 0 means that there is a slack or float in the activity, this is important to know for the management team because critical activities are those activities that managers should put more attention to stay in the schedule, any delay in critical activities will delay the whole project execution. The example shows the critical phat that in this case are event 0,2,6,8.

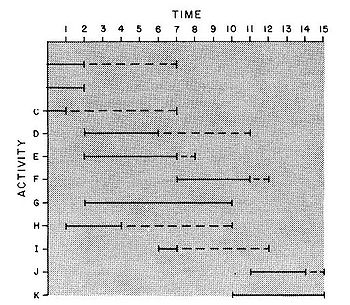

illustration Precedence, duration and slack time and GANT chart

GANT chart is a common tool to illustrates the tables of duration and precedence to the manager team, to the contractors, to the clients, investors and to the organization in general, in order to be able to understand the project in terms of time. GANT chart also is used to determinate a unit of time (days, months, years) of a project, the future goals of the organization and it is useful for the predicted cash flows and budge that management team is going to forecast in the stage of analysis 5d.

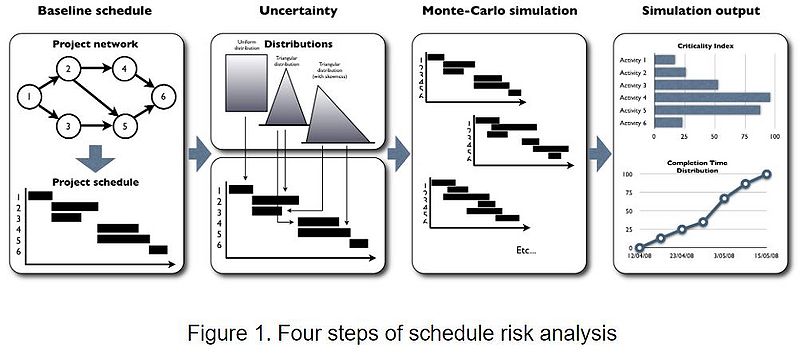

Monte-Carlo Analysis PERT Distribution

Nonrealistic cash flow forecasting is the main cause of financial failure for contractors, therefore the incorporation of the impact of the stochastic variables improves the accuracy of the forecast cash flow parameters, which make contractors more prepared to deal with the real encounters, Zayed & Elazouni (2013). [4] Monte Carlo analysis is a method based in a simulation made by a complex mathematical structure, the idea is to approximate the calculus of what you can’t obtain exact solution, is a method used to estimate parameters of a model, parameters that shows variability. Project management use this method to run thousands of possible scenarios changing certain group of variables. Time is not a deterministic variable hence time should be measure in a stochastic form, especially for long terms (3 or more years) projects as roads or ways.However due to fact that nobody has collected relevant time data for the construction activity, manager should do a simplification of the problem, instead of using complex probabilities distribution (randomly variable) for each activity, Management team can use PERT, Triangle and Uniform Distribution, this distribution are known as distributions of maximum ignorance because only reflect two or three values data for relevant experience. Usually this data collected from previous experience of others projects is reflected in a PERT distribution for each activity, thus the activities that have PERT information shows three main values for each parameter like cost and time; the probable pessimistic value, the probable value and the probable optimistic value. If managers take into account PERT information in the scheduling, they will be able to do stochastic scheduling taking in consideration the predecessors and the stochastic duration of each activity.

To end, if managers produce stochastic scheduling and take into account stochastic variables and no deterministic variables they would notice easily the logistic risk involved in a project scheduling, for instance to analyze the CPM with deterministic variables would give to managers a series of activities in the critical phat. However, if managers add volatility to each variables and parameters, the final result can change dramatically compared with a deterministic CPM model and might be the line base and the critical phat can be altered owing to the uncertainty of the parameter and activities predecessor.

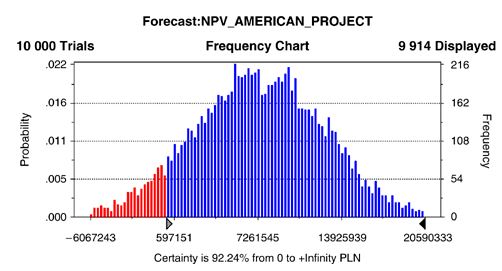

Project Finance Analysis 5D

Global control of the movement of funds is gotten by planning project finance, while detailed control of each project may be feasible by the critical phat method analysis to include de programing of the expenditure on the project at the same time that the project itself is planned, Parker (1969 p.261) [5]. Project finance with Monte- Carlo analysis allows the management team to improve the agreements with the market, client and costumers. This kind analysis takes into account the interest of the investor (Cost of Equity), the interest of the bank and the cost itself of the project (contractors, suppliers and workers). In this sense the whole process of the project and stakeholders are resume in one mathematical indicator the net present value of the project, indicator that if it is forecasted in thousands of scenarios will bring a lot of information to the management team, investors and consumer.

Free Cash Flow in the Project

The Free Cash in the Project can be calculate in different ways, however there are to main important concepts to understand the free cash flow to the firm FCFF is the same to the free cash flow of the project FCFP, in that other of ideas the equation will illustrate an unlevered cash flow to the project which means a cash flow after interests and debts. The FCFE means the free cash flows of the equity and investors adjusted by the debt cash flows.

Notice that the forecasted and predicted Cash Flows of each period of time depends on the amount of Net income or the EBIT earnings before interest and taxes, the outstanding fact is that the earnings itself depends on incomes of the organization clients, costumers or state and the cost of production represented by: suppliers, contractors, workers and administration. Also it’s possible to understand that in the free cash flow is represented the state or government (taxes) and the banks or creditors of the business(interests). Finally, we just need to represent the equity or investors in the model.

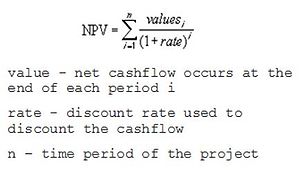

Time Value of Money

Time value of Money is represented by the equation of the net present value:

Each free cash flow in the period of time i is discounted by a discount factor corresponding to the period of time i of the project in this stage analysis 3d and 4d is used, the discounts factors depends on time (scheduling of the project analysis 4d) and the cost of capital (Minimum rate of risk demanded by the investors) that can be determinate by Capital Asset Pricing Model (CAPM), in other words CAPM will take into account the Cost of Equity Ke and the Cost of Debts Kd (Note: this assumption only works if the structure of capital is flat during the all project). In this way and with a Monte Carlo analysis the project manager can get a lot of scenarios reflected in one indicator the NPV, this analysis will reflect the volatility and the uncertainty of the project and will give to the management team the probability of destroy value NPV<0 in the project or organization, this plus a slant towards the construction company probability of NPV>0 above 70% it going to be good decision for the organization, the company and the project, therefore projects that are risky and have probabilities of 30-35% to destroy or below should be considered by the management team.

Annotated bibliography

PMBOK® Guide: This book provides guidelines for managing individual projects and defines project management related concepts. It also describes the project management life cycle and its related processes, as well as the project life cycle.

References

- ↑ 1.0 1.1 R. Saxena and A. Srinivasan, Business Analytics, International Series in Operations Research & Management Science 186 (2013), DOI: 10.1007/978-1-4614-6080-0_10, © Springer Science+Business Media New York 2013.

- ↑ 2.0 2.1 2.2 2.3 Kumar, B. (2015). A practical guide to adopting bIM in construction projects. Dunbeath: Whittles.

- ↑ 3.0 3.1 3.2 States, U., Service, F., B. Anderson, E., Stanton Hales, R., B. Anderson, E., & Stanton Hales, R. (2008). Critical Path Method Applied. https://doi.org/10.1.1.115.6122.

- ↑ 4.0 4.1 Ahmed, M., Zayed, T., & Elazouni, A. (2013). Application of Monte Carlo simulation with activity start times to determine cash flow parameters. Proceedings, Annual Conference - Canadian Society for Civil Engineering, 2(January), 1089–1098.

- ↑ 5.0 5.1 PARKER, E. J. (1969). PLANNING OF PROJECT FINANCE. Proceedings of the Institution of Civil Engineers, 43(JUN), 261-&.

- ↑ States, U., Peterson Drake. What is a Free Cash Flow and How do I calculate it?. http://educ.jmu.edu/~drakepp/general/FCF.pdf A Guide to the Project Management Body of Knowledge (PMBOK® Guide), Fifth Edition, 2013, ISBN-13: 978-1-935589-67-9