Application of Balanced Scorecard in Portfolio Management

Contents |

Abstract

In this article the application of Balanced Scorecard (BSC) will be investigated in relation to Project Portfolio Management (PPM). BSC is a strategic planning tool, which addresses the strategic objectives and often measures them in form of Key Performance Indicators which is evaluated, reported and incorporated into a strategic feedback-loop[1]. Each executed project within a portfolio should be aligned with the strategic objectives in the organisation. To ensure the linkage between each project and the strategic objectives, balanced scorecard can be applied and provide the PPM with a set of initiatives and measures, which would indicate if the outcomes from a given project provides the expected returns or growth to the portfolio and organisation.[2][3][4]

To facilitate the merge between strategic management and portfolio management this article will present an argumentation of why BSC benefits PPM, including a definition of both PPM and BSC, the direct linkages in between and a reasoning for application based on theory. This will be followed by how the application of BSC in PPM should be initiated and an identification of the strength and weaknesses. Also the limitations and risks derived from the application of BSC will be identified and elaborated. To inspire further reading an annotated bibliography will be conducted, to enhance the understanding of the tool and core literature.

Definitions

In this section all theories and definitions will be outlined and discussed. The purpose is to give the reader an enhanced understanding of the BSC and the linkage to PPM.

Balanced Scorecard

BSC is a framework and tool which enable the opportunity for a company to describe its intangible and tangible assets. It does not try to valuate the intangible assets but to provide measures to evaluate these. [1] Furthermore, BSC differentiate from traditional balance sheets[5], through its describtion of intangible assets and not only tangible assets, such as materials, lands, equipment etc.[1]

The definition of BSC by Kaplan and Norton (2001) together with the definition by Abernethy et al. (2005) used as the baseline of reasoning to application into PPM:

1) "The Balanced Scorecard describes how intangible assets get mobilized and combined with intangible and tangible assets to create differentiating customer-value propositions and superior financial outcomes."[1]

2) "...it [balanced score card] articulates the links between leading inputs (human and physical), processes, and lagging outcomes and focuses on the importance of managing these components to achieve the organization's strategic priorities" [6]

Strategy Maps

The article by Tharp (2007), she addresses some of the current weaknesses which is identified in the executive management. One of the major weaknesses she identify is: "Many companies fail to distinguish between operational effectiveness and strategy."[2] This distinguish is very important to ensure a future perspective and to achieve an excellent, effective and efficient operational culture. [4]

In relation to BSC, it is very important that the strategy defined by the executive management is perceived and translated into operational targets and measures. [2] [4] Also BSC is an excellent framework to realize this and closing the gap that often exists. BSC contain both a high level strategic view and works as an enablers to translate the strategy into measures and targets, which directly relates to PPM and initiatives [4]

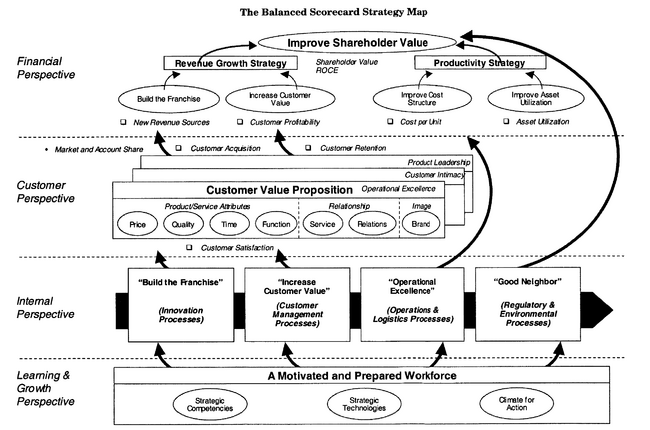

A highly recommended approach to ensure that the strategy is sufficient developed and transparent is to apply the framework of the "Strategy Maps". Strategy maps is a a logical and comprehensive architecture to describe the strategy, through all its elements and linkages to the organizational strategy. [1][4] An example of the framework can be seen in Figure 1. The strategy maps in interplay with the BSC provide a common and understandable reference point of the strategy for all organisational units and employees. [1] Which will help to minimize the "Vision Barrier" which result in 95% of the workforce not understanding the strategy and their contribution to it, resultingt in an ineffective and inefficient project management across the entire portfolio. [7]

With a well defined and transparent strategy, the PPM will be able to define actions to accomplish the strategy and objective goals, while manageging the all programmes and projects. Which will result in increase in value creation and production capabilities. [8]

The Four Perspectives

Both the BSC and the strategy maps framework is based on the four perspectives in which strategic objectives can be organized. [1][2][7]

The Financial Perspective concern the aspects of the strategy which directly impact the shareholder value.[1][2] Its a critical perspective in business which operate to increase value and generate value to the shareholders. Also it measures the very bottom-line of the company. [7] It is an easy perspective to measure, but the perspective is very limited, in the horizon and is only able to look backwards and therefore is more likely to determine short term strategic decisions. [2] In relation to PPM, measures in this perspective could be profitability, growth, shareholder value and budgets. [2]

The Customer Perspective address the very core of any business strategy which is the customer value proposition. It differentiates a company from it competitors in attracting, retaining and deepening customer relationship.[1][7] Many of the market leaders have only chosen one discipline and excels within it, the disciplines is: Operational excellence, Product leadership and Customer intimacy. [7] Lastly its important, that this perspective do not solely consists of customer surveys, but should include measurable like response time, customer acquisition and customer loyalty.[2][7]

The Internal Process Perspective address organizational and operational measures in which a company when excels is providing good financial performance and excellent value proposition to reach the customers.[1][7] It consist of four high-level processes: 1. build the franchise, 2. Increase customer value, 3. achieve operational excellence and 4. Become a good cooperate citizen. [1] Measures in this perspective when considering PPM could include operational availability, reliability and post-sale processes.[2]

The very last perspective is the Learning and Growth Perspective, this perspective is the enabler of the three previous. It is the foundation for the BSC, since it concerns the employees and informative systems, which let you reach ambitious results and achieve a leading market position. During the identification of the other measures, it is mostly certain that significant gaps will be identified during development of this perspective, these would likely concern the human, informational and organizational capitals. Measures in relation to PPM could be planning accuracy, employee development and availability of information.[2][7] When this as the last perspective have been developed, then the strategy map is complete across all four perspectives of the strategy.[1]

Key Performance Indicators

In relation to BSC, Kaplan and Norton (2001) has identified, during 200 consultancy projects, two main types of BSC. The first one is the Key Performance Indicator BSC (KPI-BSC) and the second is the Stakeholder BSC (S-BSC). In this section the KPI-BSC will be discussed, while the S-BSC will follow in next section.[1]

The KPI-BSC is one of the major BSC types. KPI-BSC is typically straight forward to implement, since it is often based on already existing KPIs within the organization. The identified KPIs need to be classified into the four above stated perspectives to ensure that they address the entire project portfolio and all the aspects. It is important that the KPI-BSC do reflect the entire strategy of the organization and not only parts, which is often the case. By looking solely at the KPI-BSC a person should be able to tell what the organizational strategy is, since it should based upon that. Also the linkages between a specific KPI and its contribution to strategic objectives should be clarified and have a common acceptance. [1]

Stakeholders

The second main type of BSC is the S-BSC. In this type the organization identifies all it stakeholders, including shareholders, employees, customer, suppliers and their point of contact with the community in which they engage. Then the organization develop goals for all these stakeholders and follow this by a set of measures and indicators. The S-BSC described, is not fulfilling the definition of the BSC, but by adjusting measures and indicators to also concern the aspect about how the organization is going to achieve this, while concerning the overall organizational strategy and their internal processes, then the S-BSC would be sufficient in the definition of a BSC.[1]

Either of the KPI-BSC nor the S-BSC is sufficient on their own, but in either a cooperation or an inspired conceptualization based on the four perspectives, both can fulfill the definition of a BSC. Each PPM is different and the design of the BSC framework should carefully be considered and changed to match the strategy of the organization.

Project Portfolio Management

The PPM definition in this article follow the standards of PPM from the Project Management Institute (PPM-Standard):

"Portfolio management is the centralized management of one or more portfolios to achieve strategic objectives. It is the application of portfolio management principles to align the portfolio and its components with the organizational strategy. Portfolio management can also be viewed as a dynamic activity through which an organization invests its resources to achieve its strategic objectives by identifying, categorizing, monitoring, evaluating, integrating, selecting, prioritizing, optimizing, balancing, authorizing, transitioning, controlling, and terminating portfolio components."[9]

Linkage between BSC and Project Portfolio Management

When considering PPM one of the critical actions or features is to carefully monitor, evaluate, controlling, balancing and optimizing portfolio components.[9] A framework which support these portfolio components is the BSC. BSC give a structure, a strategy map and measures to manage, which when performed correctly will help to achieve an excellent PPM performance within the highlighted components.

Furthermore, the PPM-Standard also emphasize the importance of a direct link between the PPM and the organizational strategic objectives.

"A portfolio is a collection of projects, programs, subsidiary portfolios, and operations managed as a group to achieve strategic objectives. The portfolio components, such as programs and projects within the portfolio, are quantifiable. ...At any given time, a portfolio represents a collection of its selected portfolio components and reflects one or more organizational strategies and objectives for that point in time. Therefore, a functioning portfolio should be a representation of an organization’s intent, direction, and progress at any given moment."[9]

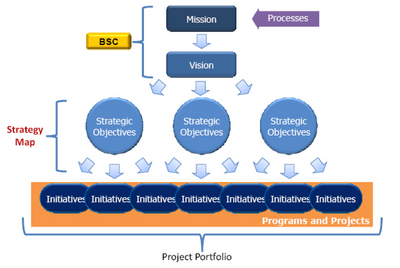

This facilitation can BSC ensure if properly designed and modified to the given organization.[7] Also see Figure 2, for visualization of the linkage in between BSC, appurtenant Strategy Map and PPM.

Identification of Need

Its not all organizations which need to implement the BSC. It is very important to underline, that it takes a lot of work to initiate and implement. Therefore, organizations which already has an excellent performance measurement discipline, should not use the resources to implement the BSC, due to small return on investment if any.[7]

To identify if an organization could benefit from the implementation of a BSC system a questionnaire from Niven (2006) has been modified and work as an subjective assessment tool for implementation of BSC. When answering the assessment you assign each statement a score from 1 to 5. The more you agree the higher a score you should assign to the statement.

| No. | Statement | Score (1-5) |

|---|---|---|

| 1 | In our portfolie we has invested in Total Quality Management (TQM) and other improvement initiatives, but we have not seen a corresponding increase in financial or customer results. | |

| 2 | If we did not produce our current performance reports for a month nobody would notice. | |

| 3 | We create significant value from intangible assets such as employee knowledge and innovation, customer relationships, and a strong culture. | |

| 4 | We have a strategy (or have had strategies in the past) but have a hard time implementing them successfully. | |

| 5 | We rarely review our performance measures and make suggestions for new and innovative indicators. | |

| 6 | Our senior management team spends the majority of its time together discussing variances from plan and other operational issues. | |

| 7 | Budgeting at our portfolio level is very political and based largely on historical trends. | |

| 8 | Our employees do not have a solid understanding of our mission, vision, and strategy. | |

| 9 | Our employees do not know how their day-to-day actions contribute to the organizational strategic objectives. | |

| 10 | Our employees do not know how their day-to-day actions contribute to the organizational strategic objectives. |

Implementation

Steps

Strengths

Weaknesses

Limitations

Risks

Annotated Bibliography

Project Management Institute. (2018). The standard for portfolio management.

Toledo, R. (2011). From the balanced scorecard to the project portfolio. Paper presented at PMI® Global Congress 2011—North America, Dallas, TX. Newtown Square, PA: Project Management Institute.

Kaplan, R. S., & Norton, D. P. (2001). Transforming the Balanced Scorecard from Performance Measurement to Strategic Management : Part I, 15(1), 87–104.

References

- ↑ 1.00 1.01 1.02 1.03 1.04 1.05 1.06 1.07 1.08 1.09 1.10 1.11 1.12 1.13 1.14 1.15 Kaplan, R. S., & Norton, D. P. (2001). Transforming the Balanced Scorecard from Performance Measurement to Strategic Management : Part I, 15(1), 87–104.

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 2.9 Tharp, J. (2007). Align project management with organizational strategy. Paper presented at PMI® Global Congress 2007—Asia Pacific, Hong Kong, People's Republic of China. Newtown Square, PA: Project Management Institute.

- ↑ Toledo, R. (2011). Bridging the strategy gap. PM Network, 25(6), 18.

- ↑ 4.0 4.1 4.2 4.3 4.4 Olivier, A. J. (2007). Guideline for travelling [i.e. traveling] from vision to projects and back. Paper presented at PMI® Global Congress 2007—EMEA, Budapest, Hungary. Newtown Square, PA: Project Management Institute.

- ↑ Taggart, R. A. (1977), A MODEL OF CORPORATE FINANCING DECISIONS. The Journal of Finance, 32: 1467-1484. doi:10.1111/j.1540-6261.1977.tb03348.x

- ↑ Abernethy, M.A., Horne, M.H., Lillis, A.M., Malina, M.A., & Selto, F.H. (2005). A multi-method approach to building causal performance maps from expert knowledge, Management Accounting Research, 16(2), 135–155.

- ↑ 7.0 7.1 7.2 7.3 7.4 7.5 7.6 7.7 7.8 7.9 Niven, P.R. (2002) Balanced Scorecard Step-by-Step New York, NY: John Wiley & Sons

- ↑ 8.0 8.1 Toledo, R. (2011). From the balanced scorecard to the project portfolio. Paper presented at PMI® Global Congress 2011—North America, Dallas, TX. Newtown Square, PA: Project Management Institute.

- ↑ 9.0 9.1 9.2 Project Management Institute. (2018). The standard for portfolio management.

- ↑ Alsadeq, I., Fatehy, T., & Othman, O. (2009). PMI® and BSC marriage! Where can PMI standards meet balanced scorecard? Paper presented at PMI® Global Congress 2009—EMEA, Amsterdam, North Holland, The Netherlands. Newtown Square, PA: Project Management Institute.

- ↑ Hoffman, W. (2004). The view from 50,000 feet. PM Network, 18(7), 26–33.