Investment portfolio management

Contents |

Abstract

The scope of this article is to points out the similarities and differences between project and investment portfolio management. Project Portfolio Management (PPM) refers to a senior leadership discipline that drives strategic execution and maximizes business value delivery through the selection, optimization, and oversight of project investments which align to business goals and strategies [1]. The objectives of PPM are to determine the optimal resource mix for delivery and to schedule activities to best achieve an organization’s operational and financial goals, while honouring constraints imposed by customers, strategic objectives, or external real-world factors. The International standard defines the framework of the Project Portfolio Management [2]

On the other hand Investment Portfolio Management is the science of making decisions about asset management , matching investments to objectives, asset allocation for private investors (mutual funds or exchange-traded funds) and institutions (insurance companies, pension funds, corporations, charities) and balancing risk against performance. Portfolio management, implies in tactfully managing an investment portfolio, by selecting the best investment mix in the right proportion and continuously shifting them in the portfolio, to increase the return on investment and maximize the wealth of the investor. [3].

A wide range of investments and financial products are available when building an investment portfolio. Those products are accessible for individual and institutional investors. Investors utilize investment products to meet various investment goals and objectives. The most well known investment products are: stocks and stock funds, bonds and bond funds and financial derivatives. Both Investment portfolio management and Project Portfolio Management include risks. In this article will be extended explanation for Project risk management versus the financial risk management.

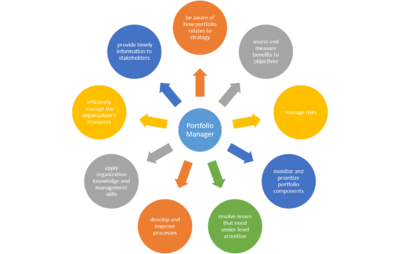

Portfolio Manager

Many firms select investment portfolio management processes to manage investment mixes efficiently and profitable. One of the essential players in portfolio management is the portfolio manager, a executive responsible for the overall running of portfolio management. The skills this individual should have are above to those of project managers, as portfolio managers should take a spherical view over all running projects. Investment portfolio manager is responsible for making investments decisions and to establish an investment strategy, selecting appropriate investments and allocating each investment properly towards an investment institution.

Project Portfolio Managers help with planning and scheduling teams to identify the fastest, cheapest or most suitable approach to deliver projects and programs. Also project portfolio managers define key performance indicators and the strategy for their portfolio [4]

Portfolio Manager Skills

Becoming a successfull portfolio manager requires some essential skills. In this article will take a look at the top nine skill areas for a portfolio manager. Those skills are:

- Tenacity

- Anticipation

- Communication skills

- Humility

- Ability to work independently

- Strong emotional control

- Decisiveness

- Competitive spirit

- Analytical ability

The Business Problem

One of the main problems associated with organisations, is that the ratio between Human resources, money and perspective or future projects is inordiate. A usual phenomenon connected with over-loading phenomenon, mentioned above is the difficulty of management teams to deny new projects. Instead, present day management teams try to do everything by cramming more work onto the calendars of already overworked project teams or by cutting corners during the project.

Despite a heavy investment of people and money in projects, the organization still gets poor results because people are working on the wrong projects or on too many projects. Trying to do too much work, causes all projects to suffer from delays, cost overuns, or poor quality[5]

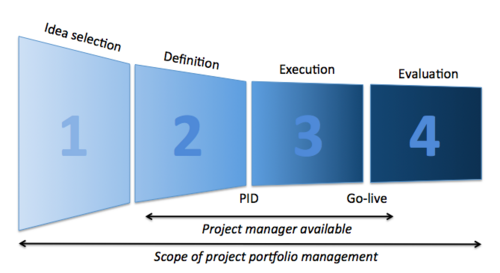

Project Portfolio Funnel Management

Sufficient project organisations, focus their limited resources on the first-rate projects, declining to contribute on projects that are not good enough. Project Portfolio Funnel Management (PPfM) empowers them to make and implement these tough project selection decisions. PPfM is a funnel that connects strategic planning to the execution of projects, making the strategic objectives executable. The inputs of the funnel takes in all of the ideas for projects or financial products that the organization might invest to. These ideas may come from strategy, customer requests, regulatory requirements or ideas from individual contributors. The purpose of the funnel is to select only those projects that meet certain criteria and not move forward with others. The resulting collection of projects is a focused, coordinated, and executable portfolio of projects that will achieve the goals of the organization. The same process is also applicable in financial or investment portfolio management as well. In this case instead of project selection organizations do the wright selection between financial products.

The Portfolio Management Process

The Project Portfolio Managemet Process contains five primary steps. Those steps are:

- Carify business objectives[5]

Portfolio management requires a systematic method of seperation between candidate projects to determine which ones are more vital. For example, one company might value environmental stewardship most higly, while another places top priority on research and development[5].

- Capture and research requests and ideas

The first step is the creation of an inventory of candidate projects for the portfolio. Include on-going projects as well as ideas for new projects. Sources can include initiatives from strategic planning, regulatory requirements and good ideas from employees and project managers. The second step is gathering of data for each candidate project on the inventory. These include data that will allow a company to rate the projects against the criteria that the company has developed. It may also include early estimates of dependencies and high-level resource requirements.

- Select the best projects using difined differentiators that align, maximixe and balance the portfolio

Based on step's two collected data, the company or the portfolio management office should determine which combination of projects creates the highest total value for the portfolio, given high-level resource constraints. This is called portfolio maximazation. A maximized portfolio may be out of balance in important ways. For example, it may have an inappropriate risk profile, subjecting the organization to either too much or too little risk. According to Cooper (Cooper, Edgett, & Kleinschmidt, 2001, p. 73), balance is the second weakest element in portfolio construction, after “too many projects.”

- Validate portfolio feasibility and intiate projects

To keep the amount of data manageable, a portfolio is initially constructed at high level of abstraction. The resulting portfolio ignores some important constraints and details about its projects. For example, a portfolio’s demand for resources often appears feasible when analyzed at the FTE (full-time equivalents) level. However, this masks bottlenecks caused by limited availability of certain skill sets. Thus, a portfolio may not be feasible to execute even though it is maximized and balanced. When a company or an investor is looking at portfolio feasibility, they have to consider those parameters: Interproject dependencies, knowledge and capabilities of the performing organizations, time-phased resource demand and availability including considerations of key skill sets, Budgetary constraints.

- Manage and monitor the portfolio

After the validation of the portfolio, the project management office should put it into execution. Moreover the portfolio manager is responsible for day-today execution of each projects. He or she monitors the execution of the portfolio and its component projects, ensuring that it continues to meet its original design objectives. In this step, the portfolio manager works closely with the project managers to: Gather information to monitor the performance of the portfolio, identify and resolve issues within the portfolio, including reallocating resources,Steer the portfolio, making changes when necessary to rescue, re-scope, cancel, or introduce new projects, manage escalations and midcycle requests for changes to portfolio composition, for example, adding new projects and initiate a full portfolio review and reconstruction on a scheduled basis, such as quarterly or annually.

Investment Portfolio Management versus Project Portfolio Management

Same as previous the same procedure is deployed for investment portfolio management, but in this specific are instead of projects, financial products (stocks, bonds, mortages, derivatives) are considered as the key subject of interest.

Project Risks

Project risk management is the process of identifying, analyzing and then responding to any risk that arises over the life cycle of a project to help the project remain on track and meet its goal. Risk management isn’t reactive only, it should be part of the planning process to figure out risk that might happen in the project and how to control that risk if it in fact occurs [6]. Risk management is a common and widely adopted project practice. Practitioners use risk management based on a common assumption that risk management techniques add value to projects. Yet, in the complex and ambiguous environment of a project, value is often subjective [7]. Following the article there will be an extensive explanation about the types of risks in projects and for the sources of projects risks.

Risks on projects can be practically branched into project risks and technical risks.

- Project Risks are those that occur during the execution or construction of the project. For example, suppose a heavy component such as a specialized vertical stabilizer needed for the construction of an aircraft, can only be purchased from a limited number of suppliers. If the demand for this product is very high and none of the suppliers can supply it on time, the plan for accomplish the project will be endangered. Generally groups such as purchasing, finance and human resources are responsible for managing project risks.

- Technical Risks are risks that occur during the operation of a project after it is completed. For example, a car's component is designed and built in such way to give better steering on the road. This type of risk should be identified during the design of the project and moderated by adjust the design.[8]

Sources of Project Risks

Project risks originate from such events as the following:

Project location: This includes geopolitical conditions, legal environment and manmade or natural catastrophes. For example, the risks posed by severe weather events such as floods, tornadoes or extreme temperatures during project execution and subsequent operation of the facilities associated with the project.

Economic, industry and market environment: This includes demographic trends, inflationary environment, business cycle, changes to the business structure, changes in the price of inputs and changes in interest rates or foreign exchange rates. For example, some project proponents purposely proceed with projects when the overall business cycle is in a trough. Although a project proponent must have the necessary financial resources, this will reduce the likelihood of cost overruns, for the equipment, material, and human resources required to execute the project can likely be procured at lower prices. Conversely, severe cost overruns can result when projects are executed at a peak in the business cycle.

Project size and complexity: Large projects tend to be more complex than smaller projects, with increased numbers of communication channels and increased levels of project governance. This tends to make large projects riskier than small projects.

Financial strength: It may be prudent for the project proponent to find a partner with whom to share financial risk. However, this will introduce new risks related to project governance, for there will now be two different entities involved in the project.

Technology: Projects using state-of-the-art technology require extensive demonstration scale testing to prove out the technology and develop the design criteria required to complete detailed design for a commercial facility.

Logistics: The transport of equipment, material, and people to and from the project site can be a major risk. During the planning of a transport must take into consideration the cargo dimensions imposed by the transport route. For example a construction site which is located near coast could take advantage of the cost savings resulting from pre-assembled parts. On the other hand, a construction site which is located inland will be restricted in terms of load size and load limits of the access road or rail line.

Communications: Communication becomes more complicated as project size increases and on remote project sites. Satellite communication or the installation of fiber optic cables may be required for the communication system to provide the bandwidth required by the project.

Commissioning: The simplicity of equipment and system commissioning will vary from project to project. This will affect commissioning duration and commissioning labor requirements.

Integration with existing operations: If the project is an expansion to existing facilities, then integration of project execution and operation of the new facilities with the existing facilities must be addressed.

Human Resources: Human resources are frequently a major source of risks on projects. Project cost and schedule can be affected depending on how the project team works together as a team.

Sustainability: Sustainability is becoming more of an issue on projects. Sustainability issues include community and heritage values, disease and health risks, potential releases of hazardous materials, high sound levels, the effects of an industrial or environmental disaster, and conservation and endangered species.

Sources of Technical Risks

Technical risks are handled separately from general project risks, being mainly linked with the design of the project's site (facilities). Technical risk management is used in the earlier stages of project life cycle and acts as a guide to the design of the facilities. In the later stages of the project's life cycle is used to verify the design of the facilities.

Sources of technical risks include the following:

- Fires or explosions

- Chemicals

- Extreme pressures

- Extreme temperatures

- Mechanical conditions

- Radiation

- Electrical condition

- Physiological conditions

- Human factors

- Ergonomic factors

- Control systems

- Vibration

- Motion

- Operating mode

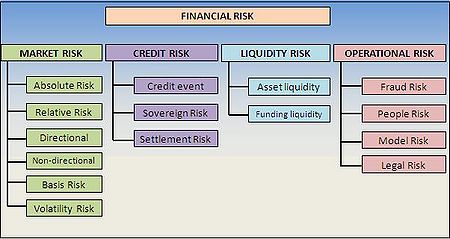

Financial Risks

In contrast with project risks, anything that relates to money flowing in and out of a business is financial risk. Financial risk is often understood in terms of financial loss and uncertainty about the extent of its loss. In simple terms, what is the amount of money a business may lose and what is the probabillity of losing it. Since the list of potential risks si so long most experts place them into one of four categories as follows[10].

Market Risk: is any risk that comes out of the marketplace in which a business operates. For example if there is a brick-and-mortar clothing store, the increasing tendency of customers shop online would be a market risk. Businesses that adapt to serve the online crowd have a better chance of surviving than businesses who stick to the offline businnes model. More generally and in any sector, every business runs the risk of being outpaced by competitors.

Credit Risk: is the possibility that a firm will lose money because someone or something fails to perform according to the terms of a contract. For example, if a firm delivery goods to customers on 30-day payment terms and the customer does not pay the invoice on time, then the firm will face credit risk. Businesses must retain sufficient cash reserves to cover their accounts payable or they are going to experience serious cash flow problems.

Liquidity Risk: also known as funding risk, this category covers all the risks that encountered when a company trying to sell assets or raise funds. If something is standing in the firm's way of raising cash fast, then it is classified as a liquidity risk. For example a seasonal business, might experience significant cash flow shortages in the off-season. Liquidity risk also includes currency risk and interest rate risk.

Operational Risk: is a catch-all term that covers all the other risks a business might encounter in its daily operations. Staff turnover, theft, fraud, lawsuits, unrealistic financial projections, poor budgeting and inaccurate marketing plans can all pose a risk to your bottom line if they are not anticipated and handled correctly.

Financial Risk Management

In the financial world, risk management is the process of identification, analysis and acceptance or mitigation of uncertainty in investment decisions. Essentially, risk management occurs when an investor or fund manager analyzes and attempts to quantify the potential for losses in an investment and then takes the appropriate action (or inaction) given his investment objectives and risk tolerance. Inadequate risk management can result in severe consequences for companies, individuals, and for the economy. For example, the subprime mortgage meltdown in 2007 that helped trigger the Great Recession stemmed from poor risk-management decisions, such as lenders who extended mortgages to individuals with poor credit, investment firms who bought, packaged, and resold these mortgages, and funds that invested excessively in the repackaged, but still risky, mortgage-backed securities (MBS)[11].

Conclusion

This article proves that Investment Portfolio Management and Project Portfolio Management have similarities according to the managerial process perspective. The obvious diferences are in the identification and managing the different kind of risks.(Projects risks versus Financial risks).

Annotated Bibliography

Pelle Willumsen, Josef Oehmen, Verena Stingl, Joana Geraldi,Value creation through project risk management,Denmark,May 2018 This scientific paper, provides a critical view view on current and further research on the actuality of risk management in projects and gives and insight of the value of project risk management.

Mike Fontaine,Enterprise Risk Management, Chapter 4, 2016 This chapter describes a typical project life cycle (conceptual study, prefeasibility study, feasibility study, project execution) and the various risk management deliverables produced during each project phase (e.g., risk management policy, risk management plan, risk registers, and Monte Carlo simulation of capital cost estimates and project schedules).

Shawkat Hammoudeh,Michael McAleer,Advances in financial risk management and economic policy uncertainty:An overview,February 2015 This scientific paper describes the difficulties of financial risk management and especially the presence of economic uncertainty and financial crises.

Augustin Purnus, Constanta-Nicoleta Bodea, Educational simulation in construction projects financial risks management, Bucharest, 2015 This scientific paper describes, how much the construction sector is vulnearable to economic changes and how project managers can hande construction financial risks.

References

- ↑ https://acuityppm.com/ppm-101-why-you-need-project-portfolio-management/

- ↑ https://www.pmi.org/pmbok-guide-standards/foundational/standard-for-portfolio-management/fourth-edition

- ↑ https://www.investopedia.com/terms/p/portfoliomanagement.asp

- ↑ 4.0 4.1 https://www.slideshare.net/igorkokcharov/what-is-project-portfolio-management

- ↑ 5.0 5.1 5.2 5.3 https://www.pmi.org/learning/library/project-portfolio-management-limited-resources-6948

- ↑ https://www.projectmanager.com/blog/risk-management-process-steps

- ↑ Pelle Willumsen, Josef Oehmen, Verena Stingl, Joana Geraldi,Value creation through project risk management,Denmark,May 2018

- ↑ Mike Fontaine,Enterprise Risk Management, Chapter 4, 2016

- ↑ https://www.simplilearn.com/financial-risk-and-its-types-article

- ↑ Shawkat Hammoudeh,Michael McAleer,Advances in financial risk management and economic policy uncertainty:An overview,February 2015

- ↑ Augustin Purnus, Constanta-Nicoleta Bodea, Educational simulation in construction projects financial risks management, Bucharest, 2015