Portfolio Evaluation Tools

Risk Matrix

A risk matrix is an effective and broadly used risk assessment tool. It is quite quick to create, and it is an easy way to identify problems. In some cases, it is also used to rank the risks to understand which one needs to be addressed first. Therefore, this tool has mainly two application:

- Decision making regarding the acceptance of risk

- Prioritize which risk needs to be addressed first.

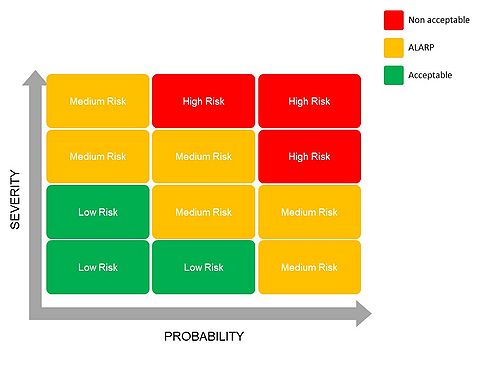

The matrix has two dimensions, the severity that indicates the extent of damages of the risk and the probability that shows how likely is that risk to happen. A combination of them will allow to collocate a risk inside the matrix. As it can be seen in the figure, three different areas can be isolated:

- Acceptable risk

- It can be seen that there is a low probability and a low severity and that indicates that the risk of an event is not high enough, or it is controlled. Usually no actions are required in this area.

- ALARP (As Low As Reasonably Practicable) risk

- This area it’s often indicated in yellow. As long as the event is placed in that zone, the risk can be accepted.k

- Non acceptable risk

- This red zone is characterized by both high severity and probability. In this case, there is the need of much more control to bring severity or probability down.

Benefit

The main benefits of this tool are that it is easy to apply and in most of the cases it does not require an extensive knowledge in risk management to use it. Furthermore, risk matrices can promote conversation in risk topics that sometimes can be avoided by managers because they may only focus in profits and revenues.

Limitations

The biggest constraint of risk matrices is that it is mainly based on qualitative discussions and thus, it lacks on quantitative and objective data.