7 principles of Stephen covey for project mangers to tackle risks

Created by Saaransh PD Kattula, March 2022

Risks are inherent challenges to any organization, which dealt with proactively, can prove to be an asset with respect to managing the threats and opportunities that arise. Uncertainty of external and internal events are faced by all organizations. A sound business strategy that realizes a set of objectives for risk management is a great tool for organizations to tackle these uncertainties. Stephen Covey in his book “7 Habits of Highly Effective People”[1] talks about what are the principles a person can follow and adhere to being successful. This book is revered by many organizational professionals who apply its principles to develop themselves and produce effective results. In this article we take a closer look at risk management principles while elucidating the opportunities and threats that accompany risks by comparing them with the principles of Stephen Covey’s book. The purpose of this article is to highlight the similarities between the risk management principles and Stephen Covey’s principles and in turn present a universal quasi-personification of Organizational Risks. The article focuses on making risks more comprehensive and risk management more malleable to both risk managers and organizations as a whole.

Introduction

There are two main works that this article focuses on. An in depth understanding of the “7 Habits of highly effective people” written by Stephen Covey and the Risk Management Standard authored by PMI is the core of this article.

The book ”7 Habits of Highly Effective People”[1] is a success book for individuals trying to hone their problem solving and decision-making capabilities. Covey first published this book in the year 1989 by researching the preceding 200 years of “success” and what are people’s perception of achieving successful results. He talks about how people should be versatile in their perceptions towards a situation and the demand for change of that situation. Covey noticed a trend shift in how people viewed change and identified success. In earlier times, the foundation of success rested upon the “character ethic” (things like Integrity, Humility, Fidelity, etc.) But the trend that Covey noticed in the later years was that the way people looked at success gravitated towards “personality ethic” where success is a function of Personality, Public image, Attitudes and Behaviors etc.

Covey in the essence of the book says that both approaches of character development and personality development are fundamentally important for all people trying to achieve success. "The way we see the problem is the problem,"[1] Covey writes. And this is where he puts forth the 7 habits to talk about the importance of both approaches.

- Habits 1, 2, and 3 are focused on self-mastery and moving from dependence to independence.

- Habits 4, 5, and 6 are focused on developing teamwork, collaboration, and communication skills, and moving from independence to interdependence.

- Habit 7 focuses on continuous growth and improvement and encapsulates all the other habits.

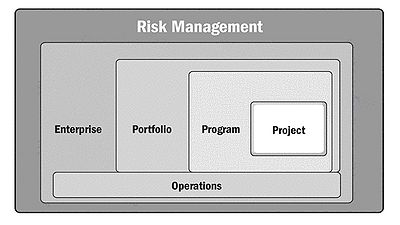

The risk management standard authored by the PMI[2] talks about risks and risk management for organizations. All organizations encounter risks because of both activity and inactivity due to internal and external factors. Risks are difficult to manage because of their variable impact i.e. big and small. Hence it is very important for organizations to be vigilant. Goals and objectives aligned with business strategies require operation plans and change plans. Change is uncertain, inevitable, and necessary for competitive sustenance[2]. To manage change and risks that come along with it, there is a need for a robust set of strategies of risk management. Risk management is the process of balancing opportunities and threats in all domains of the organization (Enterprise, Portfolio, Program and Project).

Enterprise risk management (ERM) reflects an organization’s culture, capabilities and strategies to create value and by sustaining this value, an organization covers all policies, processes and methods to manage risks. ERM methodologies can also translate to Portfolio risk management, Program risk management and Project risk management[2]. Organizations need to build adaptive frameworks of risk management to align with competitiveness and confront increasing complexity attached with goal attainment and decision making. Complexity exists in various aspects of workflow (Human behavior, Systems behavior, uncertainty and ambiguity). Thus arises a need for integrated view of risk management to define the construct of organizational governance and operations.

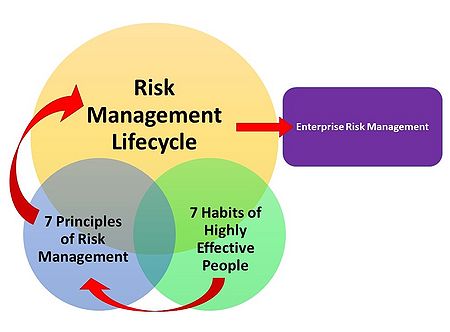

A construct of risk management framework is the risk management lifecycle[2]. It ensures a structure regardless of different domains in an organization and risk management requires execution of the risk management lifecycle. Due to complexity and uncertainty, a robust risk management lifecycle would require adhering to risk management principles for effective results.

The 7 principles of risk management from the PMI standard[2] for risk management and the 7 habits of Stephen Covey seemingly have similarities among them. These 7 principles of risk management form the framework for Risk Management Lifecycle which in turn is the basis for ERM. With all the uncertainty that comes with risk, an added perspective of quasi-personification of organizational risk management principles is beneficial for tackling risks. This article is an extra guide to consider when looking at Enterprise Risk Management.

The article first illustrates the 7 habits of Stephen Covey[1] followed by a basic understanding of the framework of risk management i.e. the Risk Management Lifecycle[2]. In the end the 7 risk management principles given in the PMI[1] are elucidated and how they are similar to the 7 habits of Stephen Covey, giving insight on where these can be used in the Risk Management Lifecycle

7 Habits of Stephen Covey

Principle 1: Be Proactive.

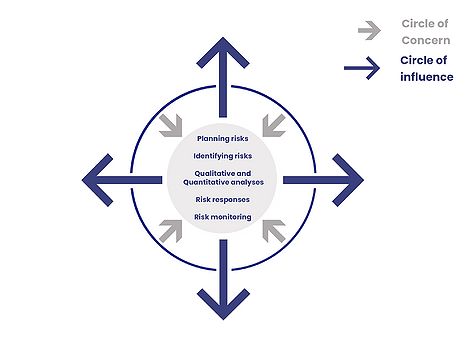

Covey talks about circle of concern and circle of influence and shows two approaches to a problem or a situation based on having a reactive or a proactive character. A reactive person focuses on responding to external forces after they have transpired. They would also complain or worry about the circumstances and the consequences of any event good or bad. Whereas a Proactive person would take responsibility of any event that has transpired or will transpire. They focus on the things they can control and are in a constant strife to learn from and more importantly take action for both internal and external forces that they can change.

Principle 2: Begin with the end in mind.

Covey mentions that a successful outcome either for a short-term or a long-term goal depends what the perceived outcome is. We can use our imagination to develop a vision of what we want to become and use our conscience to decide what values will guide us. The summary of what he explains is that we need to set goals and set control on doing things before someone or something else takes control.

Principle 3: Put first things first.

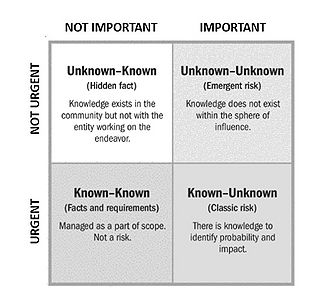

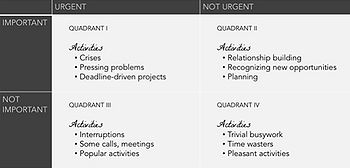

Covey says “The challenge is not to manage time, but ourselves”[1] and “The key is not to prioritize what’s on your schedule but to schedule priorities,”[1] when talking about the importance of time management and scheduling tasks. The first two habits focus on developing an individual’s mindset but this third habit talks about personal time management of a successful individual. Covey even suggests a matrix to help individuals be able to categorize tasks based on their urgency and importance which enables us to prioritize tasks. Each of these quadrants has a detrimental effect on how to prioritize responsibilities.

Principle 4: Think Win-Win.

Covey’s fourth habit moves from an independent to an interdependent habit where he observes the commitment patterns of individuals. The observations show us that there are six paradigms to human interactions, and they are, “WIN – WIN”, “WIN – LOSE”, “LOSE – WIN”, “LOSE – LOSE”, “LOSE” and “WIN – WIN or NO DEAL.” The paradigms involve two parties who either lose or win in working in coherence with each other. Covey states the ideal way to achieve successful results and developing a strong character, one should always aim for a situation where he WINs and make sure that the person he is working with does not lose to get the most benefit. Often people who LOSE or perceive to LOSE will not comply with the terms of a deal and possibly benefit from it if there would be low or no profit. Based on the consideration and courage factor we can say that the ideal outcome for any interaction would be “WIN – WIN” paradigm. The “WIN – WIN or No Deal” paradigm can be considered an alternative for “WIN – WIN” because it liberates an individual from the need to manipulate people and push their own agenda.

Principle 5: Seek to understand and then to be understood

Every human has an opinion and wants to be heard because every opinion is valid. Every person jumps at the opportunity to provide solutions or their understanding of a situation without considering that others too have a say in that situation. Usually people tend to prescribe a solution before they diagnose the problem. It is hard for an individual to have a different frame of reference than that of their own and it takes time to shift their focus from self to others and they must be willing to do so. “Empathetic listening takes time but it doesn’t take anywhere near as much time as it takes to back up and correct misunderstandings when you’re already miles down the road, to redo, to live with unexpressed and unsolved problems, to deal with the results of not giving people psychological air”, Covey says. By this he says that we need to practice empathetic listening before we do anything to avoid mistakes due to miscommunication down the line when it is too late.

Principle 6: Synergy

The next step would be to synergize with others. By understanding and valuing the differences in other people’s perspectives, an individual has the opportunity to create synergy, which allows people to enter new levels of openness and creativity. Synergizing allows an individual to overcome obstacles they would never have done before because they have adopted all the other habits of independence and interdependence. When a person adopts habits 4 and 5, people automatically pool subjective desires of their own to tackle a problem with others with different ideologies. The versatility and the adaptability that comes with different perspectives is why organizations do projects with multidisciplinary teams..

Principle 7: Sharpen the saw

The last habit is all about renewal and persisting to improve. It is likely that a lot of effort and time is taken up by adopting the previous habits into one’s life, but it is important that one should not be swallowed up by the failures and continue to develop themselves. All the previous habits need to be constantly improved and developed. People need to focus on developing themselves through the mentality “You either win or you learn.”

Risk and Framework for Risk Management

Risk is an uncertain event or condition that, if occurred could have a detrimental positive and/or negative effect[2]. Overall risk is the effect of uncertainty of individual risks at all levels, aspects or domains of an organization, which means it is the culmination of individual risks in Enterprise, Portfolio, Program, and Project domains. To manage complexity that comes with the uncertainty of risks, there is a need for an integrated view of risk management to define the construct of organizational governance and operations framework. The framework is as follows:

- Articulate Objective

- Define internal and external parameters for processing an effective risk management life cycle

- Establish risk criteria within the scope of risk management lifecycle and iterate these criteria.

The main part of the framework for risk management is the Risk Management Lifecycle. The PMI[2] standards illustrates the steps an organization need to take in order to build a sound risk management strategy.

Risk Management Life Cycle:

The different phases of Risk management lifecycle are assessed in terms of its purpose and success criteria. The sequence of logical phases in life cycle approach which is also an iterative process is as follows:

- Plan Risk Management:

A plan describes how risk management processes should be carried out and how they fit. It needs to be adaptive to the requirements of the work and stakeholder demands.

- Purpose: To develop an overall risk management strategy, how risk management processes will be executed and integrate risk management with all other processes.

- Risk appetite: It is the acceptable consideration of stakeholders like tolerance to uncertainty and relative importance, thresholds and critical values of risk management etc. achieved by sharing a common understanding.

- Success Factors: Acceptance by stakeholders; Identification of bias and correction; Alignment with internal risks and external constraints and priorities; Balance between cost and benefits/efforts; Competencies and comprehension.

- Identify Risk:

It is important to distinguish genuine risks and non-risks.

- Purpose: identify practicable risks. Iteration and repetition of risk management helps. Identifying risk is important to identify risk responses, which will be discussed later in this section. With input from different stakeholders, identification of risks aims to expose and document present and emergent risks, which allows the organization to create contingency plans and assign relevant risk owners to monitor these risks.

- Success factors: Early Identification; Iterative Identification; Emergent identification; Comprehensive Identification; Explicit identification of opportunities; Multiple perspectives; Linking risks; Complete risk statement; Ownership and level of detail; Frequent and effective communication; Minimize bias.

- Perform Qualitative Risk Analysis:

It is subjected to singular risks. It is the process of categorizing and prioritizing risks to efficiently manage them.

- Purpose: Understanding in detail by considering probability of occurrence, degree of impact, manageability, timing of possible impacts of causes and/or effects. Although it does not address overall risk results with combined effect of other risks.

- Success factors: Use agreed approach; Use agreed definition of risk terms; collect credible information; perform interactions.

- Perform Quantitative Risk Analysis:

It provides insight into combined and overall effect of risk this includes correlation with other risks, interdependency, feedback loops etc.

- Purpose: To provide a numerical estimate of overall risk. Results are used to evaluate likelihood of success and estimate contingency reserves. Not all cases can be quantified, hence both the qualitative and quantitative analyses are required but both can be of varied importance due to their subjective nature. Both approaches cover individual risks and overall risks.

- Success factors: Prior risk identification and opens insight into qualitative Risk analysis; Appropriate model/framework; competence with technical tools; commitment to collect credible risk data; unbiased data; Inter relationships with risks.

- Implement Risk Responses:

Once the planning is done, the risk owner then implements these plans and looks for secondary associated. Effective communication is key.

- Purpose: carry out risk responses if and when risk should occur.

- Success factors: Accountability of risk owners; Stakeholder commitment to implement the risk responses; Effective communication; Contingencies and management reserves are made available.

- Monitor Risk:

It is the process where the ability to re-evaluate the status of risk is assessed. It helps identify emergent, residual, and secondary risks which helps determine the effectiveness of risk management. Relevancy of risks over time becomes obsolete with change and monitoring of foreseen and unforeseen risks helps organizations to create sound risk management practices for the present and future. It is possible through periodic risk assessment practices.

- Purpose: track and maintain viability of risk response plans.

- Success factors: Integrated risk monitoring; continuous monitoring of risk trigger conditions; Maintaining risk awareness.

Risk management principles in relation to Stephen Covey's Principles

The PMI[2] illustrates the guide to build a framework for risk management. It also gives information for risk managers to adhere to 7 principles of to produce an effective risk management lifecycle structure. The 7 principles itself is a broad and highly subjective big picture approach to building the framework for risk management and added perspective to this big picture is the 7 habits of Stephen Covey[1]. The familiarity and the individualism that comes from the 7 habits is a huge confidence booster for risk managers when facing risks and its uncertainty. The 7 principles of risk management in terms of the 7 habits to build the risk management framework is as follows:

Strive to Achieve Excellence – Be Proactive

To achieve effective results of risk management, an organization needs to be able to increase the predictability of outcomes which in turn is used in all stages of the risk management life cycle. It does not help an organization to react to a risk. They need to PROACTIVELY look for information regarding risks, especially in the Planning risk management, Identifying Risks, Performing Qualitative and Quantitative analyses, and in the Monitoring risk of the risk management lifecycle.

Align Risk Management with Organizational strategy & Governance practices – begin with End in mind

The purpose of risk management in any organization is to develop and evolve their risk management practices with respect to other organizational processes like strategy and governance. With the uncertainty of risk due to change, strategies and objectives need to change as well. It is helpful for an organization to have small achievable goals along the way to achieve these objectives. Milestones of risk management should be scoped before implementing. All of the lifecycle phases of risk management can use the “begin with the end in mind” mindset, especially the Planning and Identifying phases.

Focus on the most impactful risk – Put first things first

Effectivity and efficiency in identifying risks is really important to an organization because they directly influence goals and objectives. Risks have variable impact. Prioritizing the risks that need to be handled first and identifying which of those risks have a detrimental effect on overall goals. The organization that is working on the Planning, Identifying and Monitoring risks phases of the risk management lifecycle needs to have the “put first things first” mindset or the capabilities to prioritize efficiently.

Balance Realization of value against overall risks – Think win – win

In any organization, exposure to risk is inevitable, so is the expectation of an organization to create or realize value from those risks if the organization aims for sustenance. It is important for an organization to find an effective balance between dealing with the risk and in the process gain maximum possible value. In any risk landscape, the high level of risk poses a high level of threat and vice versa. So organizations need to be willing to sacrifice overambitious value creation and choose which is the most optimal solution. The “win-win” mindset to get optimal value helps to stay vigilant of high levels of threats from high levels of risk. This mindset helps especially in the performing of Qualitative and the Quantitative analyses phases of the risk management life cycle. Another phase where the “win-win” mindset works is in the implement risk responses phase of the lifecycle. It is important for an organization to keep in mind the stakeholder or risk owner needs and demands to maintain harmony.

Risk is uncertain and complex. There are many stakeholders that are involved. The Planning phase, identifying phase and especially the Monitoring phase of the risk management lifecycle has to focus on understanding the risk through clear communication between responsible stakeholders to create an Implementation plan. It takes resources for an organization to carry out qualitative and quantitative analyses and also to implement risk responses. Therefore, the organization needs to have a good understanding between the risk owners and their problems in implementing risk responses to generate better risk management practices for the present and future.

Foster a culture that embraces risk – Synergize

Risk management practices are propagated in all domains of the organization. This means that there are several stakeholders that are directly affected concerning a risk or a combination of risks. It is essential for an organization to promote a common understanding of risk management practices to achieve common goals and objectives. In all phases of the Lifecycle from Planning risk management to Monitoring risks the “synergy” between all levels of stakeholders is essential for effective risk management practices.

Continuously improve Risk Management competencies – Sharpen the saw

Risk management is an iterative process due to its uncertainty and complexity. An organization needs to have the mindset of “sharpening the blade” to keep up with the ever changing nature of risk. In all phases of the risk management lifecycle, iteration is key for effectiveness and one can only get better by learning from previous success as well as failures to maintain and increase the level of risk management practices.

Limitations

The biggest limitation of this connection is that it is highly subjective to user bias. Risk managers may have their own inhibitions and interpretation of this connection and broaden their research on tackling risks. It is a limitation only when risk managers work alone and let themselves stray far away from the process due to the flood of information. To avoid that risk managers should work in groups to have simple interpretations of risk management using this connection but each opinion unique in their own ways. This aligns well with creating synergy and understanding different opinions on the process of creating a sound risk management framework.

Conclusion

The 7 habits of Stephen Covey[1] is aimed towards individual's personal development to attain effectiveness. These habits can be used by people not just in their professional life but also in their everyday lives. The book and its habits could be interpreted into many facets of project, program or portfolio management by managers but it is not a definite formula for effectiveness for the same managers. The book does not necessarily account for the more important elements of project management for example resource management or cost management. On the other hand, the PMI standard for risk management[2] gives a generic methodology for the risk management space as a whole and it is very process oriented. To people in the risk management processes, especially for risk managers, it is just another set of rules they have to follow and this may seem like another mundane task. This is where this article and its contents come into play and create a unique synergy between people and processes. This article highlights how the 7 habits of Stephen Covey can be targeted towards processes in risk management while also elucidating how the principles of risk management can be relatable to people.

Annotated Bibliography

Covey, Stephen R. THE 7 HABITS OF HIGHLY EFFECTIVE PEOPLE. New York: Free Press, [1989] ©1989 – This book by Stephen R. Covey is a self help book for managers or any person in the business landscape who is trying to achieve effective results. Covey talks about the 3 phases of human development and interactions namely Dependence, Independence and Interdependence in terms of 7 habits to conquer oneself and achieve success.

Project Management Institute, Inc. The Standard for Risk Management in Portfolios, Programs, and Projects (None Edition). Project Management Institute, Inc. (PMI); June 1, 2019. – This standard focuses on the “what” of risk management (i.e., the key considerations for effective risk management). This standard:

- Identifies the core principles for risk management;

- Describes the fundamentals of risk management and the environment within which it is carried out;

- Defines the risk management life cycle; and

- Applies risk management principles to the portfolio, program, and project domains within the context of an enterprise risk management approach.

It is primarily written for portfolio, program, and project managers, but is a useful tool for leaders in risk management, business consumers of risk management, and other stakeholders involved with risk management.

References

- ↑ 1.00 1.01 1.02 1.03 1.04 1.05 1.06 1.07 1.08 1.09 1.10 Covey, Stephen R. THE 7 HABITS OF HIGHLY EFFECTIVE PEOPLE. New York: Free Press, [1989] ©1989

- ↑ 2.00 2.01 2.02 2.03 2.04 2.05 2.06 2.07 2.08 2.09 2.10 2.11 2.12 Project Management Institute, Inc. The Standard for Risk Management in Portfolios, Programs, and Projects (None Edition). Project Management Institute, Inc. (PMI); June 1, 2019.

- ↑ 3.0 3.1 3.2 https://blog.hubspot.com/sales/habits-of-highly-effective-people-summary