Bubble Diagram

(→The use and implementation of a Bubble Chart) |

(→The use and implementation of a Bubble Chart) |

||

| Line 65: | Line 65: | ||

<br> | <br> | ||

| − | =The use | + | =The use of a Bubble Chart= |

| − | The Bubble Chart is a simple tool that is meant to fairly quick and easy help managers get an overview and make fast decisions. | + | The Bubble Chart is a simple tool that is meant to fairly quick and easy help managers get an overview and make fast decisions. However as this is a tool with up to 4 dimensions of data, it relies on some kind of source feeding it information. In other words, The BC cannot be made before the right upstream processes are in place. Very few or no studies can be found in the literature regarding the exact effect of the chart in use. It is therefore impossible to generalize and conclude generically whether the BC is worth implementing in a company. In order to get an overview a list of benefits and disadvantages is conducted. This list can be used to understand in which situation BCs would be easy to implement and use, and in which situation the implementation such a chart can be a costly and non-benefiting project. |

| − | However as this is a tool with up to 4 dimensions of data, it relies on some kind of source feeding it information. In other words, The BC cannot be made before the right upstream processes are in place. | + | |

===Benefits=== | ===Benefits=== | ||

| − | <ol start=" | + | <ol start="B1"> |

<li>Easy implementation</li> | <li>Easy implementation</li> | ||

<li>Intuitive and no training needed</li> | <li>Intuitive and no training needed</li> | ||

Revision as of 17:34, 1 December 2014

The Bubble Chart is used as a visual tool to support the decision making in Project Portfolio Management. The chart is much similar to the regular xy-scatter-plot, however including the variables size and colour, the user can get up to four dimensions of data in an easily understandable two-dimensional chart. In the most popular version the horizontal axis represents the Net Present Value over a period of time and the vertical axis represents the probability of success. A Study has shown that more than 40 % of examined companies use this method, although only 5-8 % use it as the dominant tool. [1] If this picture is representative is however not evident. The article aims to provide a clear overview trough a description of the tool and its uses in practice and further raises the question if a tool as simplistic as the bubble chart can add real support to the decision making in Project Portfolio Management? A short comparison of the Bubble Chart to alternatives tools such as decision trees and scoring models are done

Contents |

Introduction to Portfolio Management

In order to obtain a profitable business in the 21th century, an organisation must excel in almost every way possible, from long-term strategic management to everyday planning and scheduling. Constant increasing global competition, ever faster changing technologies together with shorter life cycles make rivalry even harder today than ever. It is evident that if a company does not master project management and does not have the capability to execute projects swift and efficiently, will not be able to maintain a profitable business for long. It is not enough to execute the projects right, but you also have to execute the right projects at the right time. [2],

In order to manage all these parameter and always be one step ahead of competitors, few errors can be made. One way to make sure this happens is to make use of Portfolio Management. There are many aspects to Portfolio management and many definitions can be found in the literature. The benefits of Portfolio Management are also somewhat dependent on in which area of business it is applied [REF]. This article will be scoped around Project Portfolio Management (PPM). Cooper et al. (1999) argues that from a company perspective PPM is all about how to invest money in order to make more money [3], and such optimization is sometimes also referred to as Project Portfolio Optimization (PPO). Choosing the right projects and building the best portfolio is however much more complicated than selecting the most profitable projects, based on a simple cost-benefit analysis, as the most profitable projects do not necessarily create the most profitable business. PPM is about prioritizing some projects over others to balance the portfolio in regards to for example risk and/or resource allocation. This makes sure that the portfolio is in balance with the values and believes of the company as well as fits the current and future market.

One of the most important trades of PPM is the assistance to the decision makers in making the right strategic choices. It is of greatest importance that all projects, small as big, are aligned internally and do not counter work, but instead support the overall corporate strategy [REF].

Bubble Chart/Diagram

The Bubble Chart (BC) is one of the tools that can be used to supports the decision making in PPM.

The BC is a two-dimensional chart where bubbles/disks are plotted. Much similar to the regular xy-scatter-plot, but instead of dots data is plotted as bubbles/disks. In addition the size of bubble, the color can also vary giving the user up to four dimensions of data in an easily understandable two-dimensional chart. Cooper et al. (2001) reports that BCs are quite abundant with approximately 41 % of companies using this method in some form or another. Only 5-8 % of the companies however use it as their dominant method [1]. Due to the simplicity of the chart, many versions exist and are used extensively. However one version shows to be very dominant as almost 45 % of all BC-users use this design[1].

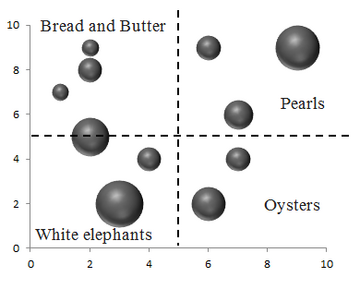

In this version the horizontal axis represents the total discounted value of the given project over a period of time (often 5-20 years) and is often referred to as NPV (Net Present Value). The vertical axis represents the probability of success, either as the probability in regards to the risk involved or the probability regarding the technical success (see the figure to the right). Lastly the size of the bubble represents cost, and thereby giving a very intuitive feeling of bubbles that are big will also represent big and demanding projects. It is important to notice that since the area of a circle grows with the quadrant of the radius, the cost should not be linear to the radius, but to the total size of the circle.

This chart can be divided into 4 quadrants: low-low, low-high, high-low and high-high. It is obvious that projects located within the high-high area are often desired and opposite projects that are located within the low-low quadrant are unwanted.

The more complicated situation arrives when projects prioritization needs to be done in either the low-high and high-low area. Trade-offs is necessary but what is more attractive? Is it a high chance of success with small rewards or the low chance of success with high rewards?...MÅSKE SVAR

It should be mentioned that this method shares some similarity to the Boston Matrix made in 1970 by Bruce D. Henderson which also works as a tool to assist in portfolio decisions [REF]. [4]...HVAD MERE

As the color of the bubbles also serves as a dimension of data, it is therefore possible to distinct certain projects from each other no matter where they are located in the matrix. This can be very important if it some kind of dependency between projects should be visualized. As stated, nearly 45 % of companies that uses Bubble Charts uses a dominant design. Below a table can be found that shows the result of a performed study[1].

| Chart Type | X-Axis | Y-Axis | % |

| Risk vs. Reward | NPV, Total benefit after years of launch | Probability of Succes | 44,4 |

| Newness | Technical newness | Market newness | 11,1 |

| Ease Vs. Attractiveness | Technical feasibility | Market attractiveness (growth, life cycle length etc.) | 11,1 |

| Strengths Vs. Attractiveness | Competitive position | Market attractiveness (growth, life cycle length etc.) | 11,1 |

| Cost Vs. timing | Cost to implement | Time to impact | 9,7 |

| Strategic Vs. Benefit | Strategic focus or fit | Business intent, NPV, attractiveness | 8,9 |

| Cost Vs. benefit | Cumulative Reward | Cumulative development costs | 5,6 |

The use of a Bubble Chart

The Bubble Chart is a simple tool that is meant to fairly quick and easy help managers get an overview and make fast decisions. However as this is a tool with up to 4 dimensions of data, it relies on some kind of source feeding it information. In other words, The BC cannot be made before the right upstream processes are in place. Very few or no studies can be found in the literature regarding the exact effect of the chart in use. It is therefore impossible to generalize and conclude generically whether the BC is worth implementing in a company. In order to get an overview a list of benefits and disadvantages is conducted. This list can be used to understand in which situation BCs would be easy to implement and use, and in which situation the implementation such a chart can be a costly and non-benefiting project.

Benefits

- Easy implementation

- Intuitive and no training needed

- Easy comparability between alike Projects

- Can be low maintenance

Disadvantages

- Hard to quantify data correctly

- Relies on upstream processes as feed

- No comparability between different types of projects

- Will often neglect not-financial driven projects

something

This means that the BC cannot work independently of other methods and tools. This means that besides the mentioned benefits all the upstream disadvantages will show in the BC.

- NPV Calculations is not always as straight forward as it can seem. One thing is to compare different products, but comparing projects can be a bit more complex. Some projects might be of a tangible nature, but other projects might have an unmeasurable NPV e.g. Projects regarding Communication flow, or knowledge sharing. This incomparability makes some projects almost impossible to plot in a BC. Even if plotted, the not impressive NPV will probably lead to a scenario where it will not be prioritised.

- For some reason it seems like the calculations of required resources are often being underestimated [REF]. This often connects to unexpected expenses because of delays or unforeseen problems. However underestimation could also be a conscience choice from the project proposer as the proposer might have a better chance getting his/her project as they will appear more attractive than they really are. As crazy as this sound this happens all the time [REF].

- Lastly the risk needs to be calculated in order to understand what the chance of success and failure is. Calculating the unknown risk is always a tricky process. For a big pharmaceutical company this could mean using a comprehensive multi-criterion qualitative analysis as feed for a stochastic Monte Carlo simulation [REF].

It is important to remember that BCs vary a lot and comprehensive upstream calculations are not necessarily needed if the chart is used in an early stage to get an easy overview.

If the axes on the BC are somewhat blurry, just called low-high, little preparation is needed. The risk analysis could be made as quick impact-probability matrix. A little portfolio board with experience would be able to make a BC rather fast based on gut-feeling from earlier projects.

The Bubble Chart is a nice tool to create overview, but is only as good as the information put into it.

How can it be used and what are the effect (case study)

Blau et al. (2004) examines the effect of a Bubble Chart compared to a computational decision support system in the pharmaceutical industry. Even though a setup of highly inter-dependent data was used the multi criteria genetic algorithm only yielded a result 28 % better than with the conventional bubble chart approach. Conclusion is that even though a more high-tech solution should be used, the bubble approach still gives an easy overview and serves its purpose in the early stages to assist managers in decision making regarding Portfolio management of any kind.

Alternatives

Many alternatives exist. In the former section it was clearly seen that a nonlinear programming yielded a solution 28 % better than the BC. Many different scoring techniques have also been developed. In comparison to the BC this method can take many aspects into consideration, and depending in the score can go from simple to comprehensive. The Decision tree approach has also been fairly used as it gives the user the ability to get a simple overview. However this method has received criticism due to the fact that the tree can quickly grow to a size where the simple overview is lost and the methods therefore uses one of it greatest benefits.

Conclusion

The BC should be continuously used as a tool to get clearer overview, but it is important to understand the limitations of this tool, and it is only as good as the surrounding supporting tools. This combined gives the user the opportunity to observe four-dimensional information in a very easy and simple two-dimensional chart. This feature is what makes the BC different from many other tools as it provides the user much data in a fast and visual manner.

References

- ↑ 1.0 1.1 1.2 1.3 Portfolio management for new product development: results of an industry practices study Volume 31, Issue 4, pages 361–380, October 2001

- ↑ Portfolio Management: Fundamental for New Product Success ???

- ↑ New Product Portfolio Management: Practices and Performance Volume 16, Issue 4, pages 333–351, July 1999

- ↑ https://www.bcgperspectives.com/content/classics/strategy_the_product_portfolio