Challenges and Execution of Innovation Portfolio Management

Innovation Portfolio Management (IPM) can be described as a dyanmic decision process, in which an array of active innovation projects is constantly updated and revised to deliver innovation/innovative products to market.[1] [2] High-tech companies are nowadays faced with a business environment which is characterized by an increasing dynamism and unpredictability. In order to stay competitive it is crucial to develop a suitable and flexible innovation strategy by means of possessing a broad setup of innovation-projects (innovation portfolio) and permanently adjusting this portfolio to the changing environment.[3] Hereby IPM can deliver support as an appropriate tool to implement strategy shifts into all innovation-project activities throughout the organization in a coordinated manner. Main difficulties arising in the IPM process are related to the risk profile of basic innovation ideas, the continued innovation portfolio prioritization and to the dynamic resource allocation.[3]

This article focuses on describing the general structure of an IPM system integrated as a connecting element between qualitative strategy definition and the project-based implementation. The IPM is seperated into a strategic and operational element (Strategic and Operational Portfolio Management).[4] Hereby there are also given tools enabling to tackle the mentioned main challenges of investment risk (staging investment), portfolio prioritization (BCG matrix / McKinsey Matrix / R&D Project Portfolio Matrix)[5] and resource allocation (RCCP and RCPSP scheduling / RCMPSP scheduling / Agile / Critical Chain). The article is concluded with a short future outlook and open research questions.

Contents |

Introduction to Innovation Portfolio Management (IPM)

This article is based on is the Project and Portfolio Management Process (PPM). PPM is defined as a formal approach that an organization can use to orchestrate, prioritize and benefit from projects. This approach examines the risk-reward of each project, the available funds, the likelihood of a project's duration, and the expected outcomes. A group of decision makers within an organization, led by a Project Management Office director, evaluates the returns, benefits and prioritization of each project to determine the best way to invest the organization’s capital and human resources.[6] This article expands this conception by relating the portfolio management procedure to the innovation management (R&D) within high-tech companies. Thus PPM gets extended into the more dynamic IPM, which is a more complex, multi-level process specifically aiming at the continuous innovation management consistent with the corporate strategy.

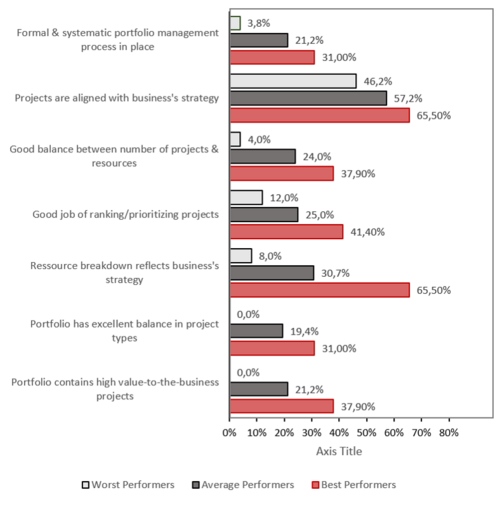

Traditionally innovation research was mainly focused on the appropriate management of single New Product Development (NPD) projects, thus focusing on innovation determinants at the project level.[2] In the face of today's globalization of markets, shorter life-cycles and increasing competition as well as complexity of technologies, high-tech firms have to hold a set of multiple NPD projects (innovation portfolio) to be flexible and reduce the risk to the lowest level possible. Hereby each project generates several changes on its own. This results in a set of cascading effects throughout the rest of the NPD projects, which have to be evaluated in relation to each other.[3] Additionally market changes and new business practices constrain firms to continuously reconsider the corporate competitive strategy, including their innovation portfolio. These two points create a permanently-changing decision context that cannot be conceived with a single-project perspective, but has to be managed with an overall IPM process. The desired outcome of an effective IPM is a stable pipeline of high-quality new products by linking the strategy formulation to the strategy implementation. This finally ensures long-term corporate growth and profitability.[2] In Figure x the best practices in portfolio management that have been observed in several studies and the impact of each practice are displayed, illustrating the positive impact of IPM on organizational performance. Despite the existence of this obvious interrelationship between corporate sustainable profitability and permanent innovation, many companies possess relatively conservative innovation strategies, rather focusing on maintaining and improving existing product lines.[2] The main reason for this mindset are the obstacles resulting from the extreme complexity of a well-implemented IPM process within an organization. In the following there is given a macro-overview of an IPM system to give the reader a good, general idea of the main structure and approach of an IPM system.

Challenges

In total there exist five main criteria characterizing effective IPM, clarifying why it is a highly complex decision-making function within a firm:

- IPM is dealing with and dependent on future events and possible opportunities. The quality of the necessary information for project selection and prioritization decisions is in best case uncertain and in worst case unreliable.

- The environment for decision making is highly dynamic. Expectations and status of all projects within the innovation portfolio is continuously changing as markets shift and new information come up.

- All projects within the innovation portfolio are characterized by different levels of completion and compete for available resources. Consequently a comparison among projects has to be conducted, based on information differing in quantity and quality.

- Available resources that can be allocated among the active projects are limited. Any prioritization of one project comes along with a deduction of resources for another project. Additionally resource transfers in real-world are not seamless as indicated by planning tools.

- Data availability over all the information gathered within the portfolio is critical. This further complicates an efficient and effective IPM process.[7]

Strategic and Operational Innovation Portfolio Management (SIPM / OIPM)

- IPM requires both strategic an tactical approaches,

References

- ↑ R.C. Ohr, K. McFarthing, Managing Innovation Portfolios - Strategic Portfolio Management, (InnovationManagement.se, 2013), http://www.innovationmanagement.se/2013/10/11/managing-innovation-portfolios-operational-portfolio-management/.

- ↑ 2.0 2.1 2.2 2.3 A. Meifort, Innovation Portfolio Management: A Synthesis and Research Agenda, Creativity and Innovation Management, 25 (2016): 251-296.

- ↑ 3.0 3.1 3.2 R. Abrantes, J. Figueiredo, Resource management process framework for dynamic NPD portfolios, International Journal of Project Management, 33 (2015): 1274-1288.

- ↑ R.C. Ohr, K. McFarthing, Managing Innovation Portfolios - Operational Portfolio Management, (InnovationManagement.se, 2013), http://www.innovationmanagement.se/2013/09/16/managing-innovation-portfolios-strategic-portfolio-management/.

- ↑ J.H. Mikkola, Portfolio management of R&D projects: implications for innovation management, Technovation, 21 (2001): 423-435.

- ↑ Definition - Project- and Portfolio Management, (TechTarget, 2015), http://searchcio.techtarget.com/definition/PPM-project-and-portfolio-management.

- ↑ S.J. Edgett, Portfolio management for product innovation, The PDMA handbook of new product development, (2013): 154-166.