Decision tree

Developed by Frederik Lybek Lind

Contents |

Abstract

When the risks related to a project, programme or portfolio have been identified and the respective impacts and probabilities have been investigated and determined, the potential risk responses within the approaches of insuring against, mitigating, avoiding, accepting and externalizing the risks in question will result in different possible outcomes with different probabilities and consequences. For projects, programmes and portfolios associated with many risks with proportionally many potential risk responses it is challenging to treat all risks most beneficially for the project.

One tool to help providing factual justification for the treatment of each risk and to establish an overview is the decision tree.

Every risk is drawn as a branch on a tree with the possible risk responses as sub-branches and the possible outcomes of each response as the final offshoots.

Exploiting the decision tree fully will likely lead to decreased costs, increased earnings, reduction in time schedule and better investment in future efficiency.

This wiki article investigates how the decision tree works as a tool in risk management, what the benefits are and what barriers are related to this tool.

Frederik Lind, s133570

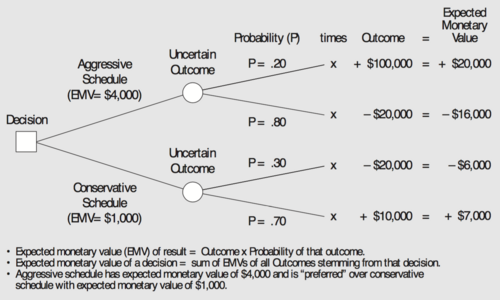

The big idea

Where risks in small projects with few possible actions available often can be treated individually, risk management in principal is a highly complex task with much to gain from an effective structure and a balanced picture. Decision trees are tools that assist decision makers in choosing between different possible actions. The simple version of a decision tree consists of a subject to which the decision maker has several possible courses of action. Every action is associated with possible outcomes and respective probabilities. Furthermore most actions are associated with direct costs, and deciding between the actions can be organized by determining the Expected Monetary Value (EMV) of every potential outcome from where the expected decision outcome can determined (Figure 4). The decision with the highest expected decision outcome will be most beneficial for the project and should be chosen as course of action.

Decision trees provide an effective decision making tool that provides framework to analyzing the possible consequences of actions, clearly exposes the risk for further possible response identification and quantifies values of outcomes and the respective probabilities.[2][3]

Initial Steps to Decision Making

Risk Identification

The identification of risks is a process that must begin early in the project during the planning phase and it must be done thoroughly to mitigate potential delays, change of scope, budget overruns and quality loss.[6]

While the definition of the term risk involves only the possibility of experiencing unfavorable events, risk identification within the project context however both includes the opportunities (positive outcomes) and the threats (negative outcomes).[4]

It is practically impossible to identify all risks before they occur, however it is possible to map an extensive majority through a combination of a number of identification methods.

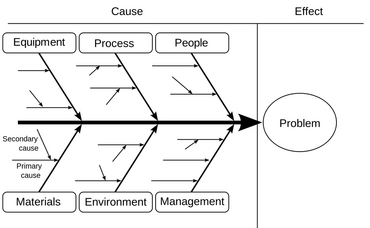

A common first step to identifying risks is to organize the possible risks in branches of causes, Figure 1.

A list of risks can be gathered through brainstorming, interviews and checklist analysis in collaboration with the project team, experts and stakeholders by focusing on what possible events and their sources within each branch that will affect changes in scope, cost, time and quality of the outcome of the project.[5]

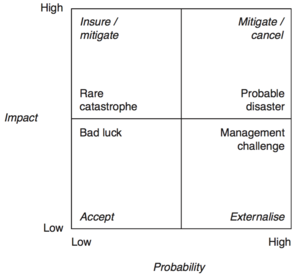

Risk Assessment

The next step is to assess the potential risks where the goal is to define the consequence and likelihood ranges for each risk source in collaboration with the stakeholders. A tool to visually map the respective probabilities and impacts for each risk and to get an immediate overview of desired response approach is to apply the Probability/Impact Matrix, Figure 2.[3]

The impact of a threat or opportunity occurring will always be associated with a direct or an indirect increase or decrease in cost for the project. The cost related to each consequence must be estimated and registered.

When the probabilities and levels of impact have been evaluated, the planning team should be divided into different field-specific sub-groups to which the respective related risks should be assigned for possible response investigation.[8]

Risk Response Analysis

The assigned sub-groups will then identify any possible actions to prevent risks and to enhance opportunities.[8]

Different response options are often available for each risk source, and the angle of attack to construct the final list of approaches for all risks can be inspired by the Probability/Impact Matrix, Figure 2. The response approach consists generally of four pillars: accept, externalise, mitigate and insurance against the risk. A fifth immediate option is to delay the response decision until more information is available.[7]

- Accept the risk. If the risk is accepted a response to the risk event occurring should be planned.

- Externalise the risk. When contracting out the source of the risk down the supply chain of the project structure, the sub-contractor in charge must be in a better position to handle the risk. The secondary risk associated with this response is that the sub-contractor will fail the commitments and either go bankrupt, hand the risk back to the principal or withdraw from the project.

- Mitigate the risk. This response underlines the necessity to risk manage very early in the project and is the main reason behind risk management. By mitigating or avoiding risks, the probabilities of risks are minimized leading to reduced delays, change orders and budget overruns. Mitigating and avoiding a threat can be done in a various number of ways and determining the possibilities to mitigate/avoid the risks or enhance/create opportunities is the main key to benefit from the decision tree.

- Insure against the risk. This response is not always possible but for uncontrollable rare catastrophes insurance is usually possible, such as fire.

- Delay the response. By delaying the response decision until more information is available, it is sometimes possible to make more efficient and tailored risk responses. This approach is often used for unknown risks where a frame for handling the risk event is the only option.

[7]

To fully exploit the opportunities related to using the decision tree, the different response angles for all estimated risks should be investigated and listed. Furthermore every preventive or enhancing action or lack hereof is associated with a direct cost which is important to determine to make a thorough scientific base for the decision tree.

Applying the Decision Tree

A planning team has initialized a risk analysis for the construction of a minor power plant. Through brainstorming, interviews and checklist analyses in collaboration with the project team, experts and stakeholders a wide list of potential risks is identified.

The list of risks is then assessed with the likelihood ranges and consequences estimated in terms of probabilities and costs respectively for each corresponding risk.

The planning team is then divided into field specific sub-groups to perform a risk response analysis, thus investigating the possible measures to mitigate, avoid, accept, externalize and insure every risk. Every potential risk response is affiliated with a direct cost and a probability of the response resulting in the risk event being avoided, of which all must be estimated and listed.

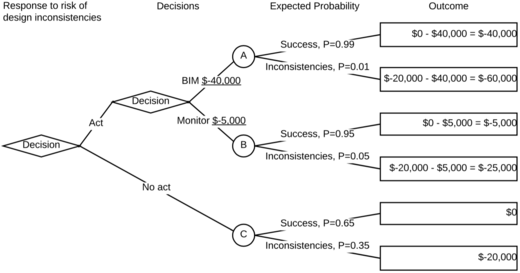

Decision tree for one risk

The firm has constructed similar projects in the past and from experience the planning team knows that the most substantial risk is inconsistencies between structural and installation design plans. The cost of inconsistencies occurring is estimated to $20,000 and with no inconsistencies expected in the initial budget planning, the two possible outcomes are listed:

| Consequence of risk | Outcome |

|---|---|

No inconsistencies ( ) ) |

$0 |

Inconsistencies ( ) ) |

$-20,000 |

Besides the possibility to accept the risk, the field specific sub-group identifies two potential responses to avoid this risk from happening. The three options are listed:

- Replace traditional processes and methods with BIM for easy clash detection

- Monitor the levels of consistencies more thoroughly through the development process

- Do nothing

The firm has never used digital solutions in construction planning before, and the planning team knows that replacing the traditional processes of making physical design drawings with BIM and digitally created models requires a larger investment than the potential cost of inconsistencies occurring. The planning team inquires with the risk manager whether they should discard BIM as a potential response but the manager tells them to keep investigating every possible measure.

The planning team determines the direct costs for each potential response:

| Action | Cost ( ) )

| |

|---|---|---|

| A: | BIM | $-40,000 |

| B: | Monitor | $-5,000 |

| C: | No act | $0 |

Statistics from earlier power plant constructions indicate that the probability of inconsistencies occurring is 0.35 (35%) when no risk response is initiated. By investigating the levels of success by implementing BIM in other construction projects in regard to clash detection a probability of success is estimated to 0.99. At the same time by applying more man hours to monitor the consistencies of the model designs throughout the planning process a probability of experiencing no inconsistencies is estimated to 0.95:

| Action | Probabilities of outcome

| |

|---|---|---|

Success ( ) ) |

Inconsistencies ( ) )

| |

BIM BIM |

0.99 | 0.01 |

Monitor Monitor |

0.95 | 0.05 |

No act No act |

0.65 | 0.35 |

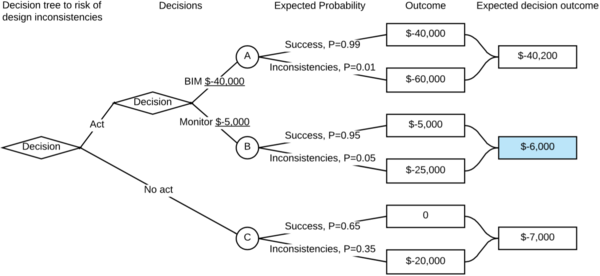

The planning team then establishes a decision tree with the potential actions leading to the estimated possible outcomes with respective probabilities in accordance with Figure 5 and Figure 6. The monetary consequence of each potential outcome is determined and noted on the decision tree.

When the monetary outcomes have been determined, the planning team must evaluate what risk responses are realistic. If the planning team decides to respond to the risk of inconsistencies by implementing BIM, they must assure that the potential outcome of experiencing inconsistencies despite the use of BIM will not result in the firm going bankrupt. In this case the firm has a solid economy.

To determine which risk response is most cost/beneficial in terms of probability and costs, the expected monetary value of each response must be calculated.

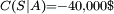

The expected monetary value is determined by summating the multiplications of the probabilities of success and failure with the respective monetary outcomes.

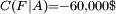

To calculate the expected monetary value of responding with BIM  , the success

, the success  and failure

and failure  probabilities

probabilities  and outcome costs

and outcome costs  are noted:

are noted:

,

,  ,

,  ,

,  .

.

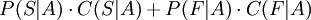

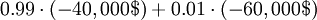

The expected monetary outcome of the BIM response is then calculated:

![E[C|A]](/images/math/6/5/1/6514f404254ff6e26d3e722c1fb7f372.png)

|

|

|

|

| |

|

|

The expected monetary outcome is determined similarly for responses  : Monitor and

: Monitor and  : No act and is written on the decision tree:

: No act and is written on the decision tree:

Without further analyses the risk response with the highest expected monetary outcome will be expected to provide the most beneficial outcome. In this case the planning team decides to treat the risk of experiencing inconsistencies by  : Monitoring.

: Monitoring.

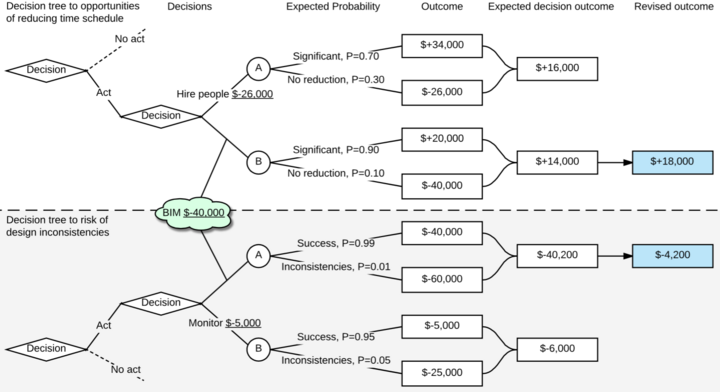

On further investigation the planning team assesses the opportunity to reduce the time schedule. The owner of the power plant has expressed a wish that action is taken to reduce the planned time schedule, and the planning team has estimated that the total duration of the critical path depends greatly on the design phase.

To simplify the example, a significant reduction in time schedule will result in monetary savings of $60,000.

| Consequence of opportunity | Outcome |

|---|---|

No reduction ( ) ) |

$0 |

Significant reduction ( ) ) |

$+60,000 |

The planning team has identified two responses to increase this opportunity; 1: hiring more people to assist during the design phase at a cost of $26,000 and 2: implementing BIM at a cost of $40,000.

| Action | Cost ( ) )

| |

|---|---|---|

| A: | Hire people | $-26,000 |

| B: | BIM | $-40,000 |

Hiring more people to a cost of $26,000 is expected to increase the probability of significant reduction by 0.7.

Measuring the increase of productivity by using BIM however depends on a wide number of factors and is difficult to estimate [9] but the planning team estimates that implementing BIM will result in a significant reduction of time schedule with a probability of 0.9.

| Action | Probabilities of outcome

| |

|---|---|---|

Significant reduction ( ) ) |

No reduction ( ) )

| |

Monitor Monitor |

0.70 | 0.30 |

BIM BIM |

0.90 | 0.10 |

The planning team recognizes BIM as a potential response to avoiding the risk of inconsistencies in the structural and installation design plans, and they decide to combine the decision trees, Figure 8.

With BIM as a tool to both mitigate risk of design inconsistencies and increase productivity, the decision whether to implement BIM as response to either risk must be revised. Replacing traditional processes with a digital platform, BIM, only has to be done once, and by responding to one risk with BIM, after applying it as a tool to another, will not result in increased costs.

If the planning team did not join the two decision trees around the action of implementing BIM, they would likely have chosen to monitor the design plans physically to mitigate design inconsistencies and to hire more people to reduce the time schedule.

Even without taking future increased productivity and inconsistency mitigating into account, the planning team decides to invest in BIM for the minor power plant.

Limitations and Barriers

Even though the decision tree provides a new perspective to potential risks and risk responses and will likely expand the identified lists of each, it is difficult to fully exploit the true potential of the decision tree concept without thorough traditional risk identification, risk assessment and risk response analyses.

Furthermore there exists risks that can not be used in the decision tree because they would cause too severe consequences and will have to be avoided or externalized as a certain risk occurring could result in bankruptcy for the firm.

The estimated consequences and probabilities of outcomes happening from risk actions can only be estimated to a certain degree of factuality. The decision tree does not provide tools for enhancement of these parameters.

Even with a thorough risk management prior to the project initialization, it is possible that a project manager is will diminish his effort to provide continuous risk management throughout the different project phases.

Identifying common actions to different risks on a decision tree can be difficult for larger projects with many risks. Sorting actions on a digital sheet will likely provide a more efficient identification of equivalent actions. A combination of the decision tree and a digital sheet with possible actions for the different risks diminishes this risk.

Annotated Bibliography

- Faber, Michael Havbro (2010) Statistics and Probability Theory - In Pursuit of Engineering Decision Support, Publisher: Springer International Publishing AG.

With the industry, government and society grow more and more informed the discipline to assess and treat this expanding level of information grows more complex as well. This increases the demand for guidelines to use mathematics, statistics and probability theory in terms of safety, risk, reliability and quality based statistics and probability theory. - Decision Trees - Choosing by Projecting "Expected Outcomes", https://www.mindtools.com/dectree.html [retrieved Oct 2nd 2017], Publisher: MindTools - Essential skills for an excellent Career.

Decision trees are effective tools to investigate and determine the best action to a problem based on precisely estimated consequences and probabilities of each potential outcome of every action. Through establishing the decision tree more actions may appear and the goal is to draw as many outcomes as possible. - Geraldi, Joana and Thuesen, Christian and Stingl, Verena and Oehmen, Josef (2017) How to DO Projects? A Nordic Flavour to Managing Projects: DS-handbook, Version 1.0, Publisher: Dansk Standard

Many books on project management provide 'recipes' on how to manage projects without keeping a realistic and individual approach. This book provides further explanation for readers to reflect on in order to be able to practice project management. Based on the international standard for project management ISO 21500, How to DO Projects? provides a holistic and practical approach to project management. - Duncan, William R. (1996). A Guide to the Project Management Body of Knowledge, Project Management Institue: PMI Standards Committee.

The purpose of A Guide to the Project Management Body of Knowledge is to identify and describe the knowledge and practices that are applicable to most projects as well as to provide a lexicon for project management. - Geraldi, Joana and Thuesen, Christian and Stingl, Verena and Oehmen, Josef (2017) Risk identification - basic methods, http://www.doing-projects.org/Conceptbox/Risk-identification-basic-methods [retrieved Sep 20th 2017], Publisher: Doing-Projects.org.

Provides a brief list of the basic methods to identify risks. - Jutte, Bart (2016) 10 GOLDEN RULES OF PROJECT RISK MANAGEMENT, https://www.projectsmart.co.uk/10-golden-rules-of-project-risk-management.php [retrieved Sep 20th 2017], Publisher: Public Smart.

10 GOLDEN RULES OF PROJECT RISK MANAGEMENT gives the reader an insight to how risk management is implemented successfully in a project through 10 'rules'. - Winch, Graham M. (2010) Managing Construction Projects - An Information Processing Approach, 2nd Edition, Publisher: John Wiley & Sons, Ltd.

This book thoroughly covers the topic of management of construction projects with focus on stakeholders, mission, forming and motivating project coalition, managing supply chain, scope creep, managing uncertainty and risk, managing schedule and budget. - Wrona, Vicki (2015) YOUR RISK MANAGEMENT PROCESS: A PRACTICAL AND EFFECTIVE APPROACH, https://www.projectsmart.co.uk/your-risk-management-process-a-practical-and-effective-approach.php [retrieved Sep 22nd 2017], Publisher: Public Smart.

While risk management can decrease problems related to a project with 80 to 90 percent, risk management is not necessarily complicated or time consuming. The article provides a simple approach to risk management of seven steps to for the reader to follow. - Lambrecht, Jan Fuglsig and Vestergaard, Flemming and Karlshøj, Jan and Hauch, Peter and Mouritsen, Jan (2016) Measuring the effects of using ICT/BIM in construction projects. Proceeding at CIB W78 conference, Brisbane, Australia.

Based on findings from a research project from 2009-2013 with the aim to measure economic effects of using BIM in construction projects. Measuring the effects of BIM is very complex although the use of BIM has become routine in the construction industry.

References

- ↑ Faber, Michael Havbro (2010) Statistics and Probability Theory - In Pursuit of Engineering Decision Support, Publisher: Springer International Publishing AG.

- ↑ Decision Trees - Choosing by Projecting "Expected Outcomes", https://www.mindtools.com/dectree.html [retrieved Oct 2nd 2017], Publisher: MindTools - Essential skills for an excellent Career.

- ↑ 3.0 3.1 Geraldi, Joana and Thuesen, Christian and Stingl, Verena and Oehmen, Josef (2017) How to DO Projects? A Nordic Flavour to Managing Projects: DS-handbook, Version 1.0, Publisher: Dansk Standard

- ↑ 4.0 4.1 Duncan, William R. (1996). A Guide to the Project Management Body of Knowledge, Project Management Institue: PMI Standards Committee.

- ↑ 5.0 5.1 Geraldi, Joana and Thuesen, Christian and Stingl, Verena and Oehmen, Josef (2017) Risk identification - basic methods, http://www.doing-projects.org/Conceptbox/Risk-identification-basic-methods [retrieved Sep 20th 2017], Publisher: Doing-Projects.org.

- ↑ Jutte, Bart (2016) 10 GOLDEN RULES OF PROJECT RISK MANAGEMENT, https://www.projectsmart.co.uk/10-golden-rules-of-project-risk-management.php [retrieved Sep 20th 2017], Publisher: Public Smart.

- ↑ 7.0 7.1 7.2 Winch, Graham M. (2010) Managing Construction Projects - An Information Processing Approach, 2nd Edition, Publisher: John Wiley & Sons, Ltd.

- ↑ 8.0 8.1 Wrona, Vicki (2015) YOUR RISK MANAGEMENT PROCESS: A PRACTICAL AND EFFECTIVE APPROACH, https://www.projectsmart.co.uk/your-risk-management-process-a-practical-and-effective-approach.php [retrieved Sep 22nd 2017], Publisher: Public Smart.

- ↑ Lambrecht, Jan Fuglsig and Vestergaard, Flemming and Karlshøj, Jan and Hauch, Peter and Mouritsen, Jan (2016) Measuring the effects of using ICT/BIM in construction projects. Proceeding at CIB W78 conference, Brisbane, Australia.