Financial appraisal in construction

Developed by Apostolos Bougas

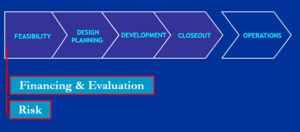

Financial appraisal in construction is one of the most important and earliest stages of the construction project planning process. The purpose of the financial appraisal is to determine whether the project is worthwhile, comparing its costs with its expected benefits. It stands as a key element for deciding whether or not to proceed with a construction project and any project in general. Also, it stands as a key element for choosing between alternative construction projects. Financial appraisal addresses not only the adequacy of funds, but also the financial vialibity of the project, estimating in the end if and when the project returns a profit or not. This article analyzes, at first, the elements, construction cost, and overall costs and benefits of a construction project that the reader has to be familiarized with, in order to understand the costs that need to be considered for a financial appraisal of a construction project. Then, some methods of financial appraisal are presented, highlighting the Net present value, which is one the most common criteria for project decision and selection. Finally, the application of these methods and the considerations about the financial appraisal of construction are mentioned in this article, referring also to strategic misrepresentation and optimism bias, challenges which lead to false financial appraisal and have to be overcome.

Contents |

Introduction

Background

Construction Costs[1]

The construction costs consist of the initial investment that the client-investor has to pay to the contractor for the building or structure. The construction costs need to be estimated as precisely as possible in the early design stage of the project, so that the overall financial appraisal of the construction can be done. The larger amount of the construction costs consists of the purchase of land and the actual construction works of the new facilities. As the design stage is developing through time, the construction costs can be estimated more accurately. However, the available budget should not overrun from the early estimation, as this could lead to a negative overall return of the project and sometimes could also lead in cancelling it. The estimation for the construction costs needs to include the following major cost elements:

- Time-as an element for labor and construction activities

- Materials

- Capital equipment as machinery

- Indirect expenses as transportation, training

- Overheads

- Contingency cost[2]

- VAT[2]

Overall costs and benefits of construction projects[1]

The overall cost and benefits of the construction project need to be evaluated and calculated for the financial appraisal of it. This appraisal include the cost from the inception of the project to the lifecycle cost and income. The precise identification will confirm if the project will pay back during its lifetime against the initial client investment. Costs and benefits that have to be taken into consideration during the justification of the investment of the project are:

- Purchase of land

- Construction works

- Professional fees

- Marketing cost - Advertisement of the investment

- Income from renting - sale or exploitation of the construction

- Cost of finance - interest rate fluctuations due to inflation

- Environmental cost

- Contingency cost [2]

Financial appraisal

The purpose of the financial appraisal is the justification that the return will exceed the estimated construction cost of the project. Through this procedure the investment capital or the resources required for the construction of the project can be estimated, after assumptions about the utility and the benefits of the asset have been determined. In the construction industry, the problem of deciding the amount of investment and the allocation of resources to the project is actually the capital budgeting problem. The benefits from the project are estimated, and then the client- investor can estimate the budget which is necessary for the completion of the project and decide if he would proceed with the construction of the project or abandon it. [3] The financial appraisal, which acts as abovementioned, as a decision-making tool for the client-investor, depends, mostly, on:

- The size of the potential construction project

- The time period over which the cost and benefits are going to be calculated

In this article the following methods for the financial appraisal of projects will be presented

- Payback period

- Net present value

- Internal Rate of Return

Methods

This return can be estimated and presented through some principles of capital budgeting:

Payback analysis – payback period

The payback period is the exact length of time needed for a company /client to have a positive return of its initial investment as it is calculated by the cash flows. The income that will be generated from a construction project is compared with the overall cost of the project (construction cost, maintenance cost e.t.c). For example, an initial investment of 50 million DKK will be paid back in 10 years if the cash inflows are 5 million DKK each year. The payback analysis is the least precise of the capital budgeting techniques, because the time value of money is not taken into consideration. As a result, payback analysis has a potential for inaccurate results, when it is used for projects with longer investments, as inflation during that time may raise significantly [4]. Furthermore, it ignores the lifecycle costs of the project, so it does not stand as a good financial model for construction projects. [3]

Net Present Value

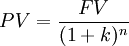

Discounting

The value of money today is greater than the value of money at a future point in time. [5] Discounting are the techniques applied so that this time value of money can be calculated.[3]. The basis of discounting is the comparison between the value of the return of an investment and the value of the same amount of money deposited in a bank account for the same period of time. Discounting considers the opportunity cost of the project.[2]

Discounted cash flow

Cash flows in a construction project at future points in time need to discount to their present value so that it can be determined whether or not a construction project is worthwhile for investing. More specifically, the outflow of cash which is necessary for the investment of the construction project, i.e the project cost is compared with the discounted inflow of cash, i.e benefits arising from the exploitation of the project. This concept is referred as discounted cash flow.

The future values discounted to present values according to the mathematical formula

where,

is the Present Value

is the Present Value

is the Future value of a cash inflow or outflow in t years hence

is the Future value of a cash inflow or outflow in t years hence

is the discount rate

is the discount rate

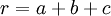

Discount rate

The discount rate values can be calculated with many methods. The project managers have usually discount rate for their organizational policy, so that the project can be evaluated in financial terms. Three factors are essential for calculating the discount rate value [6]

: Interest rate: It is the rate charged for the use of capital and it is arranged between the borrower and the lender.

: Interest rate: It is the rate charged for the use of capital and it is arranged between the borrower and the lender.

: Inflation rate: It is the rate due to inflation, raising of prices. Inflation rate has to be taken into consideration, so that there is no reduction in the purchasing power.

: Inflation rate: It is the rate due to inflation, raising of prices. Inflation rate has to be taken into consideration, so that there is no reduction in the purchasing power.

: Minimum Attractive Rate of Return (MARR): This rate is a factor corresponding to the risks of the project, as the investment amount of money can never be repaid.

: Minimum Attractive Rate of Return (MARR): This rate is a factor corresponding to the risks of the project, as the investment amount of money can never be repaid.

The discount rate is calculated as:

.

.

This effect that the discount rate is larger than the interest rate, more specifically sometimes in construction companies can reach almost 20% .[5]

Net Present Value Calculation

The Net Present Value Is a capital budgeting technique that calculates the discounted cash flows against the investment. In mathematical terms, The minimum criterion for investing in a project is that the NPV is greater or equal than zero at a given discount rate and a specific time period in the future. [5] The effect that the discount rate can be in some cases, according to the selection of the construction consultant manager and the project accountant, almost 20%, makes the compliance with the minimum criterion of having a NPV equal to zero a very difficult and demanding task. In mathematical terms

![NPV=\sum_{t=1}^{n}\Big[\frac{FV_t}{(1+k)^t} \Big] - II](/images/math/8/1/e/81e20824db25d6feb43c339f19a979ac.png)

where,

is the future value of the cash inflows in t year hence

is the future value of the cash inflows in t year hence

is the discount rate

is the discount rate

is the initial investment

is the initial investment

According to the Net Present Value method, investments should be made in projects with a positive NPV, so that the company profit or the investor's wealth could increase.<red name="Invest"></ref>

Example

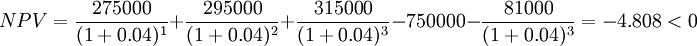

A highway department is considering constructing a bridge to cut travel time during the three years it will take to build a permanent bridge. The temporary bridge can be manufactured in a few weeks at a cost of DKK 750000. At the end of three years, it would be removed. The cost of removing this bridge would be DKK 81000. Based on estimated time savings and wage rates, fuel savings, and reductions in risks of accidents, the department analysts predict that the benefits would be DKK 275000 during the first year, DKK 295000 during the second year, and DKK 315000 during the third year. Departmental regulations require use of a real discount rate of 4%. All the costs and the benefits are in real DKK.

Solution

The present value of the costs is calculated. This includes the construction cost of the temporary bridge, which occurs at the beginning of year 1, and the net cost of decommissioning the bridge at the end of year 3. Also the present value of benefits is calculated. For the decision of the construction of the bridge, the Net Present Value (NPV) needs to be calculated. If NPV is greater or equal to zero, then the construction of the bridge yields a profit on return, so it should be put on temporarily.

So the bridge should not be constructed.

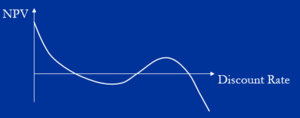

Internal rate of return

The internal rate of return (IRR) is more complex capital budgeting technique and more difficult to calculate than Net Present Value(NPV). The internal rate of return is the discount rate for which NPV is equal to zero. In other words, it is the discount rate for which the cash inflows are equal to the initial investment. In mathematical terms,

![\sum_{t=1}^{n}\Big[\frac{FV_t}{(1+IRR)^t} \Big] - II = 0](/images/math/d/a/f/daf360e18f079c524ec1f50c422b7693.png)

where,

is the future value of the cash inflows in t year hence

is the future value of the cash inflows in t year hence

is the Internal Rate of Return

is the Internal Rate of Return

is the initial investment

is the initial investment

The calculation of IRR is done mathematically through a number of iterations, based on the trial-and-error solution. A variety of discount rates are used and gradually leading to the point, value of IRR, for which NPV is equal to zero.

NPV vs IRR

For most projects, NPV and IRR provide the same decision or ranking between different projects. However, there are differences that exist in the assumptions regarding these methods that can cause projects to be ranked differently. [6]

- IRR represents a rate of the profit-not a size of the profit

- IRR calculation does not require to discount rate assumption or calculation

- IRR cannot cope with the rapid changes of the discount rate over time [3]

- IRR may not be unique as the benefit and cost increases.

If two projects have the same IRR, the NPV of the projects is compared. The project with the higher NPV is chosen. The best way for deciding or comparing different projects is the use both of NPV and IRR together, in order to calculate both the size of and the rate of the return, respectively. However, NPV is the only criterion that ensures wealth maximization. [6]

Application

In the past years, only skilled accountants could have made a financial appraisal of a construction project. Although, still now, applying this method has some difficulties, regarding considering all the cost and benefits, it is now available not only into most financial appraisal systems, but also in many spreadsheets such as Lotus and Excel, with functions, so that nearly everyone can perform a financial analysis. [3]. This fact provides the possibility for client, investors and consultant companies to perform an analysis informally. Project and construction managers can build financial models that can be interpreted and evaluated by non-experts. This is a key towards the innovation of construction and project management processes, as consultants can easily and quickly evaluate the worth of their ideas in financial terms.[3]

Considerations

NPV calculation

The calculation of the NPV requires a very accurate estimation of the cash inflows and outflows, especially a precise calculation of the potential benefits in terms of money that they will be raised from the project completion. Especially with the construction projects, this is a very difficult task, as the NPV calculation is a quantitative method [6]. It is not possible to value all the benefits in terms of money. For instance, in many cases, the client/investor is in a not-for-profit sector as the government.

Market prices

The market prices, which act as a guide for the calculations of the costs and benefits of the project, may not be appropriate due to inflation and market failure.[2] Return on a construction project is not something which should always be taken as granted.[3]. Also, some elements of the costs and benefits of the construction projects are not quantitative, so there is a great difficulty to be valued. Damage to the environment has to be considered in the cost of the project, which on the benefit side, increased safety of the users or other macroeconomical impacts, such as the regeneration of a whole city area due to construction projects have to be considered. For this reason, shadow prices, which represent the willingness to pay for obtaining one more unit of an asset have established, such as value of a fatality. These values have to be assigned, if full cost-benefit analysis needs to be carried out in a project. [2]

Uncertainty

Both the cost and the benefits of an investment construction project are uncertain. As it is concerns the benefits of a project: [2]

- There is an uncertainty on the operational cost of the project.

- The construction project – facility has to operate as planned so that the estimated benefits can be acquired.

- A late project delivery changes the income stream. This may eventually lead to missing of market opportunities, resulting eventually of minimizing the potential benefits of the project.

Uncertainty is also taken into account for the cost of the project[2]

- The cost of the project – investment may be higher than expected (budget overrun).

- Late delivery of a facility (building, railway, road e.t.c. ) results in more operational costs in the existing facility (for instance continuation of maintenance of an old road).

Challenges

Optimism Bias

Research has shown that 'there is a demonstrated systematic tendency for project appraisers to be overly optimistic' [2]. People tend to judge future events in a more positive and optimistic way than it is instructed by past and actual experience. Psychological reasons are the route for this behavior. In addition, when the project managers make an estimation about the financial aspect of a construction project, overestimate benefits and underestimate costs. Optimism bias is not intentional, actually, it is a self-deception. [7]

Strategic misrepresentation of financial appraisal

Research has shown that decision-makers project managers act in bad faith when estimating financial project appraisals. Strategic misrepresentation is closely related with the NPV calculation. One of the main uses of NPV calculation is to provide a tool for choosing the most profitable project. As the NPV calculation projects cost and benefits for the project in the future, some benefits and costs are judgements not facts. Also, some benefits can be interpreted in real prices, but instead they are based in shadow pricing techniques. Inevitably, it is clear that NPV calculation is subjective, a fact that managers who want to promote certain construction projects tend to take advantage of it. Research has shown also that strategic misrepresentation is happening not only in private projects, but also in the public sector, as construction projects are interpreted as an action for collecting votes. Strategic misrepresentation can be seen to political and organizational pressures, for instance, competition for obtaining funds or fight for a governmental position, and to lack of incentive alignment. Consequently, strategic misrepresentation are one of the major factors for budget overruns and inaccurate financial appraisals in the construction industry.[2].

References

- ↑ 1.0 1.1 The Construction Learning Resources: Financial Appraisal, Procurement and Payments [URL:http://www.constructionsite-resources.org/page_12.html]Retrieved on 22 July 2017

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 2.6 2.7 2.8 2.9 Winch, G. M. (2010), "Managing Construction projects". Second edition

- ↑ 3.0 3.1 3.2 3.3 3.4 3.5 3.6 3. Maylor, H. (2010), "Project Management". Fourth Edition

- ↑ Investopedia:Net Present Value[URL:http://www.investopedia.com/terms/n/npv.asp]Retrieved on 22J June 2017

- ↑ 5.0 5.1 5.2 Kerzner, H., Ph.D., (2006), ""Project Management: A systems approach to planning, scheduling and controlling"". Ninth edition

- ↑ 6.0 6.1 6.2 6.3 Lee, S. (2007), "Project Management 2007: Project Financing & Evaluation" Department of Civil and Environmental Engineering, Massachusetts Institute of Technology [URL:http://web.mit.edu/course/1/1.040/www/docs_lectures/Lecture_2_Project_Financing_&_Evaluation.ppt.].Retrieved on 21 June 2017

- ↑ Flyvbjerg, B. (2008) "Curbing Optimism Bias and Strategic Misrepresentation in Planning": Reference Class Forecasting in Practice, European Planning Studies Vol. 16, No. 1

Annotated bibliography

- 1. Winch, G. M. (2010), "Managing Construction projects". Second edition

- Summary: The book presents a holistic approach of construction management. The basic principles of construction project management are presented along with different tools and techniques that aims to enhance construction performance and provide innovative techniques. The use of information and communication technologies is also a point of interest in the book.

- 2. Kerzner, H., Ph.D., (2006), "Project Management: A systems approach to planning, scheduling and controlling". Ninth edition

- Summary: The book illustrates the basic principles of project management. The book is targeting for enhancing the project skills of not only students, but also executives, pointing out that project management can be related to every profession apart from engineeering, including information systems and business.

- 3. Maylor, H. (2010), "Project Management". Fourth Edition

- Summary: This book cover all the topics of project management, focusing in the theory, as well as in the application and usage of the ideas discussed in it. The book points great emphasis into the 4D-model of the project.

- 4. Flyvbjerg, B. (2008) "Curbing Optimism Bias and Strategic Misrepresentation in Planning": Reference Class Forecasting in Practice, European Planning Studies Vol. 16, No. 1

- Summary: This paper presents the method and illustrates the first instance of reference class forecasting. The paper targets in the inaccuracy of the financial appraisal in planning in construction, explains them in terms of optimism bias and strategic representation and present a method of eliminating this inaccuracy.