Financial appraisal of project proposals

(→Abstract) |

|||

| Line 1: | Line 1: | ||

==Abstract== | ==Abstract== | ||

| − | Generally, project managers have a difficulty in selecting the potential project proposals which give the best rewards for the company into their program or portfolio. One way to do this is to apply financial appraisal tools to evaluates the best investment decision based on predicted costs and revenues which have been determined from either ground-up or top-down costing. The evaluation also depends on the size of the project and the time span over which the costs and benefits are going to be spread | + | Generally, project managers have a difficulty in selecting the potential project proposals which give the best rewards for the company into their program or portfolio. One way to do this is to apply financial appraisal tools to evaluates the best investment decision based on predicted costs and revenues which have been determined from either ground-up or top-down costing. The evaluation also depends on the size of the project and the time span over which the costs and benefits are going to be spread<ref> |

| + | Harvey Maylor (2010) 'Project Management'. Bath, United Kingdom: Pearson Education Limited </ref>. Usually, project managers take responsibility for two types of decision which are investment and financial decision. The investment decision is the decision that focuses on the concept of what to do in order to gain the maximum value, financial decision, however, related on how the projects should get the money from in order to run. | ||

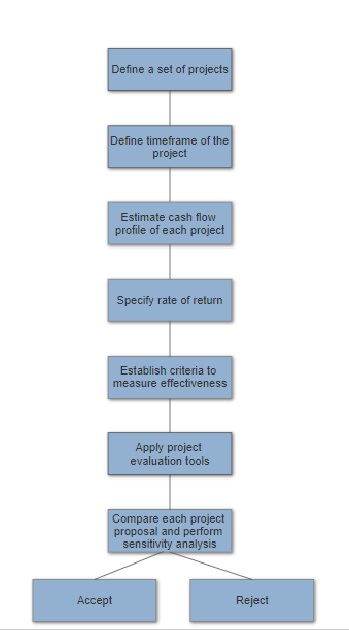

[[File:Project evaluation step.jpg]] | [[File:Project evaluation step.jpg]] | ||

| Line 9: | Line 10: | ||

[[Category:''Time Value of Money'']] | [[Category:''Time Value of Money'']] | ||

==Time Value of Money== | ==Time Value of Money== | ||

| + | |||

| + | |||

| + | |||

| + | |||

| + | |||

| + | ==References== | ||

| + | |||

| + | <references/> | ||

Revision as of 23:37, 4 February 2018

Abstract

Generally, project managers have a difficulty in selecting the potential project proposals which give the best rewards for the company into their program or portfolio. One way to do this is to apply financial appraisal tools to evaluates the best investment decision based on predicted costs and revenues which have been determined from either ground-up or top-down costing. The evaluation also depends on the size of the project and the time span over which the costs and benefits are going to be spread[1]. Usually, project managers take responsibility for two types of decision which are investment and financial decision. The investment decision is the decision that focuses on the concept of what to do in order to gain the maximum value, financial decision, however, related on how the projects should get the money from in order to run.

The aim of this article is to present techniques to make an accept or reject decision on investing project which are payback analysis, discounted cash flow, and internal rate of return which based on the concept of the “Time value of money”, and application of these tools also their limitations.

Time Value of Money

References

- ↑ Harvey Maylor (2010) 'Project Management'. Bath, United Kingdom: Pearson Education Limited